The Rise Of Crude Tanker “Cannibals” In Wake Of Russia-Ukraine War

By Greg Miller of FreightWaves,

The Ukraine-Russia war has rerouted crude tanker flows over the past year, equating to higher profits for shipowners. But the upside is not evenly spread. Midsize crude tankers have been the big beneficiaries.

It’s not only that Russian crude export terminals can’t handle larger tankers. A highly unusual transport pattern for U.S. crude exports has emerged, creating another war-induced headwind for owners of larger tonnage.

VLCCs cannibalize trans-Atlantic trade

Prior to the war, U.S. crude exports to Europe were loaded aboard midsize Aframaxes (tankers with capacity of 750,000 barrels) and Suezmaxes (1 million barrels). U.S. crude exports to Asia were loaded aboard very large crude carriers (VLCCs; 2 million barrels).

Europe hiked its crude imports from the U.S. in the wake of the invasion, replacing seaborne imports from Russia, which have been banned since Dec. 5.

Much of Europe’s incremental volume from the U.S. has moved aboard VLCCs, not midsize tankers — a transport model that was extremely rare before Russia’s invasion of Ukraine.

“Virtually all the additional [U.S.] sales to Europe were done on VLCCs,” wrote Erik Broekhuizen, manager of marine research at Poten & Partners, in a report Friday.

Tanker demand is measured in ton-miles: volume multiplied by distance. If ships switch to shorter routes, it’s a negative for demand, and thus, for spot rates.

VLCCs have “cannibalized” the shorter-haul U.S.-Europe business of Aframaxes and Suezmaxes. Simultaneously, China has increased imports from Russia, limiting Chinese demand for longer-haul U.S. exports. Both are negative for VLCC voyage distance.

“The problem is that more VLCCs are arriving in the Atlantic than leaving,” said ship brokerage BRS on Monday. “The latest data suggests that 108 VLCCs are currently trading west of Suez and that more are arriving every day, making the Atlantic crude tanker market more competitive.

“Preliminary information suggests that the number of VLCCs transporting U.S. crude to Europe could hit a record over the coming weeks,” BRS said.

VLCCs now ‘world’s largest shuttle tankers’

Changes in crude trade patterns since the war “have benefited the midsize sectors given that the main Russian load ports in the Baltic, the Black Sea and the Far East are all inaccessible to VLCCs,” explained Kevin Mackay, CEO of Teekay Tankers (NYSE: TNK), during a conference call Thursday.

Clarksons Securities estimated Monday that spot rates of non-eco-designed VLCCs were $59,700 per day. That’s a highly profitable rate, but Suezmaxes — with half the carrying capacity of VLCCs — were earning $65,600 per day.

“VLCCs are now regularly cannibalizing multiple cargoes that would usually be transported on two Suezmaxes or three Aframaxes,” said BRS, noting that VLCCs are more competitive than midsized tankers on a dollar-per-ton basis.

Consequently, VLCCs have become “the world’s largest shuttle tankers,” BRS said.

Lars Barstad, CEO of Frontline (NYSE: FRO), said during a conference call Tuesday, “With the situation around oil being redirected from Russia, you’re basically seeing both Aframaxes and Suezmaxes getting drawn into that trade. That’s giving VLCCs an opportunity to enter [midsize tanker] markets.

“VLCCs have started trading Suezmax stems [cargoes]. So right now, you’re seeing a high number of fixtures where VLCCs are stepping in to what you’d typically call a Suezmax trade — U.S. Gulf to UK Continent [Europe], for example. Various asset classes are eating into each other’s business segments.”

More ‘reverse lightering’ in US Gulf

U.S. Gulf ports do not have the water depth to accommodate fully loaded VLCCs. Instead, these cargoes are “reverse lightered.” They are loaded first on Aframaxes or Suezmaxes, with the oil then moved to VLCCs via ship-to-ship transfers.

“Since the cannibalization trend arrived in mid-2022, charterers have become better at utilizing infrastructure in the U.S. Gulf,” explained BRS. “[They are] part-loading in ports and booking reverse lightering in advance to more efficiently load VLCCs.”

BRS also pointed out the increased use of VLCCs for shorter-haul shipments to Europe is tying up more Aframaxes and Suezmaxes in reverse-lightering duties in the U.S. Gulf, another plus for midsize tanker rates.

China favoring Russian crude over US crude

The U.S.-China crude trade, because of its extreme distance, is a key variable in global VLCC demand. It takes seven weeks to travel from the U.S. to China via the Cape of Good Hope at 13 knots.

According to BRS, “Long-haul U.S. crude exports remained relatively flat year on year [in 2022], which, when viewed in the context of the surge in total U.S. crude exports, was viewed as disappointing, especially by VLCC owners.”

U.S. crude shipments to China averaged around 200,000 barrels per day last year, in line with 2021 volumes. They have remained at the same level in the first two months of this year.

“Considering the backdrop of steadily rising Chinese crude runs, this suggests that U.S. barrels have been losing out to soaring imports of cut-price Russian barrels,” said BRS. (Crude shipments from Russia to China are mainly shipped aboard the so-called “shadow fleet,” comprising vessels with opaque ownership that do not trade in Western markets.)

Broekhuizen of Poten is optimistic on U.S.-China crude flows in the remainder of this year. “We expect more crude exports from the U.S. Gulf in 2023, [and] we anticipate that less of the incremental barrels will go to Europe,” he said. “This means that more crude may find its way to Asia, especially to China.

“For the VLCC markets, this means more tonnage will likely be employed on the long-haul routes to Asia, boosting ton-mile demand and freight rates. As a result, we expect VLCCs will become less competitive in the trans-Atlantic trade and Suezmaxes and Aframaxes will regain market share.”

Earnings roundup

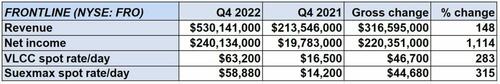

On Tuesday, Frontline reported net income of $240.1 million for the fourth quarter of 2022 versus $19.8 million in Q4 2021. Adjusted earnings of 97 cents per share came in below the consensus estimate of $1.08. The latest period was Frontline’s best quarter since Q2 2008.

Frontline owns VLCCs, Suezmaxes, Aframaxes and product tankers. Its spot VLCCs earned an average of $63,200 per day in Q4 2022, nearly four times rates a year ago. The company has 87% of its available VLCC days booked for Q1 2023 at $58,300 per day.

Also on Tuesday, International Seaways reported net income of $218.4 million for Q4 2022 compared to a loss of $34 million in Q4 2021. Adjusted earnings of $4.21 per share came in much higher than the consensus forecast for $3.92. The latest period was the best quarter since the company’s listing in 2016.

International Seaway’s owns a fleet of VLCCs, Suezmaxes, Aframaxes and product tankers. Its spot VLCCs earned an average of $64,596 per day in the latest quarter, compared to $14,326 per day the year before. It has 83% of its available spot VLCCs days for Q1 2023 booked at $46,600 per day.

Tyler Durden

Fri, 03/03/2023 – 06:30

via ZeroHedge News https://ift.tt/lRTX3c2 Tyler Durden