Diversification’s Dead: ‘Holy Moly’ 6.25% Mortgage Is Back As Summer Stock Rally Unwinds

Authored by Wolf Richter via WolfStreet.com,

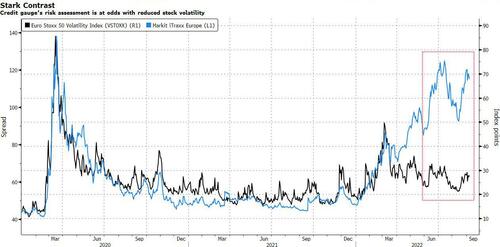

In terms of diversification between stocks and bonds, there is none. Not anymore. They even nailed the bear market rally in lockstep.

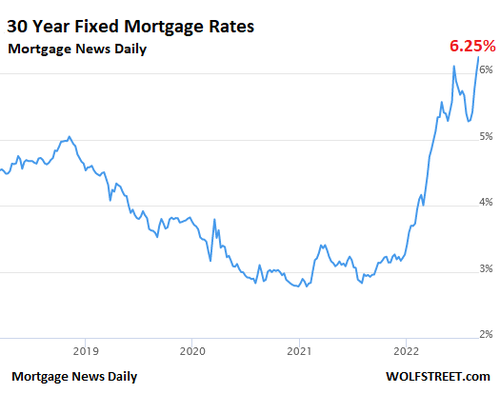

The average 30-year fixed mortgage rate, after weeks of enormous day-to-day volatility, was back at 6.25% on Tuesday, according to Mortgage News Daily. Today’s rate was just about even with the June-14 high of 6.28%, before the beautiful summer bear-market rally set in and turned everything upside down for a couple of months. With mortgage rates, that rally has now unwound.

I call them holy-moly mortgage rates because that’s the sound people are making when they figure the mortgage payment at those rates to buy their dream shack at today’s ridiculous prices (chart via Mortgage News Daily):

Treasury yields jumped, some to multi-year highs.

The bear-market rally was quite something. It started in mid-June and ran through mid-August. Both bonds and stocks surged, and then began unwinding the surge. While stocks have only partially unwound the bear market rally, mortgages and Treasury securities have unwound all of it already.

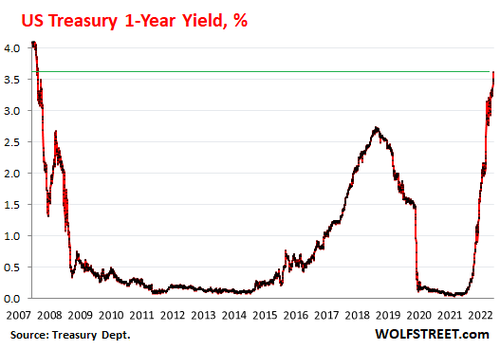

The 1-year Treasury yield jumped by 14 basis points, to 3.61%, the highest since November 2007. The spike started in November 2021, from near 0%. The summer bear-market rally was shallow and is barely visible in the long-term chart:

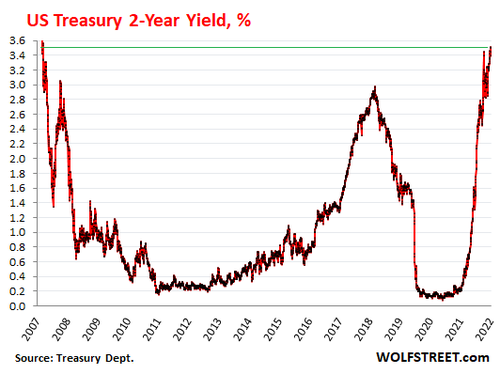

The 2-year Treasury yield jumped 10 basis points today to 3.50%, nearly matching the 3.51% last Thursday, which had been the highest since November 2007. The spike started in September 2021, when the Fed had its infamous pivot, the real one, and the 2-year yield reacted instantly. The summer rally was a little more pronounced than with the 1-year yield:

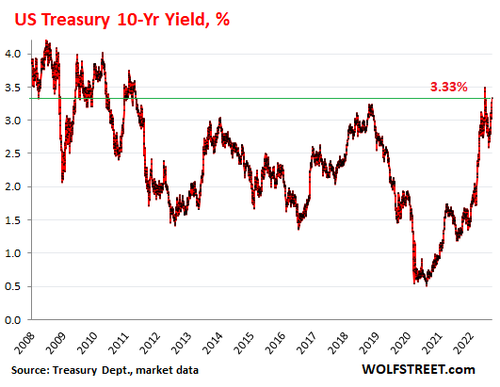

The 10-year Treasury yield jumped by 13 basis points today to 3.33%, the third highest since February 2011, behind only a couple of days in mid-June before the summer bear-market rally kicked off, which has now been wrung out of the 10-year yield:

The 30-year Treasury yield jumped by 14 basis points to 3.49%, the highest since September 2011, having squeaked past the November 2018 high. The summer bear-market rally is nicely visible in the chart, but right in line with other short-lived rallies:

So now there is all kinds of hand-wringing about the end of the bear-market rally that had been so much fun over the summer and that ended in mid-August at which point stocks and bonds began to spiral down again.

In terms of diversification between stocks and bonds, there is none. Back in the day, there was. But not anymore. They were going up together – when bond prices rise, yields fall. And now they’re going down together – when bond prices fall, yields rise. They even nailed the summer rally in lockstep. It’s just a question of which moves faster.

In terms of the bond market, corporate bond issuance came back to life as companies are trying to lock in still relatively low interest rates. According to Bloomberg, about 20 companies – including Lowe’s, Walmart, Deere, and McDonald’s – are lining up $30 billion to $40 billion in bond offerings this week, looking for buyers. And this apparently has caused Treasury yields to spike, or whatever.

There is always one reason or another that we can cite why yields are rising and unwinding the bear-market rally.

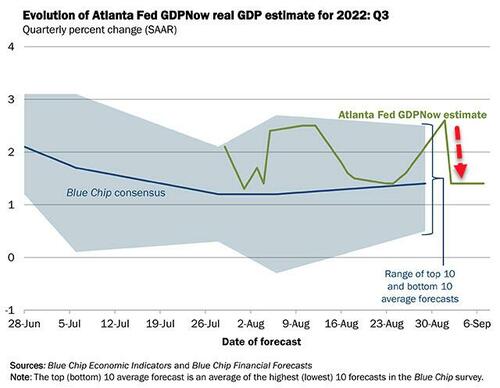

At the most basic level, markets spent two months, from mid-June through mid-August fighting the Fed, blowing off its hawkish statements, and citing stuff out of context to conjure up delusions about the Fed being in fact dovish and on the way to a pivot. As the tightening deniers fanned out and spread the gospel of the pivot, enough folks took it seriously, and so there was the summer bear-market rally.

But by mid-August, under steadfastly hawkish Fed comments, the rally petered out. And then came Powell’s Jackson Hole speech on August 26, which cleared up any remaining confusion.

So now we’re back to basics: The path of inflation, QT ramping up to full speed this month, the coming rate hikes, and still way over-inflated markets, along with speculation about when the Fed would pause to let the higher rates sink in – at 4%? – and let them and QT do their magic hopefully on cooling inflation and the labor market.

* * *

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely.

Tyler Durden

Wed, 09/07/2022 – 12:19

via ZeroHedge News https://ift.tt/3Ts7Ep8 Tyler Durden