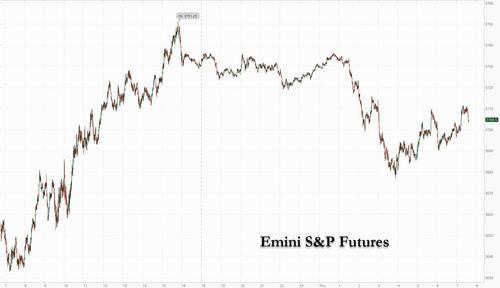

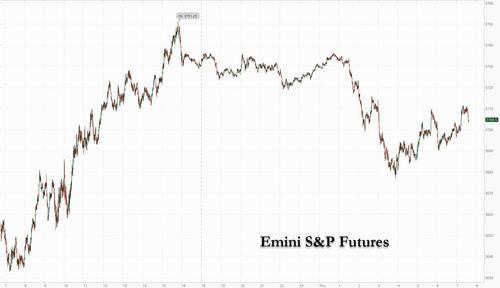

The brief post-BOE euphoria has worn off, and risk-off sentiment returned to markets as concern about inflation and the global economy overshadowed the Bank of England’s desperate attempt to restore calm by restarting QE, exacerbated by more hawkish central bank talk and defiance by British PM Liz Truss’s tax plan (which has been slammed from the IMF all the way to the White House). Treasuries resumed their slide with UK gilts, while US equity futures fell as European stocks extended a selloff that’s caused valuations to drop to their lowest since 2012. As of 730am, emini S&P futures slid 0.7% to 3704, recovering from losses as big as 1.5% earlier.

The dollar rose and Treasuries resumed their slump as investors focused on expectations the Federal Reserve will continue to deliver aggressive interest-rate hikes. The pound snapped a two-day gain and UK gilt yields rose as Prime Minister Liz Truss defended a giant package of unfunded tax cuts that sent markets into turmoil.

“Other than the dollar, there are not many assets that are trading constructively,” said Julia Raiskin, Asia-Pacific head of markets for Citigroup Inc. “The markets are very pessimistic. Investors are fairly on the sidelines.”

In premarket trading, US-listed Chinese stocks drop in premarket trading, following in the footsteps of Hong Kong- listed peers as the Hang Seng Tech Index erased almost all gains since a March nadir. Alibaba (BABA US) -3%, Nio (NIO US) -2.9%, Baidu (BIDU US) -2.4%, Pinduoduo (PDD US) -2.6%, JD.com (JD US) -2.4%. Bank stocks also slumped after snapping a six-day losing streak the day earlier. Here are other notable premarket movers:

- Coinbase falls 2.5% in premarket trading after Wells Fargo starts coverage at underweight, with operating results set to remain under pressure. Bakkt (BKKT US) and Riot Blockchain (RIOT US) are both initiated at equal-weight, with Riot declining 3% in premarket trading.

- Altus Power (AMPS US) slumped 16% in premarket trading after the company’s secondary offering priced at $11.50 per share, below Wednesday’s record close of $14.23.

- First Solar (FSLR US) gained 1.3% in premarket trading after Evercore ISI analyst Sean Morgan raised the recommendation to outperform from inline, saying the company is poised to benefit from the Inflation Reduction Act.

- Apple (AAPL US) shares were down 2.6% in premarket trading, set to extend Wednesday’s decline, as BofA Global Research cut the recommendation on the stock to neutral from buy.

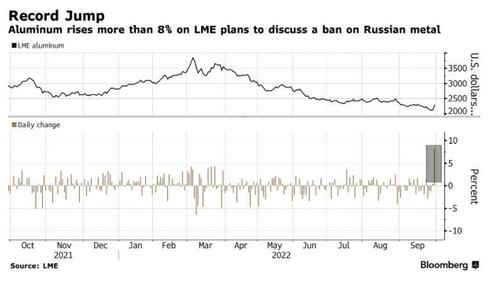

European stocks bounced off session lows amid heightened risk-off mood. Euro Stoxx 50 slumped as much as 1.2%. Autos, retailers and real estate are the worst performing sectors as all slump. European miners rose after news that the London Metal Exchange is launching a discussion paper that marks the first step toward a potential ban on new supplies of Russian metal. Porsche AG rose as much as 5.2% as its shares started trading in Frankfurt after parent Volkswagen AG set the final listing price for the sports-car maker at the upper limit of its offer range. Here are some other notable European movers:

- Accor shares jumped as much as 8.1%, before paring gains, after the French hospitality company raised FY22 Ebitda guidance to a level which analysts said was above consensus estimates.

- Rational rose as much as 16% after the German kitchen appliances manufacturer raised its sales and Ebit guidance, citing improvements in the supply chain picture.

- Capricorn Energy shares rose as much as 8.9% to 261p amid a proposed merger with NewMed Energy that’s expected to deliver total value to Capricorn shareholders of 271 pence per share.

- H&M shares dropped as much as 7.2%, heading for the lowest close since September 2004, after it reported 3Q results that missed estimates and highlighted “very negative” market conditions.

- Next fell as much as 10% after the UK high street retailer cut its FY guidance, citing the cost of living crisis and saying the devaluation of the pound is set to prolong inflationary pressures.

- Colruyt shares plunged 24%, the most intraday on record, after it said the consolidated net result for FY22/23, ex. one-offs, is expected to decrease considerably compared with last year.

- Ubisoft shares fell after the video-game company pushed back its Skull & Bones title to March 2023 from November, despite maintaining FY guidance. Analysts say the decision raises concern.

- Wacker Chemie shares dropped as much as 7.8% after Stifel cut its price target, saying lower silicone and polysilicon prices hit sentiment.

- Hornbach shares dropped as much as 7% after it published its latest 2Q report. The home improvement retailer posted a worse-than expected Ebit decline y/y, Warburg said.

- European auto stocks fell and were among the worst performing subgroups on the wider market, with Volkswagen and its parent Porsche Automobil Holding SE leading declines.

European bond yields also rose as investors digested the latest inflation data and commentary from European Central Bank officials. Euro-area economic confidence dropped to the lowest since 2020.

Investors are contending with threats posed by discordant moves from central banks over the past few days, with Fed officials adamant on further monetary tightening, the BOE unveiling a £65 billion ($71 billion) plan to support government debt and authorities in Asia trying to prop up weakening currencies.

“The central bank is in a very difficult position right now,” Julie Biel, Kayne Anderson Rudnick portfolio manager and senior research analyst, said of the BOE in an interview with Bloomberg TV. “Everyone has been a little bit backed into a corner in seeing the volatility and market reaction.”

Former Bank of England Governor Mark Carney accused the UK government of “undercutting” the nation’s economic institutions, and said that its fiscal plans were to blame for the drop in the pound and bonds. Simon Wolfson, the boss of Next Plc and a Conservative peer, also appeared to blame the Tory government for a crash in the currency and a worsening outlook for UK inflation, which the company cited as it lowered guidance for sales and profits.

Separately, the European Commission announced an eighth package of sanctions that would include a price cap on Russia’s oil exports as Russia vowed to go ahead with the annexation of the parts of Ukraine that its troops currently control after UN-condemned votes, putting the Kremlin on a fresh collision course with the US and its allies.

Earlier in the session, Asian stocks pared earlier gains spurred by the Bank of England’s unlimited bond-buying plan, as sentiment again turned cautious with fears over a global recession. The MSCI Asia Pacific Index was up 0.2%, having earlier gained as much as 1.2%. Benchmarks in Australia and Japan outperformed, while South Korea’s market closed almost flat. Gauges in Hong Kong and China ended in the red with tech stocks sliding near the lowest since to a sector index was introduced in 2020. Hang Seng Tech Index Slides Toward Lowest Since 2020 Inception The key Asian equity benchmark slumped Wednesday to its lowest since April 2020 on concerns over the Federal Reserve’s ongoing rate hikes. While the the UK central bank’s intervention to avert a crash in the gilt market helped calm investor nerves briefly, few saw the rally as a signal for a full-fledged rebound.

“We remain very cautious on the markets and would exercise a degree of patience,” Kerry Craig, a global market strategist at JPMorgan Asset Management, said in an interview with Bloomberg TV. Central bank moves, inflation and “the looming risk of recession” need to be monitored, he said. Down almost 12% in September, the MSCI Asian benchmark is set to post its worst monthly performance since the pandemic-triggered crash in March 2020. An index of Asia Pacific stocks excluding Japan is on course for its fifth-straight quarterly loss, its longest losing streak in 21 years.

Japanese equities rose, rebounding along with global peers as investors assessed the Bank of England’s move to buy government bonds. More than 1,100 Topix stocks traded without rights to the next dividend. The Topix rose 0.7% to close at 1,868.80, while the Nikkei advanced 0.9% to 26,422.05. Out of 2,169 stocks in the Topix, 1,854 rose and 271 fell, while 44 were unchanged. “Though there is still a strong uncertainty in the US and UK markets over the rise in long-term interest rates, for now there is a sense of relief in the markets as government bond yields in the UK settled down due to the unlimited purchase plan,” said Tomo Kinoshita, a global market strategist at Invesco Asset Management.

In Australia, the S&P/ASX 200 index rose 1.4% to close at 6,555.00, boosted by gains in mining shares and banks. In New Zealand, the S&P/NZX 50 index rose 0.7% to 11,200.04

Stocks in India declined for a seventh straight day in the longest losing streak since February, tracking a selloff across global markets amid worries over possible recession. The S&P BSE Sensex gave up an advance of as much as 1% to end 0.3% lower at 56,409.96 in Mumbai. The NSE Nifty 50 Index slipped 0.2% as both indexes posted their longest stretch of declines in seven months. The key gauges have dropped more than 5% each this month and are on track to record their worst monthly performance since the pandemic led crash of March 2020. Ten of the 19 sector sub-indexes compiled by BSE Ltd. declined Thursday led by the utilities gauge which has lost 11% for the month, making it the worst sectoral performer.

In FX, the Bloomberg Dollar Spot Index first rose then fell, as Treasuries slumped to unwind some of the previous day’s swift rally. The euro fell as much as 1% to $0.9636, before paring losses. It’s significantly more costly to hedge against euro price swings compared to a week ago, as traders bet on wider ranges with risks skewed to the downside. The pound erased losses amid month-end flows, after earlier falling by as much 1.2% to $1.0763. UK bonds extended losses after Prime Minister Liz Truss defended her new government’s giant fiscal package of unfunded tax cuts, which have tipped markets into chaos. Commodity currencies led declines among G-10 peers. Onshore yuan eked out the first gain in nine days following a stern PBOC warning against “one-sided” speculation, but offshore yuan weakened 0.4%

In rates, Treasuries pared Wednesday’s gains with yields cheaper by up to 11bp across the 5-year tenor into early US session, with the belly’s underperformance helped by a large block sale in 5-year note futures. Treasury 10-year yields near highs of the day at around 3.83%, outperforming bunds and gilts by 3.5bp and 4.5bp in the sector; belly-led losses cheapens 2s5s30s Treasuries fly by 7bp on the day. Moves follow a more aggressive bear flattening move in gilts, wit front-end yields are cheaper by 20bp on the day. US session focus on GDP and Fed speakers throughout the day. Bunds, Italian bonds dropped and money markets raised ECB tightening bets after German state CPIs rose in September while euro-area economic confidence dropped to 93.7 in September, the lowest since 2020. UK 10-year bonds decline after Truss doubled down on her economic package;

In commodities, Brent rebounded from earlier lows, to trade near $89.50 following reports of OPEC+ considering production cuts. Spot gold falls roughly $12 to trade near $1,648/oz. Bitcoin is under modest pressure but lies within narrow ranges of less than USD 500 at present and well within recent parameters as such.

Looking to the day ahead now, and data releases include German CPI for September, Italian PPI for August, and UK mortgage approvals for August (the calm before the storm). We’ll also get the weekly initial jobless claims from the US, as well as the third estimate of Q2 GDP. From central banks, we’ll also hear from an array of speakers, including ECB Vice President de Guindos, and the ECB’s Simkus, Panetta, Centeno, Villeroy, Knot, Elderson, Rehn, Vasle, Kazaks, Muller and Lane. In addition, there’ll be remarks from the Fed’s Bullard, Mester and Daly, as well as BoE Deputy Governor Ramsden and the BoE’s Tenreyro.

Market Snapshot

- S&P 500 futures down 1.1% to 3,692.25

- MXAP up 0.2% to 139.97

- MXAPJ little changed at 453.71

- Nikkei up 0.9% to 26,422.05

- Topix up 0.7% to 1,868.80

- Hang Seng Index down 0.5% to 17,165.87

- Shanghai Composite down 0.1% to 3,041.21

- Sensex down 0.3% to 56,446.56

- Australia S&P/ASX 200 up 1.4% to 6,554.97

- Kospi little changed at 2,170.93

- STOXX Europe 600 down 1.6% to 383.23

- German 10Y yield little changed at 2.23%

- Euro down 0.9% to $0.9650

- Brent Futures down 1.2% to $88.23/bbl

- Brent Futures down 1.2% to $88.23/bbl

- Gold spot down 0.9% to $1,644.68

- U.S. Dollar Index up 0.92% to 113.64

Top Overnight News from Bloomberg

- Britain is in a self-inflicted financial crisis that threatens to accelerate the economy’s dive into recession — and the country’s new prime minister is coming under intense pressure to blink

- The ECB should opt for a “big” increase in interest rates in October, according to Governing Council member Martins Kazaks, who said in an interview that subsequent hikes are likely to be smaller. His Baltic counterparts Gediminas Simkus and Madis Muller also indicated they’d back significant moves, while Mario Centeno of Portugal called for a “measured and balanced” approach

- The ECB must ensure pay pressures don’t get out of control in its efforts to keep expectations stable, according to Governing Council member Olli Rehn

- The Riksbank believes it is very important that monetary policy continues to act for inflation to fall back and stabilize at the target of 2% within a reasonable time perspective, the Swedish central bank says in minutes from its latest monetary policy meeting

- Japan’s capital markets suffered the biggest foreign outflow in three months last week as growing fears of a global downturn fueled a search for liquidity

- China’s economy stabilized in the current quarter, and the final three months of the year will be key to the nation’s economic recovery, Premier Li Keqiang said

- As doubts grow over whether Xi Jinping still prioritizes expanding China’s economy over other goals, he’s tipped to appoint a new economic adviser who’s vowed to put growth first

- OPEC+ has begun discussions about making an oil-output cut when it meets next week, a delegate said

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded higher as the region took impetus from the rally on Wall St where risk sentiment was buoyed and yields retreated following the BoE’s announcement to resume Gilt purchases. ASX 200 outperformed in which the commodity-related sectors led the broad advances across industries following the recent upside in energy and metal prices, while firm monthly CPI data did little to dent risk sentiment. Nikkei 225 was also positive but with gains initially capped as more than half of the stocks traded ex-dividend. Hang Seng and Shanghai Comp were also firmer with the Hong Kong benchmark spearheaded by tech and energy stocks, while the mainland also digested reports that the PBoC is setting up a more than CNY 200bln re-lending facility quota for equipment upgrades which aims to expand market demand in the manufacturing sector.

Top Asian News

- PBoC injected CNY 105bln via 7-day reverse repos with the rate kept at 2.00% and injects CNY 77bln via 14-day reverse repos with the rate kept at 2.15% for a CNY 180bln net injection.

- Chinese President Xi told Japanese PM Kishida that they attach great importance to the development of China-Japan relations and he is willing to work with Kishida to build relations, while Kishida told Xi that bilateral relations are currently facing many issues and challenges but he hopes to build constructive and stable relations to boost peace and prosperity, in messages to mark 50 years of diplomatic relations.

- Hong Kong’s Worst Trading Debut in 2022 Sends EV Maker Down 34%

- US’s Harris Goes to DMZ Hours After North Korea Missile Launch

- Japan’s First Bond to Help Ocean Planned by Major Seafood Firm

- Best HK IPO Quarter in Year Ends With Disaster Debut: ECM Watch

- Yuan Bears Bet China Is Powerless to Fight the Mighty Dollar

- China Vows to Speed Up Delayed Homes With Special Loans

European stocks are experiencing another bleak session thus far as the overnight gains in futures dissipated heading into the cash open. Sectors are in a sea of red with no clear theme. Autos kicked off the day as the outperformer as the Porsche AG IPO occurred at a premium to the guided price of EUR 82.50/shr. US equity futures are also trading with losses across the board, with relatively broad-based downside of 1.3-1.5% seen across the front-month contracts.

Top European News

- UK PM Truss says the fiscal statement (i.e. mini-Budget) is the correct plan.

- UK Chief Secretary to the Treasury says the growth plan will get the economy growing, one of the reasons growth plans included tax cuts was to alleviate the household burden. BoE intervention has had the desired effect. Disagrees with the IMF’s remarks.

- US President Biden’s administration was reportedly alarmed by the market turmoil caused by the UK’s economic program and is seeking ways to encourage PM Truss’s team to dial back its tax cuts, according to Bloomberg.

- France is reportedly considering proposals for up to two hour power cuts for parts of the country on a rotating basis, via Reuters sources; additionally, telecom names have highlighted power issues with the German and Swedish gov’ts.

- German Network Regulator says recent gas consumption by households is too high to remain sustainable, via Reuters; gas savings of 20% are required to avoid an emergency.

- German gov’t could make a “low three-digit billion amount” available for the gas price break, discussion of EUR 150-200bln, via Handelsblatt citing gov’t circles; will reportedly be announced today.

- Europe Gas Eases With Traders Weighing Impact of Pipeline Blasts

- Rational Jumps After Boosting Sales Guidance Above Consensus

- Truss Says UK Tax Cuts Are the ‘Right Plan’ Amid Market Rout

- German Economy Seen Shrinking Next Year Due to Energy Crisis

- Profligate Government to Blame for Pound Drop, Says Wolfson

FX

- USD has regained some poise after a mid-week pullback; though, the DXY remains off earlier 113.79 highs and thus shy of the YTD/WTD peak at 114.78.

- Yuan has derived pronounced support from Reuters reports that China’s state banks have been told to stock up for intervention offshore, sending USD/CNH to 7.1437 from circa. 7.20 pre-release.

- Cable managed to ‘recover’ to a test of 1.09 but failed to breach the level with multiple BoE speakers in focus later.

- EUR/USD moving at the whim of broader USD action and failing to glean any real traction from multiple speakers and German state/Spanish mainland CPI data.

Fixed Income

- Core benchmarks are pressured across the board in a modest pullback of the pronounced BoE-induced ‘recovery’ seen yesterday, with numerous speakers due and the second BoE operation.

- Specifically, Bund lies towards the bottom of a 200 tick range while Gilts are holding onto the 95.00 handle with the associated yield lifting further above 4.0%.

- Stateside, USTs are similarly at the lower-end of parameters ahead of data and numerous speakers while the curve flattens further

Central Banks

- ECB’s Simkus says his choice of hike for October is 75bp, says 50bp would be the minimum, via Bloomberg. A 100bp hike would be too much at this point.

- ECB’s Centeno says decisions must be measured and balanced, still far from the neutral rate, via Bloomberg.

- ECB’s Rehn says prospect of recession in Euro Area is likely.

- ECB’s Vasle says current hike pace is “appropriate” response to inflation; expects to raise rates at the next several meetings.

- ECB’s de Cos says so far there is no clear evidence of de-anchoring of inflation expectations. Based on current models, median terminal rate value is at 2.25-2.5% (significant uncertainty).

- ECB’s Kazaks says 75bp will likely be appropriate for October, via Bloomberg.

- PBoC says they are to add more loans to ensure property delivery when required, via Reuters.

- China’s state banks have reportedly been told to stock up for Yuan intervention offshore, according to Reuters sources, in a bid to defend the weakening Yuan.. State banks were asked to asked offshore branches, such as those in Hong Kong, New York and London, to review holding of the CNH to ensure dollar reserves are ready to be deployed.

- RBI likely selling USD via state-run banks around 81.92-81.93 levels, according to traders cited by Reuters

- NBH hikes one-week deposit rate by 125bp, to 13.00%.

- Turkish President Erdogan says interest rates need to come down further; CBRT needs to lower rates at the next meeting, via Reuters.

Geopolitics

- Japanese Chief Cabinet Secretary Matsuno said North Korea’s multiple missile launches are unacceptable and Japan will maintain close contact with allies including the US to monitor and deal with North Korea, according to Reuters.

- Turkish President Erdogan said Turkey will increase its military presence in northern Cyprus, according to Sky News Arabia.

- EU Official expects an agreement on the next Russian sanctions package, or at least major parts of this, before the EU Summit next week. Expects the discussion to focus on referendums, possible annexation, nuclear threat and Nord Stream.

- Russian State Duma representatives have received invitations to the Kremlin for Friday, September 30th at 13:00BST, via Ria.

- Russian Kremlin says the ceremony on incorporating new territories will occur on Friday, September 30th – President Putin will speak.

US Event Calendar

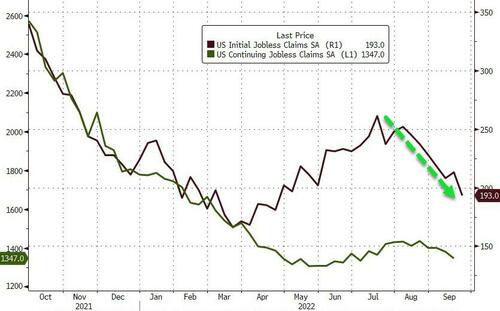

- 08:30: Sept. Initial Jobless Claims, est. 215,000, prior 213,000

- 08:30: Sept. Continuing Claims, est. 1.39m, prior 1.38m

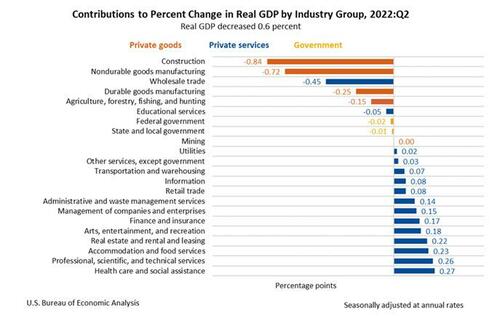

- 08:30: 2Q GDP Annualized QoQ, est. -0.6%, prior -0.6%

- 08:30: 2Q PCE Core QoQ, est. 4.4%, prior 4.4%

- 08:30: 2Q Personal Consumption, est. 1.5%, prior 1.5%

- 08:30: 2Q GDP Price Index, est. 8.9%, prior 8.9%

Central Bank Speakers

- 09:30: Fed’s Bullard Discusses Economic Outlook

- 13:00: Fed’s Mester and ECB’s Lane Take Part in Policy Panel

- 16:45: Fed’s Mary Daly Speaks at Boise State University

DB’s Jim Reid concludes the overnight wrap

How could you have earned a 42% return yesterday from a AA-rated investment? Simple. At anytime between 8-11am all you had to do was buy 40yr Gilts before the BoE effectively restarted QE only days before QT was suppose to start (it’s been postponed until October 31st – ironically Halloween). The buying operation is aimed at restoring liquidity to a broken long end market and is temporary but it’s another stunning development to a stunning year. I’ve always felt that this debt supercycle would end up with central banks doing QE even if interest rates were positive. The reason being is that the economy can be growing and seeing inflation at a point when investors baulk at funding all the debt. I appreciate this BoE operation is slightly different and I would have never have guessed the series of events that got us here but it might not be the last time a central bank buys government bonds when not at the zero bound given how much debt there is and how much there’s likely to be going forward.

It’s becoming clearer the extent to which Tuesday’s rout at the long-end was exacerbated by collateral calls on LDIs (liability driven investments) that pension funds have typically used in some size in recent years. With these swaps moving so far out of the money, the risk was that investors would have to sell liquid assets to meet margin calls. If they didn’t have this (which a lot don’t), then obviously there would have been huge liquidity events. To understand the fears that were around over the last 48 hours, Sky News’ economics editor Ed Conway said yesterday that “I am told there were a swathe of pension funds that … would have essentially collapsed by this afternoon”. Whether that’s true, we’ll never know but it shows the level of fear.

Overall, this isn’t quite monetising debt in the purest sense but at the end of the day we have seen fresh central bank buying of debt after unfunded tax cuts pushed up yields dramatically. Despite the BoE’s insistence that these are targeted, temporary purchases designed to ease market dysfunction, global pricing reacted as if they were launching a new QE program to ease financial conditions. Global equities increased, with the S&P 500 (+1.97%) breaking a run of 6 consecutive losses and global bond yields fell across the curve.

In yield terms, 30yr gilts had been trading above 5% prior to the BoE’s announcement, but afterwards they staged a stunning turnaround to fall by an astonishing -105.9bps yesterday. That was easily the largest decline in the 30 years of available Bloomberg data, with the next two closest being a -39.7bps and -30.5bps decline in 1997 and 2009, respectively. It was also the largest absolute daily yield move in the 30yr, with the next two closest being Monday and Tuesday’s sell-offs. The decline takes 30yrs back to 3.92%, which is still above the c.3.5% level prior to the fiscal announcement last Friday but more within normal market reaction levels. Yields on 10yr gilts were down by a smaller -49.8bps, although that reflected the BoE only purchasing gilts with a residual maturity of more than 20 years. Sterling also managed to strengthen for a second day running, with a +1.45% gain against the US Dollar. But that overall performance hides some incredible intraday swings, with sterling moving sharply higher immediately after the BoE’s announcement before tumbling by -2.74% over the subsequent hour and a half before paring back those losses once again. It is down -0.75% in Asia as I type. Remember that markets are still pricing in around +150bps worth of hikes by the next BoE meeting on November 3, and implied sterling-dollar volatility for the next month remains at levels we’ve only previously seen around the GFC, the Covid pandemic and Brexit in the 21st century, so we certainly haven’t heard the end of the UK’s turmoil just yet.

That intervention from the BoE helped sovereign bonds across the world. Indeed, yields on 10yr US Treasuries had been trading just above 4% immediately prior to the intervention, before reversing course to close -21.0bps lower on the day at 3.71%, which is their biggest move lower since the wild intraday swings we had in March 2020 when the Fed was stepping in to buy Treasuries and MBS in unlimited size; sound familiar? Those gains came as investors moved to downgrade the likelihood that the Fed would be pursuing aggressive policy into next year, with the rate priced in for December 2023 coming down by -23.3bps. This morning in Asia, yields on 10yr USTs (+3.6bps) have edged higher again to 3.77% as we type. In terms of the Fed, we did hear from Atlanta Fed President Bostic, who said he favoured another 125bps of hikes this year, but Chair Powell didn’t comment on policy in an appearance at a Community Banking Research Conference.

Over at the ECB, we heard from an array of speakers yesterday, including President Lagarde who said that the ECB would “continue hiking rates in the next several meetings”. Multiple speakers separately endorsed another 75bps hike next month as well, including Latvia’s Kazaks who said that “I would side with 75 basis points”, Austria’s Holzmann who said that “I think 75 would be a good guess”, and Slovakia’s Kazimir who said that 75bps was “a good candidate to continue and keep tightening.” However, sovereign bonds still rallied across the continent, with yields on 10yr bunds (-11.1bps), OATs (-11.8bps) and BTPs (-22.2bps) all down significantly.

When it came to equities, yesterday also finally brought a reprieve from the heavy selling over recent days, which had taken a number of major indices to their lowest levels since late-2020. As mentioned at the top, the S&P 500 (+1.97%) ended its run of 6 consecutive declines with a strong advance that took the index back into positive territory for the week. Despite the rally, the Vix managed to finish above 30 again, as it has every day this week. Indeed, the Vix has finished above 30 on nearly 19% of trading days this year, which is the fourth most in the last 20 years, behind just the crisis years of 2008, 2009, and 2020. The count hides how skewed the distribution is as in ten of those years, the Vix never once finished the trading day above 30. Yesterday’s equity rally was less extreme in Europe, with the STOXX 600 (+0.30%), the DAX (+0.36%) and the FTSE 100 (+0.30%) seeing modest gains.

In Asia, the Hang Seng (+1.05%) is leading gains, rebounding from recent steep losses with the Kospi (+1.01%), the CSI (+0.50%), the Shanghai Composite (+0.24%) and the Nikkei (+0.25%) are trading higher. Stock futures in the US are pointing to a slightly more negative start though with contracts on the S&P 500 (-0.11%) and NASDAQ 100 (-0.22%) both in the red. As we go to print, the Swedish media is reporting that coast guards have found a fourth leak on the Nord Stream pipeline. What worries me is that if this can be done to this pipeline what stops it being done to a fully working pipeline.

Elsewhere, the People’s Bank of China (PBOC) stepped up its efforts to limit FX weakness by warning banks against betting on the yuan, after its rapid decline against the US dollar this week which pushed the Chinese currency to as high as 7.25 yesterday. Indeed, the US dollar index (+0.59%) at 113.27 is trending upwards this morning, after hitting a fresh two-decade peak yesterday before pulling back.

There wasn’t much in the way of data yesterday, although US pending home sales for August were down -2.0% (vs. -1.5% expected). With the exception of April 2020 during the lockdowns, that takes them to their lowest level in over a decade. In the meantime, the US goods trade deficit for August narrowed to $87.3bn (vs. $89.0bn expected), which is its smallest level since October 2021.

To the day ahead now, and data releases include German CPI for September, Italian PPI for August, and UK mortgage approvals for August (the calm before the storm). We’ll also get the weekly initial jobless claims from the US, as well as the third estimate of Q2 GDP. From central banks, we’ll also hear from an array of speakers, including ECB Vice President de Guindos, and the ECB’s Simkus, Panetta, Centeno, Villeroy, Knot, Elderson, Rehn, Vasle, Kazaks, Muller and Lane. In addition, there’ll be remarks from the Fed’s Bullard, Mester and Daly, as well as BoE Deputy Governor Ramsden and the BoE’s Tenreyro.

(@realchrisrufo) September 28, 2022