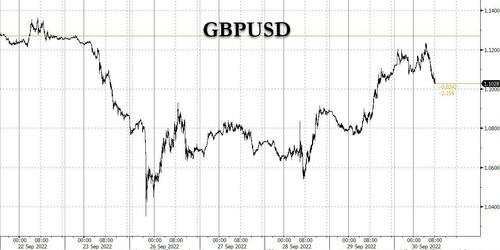

If yesterday markets made little sense, when the dollar and yields slumped yet stocks and other risk assets tumbled alongside them in a puzzling reversal of traditional risk relationships (a move which was likely precipitated by the plunge in AAPL and KMX), today things are a bit more logical with the dollar initially extending its slide helping futures rise to session highs just below 3,700, before the dollar surged just after 5am as sterling tumbled after Bloomberg reported that Prime Minister Liz Truss’s government signaled it was sticking with its plan for tax cuts after a meeting with the UK’s fiscal watchdog, dashing market expectations that a policy U-turn might be imminent which has pushed cable briefly above 1.12 overnight, wiping out a week’s worth of losses. As a result, after rising as much as 0.8%, S&P futures were flat, up just 0.1%, the same as Nasdaq futures. Government bonds rallied across Europe and the US, as the dollar strengthened after reversing its earlier loss.

In premarket trading, Nike shares fall 10% after the sportswear giant cut its margin outlook for the year while reporting surging inventory, fueling worries over consumers’ ability to spend as inflation takes a toll. Micron shares rose 3% in premarket trading, after analysts said the ongoing inventory correction was only a short-term hurdle and that the bottom is near, a potential relief for semiconductor stocks that have taken a beating this year. Amylyx Pharmaceuticals’s (AMLX US) shares soared as much as 13% in US premarket trading after winning FDA approval for its Relyvrio drug, for the treatment of amyotrophic lateral sclerosis (ALS) in adults. Analysts said they expected the drug to see a strong launch given demand from patients. Xos jumped 6.3% in extended trading after delivering 13 battery-electric vehicles to FedEx.

Thursday’s bruising session took the S&P 500 down 2% to the lowest in almost two years and the Nasdaq 100 tumbling almost 4%. The S&P 500 Index has dropped on seven of the past 8 days, and is headed for its third straight quarter of losses for the first time since 2008-2009 and the Nasdaq 100 Stock Index for the first time in 20 years. Fears of global recession are growing by the day as the threat of higher rates saps growth and as the Fed confirms with every speech that not even a recession will stop it. The case of the UK shows how faultlines between government and central bank policy on tackling inflation can erupt into a crisis. Hopes evaporated that the British government would succumb to pressure to back down from tax cuts that brought the pound to the edge of dollar parity.

“Today, everything is just oversold so you are seeing a rebound,” said Esty Dwek, chief investment officer at Flowbank SA. “We are closer to bottoms and sentiment is so negative the downside is becoming more limited.”

Elsewhere, Global equity funds garnered inflows of $7.6 billion in the week to Sept. 28, according to data compiled by EPFR Global. Bonds had $13.7 billion of outflows in the week, while $8.9 billion flowed into US stocks, the data showed.

In Europe, the Stoxx 50 rose 0.9%. Real estate, energy and retailers are the strongest-performing sectors. Here are some of the biggest European movers today:

- Krones shares rose as much as 2.7% to their highest intra-day level since Feb. 2022, after HSBC increased the German machinery and equipment company’s price target to EU102

- Clariant shares rally by the most intraday since mid-May after Credit Suisse raises to outperform, partly as it expects Clariant’s new management team to boost performance

- ABN Amro jumped as much as 6.3% after Goldman Sachs raised the stock to buy from neutral, citing its gearing toward higher interest rates, increasing estimates on net interest income

- Zealand Pharma rise as much as 35%, the most on record, after the company announced positive data from its phase 3 trial of glepaglutide to treat patients with short bowel syndrome

- Sinch shares rise as much as 24% after SoftBank sold its entire stake in Sinch AB following a share price collapse of more than 90% in the Swedish cloud-based platform provider

- Adidas and Puma drop as their US peer Nike slumped in late trading Thursday after it said inventory buildup forced it to push through margin-busting discounts

- Hurricane Energy shares drop as much as 5.6% after 1H earnings; Canaccord Genuity notes the results did not surprise, and flags lack of regulatory reassurance on gas-management approvals

- Fingerprint Cards shares drop as much as 17% after saying it is raising fresh capital in order to strengthen the balance sheet and to address a forecasted covenant breach

Earlier in the session, Asian stocks fell again, putting the regional benchmark on course for its worst monthly performance since 2008, as a selloff spurred by concerns over higher interest rates and a global recession deepened. The MSCI Asia Pacific Index slid 0.5% after earlier falling as much as 1% on Friday. Still down over 12% this month, the gauge has trailed global peers and is set to cap a seventh straight week of declines. That matches its losing streak from September 2015, which was the longest since 2011. Equities in Japan, which has the highest weight in the Asia index, were among the biggest losers on Friday, with the Topix falling 1.8%. Consumer discretionary and industrials were the worst sectors, while Chinese tech shares listed in Hong Kong also fell. READ: China Shares Plunge to Lowest Valuation on Record in Hong Kong Global funds have pulled almost $10 billion from Asian emerging-market stocks excluding China this month, as the dollar and Treasury yields climbed after Federal Reserve officials ramped up their rate-hike rhetoric. Taiwan’s tech-heavy market has suffered the bulk of the outflow from Asia. Its regulators tightened short selling rules as shares extended their slide.

“I think emerging markets as a whole are still going to have a pretty difficult six months until the Fed rate peaks,” Louis Lau, a fund manager at Brandes Investment Partners, said in an interview with Bloomberg TV. How much damage is a strong dollar causing? That’s the theme of this week’s MLIV Pulse survey. It’s brief and we don’t collect your name or any contact information. Please click here to share your views. The turmoil in the UK has been another source of market volatility for Asia investors, who continue to grapple with the fallout from strict lockdowns in China, the region’s biggest economy. “There’s been some correlation (between risk assets and sterling) recently,” said Takeo Kamai, head of execution services at CLSA. Overall, “the theme hasn’t changed. The scenario that the Fed will cut rates next year is breaking down. I think we could see further downside in stock prices towards November,” he said. Stocks in India gained after the central bank raised the benchmark rate by an expected 50 basis points. The MSCI Asia Pacific Index is down 4% this week and on course for its lowest close since April 2020

Japanese equities extended declines on Friday as a global market rout deepened, capping its worst month since the onset of the pandemic in 2020. The Topix Index fell 1.8% to 1,835.94 as of market close Tokyo time, taking declines in September to 6.5%. The Nikkei declined 1.8% to 25,937.21. Toyota Motor Corp. contributed the most to the Topix Index decline, decreasing 4.2%. Out of 2,169 stocks in the index, 299 rose and 1,823 fell, while 47 were unchanged. Federal Reserve officials reiterated Thursday that they will keep raising interest rates to rein in high inflation. “There are concerns that the economy will slow from further rate hikes while inflation doesn’t stop,” said Kenji Ueno, a portfolio manager at Sompo Asset Management.

In Australia, the S&P/ASX 200 index fell 1.2% to close at 6,474.20, dragged by banks and industrials, after another plunge on Wall Street as the prospect of higher interest rates and turmoil in Europe stoked fears of global recession. The benchmark notched its third-straight week of losses. In New Zealand, the S&P/NZX 50 index fell 1.2% to 11,065.71

Stocks in India outperformed Asian peers after the Reserve Bank of India raised borrowing costs and exuded confidence to tackle inflation without any major impact to its growth projections. The S&P BSE Sensex added 1.8% to 57,426.92, while the NSE Nifty 50 Index rose by 1.6% as the indexes posted their biggest single-day jump since Aug. 30. Despite the rally, the key gauges fell more than 1% each for the week and over 3% for the month, their biggest decline since June. India’s central bank raised its repurchase rate by 50 basis points to 5.90%, matching the expectations of most economists. The RBI trimmed the economic growth outlook for the financial year ending March to 7% while retaining it 6.7% forecast for inflation. The increase in the benchmark interest rate “mainly supports stocks of financial companies, which have been seeing strong credit growth,” said Prashanth Tapse, an analyst at Mehta Securities.

In FX, the Bloomberg Dollar Spot Index rebounded after sliding initially, as cable tumbled when it emerged that Liz Truss is not backtracking on its massive fiscal easing. Iniitlally, the pound advanced a fourth day, to briefly trade above $1.12, fully reversing the moves since last Friday, however it then tumbled, wiping out all gains after Prime Minister Liz Truss’s government signaled it’s sticking with its plan for tax cuts after a meeting with the UK’s fiscal watchdog, dashing market expectations that a policy U-turn might be imminent. Notable data: U.K. 2Q final GDP rises 0.2% q/q versus preliminary -0.1%. The Aussie and kiwi crept higher, but are still set for their biggest monthly declines since April as rising Fed interest rates and fears of a global economic slowdown sap demand for risk assets

In rates, Treasuries advanced, 10-year yield dropping 8bps while bunds 10-year yield drops 6bps to 2.11%. Treasury 10-year yields around 3.685%, richer by 10bp on the day — largest moves seen in UK front-end where 2-year yields are richer by 25bp on the day as BOE tightening premium fades out of interest-rate swaps. Short-end UK bonds surged amid political pressure on the government to water down some of its budget proposals, while the pound regained its budget-shock losses. US session focus is on PCE data and host of Federal Reserve speakers while month end may add some support into long end of the curve. Long end of the Treasuries curve may find additional month-end related buying support over the session; Bloomberg index projects 0.07yr Treasury extension for October. Gilts rallied, with short-end bonds leading gains as traders trimmed BOE tightening bets amid political pressure on the government to water down some of its budget proposals. Meanwhile in Japan, JGBs gained after the BOJ boosted purchases for maturities covering the benchmark 10-year zone. The Bank of Japan will buy more bonds with maturities of at least five years in the October-December period, according to a statement from the central bank

In commodities, WTI trades within Thursday’s range, adding 1.3% to near $82.26. Spot gold rises roughly $10 to trade near $1,671/oz.

Bitcoin is essentially unchanged and in very tight ranges of circa. USD 400 and as such well within the week’s existing parameters

Looking to the day ahead now, and data releases include the flash Euro Area CPI release for September, as well as the Euro Area unemployment rate for August and German unemployment for September. In the US, we’ll also get August data on personal income and personal spending, the MNI Chicago PMI for September, and the University of Michigan’s final consumer sentiment index for September. Finally, central bank speakers include Fed Vice Chair Brainard, the Fed’s Barkin, Bowman and Williams, as well as the ECB’s Schnabel, Elderson and Visco.

Market Snapshot

- S&P 500 futures up 0.9% to 3,686.00

- STOXX Europe 600 up 1.3% to 387.83

- MXAP down 0.5% to 139.25

- MXAPJ little changed at 453.72

- Nikkei down 1.8% to 25,937.21

- Topix down 1.8% to 1,835.94

- Hang Seng Index up 0.3% to 17,222.83

- Shanghai Composite down 0.6% to 3,024.39

- Sensex up 2.0% to 57,539.66

- Australia S&P/ASX 200 down 1.2% to 6,474.20

- Kospi down 0.7% to 2,155.49

- Brent Futures up 1.2% to $89.55/bbl

- Gold spot up 0.7% to $1,671.56

- U.S. Dollar Index down 0.52% to 111.67

- German 10Y yield little changed at 2.10%

- Euro up 0.3% to $0.9840

Top Overnight News from Bloomberg

- Prime Minister Liz Truss is under pressure to cut spending on the same scale as George Osborne’s infamous austerity drive of 2010 in order to stabilize the UK public finances and win back the confidence of investors

- Prime Minister Liz Truss and Chancellor of the Exchequer Kwasi Kwarteng are holding talks Friday with the UK government’s fiscal watchdog, amid intense criticism over their unfunded tax cuts that roiled markets

- A dash for cash among sterling investors after market turmoil sparked by pension fund margin calls is coming at a bad time, according to an M&G Investments executive

- The ECB shouldn’t let concerns about its profitability obstruct decision-making over monetary policy, according to Governing Council member Gediminas Simkus

- The SNB trimmed its foreign-exchange portfolio in the second quarter as the franc gyrated against the euro before rising above parity for the first time since 2015. The central bank sold 5 million francs ($5.1 million) worth of foreign currencies in the three months through June

- Norway’s central bank will increase its purchases of foreign currency to 4.3 billion kroner ($400 million) a day in October from 3.5 billion in September as it deposits energy revenues into the $1.1 trillion sovereign wealth fund.

- Japan’s factory output expanded by 2.7% in August from July, according to the economy ministry Friday, beating analysts’ 0.2% forecast. The output of semiconductor and flat-panel making equipment hit its highest level in data going back to 2003, as the effect of lockdowns in China abated

- Japanese Prime Minister Fumio Kishida instructed the government Friday to come up with an economic stimulus package by the end of October to help mitigate the impact of inflation, as economists warned against over-sized spending

- China’s factory activity continued to struggle in September, while services slowed, as the country’s economic recovery was challenged by lockdowns in major cities and an ongoing property market downturn. The official manufacturing purchasing managers index rose to 50.1 from 49.4 in August

- An organization formed by China’s biggest foreign- exchange traders asked banks to trade the currency at levels closer to the central bank’s fixing at the market open, according to people familiar with the matter

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly lower after the negative performance across global peers amid inflationary headwinds and with risk appetite subdued heading quarter-end, while the region also digested mixed Chinese PMI data. ASX 200 declined amid weakness across most sectors and with tech the notable underperformer after the recent upside in yields and with Meta the latest major industry player to announce a hiring freeze. Nikkei 225 was pressured and fell below the 26,000 level with better-than-expected Industrial Production and Retail Sales data releases overshadowed by the broad risk aversion. Hang Seng and Shanghai Comp were indecisive after the PBoC conducted its largest weekly cash injection in more than 32 months ahead of the week-long closure in the mainland, while participants also digested mixed PMI data in which Official Manufacturing PMI topped forecasts with a surprise return to expansion, but Non-Manufacturing and Composite PMIs slowed and Caixin Manufacturing PMI printed at a wider contraction. NIFTY eventually notched mild gains in the aftermath of the RBI rate decision in which it hiked the Repurchase Rate by 50bps to 5.90% as expected via 5-1 split and with the central bank refraining from any major hawkish surprises.

Top Asian News

- Japan’s Chief Cabinet Secretary Matsuno said they want to compile an extra budget swiftly after the economic package in late October, while they will consider further support for hard-hit consumers and businesses in view of higher energy and food prices, as well as consider steps to promote wage hikes, according to Reuters.

- Chinese Finance Ministry is to offer a tax refund for people who sell their homes and repurchases new ones by the end of 2023; additionally, China has told banks to provide USD 85bln in property funding by the end of the year, according to Bloomberg.

- Chinese NBS Manufacturing PMI (Sep) 50.1 vs. Exp. 49.6 (Prev. 49.4); Non-Manufacturing PMI (Sep) 50.6 vs Exp. 52.4 (Prev. 52.6)

- Chinese Composite PMI (Sep) 50.9 (Prev. 51.7)

- Chinese Caixin Manufacturing PMI Final (Sep) 48.1 vs. Exp. 49.5 (Prev. 49.5)

- Japanese Industrial Production MM SA (Aug P) 2.7% vs. Exp. 0.2% (Prev. 0.8%); Retail Sales YY (Aug) 4.1% vs. Exp. 2.8% (Prev. 2.4%)

European equities are attempting to claw back some of yesterday’s downside on quarter and month end. Sectors are firmer across the board with Real Estate outperforming peers in what has been a tough week for the UK property market. Stateside, futures are also attempting to recover from yesterday’s losses which saw a tough session for the tech sector after Apple shed the best part of 5%.

Top European News

- UK OBR Chair Hughes says a statement will be released today after the meeting with UK PM Truss and Chancellor Kwarteng. On this, the UK Treasury has not sought to accelerate watchdog’s economic forecast, according to Bloomberg. Reminder, UK PM Truss to conduct emergency talks with the OBR on Friday after failing to calm markets, according to the Guardian.

- UK cross-party MPs in the Treasury Select Committee called for Chancellor Kwarteng to release a full economic forecast from the OBR by end of October, according to Sky News.

- UK PM Truss has confirmed she will attend next week’s European Political Community summit, via BBC.

- Reports that technical level discussions between the UK and EU could resume as soon as next week, via BBC’s Parker; writing, that there has been a ‘warmer’ tone in recent weeks, some believe pressure from the US on the UK has had influence.

- German VDMA, survey of members: majority expect nominal sales growth in 2022 and 2023.

FX

- GBP’s revival has continued ahead of a meeting between PM Truss and the OBR, with a statement expected, a move that has taken Cable above 1.12 but shy of mini-Budget levels.

- USD is firmer overall but continues to retreat from YTD peaks, though the DXY is seemingly drawn to the 112.00 area.

- Yuan derived further, fleeting, support from reports the FX body has asked banks to trade closer to the onshore fixing.

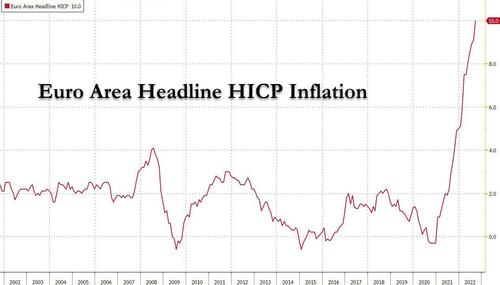

- Elsewhere, FX peers are under modest pressure but more contained vs USD; EUR unfased by a record EZ flash CPI print of 10.0%.

Fixed Income

- Benchmarks bid but modestly off best levels with Bunds leading the charge, but well within recent ranges, amid potential month/quarter-end influence.

- Gilts lifted, but the 10yr yield remains above 4.0% ahead of the OBR statement.

- Stateside, USTs are equally buoyed ahead of a packed PM agenda include PCE Price Index and Fed speak.

Commodities

- The broader commodity market is benefitting from a pullback in the USD coupled with a broader risk appetite.

- Metals are buoyed by the recent pullback in the Dollar with spot gold edging above its 10 DMA (USD 1,656.72/oz) and towards the USD 1,680/oz mark which coincides with the yellow metal’s 21DMA (USD 1,680.56/oz) and 200WMA (USD 1,680.20/oz).

- Base metals are also firmer across the board with 3M LME copper back above the USD 7,500/t mark, whilst nickel and aluminium outperform on the exchange.

Central Banks

- China loosened FX restrictions in response to the Fed rate hike and the yuan’s fall over the past week, according to people familiar with the matter cited by FT.

- China’s FX body is reportedly asking banks to trade the Yuan closer to the PBoC fixing, according to Bloomberg.

- PBoC injected CNY 128bln via 7-day reverse repos with the rate kept at 2.00% and injected CNY 58bln via 14-day reverse repos with the rate kept at 2.15% for a CNY 184bln net daily injection and a net CNY 868bln weekly injection.

- RBI hiked Repurchase Rate by 50bps to 5.90%, as expected, via 5-1 vote and the Standing Deposit Facility was adjusted to 5.65%. RBI Governor Das said MPC is to remain focused on the withdrawal of accommodation and that the persistence of high inflation necessitates further calibrated withdrawal of monetary accommodation. However, Das noted that the Indian economy continues to be resilient with economic activity stable and overall monetary and liquidity conditions still remain accommodative, while Real GDP growth forecast for 2022/23 was revised lower to 7.0% from 7.2% and 2022/23 CPI was seen at 6.7%.

- RBI is reportedly encouraging state-run refiners to reduce USD buying in the spot market; asking to lean on USD 9bln credit line instead, according to Reuters sources.

- BoE was reportedly warned about a looming catastrophe in the pensions sector within the next 5 years before it was forced to intervene to prevent a market collapse, according to The Telegraph.

- Fed’s Daly (2024 voter) said a downshift in economic activity and labour is needed to bring down inflation and additional rate increases are necessary and appropriate. Daly also stated that a myriad of risks narrows the path to a smooth landing but does not close it, while she added they have gotten rates to neutral and expect to raise rates further in coming meetings and early next year.

- Norges Bank will purchase FX equivalent to NOK 4.3bln/day in October (3.5bln in September); reflecting an increase in projected NOK revenues from petroleum activity.

Geopolitics

- Russian President Putin signed decrees recognising occupied Ukrainian regions of Kherson and Zaporizhzhia as independent territories which is an intermediate step before the regions are formally incorporated into Russia, according to Reuters.

- ** Russia’s Kremlin says strikes against the new territories incorporated into Russia will be considered an act of aggression against Russia**; says Ukraine has shown no willingness to negotiate, via Reuters.

- Russia’s Spy Chief says they have material which show a Western role in Nord Stream incidents, via Ifx.

- Armenia’s Foreign Ministry says their Ministers and Azerbaijani counterparts will meet in Geneva on October 2nd, via AJA Breaking.

US Event Calendar

- 08:30: Aug. Personal Spending, est. 0.2%, prior 0.1%

- Aug. Real Personal Spending, est. 0.1%, prior 0.2%

- Aug. Personal Income, est. 0.3%, prior 0.2%

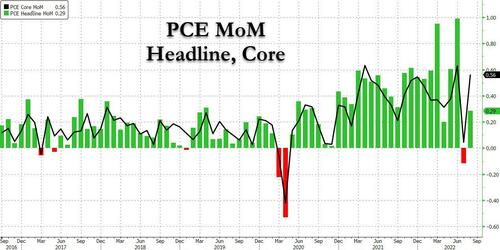

- Aug. PCE Deflator MoM, est. 0.1%, prior -0.1%

- Aug. PCE Core Deflator MoM, est. 0.5%, prior 0.1%

- Aug. PCE Core Deflator YoY, est. 4.7%, prior 4.6%

- Aug. PCE Deflator YoY, est. 6.0%, prior 6.3%

- 09:45: Sept. MNI Chicago PMI, est. 51.8, prior 52.2

- 10:00: Sept. U. of Mich. Current Conditions, est. 58.9, prior 58.9

- U. of Mich. Sentiment, est. 59.5, prior 59.5

- U. of Mich. Expectations, est. 59.9, prior 59.9

- U. of Mich. 1 Yr Inflation, est. 4.6%, prior 4.6%; 5-10 Yr Inflation, est. 2.8%, prior 2.8%

Central Bank Speakers

- 08:30: Fed’s Barkin Speaks at Chamber of Commerce Event

- 09:00: Fed’s Brainard Speaks at Fed Conference on Financial Stability

- 11:00: Fed’s Bowman Discusses Large Bank Supervision

- 12:30: Fed’s Barkin Discusses the Drivers of Inflation

- 16:15: Williams Speaks at Fed Conference on Financial Stability

DB’s Jim Reid concludes the overnight wrap

As we arrive at the end of a tumultuous month in financial markets, there’s been little sign of respite for investors over the last 24 hours, with the S&P 500 (-2.11%) reversing the previous day’s gains to close at a 21-month low. There were a number of factors behind the latest selloff, but fears of further rate hikes were prominent after the US weekly initial jobless claims showed that the labour market was still in decent shape, whilst the PCE inflation readings for Q2 were revised higher as well. That came alongside fresh signals of inflationary pressures in Europe, where German inflation in September moved into double-digits for the first time in over 70 years. Thanks to some hawkish rhetoric from central bank officials on top of that, the result was that the synchronised selloff for equities and bonds continued. In fact, barring a massive turnaround today, both the S&P 500 and the STOXX 600 are on course for their third consecutive quarterly decline, which is the first time that’s happened to either index since the financial crisis.

We’ll come to some of that below, but here in the UK there were signs that the market turmoil was beginning to stabilise slightly relative to earlier in the week. For instance, sterling (+2.09%) strengthened against the US Dollar for a third consecutive session, moving back above $1.10 for the first time since last Friday when the mini-budget was announced, and at a couple of points overnight was very briefly trading above $1.12. Indeed, it was the strongest-performing G10 currency on the day, so this wasn’t simply a case of dollar weakness. In the meantime, investors moved again to lower the chances of an emergency inter-meeting hike from the Bank of England, instead looking ahead to the next scheduled MPC meeting on November 3. That followed a speech from BoE Chief Economist Pill, in which he said “it is hard to avoid the conclusion that the fiscal easing announced last week will prompt a significant and necessary monetary policy response in November.”

However, gilts continued to struggle yesterday following the massive Wednesday rally after the BoE’s intervention. Yields on 10yr gilts were up by +13.0bps by the close, a larger increase than for German bunds (+6.4bps) or French OATs (+8.0bps). Furthermore, the spread on the UK’s 5yr credit default swaps closed at its highest level since 2013, so there are still plenty of signs of investor jitters. That came as the government showed no signs of U-turning on their programme of tax cuts, with Prime Minister Truss saying “I’m very clear the government has done the right thing”. It’s also worth noting that one factor seen as supporting sterling overnight was growing speculation that Truss might come under political pressure to reverse course on the fiscal announcements, particularly after a YouGov poll gave the opposition Labour Party a 33-point lead, which is its largest in any poll since the late-1990s. We also heard from the Conservative chair of the Treasury Select Committee, who tweeted that Chancellor Kwarteng should bring forward the November 23 statement on his medium-term fiscal plan and publish the independent OBR forecast as soon as possible.

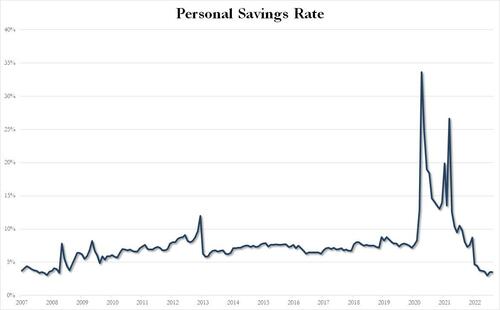

Away from the UK, the broader selloff in financial markets resumed yesterday as investors priced in a more hawkish response from central banks over the months ahead. In the US, that followed a fresh round of data that was collectively seen as offering the Fed more space to keep hiking rates. First, the weekly initial jobless claims fell to a 5-month low of 193k over the week ending September 24. That was beneath the 215k reading expected, and the previous week was also revised down by -4k. Nor was this just a blip either, as the 4-week moving average is now at its lowest level since late May as well. In the meantime, we had an upward revision to core PCE in Q2, taking the rate up by three-tenths to an annualised +4.7%.

Those data releases came alongside some pretty hawkish Fed rhetoric, with Cleveland Fed President Mester saying that a recession wouldn’t stop the Fed from raising rates. And in turn, that led markets to price in a more aggressive Fed reaction, with the terminal rate expected in March 2023 up by +3.0bps on the day. Incidentally, we saw yet further signs that the Fed’s tightening was having an effect on the real economy, with Freddie Mac’s mortgage market survey showing that the average 30-year fixed rate had risen to 6.70%, which is their highest level since 2007. The more hawkish developments were reflected in US Treasury yields too, particularly at the front end, with yields on 2yr Treasuries up +5.8bps to 4.19%, and those on 10yr Treasuries up +5.4bps to 3.79%. Overnight in Asia, yields on the 10yr USTs are fairly stable as we go press, seeing a small +0.3bps rise, whilst those on 2yr Treasuries are up +1.8bps to 4.21%.

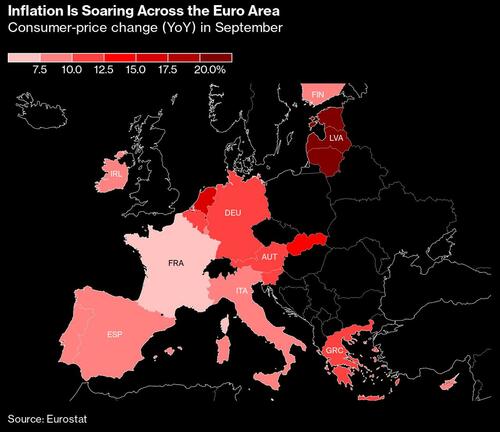

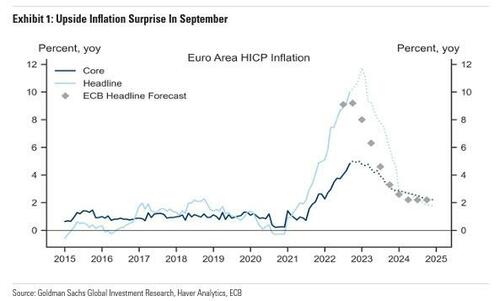

Europe got a fresh reminder about inflation as well yesterday, after the German CPI release for September came in well above expectations. Using the EU-harmonised measure, inflation rose to +10.9% (vs. +10.2% expected), which marks the first time since 1951 that German inflation has been running in double-digits. Earlier in the day, the German government separately announced that they’d be borrowing another €200bn to cap gas prices, with the previously planned consumer levy not going ahead. Looking forward, it’ll be worth looking out for the flash CPI release for the entire Euro Area today at 10am London time, where the consensus is expecting we’ll see the highest inflation since the formation of the single currency. That would keep the pressure on the ECB, and markets are continuing to price in another 75bps hike as the most likely outcome at the October meeting.

With investors digesting the prospect of continued hawkishness from central banks, equities lost further ground over yesterday’s session. The S&P 500 fell -2.11%, meaning the index is now down by nearly a quarter (-24.10%) since its closing peak in early January. The declines were incredibly broad-based across sectors, but interest-sensitive tech stocks struggled in particular, with the NASDAQ (-2.84%) and the FANG+ index (-3.38%) seeing even larger losses. Those heightened levels of volatility were also reflected in the VIX index (+1.7pts), which closed at 31.8pts. For European equities it was much the same story, with the STOXX 600 (-1.67%) closing at a 22-month low. Adding to the tech woes, Meta (-3.67%) joined the growing list of firms announcing a hiring freeze, with the tech giant also issuing a warning of potential restructuring, so it’ll be important to see if this is echoed more broadly and what this means for the labour market. In overnight trading, equity futures are pointing to further losses today, with those on the S&P 500 (-0.25%) and NASDAQ 100 (-0.27%) both moving lower.

As we arrive at the final day of the month, Asian equities are similarly retreating this morning, putting a number of indices on course for their worst monthly performance in years. For instance, the Nikkei is currently on track for its worst month since March 2020, and the Hang Seng is on track for its worst month since September 2011. In terms of today, the Nikkei (-1.67%) is leading losses in the region with the Shanghai Composite (-0.21%), the CSI (-0.14%), the Kospi (-0.11%) and the Hang Seng (-0.07%) following after that overnight sell-off on Wall Street.

One source of better news came from the Chinese PMIs, with the official manufacturing PMI unexpectedly in positive territory in September with a 50.1 reading (vs. 49.7 expected), which is up from a contractionary 49.4 in August. The composite PMI was also in positive territory with a 50.9 reading. However, the Caixin manufacturing PMI unexpectedly deteriorated further to 48.1 in September, so not every indicator was positive. In the meantime, Japanese data showed that industrial production growth came in above expectations with a +2.7% reading (vs. +0.2% expected), as did retail sales with growth of +1.4% (vs. +0.2% expected).

There wasn’t much in the way of other data yesterday. However, the European Commission’s economic sentiment indicator for the Euro Area fell for a 7th consecutive month to 93.7 in September (vs. 95.0 expected).

To the day ahead now, and data releases include the flash Euro Area CPI release for September, as well as the Euro Area unemployment rate for August and German unemployment for September. In the US, we’ll also get August data on personal income and personal spending, the MNI Chicago PMI for September, and the University of Michigan’s final consumer sentiment index for September. Finally, central bank speakers include Fed Vice Chair Brainard, the Fed’s Barkin, Bowman and Williams, as well as the ECB’s Schnabel, Elderson and Visco.