No ‘Powell Pivot’: Nomura Warns “The Fed Cannot Risk Getting ‘Arthur-Burns-ed'”

Almost nothing Powell can say will have the Equities market “hear” anything less than a “de facto dovish” message, versus an impossible “balancing act” expectation that he cannot fulfill without likely easing FCI (re-iterating focus on inflation but unable to ‘Forward guide’ tighter, while also acknowledging slowing growth and fading Commods / Inflation Expectations Surveys as tailwinds to ‘past peak’story)…

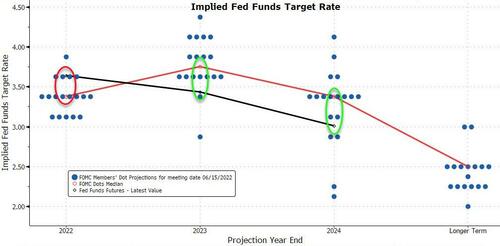

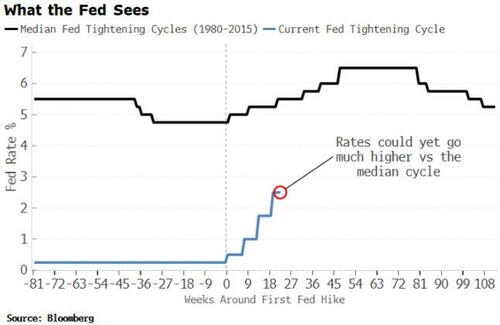

Remember, financial conditions are now EASIER than they were when The Fed STARTED TIGHTENING…

… all of which is why Nomura’s Charlie McElligott believes Powell’s speech is largely being viewed as a “nothing-burger”.

Accordingly, markets are continuing on their own ways:

-

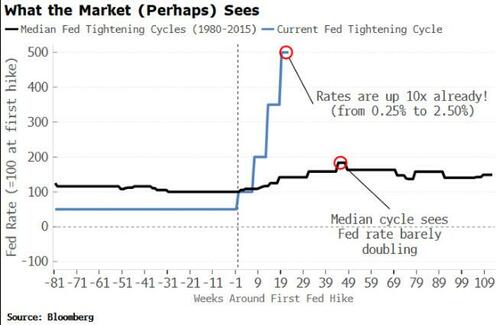

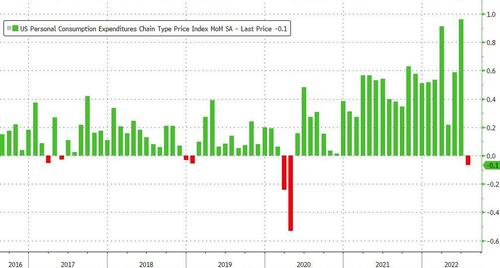

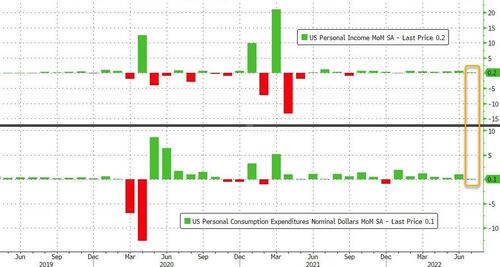

Equities are seeing an approaching “end to tightening” as an ongoing “stabilization” dynamic which cuts “left tail” Inflation >>> “Policy Error” scenarios, not really putting any credence into the potential for Terminals to move higher from here –ESPECIALLY following this morning’s light prints in Personal Income, Personal Spending and PCE Deflators across boards which “keep hope alive” for an earlier end to tightening

-

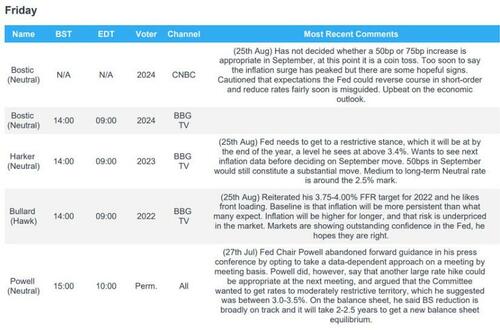

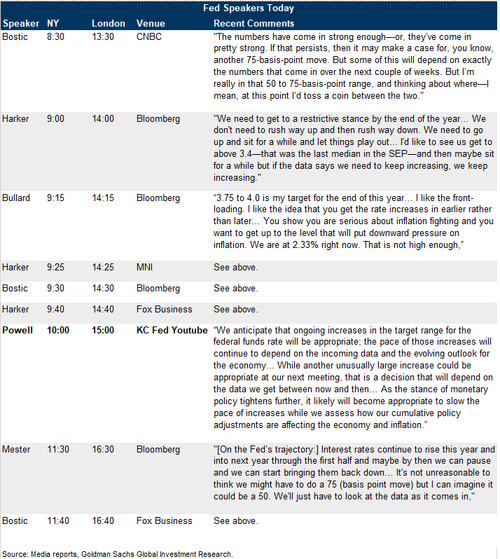

Rates act with far more nuance, adjusting to “higher / more restrictive for longer” view, with Terminal now priced for Apr23 at 3.76% (was down to an absurd 3.20% on 7/28), before by end of year adjusting lower to 3.47% by Dec23…but still currently seeing nominal 10Y yields chopping in the middle of their 3 month range (high of 3.497% on 6/14, low of 2.514% on 8/1)

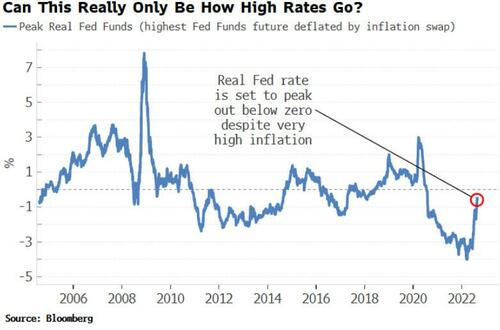

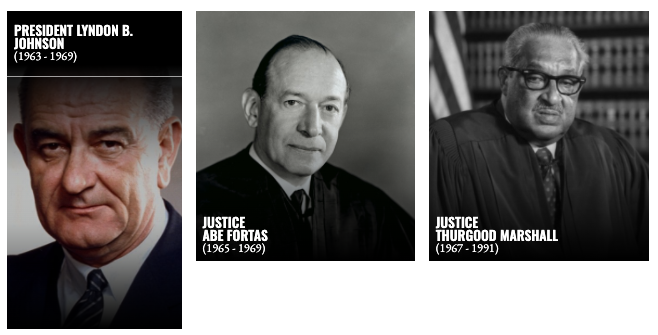

The Nomura strategist warns that the reality is, the Fed cannot risk getting “Arthur Burns-ied” and signal any sort of policy easing pivot preemptively, while “inflation tensions” are likely to remain structurally present for potentially another year +…so the showdown is with the Equities market, which continues to reflexively pull-forward easier financial conditions on the expected exit from “tightening”

The only true “hawkish surprise” path that Powell could go down would be for him to hypothetically tell us “outright” that said Terminal rate is needs to go higher than current market implieds are pricing, which would then risk a snap-tightening in FCI: US Dollar and Real Yields higher, Equities lower, Credit / Spread product wider, Vol up

And…ummmmm…FAT CHANCE of that occurring, without Powell having “hot” future CPI- or NFP- inflation data in-hand (despite having this morning’s LIGHT—thus “bullish Equities” PCE Deflator and Personal Income / Spending data) to allow him …especially when he is also certain to mention the economic “pain” being caused by their inflation fighting efforts as further counterbalance which offsets his usual word salad about the Committee’s prioritization of not allowing for inflation to become unanchored / embedded

In the meantime, the market has already been doing its “de facto dovish” relief trade before the Powell “event” itself even occurs (Equities / Credit / Crypto rally past few days, while this morning, we see modest Curve Steepening and USD lower), as the current belief is that the Fed is becoming less aggressive on the policy rate stance, which is why everybody underexposed to this Equities rally—or, having been sitting on grossed-up “short” books and hedges—has been hurt over the past few months

It went like this: the market’s gaze shifted from the prior focus on “upside inflation risk” during the first six months of the year on the “behind the curve” Fed playing catch-up to inflation…instead then to “growth downside risk” since July by-and-large, as negative Survey- and Housing- data began showing the “variable and lagged” impact of tightening which has already occurred

Ironically, a shift of focus to “growth downside” was a large part of the stabilizing “bull-case” for Equities, as the entirety of the YTD Equities destruction through the lows in June had come via multiple compression (NOT from the earnings side)—so btwn slowing growth data in July, and then ultimately, the first meaningful “downside” miss in inflation data in August, markets finally saw the “light at the end of the (tightening) tunnel” on “past peak inflation = closer to the policy pivot”

And then to further spike the football, you had the bears frustrated by the “not as catastrophically bad as feared” Q2 earnings season, which many thought was going to be the “next shoe to drop” for Equities, and cause that “final” valuation cleanse which they could then rationalize as a “dip to buy” on a push down a historically appetizing level

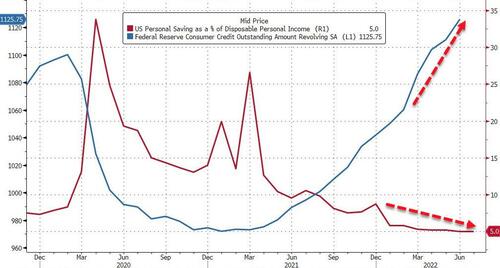

But of course as noted here repeatedly, it didn’t happen, earnings were okay-ish and many corporates showed pricing-power yet again despite evidence of yes, slowing macro volume / sales…but were propped-up by, you guessed it, “inflation,” and consumers who “middle class and up” took down the pain of higher prices

So what happens next?

While McElligott believes the lows are in for Stocks, he warns that there is still more of the “uncomfortable range chop” to come out in the medium-term, because inflation dynamics are going to remain “tense” due to structural drivers and sticky components, as well as the ongoing re-accleration in Energy prices (OPEC+ vs Iran), with the EU / UK crisis in particular “dragging-up” the rest of world’s costs

-

Another fresh Asian LNG benchmark record high overnight

-

Brent Crude back above $100/bbl

-

US Nat Gas nearing a re-test of its own record high

-

German and French 1Y Ahead Electricity prices yet-again making record highs overnight as well, with hedging costs become excruciating

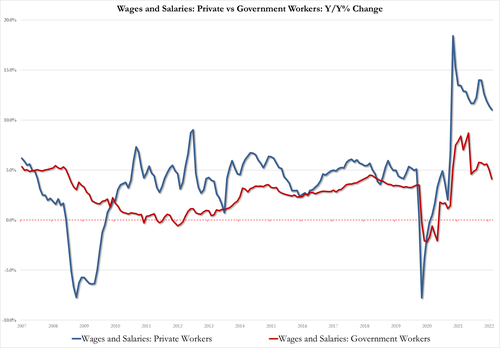

With these Energy dynamics continuing to run in the background, the Fed and other Central Banks thus will remain stuck “higher for longer” than most can appreciate currently, especially with Labor so tight / Wages so high—which alongside “max cap” QT impact set to kick-off in September, we should continue getting those “Rate Vol” impulses (into year-end funding / tight balance sheet risks) occurring simultaneously that we see much “harder economic slowdown” being evidenced in the data…

…but still with inflation “sticky higher” and not fully capitulating back to target, despite local signs of ongoing easing supply chain dynamics, slowing growth and inventory bullwhip disinflationary effects.

This is my late 4Q22 / 1Q23 stagflationary “now what?!” scenario, one last Equities scare, with growth going lower and heading south with Jobs…but versus inflation which is “off peak,” but def not back to target either

This is why I truly believe that the Fed being “more hawkish now” would be a counter-intuitive ultimate POSITIVE for risk-assets – just get it over with, stop slow-playing it (and risking the “Arthur Burns 1970’s” scenario), hit it harder than most expect, take the pain to get demand crunched – so that the exit can be pulled-forward… BUT “WHAT MAKES SENSE” IS A VERY DIFFERENT CONVO THAT “WHAT’S GOING TO HAPPEN”

In the meantime, McElligott sees this current “valuation” range trade “chop” continuing, which is 18 x’s $240 = 4320 upper end, which coincides with us back near the 200dma of 4310 as well…

…where maybe if that Q3 “negative earnings revision” were to hit from the Consumer and Volumes / Sales drags, we could see that 18 x’s $220 = 3960 downside.

Tyler Durden

Fri, 08/26/2022 – 09:40

via ZeroHedge News https://ift.tt/5KAW9MX Tyler Durden