Authored by Alasdair Macleod via GoldMoney.com,

This article is in two parts.

In Part 1 it looks at how prospects for gold should be viewed from a monetary and economic perspective, pointing out that it is gold whose purchasing power is stable, and that of fiat currencies which is not. Consequently, analysts who see gold as an investment producing a return in national currencies have made a fundamental error which will not be repeated in this article.

Part 2 covers geopolitical issues, including the failure of US policies to contain Russia and China, and the consequences for the dollar. By analysing recent developments, including how Russia has secured its own currency, the Gulf Cooperation Council’s political migration from a fossil fuel denying western alliance to a rapidly industrialising Asia, and China’s plans to replace the petrodollar with a petro-yuan crystalising, we can see that the dollar’s hegemonic role will rapidly become redundant. With about $30 trillion tied up in dollars and dollar-denominated financial assets, foreigners are bound to become substantial sellers – even panicking at times.

The implications are very far reaching. This article limits its scope to big picture developments in prospect for 2023 but can be regarded as a basis for further debate.

Part 1 — The monetary perspective

Whether to forecast values for gold or fiat currencies

This is the time of year when precious metal analysts review the year past and make predictions for the year ahead. Their common approach is of investment analysis — overwhelmingly their readership is of investors seeking to make profits in their base currencies. But this approach misleads everyone, analysts included, into thinking that precious metals, particularly gold, is an investment when it is in fact money.

Most of these analysts have been educated to think gold is not money by schools and universities which have curriculums which promote macroeconomics, particularly Keynesianism. If their studies had not been corrupted in this way and they had been taught the legal distinction between money and credit instead, perhaps their approach to analysing gold would have been different. But as it is, these analysts now think that cash notes issued by a central bank is money when very clearly it has counterparty risk, minimal though that usually is, and it is accounted for on a central bank balance sheet as a liability. Under any definition, these are the characteristics of credit and matching debt obligations. Nor do the macroeconomists have an explanation for why it is that central banks continue to hoard massive quantities of gold bullion in their reserves. Furthermore, some governments even accumulate gold bullion in other accounts in addition to their central banks’ official reserves.

The wisdom of central banks and Asian governments to this approach was illustrated this year when the western alliance led by America emasculated the Russian central bank of its currency reserves with little more than the stroke of a pen. This is the other side of proof that the legal distinction between money and credit remains, despite any statist attempts to redefine their currency as money. That it can be reneged upon further confirms its credit status.

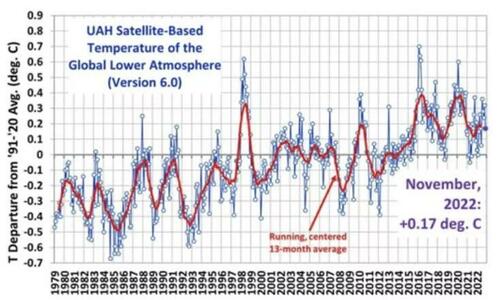

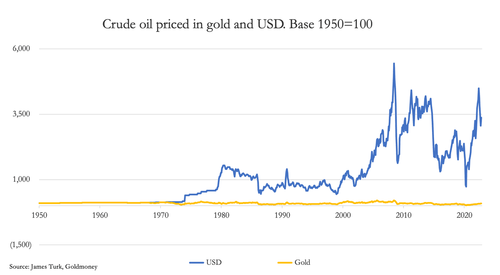

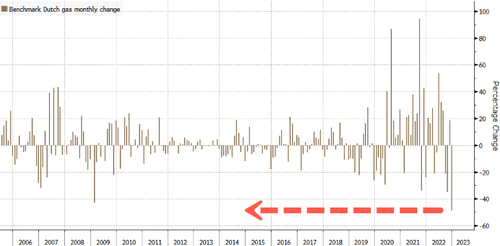

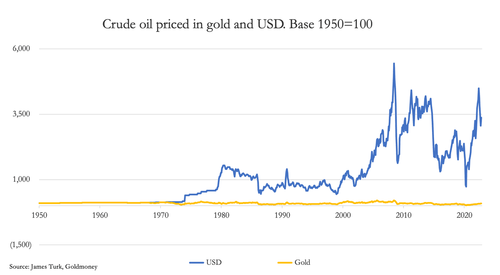

We must therefore amend our approach to analysing gold and its bed-fellow, silver. Other precious metals have never been money, so are not part of this analysis. Silver was dropped as an official monetary standard long ago, so we can focus on gold. With respect to valuing gold, the empirical evidence is clear. Over decades, centuries, and even millennia its purchasing power measured by commodities and goods on average has varied remarkably little. But we don’t need to go back centuries: an illustration of energy prices since the dollar was on a gold standard, in this case of crude oil, makes the point for us.

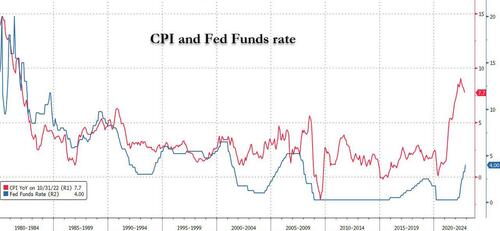

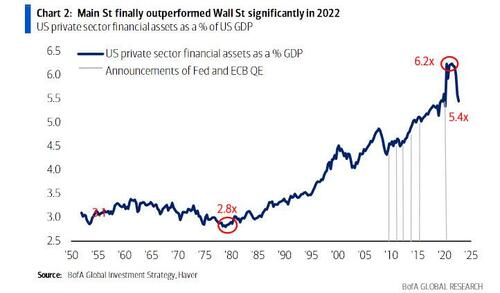

The first point to note is that between 1950—1971, the price of oil in dollars was remarkably stable with almost no variation. Pricing agreements stuck. It was also the time of the Bretton Woods agreement, which was suspended in 1971. Bretton Woods tied the dollar credibly to gold, until the expansion of dollar credit became too great for the agreement to bear. The link was then broken, and the price of oil in dollars began to rise.

Priced in US dollars, not only has the price of crude been incredibly volatile but before the Lehman crisis by June 2008 it had increased fifty-four times. Measured in gold it had merely doubled. Therefore, macroeconomists have a case to answer about the suitability of their dollar currency replacement for gold in its role as a stable medium of exchange.

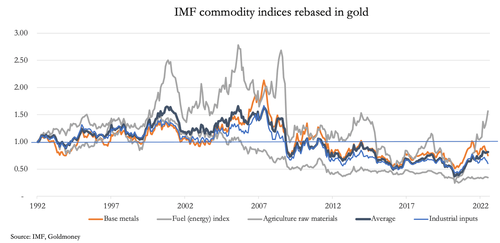

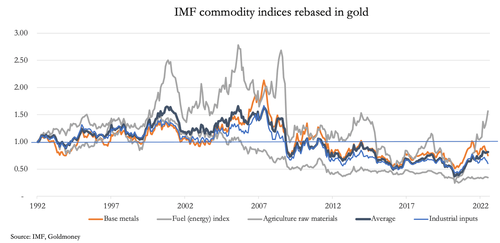

The next chart shows four commodity groups, consolidating a significant number of individual non-seasonal commodities, priced in gold. Over the last thirty years, the average price of these commodities has fallen a net 20%, with considerably less volatility than priced in any fiat currency. Whichever way we look at the relationships between commodities and mediums of exchange, the evidence is always the same: price volatility is overwhelmingly in the fiat currencies.

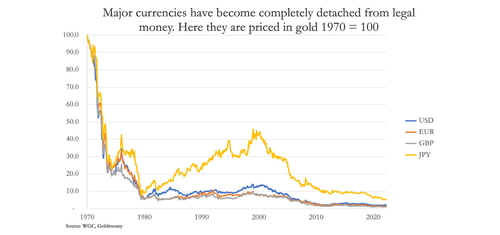

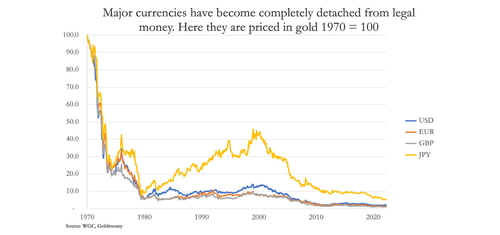

The only possible conclusions we can draw from the evidence is that detached from gold, fiat currencies as money substitutes are not fit for purpose. Our next chart shows how the four major fiat currencies have performed priced in gold since the permanent suspension of the Bretton Woods agreement in 1971.

Since 1970, the US dollar, which establishment economists accept as the de facto replacement for gold, has lost 98% of its purchasing power priced in gold which we have established as still fulfilling the functions of sound money by pricing commodities with minimal variation. The other three major currencies’ performance has been similarly abysmal.

Analysts analysing the prospects for gold invariably assume, against the evidence, that price variations emanate from gold, and not the currencies detached from legal money. There is little point in following this convention when we know that priced in legal money commodities and therefore the wholesale values of manufactured goods can be expected to change little. The correct approach can only be to examine the outlook for fiat currencies themselves, and that is what I shall do, starting with the US dollar.

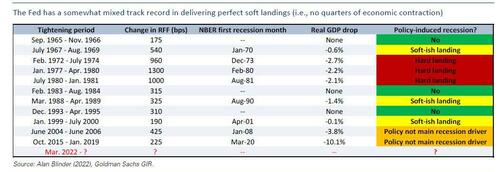

2023 is likely to make or break the US dollar

Outlook for dollar credit

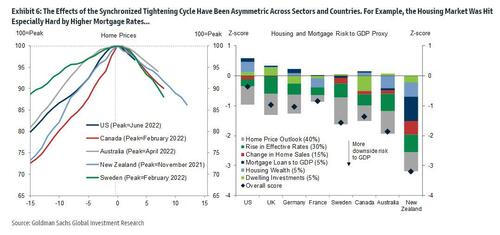

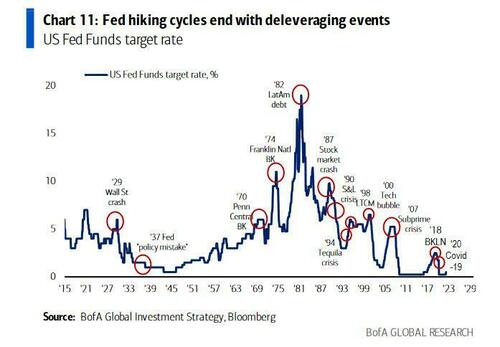

We know that the commercial banking system is highly leveraged, measured by the ratio of balance sheet assets to shareholders’ equity, typical of conditions at the top of the bank credit cycle. While interest rates were firmly anchored to the zero bound, lending margins became compressed, and increasing balance sheet leverage was the means by which a bank could maintain profits at the bottom line.

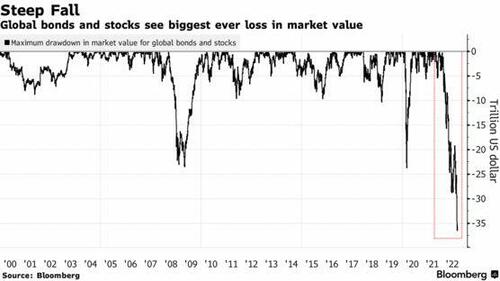

Now that interest rates are rising, the bankers’ collective attitude to bank credit levels has altered fundamentally. They are increasingly aware of risk exposure, both in financial and non-financial sector lending. Already, losses in financial markets are accumulating both for their customers and for banks themselves, where they have bond exposure on their balance sheets. Consequently, they have begun to modify their business models to reduce their exposure to falling asset values in bond, equity, and derivative markets. Furthermore, while US banks appear less leveraged than, say, the Eurozone and Japanese banking systems, paring down bank equity to remove intangibles and other elements to arrive at a Tier 1 capital definition severely restricts an American bank’s ability to maintain its balance sheet size.

There are two ways a bank can comply with Basel 3 Tier 1 regulations: either by increasing shareholders’ capital or de-risking their balance sheets. With most large US banks capitalised in the markets at near their book value, issuing more stock is too dilutive, so there is increased pressure to reduce lending risk. This is set by the net stable funding ratio (NSFR) introduced in Basel 3, which is the ratio of available stable funding (ASF) to required stable funding (RSF).

The application of ASF rules is designed to ensure the stability of a bank’s sources of credit (i.e., the deposit side of the balance sheet). It applies a 50% haircut to large, corporate depositors, whereas retail deposits being deemed a more stable source of funding, only suffer a 5% haircut. This explains why Goldman Sachs and JPMorgan Chase have set up retail banking arms and have turned away large deposits which have ended up at the Fed through its reverse repo facility.

The RSF applies to a bank’s assets, setting the level of ASF apportionment required. To de-risk its balance sheet, a commercial bank must avoid exposure to loan commitments of more than six months, deposits with other financial institutions, loans to non-financial corporates, and loans to retail and small business customers. Physically traded commodities, including gold, are also penalised, as are derivative exposures which are not specifically offset by another derivative.

The consequences of Basel 3 NSFR rules are likely to see commercial banking move progressively into a riskless stasis, rather than attempt the reduction in balance sheet size which would require deposit contraction. While individual banks can reduce their deposit liabilities by encouraging them to shift to other banks, system-wide balance sheet contraction requires a net reduction of deposit balances and similar liabilities across the entire banking network. Other than the very limited ability to write off deposit balances against associated non-performing loans, the creation process of deposits which are always the counterpart of bank loans in origin is impossible to reverse unless banks actually fail. For this reason, system-wide non-performing loans can only be written off against bank equity, stripped of goodwill and other items regarded as the property of shareholders, such as unpaid tax credits. For this reason, US money supply (a misnomer if ever there was one, being only credit — but we must not be distracted) has stopped increasing.

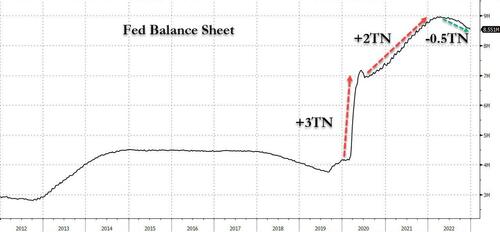

Short of individual banks failing, a reduction in system-wide deposits is therefore difficult to imagine, but banks have been turning away large deposit balances. These have been taken up instead by the Fed extending reverse repurchase agreements to non-banking institutions. In a reverse repo, the Fed takes in deposits removing them from public circulation. More to the point, they remove them from the commercial banking system, which is penalised by holding large deposits.

The level of reverse repos at the Fed started to increase along with the coincidence of the introduction of Basel 3 regulations and a new rising interest rate trend. In other words, commercial banks began to reject large deposit balances under Basel 3 NSFR rules as a new set of risks began to materialise. Today, reverse repos stand at over $2.2 trillion, amounting to about 10% of M2 money supply.

Further rises in interest rates seem bound to undermine financial asset values further, encouraging banks to sell or reclassify any that they have on their balance sheets. According to the Federal Deposit Insurance Commission, in the last year securities available for sale totalling $3.186 trillion have fallen by $750bn while securities held to maturity at amortised cost have risen by $720bn. This sort of window dressing allows banks to avoid recording losses on their bond positions.

This treatment cannot apply to collateral liquidation against financial and non-financial loans. In the non-financial sector, many borrowers will have taken declining and very low interest rates for granted, encouraging them to enter into unproductive borrowing. The continuing survival of uneconomic businesses, which should go to the wall, has been facilitated.

By putting a cap on banking activities the Basel 3 regulatory regime appears to starve both the financial and non-financial economy of bank credit. In any event, the relationships between shareholeders’ equity and total assets has become very streached. Even without bank failures the maintenance of credit supply will now fall increasingly on the shoulders of the Fed, either by abandoning quantitative tightening and reverting to quantitative easing, or by the inflationary funding of growing government deficits. But the Fed already has substantial undeclared losses on its assets acquired through QE, estimated by the Fed itself to have amounted to $1.1 trillion at end-September. Not only is the US Government sinking into a debt trap requiring ever-increasing borrowing while interest rates rise, but the Fed is also in a debt trap of its own making.

We have now established the reasons why broad money supply is no longer growing. Furthermore, commercial banks are thinly capitalised, and therefore some of them are at risk of insolvency under Tier 1 regulations, which strip out goodwill and other intangibles from shareholders’ capital. Working off the FDIC’s banking statistics for the entire US banking system at end-2022Q3, these factors reduce the US banking system’s true Tier 1 capital from $2,163bn to only $1,369bn, on a total balance sheet of $23,631bn. Shifting on-balance sheet debt from mark-to-market to holding to redemption conceals losses on a further $720bn.

Furthermore, with counterparty risks from highly leveraged banking systems in the Eurozone and Japan where asset to equity ratios average more than twenty times, systemic risk for the large American banks is an additional threat to their survival. The ability of the Fed to ensure that no major bank fails is hampered by its own financial credibility. And given that the only possible escape route from a crisis of bank lending and the US Government’s and the Fed’s debt traps is accelerating monetary inflation, foreign holders of dollars and dollar-denomicated assets are under pressure to turn sellers of dollars.

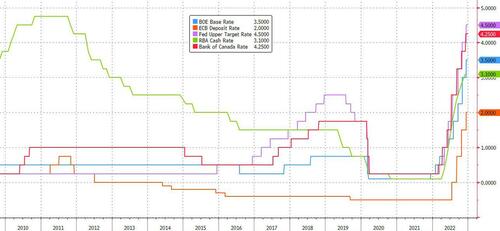

The euro system faces its own problems

The euro system’s exposure to bond losses (collectively the ECB and national central banks) are worse proportionately than those of America’s Fed, with the euro system’s balance sheet totalling 58% of the Eurozone’s GDP (versus the Fed’s at 37%). The yield on the German 10-year bond is now higher than at its former peak in October, leading the way to further Eurozone bond losses at a time when Eurozone governments are increasing their funding requirements. While Germany and the Netherlands are rated AAA and should not have much difficulty funding their deficits, the problem with the Club Med nations will become acute.

With the ECB belatedly turning hawkish on interest rates, a funding crisis seems certain to hit Italy in particular, repeating the Greek crisis of 2010 but on a far larger scale. Furthermore, in the face of falling prices Japanese investment which had supported French bond prices in particular is now being liquidated.

The Eurozone’s global systemically important banks (G-SIBs) are highly leveraged, with average asset to equity ratios of 20.1. Rising interest rates are more of a threat to their existence than to the equivalent US banks, with a bloated repo market ensuring systemic risk is fatally entwined between the banks and the euro system itself. The Club Med national central banks have accepted dubious quality collateral against repos, which will have a heightened default risk as interest rates rise further.

It should be borne in mind that the ECB under Mario Draghi and Christine Lagarde exploited low and negative rates to fund member states’ national debt without the apparent consequences of rising price inflation. This has now changed, with international holders of euros on inflation-watch. It is probably why Lagarde has turned hawkish, attempting to reassure international currency and debt markets. But does a leopard really change its spots?

A combined banking and funding crisis brought forward by a rising interest rate trend is emerging as a greater short-term threat to the euro system and the euro itself than runaway inflation. The importance of the latter is downplayed by official denial of a link between inflation of credit and rising prices. Instead, in common with other central banks, the ECB recognises that rising prices are a problem, but not of its own making. Russia is seen to be the culprit, forcing up energy prices. In response, along with other members of the western alliance the EU has capped Russian oil at $60. This is meaningless, but for the ECB it allows the narrative of transient inflation to be sustained. The euro system hopes that the dichotomy between Eurozone CPI inflation of 10.1% while the ECB’s deposit rate currently held at 2% can with relatively minor interest rate increases be ignored.

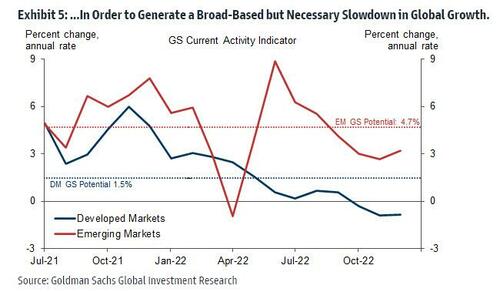

This amounts to a policy based on hope rather than reality. It also assumes central banks will maintain control over financial markets, a policy united with the other central banks governing the finances of the entire western alliance. But foreign exchange markets are slipping out of their control, because in terms of humanity, the western alliance covers about 1.2 billion souls, with the rest of the world’s estimated 8 billion increasingly disenchanted with the alliance’s hegemony.

Part 2 — Geopolitical factors

The foreign exchange influence on currency values

A currency’s debasement and the adjustment to its purchasing power is realised in two arenas. First and foremost, economists tend to concentrate on the effects on prices in a domestic economy. But almost always, the first realisation of the consequences of debasement is by foreign investors and holders of the currency.

According to the US Treasury TIC system, in September foreigners had dollar bank deposits and short-term securities holdings amounting to $7.422 trillion and a further $23.15 trillion of US long-term securities for a combined total of $30.6 trillion. To this enormous figure can be added Eurodollar balances and bonds outside the US monetary system, and additionally foreign interests in non-financial assets.

These dollar obligations to foreign holders are the consequence of two forces. The first is that the dollar is the world’s reserve currency and dollar liquidity is required for global trade. The second is that declining interest rates over the last forty years have encouraged the retention of dollar assets due to rising asset values. Now that there is a new rising trend of interest rates, the portfolio effect is going into reverse. Since October 2021, foreign official holdings of long-term securities (including US Treasuries) have declined by $767bn, and private sector holdings by $3,080bn. Much of this is due to declining portfolio valuations, which is why the dollar’s trade weighted index has not fully reflected this decline. Nevertheless, the trend is clear.

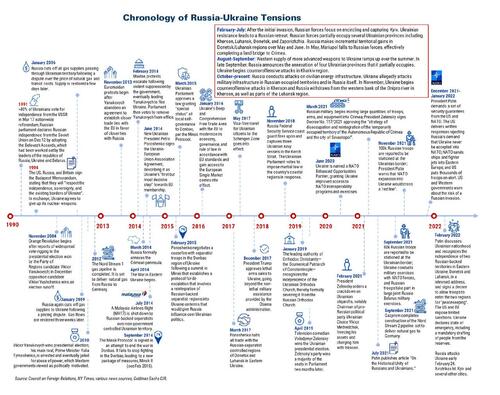

By weaponizing the dollar, the US Government chose the worst possible timing in the context of a financial war against Russia. By removing all value form Russia’s foreign currency reserves, a signal was sent to all other nations that their foreign reserves might be equally rendered valueless unless they toe the American line. Together with sanctions, the intention was to cripple Russia’s economy. These moves failed completely, a predictable outcome as any informed historian of trade conflicts would have been aware.

Instead, currency sanctions have handed power to Russia, because together with China and through the memberships of the Shanghai Cooperation Organisation, the Eurasian Economic Union, and BRICS, effectively comprising nations aligning themselves against American hegemony, Russia has enormous influence. This was demonstrated last June when Putin spoke at the 2022 St Petersburg International Economic Forum. It was attended by 14,000 people from 130 countries, including heads of state and government. Eighty-one countries sent official delegations.

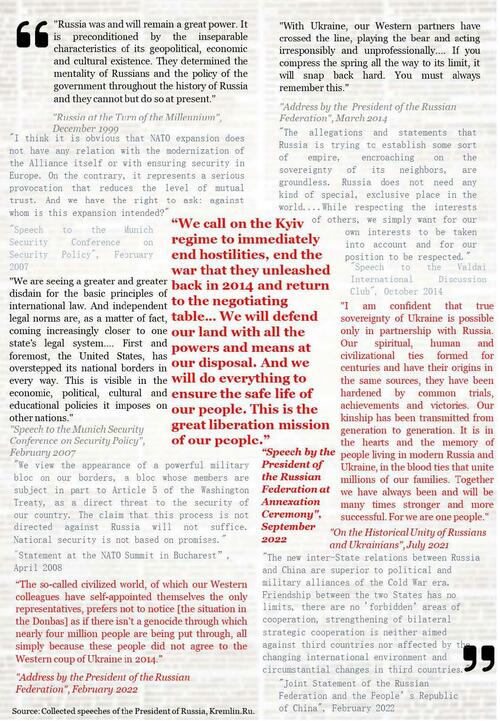

The introductory text of Putin’s speech is excerpted below, and it is worth reflecting on his words.

It amounts to an encouragement for all attending governments to dump dollars and euros, repatriate gold held in financial centres controlled or influenced by partners in the American-led western alliance, and favour reserve policies angled towards commodities and commodity related currencies.

More than that, it amounts to a declaration of financial conflict. It tells us that Russia’s response to currency and commodity sanctions is no longer reactive but has turned aggressive, with an objective to deliberately undermine the alliance’s currencies. Being cut off from them, Russia cannot take direct action. The attack on the dollar and the other alliance currencies is being prosecuted by the supra-national organisations through which Russia and China wield their influence. And Russia has protected the rouble from a currency war by linking it to an oil price which it controls. And as we have seen in the discussion of the relationship between oil prices and gold in Part 1 above, the rouble is effectively tied more to gold than to the global fiat currency system.

Other than looking at the dollar overhang from US Treasury’s TIC statistics, we can judge the forces aligning behind the western alliance and the Russia-China axis in terms of population. Together, the western alliance including the five-eyes security partners, Europe, Japan, and South Korea total 1.2 billion people who by turning their backs on fossil fuels are condemning themselves to de-industrialising. Conversely, the Russia-China axis through the SCO, EAEU, and BRICS directly incorporates about 3.8 billions whose economies are rapidly industrialising. Furthermore, the other 3 billions, mainly on the East Asian fringes, Africa and South America while being broadly neutral are economically dependent to varying degrees on the Russia-China axis.

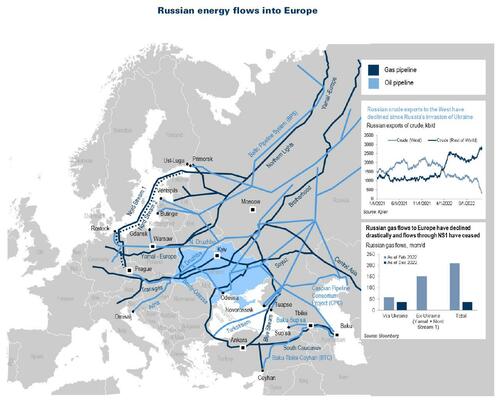

In terms of trade and finance, the geopolitical tectonic plates have shifted more than is officially realised in the western alliance. Led by America, it is fighting to retain its hegemony on assumptions that might have been valid twenty years ago. But in recent months, we have even seen Saudi Arabia turn its back on America and the petrodollar, along with the entire Middle East. Admittedly, part of the reason for the ending of the petrodollar, which has sustained the dollar’s hegemony since 1973, must be the western alliance’s policies on fossil fuels, set to cut Saudi Arabia off from Western markets entirely in the next few decades. Contrast that with China, happy to sign a gas supply agreement with Qatar for the next 27 years, and the welcome Mohammed bin Salman, Saudi Arabia’s de facto leader gave to President Xi earlier this month. In return for guaranteed oil supplies, China will recycle substantial sums into Saudi Arabia and the Gulf region, linking it into the Silk Roads, and a booming pan-Asian economy.

The Saudis are turning their backs not only on oil trade with the western alliance but on their currencies as well. There is no clearer example of Putin’s influence, as declared at the St Petersburg Forum in June. Instead, they will accumulate trade balances with China in yuan and bring business to the International Shanghai Gold Exchange, even accumulating bullion for at least some of its net trade surplus.

The alignment of the Saudis and the Gulf Cooperation Council behind the Russia-China axis gives Putin greater control over global energy prices. With reasonably consistent global demand and cooperation from his partners, he can more or less set the oil price as he desires. Any response from the western alliance could even lead to a blockade of the Straits of Hormuz, and/or the entrance to the Red Sea, courtesy of Iran and the Yemeni Houthis.

He who controls the oil price controls the purchasing power of the dollar. The weapons at Putin’s disposal are as follows:

-

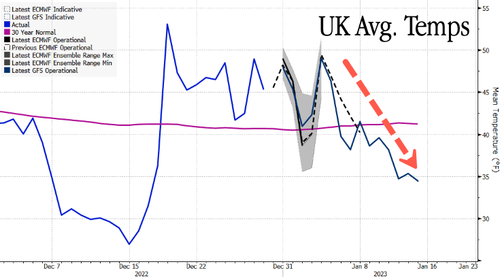

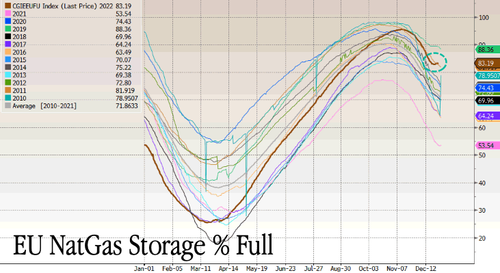

At a moment of his choosing, Putin can ramp up energy prices. He would benefit from waiting until European gas reserves begin to run down in the next few months and when global oil demand will be at its peak.

-

By ramping up energy prices, he will undermine the purchasing power of the dollar and the other western alliance currencies. At a time of economic stagnation or outright recession, he can force the alliance’s central banks to raise their interest rates to undermine the capital values of financial assets even further, and to undermine their governments’ finances through escalating borrowing costs.

-

Putin is increasing pressure on Ukraine. He is doing this by attacking energy infrastructure to force a refugee problem onto the EU. At the same time, he is rebuilding his military resources, possibly for a renewed attack to capture the Ukraine’s Eastern provinces, or if not to maintain leverage in any negotiations.

-

He can bring forward the plans for a proposed trade settlement currency, currently being considered by a committee of the Eurasian Economic Union. The development of this currency, provisionally to be backed by a basket of commodities and participating national currencies can easily be simplified into a commodity alternative, perhaps represented by gold bullion as proxy for a commodity basket.

-

By giving advance warning of his strategy to undermine the dollar, he can accelerate selling pressure on the dollar through the foreign exchanges. Already, members of the Russia-China axis know that if they delay in liquidating dollar and euro positions they will suffer substantial losses on their reserves.

While he is in a position to control energy prices, it is in Putin’s interest to act. By a combination of escalating the Ukraine situation before battlefields thaw and the need to ensure that inflationary pressures on the western alliance are maintained, we can expect Putin to escalate his attack on the western alliance’s currencies in the next two months.

China’s renminbi (yuan) policy

While Putin took a leaf out of the American book by insisting on payment for oil in roubles in order to protect its purchasing power, less obviously China has agreed a similar policy with Saudi Arabia. Instead of dollars, it will be renminbi, or “petro-yuan”. Payments for oil and gas supplies to the Saudis and other members of the Gulf Cooperation Council will be through China’s state-owned banks which will create the credit necessary for China and other affiliated nations importing energy to pay the Saudis. Through double-entry bookkeeping, the credit will accumulate at the banks in the form of deposits in favour of the exporters, which will in turn be reflected in the energy exporters’ currency reserves, replacing dollars which will no longer be needed.

Through its banks, China can create further credit to invest in infrastructure projects in the Middle East, Greater Asia, Africa, and South America. This is precisely what the US did after the agreement with the Saudis back in 1973, leading to the creation of the petrodollar. The difference is that the US used this mechanism to buy off regimes, principally in Latin and South America, so that they would not align with the USSR.

We can expect China to follow a commercial, and not a political strategy. Bear in mind that both China and Russian foreign policies are not to interfere in the domestic politics of other nations but to pursue their own national interests. Therefore, the expansion of Chinese bank credit will accelerate the industrialisation of Greater Asia for the overall benefit of China’s economy. So long as the purchasing power of the yuan is stabilised, this petro-yuan policy will not only succeed, but generate reserve and commercial demand for yuan. It was the policy that led to the dollar’s own stabilisation. With the yuan prospectively replacing the US dollar, we can see that the dollar’s hegemony will also be replaced with that of the yuan.

The Saudis will be fully aware of their role in providing stability for the dollar. Triffin’s dilemma describes how a reserve currency needs to be issued in large quantities for it to succeed in that role. The creation of the petrodollar assisted materially. In America’s case, the counterpart of that was deliberate budget and trade deficits. But China has a savings culture, which tends to lead to a trade surplus. Therefore, it must satisfy Triffin by credit expansion.

Looking through an initial phase of currency disruption, which we are bound to experience as markets gravitate towards petro-yuan, in the longer-term China might find itself in the position of having to put a lid on the yuan’s purchasing power to stop it rising to a point which becomes economically disruptive. Bizarrely, this might end up being the role for China’s undoubted massive hidden gold reserves. By introducing a gold standard for its currency, China could put a cap on the yuan’s purchasing power.

Given the initial disruption to global foreign exchanges as the dollar loses its status, there would be sense in China declaring a gold standard sooner rather than later. Remember, gold retains a stable purchasing power over the long term with only modest fluctuations, the characteristics the Chinese planners are bound to want to see in their currency as the transacting and financing medium for its pan-Asian plans.

In this scenario the US Government and the Fed will be faced with collapsing currency, which can only be stabilised by going back onto a gold standard. But this igoes so against ingrained US policy, a move back to securing the dollar’s purchasing power is hardly even a last resort.

Finally, some comments on gold

From the foregoing analysis, it should be clear that in estimating the outlook for gold it is not a question of forecasting what the gold price will be in 2023, but what will happen to the dollar, and therefore the other major fiat currencies. These currencies have shown themselves not fit to be mediums of exchange, only being stealthy fund raising media for governments.

While western market analysts appear to have failed to grasp this point, President Putin certainly has, as his speech in Leningrad last June demonstrated. If he follows through on his comments with action, he has the potential to inflict serious damage on the dollar and the other western alliance currencies. Furthermore, China has also made a major step forward with its agreement with Saudi Arabia to replace the petrodollar with a petro-yuan.

Throughout history, gold, which is legal money, has maintained its value in general terms with only modest variation. It is fiat currencies which have lost purchasing power to the point where from 1970 the dollar has lost 98% of it. The comparison between gold and the dollar is simply one between legal money and fiat credit — the only way in which relative values can be determined between them.

Our last chart will not be a technical presentation of gold, but of the dollar, for which we will use a log scale so that we can think in terms of percentages. Watch for the break below the support line at about 2%.

The modest fall projected by the pecked line is a halving of the dollar’s purchasing power, measured in real money, which suggests a gold price for the dollar at 1/3,600 gold ounces. This is not a forecast but gently chides those who think it is the gold price which changes. Where the rate actually settles in 2023 will depend on President Putin, who more than any technical analyst, more than any western investment strategist, and even more than the Fed itself has the power to set the dollar’s future price measured in gold.

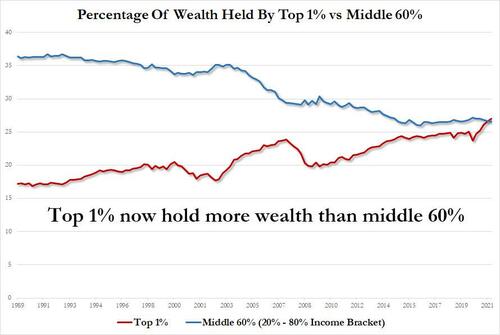

One thing we will admit, and that is when fiat currencies begin to slide to the point where domestic Americans realise that it is the dollar falling and not gold rising, a premium will develop for gold’s value against consumer items and assets, such as residential property, reflecting the awful damage a currency collapse does to the collective wealth of the people.