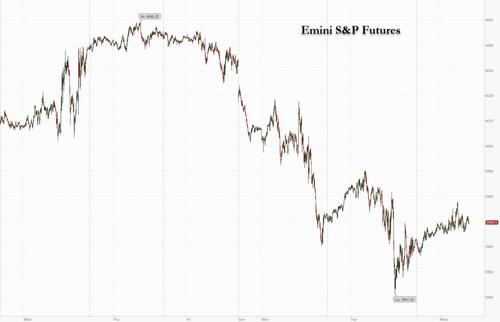

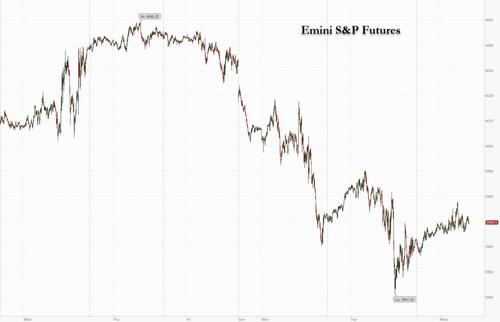

US futures rose on the last trading day of November as anxious investors awaited a potentially monkey-hammering speech from Federal Reserve Chair Jerome Powell (although as JPM said, most of the downside is already priced in) and assessed a softer stance from China on Covid curbs. S&P 500 futures rose 0.2% by 745a.m. ET while Nasdaq 100 futures rose 0.3%. The underlying indexes have closed lower for three consecutive days amid Covid restrictions and unrest in China. In Europe, shares climbed the most in more than a week as data showed eurozone inflation slowed for the first time in 1-1/2 years. Benchmark Treasury 10-year yields slipped and are down more than 25 basis points in November.

In premarket trading, NetApp plunged 14% after the data-management company cut its guidance for earnings and revenue growth, while cybersecurity stocks fell after CrowdStrike’s forecast for fourth-quarter revenue fell short of estimates with analysts noting that macro headwinds have started catching up to the business as clients pull back on tech spending, while deals are taking longer to close amid an economic slowdown. HP Enterprise shares rose after sales beat forecasts on strong demand. Here are some other premarket movers:

- Cryptocurrency- exposed stocks climb as Bitcoin rose to a two-week high, before a keenly awaited speech by Fed Chair Jerome Powell that is expected to signal a slower pace of interest rate hikes in the US. Marathon Digital +4.8%, Riot Blockchain +5%, Coinbase +2.9% and Silvergate +2.4%

- Horizon Therapeutics stock rises 33% after the company confirmed it’s in “highly preliminary discussions” with Amgen, Johnson & Johnson and Sanofi about a possible sale. Such a deal would be accretive, analysts said, estimating a takeout price range between ~$110 and $135 a share.

- X4 Pharmaceuticals shares fall 18%, weakness that Stifel (buy) said is likely “balance-sheet driven” after the company disclosed in a presentation that it has sufficient cash to fund operations into 3Q next year.

- AST SpaceMobile shares decline 5.8% after offering of $65m of its Class A common stock via B. Riley, with net proceeds to be used for general corporate purposes.

- Keep an eye on LPL Financial stock as Morgan Stanley downgrades it to equal-weight and removes the broker-dealer from its ‘Financials’ Finest’ list, with private-equity group Blackstone (BX US) added.

- Watch Fisker stock as it was initiated with an outperform rating at Evercore ISI, with the broker positive on the firm’s “unique” business model. Lucid and Rivian which both gain in US premarket trading, are started at inline.

- Workday shares jumped 8.5% in US postmarket trading on Tuesday as the finance and human resources cloud software provider narrowed its subscription revenue guidance for the full year, with analysts saying that demand is holding up even against a tough macroeconomic backdrop.

US equities have been consolidating over the past 20 days, with the S&P 500 hovering around the 4,000 point-level, as volumes have collapsed heading into the year-end.

“The reality is that as we approach year-end, people’s appetite to add new risk will severely diminish,” said James Athey, investment director at Abrdn. “Indeed, with a recession the base case for 2023, investors who have made a quick profit on this recent rally are increasingly liable to want to book profit before liquidity dries up. That probably means we will continue to drift without much force in either direction.”

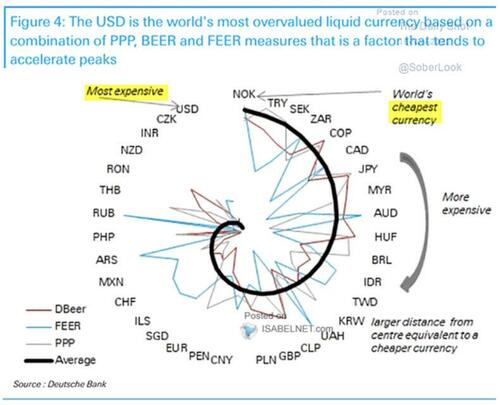

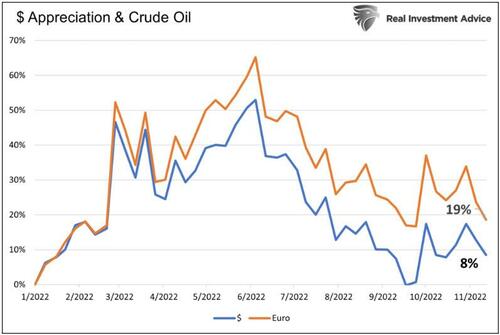

As previewed yesterday, Fed chair Jerome Powell is expected to speak about the state of the economy and the labor market at 1:30pm ET. Investors will pay attention to any clues about future policy, with the Fed Chair widely expected to signal lower rate hikes, but also warn that monetary tightening has further to run. He is widely expected to signal that the next Fed rate hike will step down to 50 basis points, though he will also likely warn that policy tightening has further to run. Those hopes of slower interest rate rises, alongside mounting optimism over China’s reopening, pushed the dollar lower and put the greenback on track for its worst month since 2009.

A degree of caution remains among traders before the Fed chair’s remarks, given still-high global inflation and a robust jobs market. “The market is hesitating a bit,” Societe Generale strategist Kenneth Broux said. “I would be very surprised if it is a dovish speech.” Some may hold the view that “the dollar has peaked and that the Fed Funds rate will peak at 5%, but I fear Powell will tell them it’s too soon,” he said.

“Where we think markets need to be cautious and where we would like to see a bit of tempering in optimism is over the pivot,” said Geoffrey Yu, senior strategist at Bank of New York Mellon. “What we are looking for is higher for longer.”

In Europe, the Stoxx 600 rose, led by consumer, auto, technology and energy shares. The benchmark is on course for a back-to-back monthly gain for the first time since August 2021. Here are the biggest European movers:

- Swedish biopharma company BioArctic jumps as much as 13% after its partner Eisai said the treatment for Alzheimer’s disease that they’re developing, lecanemab, isn’t to blame for two deaths involving brain bleeding of patients in a clinical trial.

- VGP gains as much as 6.6% after KBC Securities reinstated its buy recommendation, highlighting the Belgian real estate developer’s “strong management,” robust demand and good positioning in taking advantage of macro trends.

- Argenx rises as much as 7.4% after the biotech company agreed to purchase another FDA Priority Review Voucher, a move that KBC (buy) says can “significantly” accelerate regulatory review in the US, reducing times from about 12 months to six.

- Adyen climbs as much as 3.1% after New Street Research initiated with a buy rating, saying expectations over the payment firm’s margins have now been reset and it’s well positioned to create long-term value versus competitors that slowed investments amid macro uncertainties.

- Catena falls as much as 7.5% after the Swedish logistics property firm offered 4.5 million shares at SEK362, a 7.4% discount versus Tuesday’s closing price.

- Rexel falls as much as 6.9% in early Paris trading, the worst performance in the SBF 120 index, after the company was downgraded to underperform by Exane.

- Telenet slides as much as 5.3% after Oddo BHF downgraded to underperform just over a month after it cut the telecom operator to neutral, saying the company will face significant earnings pressure in 2023, while its fiber joint venture with Fluvius will take years to unlock the value.

- Pennon falls as much as 8.4% after the UK water company’s 1H results, which Jefferies said imply downside risk to earnings estimates.

- Sanofi declines as much as 3% after Horizon Therapeutics disclosed that the French company is among potential suitors it’s holding “highly preliminary discussions” with about a possible sale. Amgen and Johnson & Johnson are others.

Earlier in the session, Asian equities rose, supported by a rally in Chinese shares amid speculation that unrest in China would pressure authorities to speed up the loosening of Covid restrictions, while traders awaited a speech from Fed Chair Jerome Powell. Meanwhile, China’s economic activity contracted further in November amid a record Covid outbreak, with growth likely to remain weak and the central bank expected to add more stimulus to bolster the recovery. The MSCI Asia Pacific Index erased a drop of as much as 0.5% to rise 0.9% on Wednesday, led by consumer discretionary and technology shares. Benchmarks in South Korea and Taiwan gained while Japanese key gauges capped a fourth day of losses. Chinese equities rose for a second day, buoyed by optimism from the removal of lockdown curbs in some districts of Guangzhou which added to hopes that the nation is laying the ground for an eventual Covid-Zero exit. Economic data released earlier Wednesday showed China’s factory and services activity contracted further in November due to Covid curbs.

“I think the direction of reopening is quite clear,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “Government is taking baby steps which is to be expected. It is also doing the right things, such as encouraging vaccination for the elderly.” Powell’s comments will provide traders with more clues on the Fed’s tightening path going forward. Market watchers recently have been expecting slower interest rate hikes, though hawkish remarks from some officials continue to temper optimism. Asian equities have seen stellar performances in November with multiple benchmarks capping their best months in years. The key MSCI Asian measure has jumped nearly 15%, set for its best month since 1998.

Japanese equities dropped, capping a fourth day of losses, as investors monitored the Covid situation in China and awaited Fed Chair Jerome Powell’s speech. The Topix fell 0.4% to close at 1,985.57, while the Nikkei declined 0.2% to 27,968.99. Keyence Corp. contributed the most to the Topix decline, decreasing 2.2%. Out of 2,165 stocks in the index, 573 rose and 1,496 fell, while 96 were unchanged. “Caution remains as the risk of inflation has not gone away, and with US stock prices having difficulty rising significantly, Japan’s stock prices have recently been moving sideways,” said Tomo Kinoshita, a global market strategist at Invesco Asset Management

Australian stocks rose: the S&P/ASX 200 index reversed an earlier loss to close 0.4% higher at 7,284.20 after data showed inflation unexpectedly decelerated in October. The print sent government bond yields lower and suggest the Reserve Bank may be approaching the peak of its policy tightening cycle. Mining and energy shares contributed the most to the benchmark’s rise, with a gauge of materials stocks notching its biggest monthly gain ever as iron ore eyed its own record surge. In New Zealand, the S&P/NZX 50 index rose 1.4% to 11,552.04

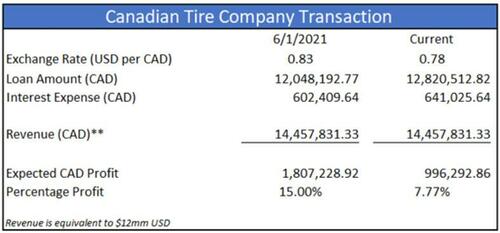

In FX, a gauge of the dollar fell for a second day. The Bloomberg Dollar Spot Index is poised to end this month around 4.5% lower, which would be its worst performance since May 2009. Investors continue to bet that China will reopen its economy after authorities on Tuesday adjusted virus restrictions in Zhengzhou, a city that’s home to Apple Inc.’s largest manufacturing site in China. Norway’s krone led gains as oil rose. The onshore yuan advanced 1% versus the dollar as hopes over a relaxation of China’s Covid curbs stoke optimism about the country’s economy. Onshore yuan rallies to 7.0830 vs dollar; offshore currency up 0.8% to 7.0840.

In rates, treasuries were slightly richer across the curve with gains led by belly out to long-end, flattening 2s10s and 2s5s spreads with 2-year yields little changed on the day. Treasuries are on pace for their third monthly gain of 2022 and the biggest since March 2020, as inflation moderated and Fed policymakers remained committed to additional rate increases to reinforce the trend. US 10-year yields around 3.72%, richer by 2bp on the day and outperforming bunds and gilts by 3bp and 4.5bp in the sector; after the data and Powell’s speech and Q&A at the Brookings Institution at 1:30pm in Washington, long-end could draw support into the month-end Treasury index rebalancing at 4pm New York time. Expected month-end duration extension is larger than average at 0.13yr for Dec. 1. Dollar issuance slate empty so far; 11 borrowers priced just over $17b Tuesday, led by Amazon multi-tranche offering. Focal points of month-end session include 3Q GDP revision, JOLTS job openings data and Fed’s Powell speaking on the economic outlook and labor market.

In commodities, OPEC and its allies are increasingly expected to hold production levels steady after the group opted to meet online amid an uncertain market outlook. Earlier this week, OPEC+ delegates signaled that Saudi Arabia and its partners would consider new output curbs at its gathering on Sunday, which was scheduled to take place at the cartel’s Vienna headquarters. But with the group’s decision to hold a virtual session, views are changing, and oil analysts and OPEC+ officials widely predict that the alliance will keep output unchanged. In futures, West Texas Intermediate rose for a third day, climbing above $80 a barrel after industry data pointed to a large decline in US crude stockpiles, while traders weighed the outlook for Chinese demand and the forthcoming OPEC+ meeting. For spot oil prices from around the world, see BOIL. IN THE NEWS The dilemma facing OPEC+ members is that the potential demand slowdown going into next year — especially in China –coincides with an “exceptionally tight” crude market, according to Bank of America’s Karen Kostanian. Here’s what other analysts are saying we should expect from this weekend’s meeting. European diplomats trying to reach a deal to curb Russian oil prices are wrestling with an awkward truth: Moscow’s main benchmark crude is already trading below the levels proposed for the cap. Saudi Aramco may reduce the official selling price of its flagship Arab Light crude by $2.10 a barrel on-month to Asia for January, according to the median estimate in a Bloomberg survey. The Caspian Pipeline Consortium, which has already suffered two major stoppages this year, is warning of the potential for more because of a lack of spare parts. China’s ongoing battle with Covid-19, which sparked street protests and conciliatory moves from the government after citizens balked at the latest lockdowns, continues to crimp oil demand in the world’s biggest importer. Chevron Corp. found almost half of employees and contractors in Australia have been bullied in the past five years and a third experienced sexual harassment, according to a survey led by an external consultancy

Binance has acquired Sakura Exchange, entering the Japanese market as a JFSA regulated entity.

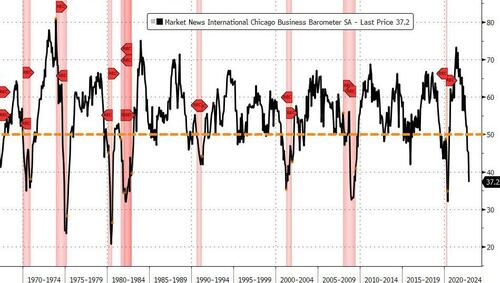

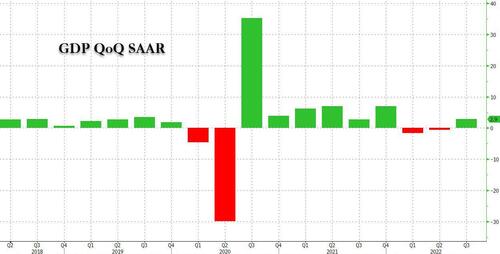

Looking to the day ahead now, one of the key highlights will be Fed Chair Powell’s speech at the Brookings Institution. Other central bank speakers include the Fed’s Bowman and Cook, the ECB’s Makhlouf and BoE chief economist Pill. The Fed will also be releasing their Beige Book. When it comes to data releases, today will we will get the November ADP employment change (8:15am), second estimate of 3Q GDP and October wholesale inventories (8:30am), November MNI Chicago PMI (9:45am), October pending home sales and JOLTS job openings (10am).

Market Snapshot

- S&P 500 futures up 0.2% to 3,969.25

- STOXX Europe 600 up 0.6% to 439.99

- MXAP up 0.9% to 156.52

- MXAPJ up 1.5% to 508.23

- Nikkei down 0.2% to 27,968.99

- Topix down 0.4% to 1,985.57

- Hang Seng Index up 2.2% to 18,597.23

- Shanghai Composite little changed at 3,151.34

- Sensex up 0.3% to 62,898.19

- Australia S&P/ASX 200 up 0.4% to 7,284.17

- Kospi up 1.6% to 2,472.53

- Brent Futures up 2.2% to $84.89/bbl

- Gold spot up 0.7% to $1,761.34

- U.S. Dollar Index down 0.36% to 106.44

- German 10Y yield up 0.4% to 1.92%

- Euro up 0.4% to $1.0371

Top Overnight News from Bloomberg

- Zhengzhou shuttered hundreds of buildings and apartment blocks hours after lifting broader lockdown measures, as officials strive to make their Covid controls more targeted in line with Beijing’s directives

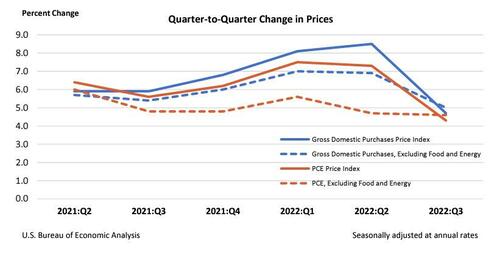

- Strong demand for goods and services may be starting to overtake supply constraints — from the pandemic and the war in Ukraine — as the driver of US prices, according to new gauges built by Federal Reserve economists

- Currency traders hoping to enjoy a quiet run up to Christmas may be in for a shock. One-month implied volatility for major currency pairs — a gauge of expectations for FX moves over that period — are sitting well above their 10-year average for this time of year

- Jiang Zemin, the Chinese leader who presided over more than a decade of dramatic economic growth following the bloody 1989 crackdown on pro-democracy protesters in Tiananmen Square, has died. He was 96

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mostly higher at month-end although gains were capped following the subdued handover from Wall St and after disappointing Chinese PMI data. ASX 200 was positive with the index led by strength in the mining-related sectors and with initial losses pared alongside a slew of data releases including better-than-expected Construction Work and softer monthly Australian CPI. Nikkei 225 slipped beneath the 28,000 level after Industrial Production further deteriorated which prompted the government to cut its relevant assessment. Hang Seng and Shanghai Comp were indecisive as recent optimism from hopes of an easing of COVID controls was clouded by disappointing Chinese PMI data which slipped into a deeper contraction.

Top Asian News

- Fullerton Health Said to Mull Stake Sale at $1.1 Billion Value

- Hong Kong Dollar Strengthens Past Strong Half of Trading Band

- Asian Stocks Gain for Second Day on China Reopening Hopes

- NDTV Founders Resign From Holding Firm Board Amid Adani Takeover

- Chinese Stocks in Hong Kong Jump, Capping Best Month Since 2003

- Binance Re-Enters Japan With Sakura Exchange Purchase

- GoTo Shares Fall to Record Low as Major Holders’ Lock-Up Expires

European equities trade on a firmer footing following mixed leads from Wall St, with eyes set on Fed Chair Powell on month-end, Euro Stoxx 50 +0.5%. Sectors in Europe are mostly positive but to a lesser extent than at the cash open; Autos, Consumer Products and Energy outpace while Real Estate and Telecoms lag. US futures are trading a touch above unchanged following yesterday’s session which was characterised by notable tech selling amid a pick-up in US yields, ES +0.2%.

Top European News

- BoE Chief Economist Pill says inflation expected to decline rapidly in H2 2023, demand is easing as household incomes are squeezed, the labour market remains very tight.

- Hungary gets initial green light from the European Commission for its EUR 5.8bln recovery plan, according to Bloomberg; recommends withholding separate EUR 7.5bln in fund.

- Hungary’s Russia-Designed Nuclear Reactors Survive Legal Attack

- Viceroy Target Home REIT Hits Back at Latest Short Report

- Houseboats Get Fresh Look in London’s Brutal Real Estate Market

- Turkish Economy Stumbles, Risks Bigger Downswing Before Election

- Germany Nov. SA Unemployment Change +17K M/m; Est. +13.5K M/m

- BOE Chief Economist Assumes UK Inflation Will Fall Next Year

FX

- DXY is under pressure in early European hours after failing to top 107.00 overnight, having printed an APAC peak of 106.90, matching the Tuesday high.

- Antipodeans lead the charge amid the positive risk move and despite the softer-than-expected Aussie CPI overnight and weak PMIs from China.

- EUR gains were somewhat stalled after EZ headline CPI printed softer than expectations but the core metrics topped forecasts while Cable has managed to attain a foothold on 1.20.

- CNH is the EM outperformer on hopes of looser Chinese COVID restrictions.

- PBoC set USD/CNY mid-point at 7.1769 vs exp. 7.1790 (prev. 7.1989)

- Japanese FX intervention amounted to 0 between October 28th-November 28th, according to MoF.

Fixed Income

- Core bonds dented as core EZ inflation fails to decline, USTs directionally in-fitting but little changed overall pre-Powell.

- Bund Dec’22 slipped from 141.24 to 140.70 (vs 140.50 low) on the EZ inflation release, with market pricing between 50bp & 75bp remains on a knife-edge.

- Gilts are lower by circa 40 ticks on the session in sympathy and were unphased by largely familiar remarks from Chief Economist Pill.

Commodities

- WTI and Brent futures are firmer intraday as the risk tone remains constructive and the Dollar declines.

- Spot gold grinds higher as DXY softens and the risk tone turns less constructive, with the yellow metal rising north of USD 1,750/oz and towards Monday’s USD 1,763/oz peak.

- Base metals are firmer across the board on hopes China will ease its Zero-COVID parameters, with 3M LME copper extending on overnight gains to levels north of USD 8,100/t during the European morning.

- US Private Energy Inventory Data (bbls): Crude -7.9mln (exp. -2.8mln), Gasoline +2.9mln (exp. +1.7mln), Distillate +4.0mln (exp. +1.5mln), Cushing -0.2mln.

- OPEC+ decision to meet virtually on December 4th signals that there is little likelihood of a change in policy and the virtual meeting puts focus on the pending Russian oil price cap decision on December 5th, according to a source with direct knowledge cited by Reuters.

- OPEC+ cancelled the 2nd Dec JTC meeting, according to Argus sources.

China covid updates

- Beijing City reports 2,378 new local COVID cases (prev. 2,126) during 15 hours to 3pm on Wednesday.

- China’s Guangzhou will gradually resume normal operations of subway stations and Haizhu trams as of November 30th, according to the Municipal government.

- Beijing is set to allow some residents to skip mass COVID testing, according to Bloomberg.

- China is reportedly mulling rolling out a 4th round of COVID vaccines, according to Bloomberg.

Geopolitics

- China and Russian warplanes temporarily entered South Korea’s air defence zone, according to Yonhap.

- Russian Foreign Ministry says Moscow does not intend to discuss the New START treaty with Washington as long as it supplies Ukraine with weapons, via Al Jazeera.

US Event Calendar

- 07:00: Nov. MBA Mortgage Applications -0.8%, prior 2.2%

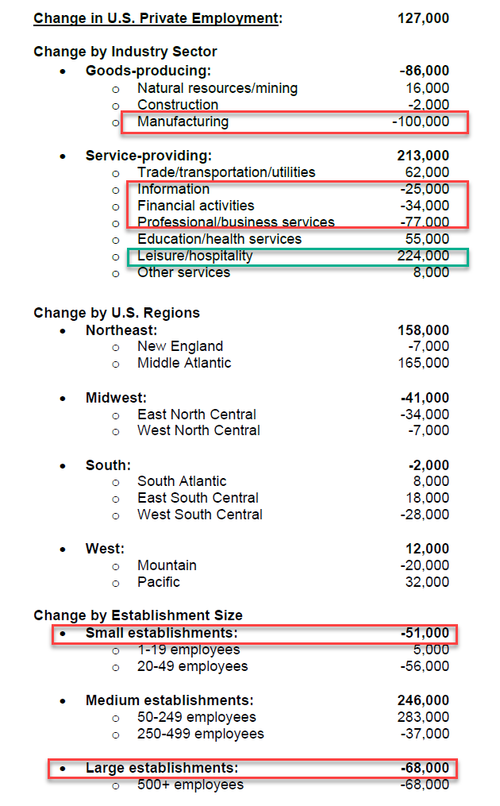

- 08:15: Nov. ADP Employment Change, est. 200,000, prior 239,000

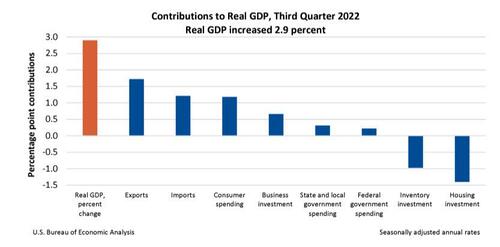

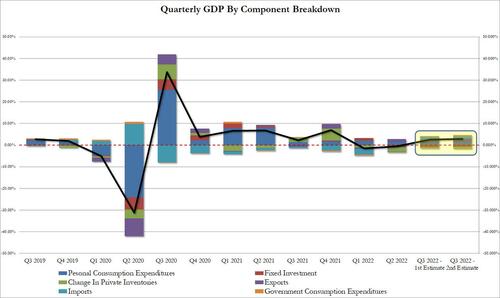

- 08:30: 3Q GDP Annualized QoQ, est. 2.8%, prior 2.6%

- Personal Consumption, est. 1.6%, prior 1.4%

- PCE Core QoQ, est. 4.5%, prior 4.5%

- GDP Price Index, est. 4.1%, prior 4.1%

- 08:30: Oct. Advance Goods Trade Balance, est. -$90.5b, prior -$92.2b

- 08:30: Oct. Retail Inventories MoM, est. 0.5%, prior 0.4%

- Wholesale Inventories MoM, est. 0.5%, prior 0.6%

- 09:45: Nov. MNI Chicago PMI, est. 47.0, prior 45.2

- 10:00: Oct. JOLTs Job Openings, est. 10.3m, prior 10.7m

- 10:00: Oct. Pending Home Sales YoY, est. -35.2%, prior -30.4%

- Pending Home Sales (MoM), est. -5.7%, prior -10.2%

- 14:00: U.S. Federal Reserve Releases Beige Book

Central Bank speakers

- 08:50: Fed’s Bowman Discusses the Future of Small Banks

- 12:35: Fed’s Cook Discusses the Economic and Policy Outlook

- 13:30: Powell Discusses the Economic Outlook and the Labor Market

DB’s Jim Reid concludes the overnight wrap

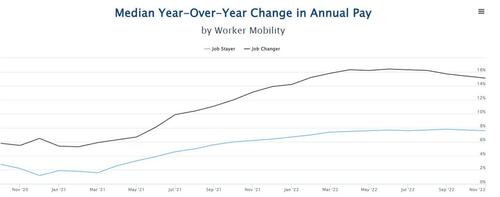

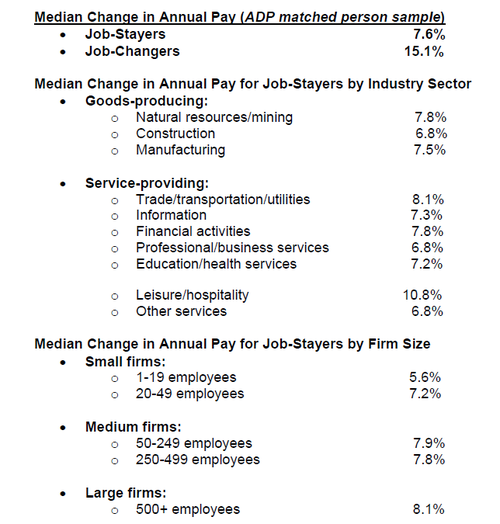

Markets bent a little yesterday but didn’t break as US stocks rallied around half a percent off their European closing lows into the NY final bell. The S&P 500 (-0.16%) still ultimately lost ground for a third day running though. Interestingly, that came in spite of several positive developments yesterday, with the latest European inflation data surprising on the downside, just as there were fresh signs pointing towards a potential reopening in China. However, the focus is now turning back to the Fed once again, with investors eagerly awaiting Chair Powell’s speech at the Brookings Institution later on today. That’s an important one since the Fed’s blackout period ahead of the next meeting begins this weekend, so this is the last chance Powell will have to give a steer on policy beforehand. In addition, today will bring the latest data on job openings and the quits rate for October, which have recently been cited by the Fed and others as a key gauge of inflationary pressures from the labour market.

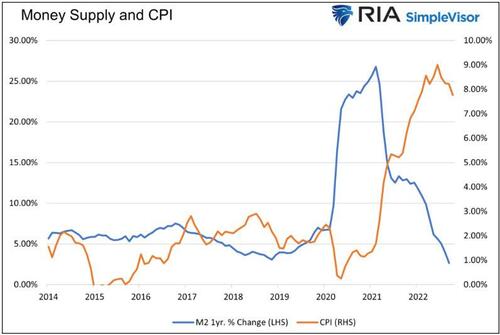

With that in mind, it’ll be a big day for Fed watchers, but we shouldn’t forget the ECB as we’ll also get the flash CPI release for the Euro Area at 10am London time. Markets will be paying close attention, but European government bonds were already rallying ahead of that yesterday after the country-specific releases surprised on the downside. For instance, Spanish inflation came in at +6.6% in November using the EU-harmonised measure, which was down from +7.3% in October and also beneath the +7.1% reading expected. Later in the day, we got further signs that inflation might be moving lower, with German inflation down from +11.6% in October to +11.3% in November, whilst Belgian inflation was down from +12.3% in October to +10.6% in November. That trend has continued overnight as well, with Australia’s CPI for October unexpectedly falling to +6.9% (vs. +7.6% expected).

Those signs of decelerating inflation led investors to price in a growing chance that the ECB would slow down the pace of their hikes to 50bps in December. Indeed, the hike that overnight index swaps are pricing in for the next meeting came down by -5.2bps on the day to 56.5bps, suggesting that investors were pricing out the chances of another 75bps hike. In turn, European government bonds rallied across the continent, with yields on 10yr bunds (-6.6bps), OATs (-6.9bps) and BTPs (-8.3bps) all falling on the day.

When it comes to Fed Chair Powell’s speech today, he’s set to be giving remarks on the “economic outlook, inflation and the labor market”, so it should be relevant for policy. It’s widely expected the Fed will downshift their rate hikes to a 50bp pace in December, but our US economists expect Powell to shift the focus away from a downshift towards the Fed’s broader tightening campaign, and to reiterate the key messages from the November press conference. Ahead of that, we had some fresh signs that the Fed’s tightening cycle was impacting the economy, with the Case-Shiller index of 20-cities’ home prices down by a further -1.24% in September, building on its -1.30% decline in August. Bear in mind as well that all 20 cities in the index posted a monthly decline, so this is a very broad-based move lower. Elsewhere, the Conference Board’s consumer confidence numbers also fell back in November, falling to their lowest level since July at 100.2 (vs. 100.0 expected).

Ahead of Powell’s remarks, US Treasuries followed a very different path to their counterparts in Europe, with yields rising at all maturities. The 10yr yield was up +6.3bps on the day to 3.74%, with the move entirely driven by a +6.7bps rise in the real yield. And those moves have only slightly retraced overnight, with the 10yr yield down -2.1bps at 3.72%. With the pickup in real yields, equities were always going to struggle, even if the S&P did recover into the close. The rate-sensitive Nasdaq underperformed, falling -0.59%. Sentiment was similar in Europe, with the STOXX 600 (-0.13%) experiencing its third consecutive decline for the first time since early October.

Over in China, there were some important developments on the Covid situation shortly after we went to press yesterday. First, officials said that they would seek to raise vaccination rates among the elderly, which was good news for markets since stronger levels of immunity are seen as increasing the chances of the economy reopening. Second, there was also a comment that local officials should avoid excessive Covid restrictions, which again was seen as taking the direction of travel further in favour of reopening following the weekend protests. Chinese assets performed strongly on the back of these developments, and in US hours the NASDAQ Golden Dragon China index surged by +5.04%, building on its +2.83% gain over the previous session. The prospect of a future reopening in China offered further support to oil prices as well, with Brent crude up +0.61% to $83.70/bbl.

That boost has continued into Asian markets this morning, with the CSI 300 (+0.10%), the Shanghai Composite (+0.05%) and the Hang Seng (+0.69%) all seeing further gains. That’s in spite of some downbeat data on the economic situation in China, with the manufacturing PMI falling to its lowest level since April at 48.0 (vs. 49.0 expected). The non-manufacturing PMI also deteriorated to 46.7 (vs. 48.0 expected), and the composite PMI fell to a post-April low as well at 47.1. Markets elsewhere in the region are a bit more mixed however, with the Nikkei shedding -0.35%, whereas the KOSPI (+1.18%) has seen solid gains. Looking ahead, US and European equity futures are pointing to gains at the open, with those on the S&P 500 up +0.18%.

Elsewhere yesterday, UK gilts underperformed their European counterparts after comments from the BoE’s Catherine Mann, who’s been one of the more hawkish members on the MPC. Mann said that inflation expectations were becoming “increasingly embedded”, and 10yr gilt yields only fell -2.6bps on the day, a smaller fall than seen for the other big European economies. In the meantime, the latest data on mortgage approvals for October came through, which is the first release entirely after the UK’s mini-budget in late-September. That showed a dip in approvals to 59.0k (vs. 60.0k expected), which is their lowest level since the initial wave of the pandemic.

To the day ahead now, and one of the key highlights will be Fed Chair Powell’s speech at the Brookings Institution. Other central bank speakers include the Fed’s Bowman and Cook, the ECB’s Makhlouf and BoE chief economist Pill. The Fed will also be releasing their Beige Book. When it comes to data releases, today will bring the Euro Area flash CPI release and German unemployment for November, whilst in the US there’s the ADP’s report of private payrolls for November, the second estimate of Q3 GDP, the JOLTS job openings for October, pending home sales for October, and the MNI Chicago PMI for November.