Authored by Bill Blain via MorningPorridge.com,

“Bang, Bang, on the door.. we can’t hear you”

As summer wends towards its end, a winter of populist discontent from left and right will make Europe increasingly fraxious. While the US economy will likely be on path to recovery – Europe will still be trending down.

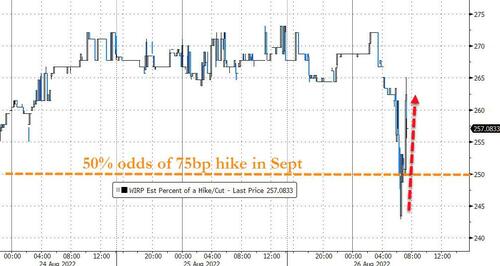

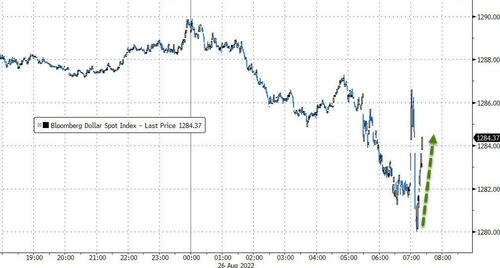

Today the market is on tenterhooks, waiting to hear words of wisdom from Jerome Powell and his thoughts on Life, Death, the Meaning of Everything, and US interest rates. (The answer, BTW, is probably 42.) Every market player, watcher, and fretter is set to make a nuanced response to whatever he says. Simples – rates go up, but only till we’ve licked inflation, or something similar. Next week we will know..

Yawn… Can I hold my attention long enough to listen to a day of Jackson Hole? There is a mellow mist on the river, burning off as the sun rises. It’s the end of a long hot summer. We have a bank holiday in the UK on Monday, and next week is Labour Day in the US.. We should enjoy it while we can. I would skive off for a swim, sail or paddleboard – but I’ve scored a winning lottery ticket!

Yep, I’ve got an actual, real, proper 10 min consultation with my GP this morning – to notionally check my dodgy ticker. He will look up and nod as I come in, tell me to lose weight, and scribble something on his screen. Most importantly, he will hopefully sign a referral to go see a private cardiac consultant. It will be the same consultant I would see under the NHS, but with the advantage I will get to speak to him this decade. I am a fortunate.

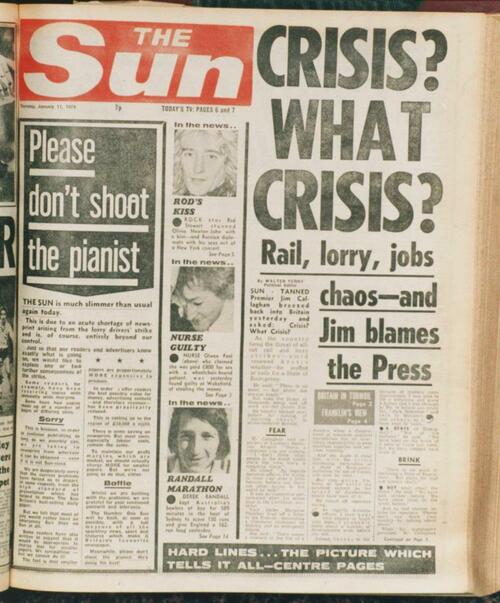

Life and markets are going to get terribly serious in the next few months. Winter is Coming, social unrest approaches, White Walkers and Putin’s Energy Games promise us a Fimblewinter of stress before the ultimate Ragnarök of economic crisis. (Overly dramatic perhaps.)

I’m wondering if it’s even worth planting spring bulbs this autumn….

(OK – I admit it – a few too many Game of Thrones quotes this week. That’s because I watched the new House of the Dragon… and thought it ok. Anything with Dragons is likely to be good. Opinion does seem divided on Matt Smith, former Dr Who and Prince Philip (from The Crown). He looks the part of an inbred mad prince, but is he villainous enough? We shall see..)

Meanwhile, back in the fantasy world of Yoorp…

There is a very scary comment in the Times about how Germany is set for an outbreak of radical protest this autumn – “Extremists plan “autumn of rage” to exploit cost of living crisis in Germany.” Speaking to a French chum yesterday, he was warning me to stay clear of Paris – the Gillet Jaune are being superseded by a far more radical left and younger protest base. The German protests have been infiltrated by the extreme right. The French by the left. You can just imagine what happens when they clash. You have to wonder, what hand Moscow has played in fermenting crisis and revolt across social media – it can’t be underestimated as a threat.

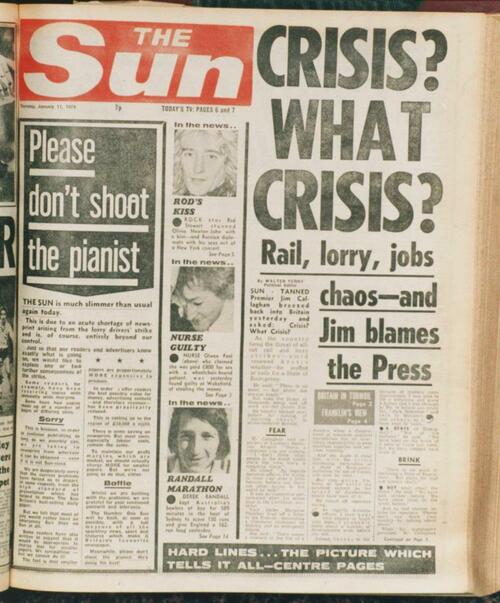

All the signs point to escalating unrest across Europe this autumn into Winter. Inflation, cost of living, energy costs, power outages, cold snaps, recession, jobs, immigration, populist politics, the failure of conventional politics, and overlay it all with increasing Russian fake-news and Kremlin Troll-bots… something is going to break this winter. The Times thinks it will be East Germany as the Epicentre. My Paris chum says Paris. I reckon Eastern Europe.

The politics of Autumn in Europe could be a massive no-see-um market shock.

There are a couple of things to make me fear it’s going to be even worse than we fear..

Liz Truss is going to start her UK Presidency by declaring war on Europe over the Northern Ireland protocols, and picking President Macron of France as her first target. I am assured she is also thinking about the other stuff, like addressing the consumer cost of living crisis, or government support on stratospheric energy bills, but the advantage of blaming the EU for the Norn Irn confustabilation is: it looks tough, considered, and Maggie-like – or so Lord Mogg has told her. I despair.

Meanwhile, there may be some hope.

Some politicians have been thinking outside the box. Surprisingly, it was in Germany.

The Germans, curiously, actually tried to do something about the miserable state of their economy this summer. Through August they slashed the price of rail transport to Euro 9 per month for unlimited train and bus travel – and it was a stunning, spectacular success. Naturally, being Germans, they are now abandoning the policy.

The monthly season ticket giveaway resulted in a huge number of Germans jumping on trains to go see their country. I know German trains – anything is better than UK trains – and they are good if not perfect. The cheap tickets resulted in over 30 mm Germans travelling, many catching a train for the first time. There were inevitable problems – many trains were packed, causing consternation for regular travellers. Some say car use actually increased to get people to stations!

It was also costly – €14 bln per annum, the Government said. So, they closed the initiative after a month. They are going to spend the money on “modernising Germany’s crumbling rail network and expanding capacity” says the FT, quoting some German politician.

The German experiment is fascinating. Yes, the trains were packed, busy and difficult for a month – but the entertainment/novelty value would soon wear off. It would be good to see how long-term cheap fares would impact the German economy. Would a €14 bln Government ticket subsidy increase economic activity in terms of long-term increased domestic travel and spend, or from increased commuting to work?

Regular readers here in the UK will know rail is my ultimate bug-bear…

My commute used to be a doddle. When first I moved out of London many years ago, the train from Southampton to London was 1 hour, reliable and very comfortable. I wrote the Porridge sitting at a nice comfy table, arriving refreshed into Waterloo. I was happy spending 2 hours working on the train each day – there and back. Not a problem. It was expensive – £400 per month, but it was a decent trade off to live out of London.

Then we bought a flat in London. Commuted up on a Monday and back on Friday. Then it became back on a Thursday, and eventually three days a week in London.. And I missed the weekdays at home. Living in a London flat – even though it overlooked the river was limiting. Here, I can go for walks, sail, swim and all the good stuff. In London I could go for a walk and get mugged. It’s just easier not living in London.

Post pandemic I am commuting again. But the train service is a travesty. In order “to improve the customer experience” the one-hour train is now one-hour twenty minutes. It’s no longer an express, but stops, meaning it gets very busy. It’s no longer comfortable seats with tables – its tiny little seats my arse doesn’t fit. And it now costs me over £80 per day for a return ticket. The two hours I used to write the Porridge in are now 3 hours of travelling purgatory on rolling stock almost my age, and pot-luck whether the air-con works.

Forget about improving the service, or improving the infrastrucuture – there is no government interest or incentive to improve trains. Which means the potential economic benefits of expanding the London commuter belt with comfortable, green transport to boost its commercial mass is simply never going to happen. I am never going back to live in London – even though I know my business would benefit from being in London more often. It was possible 10 years ago, but neglect and underinvestment mean’s it’s impossible today.

Enough ranting about rail, but think about it this way.. Planned government infrastructure spending could benefit the economy long term and short-term stimulate recovery. If we can’t make the railways work because of bureaucratic and government disinterest… how are we going to fix the NHS, the broken education system, our broken power infrastructure, the leaking public water utilities (owned by US private equity)? etc etc..

And on that note.. its just over a week till the next Tory premier takes power… My guess is Liz Truss will embark on an all-out series of populist give-aways before an early election. It will probably work because the UK opposition Labour party looks about as organised as a Russian invasion…