Strong 5Y Treasury Auction Stops Through As Nosebleeding Rates Vol Dips

After weeks of bone-breaking treasury volatility, today has been the first day when the post-bank failure rollercoaster has finally stabilized, and after yesterday’s ridiculously bad 2Y auction (which saw a record tail) which only added to the volatility of 2Y bonds, moments ago the US sold 5Y notes in an auction which almost surprisingly came in stronger than anything we have seen in recent weeks.

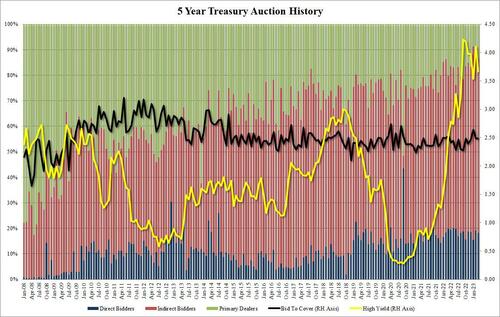

The high yield of 3.665% was 44bps below the February yield of 4.106%, but above the January 3.530%; it also stopped through the When Issued 3.675% by 1.0bps.

The bid to cover of 2.48 was unchanged from last month and was just above the six-auction average of 2.45.

The internals were also solid, with Indirects awarded 68.5%, below last month’s 70.0% but above the recent average of 67.3%; and with Directs taking down 18.2%, also above the 17.7% average, means Dealers were left holding 13.3%, the most since December if below the recent average of 15.0%.

The market reaction to the strong auction was modest, with the 10Y dipping from session highs of 3.57% to 3.55%. That said, the 10Y has been stuck in a very narrow range all day, a welcome change from the rollercoaster moves we have observed in recent weeks.

Tyler Durden

Tue, 03/28/2023 – 13:22

via ZeroHedge News https://ift.tt/YRjFTlO Tyler Durden