“The Smartest Guys In The Room”: What Do Market Analysts Actually Do?

By Michael Every of Rabobank

The Smartest Guys In The Room

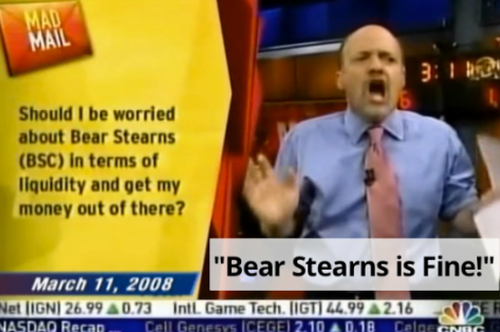

The smartest guys in the room’ is a phrase one hears in markets. It’s also a book and documentary about the US Enron scandal. I sat next to someone who worked under one of the three key Brits involved in the affair while it happened, both of us totally oblivious. They gushed about what good lunches he held while I wrote notes arguing the pre-2008 US economy looked like the pre-1997 Thai economy, which were summarily ignored. Later, this individual was shocked to share that the ‘energy trading’ Enron showed them from behind glass walls on a trip to its trading floor had actually been actors shouting “rhubarb!” into phones. The colleagues who ignored my economic notes were then shocked when global markets collapsed in 2008.

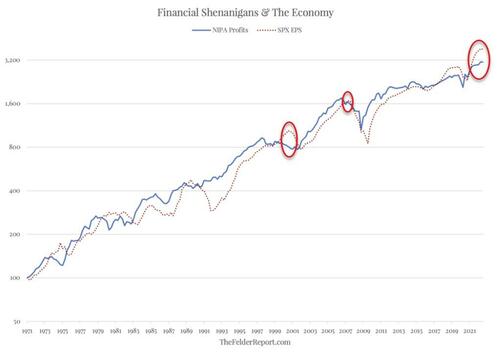

Sadly, ‘the smartest guys in the room’ is a tradition that carries on today: huge scandals like WorldCom, Madoff, FTX, and modern emerging markets disasters; and didn’t-see-it-coming market analysts who don’t realize they are shouting “rhubarb!”

On which note, let me turn my attention to analysis of market analysts. Philosophically, what is it that they do?

Let’s presume markets are efficient and price for all possible information. If so, the ‘correct’ price of EUR/USD is already set. So is the S&P. So is the US 10-year yield, etc. (Which just hit 4% again by the way.) What, then, does one do as an analyst?

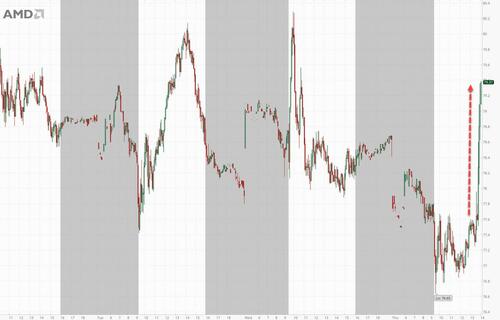

Nothing! One can’t analyze the price of FX, stocks, or bonds, etc., because the market says it’s right. One can merely describe that price with nice charts or turns of phrase. Or one can say why the current price is correct today vs. the day before, when it was also correct, via ‘post hoc ergo propter hoc’. However, that assumes new information forces a market bullish/bearish reassessment on a daily basis, which is something only ADHD day-traders do. Worse, that is a very target-rich environment for ChatGPT. Logically, the analysis one can do that ChatGPT can’t is to forecast events the market hasn’t priced for, e.g., the 2008 US economy doing what Thailand’s did in 1997; Brexit; Trump 2016; a US-China trade war starting; or a war in Ukraine.

Yet these kind of forecasts have nothing to do with markets! How does knowing about FX flows tell you ‘Brexit’ or ‘Trump’, knowing about stock trends tell you a US-China trade war will start, or knowing about bonds tell you Russia will invade Ukraine? They can’t. If someone asks a market analyst what the market would do if X happens, they can give a helpful hypothetical answer – but market knowledge is not going to say if it will or won’t happen.

So, what can? Perhaps nothing and nobody; at least, not any one ‘golden rule’. But if anything can, each of the above listed calls required a Liam Neeson-esque “very particular set of skills”: (geo)political-economy, psychological, sociological, geographical, historical, and cultural. Either that or plain good luck – though the odds of getting all those calls right is low, you still might have been that one lucky draw, probabilistically.

However, market analysts only have one too-particular set of skills – economics/finance. Few study (geo)political-science, psychology, sociology, geography, history, or foreign cultures, etc., even as auto-didacts; and even though Keynes said anyone who is only an economist is unlikely to be a good one. Of the few who do, fewer are free to write about these topics vs. up/down x.x%, etc. If so, how is one supposed to do serious analysis backing serious market calls? Surely one can’t.

Therefore, we have commentary: and the financial equivalent of ‘Colemanballs’. “It’s a game of two halves.” “The side that scores most goals will win.” “Anyone could win this game – unless they draw.” Or just reading the football results: “Bonds two, Stocks one.”

OK, so let’s presume markets are not efficient, don’t know what is happening, and price incorrectly. Let’s presume Enrons and Madoffs as well as honest brokers; target and bonus chasers prepared to bend things like Beckham to try to get some green; even central banks like dodgy refs allowing what we used to call Fergie Time. In that case –while recognising the market can steamroller you if you are long and it is wrong, or if you are short and they know you’re caught– the current price is as likely to be wrong as right. For example, where GBP was trading just before the Sunderland result came in on Brexit night vs. where it did afterwards. (“Brexit 1, Remain 0.”)

But we don’t have to presume the above. We can logically impute that either markets are not efficient, or analysts aren’t – because the latter don’t agree among themselves.

For example, this weekend’s Chinese National People’s Congress will see a further direct concentration of economic and financial power under the CCP, on which Bloomberg notes: “While the assumption among many China watchers is that the changes represent a further tilt away from markets that is ultimately bad for growth, recent moves to end Covid Zero restrictions, boost support for the property sector and seek better ties with the US suggest that investors shouldn’t rush to conclusions, according to Tom Orlik, Bloomberg Economics’s chief economist. “The potential positive way of looking at the looming personnel and organizational changes is when Xi has a team around him who he’s familiar with and who he trusts,” he said in an interview on Bloomberg Television. “Perhaps there’s just some more space to get some good things done, to make some pragmatic decisions.”” So who is right, and why? We shall see.

Logically, if one accepts the more sceptical view about markets, or anything, including China, then one has to base one’s view on something else:

-

The recent trend? But it’s only your friend until it ends.

-

An economic model? But neoclassical or heterodox, and which of the latter? The former tend to presume markets are efficient too, and as a result forecasts based on them can be wildly inefficient.

-

Relative value? But they break down or change when fundamentals change.

-

Fundamentals? You mean economics and Liam Neeson’s (geo)political-science, psychology, sociology, history, culture, etc.? They can change too, and certainly are changing now. For example, see “It’s bargaining power, Jim, but not as we know it” from Elwin de Groot for both its Trek puns and its view that Eurozone wage inflation will be sticky this time round. That’s a Shatner-ing revelation I would summarise as: “Can I get a pay rise?” “Yes, you Khaaaaaaan!”

Of course, many don’t have a world view of math or defined political-economy structures, even when looking at political-economy. Just a general ‘what goes up must come down’-ism. Or, worse, a whatever-makes-my-fund-go-up-ism. Until it goes down – which we are seeing rather a lot of at the moment as optimistic 2023 outlooks come undone within weeks of their launch. Again.

‘The smartest guys in the room’.

Tyler Durden

Thu, 03/02/2023 – 15:20

via ZeroHedge News https://ift.tt/PCgecLQ Tyler Durden