Authored by Clarissa Hawes via FreightWaves.com,

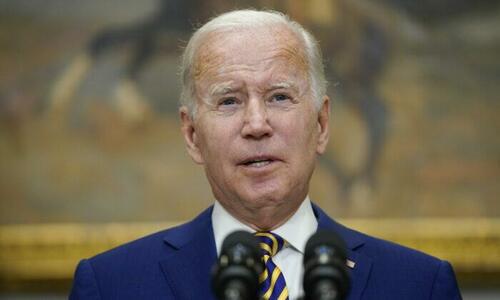

Nearly 115,000 railroaders were closely following two votes Wednesday in the U.S. House of Representatives after President Joe Biden called on Congress to immediately pass legislation to avert a rail strike.

The House voted 290-137 Wednesday to avert a possible rail strike amid debate over the national tentative agreement brokered by the White House between union employees and Class I railroads in September. Nearly 40% of the nation’s freight is moved by rail.

Railroad workers for the 12 freight unions have been operating without a new contract for over three years.

However, strict attendance policies and the lack of paid sick days have been sticking points for the majority of rail workers, including the nearly 60,000 members of four freight rail unions that voted to reject the national contract in mid-November.

“It’s been a long three years, depending on how you look at it,” Jeremy Ferguson, president of the International Association of Sheet Metal, Air, Rail, and Transportation Workers (SMART-TD), told FreightWaves.

“The workforce is cut back to the bone, and those that are left are having to pick up the slack.”

On Wednesday, SMART-TD issued a statement that it “does not support the notion of Congress intervening in our collective bargaining negotiations to prevent a strike.”

“We firmly believe in the workers’ right to fight for their own best interests, as well as the best interests of their families,” according to the SMART-TD statement.

“Unfortunately, threats to the economy have caused this Congress to believe that a strike aversion is the best course for this nation.

Separately Wednesday, the House passed legislation by a vote of 221-207 to add seven days of paid sick leave to the tentative rail agreement. Both pieces of legislation aimed to stop a rail strike now head to the Senate.

None of the railroaders FreightWaves spoke to for this article want to go on strike but said they wanted the rail carriers and shippers “to put employees over record profits” and address some of the major challenges, including precision scheduled railroading (PSR), the attendance policy and lack of paid sick leave, that have resulted in a mass exodus among railroad employees.

Railroaders say morale, quality of life at all-time low

One locomotive engineer says morale is at an all-time low at the Class I railroad where he’s worked for more than 25 years. He’s seen engineers with 15 or 20 years “tie up for the last time” and quit.

He’s among nearly 24,000 locomotive engineers and trainmen who make up the Brotherhood of Locomotive Engineers and Trainmen (BLET). BLET was among eight freight unions that voted in mid-November to accept the national tentative agreement reached between the unions and railroads in September.

BLET, the second-largest rail union, voted 53.5% in favor of ratifying the national agreement, while 46.5% of its membership voted against it.

While the engineer, who didn’t want to be named in the article for fear of retaliation, wouldn’t say how he voted earlier this month, he understands why four of the 12 freight unions, including SMART-TD, the largest union, rejected the agreement.

“I know some of the younger engineers voted for the agreement so they can receive their back pay because they plan to quit because they don’t have the seniority that I do,” he said.

“I don’t blame them — they want jobs where they are home more, can attend their kids’ events, and some are trying to save their marriages after being on call 24/7 for the past few years.”

He said there used to be several road engineers at any given time who were marked up as available to work once his shift ended. That’s not the case now, he said, as some have quit, were fired or took other jobs.

“Now, sometimes I get off the train after being gone on the road for a few days, drive an hour to my house, sleep for 10 hours, then I’m being woken up by a call from a crew dispatcher to report for work in two hours,” the engineer said.

“It’s not much of a life for road engineers and conductors anymore.”

He and his conductor both contracted COVID in 2020 at a time when all of the Class I railroads had slashed their workforces because of precision scheduled railroading (PSR) running longer trains with fewer employees. Around the same time, the rail carriers had made major cuts to middle management and ground employees, forcing him and others “to do more with less.”

Unable to work for three days because of COVID, he received a call from his dispatcher threatening disciplinary action if he did not return to work.

His railroad does offer short-term disability that pays him 65% of his hourly rate after seven days of unpaid leave, but he couldn’t afford to stay home. The engineer said he also faced immense pressure from his bosses to return before he was well. Prior to the COVID-19 vaccine being available, he said engineers and conductors continued to pass the potentially deadly virus back and forth and to other employees amid demand to keep up with the freight volume.

“I had friends that I worked with for 20 years who died of COVID, but we couldn’t even go to their funerals without facing scrutiny by management,” the engineer said. “We had no choice but to work.”

Jeremy Ferguson, president of SMART-TD, appeared on a recent episode of FWNOW to talk about next steps to avoid a possible rail strike. (Photo Credit: FWTV)

Ferguson said his membership wants changes to the railroad carriers’ emphasis on PSR and building massive trains.

“One of the biggest issues that we’ve had in the past year with precision scheduled railroading was trying to cut the workforce and then the attendance policies being ratcheted up to a level that we’ve never seen before. … Before, some people were allowed five to six days off a month [but] now are down to one day a month and no family time,” Ferguson said.

A Class I railroad conductor with more than 25 years of experience said he’s never worked at a job that spends so much money to train employees, only to spend double that amount to find something to fire them for once they are considered trained and marked up to work.

“There’s this rush to get everybody trained but management isn’t focused on teaching or ‘on-the-job training’ once they mark up at our railroad,” the conductor told FreightWaves.

“In the early days when I was starting out, I had a mentor who had been with the railroad a long time that would pull me aside and explain to me what I did wrong. There’s a learning curve to working on the railroad. Sure, I would get ribbed by the old-timers for a while, but they helped me.”

The biggest lesson he learned was to buy job insurance from companies that specialize in the rail industry.

“I explain it to new hires that it’s like ballerinas who have insurance on their legs and/or feet because that’s how they make a living,” the conductor said.

“Buying job insurance is a product of the way they treat people on the railroad; we have to do this.”

A locomotive engineer for another railroad agreed.

“The railroad wants to fire you at every turn — that’s why almost every single one of us carries job insurance,” the engineer said.

“I don’t know that there’s too many other industries on the planet that carries insurance to protect our jobs.”

A member of the Brotherhood of Maintenance of Way Employes Division (BMWED), who also declined to have his name published for fear of being targeted, said he was among 56% of the rank and file who rejected the tentative national agreement in October.

The BMWED has nearly 26,000 workers who build and maintain the tracks and bridges on railroads across the nation.

He voted against the contract over the Class I railroads’ refusal to provide paid sick leave for railroad workers. He said he was told by railroad management that his union contract provided him with ample weeks of vacation time to go to the doctor if needed. The maintenance-of-way employee said that even though he ranks relatively high in seniority and is among the first to pick his weeks of vacation for the next year, there’s no way he could predict when he needs to go to the doctor or use a day to stay home with a sick child.

“My wife is my hero,” the employee said.

“She has a demanding job, too, but she never uses her sick days for herself; it’s always for the kids because I can’t do it without repercussions. It’s been a huge strain on our marriage.”

He said most railroaders hope to avert a strike, which could result in economic losses of $2 billion per day. He said he and approximately 115,000 railroaders would be without paychecks right before Christmas.

“I’ve been called selfish and greedy because no paid sick time by the railroads is a deal-breaker for me, but the office employees at these railroads automatically get 80 hours of sick time,” the worker told FreightWaves.

“We worked through a pandemic and didn’t have the option of working from home or shelter in place like the office personnel,” he said.

“The railroad told us how proud they were and thanked us for being essential workers. When you offer some employees paid sick time and tell them to stay safe, but then management tells us to get back on the road because there are not enough workers, it sends a message that we aren’t important and we are only essential to their bottom lines.”