Key Events This Week: All Eyes On J-Pow’s J-Hole Speech

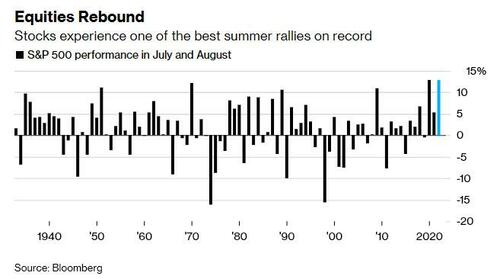

Now that Q2 earnings season is officially over, and liquidity is especially dismal with more than half of Wall Street pros on vacation, the annual plenary of the global central bank cognoscenti kicks off in Jackson Hole this week. As DB’s Tim Wessel puts it, the main macro event of the deep dog days of summer – where this year’s theme is “Reassessing Constraints on the Economy and Policy” – will be kicked off by Jerome Powell’s remarks on Friday morning. Commenting on the week’s main event, Bloomberg’s Garfield Reynolds writes that equity investors may be more on edge than normal going into this year’s Jackson Hole gathering as there is plenty of anticipation Powell “will push back hard against the considerable loosening in financial conditions, a decent part of which has involved the strong rebound rallies in equities.”

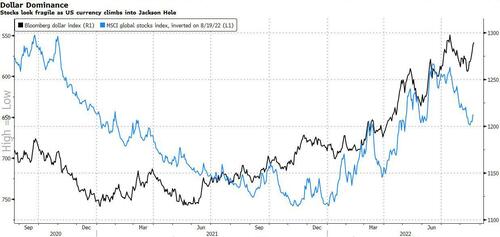

As Reynolds further notes, the dollar just had its biggest weekly gain since the pandemic and the risks look skewed toward the upside as “stocks globally have been moving inversely in line with the dollar, so if the greenback busts out to fresh record highs it’s likely equities would make fresh lows” and “shares are a lot further away from this cycle’s troughs than the dollar is from recent peaks.”

That said, while the strength of the USD last week suggests that a J-Hole “Hawk-ano” is a popular market view, there are whispers that Powell will be more cognisant of the impact of USD strength on other economies and may therefore chose not to project an overly hawkish view.

While we wait for J-Pow’s Friday comments, global production data will serve as suitable hors d’oeuvres throughout the week, while US PCE data on Friday will be a side dish commanding ample attention. Elsewhere, we receive the second estimate of 2Q US GDP; will the poor aftertaste of two consecutive quarterly retractions continue to overwhelm the otherwise supportive ingredients that comprise near-term growth?

Back to Jackson Hole, as the market looks for direction on the uncertain economic outlook and Fed reaction function, Chair Powell’s remarks are one of the key events that can jolt US policy expectations from their recent range, along with inflation and employment data preceding the September FOMC. Indeed, as DB notes, since the day of the July CPI print, 2yr Treasury yields are on net less than a basis point lower, while pricing of the September rate hike has oscillated in a narrow range that effectively has placed equal probabilities on a 50 or 75bp hike, as conviction around the terminal rate and intervening path of policy is low until the market can assess which way inflation (and the Fed) is breaking.

The Chair will likely strike an imposing tone against the inflationary scourge, all the more given his remarks last year noted the bout of inflationary pressure was likely to be a transitory phenomenon (important to keep in mind how much the policy outlook can evolve over a 12-month time frame, let alone when uncertainty is this high here). While the Fed has taken to emphasizing two-way risks around the tightening cycle, most visibly in the minutes at the July meeting, the easing of financial conditions since the July meeting may force the Chair to re-orient expectations away from the balance of risks back toward the primary objective of bringing inflation lower.

Elsewhere, tomorrow’s round of August PMI data will provide a snapshot as to how the Eurozone economy is has been holding up recently. Germany’s July manufacturing PMI reading registered a 2-year low, signalling the acuteness of the headwinds already being felt. The release of Germany’s IFO survey later in the week is also expected to reflect further deterioration in business sentiment. Despite this, the ECB is expected to retain a hawkish tone in the face of strong price pressures. Although ECB President Lagarde will not be travelling to Jackson Hole this week, several members of the Governing Council will reportedly be there. Their remarks are likely to set the tone for the ECB’s forthcoming September 8 policy meeting.

Executive Board member Schnabel will be the highest profile ECB speaker at the gathering, where focus is on calibrating the ECB’s next policy action. Before Schnabel, due on a panel Saturday, the ECB’s account of the July meeting’s 50bp hike will provide yet more detail into the super-sized kickoff to the ECB’s tightening cycle. Elsewhere in Europe, the looming energy crisis will remain top of mind. German Chancellor Scholz and Vice Chancellor Habeck are in Canada to try and plug the energy gap left by dwindling Russian gas supplies. Along with alternative imports, the government is still weighing whether to extend the life of heretofore condemned nuclear facilities if sufficient supplies cannot be secured.

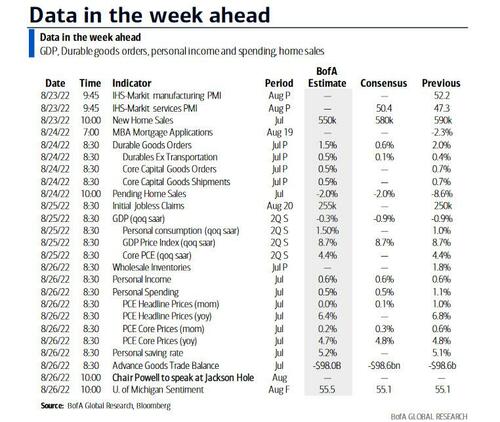

There will also be a few interesting US data releases this week, which may color the tone that Powell takes this week. These include August US PMI, July new homes sales, durable goods orders, a Q2 GDP revision and some inflation data. The Bloomberg market consensus sees little scope for an alteration from the shockingly soft Q2 GDP plunge of -0.9% q/q saar. The Fed’s favored measure of inflation, the PCE deflator, is expected to show some moderation in price pressures. The market median stands at 6.4% y/y, down from a June figure of 6.8% y/y.

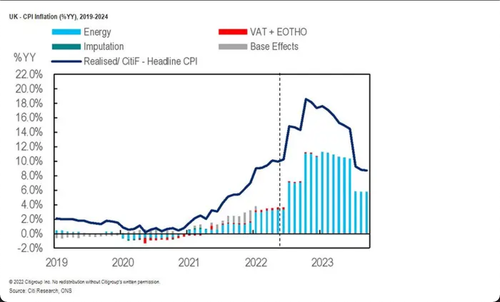

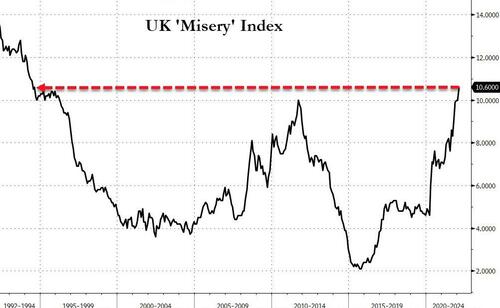

A notable event for the UK on Friday will be the announcement from Ofgem regarding how much average household energy bills are set to rise in October. In recent weeks, estimates have only been headed one way and are currently pointing to annual bills rising to around GBP3,600, with more increases to follow next year. Given the stark reality that energy bills will simply be unaffordable for some households this winter, Liz Truss, the favoured contender for the Tory party leadership, is now indicating that additional support could be at hand. Earlier this month she had announced that she did not believe in “giving out handouts”. On the back of the surge in the cost of living in the UK, workers at the port of Felixstowe, the biggest container facility in the country, have commenced an eight day walk out over pay. The impact is likely to enhance supply side issues for businesses around the country. Additionally, UK barristers are voting on proposals for an all-out strike next month as part of an ongoing dispute with government over pay and cuts to legal aid. Having broken below the GBP/USD1.20 level last week, cable is holding well clear of that level this morning.

Wednesday will mark 6 months of war between Russia and the Ukraine. The FT is reporting this morning that Moscow sees no possibility of a diplomatic solution to the end of the conflict, according to Russia’s permanent representative to the UN in Geneva. These comments are a blow to hopes that the recent agreement to allow grain exports from Ukraine’s Black Sea ports could have formed the basis for a broader solution.

Courtesy of DB, here is a day-by-day calendar of events:

Monday August 22

- Data: US July Chicago Fed national activity index

- Earnings: Zoom, Palo Alto Networks

Tuesday August 23

- Data: US, Germany, France, Eurozone, UK, Japan August PMIs, US August Richmond Fed manufacturing index, July new home sales, Japan July nationwide department store sales, Eurozone August consumer confidence

- Central Banks: ECB’s Panetta speaks

- Earnings: XPeng, JD.com, Macy’s, Intuit

Wednesday August 24

- Data: US July durable goods orders, capital goods orders, pending home sales

- Central Banks: Fed’s Kashkari speaks

- Earnings: Royal Bank of Canada, Ping An, Salesforce, Snowflake, Autodesk

Thursday August 25

- Data: US 2Q second reading of GDP, core PCE, August Kansas City Fed Manufacturing Activity index, initial jobless claims, Japan July services PPI, Germany 2Q private consumption, government spending, capital investment, August Ifo survey, France August business and manufacturing confidence

- Central Banks: Jackson Hole Forum begins, BoJ’s Nakamura speaks, ECB’s account of July meeting

- Earnings: Fortum Oyj, Dollar Tree, Dollar General, Peloton, Affirm, Workday, Marvell Technology

Friday August 26

- Data: US July advance goods trade balance, wholesale inventories, personal income, personal spending, retail inventories, PCE deflator, final reading of August University of Michigan consumer survey, Japan August Tokyo CPI, Germany September GfK consumer confidence, France August consumer confidence, Eurozone July M3, Italy August consumer and manufacturing confidence, economic sentiment

- Central Banks: Fed Chair Powell speaks

Turning just to the US, Goldman writes that the key economic data releases this week are the durable goods report on Wednesday, the second Q2 GDP release on Thursday, and the core PCE inflation report on Friday. There are a few scheduled speaking engagements from Fed officials this week, including a speech by Fed Chair Jerome Powell on Friday at the Jackson Hole Economic Policy Symposium.

Monday, August 22

- There are no major economic data releases scheduled.

Tuesday, August 23

- 09:45 AM S&P Global US manufacturing PMI, August preliminary (consensus 51.9, last 52.2): S&P Global US services PMI, August preliminary (consensus 50.0, last 47.3)

- 10:00 AM Richmond Fed manufacturing index, August (consensus -5, last flat)

- 10:00 AM New home sales, July (GS -1.0%, consensus -2.5%, last -8.1%): We estimate that new home sales declined 1.0% in July, following an 8.1% decline in June.

- 07:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a Q&A session at the Wharton Minnesota Alumni Club. Audience Q&A is expected. In his last public appearance, on August 18th, President Kashkari emphasized that the FOMC needs to “get inflation down urgently,” and that this will require the Committee to “get demand down.” President Kashkari also noted that he “[doesn’t] know” whether the Fed “can bring inflation down without triggering a recession.”

Wednesday, August 24

- 08:30 AM Durable goods orders, July preliminary (GS +2.0%, consensus +0.8%, last +2.0%); Durable goods orders ex-transportation, July preliminary (GS +0.3%, consensus +0.1%, last +0.4%); Core capital goods orders, July preliminary (GS +0.4%, consensus +0.3%, last +0.7%); Core capital goods shipments, July preliminary (GS +0.6%, consensus +0.3%, last +0.7%): We estimate that durable goods orders rose 2.0% in the preliminary July report, reflecting strong commercial aircraft orders. We also expect a continued solid rise in shipments of core capital goods (+0.6%), but we assume a more moderate rise in new orders for that category (+0.4%) due to mixed foreign demand.

- 10:00 AM Pending home sales, July (GS -0.5%, consensus -2.5%, last -8.6%); We estimate pending home sales declined 0.5% in July, following an 8.6% decline in June.

Thursday, August 25

- 08:30 AM GDP, Q2 second release (GS -0.6%, consensus -0.9%, last -0.9%); Personal consumption, Q2 second release (GS +1.5%, consensus +1.5%, last +1.0%): We estimate a three-tenths upward revision to Q2 GDP growth to -0.6% (qoq ar), mainly reflecting the upward revisions in the July retail sales report. We also assume a boost from a post-Omicron rebound in recreation and travel categories, based on last Friday’s Quarterly Services Survey (QSS). However, we expect a downward revision to healthcare services consumption, reflecting the softer QSS details for that category.

- 08:30 AM Initial jobless claims, week ended August 20 (GS 247k, consensus 252k, last 250k); Continuing jobless claims, week ended August 13 (consensus 1,443k, last 1,437k): We estimate initial jobless claims declined to 247k in the week ended August 20.

- 11:00 AM Kansas City Fed manufacturing index, August (consensus NA, last 13)

Friday, August 26

- 08:30 AM Personal income, July (GS +0.6%, consensus +0.6%, last +0.6%); Personal spending, July (GS +0.6%, consensus +0.5%, last +1.1%); PCE price index, July (GS +0.05%, consensus +0.1%, last +0.95%); PCE price index (yoy), July (GS +6.39%, consensus +6.4%, last +6.76%); Core PCE price index, July (GS +0.22%, consensus +0.3%, last +0.59%); Core PCE price index (yoy), July (GS +4.69%, consensus +4.7%, last +4.79%): Based on details in the PPI, CPI, and import prices reports, we estimate that the core PCE price index rose by 0.22% month-over-month in July, corresponding to a 4.69% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.05% in July, corresponding to a +6.76% increase from a year earlier. We expect that personal income and personal spending both increased by 0.6%.

- 08:30 AM Advance goods trade balance, July (GS -$97.1bn, consensus -$98.3bn, last -$98.6bn): We estimate that the goods trade deficit decreased by $1.5bn to $97.1bn in July compared to the final June report, reflecting a decrease in imports.

- 08:30 AM Wholesale inventories, July preliminary (consensus +1.4%, last +1.8%)

- 10:00 AM University of Michigan consumer sentiment, August final (GS 56.0, consensus 55.3, last 55.1): University of Michigan 5-10 year inflation expectations, August final (GS 3.0%, consensus NA, last 3.0%): We expect the University of Michigan consumer sentiment index rose to 56.0 and that the 5-10 year inflation expectations measure remained unchanged at 3.0% in the final August reading.

- 10:00 AM Fed Chair Powell (FOMC voter) speaks: Federal Reserve Chair Jerome Powell will deliver a speech titled “The Economic Outlook” at the Kansas City Federal Reserve Bank’s annual Economic Symposium in Jackson Hole. The topic of the conference this year is “Reassessing Constraints on the Economy and Policy.” Text and media Q&A are expected. At the press conference following the July FOMC meeting, Chair Powell endorsed the message from the June dot plot—which is consistent with our forecast for an additional 100bp of rate hikes in 2022—as the “best guide” we currently have for the near-term policy path. Chair Powell also noted that 75bp hikes are “unusually large” and that “as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.”

Source: DB, Goldman, BofA

Tyler Durden

Mon, 08/22/2022 – 09:27

via ZeroHedge News https://ift.tt/tyBUvr3 Tyler Durden