As Morgan Stanley rates strategist Matthew Hornbach writes in his final note of the year, “a year without surprises would be a surprise itself.” And given that every year comes with some, Hornbach has laid out 10 that would make investors think differently and move global macro markets. Below, we excerpt from the note “Top 10 Surprises for 2023” (available to pro subs in the usual place), and provide some additional detail on select points.

Surprise #1: Covid-19 in China leads to global deflation fears:

- An overloaded healthcare system in China leads to weaker growth, lower commodity prices, fears of global deflation, a weaker USD vs. EUR but stronger USD vs. EM, earlier DM rate cuts and steeper DM yield curves.

Surprise #2: The Fed doesn’t cut rates, even in a recession:

- Even as growth moves into recession territory, inflation stays sticky and lags growth, keeping the Fed on hold through 2023 amid a recession – much like Paul Volcker’s Fed in 1982.

Surprise #3: Dysfunctional UST market forces Fed to pause/end QT:

- Challenged liquidity continues to pose a threat to QT and could force the Fed to intervene next year.

Surprise #4: 2H23 ECB rate cuts on sharply falling house prices:

- An acceleration in the decline in house prices, leading central banks to cut rates as soon as 2H23.

Surprise #5: Renewed gilt underperformance due to net supply:

- Lack of a compositional change in supply leads to high net DV01 issued in FY 2023/24 and hence gilts underperform other bond markets.

Surprise #6: Nothing from the BoJ:

- The BoJ keeps the status quo even under the new BoJ governor, given a global growth slowdown and lack of a wage-inflation spiral.

Surprise #7: The bull case for GBP:

- A material fall in energy prices, the return of labor supply and/or a more resilient consumer could lead to a constructive UK growth (and hence GBP) outlook

Surprise #8: Citizens could cushion a Canadian condo crash:

- A surge in immigration prevents a housing crash from lifting USD/CAD.

Surprise #9: The Fed reviews its 2% target:

- The 2025 framework review encourages the Fed to consider altering its inflation target amid mounting political pressures.

Surprise #10: EUR and UK breakevens heading to record highs:

- De-risking from pension schemes amidst low linker supply could send breakevens to new highs in both markets.

* * *

Below are some more details on a handful of these surprises, starting with…

Surprise #1: Covid-19 in China leads to global deflation fears

Healthcare overload leads to weaker growth in China

One of the big surprises to hit global macro markets as we approached the end 2022 was the speed with which Beijing pivoted away from Covid Zero. Many in the market expected the government would aim for a reopening in the spring of next year and use the intervening months to boost vaccinations and healthcare capacity.

Events have led to an accelerated timeline, with a winter reopening now under way. This accelerated timeline alongside more proactive policy easing from Beijing has led our China economics team to upgrade its growth forecast for 2023 to 5.4%. Investors and markets now generally expect Beijing to be determined to push on with reopening as the Covid case count surges over the coming weeks and months, even if it’s a bumpy ride. Living with Covid would be the new normal in China in 2023, just like it was for the rest of the world in 2022. This is the consensus view.

The risk to this view is that China faces waves of surging Covid cases over the coming months, testing healthcare capacity. Nobody would want to reimpose restrictions, when the decision had previously been made to open the economy.

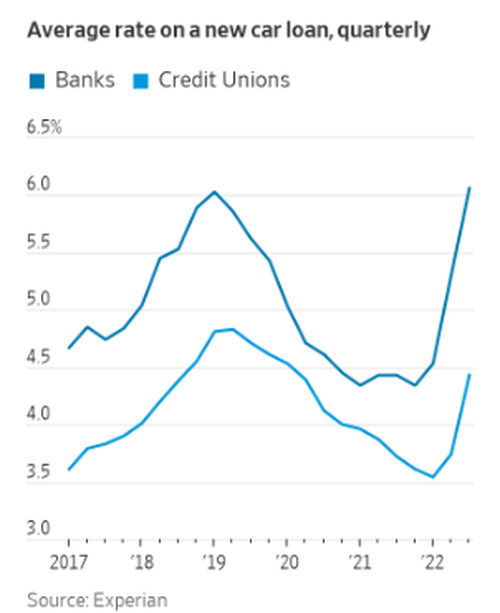

But if healthcare systems become overloaded, then restrictions may need to be reimposed temporarily to simply manage the caseload and give authorities time to make more progress on vaccination and boost healthcare capacity more generally. Such an outcome is hardly farfetched. In the UK, for example, the discovery of the first cases of the Omicron variant was announced on November 27, 2021.

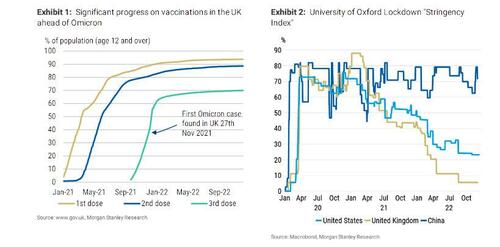

The initial phase of the UK vaccination campaign was in the rearview mirror, with 2nd doses largely complete and a significant proportion of the elderly population having received their 3rd dose too (see Exhibit 1). By this time, restrictions had started to be lifted in the UK, as is currently happening in China, though this is not yet reflected in the Oxford Stringency Index data (see Exhibit 2).

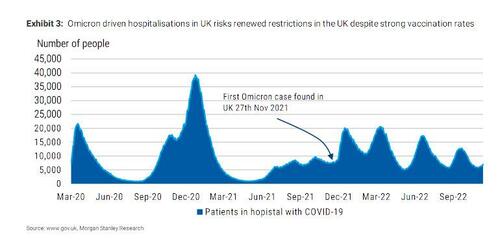

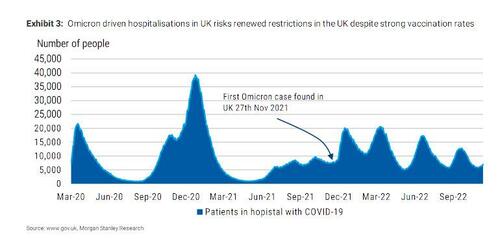

As Omicron swept through the UK, the number of patients in hospital with Covid-19 surged (see Exhibit 3). The situation was serious enough for the UK to re-impose some restrictions on November 27, 2021, as a precautionary measure, and impose other restrictions, such as a two-week circuit breaker, later in December of the same year.

As our China team has pointed out, the effect of Omicron in other economies around the world suggests there could be a sharp but short-lived impact on China’s economy, with the largest effect on demand rather than supply.

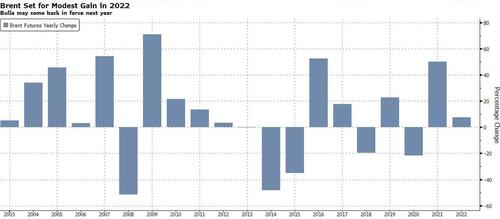

This could lead to a drop in mobility indicators (which could explain why oil prices have been trading so softly recently), with Covid cases peaking around the Lunar New Year, before infections gradually come lower and plateau by the end of Q1, in their view.

The hit to activity in the short term seems baked in at this point, given the experience from other economies that have gone through an Omicron wave. However, healthcare capacity in China has not yet been tested. A surge in hospitalizations could force a temporary reimposition of restrictions across the country, leading to weaker growth in China in 2023.

* * *

Surprise #2: The Fed doesn’t cut rates, even in a recession

No “Fed put” in 2023 – for markets, or even the economy

In this surprise scenario, the Fed delays cutting rates until 2024, even when recession begins in 2023. The Fed’s concerns about inflation stickiness trump concerns about slowing growth and weakening labor markets, and the Fed waits for evidence of a sustained inflation decline. Inflation, being a lagging indicator, declines much later than growth and payrolls do, and the Fed cuts rates a few quarters after the recession begins. 10y yields do not decline much in a recession in 2023, and the 2s10s yield curve stays inverted through 2023 – and flatter than expected.

Markets and the economy are conditioned to seeing the Fed ease at the first signs of economic distress, or with tightening financial conditions. And even with the highest, and possibly stickiest, inflation in decades, markets think inflation will cool off next year, and the Fed will be cutting rates beginning in 2H23 (see Exhibit 14), delivering about 7 cuts by the end of 2024.

The Fed has already hinted at this possibility with the latest summary of economic projections at the December FOMC meeting. With the median Fed participant projecting real GDP growth at 0.5% in 2022 and 2023, the Fed plans to maintain a terminal rate of 5.125% through the end of 2023, with core PCE inflation expected to be 3.5% by the end of 2023 in the Fed’s projections.

This disconnect – where markets are heavily priced for a recession scenario, and “Fed put” protects against it – is due to the completely different views on recent inflation prints between the markets and the Fed. As we noted in our December FOMC reaction, the Fed is more focused on service sector inflation, which largely makes up Phillips curve sensitive inflation. Meanwhile, markets are looking at overall inflation (see Exhibit 15), which has been coming down rapidly, driven by goods deflation as well as a healthcare insurance reset.

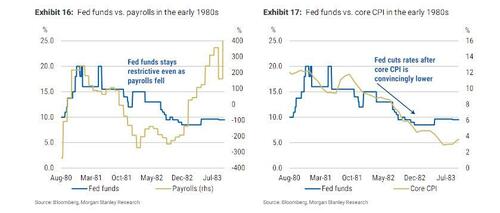

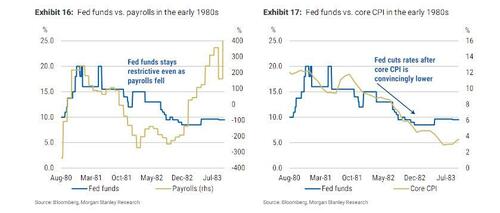

It would not be unprecedented for the Fed to not cut rates in a recession (NBER recession dates : July 81 – November 82). Recall that back in late 1981 to mid-1982, the Fed under Chair Paul Volcker did not cut rates even as real GDP prints were negative and payrolls were clearly declining. In fact, payrolls started falling sharply in September 1981, but the Fed did not start cutting rates meaningfully until July 1982 (see Exhibit 16), a clear departure from the previous quarters, where the Fed had been much more reactive to payrolls.

This was because Volcker decided to hold a restrictive stance until core CPI inflation itself started to cool meaningfully (see Exhibit 17) and, by definition, inflation readings lag the labor market and growth. Chair Powell has referred to this many times, most notably when he said in his Jackson Hole speech that “history cautions against loosening policy prematurely.”

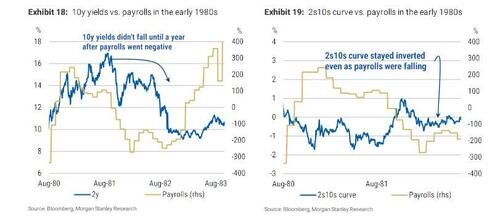

With such a delay in cutting rates, the US rates market had a turbulent repricing. First, US rates markets, which were used to the Fed easing with payroll weakness, priced in easing. 1y and 10y yields fell sharply as payrolls fell, only to realize that the Fed wasn’t cutting rates into a weakening economy, but was waiting for inflation to cool. Soon, the initial easing expected by the market faded and the 10y yield rose again (see Exhibit 18), only falling sustainably when the Fed cut rates in mid 1982.

The 2s10s curve also steepened initially, but then flattened back when it became clear the Fed wasn’t cutting rates anytime soon. We think, given the sticky inflation perception the Fed has, the US rates market could be surprised by the Fed in 2023 – a similar dynamic as in 1982. Yields may not decline much and the 2s10s curve may stay inverted through 2023.

* * *

Surprise #3: Dysfunctional UST market forces Fed to pause/end QT

Challenged liquidity continues to pose a threat to QT

Most investors expect the Fed’s second attempt at QT to come to an end due to reserve scarcity or policy rate cuts. However, a challenged liquidity environment makes market functioning another obstacle to QT that deserves attention from investors.

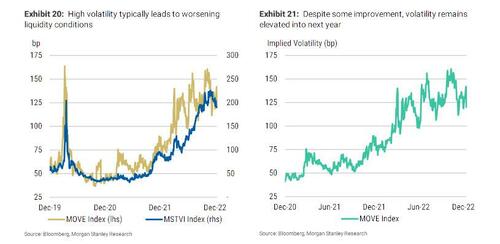

We see the two main drivers of lower liquidity (elevated volatility and intermediation constraints) lingering into next year, creating the possibility that the Fed would have to intervene and pause/end QT to restore market functioning in the event of a rush to liquidity.

Such an event should result in a rapid cheapening of UST yields relative to swaps, leading to lower swap spreads. Ideally, the best way to position for this is to short swap spreads (short UST, receiver swap), but knowing exactly when this will materialize, if at all, is very difficult. A more attractive proposition could be to go long swap spreads (long UST, payer swap), if evidence of liquidity strains materializes (rapid 10-20bp move in swap spreads), in the expectation that the Fed would intervene and restore market functioning.

The November NY Fed primary dealer survey shows that the market generally expects the Fed to stop reducing its balance sheet in 3Q24 (based on the median response). This is in broadly in line with our expectation that QT will end in mid-2024 as the Fed starts to see evidence of reserve scarcity in funding markets. Alternatively, some investors see policy rate cuts as another strong candidate to bring an end to QT (the market expects the first full 25bp cut by the November 2023 FOMC meeting).

However, as we observe in QT: A Marathon with Multiple Obstacles, challenged liquidity continues to leave the UST market vulnerable, making market functioning another obstacle to QT that deserves attention from investors. Next year, a rush-to-liquidity event (e.g., a surge in demand to sell US Treasuries for USD) could force the Fed’s hand in having to act as the buyer of last resort, leading to a premature pause/end to QT.

As we have highlighted recently (see UST Liquidity: Cloudy Skies), the US Treasury market has experienced deteriorated liquidity conditions this year given:

- Elevated levels of both implied and realized volatility; and

- Structural market issues such as limited primary dealer intermediation capacity

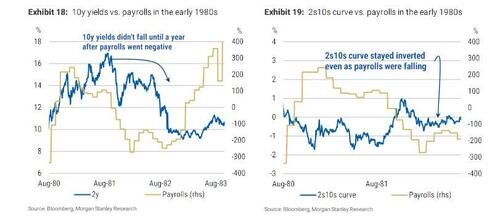

First, the rapid move higher in rates as the Fed hikes and unwinds its balance sheet to bring down inflation has led to one-sided markets (many sellers versus few buyers) and greater unwillingness from dealers to warehouse interest rate risk. Intuitively, periods of high implied volatility tend to result in worsening liquidity conditions (see Exhibit 20).

Moving forward, a positive is that further clarity around the future path of hikes combined with a Fed that eventually pauses would help to reduce implied volatility next year and, consequently, help to improve liquidity. For now, as shown in Exhibit 21, implied volatility remains relatively elevated, albeit there has been a recent move lower, as a fair degree of uncertainty remains around the future path for inflation, growth, and interest rates.

This week’s FOMC meeting (see FOMC Reaction: An Inconsistent Message) suggests that the path to lower implied volatility could be bumpy over the coming months, particularly as markets balance recent weak inflation data with an FOMC that needs “substantially more evidence to give confidence that inflation is on a sustained downward path.”

In particular, intermediation capacity continues to be limited (see Exhibit 22) as primary dealers have not kept up with the exponential growth of outstanding UST debt given regulatory capital constraints post-GFC (the most relevant being the supplementary leverage ratio). Although we expect to see further progress from regulators in 2023, final changes besides increased data transparency will likely take some time to implement.

Consequently, it is no surprise that deteriorating UST liquidity due to the two factors just mentioned has led to elevated moves in rates relative to past years. As shown in Exhibit 23, the absolute day-over-day changes in the 10-year UST yield have, on average, been elevated this year relative to the 5-year average.

Given that both of the conditions that led to a deterioration in liquidity in 2022 could still linger into next year, the UST market remains vulnerable to an unexpected liquidity event.

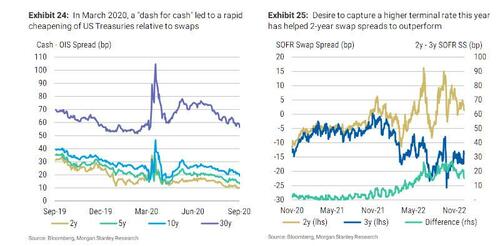

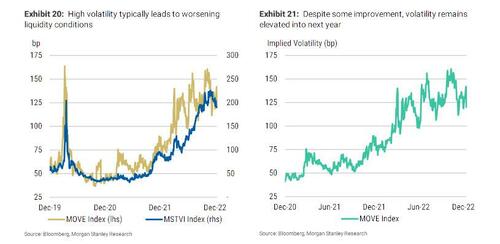

If an outsized demand to sell US Treasuries materializes next year, we expect US Treasuries to underperform swaps significantly (i.e., the yield on USTs increases at a faster pace relative to swaps). As shown in Exhibit 24, this occurred during March 2020’s “dash for cash” and led the Fed to intervene to restore market stability. This presents opportunities for investors in swap spreads if such conditions repeat themselves.

Although not our base case, a sharp slowdown in growth and an unexpected increase in global political and financial risks could put US Treasury market functioning to the test. Ideally, the best way to position for this is to short swap spreads (short UST, receiver swap), but knowing exactly when this will materialize, if at all, is very difficult.

* * *

Much more, including details on the remaining 7 surprises, in the full note available to pro subs.