The No Landing Scenario And UFOs

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

As if the 2020s haven’t been strange enough, the United States military recently shot down several UFOs. Equally bizarre as the possibility of aliens, some investment analysts are projecting an economic no landing scenario. They believe economic activity will easily absorb significant headwinds and chug along.

The last few years have been humbling for economists, the Fed, and investment professionals. In late 2021 no one expected the Fed would raise rates by over 4% within a year and inflation would approach levels last seen 40 years ago. In hindsight, had we or any economist foreseen the future, a recession prediction would have been appropriate. Such has yet to happen, but that doesn’t mean a recession won’t happen. Unfortunately, current monetary policy all but ensures the economic cycle will play out as it always does.

While the economy may seem unpredictable, the economic future is predictable. The no landing scenario assumes economic cycles have ceased to exist. The economic cycle is alive and well. But timing its ups and downs with unprecedented amounts of fiscal and monetary stimulus still flowing through the economy and markets is proving incredibly challenging.

What is a No Landing Scenario

Unlike a soft landing that envisions the Fed action’s dampening economic growth, the no landing scenario believes the economy will continue to grow at or above the trend growth rate. Such optimism assumes that the Fed’s restrictive monetary policy will not cause the economy to stumble.

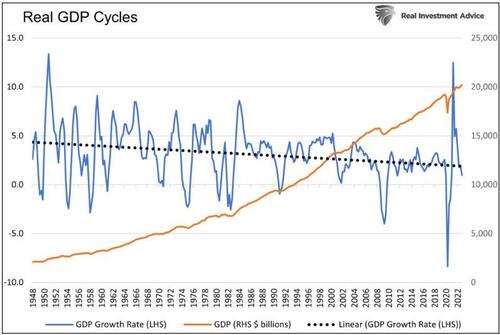

GDP, as graphed below, in dollar terms (orange line), paints the picture of an economy constantly growing and essentially free of cycles. However, viewing annual growth rates (blue line) and the trend (dotted blue line), we find that GDP cycles regularly, and the growth trend is steadily declining. To forecast a no landing means you believe the blue GDP growth rate line will flatten and stay linear.

That did occur, to a degree, following the financial crisis (2010-2018), but the Fed pegged interest rates to zero and resorted to multiple rounds of QE at the first sign of trouble. The monetary conditions during that no landing period versus the current period are polar opposites.

What Drives the Economy?

The economy’s trend growth rate is around 2.0%, well below the rates of prior decades. The Fed predicts the long-run growth rate (beyond 2025) to be 1.8%.

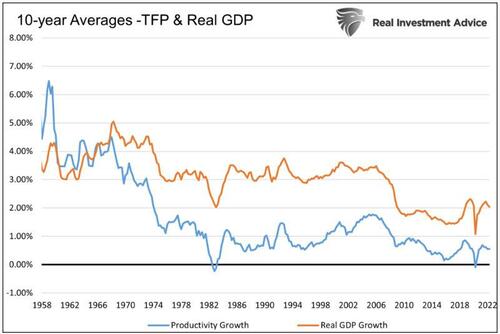

Growth is and has been declining for decades. The two leading factors supporting economic activity, productivity, and demographics, contribute less and less each year to economic activity.

In Capital Neglect is Killing Capitalism, we elaborated on the importance of productivity growth and how the Fed’s aggressive monetary policy in years past has stifled productivity growth.

Not surprisingly, GDP growth followed the declining path of productivity growth. As we share below, it’s possible GDP could run much higher if the pre-1970 productivity trends continued.

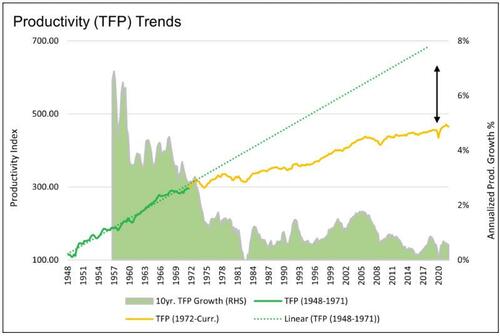

The following graph, also from the article, shows how the trend in productivity growth changed about 50 years ago.

In addition to declining productivity growth, demographic trends in the U.S. and other developed countries are problematic. Population growth among the world’s leading economies is growing at a trickle and, in some cases, starting to decline. Consider the following population growth rates for the top five economies:

-

United States +0.1%

-

China +0.1%

-

Japan -0.5%

-

India +0.8%

-

Germany 0.0%

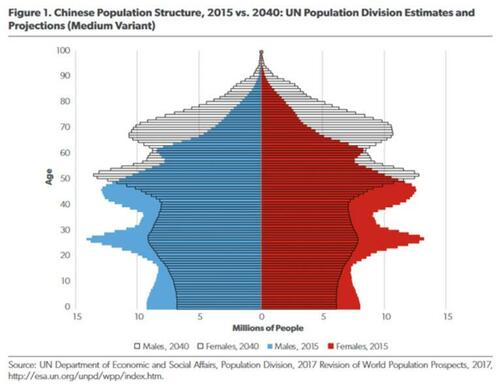

Equally alarming is the increase in the elderly population as a percentage of the entire population. For example, the chart below from the United Nations shows the dramatic shift in China’s population between 2015 and forecasts for 2040.

Similar, albeit less severe shifts are expected in the U.S. Declining population growth, and a growing financial dependency by the baby boomers will reduce GDP.

Barring any trend changes in productivity or demographics, we should expect GDP growth to continue to drift lower.

Fed Juice Counteracts Productivity and Demographics

The Fed uses monetary policy to boost the economy and counter the aforementioned deteriorating economic building blocks. Lower interest rates and the accompanying debt-driven consumption grew the economy above its natural growth rate. However, in the wake of this strategy lies a highly leveraged economy that is exceptionally vulnerable to higher interest rates.

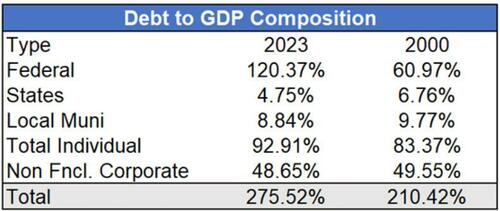

The table below shows that debt as a percentage of GDP has risen from 210% to 275% this century. Over the last 22 years, GDP grew by $16 trillion while debt increased by $52 trillion. Is that sustainable?

The more leveraged an economy, the more sensitive it is to interest rate changes. Reducing interest rates makes servicing the debt and repaying the principal easier. However, higher interest rates make servicing and repayment more costly.

We can think of higher interest rates as a tax on the economy. The Fed’s juice of years past, low-interest rates, is being replaced with the highest interest rates in fifteen years. High-interest rates are stifling new debt creation. More importantly, borrowing to repay old debt introduces a financial shock to the borrower and a tax on the economy.

Current Scenario

If the expected growth rate is sub 2% and higher interest rates are and will be extracting a heavy tax on the economy, why is the economy running hot? The answer likely lies in the pandemic-related stimulus and the psychology of consumers. Both stimulus and irregular consumer behaviors support extra growth.

While the no landing crowd likes to think the relatively high economic growth is sustainable, we got news for them. The means supporting such strong economic growth is not likely to continue.

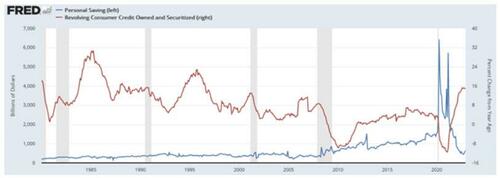

The blue line below shows that personal savings have fallen to a 12-year low. The growth of credit card debt has swelled to a 25+ year high. Unless wages spike higher, many consumers will cut back as savings deplete and credit card limits are reached. Further, higher interest rates on credit cards will reduce their spending ability.

We remind you personal consumption accounts for nearly 70% of economic activity.

Is this Time Different?

The no landing scenario crowd assumes this time is different. Therefore, by default, they argue the graphs and bullet points below are irrelevant.

-

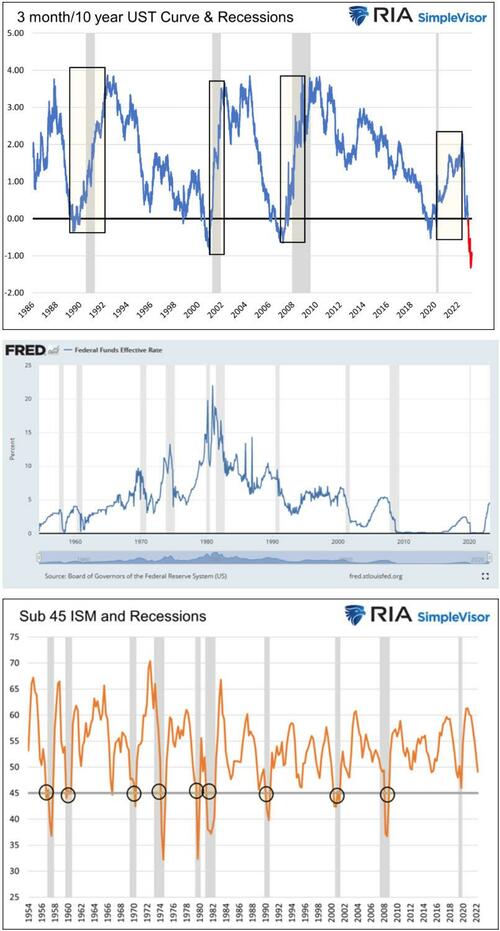

A recession occurred every time the 10-year/ 3-month yield curve inverted and then un-inverted.

-

Fed rate hikes have preceded each of the last ten recessions.

-

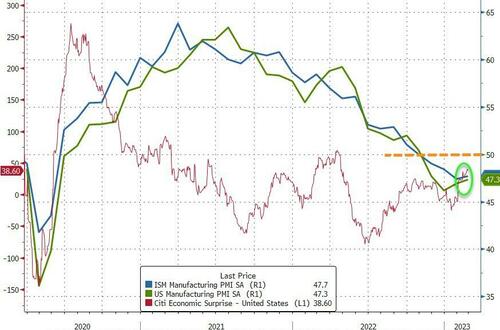

Except once, in 1965, every time the ISM manufacturing index fell below 45, a recession occurred.

-

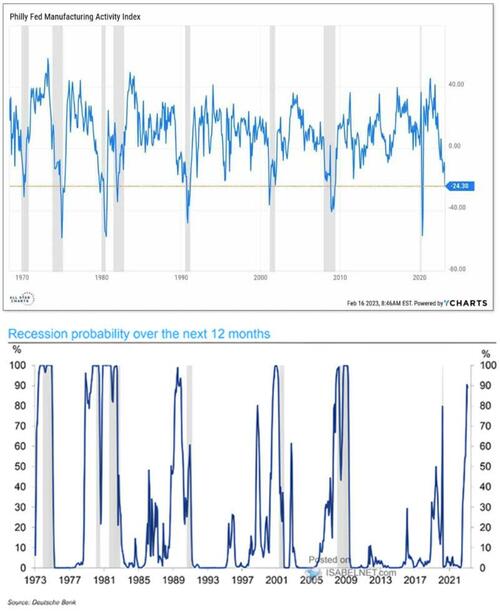

A recession occurred each time the Philadelphia Fed Index was at its current level.

-

A reading of over 50% of Deutsche Bank’s recession probability gauge preceded each recession.

-

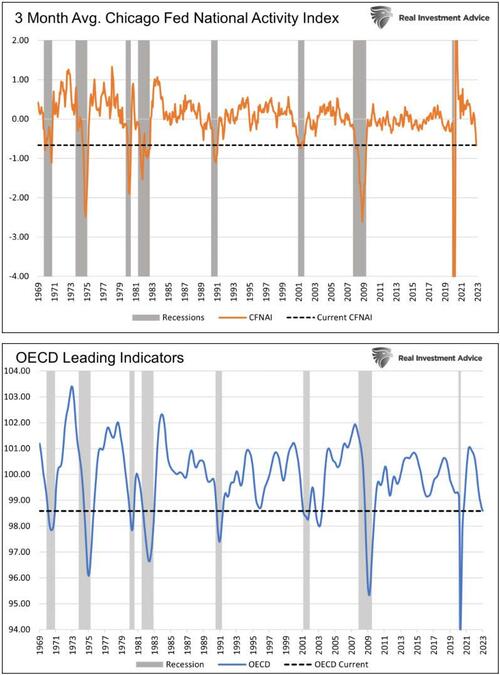

The current level on the 85-factor Chicago Fed National Activity Index (CFNAI) and the OECD leading indicators are commensurate with prior recessions.

Summary

Maybe UFOs have wealthy aliens onboard wanting to buy a lot of stuff and boost our economy. Most likely, those forecasting a no landing have a false sense of optimism as the economy has thus far proven resilient.

Time is not on the no landing scenario’s side. With every passing day, the effect of yesterday’s interest rate hikes will weigh more on the economy. As we wrote in Janet Yellen Should Focus on Hope, understanding the progression of economic activity deterioration and the time lag between monetary policy changes and full consequences helps us appreciate that a no landing scenario is a pipe dream.

We hope for a soft landing but fear the more typical hard landing is the likely course. We caution those who believe the economy is unaffected by interest rates. It is dangerous to believe this time is different!

Tyler Durden

Wed, 03/01/2023 – 11:05

via ZeroHedge News https://ift.tt/0h5ENoB Tyler Durden