It’s Prudent To Dust Off The Stagflation Hedges Again

By Cormac Mullen, Bloomberg Markets Live reporter and strategist

Stagflation, the bogeyman for markets last year, was never truly vanquished. Like the victims in any good horror movie, investors aren’t really prepared for its return.

The fear surrounding it has fallen out of the public eye somewhat. A non-scientific look at Bloomberg’s News Trend function shows that this year we’re down to an average of 2,000 stagflation stories a month, from over 6,600 in 2022 and 2,400 the year before. That’s despite a jump in stories with “sticky” in them, a proxy for persistent inflation, to 9,600 from 7,500 in 2022

From an economic standpoint, talk of a global recession has gained fresh impetus from the banking crisis. Investors seem to assume that inflation will just collapse as a result.

While annual inflation slowed across the US last month, many parts of the country recorded CPI near or above 6%, three times higher than the Federal Reserve’s 2% target. In the UK, it jumped back above 10% and in the European Union, core prices probably reached a new euro-era record this month.

Beyond the drivers of labor- and housing-market tightness and supply-chain disruptions, a rarely-spoken reason for the stickiness of price gains is that companies now feel they can get away with it, and have a not easily-quenched desire to recapture lost profits from the pandemic.

And the threat of a renewed surge in energy prices is ever present thanks to the war in Ukraine and other geopolitical flashpoints, with Russia’s recent nuclear sabre-rattling an unwelcome reminder of the possibility of escalation.

There are some ominous parallels with what happened in the 1970s, when the world suffered from slow growth, stubborn high prices and rising unemployment, thanks in part to surging energy prices and a weaker dollar. Economists link the phenomenon to a combination of external shocks and policy missteps. The pandemic and the invasion of Ukraine surely count as the former in today’s context, and it’s easy to make a case for the latter.

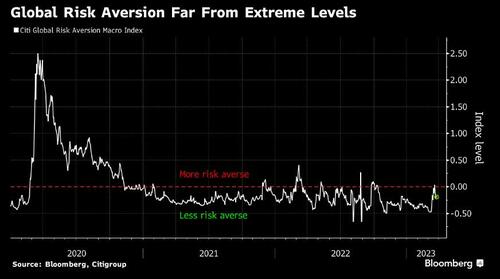

Of course, inflation is likely to lose impetus in an economic slowdown. But the tail risk that it’s not adequately priced in remains elevated. A gauge of global risk aversion from Citigroup is back in benign territory and a long way from levels seen during the pandemic.

Hedging against stagflation is easier said than done, as it’s a horrible environment for both equities and bonds alike. Take 2022 as a dry run. But some commodity exposure, in particular gold, is an option, as are real assets. Some have argued there’s a case for some emerging market securities too.

Whatever the hedge, it’s at least prudent now for investors to stress test their portfolios for economic growth to slow right down but not take inflation along with it.

Tyler Durden

Tue, 03/28/2023 – 13:40

via ZeroHedge News https://ift.tt/e6VvEh1 Tyler Durden