Authored by Bill Blain via MorningPorridge.com,

“The difficulty, the extraordinary, is not to score 1,000 goals like Pele – it’s to score one goal like Pele.”

I was going to take the whole of this week off, but I could not resist a final comment on this, the very last business day of 2022…

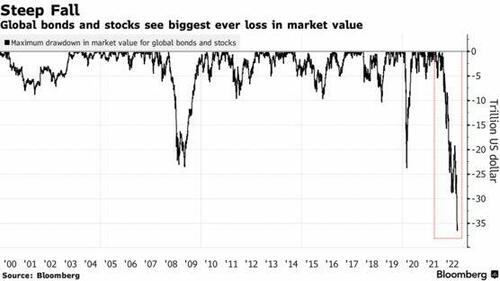

2022 has been an … “interesting” year. What’s the main lesson we’ve learnt?

-

That interest rates don’t stay low for ever?

-

Inflation is real?

-

Real events overcome hopes and expectations?

-

All Ponzis are uncovered – sooner or later?

Or,

I suspect the final one contains a sizable element of truth.

Markets are just enormous voting machines calculating the opinion of every participant, therefore no single “idiot” can drive them.. but they can certainly influence how the other participants vote.

A few months ago I mentioned one of my favourite Sci Fi authors, John Scalzi. I’ve been reading him for years. He’s written some very clever series including Old Man’s War, and the off-the-wall Kaiju Preservation Society. He also written fantastic tales for the Netflix series Life, Death and Robots – with some very unsubtle digs at big tech barons! This week a client posted me this fascinating and insightful comment by Scalzi: The Worthless Billionaires of 2022

It is spot on.

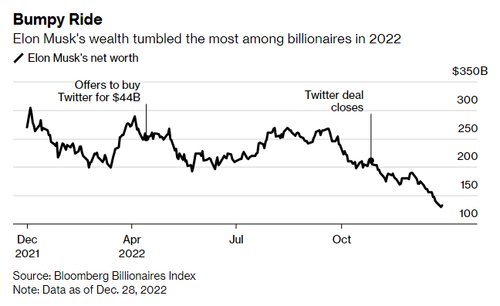

Scalzi debunks the whole mythos of the assumed competence and virtue of billionaires with style and aplomb. He focuses on the implosion of value-bunkum across crypto and big-tech, and is particularly scathing about the self-immolation of Elon Musk. He warns on the danger of believing billionaires come with inherent virtue. Believe that, and it’s easy to follow dangerous ideological concepts like trickle-down economics – which simply doesn’t exist, btw!

Scalzi can be quite blunt:

“Billionaires do not deserve your respect simply for being rich, and that fact that people gave them respect because of that money allowed them to cover for their other and continuing ethical and moral deficiencies, of which there are many, and which continue to damage our society.”

The thing is… Billionaires are the not the only folk we should probably not be unquestioningly listening to.

It’s a false assumption to think people in positions of power know what they are doing or understand what they are saying. 2022 has been an extraordinary year for seeing our idols exposed as mere craven images.

If there is one lesson from this difficult year, it’s the realisation most folk are not that clever. Understand that, and suddenly everything becomes clearer in terms of how markets are driven by behaviour.

Behavioural economics: understanding why markets function the way they do by understanding why participants act in the ways they do…

Markets tend to follow the noise. Trading floors are absolutely littered with people who believe they are bone-fide geniuses – and loudly tell us just how clever they are. Typically, the successful ones might have been dealt a lucky hand or make a fortunate throw and ascribe their success to smarts. In reality, most don’t have a breeze about what they are doing, or the damage they could inflict upon us all. They got lucky – but think they are clever. Danger, Danger, Will Robinson, Danger!

Herd stupidity is a problem, but it’s also an opportunity. When you realise that its ok to question, disagree, argue and counter the propositions of the consensus (which is often built around luck and stupidity), then markets start to get interesting again! Understand why others are wrong, and you are halfway to grasping why you might be right.

2022 has been extraordinary for the sheer scale of mistakes people have made. The volume of miscalculations, most of which are then reinforced and magnified by denials and rebuttals after the initial mistakes have clearly been made, has been staggering.

From Liz Truss establishing herself as the least competent UK leader of all time, Putin beggaring Europe and Russia through the invasion of Ukraine, Musk buying Twitter, fund managers seeking bargains in big-tech, crypto-shills telling us this is the buy-moment before a new crypto-spring, to the man who is putting everything on Red because it’s come up Black the last three rolls (clue – its still a 50/50 discrete call), 2022 has been revelatory.

I suspect there are good reasons why 2022 represented “peak-silliness” in markets. We had a whole series of macro “behavioural” forces coinciding:

-

The end of the speculative era of easy QE money distorting markets

-

The instability in global systems from Covid, Supply Chains, Ukraine, Taiwan, etc

-

The growing income inequality caused by QE

-

Growing voter disenchantment and new generations feeling unwanted

-

FOMO (Fear of Missing Out) becoming a driver of wealth hopes

-

The rise of social media, fake news and news manipulation, and a pandemic of conspiracy theories..

Put all these trends/themes together, and its no wonder behaviours changed, people began to accept the unlikely as probable, and unquestioningly believed a pocketful of pixels was worth more than gold…

The bottom line is markets, and the factors that influence them, are full of idiots. They range from politicians making fundamental mistakes, fund managers dramatically mispricing risks, central bankers studiously miscalculating economic shifts, company boards focusing on all the wrong things, right the way down to investors who really did believe what the Reddit Boards told them.

It’s a skill to listen. Its even more skilful to question.

And on that piece of blindingly obscure advice…. Have a Guid and Prosperous New Year!

I will be back on Tuesday with my big worry for 2023 – The Bond Market!

* * *

Subscribe to Blain’s Morning Porridge here…