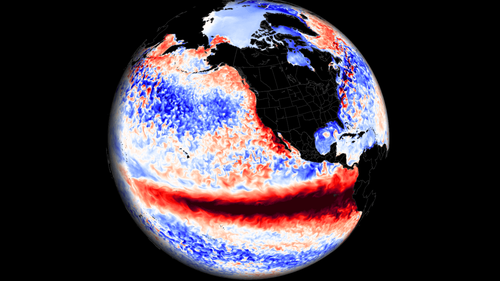

On Wednesday, the World Meteorological Organization reported that a ‘triple-digit’ La Nina weather phenomenon, which caused severe droughts and floods, is finally ending. Nonetheless, the probability of an El Nino occurring is increasing and could affect global weather patterns.

Severe Weather Europe provides an in-depth forecast of one of the most important weather changes in years:

La Nina is over, and an El Nino event is forecasted to begin this Summer. An El Nino event can completely change the weather patterns in the upcoming seasons, especially during the late Fall and Winter seasons, so this will likely be one of the biggest global events in 2023.

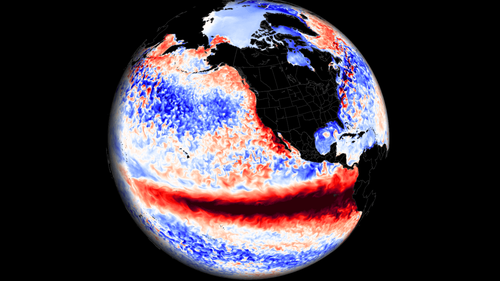

Ocean anomalies and especially their changes can significantly influence seasonal weather patterns. Perhaps even more so in Winter, when the pressure systems are strongest.

First, we will look at why these ocean anomalies affect global weather on a large scale. Then we will look at how and when El Nino will emerge and how it can influence the Winter season of 2023/2024 based on historical data.

OCEAN-ATMOSPHERE WEATHER RELATIONS

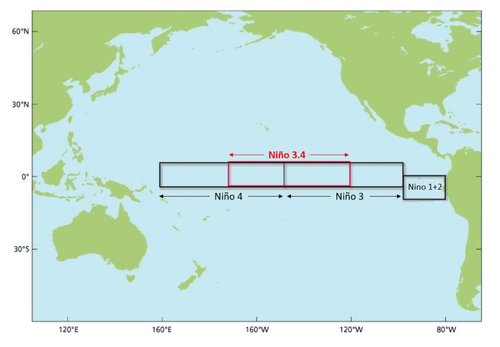

El Nino and La Nina are two phases of the ENSO, which stands for “El Niño Southern Oscillation.” This is a region of the equatorial Pacific Ocean that shifts between warm and cold phases. Typically there is a phase change around every 1-3 years.

ENSO significantly influences tropical rainfall, pressure patterns, and the complex energy exchange between the ocean and the atmosphere. As a result, we can observe large-scale pressure changes in the tropics with each developing phase or during its breakdown.

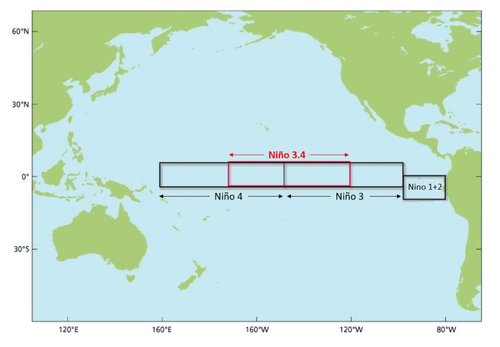

The image below shows the ENSO regions across the tropical Pacific. Regions 3 and 4 expand over the east and west tropical Pacific. The main area combines regions 3 and 4, seen in the image as the Nino 3.4 region.

Each ENSO phase influences the pressure and weather in the tropics differently. This affects the overall global circulation over time, changing the weather patterns worldwide.

A new (cold/warm) phase usually develops between late Summer and early Fall. It then lasts until Spring, but some events can last up to two or three years.

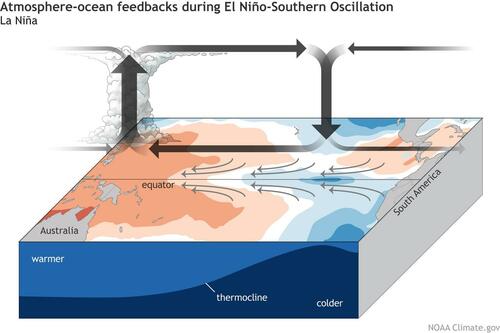

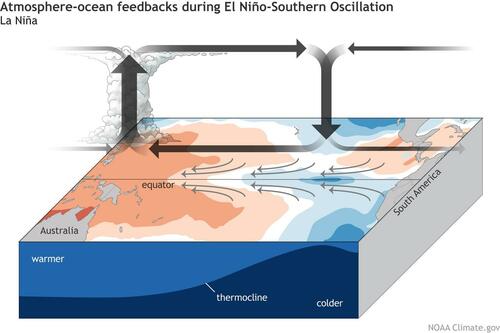

The following image below from NOAA Climate shows the typical circulation during a cold ENSO phase, which is currently on its way out.

Descending air in the eastern Pacific causes high pressure and stable weather. At the same time, the air is rising in the western Pacific, causing frequent thunderstorms, low pressure, and more rainfall.

This way, ENSO strongly impacts the tropical rainfall and pressure patterns, affecting the ocean-atmosphere feedback system. Through this ocean-atmosphere system, the ENSO influences the weather globally.

ATMOSPHERIC CHANGES

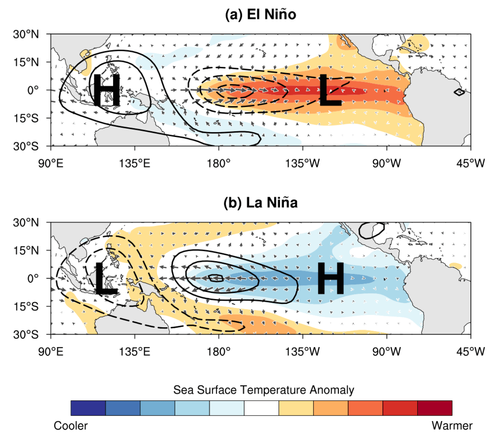

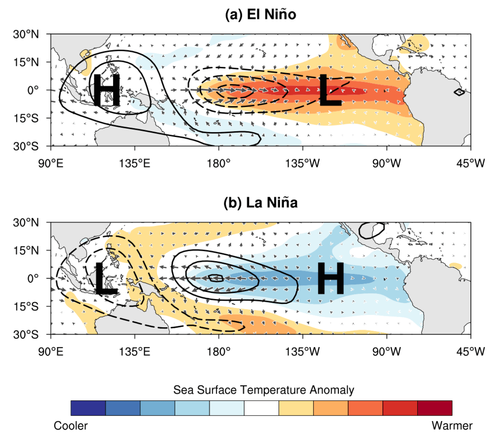

The cold ENSO phase is called La Nina, and the warm phase is called El Nino. Besides the ocean temperatures, one of the main differences between the phases is the pressure patterns they develop, seen below as high (H) and low (L) pressure zones.

During an El Nino, the pressure over the tropical Pacific is lower, with more rainfall and storms in this region.

But during a La Nina, the pressure over the equatorial Pacific is higher, creating stable conditions and fewer storms. These pressure changes translate into global circulation over time, affecting seasonal weather over both Hemispheres.

We can observe a global shift in pressure patterns during the emergence of an ENSO phase. But it is usually more influential during the peak of its phase.

But how does ENSO even shift between cold and warm phases? The simplest answer is that it happens because of a complex relationship between pressure, winds, and ocean currents.

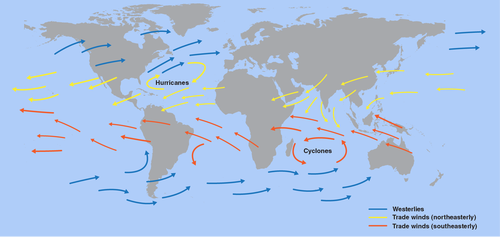

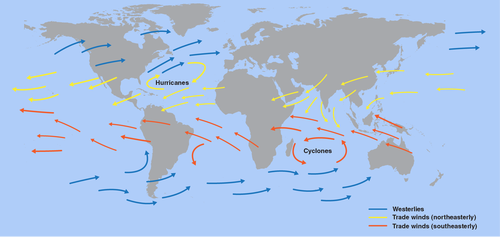

Global trade winds usually start or stop a certain ENSO phase by overturning the ocean surface layers and altering the ocean currents. Trade winds are steady and persistent winds, blowing towards (and along) the Equator in both Hemispheres.

But the key here is not just in the winds, as pressure differences drive them. Thus, the ENSO phase directly responds to an atmospheric pressure change called the Southern Oscillation Index (SOI).

The Southern Oscillation Index or SOI represents the difference in air pressure measured at Tahiti (French Polynesia) and Darwin (Australia). The image below shows the location of the two pressure zones important for ENSO.

Positive SOI values mean the pressure over the Tahiti side is higher than over Darwin in Australia. This corresponds to stronger easterly trade winds, supporting La Nina conditions.

But during an El Nino, we see lower pressure in the eastern Pacific, over Tahiti, and higher pressure over Darwin. This produces a negative SOI value and weaker trade winds, which means less ocean surface cooling.

This entire process is much better seen in the video animation below. It shows the ocean temperature anomalies from Summer to Fall and how quickly they can change in the ENSO regions.

ENSO cooling restarted in August as the trade winds intensified. As a result, cold waves developed across the equatorial Pacific as the winds pushed surface waters to the west.

WINTER SEASON 2022/2023 CLOSES

So with La Nina slowly saying goodbye, we will quickly look at its influence on the Winter season.

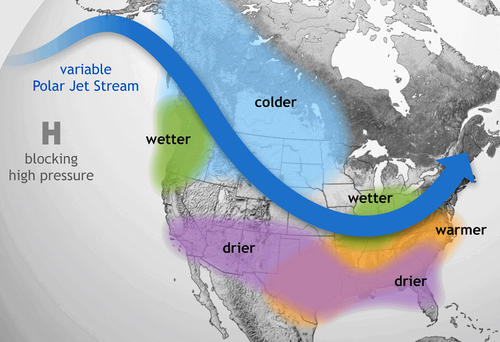

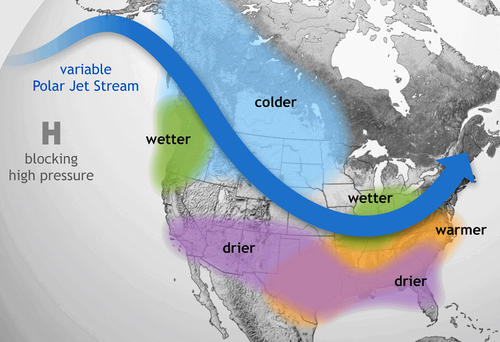

A strong blocking high-pressure system in the North Pacific is a typical effect of a cold ENSO phase (La Nina). That usually redirects the polar jet stream down over the northern United States. You can see the La Nina winter weather patterns in the image below by NOAA Climate.

The colder air is typically spread over the northwestern United States, the Midwest, and western Canada. Warmer than normal winter weather is found in the southeastern and eastern parts of the United States.

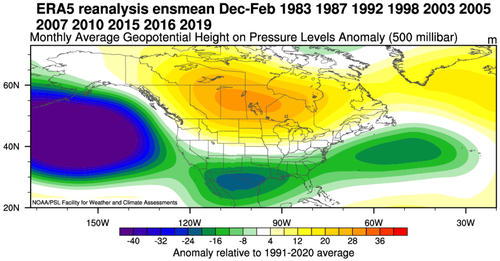

Looking below at the actual 22/23 Winter analysis, you can see a very similar pattern. Colder air focused on western Canada, the northwestern United States, and parts of the Midwest. The rest of the United States ended up warmer than normal. Europe is also warmer than normal, but that is not a direct La Nina-specific pattern.

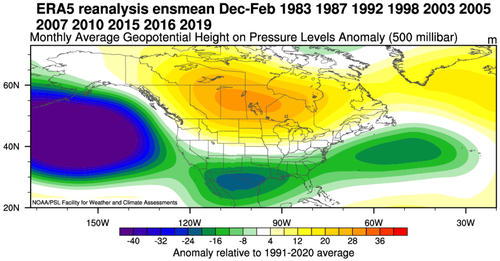

This is due to the jet stream changes, which you can see reflected in the pressure anomalies below. A high-pressure anomaly extends from the North Pacific and into the polar regions. A low-pressure area was present over the western United States, bringing more unsettled Winter to the west and pumping warm weather into the eastern United States.

Over Europe, we mainly see higher-than-normal pressure anomalies and lower pressure to the southwest. Again, this is something that was indicated in the seasonal forecast models, which had a good idea about this pattern in advance.

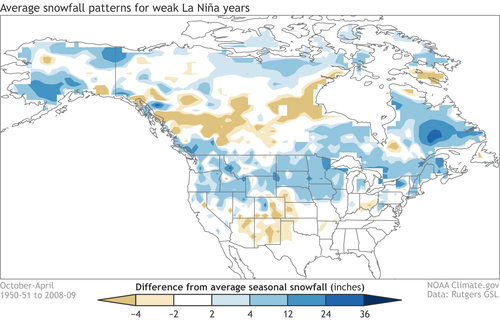

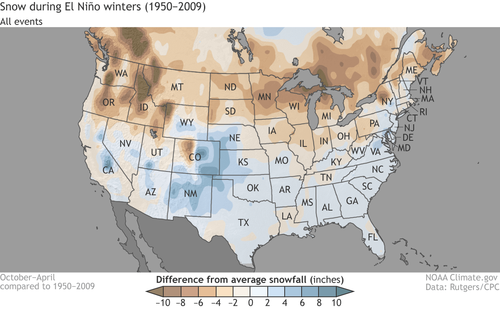

What about snowfall? The historical data shows that the jet stream from a La Nina also changes the snowfall potential over North America as the pressure systems take a different path.

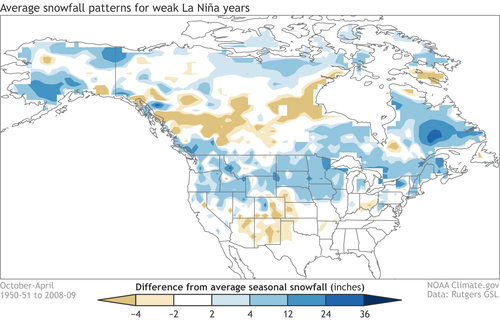

The colder air is more easily accessible to the northern United States, which increases the snowfall potential when moisture is available. The graphic below by NOAA-Climate shows the average snowfall pattern for La Nina Winters.

Besides the northwestern United States and the Midwest, we can see more snowfall potential over the northeastern United States and eastern Canada.

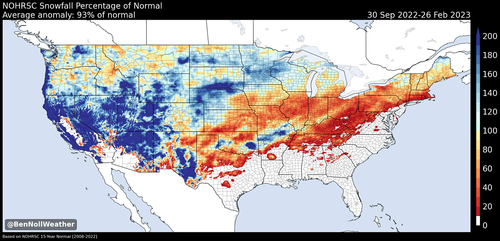

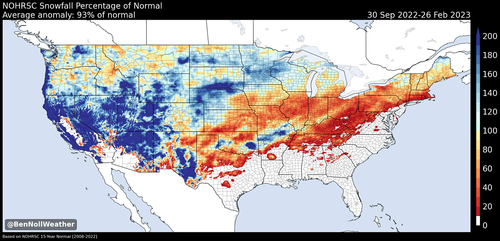

Looking at the actual Snowfall anomalies, we can see more snowfall across the western and northern United States. This is where we typically see more snow in a La Nina winter. But there is a large lack of snowfall in the central and eastern United States. Image by Ben Noll.

But, as you will see, La Nina is already breaking down, slowly losing its influence in the atmosphere.

LA NINA HEADS FOR THE EXIT

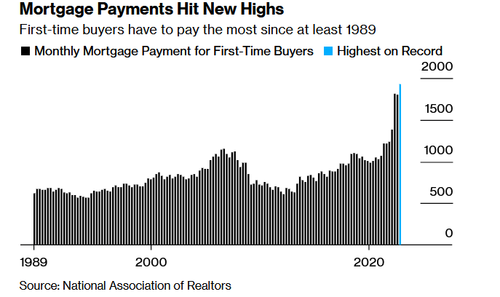

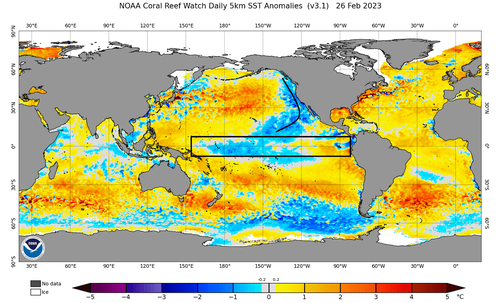

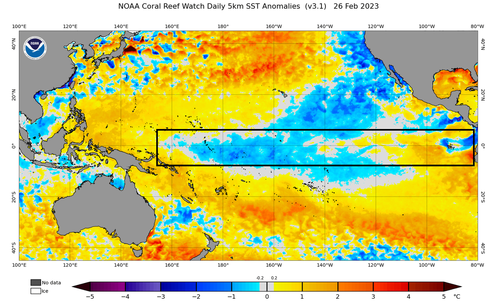

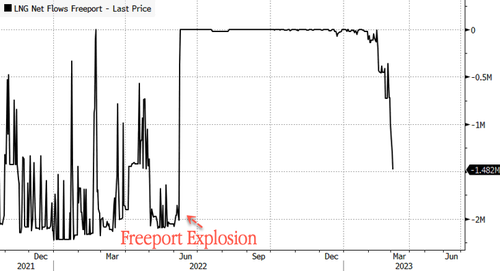

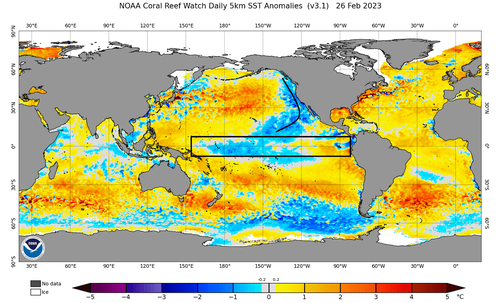

The latest global ocean analysis below reveals weakening cold ocean anomalies in the tropical Pacific. However, cold anomalies remain in the western regions. A relatively strong cold horseshoe pattern persists on the west coast of North America, associated with a negative PDO phase. But more on that in another article. Image by NOAA CRW.

Below, you can see the anomaly data from the past years across the ENSO region. You can see the first La Nina event in 2020. The second La Nina occurred in late 2021, lasting through the Winter. A third-year event is currently active but is already on its way out.

The current La Nina was 3rd consecutive. No cold ENSO event has gone into the 4th year in the known records. So it is expected that this is the last La Nina phase for some time, increasing the statistical likelihood of an El Nino event for the 2023/2024 season.

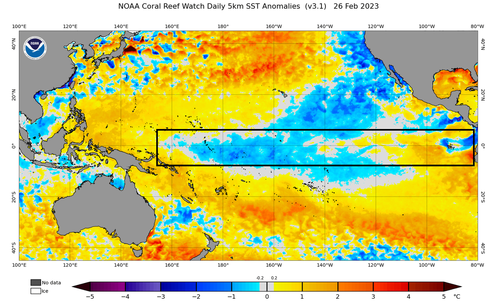

Looking more closely at the latest analysis of the ENSO regions below, the cold anomalies are breaking down over the east. So overall, La Nina is really hard to define at this point. But as the ocean anomalies break apart, the atmospheric influence lingers for a while.

Below we have the latest 7-day ocean temperature anomaly change. You can clearly see an active warming trend across the ENSO regions. Some of it is seasonal, but the patterns are changing, and the La Nina is looking at its last days.

But there is more going on beneath the ocean surface as well.

BELOW THE OCEAN SURFACE

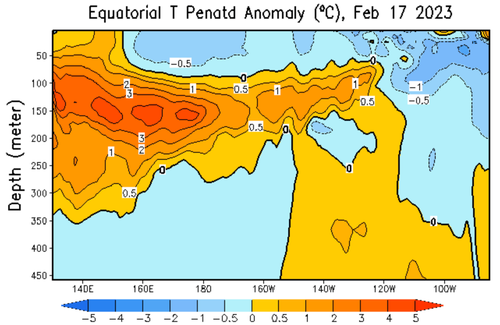

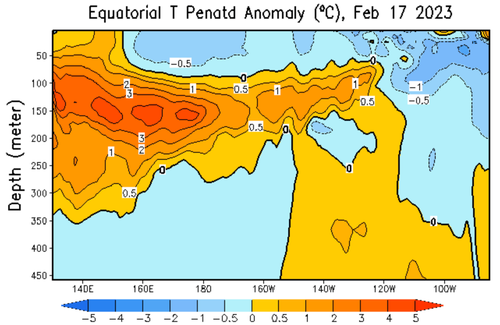

The activity below the ocean surface shows a strong subsurface wave of warm anomalies, also known as a Kelvin Wave, expanding from the west. In the east, you can see the remaining cold anomalies. These cold patches are what remains of the subsurface “engine” of the La Nina, now starting to turn off slowly as warmer waters move in.

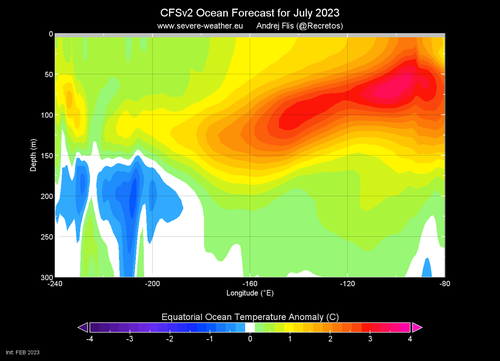

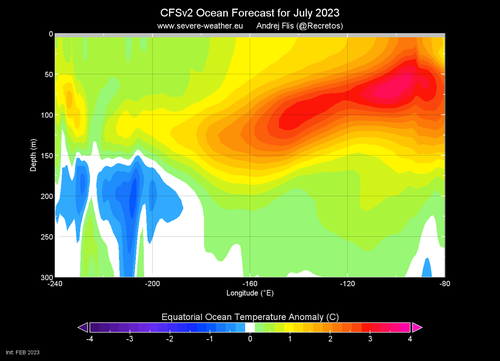

Looking at the latest July 2023 ocean forecast from CFS, we can see the warm pool taking over the subsurface waters. This signals that El Nino conditions may appear on the surface during Summer, creating completely different weather patterns by the end of the year.

But what do the forecasts show for the ocean surface layer?

EL NINO EVENT 2023 FORECAST

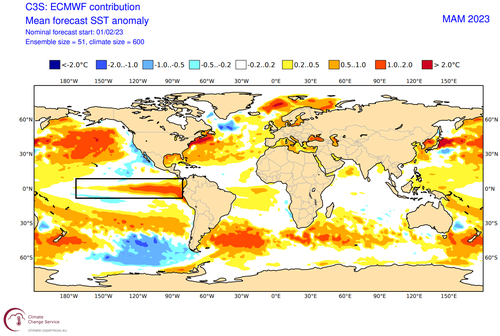

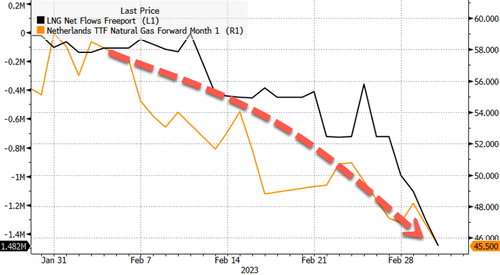

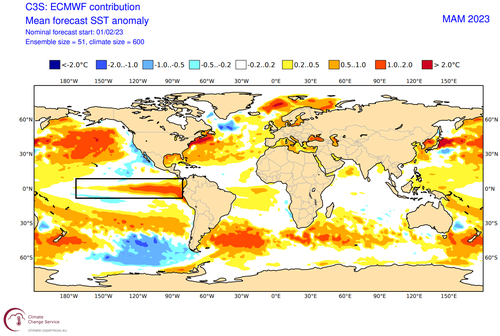

The ocean temperature forecast from the ECMWF model shows the eastern and central ENSO regions going warm this Spring. The image below shows the average anomaly forecast for the March-April-May season, which is the meteorological Spring season.

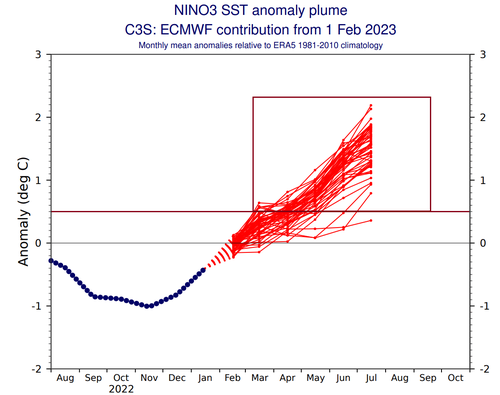

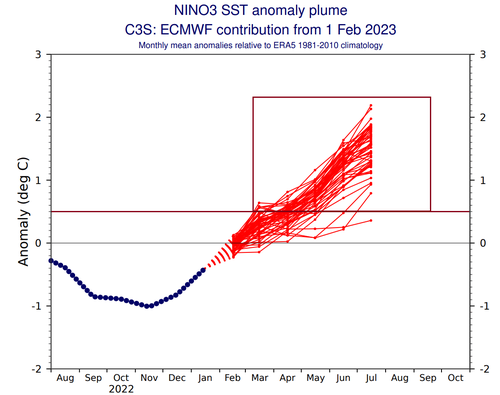

Below you can see the ensemble forecast for the eastern ENSO region. The La Nina conditions are forecast to dissipate rapidly. A shift into the warmer territory is forecast during Spring, with the El Nino threshold being above +0.5. So far, this looks like a moderate event in the works.

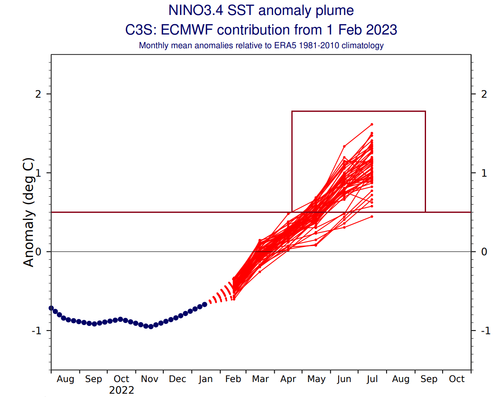

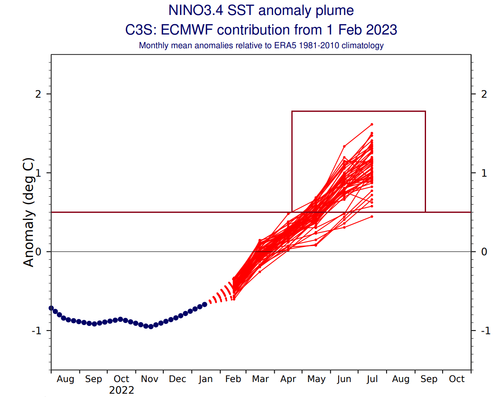

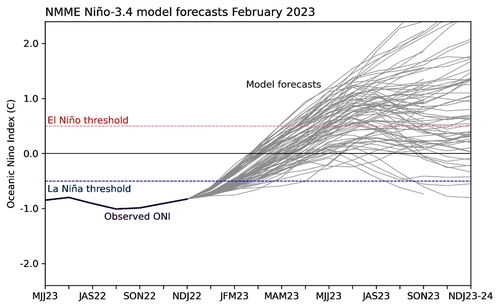

But below, you can look at the latest shorter-term seasonal forecast for the main ENSO region. Compared to the previous month, the latest update shows an even better consolidation in the El Nino territory over the Summer. Most of the ensembles reach above the El Nino threshold.

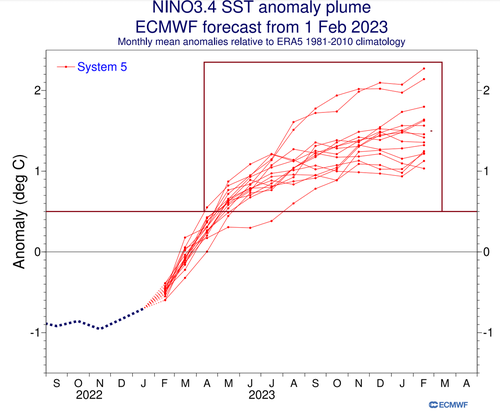

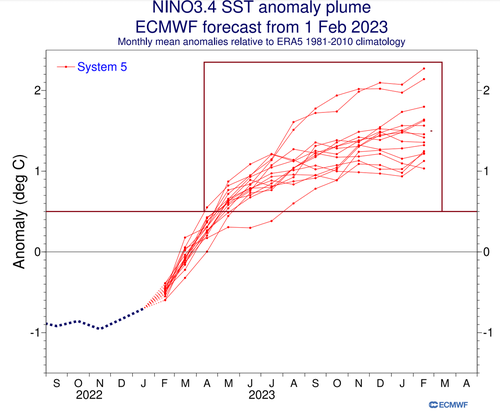

You can also see that in the extended seasonal forecast by ECMWF for the main ENSO region. It shows the cold phase going out rapidly by early Spring. A sustained shift into El Nino territory is forecast for the next Fall and Winter seasons of 2023/2024.

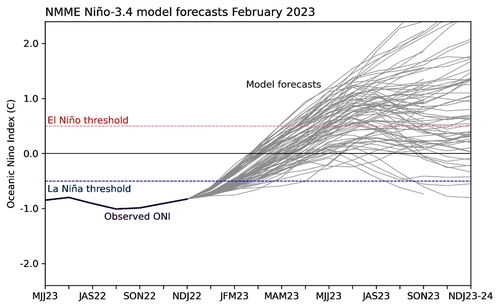

The ENSO forecast from the NOAA multi-model forecast is similar. First, it shows the current cold anomalies will weaken over the Winter. Then the forecast suite goes for the shift into the warm phase, but not as convincingly as the other model solutions for now.

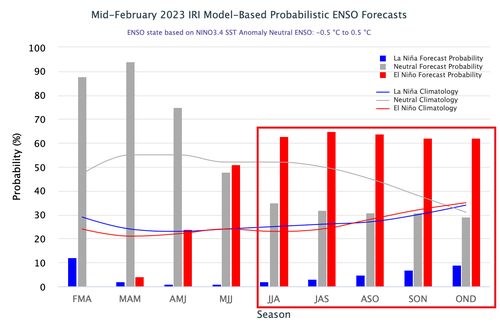

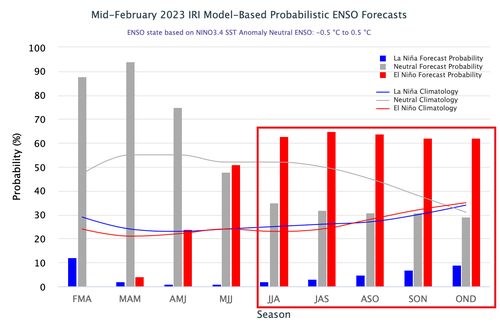

The IRI official probabilistic ENSO forecast also shows the current La Nina quickly disappearing. But it is typical for a new phase to emerge in late summer/fall with seasonal pressure changes. Below, you can see a strong sustained probability increase of an El Nino event in 2023.

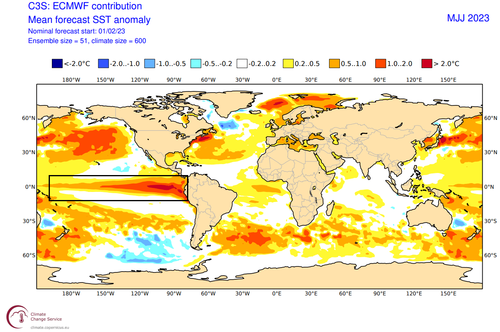

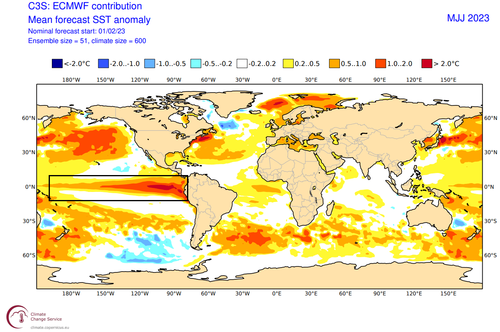

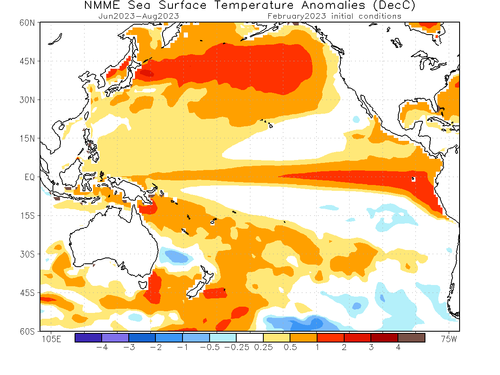

Looking at the warm season ahead, the ECMWF forecasts a strong tongue of warm anomalies across the equatorial Pacific. These conditions, as forecast, show a full El Nino event starting in Summer and would likely last till next Spring.

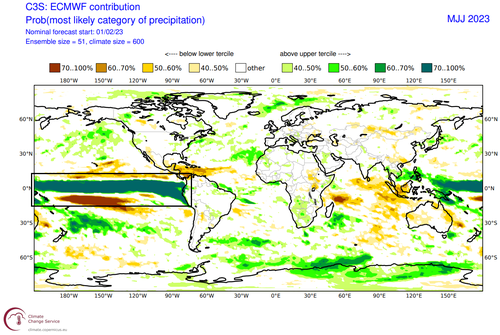

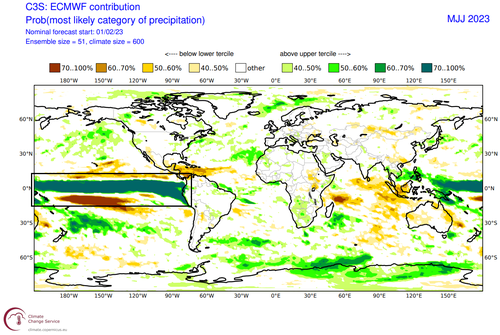

We can also look at the precipitation forecast, where you can see a strong area of increased precipitation over the ENSO regions. This is because an El Nino event causes lower pressure over the central and eastern tropical Pacific, increasing the number of storms and precipitation.

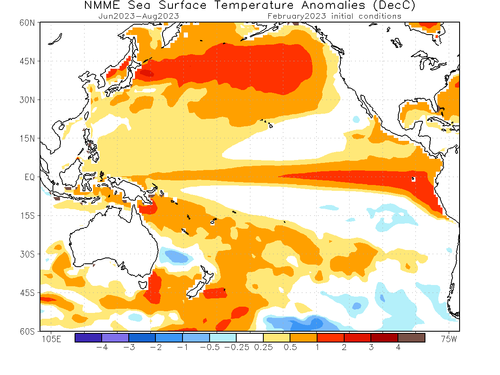

The North American multi-model ensemble forecast (NMME) also shows the same anomalies developing over Summer. It is somewhat weaker than the ECMWF forecast. But as the anomalies tend to strengthen over Fall, this is a healthy case for an El Nino Winter of 2023/2024 in the works.

ATMOSPHERIC PRECURSOR

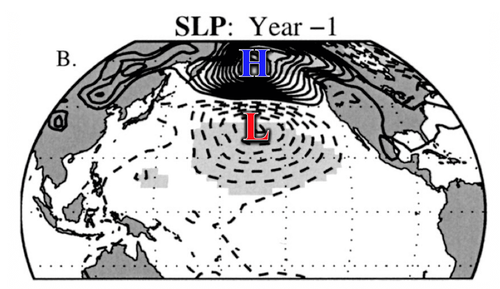

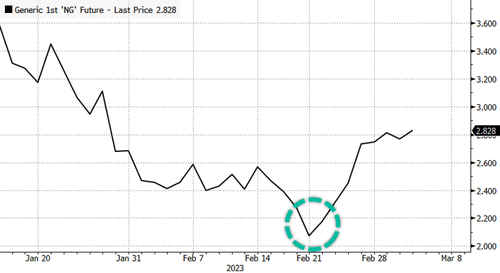

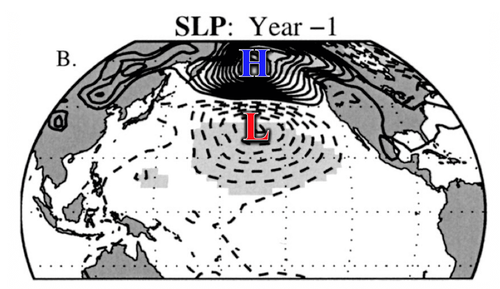

Another sign of the El Nino development was pointed out by Eric Webb. He showed data from a study by Vimont et al. (2002) on how specific North Pacific pressure patterns precede El Nino events. Below is the expected pressure pattern ahead of El Nino events.

As you can see, the main pattern is a high-pressure system in the far North Pacific. Under that system is a low-pressure area, driving westerly winds across the equatorial Pacific.

The EMCWF pressure forecast for this Spring shows a very similar pattern. A strong surface high-pressure system with an underlying low-pressure area. This does raise confidence for a proper weak to moderate El Nino event developing over the year.

But how does an El Nino change the weather patterns during the cold weather season?

EL NINO WINTER WEATHER IMPACT

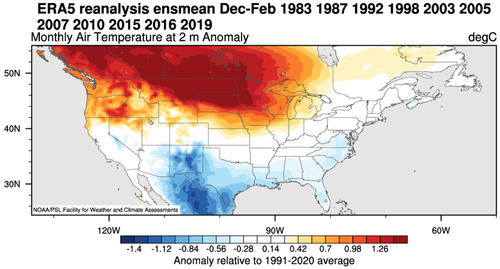

During the El Nino winter season, we usually have a strong and persistent low-pressure area in the North Pacific. That pushes the polar jet stream further north, bringing warmer-than-normal temperatures to the northern United States and western Canada.

But the southerly Pacific jet stream is amplified, bringing storms with lots of precipitation and cooler weather to the southern United States.

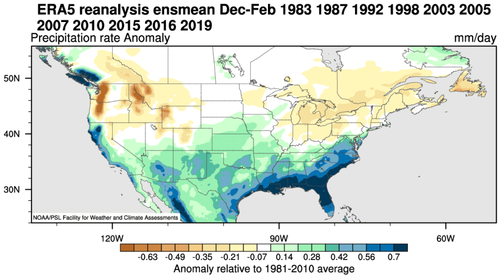

The image below shows the average winter pressure pattern for the past few El Nino winters. You can see the strong low-pressure area in the North Pacific, typical for an El Nino. A high-pressure zone is over Canada, and a low-pressure storm track with precipitation spans the southern United States.

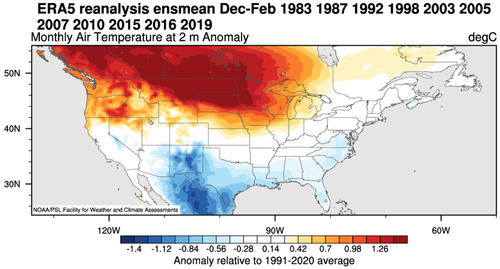

Below are temperature anomalies in these winters. You can see the average El Nino winter having colder temperatures in the southern half of the United States and parts of the eastern United States. The northern half of the country is warmer than usual, as is southern Canada.

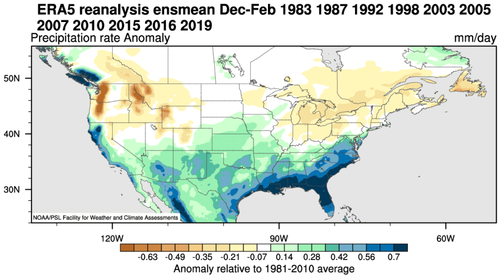

Precipitation-wise, an average El Nino winter can bring more precipitation to the southern half of the United States, especially in the southeast, due to the stronger subtropical jet stream. However, drier winter conditions prevail in the northwestern United States and around the Great Lakes, opposite a La Nina’s influence.

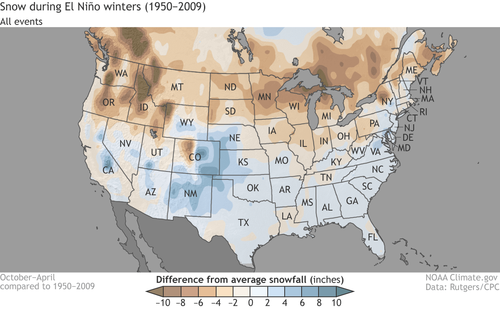

Of course, an El Nino also changes the snowfall patterns, as seen in the image below. There is usually less snowfall in the northern United States during the El Nino winter seasons. But more snow than normal is seen in the central and southern United States during an El Nino. And also over parts of the east.

This is mainly due to low-pressure systems trailing across the southern United States. With cooler air available and more moisture, the chances of snowfall increase in the southern half of the country. But a lot depends on the availability of the cold air coming from the north.

After passing Canada and the United States, the jet stream moves into the North Atlantic, where it can take different paths toward Europe.

But the ENSO effects are much less direct in Europe than North America. That is why we focus more on North America to track direct (and more predictable) weather changes.

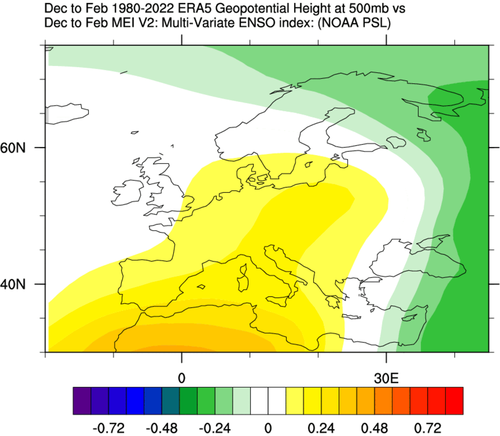

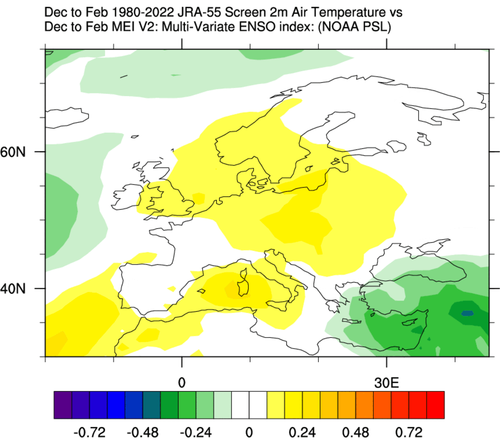

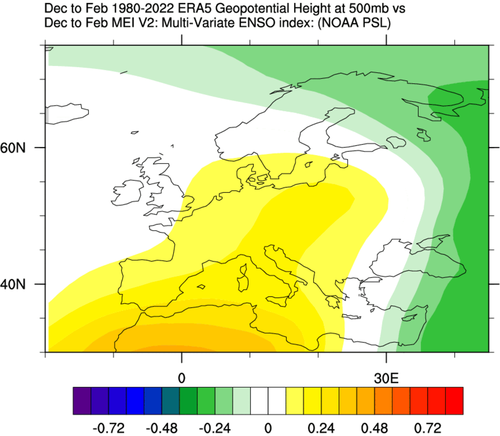

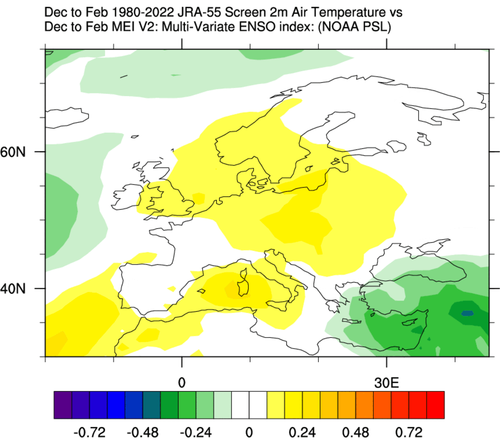

But still, looking at the historical connections of ENSO to Europe, we produced two graphics below. First is the Winter pressure anomaly signal. It shows a high-pressure tendency over most of Europe, with the subtropical ridge expanding during an El Nino winter season.

The following temperature is, of course, warmer than normal over much of the continent. But the signal has a weak strength, as the ENSO influence loses most of any direct influence this far out. So while there is a signal in the average, it cannot be used for any direct weather pattern forecasts over Europe.

As El Nino changes the weather globally, hardly a corner of the world does not feel its effect. But the weather changes in parts further away are less predictable. That is because local weather systems play a specific role, as well as other global weather drivers.

But what does the long-range forecast data show for the upcoming Spring, still partially under the influence of the outgoing La Nina?

SPRING 2023 WEATHER OUTLOOK

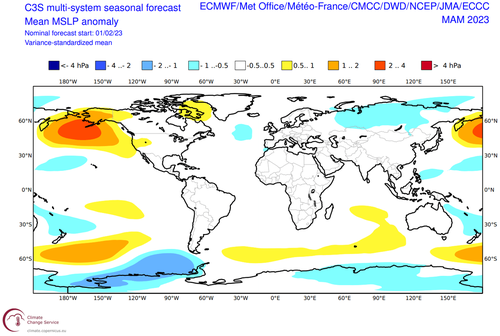

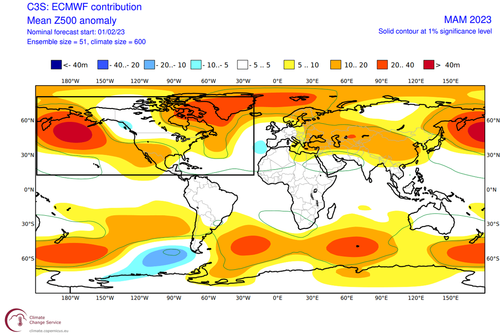

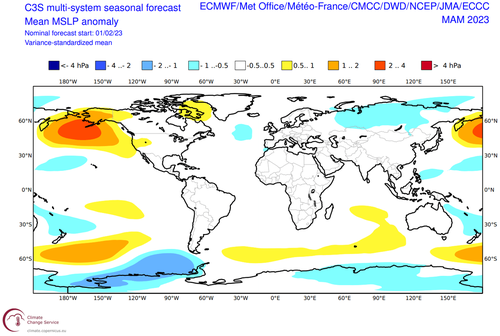

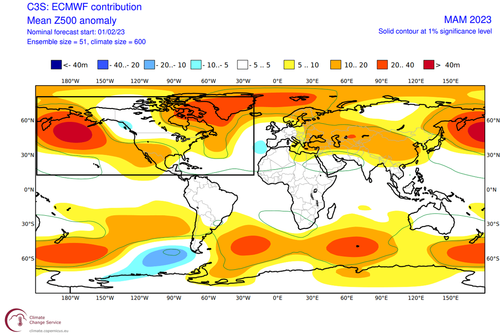

The pressure pattern forecast from ECMWF below shows the typical La Nina high-pressure system in the North Pacific. The low-pressure system is indicated over western Canada, with another high-pressure area over Greenland. This helps to keep a low pressure over western Canada and southwestern/western Europe.

We also see the North Atlantic in a west-negative North Atlantic Oscillation (NAO) mode and blocking over the North Atlantic.

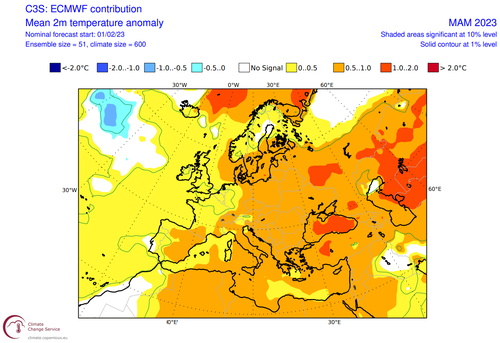

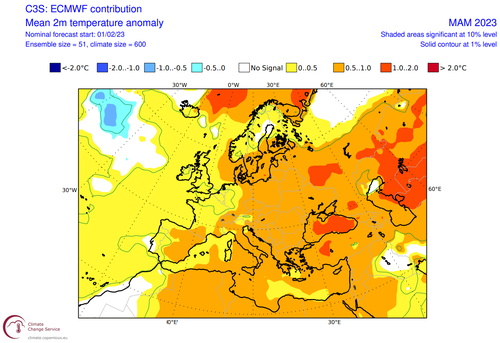

Looking closer at Europe, you can see that the surface temperatures are mostly above normal. This is due to the low-pressure area focused to the southwest, creating a warmer southerly flow over the continent.

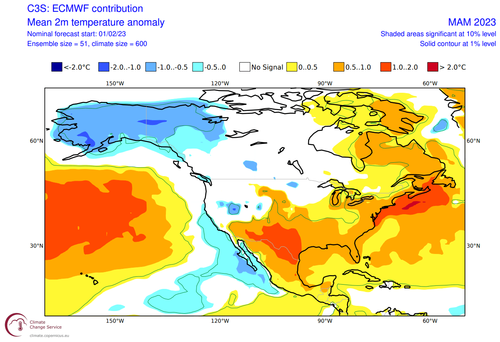

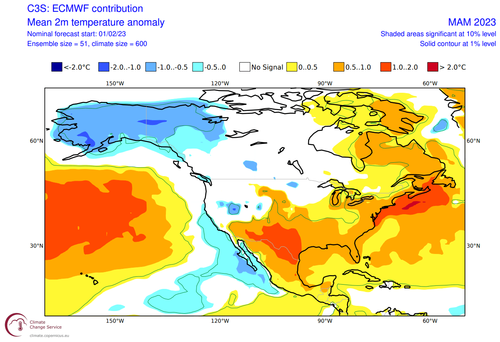

Over Noth America, the ECMWF forecast hints at normal to colder-than-normal surface temperatures over the northwestern United States and upper Midwest. In addition, we see an indication or a gap in the warmer anomalies toward the Ohio Valley. This is likely caused by a cold outbreak, common during Spring, especially early in the season.

Despite being shown warmer than normal, the central parts of the United States can also get occasional colder weather and snow in early Spring during these jet stream patterns. But mostly warmer than normal temperatures are forecast over the far south and the southwestern United States.

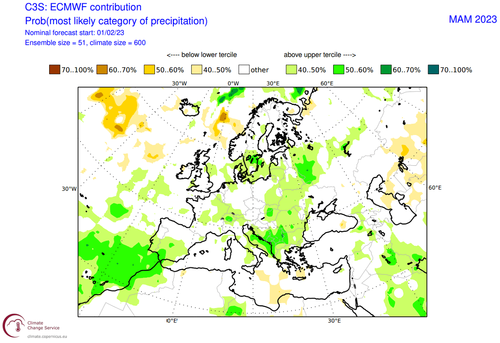

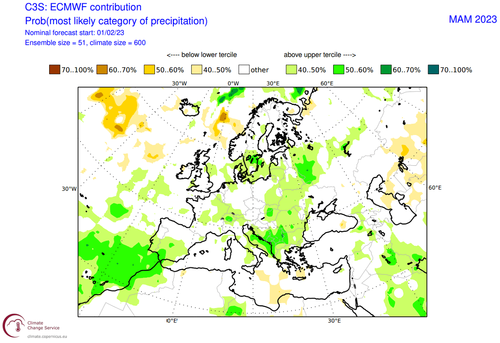

Precipitation-wise, Europe is trending to have more precipitation over the continent. This is the expected scenario as the model is going for a lower-pressure area over western and southwestern Europe, sustaining a warm and moist southerly flow over the mainland.

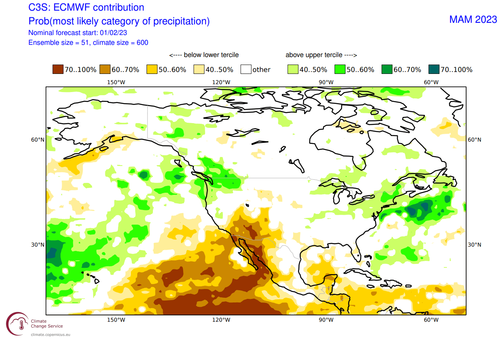

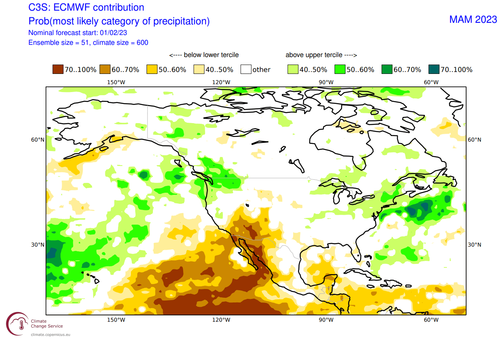

The North American precipitation anomaly forecast below shows a more La Nina-type pattern over Canada and the United States. As a result, the United States has wetter conditions in the northwest and the northeast and drier conditions over the southwest.

In Canada, the forecast currently shows more precipitation over the west and southeast. In combination with colder temperatures, that also affects the snowfall potential in early Spring.

NOAA OFFICIAL SPRING 2023 FORECAST

Below is the official Spring temperature forecast for the United States by NOAA. It shows the temperature probability, with colder to equal chances in the northern United States. The southern half of the country and the northeast have a higher probability of warmer than normal weather, as seen in the models above.

The official precipitation forecast is also quite similar to the model forecast. We see an equal-to-higher probability for more precipitation in the eastern United States across the Ohio Valley and the Great Lakes area. On the other hand, the southwestern United States is forecast to have a drier-than-normal spring season.

* * *

We would like to remind all the climate warriors on social media: “El Nino and La Nina are naturally occurring climate patterns and humans have no direct ability to influence their onset, intensity or duration,” according to the UN Office for the Coordination of Humanitarian Affairs.