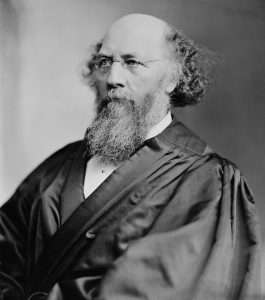

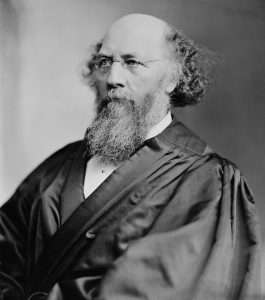

12/1/1897: Justice Stephen Field resigns.

The post Today in Supreme Court History: December 1, 1897 appeared first on Reason.com.

from Latest https://ift.tt/IfmjzyR

via IFTTT

another site

12/1/1897: Justice Stephen Field resigns.

The post Today in Supreme Court History: December 1, 1897 appeared first on Reason.com.

from Latest https://ift.tt/IfmjzyR

via IFTTT

Banking Elites Are Using Crypto Bloodbath And FTX Fraud To Justify CBDCs

Central bankers and international corporate financiers have long been pretending to hate the very concept of cryptocurrencies like Bitcoin and Etherium while at the same time investing heavily in blockchain technologies and infrastructure. The purpose of the ruse is not clear, but more than likely it was an attempt at mass reverse psychology – “We don’t like crypto and digital currencies because we supposedly have no control over them; free market proponents should embrace them blindly because that is how you will beat us.”

In the meantime, while major banking firms are investing billions into various blockchain products, central banks and global institutions like the BIS and IMF have been developing their own systems. In fact, the BIS notes with enthusiasm that around 90% of central banks around the world are already in the process of adopting CBDCs.

But why would anyone want to use government and establishment bank controlled cryptocurrencies when they have access to Bitcoin and dozens of other coins that are supposedly independent? Why trade freedom for more centralization?

First, existing cryptocurrencies are not as free as many people believe, with ample government tracking of blockchain transactions in place for years, the notion of the completely anonymous crypto user is a bit of a fantasy, and the idea that a product such as Bitcoin is going to “bring down” the central banks is becoming less realistic by the year.

Second, the crypto market is highly unstable in part because it is still very limited. While crypto use in America is higher than most other countries with around 12% of people using it as an investment (not as a currency), the rest of the world is mostly uninterested with an estimated global footprint of around 4%. Of that 4% only a handful of people actually own the majority of the market; these people are known as “whales” and they have the ability to tip the market up or down with little effort.

This happens in many other trade commodities and paper currencies also. The point is, crypto is not immune to manipulation.

Third, crypto is enticing to people because of the quick profits that can be had, but massive losses are also a danger. The overall crypto market has plunged by $2 trillion in the past year alone – Over 60% of its value. The implosion of huge trading companies like FTX also undermines the stability of the market and usually it’s the average investor that ends up suffering the consequences.

All of these factors and more can be used by banking elites as a rationale for the implementation of CBDCs and global regulation of crypto trading. And, if the bloodbath in existing coins continues, people may even welcome CBDCs as a “safe” investment or currency system.

The investment losses in blockchain products along with the scandals in exchanges is a rather convenient opportunity for the banking establishment to promote their own currencies as a replacement. In the wake of the FTX event, multiple international banks including JP Morgan and Goldman Sachs have called for government regulation and a shift over to CBDCs.

The US House has scheduled hearings on FTX with an emphasis on regulation. In Europe, globalist Christine Lagarde and the ECB are calling for global cooperation on monitoring and controlling cryptocurrencies. Lagarde wants a “digital Euro” to take the place of existing coins and blames FTX and the larger market losses on lack of oversight.

Numerous crypto analysts are also demanding regulation, calling crypto “broken and useless” until governments step in to mediate (control) trade. This is the exact opposite of what crypto activists originally intended over a decade ago when Bitcoin was in its infancy, and digital trade back then was sold as some kind of revolution against the banking oligarchy. However, it’s easy to see where this is all going.

It means even more pervasive centralization. With paper currencies at least there is true anonymity, but with CBDCs the existence of the blockchain ledger precludes any and all privacy in trade. Not only that, but the institutional ability to cut off people from their wealth and economic access is going to be profound. If you think corporate and government led cancel culture is bad now, just wait until they can freeze your digital accounts at a moment’s notice because of something you said on social media. And, in a cashless society there are few alternatives beyond some kind of black market.

CBDCs mean the total death of any economic freedom the public has left, and central banks are exploiting disasters like FTX to make that death happen even faster.

Tyler Durden

Thu, 12/01/2022 – 06:55

via ZeroHedge News https://ift.tt/wln0Km4 Tyler Durden

IMF Chief Says US Must Keep Raising Interest Rates Because “They Owe It” To The World

Authored by Katabella Roberts via The Epoch Times,

The head of the International Monetary Fund (IMF), Kristalina Georgieva, has cautioned against the Federal Reserve slowing down with its interest rate hikes as it attempts to tame soaring inflation.

Speaking in an interview with The Associated Press on Tuesday, the IMF Managing Director was asked for her thoughts on pausing interest amid concerns that a strengthening U.S. dollar is weakening other currencies around the world, particularly those in poorer nations, and contributing to a cost of living crisis in those countries.

Georgieva said that the Central Bank “has no option but to stay the course” until the cost of living significantly declines.

“They owe it to the U.S. economy, they owe it to the world economy, because what happens in the United States if inflation does not get under control can have also spillover impacts for the rest of the world,” Georgieva said.

The dollar is up 18 percent this year and hit a new fresh two-decade high in September after the Federal Reserve raised interest rates by another 75 basis points.

In October, the U.N. Development Programme (UNDP) warned that developing economies are on the verge of a significant crisis due to the financial and monetary policies of developed nations like the United States.

“Rich countries have the resources to end the debt crisis, which has deteriorated rapidly in part as a consequence of their own domestic policies,” UNDP said.

“These policies have sent interest rates in developing economies skyrocketing and investors fleeing,” UNDP said.

“Market conditions are shifting rapidly as a synchronized fiscal and monetary contraction and low growth are fuelling volatility around the globe: 19 developing economies are now paying more than 10 percentage points over US Treasury bonds to borrow money on capital markets, effectively shutting them out of the market. Holders of many developing economy bonds are seeing them trade at deep discounts of between 40 to 60 cents on the dollar,” the UNDP said.

“The international community should not wait until interest rates drop or a global recession kicks in to take action: The time to avert a prolonged development crisis is now.”

A currency exchange vendor counts U.S. dollar notes at Tahtakale in Istanbul, Turkey. (Ozan Kose/AFP via Getty Images)

Also in October, the United Nations, in its Trade and Development (UNCTAD) report, warned of a looming global recession driven by the monetary and fiscal policies of advanced economies, including that of the Federal Reserve.

UNCTAD warned that developing countries would edge closer to debt default unless central banks in advanced economies revert their course of action.

Despite concerns regarding the impact of domestic monetary policy on developing nations, the U.S. central bank has dismissed the possibility of easing its tight monetary policy, as inflation came in at 7.7 percent in October, way ahead of the Fed’s 2 percent goal.

Jim Bullard, president of the Federal Reserve Bank of St. Louis, in an interview with MarketWatch on Nov. 28., said he believes the FOMC [Federal Open Market Committee] will likely need to be more aggressive with their rate hikes going forward, raising them to at least 5 percent in an effort to cool down red-hot inflation.

The committee is scheduled to meet again on Dec. 13–14 for its final meeting of 2022.

Georgieva on Tuesday noted that inflation remains high in the United States and Europe, adding that “the data at this point says: too early to step back.”

Tyler Durden

Thu, 12/01/2022 – 06:30

via ZeroHedge News https://ift.tt/G1vWNRc Tyler Durden

Top Citi Exec Marvels That An Entire Generation Of Bankers Only Knows Cheap Money

A top Citigroup banker said it was “fascinating” that some of the Wall Street firm’s “rising stars” had spent their whole careers in an era of cheap money.

According to Bloomberg, Alison Harding-Jones, vice chair of corporate and investment and head of M&A in EMEA at Citigroup, said rising rates were helping create an environment where more junior bankers “will learn a lot.”

“It is absolutely fascinating to me that I have people who come to me who are starting to think about being made a managing director in an investment bank who started in this business in 2010 or 2011, and so they’ve never really seen an environment where money hasn’t essentially been free or very, very cheap,” Harding-Jones said at the Financial Times Global Banking Summit on Tuesday.

“We’ve seen this pandemic, which has inflated this bubble, which has driven this incredible amount of activity, and they’ve kind of thought ‘Well, that’s normal,’” she said.

“That clearly isn’t normal and I think all the old heads on this call and all of my old-headed colleagues, we are looking at this and thinking this is going to be an environment where you will learn a lot.”

As Bloomberg notes, her comments were echoed by Clare Woodman, Morgan Stanley’s head of Europe, the Middle East and Africa, who told the conference that banks were faced with an outlook that hadn’t been seen “in the last half a century.”

Tyler Durden

Thu, 12/01/2022 – 05:45

via ZeroHedge News https://ift.tt/xQ0FA2P Tyler Durden

Inflation is up. The stock market is down. Unemployment is just 3.5 percent. Yet labor force participation remains stubbornly low, with only 62.3 percent of the civilian population working or actively looking for work—well below pre-pandemic levels. And even before the pandemic, that figure had been steadily declining for years.

There are plenty of uncharitable theories about why the American work force is shrinking as a percentage of the population, resulting in 10 million unfilled jobs and a lot of well-wrung hands. The most common is simply that Kids These Days don’t want to work and it’ll be Gen Z’s fault when the U.S. is no longer a global economic superpower.

A substantial number of younger people are not, in fact, keen to get hitched with an employer. In 2022, “for every [25- to 54-year-old] guy who is out of work and looking for a job,” American Enterprise Institute economist Nicholas Eberstadt told the Fifth Column podcast, “there are four guys who are neither working nor looking for work.”

But the Kids These Days hypothesis is complicated by the fact that while the labor force participation rate includes people 16 and older, the largest component of the most recent reduction appears to be older people who took retirement early and/or previous retirees who have not rejoined the work force at the rates they once did. This trend may well reverse itself if the stock market continues to decline and retirement accounts evaporate, but for now it looks like baby boomers turning on, tuning in, and dropping out—however belatedly—are at least as much of a labor force problem as wayward youths.

What these two groups have in common can be found in an old chestnut of game theory: the ultimatum game. Even if you don’t know the 1982 paper that popularized the experiment, you’ve certainly encountered the phenomenon. Imagine two people, one of whom is given $10 and told to propose a way to split the money with another person—a stranger, let’s say. The catch is that if the stranger doesn’t agree to the deal, they both get nothing.

Economists and psychologists alike love this experiment because it captures an interesting facet of human behavior that appears irrational at first glance. Surely the second man should accept any deal offered by the first. So what if he’s offered just a penny? Free money is free money! Who cares if the other guy gets to keep $9.99? Instead, across all cultures and contexts, people reject offers they perceive to be unfair: The details vary, but human beings turn down money with astonishing consistency if they think they’re being done dirty.

This allergy to economic unfairness may well be what unites the “quiet quitters” of Gen Z and the early boomer retirees: They increasingly perceive the terms of employment to be so off-kilter that they would rather not work at all, even if that decision screws them over in the end.

“The process of contracting a worker is often close to ultimatum bargaining,” explained Elwyn Davies (then with the University of Oxford) and Stanford University’s Marcel Fafchamps in a 2016 paper exploring the effects of competition on behavior within the ultimatum game. “The employer specifies a job description and proposes a wage and the worker accepts or rejects.”

So if employment is an ultimatum game—where playing along might get workers less than employers, but refusing to play gets everyone zero—what is causing the perception that the terms of employment are no longer worth accepting, even when both parties would benefit?

Positive views of capitalism more generally have slipped since 2019, with 39 percent expressing negative views in an August Gallup poll. Another Gallup poll found an uptick of 3 percentage points in people who say they are “completely dissatisfied” with their jobs, while the number of people who were “completely satisfied” fell 8 points.

The perception that conventional jobs are essentially offering workers a pittance while greedily holding back the bulk of the wealth is common in places like the r/antiwork subreddit, which has 2.3 million members. In fact, there’s at least one discussion of the ultimatum game itself on that subreddit, which pulls some figures on companies’ revenue vs. worker compensation and concludes: “If working for Apple was the ultimatum game, the proposer just got $100. They’re offering you 23 [cents], and they keep $99.77. Deal or no deal?” The relative sizes of these numbers might also explain why simply raising wages hasn’t brought people into the workforce, especially when paired with increased awareness of and dissatisfaction with the gap between CEO pay and worker pay in large corporations.

Early retirement also makes some sense on this accounting. Older people may have expectations about what their compensation or responsibilities should be, with reference to either the generation who retired before them or to their younger colleagues. When they are not offered what they perceive to be their due, they would rather zero out their income than continue to work.

Paul J. Zak, a neuroeconomist who has done experimental work on the role of empathy and perspective-taking in the ultimatum game, cautions against an approach that is “too econo-centric.” Large and unpredictable government subsidies to individuals and corporations erode the broader sense that hard work will be rewarded and is worth pursuing, even if the wages offered previously seemed fair. There is almost certainly more at play than wage and price levels alone.

The pandemic threw a wrench into this and every sociological and economic question and will continue to annoy academics looking for patterns for at least another century. Many jobs did get appreciably worse during the height of COVID, when death suddenly became a possible side effect of working in the grocery store, a factor that shouldn’t be underestimated. But decreases in labor force participation predate the pandemic.

In many ways, work is better than it has ever been. It is less dangerous, requires fewer hours, is less physically taxing, and affords the purchase of better stuff than for most of human history. But the supply chain interruptions of recent years paired with rapid changes in the terms of employment during the pandemic may well have disrupted the sense that the deal workers were being offered was fair.

The temptation of the ultimatum game is to dismiss the results as irrational and therefore bad. It’s easy to dismiss workers as lazy or employers as short-sightedly selfish. But the consistency with which individuals in nearly all situations perform in the ultimatum game actually highlights something good about people: They care about what is fair and they will devote significant effort to making deals where everyone wins. The authors of that 2016 paper found, for instance, that in an environment with multiple employers and multiple employees, the offers tended to start higher and employees tended to do better overall. Competition causes employers to think harder about what workers want and to offer it as seamlessly as possible.

Right now there’s something broken in our economy that is preventing employers and employees from cooperating with each other. The result is that too few deals are being struck and everyone is suffering. The challenge ahead is how to rebuild a sense that the game is fair and everyone is playing in good faith.

The post The Labor Market Is Broken appeared first on Reason.com.

from Latest https://ift.tt/AJ26aCI

via IFTTT

Biden Admin Pledges $53 Million To Help Restore Ukraine’s Damaged Power Grid

Authored by Katabella Roberts via The Epoch Times (emphasis ours),

The Biden administration on Tuesday vowed to provide Ukraine with $53 million to help the war-torn nation acquire critical electric grid equipment amid repeated missile attacks from Russian forces.

Secretary of State Antony Blinken announced the funding during a meeting with NATO allies and Group of Seven members on Tuesday.

“This equipment will be rapidly delivered to Ukraine on an emergency basis to help Ukrainians persevere through the winter,” the State Department said. “This supply package will include distribution transformers, circuit breakers, surge arresters, disconnectors, vehicles, and other key equipment.”

Russian forces have conducted a string of attacks on Ukraine’s energy infrastructure since October in what some officials believe to be a deliberate move to harm millions of civilians who are being left without heat or electricity as temperatures fell below zero.

In a Nov. 23 post on Facebook, Ukraine’s Energy Ministry said that significant shelling by Russian forces had resulted in temporary blackouts at nuclear plants, most heating and hydroelectric plants, and had also impacted electrical facilities.

“As a result, the vast majority of electricity consumers across the country have been disrupted. There are some emergency outages happening. The lack of electricity can affect the availability of heat and water supply,” the ministry wrote. “Only terrorists do this to a nation they cannot defeat so they try to simply destroy.”

The Russian attacks have resulted in Ukraine imposing regular emergency blackouts across the country.

Moscow denies targeting civilians as part of its “special military operation” in Ukraine.

The latest financial assistance from the United States comes shortly after the U.S. Agency for International Development in October announced it would grant $55 million in emergency infrastructure support in Ukraine ahead of the winter season.

That funding will support the repairs and maintenance of pipes and other equipment necessary to deliver heating to homes, hospitals, schools, and businesses across Ukraine, officials said. It includes funding for generators, as well as money for alternative fuel sources to hospitals and shelters among others.

The Biden administration recently requested $37.7 billion in additional funds for Ukraine. If approved by Congress, the total military and other assistance for Russia’s neighbor would amount to about $105 billion since the start of the conflict.

In September, Ukraine reached an agreement with the Biden administration to receive 2 billion cubic meters of natural gas from the United States over the fourth quarter of 2022 and the first three months of 2023.

“We will continue to identify additional support with allies and partners, and we are also helping to devise long-term solutions for grid restoration and repair, along with our assistance for Ukraine’s effort to advance the energy transition and build an energy system decoupled from Russian energy,” the State Department said on Tuesday.

Read more here…

Tyler Durden

Thu, 12/01/2022 – 05:00

via ZeroHedge News https://ift.tt/bBIG4KA Tyler Durden

A federal jury in Alabama has awarded Auburn University professor Michael Stern $645,837 in damages after finding Stern’s former dean violated his First Amendment rights by punishing him for criticizing the high number of athletes in the school’s public administration program in 2014. Stern was removed as chair of the economics department after raising his concerns about donor meddling in order to protect student-athletes. A 2015 article in The Wall Street Journal found about half of students majoring in public administration at Auburn played sports. The story quoted one school official writing in an email that “If the public administration program is eliminated, the (graduation) numbers for our student-athletes will likely decline.”

The post Brickbat: Tiger By the Tail appeared first on Reason.com.

from Latest https://ift.tt/AzbPSyI

via IFTTT

The post Thursday Open Thread appeared first on Reason.com.

from Latest https://ift.tt/4Zgo3CX

via IFTTT

EU Threatens Musk With Twitter Ban Over Content Moderation

The EU has threatened to ban Twitter in Europe unless new owner Elon Musk adheres to its strict rules on content moderation.

The threat was made by Thierry Breton, the EU’s commissioner in charge of implementing the bloc’s digital rules, who said during a video meeting with Musk on Wednesday that Twitter must follow a checklist of rules, including ditching his “arbitrary” approach to reinstating banned users, the Financial Times reports, citing people with knowledge of the conversation.

Musk was warned that unless he stuck to those rules Twitter risked infringing the EU’s new Digital Services Act, a landmark law that sets the global standard for how Big Tech must police content on the internet. Breton reiterated that the law meant, if in breach, Twitter could face a Europe-wide ban or fines of up to 6 per cent of global turnover.

Twitter’s owner said repeatedly that he thought that the DSA was “very sensible”, according to people briefed on the conversation, adding that he had read the legislation and thought it should be applied everywhere in the world. -FT

The warning appears to be a direct response to Musk’s approach to content moderation, in which he said he would allow all speech on the platform as long as it was legal, though “negative/hate speech” will be “deboosted,” FT notes.

The EU’s demands also include a requirement that Musk provide clear rules on which users are at risk of being banned. Users such as Kanye West and Andrew Tate, who were unbanned from Twitter – yet remain banned on rival platforms Facebook and Instagram, might be of concern to the EU.

Briton also said Musk should apply strict rules when it comes to advertising, such as those which target children or appear alongside unbanned users who were originally banished for religious or political beliefs.

Further, the EU wants Twitter to commit to an audit by summer 2023, when the company must hand over data on various metrics such as the number of active users and banned accounts.

Tyler Durden

Thu, 12/01/2022 – 04:15

via ZeroHedge News https://ift.tt/0cC9fSl Tyler Durden

‘Operation Pelican’: Details Of UK’s Secret Op To Seize Assange Revealed

Authored by Matt Kennard via Consortium News/Declassified UK,

The British government assigned at least 15 people to the secret operation to seize Julian Assange from the Ecuadorian embassy in London, new information shows. The WikiLeaks founder was given political asylum by Ecuador in 2012, but was never allowed safe passage out of Britain to avoid persecution by the U.S. government.

The Australian journalist has been in Belmarsh maximum-security prison for the past three and a half years and faces a potential 175-year sentence after the High Court of England and Wales green-lighted his extradition to the U.S. in December 2021. “Pelican” was the secret Metropolitan Police operation to seize Assange from his asylum, which eventually occurred in April 2019. Asylum is a right enshrined in the Universal Declaration of Human Rights.

The operation’s existence was only revealed in the memoirs of former Foreign Minister Sir Alan Duncan which were published last year. The U.K. government routinely blocks, or obfuscates its answers to information requests about the Assange case.

But the Cabinet Office recently told Parliament it had seven officials working on Operation Pelican. The department’s role is to “support the Prime Minister and ensure the effective running of government,” but it also has national security and intelligence functions.

It is not immediately clear why the Cabinet Office would have so many personnel working on a police operation of this kind. Asked about their role, the Cabinet Office said these seven officials “liaised” with the Metropolitan Police on the operation.

The Home Office, meanwhile, told Parliament it had eight officials working on Pelican. The Home Office oversees MI5 and the head of the department has to sign off extraditions to most foreign countries. The then home secretary, Priti Patel, ordered Assange’s extradition to the U.S. in June.

‘Disproportionate Cost’

Other government ministries refused to say if they had staff working on Pelican, including the Ministry of Justice (MoJ). The MoJ is in charge of courts in England and Wales, where Assange’s extradition case is currently deciding whether to hear an appeal. It is also in control of its prisons, including Belmarsh maximum security jail where Assange is incarcerated.

When asked if any of its staff were assigned to Pelican, the MoJ claimed: “The information requested could only be obtained at disproportionate cost.” It is unclear why the Home Office, a bigger department with more staff, could answer such a question, but the MoJ could not. There is no obvious reason why the MoJ would have staff assigned to Pelican, so revelations that it did would cause embarrassment for the government.

Meanwhile, the Foreign Office told Parliament it had no staff “directly assigned” to Pelican, but refused to say if people working on the operation were located on its premises.

‘Julian Assange’s Special Brexit Team’

Sir Alan Duncan, foreign minister for the Americas from 2016-19, was the key U.K. official in the diplomatic negotiations between the U.K. and Ecuador to get Assange out of the embassy. In his memoirs he wrote that he watched a live-feed of Assange’s arrest from the Operations Room at the top of the Foreign Office alongside Pelican personnel.

OUTRAGEOUS‼

In his book “In the Thick of It –

The Private Diaries of a Minister” fmr #UK Foreign Affairs Minister Alan Duncan #shamelessly provides #proof of his #corruption & brags about his months of #negotiations w/ #Ecuador in OPERATION PELICAN to illegally evict #Assange 😡 pic.twitter.com/a5XdTbqFBP— Dr Lilliana Corredor (@Dr_LCorredor) April 13, 2021

After Assange had been imprisoned in Belmarsh, Duncan had a drinks party at his office for the Pelican team.

“I gave them each a signed photo which we took in the Ops Room on the day, with a caption saying ‘Julian Assange’s Special Brexit Team 11th April 2019,’” he wrote.

Ecuador’s president from 2007-17, Rafael Correa, recently told Declassified he granted Assange asylum because the Australian journalist “didn’t have any possibility of a fair legal process in the United States.” He added that the U.K. government “tried to deal with us like a subordinate country.”

In September 2021, 30 former U.S. officials went on the record to reveal a CIA plot to “kill or kidnap” Assange in London. In case of Assange leaving the embassy, the article noted, “US officials asked their British counterparts to do the shooting if gunfire was required, and the British agreed, according to a former senior administration official.” These assurances most likely came from the Home Office.

Tyler Durden

Thu, 12/01/2022 – 03:30

via ZeroHedge News https://ift.tt/3MQk9B5 Tyler Durden