Submitted by QTR’s Fringe Finance

As someone who is skeptical of monetary policy and that looks at economics and markets through an Austrian lens, there are two perfunctory phrases I have heard Keynesians constantly rattle off, non-stop, for the last decade.

The phrase “even a broken clock is right twice a day” is an idiom for someone who constantly gets things wrong, only to very rarely get something right. “Crying wolf” is a phrase that refers to the lesson of not causing a panic or calling for help when it isn’t necessary. The juxtaposition of the two in the title is an homage to my favorite proverb-bending, Tourette’s-sporting movie bartender, Gerard Parkes, from The Boondock Saints.

Keynesian cheerleaders who use these phrases – the same ilk who happily tune in to watch financial media sniff the ass of whatever Fed member happens to be offering up their special brand of paid speech farts that day – use them to parry critics of their monetary theories like they’re drowning and these words will somehow conjure up oxygen.

Of course, under the shallow veneer of arrogance and hubris cast forth every time someone utters one of these two phrases, lies a small sliver of worry. It isn’t as though Keynesians can’t understand what Austrian economists are arguing – in fact, modern monetary theory is something of an over-understanding of economics – they just choose to ridicule it. And they likely can’t help but wonder in the back of their minds if these dumbed down “fringe” financial conspiracy theorists are on to something.

Economic academics, Keynesians and Modern Monetary Theorists have tricked themselves into thinking that because they have the capacity to learn the complex jargon of their faux ideologies, that the entire field of economics, and all of the basic laws that govern it, somehow become a malleable, ethnocentric Play-Doh that they can twist, bend and finesse to their needs.

In other words, they think they have it all figured out.

“Some of the biggest cases of mistaken identity are among intellectuals who have trouble remembering that they are not God.” – Thomas Sowell

The Austrian school represents a return to basics and reality for economics.

For Keynesians, the Austrian school is a check coming due for a meal that they were told they could eat perpetually – and have been for decades – without paying for.

Austrian economics may not be the total antithesis of everything that they learned in school, but the further off the path we veer – $30 trillion in debt, unlimited quantitative easing, blowing out the money supply, trying to sanction countries replete with resources and productive capacity – the more Keynesians feel they have to justify their logic, and the more that small sliver of worry grows ever so slightly larger in the back of their heads.

I mean, how else do you explain Paul Krugman constantly taking to Twitter to try and justify himself? Here’s an incomprehensible thread he published this weekend to explain another, self-described “incomprehensible” thread from the day prior.

His Tweets are like those browser windows that replicate and pop up again every time you try to close out of one – except that instead of trying to navigate your way off a porn site, Krugman’s Twitter is caught up in a far more grotesque self-fulfilling circle jerk, an intellectual masturbatory exploration of useless jargon, models and inane musings that could easily double as the torturous jingles played over loud speakers at Guantanamo during “advanced interrogation techniques”.

But that’s how it goes: Austrians warn of a coming reality check while Keynesians do…well, whatever the hell Krugman is doing.

Every time Keynesian economists and the Fed figure out a new way to manipulate numbers, economic variables or definitions to their advantage, they feel even more empowered to cast aspersions onto those who suggest day of reckoning will eventually come.

“A broken clock is right twice a day!” “How long are you going to cry wolf?”

If you have the means to support my work and want to become a subscriber, you can use this link for 50% off: Get 50% off forever

Therein lies some of the misunderstanding about these two sayings.

Keynesians think they are making great points every time they point out that Austrians only get things right once in a while.

“Sure Peter Schiff predicted the housing crisis, but he also said gold would be going to $5000! He’s an idiot that only gets things right once in a while,” they’ll say.

But the truth is that the general argument being made by Austrian economists is that the whole fucking charade is going to come to an end at some point. At that point, there will be no quick fix, there will be no jargon, there will be no debt jubilee and there will be no more Band-Aids in the Fed’s quiver.

Peter Schiff often says it’s like a man biding his time at the poker table as hands come and go. The Keynesians may have most of the chips now, but at the end of the day, if he plays his one big hand right, he believes he’ll have them all.

Lest we forget that politicians and economists generally have to learn the hard way. After all, they don’t predict or acknowledge recessions or depressions ahead of time or as they’re happening, and, either through ignorance or purposeful manipulation, they never really seem to have a single negative word of criticism about the path that they are on.

In some respects, it’s even more ironic because these two phrases about only rarely getting things right could be turned around and pointed right back at the Keynesians: What happened to “transitory” inflation? What happened to the idea that low inflation was the problem? What happened to saying that subprime housing was contained in 2008? Are stocks ever overvalued? Does Neel Kashkari really believe that we can print infinite amounts of money with no consequences?

Surely, if roles were reversed and financial media was littered with Austrian sycophants, perhaps Keynesians would be cast as the outsiders. But as we all know, this isn’t the case – which brings us to where we are right now.

No matter how much the government and the Federal Reserve try to downplay what’s occurring right now economically in the United States, there should be absolutely no doubt about it: we have never experienced a situation like the one we are in right now in modern history:

-

Inflation is occurring at a brutalizing rate that, if measured by 1970 standards, would likely be the highest or near the highest inflation in the country’s history

-

We just conducted another monetary policy “experiment” wherein we printed more money over the course of two years than we had in all of the years combined prior to them

-

Our country’s productive capacity is severely crippled and the White House is waging a war on energy at a time when we have an energy shortage

-

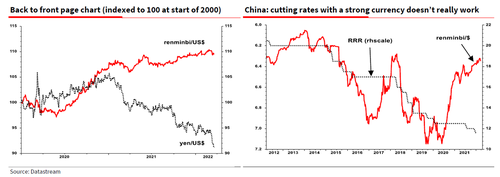

We are standing at stark odds with Russia and China economically, more than we have in many decades. They are exploring their own reserve currency.

-

Equities are almost the most egregiously valued that they’ve been in their history, as measured by Shiller PE and market cap/GDP

-

With over $30 trillion in debt, we have just hiked interest rates at the quickest clip in decades

Examining this list, even an elementary school student could tell you that we may be on the verge of a shit sandwich the likes of which this country has never seen before. Yet, we continue to have ticky-tacky discussions about inflation coming down a couple tenths of a percent or jobs numbers slightly beating expectations.

In a lot of respects, given how wild the circumstances are, it’s fascinating to see people pretty much acting as though it is business as usual for our country.

I think that’s the furthest thing from the truth. The reality of the situation is that it doesn’t appear market participants, politicians or even the Fed understand what a perfect storm the above variables could be creating. This is why I can’t help but laugh when people call me a “broken clock” or say that I’m “crying wolf”.

The thing is: I don’t mind being wrong. In fact, I hope I am wrong. But while some may think it takes bold ignorance to continue suggesting that there will be an Austrian reckoning coming to the economy and markets, such an ignorance pales in comparison to the ignorance necessary to pretend as though everything is normal.

The lesson about not crying wolf makes sense: you don’t want to cause a panic when it isn’t necessary – I agree with that.

But given the unique and unprecedented circumstances unfolding right now in the United States, what the hell are you supposed to do when the wolves are, in fact, looming large right outside of our door?

Thank you for reading QTR’s Fringe Finance . This post is public so feel free to share it: Share