The post Thursday Open Thread appeared first on Reason.com.

from Latest https://ift.tt/kph9F16

via IFTTT

another site

The post Thursday Open Thread appeared first on Reason.com.

from Latest https://ift.tt/kph9F16

via IFTTT

Conrad Black: Can This Be Happening In America?

Op-ed by Conrad Black via The Epoch Times,

We have familiar experience of the phenomenon of what are clearly intolerable circumstances being tolerated if they worsened only gradually. Everyone has looked back on a grueling experience and thought that it could not have been endured had the individual known how unpleasant it would become. No matter how familiar anyone may be with the horrors of the Nazi regime, it remains to us inconceivable that the culture of Beethoven and Goethe could have committed such crimes.

The United States has now reached the point where the sequence of outrageous and unconstitutional measures that have occurred in the last six years would have been inconceivable six years ago.

It’s unimaginable that anyone who has ever been nominated for president by a serious American political party could be an intelligence asset for a foreign power. We now know that there has never been one scintilla of evidence remotely hinting that Donald Trump was guilty of any such offense, or that he had any inappropriate relations or even a particular regard for the government of Russia. Yet for over two years it was endlessly bandied about that Trump had been “groomed” by Russian agents like the Manchurian Candidate to debase the presidency of the United States into boot-licking subordination to the national interest of Russia. The former directors of the National and Central Intelligence Agencies, James Clapper and John Brennan, solemnly told national audiences that Trump was a Russian intelligence agent and was guilty of treason in favor of the Russians.

Both these senior officials on occasion allegedly lied to Congress but were never prosecuted. Former FBI Director James Comey, who improperly removed government property from his office, improperly leaked confidential information to the media, improperly presumed to decide that Hillary Clinton should not be prosecuted for destroying 33,000 emails that were under subpoena from Congress, signed a false affidavit in support of a FISA warrant to conduct illegal telephone intercepts on the Trump campaign, and supported the pretense that the infamous Steele dossier, which he knew to be a pastiche of lies and defamations, was authentic intelligence, indicating the guilt of Trump of unlawful collusion with the Russian government. The ranking Democrat on the House intelligence committee, Rep. Adam Schiff (D-Calif.), and other Democrats repeated ad nauseam that they had conclusive evidence of Trump’s guilt. They lied. The inspector general of the Justice Department recorded 17 separate instances of improper official behavior. There has been no prosecution of any of this.

In all of pre-Trump U.S. history, there had been two impeachment trials of presidents: Andrew Johnson in 1868 and Bill Clinton in 1998. Neither of them should have occurred and both failed, but in the last four years Trump was impeached twice, once for a telephone conversation with the president of Ukraine in which he asked if the Biden family and particularly the current president’s son Hunter Biden had committed illegalities in Ukraine. He did not direct the verdict; he did not ask for any incrimination of the Bidens. This was a completely inadequate pretext for impeaching a president and yet he was impeached, and on one count 49 senators including a former Republican presidential candidate, Mitt Romney, did vote Trump guilty, though he was, of course, acquitted. And at the end of his term, he was impeached again for having allegedly fomented an insurrection even though the FBI director had already testified that there was no evidence that Trump or his campaign organization or his administration were connected in any way to the trespass and the vandalism that occurred at the U.S. Capitol on Jan. 6, 2021, and Trump requested and offered extra security, but this was declined by House Speaker Nancy Pelosi and Washington mayor Muriel Bowser.

The various comprehensive accumulations of evidence about the behavior of Hunter Biden incite the strong inference that he has committed a number of illegalities and that the president repeatedly lied to the public about his own connections to his son’s activities. There is no evidence that U.S. official conduct was altered in respect of Ukraine, China, or other countries, in consideration for bribes paid to the Biden family. But there seems to be no doubt the current president and his family were engaged in improper activity that not only allegedly involves substantial lawbreaking by family members but also seems to have been suppressed rather than investigated by the FBI. The allegation that the FBI seems to have suggested to Facebook that the allegations against Hunter Biden were likely Russian disinformation and requested that they not publicize them would have been unthinkable six years ago. But it seems to have been assimilated by the American political community as a perfectly normal and acceptable occurrence.

It seems clear that in the 2020 presidential election, where Trump could have prevailed in the Electoral College if 50,000 votes had flipped in Pennsylvania and any two of Arizona, Georgia, and Wisconsin, that millions of ballots potentially passed through hands that could not be identified. All of this occurred in swing states where rules were changed ostensibly to facilitate voting during the pandemic. But in the case of a number of states, contrary to the Constitution, these changes were determined not by the state legislatures but by executive branches or state judiciaries. In every one of the 19 lawsuits launched to attack these questionable changes to voting and vote counting rules, the judiciary, including in the case of the Texas attorney general’s action against the swing states and supported by 18 other state attorneys general, the U.S. Supreme Court declined to hear any of these cases on their merits; they were disallowed for technical reasons, some of those quite spurious.

Now we have had, on the complaint of federal archivists, the intrusion and occupation for nine hours of the former president’s home on a warrant alleging just cause to believe that crimes have been committed involving the improper removal and retention of classified information. Trump had been collaborating with the archivists, possessed the power to act as he pleased with classified material when he was president, and this isn’t a classified material case anyway. He didn’t pack any of this himself as he left the White House, has not mislaid or misused any of this material, and 19 months have gone by since he left office. It’s a document-handling case. There’s no conceivable justification for such a sensational invasion in the absence of any plausible claim of significant wrongdoing—except that it’s a political tainting job against the former president, and the Presidential Records Act isn’t a criminal statute. This is just the Democrats transmuting a grumpy librarian’s complaint into the insinuation that the former president committed unimaginable crimes.

A disastrous and shaming flight from Afghanistan is described by President Joe Biden as “a triumphant success.” Dr. Anthony Fauci retires with dignity after doing terrible damage to the country with his nonsense about shutting schools, “droplets,” the ups and downs of masking, the “abolition of hand-shakes”—almost all of it now thoroughly discredited.

Six years ago, no one could have imagined that these outrages would have occurred, much less that they would be accepted by a bedraggled, degraded, demoralized America, its federal government in the hands of lawless and authoritarian myth-makers, applauded by the complicit national political media. Can this be America?

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Tyler Durden

Thu, 09/01/2022 – 00:00

via ZeroHedge News https://ift.tt/jmEvBQz Tyler Durden

After nearly seven years of Trumpamania, I have become immune to stories that Trump will be indicted. Yet, the most recent DOJ filing suggests that there is a roadmap to indict Trump for (among other charges) obstruction of the investigation.

In the past, I have considered Garland’s choice about whether to indict Trump for insurrection based on January 6. Seth Barrett Tillman and I wrote an article on this issue. But the Mar-A-Lago allegations are different. These charges concern conduct that arose after Trump left the White House, and there is no obvious constitutional defense (if Nixon v. GSA is on point).

Still, Merrick Garland faces a dilemma. If DOJ indicts Trump, then Trump may see the presidency as his (literal) get-out-of-jail free card. And the prosecution of Trump could galvanize his supporters, leading to his re-election. On January 20, 2025, Trump could order the Attorney General to dismiss the prosecution (assuming his AG gets confirmed). And, he could pardon himself. (Brian Kalt, please call your office.) Perversely, the decision to indict Trump could pave the way for Trump never being convicted of this offense.

And, of course, a self-pardon would not affect a conviction in Fulton County, Georgia. Though, I think the President could not be incarcerated during his time in office.

To indict or not to indict? That is the question.

The post To Indict Or Not To Indict? That Is the Question. appeared first on Reason.com.

from Latest https://ift.tt/Hpv6TqS

via IFTTT

After nearly seven years of Trumpamania, I have become immune to stories that Trump will be indicted. Yet, the most recent DOJ filing suggests that there is a roadmap to indict Trump for (among other charges) obstruction of the investigation.

In the past, I have considered Garland’s choice about whether to indict Trump for insurrection based on January 6. Seth Barrett Tillman and I wrote an article on this issue. But the Mar-A-Lago allegations are different. These charges concern conduct that arose after Trump left the White House, and there is no obvious constitutional defense (if Nixon v. GSA is on point).

Still, Merrick Garland faces a dilemma. If DOJ indicts Trump, then Trump may see the presidency as his (literal) get-out-of-jail free card. And the prosecution of Trump could galvanize his supporters, leading to his re-election. On January 20, 2025, Trump could order the Attorney General to dismiss the prosecution (assuming his AG gets confirmed). And, he could pardon himself. (Brian Kalt, please call your office.) Perversely, the decision to indict Trump could pave the way for Trump never being convicted of this offense.

And, of course, a self-pardon would not affect a conviction in Fulton County, Georgia. Though, I think the President could not be incarcerated during his time in office.

To indict or not to indict? That is the question.

The post To Indict Or Not To Indict? That Is the Question. appeared first on Reason.com.

from Latest https://ift.tt/Hpv6TqS

via IFTTT

These Are The Wealthiest Billionaires In Each US State In 2022

The U.S. is home to over a quarter of the world’s billionaires, representing about 720 of the roughly 2,700 that exist globally.

While the country has more billionaires than any other, the U.S. share of global billionaires has actually been shrinking in recent decades. In 2010, about 40% of the world’s billionaire population lived in America—and today, that number is closer to 27%.

But who is the richest billionaire in every American state in 2022? Visual Capitalist’s Aran Ali uses data from Forbes to find out.

The billionaires on this list have made their fortune in a wide range of industries, including tech, automobiles, asset management, and video games.

Jeff Bezos and Elon Musk have had their relative fortunes fluctuate in tandem with Amazon and Tesla stock prices in recent years. The volatility in share prices has meant they’ve each carried the title of the world’s wealthiest person at varying points.

Jeff Bezos previously had the top spot but now has a net worth of $162 billion. While he’s stepped down from the CEO role and has sold large amounts of Amazon stock, his ranking will likely still tie in closely to the company’s performance for the foreseeable future.

Elon Musk is the richest billionaire in Texas, however, he only recently became a resident of the state. His move is part of a broader migration trend occurring in the U.S. today, where California is experiencing a population decline for the first time ever. Last year, 68% of counties in California saw population declines, and data from the U.S. Census Bureau suggests many of these Americans opted for states like Florida and Texas.

Between 2019 to 2021, the South is the only region that saw positive net flows of over a million people, while the Northeast, Midwest, and West all saw declines.

Warren Buffett, the “Oracle of Omaha,” is the richest billionaire in Nebraska by a wide margin, with a net worth of $105 billion. Despite the stock market experiencing one of its worst starts to the year historically, Buffett’s net worth has been surprisingly steady.

This might be due to value assets rotating back into fashion in favor of growth and tech themes this year. Also, historically Buffett has been bullish in environments where fear and negative sentiment reflect through lower asset prices.

There are eight different women that hold the title of richest billionaire in their state.

Tamara Gustavson is Public Storage’s largest shareholder, with an 11% stake in the company, valued at $60 billion on the New York Stock Exchange. In addition, she acts as the director of the company and is the daughter of founder B. Wayne Hughes, who recently passed away last year. Incredibly, Public Storage operates more than 170 million square feet of real estate.

Abigail Johnson and Jacqueline Mars were featured on our infographic showing the richest women in the world last year. Johnson has served as CEO of top asset manager Fidelity, which her grandfather Edward Johnson founded. And Jacqueline Mars is part of the Mars family, which owns the world’s largest candy maker.

The U.S. wealth landscape is one of extremes. On one end, there are ample opportunities to earn substantial wealth, but on the other, wealth inequality and income disparity are higher than many other peer countries.

This productivity and hustle-oriented culture suggests that while there isn’t a billionaire in every state in 2022, it seems like it’s only a matter of time before the likes of Alabama, New Mexico, and North Dakota add a billionaire to their ranks.

Tyler Durden

Wed, 08/31/2022 – 23:40

via ZeroHedge News https://ift.tt/Ot9N6Ax Tyler Durden

Record Trade Deficit Hitting Korea Won Foreshadows More Weakness

By Ken McCallum, Bloomberg markets live reporter and commentator

The Korean won’s drop after the nation’s trade deficit widened even more than expected to a record suggests that bearishness toward the currency will stay intact for now.

Signs of Korea’s economic woes may help push the dollar-won convincingly above the psychological level of 1,350, which it’s been briefly breaching this week. Morgan Stanley analysts have said that a break above that level may pave the way for a move toward 1,370, while Korea Investment & Securities Co. sees a rise to 1,380 in the second half of the year, compared with around 1,348 today.

There’s a vicious cycle feel to the won’s weakness: Korea’s reliance on energy imports means that a stronger dollar may increase costs and fan more inflation, further undermining the won. Korea has the largest fuel and food deficit as a share of gross domestic product in Asia, according to Natixis (also, Korea’s share of net exports as a contributor to economic growth is the highest in the world at a mind-blowing 70% of GDP, which in turn is the 10th largest in the world).

And it’s not only the trade deficit that weighs on the won. Other negatives include a downturn in the semiconductor market, economic slowdown in a China–the biggest destination of Korean exports, and the Bank of Korea’s likely inability to match the Federal Reserve’s jumbo rate hikes due to concerns about the pain it will cause for households weighed down by massive debt.

Tyler Durden

Wed, 08/31/2022 – 23:20

via ZeroHedge News https://ift.tt/w0aE8I3 Tyler Durden

NASA’s Webb Telescope Captures Hypnotizing Swirls Of “Phantom Galaxy”

NASA’s $10 billion James Webb Space Telescope (JWST) has provided an even deeper look into the cosmos, revealing the clearest view of the Phantom Galaxy, more formally known as M74, located around 32 million light-years away from Earth.

“Webb’s sharp vision has revealed delicate filaments of gas and dust in the grandiose spiral arms of M74, which wind outwards from the center of the image. A lack of gas in the nuclear region also provides an unobscured view of the nuclear star cluster at the galaxy’s center,” NASA and the ESA wrote in a statement.

Combining data from the Hubble Space Telescope and ground-based observatories, both space agencies pieced together a crystal-clear view of the Phantom Galaxy.

The Phantom Galaxy has been a significant focus for astronomers studying the origin and structure of galactic spirals. The new spacecraft with infrared technology allows astronomers “to pinpoint star-forming regions in the galaxies, accurately measure the masses and ages of star clusters, and gain insights into the nature of the small grains of dust drifting in interstellar space,” NASA and ESA said.

“Now we have a broader (and even more beautiful!) understanding of the galaxy M74!

“These Hubble and NASAWebb views show the power of observing in different wavelengths. Hubble’s optical vision highlights older stars near the center and younger, bluer stars in the spiral arms,” NASA tweeted this week.

In July, NASA released the first images of JWST’s findings since the spacecraft was launched into deep space last December. Though still operational, JWST has already been struck by tiny meteoroids, causing significant uncorrectable damage to the craft’s infrared technology.

Tyler Durden

Wed, 08/31/2022 – 23:00

via ZeroHedge News https://ift.tt/lwmtUZz Tyler Durden

Biden’s IRS Auditor Army Will Disrupt Economic Recovery

Authored by Julio Gonzalez via RealClear Politics,

The Biden administration’s decision to recruit nearly 90,000 new IRS auditors could have a chilling effect on small businesses and economic growth, permanently impeding our nation’s ability to recover from its current economic malaise.

As part of the misleadingly titled “Inflation Reduction Act,” President Biden and his allies secured roughly $80 billion in new IRS funding to hire 87,000 auditors. This is bad news for the American economy.

One of the many ways that small businesses can succeed and help grow the economy is by taking advantage of tax credits and deductions which leave more money in the hands of owners to reinvest in their businesses and offer more competitive pay for their employees.

But with the looming threat of a veritable army of auditors being mobilized by the Biden administration, it is highly likely that many small businesses will decline to seek the benefits of those credits and deductions, lest they face the costly headache of aggressive audits from the IRS. In fact, my firm, Engineered Tax Services, specializes in working with businesses to understand and utilize those credits and deductions, and some of my firm’s small business clients have told me this is the case.

Business and financial experts are equally certain that Biden’s Auditor Army will target small businesses.

“There is no doubt that boosting IRS audit capabilities through a vast increase in the hiring of 87,000 new staff focused on this effort will hit small businesses the hardest,” said Karen Kerrigan, president and CEO of the Small Business and Entrepreneurship Council, in an interview with The Center Square. “The tax data shows that it is small businesses of moderate means, not ‘the wealthy,’ that are targeted most frequently.”

Basic math proves this will undoubtedly be the case with Biden’s new Auditor Army. Biden wants to unleash 87,000 additional IRS agents on the American people, but there are fewer than 800 billionaires and roughly 34,000 millionaires in the country. Even if each of them gets assigned a full-time, year-round personal auditor, that leaves 52,200 agents free to harass small business owners and everyday Americans.

Undergoing an audit is an incredibly serious and costly endeavor, regardless of the reason for the audit or the outcome, and this cost is a burden both on the business and the community in which it operates, a clear impediment to economic growth and prosperity. Even when auditors find no wrongdoing, the experience can be financially devastating for small business owners.

“Obviously, this will be a huge burden on many small business owners, who will be forced to endure lengthy audits and do not have the resources to hire expert lawyers or accountants,” Kerrigan explained.

“Some will be forced to bring in this expensive support, which means fewer resources to invest in their business, their workers and their communities…. Dealing with crushing inflation and the economic downturn is unbearable enough for small business owners, without having this type of threat hanging over their heads,” he continued.

The insult to the injury Biden’s Auditor Army will inflict on the American economy is that it comes at a time when many small businesses are already facing severe economic hardship, if not outright ruin.

A July survey by the small business network Alignable found that “45% of small businesses (SMBs) are halting their hiring, largely because they say they can’t afford to add staff.”

A different survey conducted by the same network, also in July, revealed that “47% of small business owners … say their businesses are at risk of closing by fall 2022, unless economic conditions improve significantly.”

That number is “up 12 percentage points from last summer, when only 35% were concerned about economic issues forcing them to shut down,” according to Alignable, and “SMBs in key industries face even bigger problems: 59% of retailers are at risk, along with 52% in construction, 51% in the automotive sector, and 50% of restaurant owners.”

Our small businesses are in crisis, and the last thing they need is an army of militarized bureaucrats going door to door carrying out audits, further crippling those businesses and the economic growth they generate.

Tyler Durden

Wed, 08/31/2022 – 22:40

via ZeroHedge News https://ift.tt/qYt06ZA Tyler Durden

“The Straw That breaks The Market’s Back”: The Fed Must Do $3.9 Trillion In QT To Control Inflation… Which It Can’t Possibly Do

Starting with first principles, there is one thing that almost all traders can agree on and it is that, sooner or later, the Fed tightening cycle will spark another financial crisis and market crash, something which we reminded readers in early 2022:

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

But while there is little disagreement on what the Fed’s endgame is, the big question is how we get there and what exactly will lead to the overtightening that crashes the economy, sparks a policy panic and bring another Fed overreaction in the opposite direction.

For much of the past 6 months, Wall Street was confident that it would be the Fed’s rate hikes which started in March from 0.0%, and have since crept up to 2.25-2.50%, and are expected to rise another 1.00%-1.25% before the Fed eases back on the breaks.

Incidentally, one of the reasons so many Wall Street professionals expected the Fed to pivot dovishly sooner rather than later, is that few expected the Fed would so aggressively seek to trigger then next recession, and to keep hiking until something did break. In fact, back in April SocGen quant Solomon Tadesse – who made waves on Wall Street trading desks four years ago, when he went against the consensus view, and in 2018 pinpointed the peak in Fed Funds at a lowly 2½% which turned out to be spot on – calculated that the Fed Funds rate won’t be able to climb above 1.0% before the Fed overtightens into restrictive territory, i.e., will have to ease (the explanation for his thinking is here).

Of course, 4 months later and 1.5% above the proposed 1.0% “redline”, Solomon’s math was clearly wrong. But was he wrong or did the SocGen quant merely underestimate the far greater weight that the Fed’s balance sheet, or QE (and thus QT) has on overall easing (and tightening) of financial conditions?

That is the topic Tadesse and his SocGen quant peers discuss in their latest Practical Quant Investor note, titled “Might QT be the straw that breaks the market’s back“, in which they note that in recent weeks, financial markets and monetary policy pronouncements seem too focused on the policy rate to deal with inflation containment. However, extending on what we said above, the SocGen quants note that “what has been unique in post-GFC monetary policy was the reliance on QE to induce the needed easing.” As they also note, in recent years it was not policy rate hikes – which were on an orderly course – that laid low financial conditions, leading to a surprise pivot in monetary policy in December of 2018, but rather the quietly accelerating QT. By the same token, Tadesse warns “it could be a ramp-up in QT, this time on a larger scale to erode a much larger balance sheet, that could surprise markets.” This is a prudent warning because three months after QT started at a pace of $47.5BN per month from June through August, starting Sept, the Fed will double the pace of Quantitative Tightening to $95Billion, draining twice as much liquidity from the market.

Before we delve deeper into the SocGen quant’s analysis, let’s first back up, and briefly discuss what happened in the post-June market meltup which as Tadasse puts it, until last week’s hiccup, “was a byproduct global markets had recently been on a bullish ascent, buoyed by hopes of an easing in inflation and thus a Fed pivot. Yet, central bank policy pronouncements and policymakers have been quick to warn that this expectation is premature.” Therefore, investors – SocGen summarizes – “face a historic dilemma: a choice between the two age-old investing creeds of ‘Don’t Fight the Fed’ versus ‘Don’t fight the Tape’.”

Global markets appear to be getting ahead of themselves. The rationale for market expectations of a quick reversal in monetary policy to easing relies on two premises: one, data interpretation, and the other historical trend projection. On data, the lower inflation print for the month of July can be interpreted as an indication of receding peak inflation. Aside from the paucity of a single data point, a close examination reveals that the weakening in the inflation print might be a symptom of some loosening of supply chain bottlenecks. While this would make the Fed’s job easier, it wouldn’t justify a near-term reversal of policy in the face of accelerated demand-driven inflation, part of it a catch-up in wages and service-related price adjustments. It can also be argued that the current stubbornly low unemployment rate could be viewed as fuel for inflation pressure, and thus calling for tightening, rather than providing respite from it. Even if inflation is assumed to have peaked, it would still take more tightening to break its hold. A long-accepted principle for containing inflation to raise rates by a larger margin than the prevailing inflation rate, and historically, it took a 20+ percent rate hike to break a peak of 15 percent inflation during the Volcker’s Fed of the early 80s.

Tadesse next hypothesizes that one of the reasons why markets have been so eager to assume a dovish pivot by the Fed is due to the central bank’s “Fed Put” Pavlovian instinct. However, due to the ongoing unexpected surge in inflation, he notes that

“policymaking has gone through a dramatic regime shift recently from one of ‘promoting growth’ on concerns of deflationary pressures to one of ‘containment of inflation’ at any cost, reminiscent of the ‘inflation-containment’ policies of the Volcker era.”

Helping to visualize this argument, the SocGen chart below shows the evolution of monetary policy over the last 60 years. As Tadesse notes, policy was driven by a need for ‘price stability’ during the inflationary periods of the 70s and early 80s when policy had a propensity to tighten rather than to ease. After the successful stamping out of inflation in the early 80s, monetary policy succumbed to fears of deflationary forces engendering chronic stagnation, which led to a propensity to ease monetary conditions rather than to tighten. But that regime seems to have changed for good now, with “unexpected” inflation raging and the Fed clearly pronouncing its monetary policy priority as containing inflation at any cost.

Thus, as we discussed extensively in recent weeks and culminating in “Even Goldman Can’t Believe It: “Did Powell Mean To Be So Dovish?” if the markets’ stubborn assumption to the contrary were to prove correct it could only result in an unsustainable easing of financial conditions, creating a risk of even more Fed overtightening that could rattle markets sooner or later. In fact, instead of expecting a Fed Put, the SocGen analyst writes that “one could argue that a market correction that could clear the policy channel from speculative-driven easing in financial conditions to a desirable tightening, might serve the long-term public interest.” Indeed, Minneapolis Fed president Neel Kashkari made it quite clear he was personally delighted with the market dump last Friday following Powell’s terse remarks. If only it wasn’t Kashkari (and his Fed pals) that made the bubble that is now deflating slowly but surely possible.

Moving on: after taking a brief tangent to look at the current drivers of inflation (supply-driven is slowing, while demand-driven inflation is accelerating, and cautioning that the stubbornly low unemployment rate could be viewed as fuelling inflationary pressure than providing a respite from it), Tadesse echoes something we have said all along, namely that “monetary policy provides little help for supply-driven inflationary pressures of the type arising from supply-chain disruptions.”

*POWELL: FED POLICIES CAN’T ADDRESS SUPPLY-SIDE CHALLENGES

bingo

— zerohedge (@zerohedge) March 2, 2022

Indeed, it was these “disruptions” that explain Policymakers’ early dismissal of the rising inflation as transitory and something that would resolve itself in time. It is only recently that official acknowledgement has been given to persistent demand-driven price pressures. Policymakers have been clear since then that the policy stand is one of inflation-containment and has expressed this stance in deeds by allowing a meltdown of several weeks in global markets that would ordinarily have triggered a Fed Put in the past. In short, the SocGen strategist writes, “policymakers are outwardly resolved to curb inflation, even if it comes with a risk of recession” and a market crash… however, once we do get a recession and a few hundred thousand lost jobs crushing the approval rating of democrats, watch how quickly Powell will change his tune after being bombarded with daily phone calls from the Liz Karens Warrens of Congress.

So what’s the Fed to do?

Well, in an earlier research note (which we addressed here), Tadesse argued that if monetary policy had followed a pro-growth impulse, as has been the case over the last four decades, the current tightening phase could have peaked with only 0.75-1pp of rate hikes, combined with a QT program to the tune of about $1.8tn. However, after the monetary policy regime shift to ‘inflation containment’, SocGen’s analysis points to a much larger amount of rate tightening, accompanied by a meaningful slash in the Fed balance sheet. The tightening phase would take an aggressive stance, with overall monetary policy tightening going beyond 900bp and the policy rate peaking at 450bp. More importantly, Tadesse’s analysis also shows that it would take implicit rate tightening of about 450bp from a QT that would slash $3.9 trillion from Fed balance sheet! The consequences for risk assets would be calamitous.

Here’s how the SocGen quant gets to these numbers: as a result of the unexpected surge in inflation, Tadesse writes that monetary policy making has gone through a regime shift, with Fed’s policy single-mindedly focused on inflation containment at any cost, resembling the monetary policy framework of the Volcker era in the 1970s and early 1980s, when the average MTE ratio was about 1.5x (left-hand chart below).

The problem – as Tadesse calculates – is that such aggressive monetary tightening with a focus solely on inflation containment, even at the cost of inducing recession, would require overall monetary tightening of about 11.6%. And since rates have already been tightened by 2.5% (with only a de minimis tightening via QT for now), another 9.25% of monetary tightening might be expected via policy rate hikes and an aggressive QT program. The policy rate could go up by as much as 4.5%, with the remainder coming from QT (right-hand chart above).

In practical terms, at a rate of 12bp per $100bn of QT (SocGen had previously calculated the price impact of QT), this amounts to a QT programme of about $3.9tn, roughly equivalent to the net growth in the Fed’s balance sheet during the pandemic (which would be logically symmetric).

An important caveat in the analysis is the presumption that current inflation levels resemble those of the late 1970s through the 1980s. As recent inflation prints are the highest in 40 years, this might be a reasonable assumption, particularly in reference to the rates seen in the early 1980s. In addition, in interpreting the results, there is an implicit assumption that the current inflation prints are persistent and all demand driven. However, earlier analysis has shown that the current inflation dynamics are driven both by some transitory supply-related disruptions and demand-driven price pressures. Should the supply bottlenecks ease over time, the degree of monetary tightening needed to contain inflation through demand destruction could turn out to be lower.

To visualize the tightening “blend” achievable through both rate hikes and QT, in the above-left chart Tadesse shows monetary policy frontiers (MPF) which are all the policy rate hike and QT combinations that could generate the ‘inflation-containing overall tightening’ of upwards of 9% and the ‘growth-conscious overall tightening’ discussed earlier, with the most likely outcomes of policy combinations identified with stars. Thus, an aggressive inflation-containing policy could mean additional policy rate hikes of up to 4.5% at peak and a further implicit rate tightening of 4.5% from QT (hence $3.9 trillion in total balance sheet reduction).

In conclusion, in a time when both markets and policymakers appear too focused on the policy rate to really deal with inflation containment, and given the substantial role of Quantitative Easing policies in inducing the needed post-Covid monetary easing, the reversal policies of QT would have an equally important, albeit non-symmetric impact on tightening.

SocGen’s analysis suggests that almost half of the required tightening could come from QT (about 450bp, accounting for $3.9 trillion in balance sheet shrinkage). Of course, from policy perspective, a lack of acknowledgement and clear communication of QT’s potential impacts may post the risk of overtightening. Furthermore, with markets expecting far less on the QT side, Tadesse now believes that “it could be the ramp-up in QT that could trigger the next fall in markets.” Appropriately enough, it comes just as the Fed’s rate of QT doubles from $47.5BN to $95BN per month.

To summarize, “it was arguably not policy rate hikes back in 2018 that laid low financial conditions, leading to a surprise pivot in monetary policy in December. It was rather gently accelerating QT in the background. In the same token, it could be a ramp-up in QT, this time on a larger scale to erode a much larger balance sheet, that may surprise markets.”

One final point: is there a snowball’s chance in hell that the Fed will do almost $4 trillion in QT? Of course not: as we explained on July 14, when we quoted from former NY Fed and current BofA iconic Fed analyst, Marc Cabana, the Fed will be forced to end QT prematurely (in no small part because BofA’s base case forecast is now for a US recession in 2023), and as such, “Fed QT that is stopped in Sept ’23 will result in $1tn less balance sheet reduction vs our prior estimates through end ’24. Over a similar period, early QT end would result in $780b less UST financing need + $350b of additional Fed UST demand.”

Cabana, is of course, correct: there is no way that the Fed will be able to do years of QT at a pace of ~$100BN per month to hit SocGen’s bogey without pushing the US into a full-blown depression (especially since the recession has already officially started). But it will take a few months of -300,000 payroll prints for markets to pivot again, and realize that when Powell vowed the Fed would not even think about think about pivoting in 2023, he was wrong… again… as usual.

The implication, however, is even more profound: if Tadesse is correct, and if indeed the Fed is unable to contain inflation unless it tightens by 9% in some combination of rates and QT, that means that the Fed will begin its next easing cycle with inflation well above the Fed’s target. Which incidentally, is how this game ends: with the Fed hiking its inflation target from 2% to 3% (or more).

Impossible, you say? Not at all: Europe is already setting the stage for what is not only not impossibly but inevitable.

And there go central bank inflation targets, first in Europe

French banking federation expects structural inflation to be at least 3%, Chairman Nicolas Thery says at business conference in Paris on Tuesday. Thery doesn’t believe in ECB’s structural inflation target: BBG

— zerohedge (@zerohedge) August 30, 2022

And yes, once the “inflation target” trial balloons start floating, readers better have all their net worth in the form of risky assets, gold, crypto and so on, because in the span of nano seconds, the entire asset market will reprice exponentially higher as the Fed finally admits it has to throw in the towel.

Tyler Durden

Wed, 08/31/2022 – 22:20

via ZeroHedge News https://ift.tt/KjaV3uz Tyler Durden

Heller explained that public carry could be restricted in so-called “sensitive” places. And Bruen reaffirmed that limitation. Just in case anyone forgot, Justice Kavanaugh’s concurrence block-quoted the worst passage from Justice Scalia’s majority opinion. Bruen did not have occasion to define a “sensitive” place. But one specific locale popped up during oral argument.

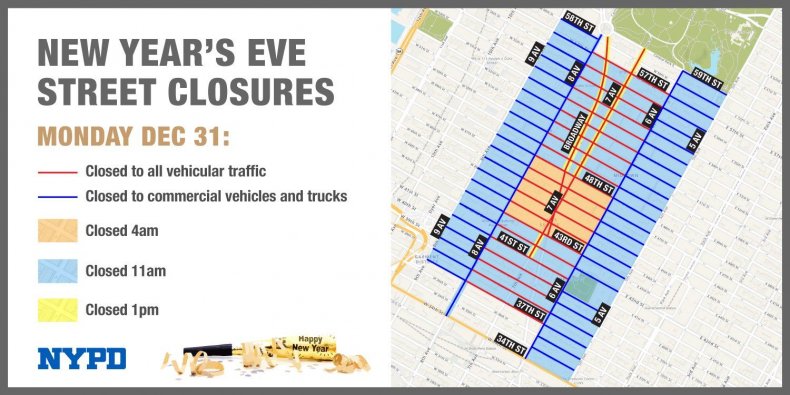

Justice Barrett asked about banning guns in Times Square on New Year’s Eve:

JUSTICE BARRETT: I mean, I guess it’s about the level of generality, all these questions that Justice Kagan’s asking you or that the Chief asked you, if — if you concede, as I think the historical record requires you to, that states did outlaw guns in sensitive places, can’t we just say Times Square on New Year’s Eve is a sensitive place? Because now we’ve seen, you know, people are on top of each other, we’ve — we’ve had experience with violence, so we’re making a judgment, it’s a sensitive place.

Paul Clement countered that restrictions on guns for New Year’s Eve would be more akin to a time-place-manner restriction:

MR. CLEMENT: So here — here’s what I would suggest, that the right way to think about limiting guns in Times Square on New Year’s Eve is not as a sensitive place but as a time, place, and manner restriction. And that might be a perfectly reasonable time, place, and manner restriction, but I don’t think that’s — the sensitive places doctrine, as I understood it, from — and, obviously, it’s a brief reference in the Heller decision, so I — I may not fully understand it — but I understood that those were certain places where they were just no weapon zones all of the time because of the nature of that institution. And I think it’s probably worth thinking about rallies and Times Square, that there may be restrictions, but they would be done —

Barbara Underwood, the New York Solicitor General, hinted that it would not be enough to ban guns only on New Year’s Eve, because the area is so congested.

MS. UNDERWOOD:Well, essentially . . . it would be very hard in the first instance . . . to specify in advance all the places that ought properly to be understood as sensitive. So it sounds like a very convenient alternative, but, for example, we were talking about Times Square on New Year’s Eve.

Times Square on — when the theater district — when — when — when commerce is in full swing, Times Square almost every night is shoulder-to-shoulder people. So then you — you end up having a very big difficulty in specifying what all the places are that have the characteristics that should make them sensitive.

To no one’s surprise, New York City has banned public carry in Times Square 24 hours a day, 365 days a year. And Times Square is not defined how I remember it–roughly a five-block sweep, bordered between Seventh Avenue and Broadway. Wikipedia confirms my understanding:

Times Square is a major commercial intersection, tourist destination, entertainment hub, and neighborhood in Midtown Manhattan, New York City. It is formed by the junction of Broadway, Seventh Avenue, and 42nd Street. Together with adjacent Duffy Square, Times Square is a bowtie-shaped space five blocks long between 42nd and 47th Streets.

(Soon enough, this Wikipedia page will be scrubbed.)

No, New York has selected the area from Ninth to Sixth Avenues, and from 53rd to 40th Streets–a total of three-dozen blocks.

The New York Times provides some more info:

In a statement, the police department said that Times Square was “not just a few streets with bright lights and video screens. It’s a unique, dense, complex space, and the area designated in our rules and the proposed bill reflects that reality.”

At a City Council hearing on Tuesday, Robert Barrows, the executive director of the police department’s legal operations and projects, said that the area would be marked by signs that warn pedestrians that the area is a “gun free zone.”

What about people who live in this area? They will be able to carry. And if you are in a vehicle, you can drive through the area, but your gun must be carried in a locked container and unloaded, and you cannot stop. (Sounds a lot like the rule at issue in New York State Rifle Pistol Association v. New York City). It will be very hard to get cross-town with those rules in effect.

We still do not know if the “campus” of New York University will be a “sensitive” place.

There will be litigation. Maybe the Supreme Court will still care about New York in a few years.

As best as I can tell, the City has mirrored the closings for–you guessed it!–New Year’s Eve, though the gun boundary stops at 51st Street rather than 59th Street (Central Park South). For those who care, Trump Tower (on 57th Street) is outside of Times Square.

It’s like T.G.I. McScratchy’s Goodtime Foodrinkery, where every night is New Year’s Eve!

I grew up in New York City, but never once went to Times Square for the ball drop. That was something only tourists did–much like going to the top of the Empire State Building (still never been!). However, I was in Times Square on December 31, 2013. The American Association of Law Schools held the annual meeting at the Midtown Hilton. But the Marriott Marquis offered a member rate on New Year’s Eve! I couldn’t believe it, so I booked it. The window in my room offered a very obstructed view of Broadway. And no, you couldn’t wait in the lobby bar. All those seats sold for a premium. But around 11:45, I went outside and stood on the street. I couldn’t quite see the ball drop, but I got the experience. Then I quickly rushed back into my warm hotel room. Fun fact: that evening, Circuit Justice Sotomayor issued an emergency stay on the shadow docket to protect the Little Sisters of the Poor from the contraceptive mandate. However, Sotomayor did not issue an emergency stay in the Utah same-sex marriage litigation. There was a flurry of activity that night! And at midnight, Sotomayor dropped the ball! I wrote all about the evening here, and in my second book Unraveled.

The post Where is Times Square? appeared first on Reason.com.

from Latest https://ift.tt/zNEYdgp

via IFTTT