Authored by Fabiann Ommar via The Organic Prepper blog,

When the system begins to fail, society can quickly crumble. Two such events have occurred recently…

Let’s reflect on the Brumadinho mining dam disaster and see about the recent cartel attack in Culiacán, Mexico, in order to discuss how these kinds of events can affect our daily lives, particularly during times of crisis.

In his work, Selco explains what occurs to individuals and society as a whole when the system completely fails. He’s unmatched and possibly one of the greatest sources to look at because of how effectively his blunt and honest style is to convey the drama and urgency of the unthinkable.

I haven’t experienced a civil war, but I can speak about other SHTFs, such as Thirdworldization, or crime that occurs when a crisis arises.

The recent events in Mexico serve as the ideal illustration.

The Brazilian uprising of January 8th took place as I was just beginning to write about it, so the immediacy of the situation took priority.

However, here’s the quick rundown:

The Sinaloa Cartel launched a significant offensive against the Mexican government and military in the first week of January in response to the detention of their leader.

“Mexican authorities have captured Ovidio Guzmán, a son of incarcerated drugs kingpin Joaquín “El Chapo” Guzmán, prompting a wave of retaliatory attacks from cartel gunmen in the northern city of Culiacán.

After a night of violence, gunmen exchanged fire with security forces, blocking roads with burning vehicles and shooting at army helicopters and police aeroplanes bringing reinforcements to the city.

According to one resident, heavy fighting raged for hours after Guzmán – a key figure in the Sinaloa cartel since the arrest of his father – was arrested in the city early on Thursday.” [source]

(If a few good books about this topic are TLDR, but you still want a broad view on this, I advise watching the Netflix’s original series Narcos. It’s Hollywood, so a little dramatized for entertainment, but it still gives a good outline of the major players and events.)

A well-armed, organized, numerous, and deadly gang of criminals put on a massive and scary exhibition of strength and firepower.

You’ve probably seen the videos making the rounds on social media and in the news, of passengers trying to take cover from the gunfire inside of an airplane, sicarios attempting to take down helicopters, groups firing heavy artillery towards the troops in the streets and avenues, and drug soldiers raiding homes.

An entire region of a democratic nation was in dread as a result of the Sinaloa Cartel offensive to put pressure on the government and force the release of Guzmán. The estimated death toll from the conflict is 19 accused cartel gunmen and 11 members of the military and law enforcement.

I’ve witnessed enough cartel activity to know that there are generally many more ‘unofficial’ victims and collateral in these drug wars, so I’m sure there are more to add to that total. It’s still ongoing, too, I’m sure – just not as openly as it has been.

The fact that such savagery produced significant stir in a populace accustomed to the cartels and their ways says something about the ferocity of the struggle, even though it may startle my first-world colleagues. Not to mention that it all took place not far from the US.

Think of that for a moment: paramilitary criminal groups directly attacking the government of a sizable democratic state.

And this is not unprecedented.

Something similar occurred in Brazil over two decades ago. In May 2006, the PCC – also known as First Command of Capital, a well-known criminal organization – unleashed a wave of violent attacks against the police and government officials and buildings. That happened in São Paulo, the wealthiest state in Brazil and the 16th in the world.

The gang instigated a mutiny in 76 jails to oppose the transfer of more than 700 of its members to highest security prisons. Then, street members were ordered to indiscriminately target police, police stations, state prosecutors, and other authorities. The forces responded by sending out a full contingent to confront the assailants.

Wild rumors and curfew announcements kept the terrified population indoors. Buses did not leave the garages (more than 40 were set on fire), and shops, schools, and businesses remained closed. My city, which has 13 million residents and is the biggest in Brazil, had deserted streets for days. At the end of the attack, there were 60 agents and 500 civilian casualties (PCC members and other suspects), and more than a hundred were injured. In ten days only.

About organized crime.

It’s enormous, it’s all around us, growing in the underground. Most of the time, we only see and hear about it when something of magnitude erupts, or if we investigate it. Some individuals don’t even know it exists, how it functions, how powerful and pervasive, as well as how deadly it can be. They think it’s like in the movies, but it’s very different in reality.

When everything is normal, mafias, cartels and other organized criminal operations stay more or less contained and operating mainly underground. They keep expanding and filtering into civil society through corruption or threats (plata o plomo – silver or lead). But also in more surreptitious, sophisticated, and “official” ways, such as financing everything from the election of local leaderships and politicians to the graduation of lawyers and promotion of DAs.

Tax revenue falls during a slump. Institutions deteriorate as a result of underfunding of the governmental apparatus. Of course, this also applies to the crime-fighting infrastructure. Criminals feel empowered and come out, making the situation worse. Though it has money and power, organized crime is not listed in the S&P 500 or the Nasdaq. That is to say, crime always tends to increase during economic downturns.

Why is this relevant?

If you watched the videos of the sicarios fighting the forces in the streets of Jesús María, Mazatlán or Los Mochis; or if you follow the actions of drug cartels, mafias and other criminal organizations in the real world, you probably know the answer to that question already. If not, let me explain it:

There’s a huge contingent of organized groups out there whose routines are a constant of firearms, violence, deception, and bloodshed. These people practice with guns daily on real targets; their “range” is the city’s streets. The idea that normal people will be dealing with untrained neighbors (or even trained ones) coming solo or in groups to their doors food in case SHTF is a fantasy for the most part.

I’m not referring to regular people turning violent due to hunger or despair or psychopaths wreaking havoc on the broken society. These criminals are all that and more, but they’re also merciless warriors accustomed to a routine of danger, confrontation, and death. It’s not that they’re capable of violence: all they know is violence. For them, it’ll be business as usual whether the system stays up or breaks down.

It’s a constant war for turf, money, narcotics, power, and plenty more.

And this battle is vicious and ferocious, bestial even – a blend of modern warfare, where the most advanced equipment money can buy gets mixed up with medieval tactics. It’s the sicarios trying to knock down a Black Hawk with anti-aircraft 0.50 and M134 miniguns, side-by-side with beheadings, dismemberments, and other horrible activities routinely employed to punish and apply lessons, instill terror on the adversary, or simply display brutality, audacity and savagery. A typical punishment is the “microwave oven”, which consists of putting the snitch or enemy inside a pile of old car tires and set them ablaze.

That may seem overly graphic, but it’s the reality. There are entire populations living on the fringe (of cities, of society) immersed in this. When a group of gangsters raid your house or come for you for whatever, you know it’s hit the fan. You have no options, and no one to ask for help.

Organized crime won’t go away.

It’s a world with very different laws and rules, like any place where the system is failing, from economic, moral, and social decadence, inside the world we all live in. More important, as Thirdworldization pushes on everywhere, the various implications of organized crime will reach closer to the ordinary citizen.

Here’s another example.

January 25th marks the fourth anniversary of the collapse of the Brumadinho mining reject dam in Brazil’s southeastern state of Minas Gerais.

“It felt like being inside a giant blender.”

Alessandra de Souza, 43, was preparing lunch with her family when they heard a loud blast splitting the air. The noise echoed through the valley and was heard by Luiz de Castro while he was working in the mining complex.

“I was twisting and turning uncontrollably and getting crushed by rocks, sticks, cars, parts of houses, and everything that came crashing down, breaking people, animals, and everything in its path.”

Luiz de Castro was installing lamps at the mining complex when he heard a massive bang from a close distance. He thought it was a truck tire popping or something, but his friend knew better.

“No, it’s not that!” the friend said. “Run!”

Dashing up a staircase, caked in mud and pelted by flying rocks, Castro clambered to safety. He watched as a tsunami of mud swallowed and buried alive 157 of his co-workers sitting in the cafeteria. It took rescue workers days to reach them.

The deluge of toxic mud stretched for five miles, crushing everything on its path: homes, offices, animals, and people. (Excerpts from a NYT article by Shasta Darlington, James Glanz, Manuela Andreoni, Matthew Bloch, Sergio Peçanha, Anjali Singhvi, and Troy Griggs.)

A true SHTF and a terrible tragedy, but hardly a surprise.

The mudslide – 11.7 million cubic meters of mining waste, the equivalent of almost 5,000 Olympic swimming pools – advanced quickly through the mine’s offices, resulting in 270 dead (259 officially confirmed and 11 still missing).

Minas Gerais is Brazil’s second-largest producer, and there are almost fifty dams built like the one that failed — enormous reservoirs of mining waste held back by little more than walls of sand and silt. And all but four of the country’s 87 dams have been rated by the government as equally vulnerable or worse.

Even more troubling is the fact that 27 of them are situated upstream above towns or cities with a population of over 100,000. It’s a massive warning sign, yet nobody notices until something bad happens. A similar catastrophe that occurred in 2015 resulted in the deaths of 19 individuals and the contamination of 12 cities along the Rio Doce valley—two significant failures in just three years.

Thirdworldization and the making of SHTF.

A crude and cheaply built reservoir of mining waste sitting upstream of a major community has all the ingredients for an SHTF. The warning indicators of the presence of structural problems that could cause a collapse were ignored by the mining corporations and the authorities, and the monitoring systems had stopped working.

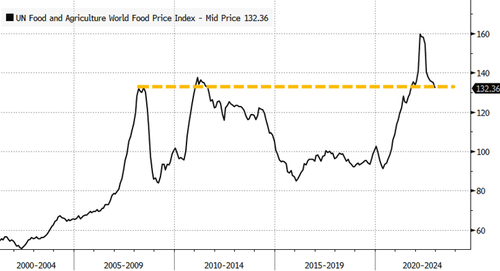

Brazil is a large exporting nation and had been benefiting greatly from the 2000s commodities boom, which saw industrial giants like China devouring critical commodities like metals, grains, and everything they could get their hands on to support a string of two-digit GDP growth.

Mining industries were accelerating their expansion plans and operating at full throttle, without much rigorous oversight or restriction from the part of authorities, while everyone was benefiting from record exports and significant inflows of foreign investment. Brumadinho is yet another tragic illustration of how an undesirable combination of large and powerful (i.e., influential) companies operating in a substandard, inefficient, and corrupt “thirdworldized” environment and can result in disasters with nasty consequences.

The crisis keeps brewing.

The US congress should be debating the debt ceiling yet again about the time this post goes live. Depending on the way this turns, the decisions will have a vast array of consequences, from moderate to severe, now and in the future. This impasse has been recurrent and ever more tense, another sign of financial and political crisis – or more ThirdWorldization.

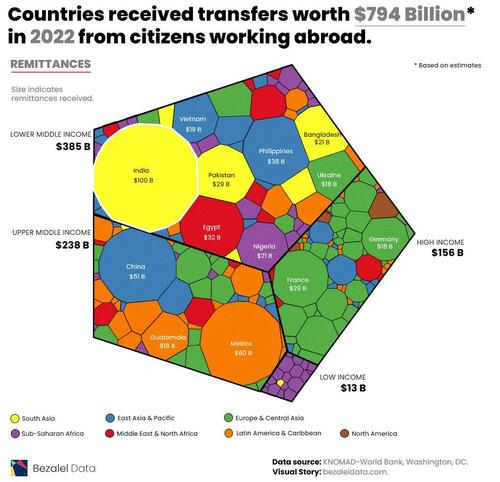

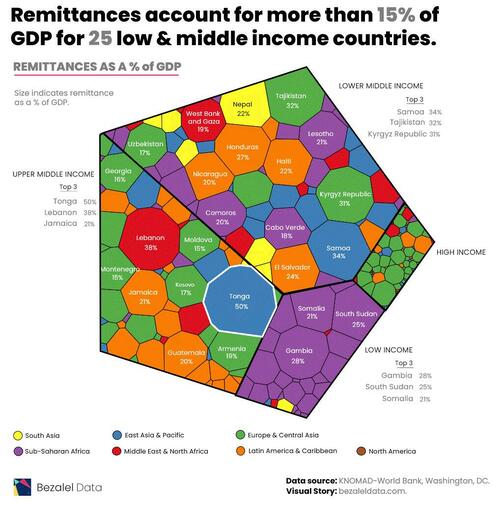

The US is, in fact, bankrupt. My country is, too. Europe is also in financial trouble. Japan, the United Kingdom, and, very likely China are as well. Everybody is drowning in debt: countries, corporations, businesses, families, and people. Though that hasn’t yet had a significant effect on the system, it has been boiling and showing occasionally.

There are countless levels of “broke,” and I could delve into this subject as I have in the past, but to emphasize that crucial contrast one more time: SHTF never hits the same way everywhere. Said differently, life in a “broke” nation that holds the world’s reserve currency (and a sizable army to back it up), or one with high-speed trains and highways, and stronger institutions will never be the same as in a place without these things.

That doesn’t mean, though, that more developed nations won’t be affected.

They will because: 1) the crisis is global; 2) everything is interconnected; and: 3) there are many ways this can happen. I’ve presented two in this article, but SHTF can also result from things like mass migration, authoritarianism, terrorism, pervasive corruption, a shortage of energy, and more.

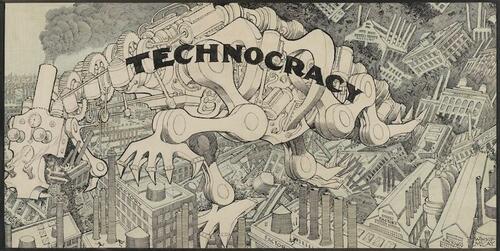

I’m not really saying anything new. A major conflict might result from all those crises. That has been the elites’ go-to response in the past, so who knows. Up until that, it will be a steady slide into a situation where institutions get overwhelmed, infrastructure deteriorates, workers cross their arms, and criminals feel empowered.

To be sure, SHTF happens; however, when a crisis is present, it happens more frequently, and the repercussions are typically more serious and widespread. That results from the system becoming increasingly unstable and handicapped. We can talk about ways to prepare and overcome that, but until then, remain vigilant and stay safe.

* * *

Fabian Ommar is the author of Street Survivalism: A Practical Training Guide To Life In The City and The Ultimate Survival Gear Handbook