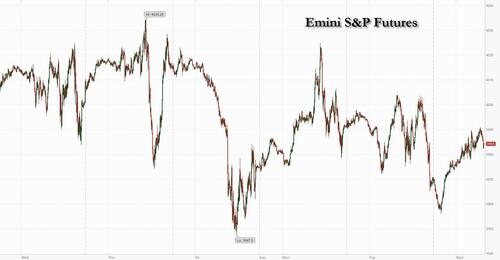

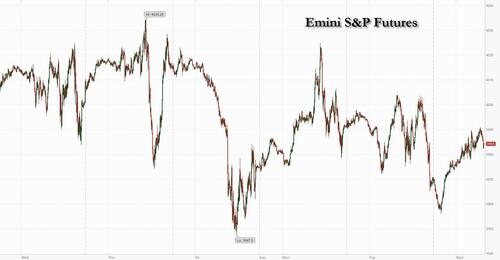

US equity rebounded from Tuesday’s month-end pension and CTA selling boosted by overnight news that China’s economy was roaring back sparked growth optimism and outweighed concerns about sticky inflation that could keep the Fed on its hawkish path. S&P 500 futures rose 0.3% at 7:40 a.m. ET, still hovering below the key technical support level of 4,000, while Nasdaq futures edged higher, up 0.4%. Sentiment was boosted by a sharp drop in the dollar which saw the Bloomberg Dollar Spot Index traded down 0.5% near session lows, the biggest drop since Feb. 14, as the yuan stormed higher. Treasuries edged lower, mirroring moves in Europe after German states saw annual inflation accelerate in February. Oil fell, while gold gained with Bitcoin.

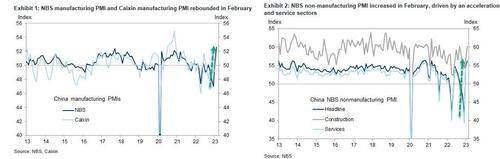

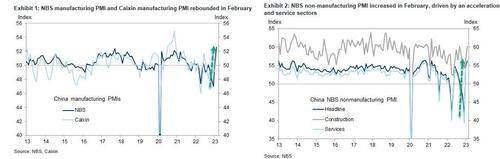

Boosting sentiment today was news that China’s economy is showing signs of a stronger rebound after Covid restrictions were abandoned, with manufacturing posting its biggest improvement in more than a decade. The big economic news overnight came from China’s random number generator, and specifically the manufacturing PMI which rose to 52.6 last month, the highest reading since April 2012. The Caixin manufacturing PMI also rose into expansion, to 51.6 in February from 49.2 in January. The NBS non-manufacturing PMI increased markedly to 56.3 in February from 54.4 in January, driven by an acceleration in both construction and service sectors. Both the NBS and Caixin manufacturing PMIs pointed to improvement in the manufacturing sector in February, as firm operations and customer demand recovered in February after the LNY impact dissipated and the post-Covid recovery gathered steam.

Some observations from Goldman on the Chinese data:

- The China NBS purchasing managers’ indexes (PMIs) survey suggested manufacturing activity improved significantly in February. The NBS manufacturing PMI headline index jumped to 52.6 in February from 50.1 in January, the highest reading since April 2012. The improvement was broad-based. Among major sub-indexes of NBS manufacturing PMI, the output sub-index rebounded to 56.7 from 49.8, the new orders sub-index increased sharply to 54.1 from 50.9, and the employment sub-index rose to 50.2 from 47.7. The suppliers’ delivery times sub-index rose notably to 52.0 in February from 47.6 in January, implying faster supplier deliveries and artificially depressed the headline PMI. NBS commented that business operations and customer demand accelerated on the dissipation of LNY impact and the removal of zero-Covid policy.

- The Caixin manufacturing PMI was released later in the morning. The headline index rose to 51.6 in February from 49.2 in January, on the relaxation of Covid restrictions. Surveyed companies mentioned that the increase in production was linked to easing Covid restrictions and recovery of business operations and client demand. Sub-indexes in the Caixin manufacturing PMI suggest expansion in output in February (53.3 vs. 49.0 in January), rising new orders (52.9 vs. 49.3 in January), stronger employment (50.6 vs. 48.4 in January), rising inventories in raw inputs (49.3 vs. 48.4 in January), faster suppliers’ delivery (51.2 vs. 49.3 in January), slightly stronger inflationary pressures in input and output prices (51.7 and 50.3 vs. 52.0 and 49.7 in January, respectively), and stronger new export orders (52.2 vs. 48.7 in January).

- Both the NBS and Caixin manufacturing PMIs reported expansion in new orders and output, stronger new export orders and faster suppliers’ delivery. Both manufacturing supply and demand expanded in February, as production quickly normalized, and domestic and external demand improved after the Covid policy change.

- The official non-manufacturing PMI (comprised of the services and construction sectors) rose to 56.3 in February (vs. 54.4 in January), driven by an acceleration in both sectors. The services PMI increased to 55.6 (vs. 54.0 in January). According to the survey, the PMIs of transport service industries such as postal, airline and road transport services were above 60 in February. The construction PMI rose in February to 60.2 (vs. 56.4 in January). NBS noted that the growth of the construction sector (presumably infrastructure-related) accelerated in February.

“US index futures are trying to rebound this morning following stronger than expected China figures suggesting the economy is responding positively to the reopening,” Peter Garnry, head of equity strategy at Saxo Bank, said in a note.

In premarket trading, Novavax shares plummeted more than 25% putting the Covid-19 vaccine maker on track for its worst day in more than two months, after fourth-quarter revenue missed analyst estimates and the firm said there is substantial doubt over its future. Reata Pharmaceuticals surged in premarket trading after winning FDA approval for a new drug. Meanwhile, Tesla is set to hold an investor day on Wednesday, where Chief Executive Officer Elon Musk is poised to unveil his latest and much-hyped “master plan” for the electric-vehicle maker. Several Wall Street analysts turned more bullish on the stock in anticipation of the event, but after a nearly 70% surge in just two months of this year, further gains may require more fireworks than are expected. Here are some other notable premarket movers:

- US-listed Chinese stocks stage a strong rally in premarket trading, rebounding from a recent slump, after a slew of data showed that China’s economy is on track for a stronger recovery. Alibaba (BABA US) +6.1%, Baidu (BIDU US) +6.8%, JD.com (JD US) +4.9%, Bilibili (BILI US) +9%, Nio (NIO US) +6%, XPeng (XPEV US) +7.4%

- Rivian (RIVN US) shares fell 8.1% after the electric-truck maker’s 2023 production forecast fell short of expectations amid supply-chain snags. Analysts at Truist cut their price targets on the stock, but noted that the lower outlook was mainly down to cost cuts, which should benefit the company in the long run.

- Sarepta Therapeutics (SRPT US) gains 20% after saying that the FDA doesn’t plan to hold an advisory committee for the approval of its experimental gene therapy to treat Duchenne muscular dystrophy.

- Monster Beverage (MNST US) shares drop 3.8% after the energy drink maker reported fourth- quarter results, with analysts highlighting the miss on revenue and earnings per share.

- BrightSpire Capital (BRSP US) shares fall 14% after holder DigitalBridge offered 30.4 million Class A shares in the mortgage finance company at $6 apiece, representing a 19% discount to Tuesday’s close.

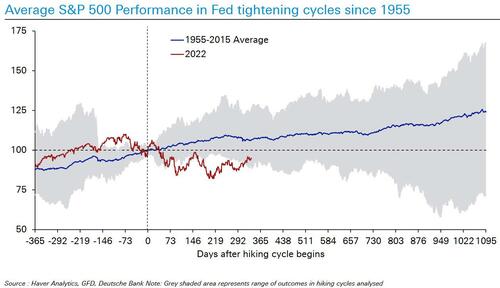

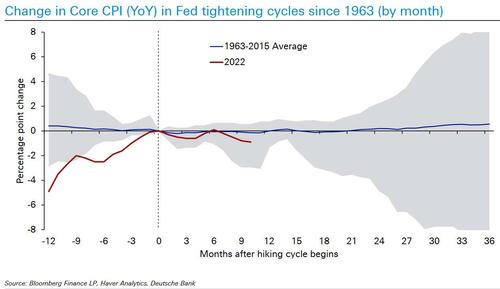

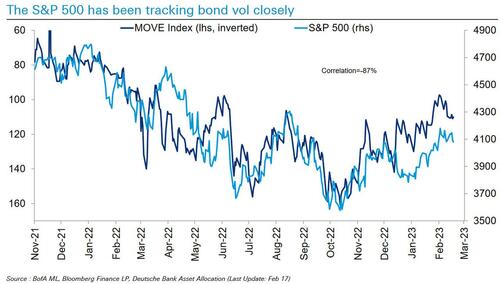

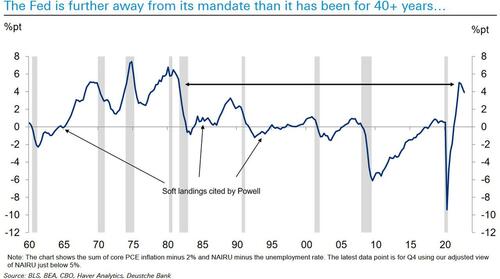

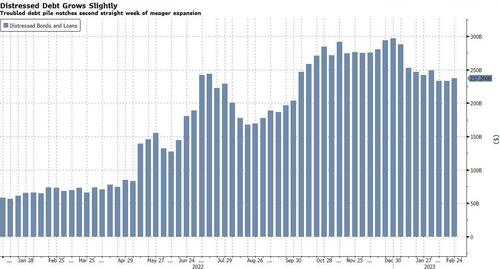

The strong rally seen at the start of 2023 in US equities is showing signs of petering out, as inflation is proving stickier than expected, prompting investors to grow wary of the potential for hawkish central bank dynamics. The S&P 500 declined 2.6% in February, paring much of the strong year-to-date gains, but JPMorgan strategists believe this doesn’t capture the sharp increase in rates since the Federal Reserve’s last meeting and that the index at risk of further losses as a divergence with bonds is yet to close. Other strategists – in fact most of Wall Street – are similarly bearish

“The market is increasingly coming around to a more bearish view and previously expected rate cuts are being taken out of the curve and terminal rates are moving up,” Marija Veitmane, strategist at State Street Bank told Bloomberg. “Investors perceive any strong economic data as evidence that the Fed’s job is not yet done” while any poor data is sign of an imminent recession.

“Since the start of February, bond markets have been pricing in higher rate hikes from the Fed, but mixed economic data and lower decline in fourth-quarter earnings kept stocks afloat,” said Ipek Ozkardeskaya, senior analyst at Swiss Group. “Yet, US yields are poised to trend higher, and that will at some point pull equity valuations lower. A setting where yields and stocks rise together is not sustainable.”

Meanwhile, economic indicators are still running hot in the US, with official data on Monday showing that orders placed with US factories for business equipment increased in January by the most in five months. Wednesday’s data on construction spending, ISM manufacturing, and light vehicle sales will be watched closely by investors for further signs that the Federal Reserve might take as reason to tighten monetary policy more aggressively, or extend high interest rates for longer.

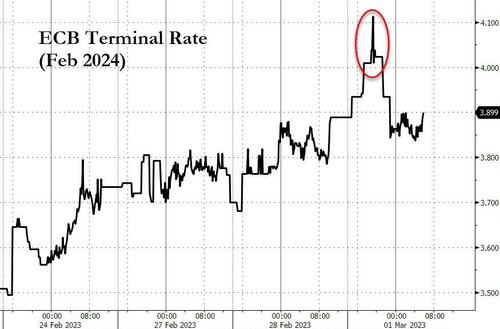

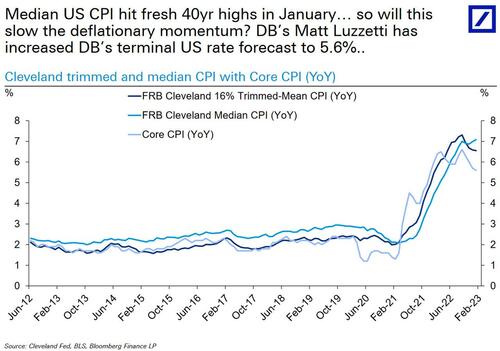

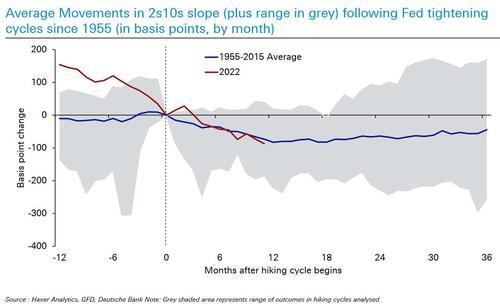

As a result, bond traders no longer view the odds of a Fed rate cut this year as better than-even, a shift from what they were expecting just a month ago. Market expectations also see the European Central Bank raising rates through February 2024, with a 4% ECB terminal rate fully priced. “February has poured cold water on hopes that policy makers may quickly tame inflation towards target,” Generali Investments strategists wrote in their monthly outlook. “We now have even higher peak rates in our books.” Watch this sentiment reverse with a bang the moment February jobs comes far below expectations next Friday..

On the other hand, contrary to expectations by Morgan Stanley’s Michael Wilson who has effectively staked his carrer on a forecast for a collapse in corporate profits, company earnings have proved more resilient than expected, even as traders question how long this can be sustained, given rising costs and the recessionary backdrop. In a sign that margins may yet be squeezed, asset manager Janus Henderson believes that dividend returns may be set to slow. Portfolio manager Jane Shoemake said she expects global dividend payouts to rise 2.3% to $1.6 trillion in 2023, a slower pace of growth compared with 8.4% last year, amid elevated inflation and geopolitical risks.

European stocks are ahead, tracking gains in Asia after Chinese manufacturing PMI rose to its highest in almost 11 years. The Stoxx 600 is up 0.1% with miners, autos and consumer products the strongest-performing sectors. Here are the biggest European movers:

- Aston Martin surges 22%, climbing to the highest since June, after the carmaker released results that analysts say showed a strong finish to the year with guidance for 2023 positive

- Moncler shares jumped as much as 8.5%, their biggest rise since November, after the luxury group’s full-year results beat expectations and Citigroup noted upbeat comments about its outlook

- Weir Group shares rise as much as 8.6%, hitting the highest since February 2021, with analysts saying the results from the mining-equipment firm are strong across the board

- Adidas shares jump as much as 3% after the sportswear brand was upgraded at HSBC, which says the company is likely to “embark on an ambitious path to reconquer market share”

- Ferrovial gains as much as 2.4% after the operator of London’s Heathrow Airport reported full-year results and a plan to shift domicile to the Netherlands and eventually apply for a US listing

- Euronext shares gain as much as 7.8% after the exchange operator withdrew its offer for investment platform Allfunds, a deal that analysts had questioned

- BNP Paribas shares dropped as much as 4.6%, their biggest decline since June, after Belgium’s Societe Federale de Participations & d’Investissement announced the sale of a 2.7% stake

- Just Eat Takeaway falls as much as 9.3% after failing to offer a gross transaction value forecast for 2023, a move analysts say looks disappointing after peer Delivery Hero did the same

Earlier in the session, Asian stocks were off to a strong start for March after China’s factory activity topped a decade high, spurring investor optimism ahead of an upcoming meeting of the nation’s political leaders. The MSCI Asia Pacific Index rose as much as 1.6%, the most since Jan. 9, lifted by communication and consumer discretionary shares. The Hang Seng China Enterprises Index jumped more than 5%, bouncing back from a recent selloff as strong manufacturing data underscores an acceleration in economic recovery.

“The latest economic data suggest China’s reopening has been working well,” said Nicolas Wang, senior equity advisor at Union Bancaire Privée. Hopes that a stimulus plan will be announced at the National People’s Congress have been somewhat priced into stocks, according to Union Bancaire’s Wang. Economists expect Premier Li Keqiang — who will deliver his last government work report on Sunday when the annual event kicks off — to outline a target for gross domestic product growth for this year of higher than 5%. Elsewhere in Asia, Taiwan advanced after traders returned from a two-day break, while Japan also edged higher. South Korean market was shut for a holiday. Asian stocks on Tuesday capped their worst month since September amid concerns over higher US interest rates and ongoing geopolitical risks. Traders no longer view the odds of a Federal Reserve rate cut this year as better-than-even, a shift from what they were expecting just a month ago.

Japanese equities rose, erasing early losses, after gauges of Chinese manufacturing beat economists’ expectations. The Topix rose 0.2% to close at 1,997.81, while the Nikkei advanced 0.3% to 27,516.53. The yen dipped about 0.1% against the dollar. Mitsui & Co. contributed the most to the Topix gain, increasing 3.4%. Out of 2,160 stocks in the index, 1,254 rose and 792 fell, while 114 were unchanged. “In addition to the cheaper yen, Japanese stocks are also benefiting from the rise in China and Hong Kong markets after the release of China’s PMI data,” said Yasuhiko Hirakawa, head of an investment department at Rakuten Investment Management. “Both manufacturing and non-manufacturing PMIs were higher previously expected, and there is positive sentiment toward the strong recovery of China’s economy.”

Australian stocks edged lower with the S&P/ASX 200 index ending 0.1% lower after a volatile session as investors assessed a slowdown in Australia’s inflation and economic growth, and how the data will impact monetary policy. The benchmark closed at 7.251.60 after swinging between gains and losses, weighed down by banks and property names. Australia’s monthly inflation eased in January to 7.4%, sending the currency and government bond yields lower. Meanwhile, the economy expanded at a slower-than-expected pace in the final three months of 2022, in a sign that the Reserve Bank’s rapid interest-rate increases are beginning to weigh on activity. In New Zealand, the S&P/NZX 50 index fell 0.2% to 11,876.35.

Stocks in India snapped an eight-day drop, the longest streak in more than three years, as investors looked for value after major benchmarks fell for a third straight month in February. The S&P BSE Sensex rose 0.8% to 59,411.08 in Mumbai, while the NSE Nifty 50 Index advanced by a similar measure. All of BSE Ltd.’s 20 sector sub-guages closed higher, led by metal and commodity related companies. All 10 companies that are part of the ports-to-power Adani conglomerate ended higher for the first time since the scathing report by US short seller Hindenburg Research was published on Jan. 24. The group is conducting a three-day roadshow this week to restore investor confidence. Reliance Industries contributed the most to the Sensex’s gain, increasing 0.9%. All but two of 30 shares in the Sensex index rose.

In FX, the Bloomberg Dollar Spot Index fell as much as 0.5%, the most since Feb. 14, as the greenback weakened against all its Group- of-10 peers, while the New Zealand dollar was the best performer.

- The New Zealand dollar led G-10 gains, rising as much as 1.3% to $0.6263, the highest since Feb. 17, and the Australian dollar swung to a gain after China’s manufacturing purchasing managers’ index rose to the highest in more than a decade and exceeded economists’ forecasts. The Aussie had dropped earlier and bonds advanced following slower-than-expected local inflation numbers.

- China’s manufacturing PMI rose to 52.6 last month, the highest reading since April 2012. A non-manufacturing gauge measuring activity in both the services and construction sectors improved to 56.3. Both indexes beat economists’ expectations. A non-manufacturing gauge measuring activity in both the services and construction sectors improved to 56.3. Both indexes beat economists’ expectations

- The euro gained as much as 0.8% to $1.0662 and European bonds dropped, led by the front end, after stronger inflation figures from Germany. Options traders scaled back their bearish bets on the euro amid money-market wagers that the ECB’s terminal rate will be higher than previously expected

- The pound pared an advance and gilts erased an earlier drop as traders trimmed bets on the peak in the BOE’s key rate. BOE Governor Andrew Bailey cautioned markets against assuming a rates move in either direction, while acknowledging the impact that monetary tightening is having on the economy

In rates, treasury futures narrowly mixed after paring losses during European morning, following wider gains across gilts where front-end outperforms. Treasuries curve pivots around a little-changed 7-year sector with long-end yields richer by more than 1bp vs Tuesday’s close and 2s10s, 5s30s spreads flatter. 10-year TSY yields are little changed around 3.92% day with gilts outperforming by 3.5bp in the sector. US curve extends Tuesday’s flattening move post month-end. Block flattener in futures adds to long-end outperformance over European session.

In Europe, Bund futures extended losses after the German state of North Rhine-Westphalia saw annual inflation accelerate in February, suggesting an upside surprise in the national reading later today. German 10-year yields are up 6bps while the UK equivalent falls 1bps. Gilts outperform following comments from BOE Governor Andrew Bailey, who said Wednesday that “nothing is decided” on the future path of rates.

In commodities, Crude futures decline with WTI falling roughly 1.0% to trade near $76.25. Spot gold adds around 0.3% to trade near $1,832.

Looking to the day ahead now, data releases include the global manufacturing PMIs for February and the ISM manufacturing reading from the US. From central banks, we’ll hear from BoE Governor Bailey, the Fed’s Kashkari, and the ECB’s Villeroy, Nagel and Visco. Finally, earnings releases include Salesforce and Lowe’s.

Market Snapshot

- S&P 500 futures up 0.2% to 3,983.00

- MXAP up 1.5% to 160.37

- MXAPJ up 2.0% to 521.54

- Nikkei up 0.3% to 27,516.53

- Topix up 0.2% to 1,997.81

- Hang Seng Index up 4.2% to 20,619.71

- Shanghai Composite up 1.0% to 3,312.35

- Sensex up 0.8% to 59,414.51

- Australia S&P/ASX 200 little changed at 7,251.60

- Kospi up 0.4% to 2,412.85

- STOXX Europe 600 little changed at 461.44

- German 10Y yield little changed at 2.71%

- Euro up 0.6% to $1.0642

- Brent Futures down 0.3% to $83.21/bbl

- Gold spot up 0.3% to $1,832.20

- U.S. Dollar Index down 0.40% to 104.45

Top Overnight News from Bloomberg

- China’s NBS PMIs for Feb were very strong, with manufacturing coming in at 52.6 (up from 50.1 in Jan and ahead of the St’s 50.6 forecast) and non-manufacturing climbing to 56.3 (up from 54.4 in January and above the St’s 54.9 forecast). BBG

- After three years of turbulence under the Covid pandemic, China’s leaders are expected to lay out economic goals to get growth back on track, restore confidence and avoid a build-up of financial risks. Economists expect Premier Li Keqiang — who will deliver his last government work report on Sunday when the annual National People’s Congress kicks off — to outline a target for gross domestic product growth for this year of higher than 5%. That’s after the economy expanded just 3% last year, missing the official goal by a wide margin. BBG

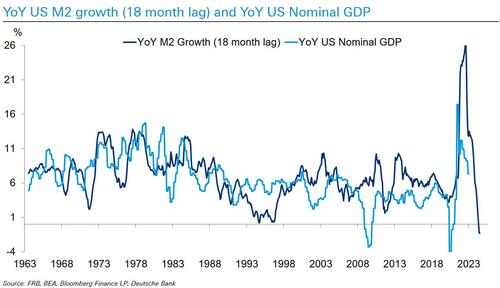

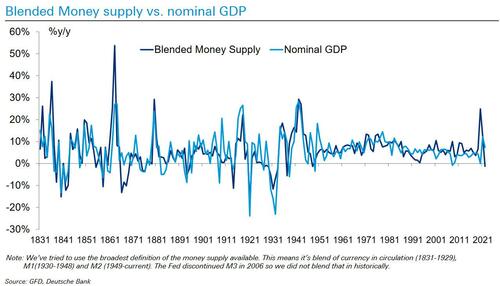

- US M2 money supply fell 1.7% Y/Y in January, the largest decline on record and the first time it has contracted in two consecutive months (but, money supply is still 39% higher than it was before COVID, which means the Fed still has plenty of work ahead of it). Barron’s

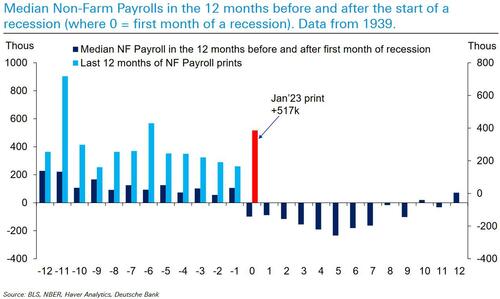

- Demand for U.S. workers shows signs of slowing, a long-anticipated development that is showing up in private-sector job postings even while official government reports indicate the labor market keeps running hot. ZipRecruiter Inc. and Recruit Holdings Co., two large online recruiting companies, say their data show the number of job postings is declining more than Labor Department reports of job openings. Investors recently hammered shares of those companies after disappointing earnings reports. WSJ

- The European Central Bank should reach its peak interest rate by September, Governing Council member Francois Villeroy de Galhau said. It would be unwise to expect the ECB to quickly reduce borrowing costs after their eventual peak, according to Governing Council member Madis Muller: BBG

- Bundesbank President Joachim Nagel said he supports a more rapid reversal of the ECB’s bond-buying to help tackle inflation, with more large interest-rate increases also a possibility beyond a planned hike this month: BBG

- The White House is coming under increased pressure to give F16 fighter jets to Ukraine (the process to deliver the jets and provide training for them is a long one, and many feel it should be started now). Wa Po

- The prices of new homes in 100 Chinese cities held steady in February versus January having fallen for seven consecutive months, data showed on Wednesday, as a flurry of property market easing measures improved buyer confidence. The flat reading followed a 0.02% decline in January from December, showed data from the China Index Academy. RTRS

- EU negotiators reached a deal to establish a green bond standard, giving investors long-awaited clarity that their money is aligned with the region’s climate ambitions: BBG

- UK house prices fell at their sharpest annual pace since 2012 last month, steepening a downturn sparked by a jump in mortgage rates. The average cost of a home fell 1.1% from a year ago last month after a gain of the same size in January, Nationwide Building Society said Wednesday. It marked the sixth consecutive monthly drop in prices and the first annual decline since June 2020: BBG

- Turkey’s parliamentary and presidential elections will take place as planned on May 14, President Recep Tayyip Erdogan has said, quashing speculation over whether the vote would be postponed following the two deadly earthquakes last month: BBG

- Economists expect China Premier Li Keqiang — who will deliver his last government work report on Sunday when the annual National People’s Congress kicks off — to outline a target for GDP growth for this year of higher than 5%. That’s after the economy expanded just 3% last year, missing the official goal by a wide margin

- Chinese President Xi Jinping welcomed Belarusian leader Alexander Lukashenko, a close Russian ally, in talks watched closely for signs that Beijing is expanding coordination with Moscow and its supporters in their standoff with the West

- BOJ Board Member Junko Nakagawa says that she wants to watch financial markets for a while longer to discern the impact of December’s adjustments to the BOJ’s yield curve control program

- The US crude buildup continues. Inventories increased by 6.2 million barrels last week, API data indicated, in what would be a 10th straight gain if confirmed by the EIA later. In fuel markets, gasoline and distillate stockpiles both eased. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as the region digested a slew of data releases including the fastest pace of expansion for Chinese Manufacturing PMI in more than a decade. ASX 200 was initially pressured by weakness in telecoms and financials, but later pared the losses as the miss on quarterly GDP and softer monthly CPI data effectively eased some of the hawkish pressure on the RBA. Nikkei 225 lacked firm direction with price action confined to a narrow range around the 27,500 level. Hang Seng and Shanghai Comp. were supported by the blockbuster official Chinese PMI data which printed its highest since April 2012 and Caixin Manufacturing PMI also returned to expansion territory. Furthermore, a surge in tech spearheaded the outperformance in Hong Kong, while advances in the mainland were somewhat moderated by US-China frictions as the Biden administration considers revoking export licenses issued to US suppliers for sales to Huawei and with the US also barring chipmakers from expanding capacity in China for 10 years if they are to receive some of the federal funding from the CHIPS Act. US equity futures (ES Unch.) were uneventful but moved off lows as sentiment in Asia gradually improved

Top Asian News

- Chinese Finance Minister Liu Kun said proactive fiscal policy will be more forceful, while he added that China’s economy will continue its rebound and local governments will see better fiscal conditions.

- BoJ JGB market survey shows the index measuring market functioning deteriorating to -64 for February (prev. -51, Nov.), the lowest on record.

- China’s economy is recovering faster than expected by top officials, suggesting that the government might be restrained in rolling out new stimulus measures this year, according to Bloomberg sources.

European bourses are firmer across the board, Euro Stoxx 50 +0.6%, in a continuation of the APAC handover following strong Chinese PMIs; though, the region awaits mainland German prelim. CPI. Sectors are mixed with Basic Resources outperforming given benchmark pricing while Real Estate names lag following earnings and as yields continue to rise. Stateside, futures are similarly in the green though magnitudes are incrementally more modest given key data points loom. Tesla (TSLA) is reportedly preparing a revamp of its Model Y, via Reuters citing sources; named “project Juniper” with a production start target of October 2024; revamp reportedly includes the exterior and interior of the Model Y. Reminder, Tesla is holding an investor day on March 1st at its Texas facility.

Top European News

- BoE Governor Bailey says he would caution against suggesting either that the BoE is done with hiking rates or that BoE will inevitably need to do more; have to monitor carefully how the tightening already done is working its way through the economy. Further increase in Bank Rate may turn out to be appropriate, but nothing is decided. The incoming data will add to the overall picture of the economy and the outlook for inflation, and that will inform our policy decisions. If BoE does too little with rates now, BoE will only have to do more later on. Must ensure that the situation does not get worse through homemade inflation taking hold.. Click here for more detail alongside analysis & reaction.

- ECB’s Villeroy expects growth in France to be slightly positive this year, desirable to reach terminal by the Summer i.e. September at the latest. France’s public debt ratio is not decreasing, unlike that of other major countries within the EZ.

- ECB’s Nagel says further significant rate hikes beyond March may be needed, favours a stepper reduction of the APP portfolio from July. Energy price decline has no essential bearing on the ECB’s medium-term inflation projections.

FX

- Dollar knocked back as punchy Chinese PMIs give the Yuan enough impetus to scale chart resistance, DXY down to 104.270 from just over 105.000, USD/CNY and USD/CNH both under 6.9000 and 200 DMAs.

- Sterling lags as BoE Governor Bailey sounds a word of caution about further hikes or calling time on the tightening cycle.

- Cable sub-1.2050 and EUR/GBP 0.8850+ as EUR/USD extends beyond 1.0665 vs Buck.

- Aussie underpinned by Yuan revival, but gains capped by soft GDP and CPI data.

- PBoC set USD/CNY mid-point at 6.9400 vs exp. 6.9409 (prev. 6.0519)

Fixed Income

- EGBs are softer on the session given initially hot German State CPIs and commentary from ECB’s Nagel; however, Gilts have seen a marked bounce in the wake of BoE’s Bailey.

- Specifically for EGBs, Bunds dropped to a 131.86 trough with the 10yr yield at a fresh 2.72% YTD peak, though they are off-worst given the readacross from Gilts and as the State CPIs overall are more in-line with the prior.

- For the UK, Bailey’s remarks prompted marked two-way action with Gilts/STIRs eventually focusing on the dovish-elements, lifting Gilts to a 100.30+ peak vs a 99.37 initial low.

- Stateside, USTs remain soft within 111.08+ to 111.18 parameters ahead of Final PMIs, ISM Manufacturing and Fed’s 2023 voter Kashkari; yield curve elevated with action much more pronounced at the short-end.

Commodities

- Crude benchmarks have given up initial gains after Tuesday’s firmer settlement, with the initial more tentative European tone vs Asia and the Private Inventory build capping upside.

- Specifically, WTI Apr and Brent May are at the lower-end of USD 76.21-77.74/bbl and USD 82.68-84.20/bbl parameters respectively.

- US Energy Inventory Data (bbls): Crude +6.2mln (exp. +0.5mln), Cushing +0.5mln, Gasoline -1.8mln (exp. +0.5mln), Distillates -0.3mln (exp. -0.5mln).

- Nat Gas futures are firmer in Europe and the US, with technicians focusing on Henry Hub’s 21-DMA while TTF reclaims some last ground after recently dipping below EUR 50/MWh.

- Spot gold and metals more broadly are modestly firmer, benefitting from the softer USD while base metals outperform their precious counterparts following China’s strong PMI releases.

Geopolitics

- Turkish President Erdogan “indicates” that Presidential and Parliamentary elections will be held on May 14th.

- “Russia is concerned about information that a Kiev provocation using radioactive materials could take place near Transnistria”, according to Russian Foreign Ministry Spokeswoman cited by Tass.

US Event Calendar

- 07:00: Feb. MBA Mortgage Applications -5.7%, prior -13.3%

- 09:45: Feb. S&P Global US Manufacturing PM, est. 47.8, prior 47.8

- 10:00: Feb. ISM Manufacturing, est. 48.0, prior 47.4

- Feb. ISM Employment, prior 50.6

- Feb. ISM New Orders, prior 42.5

- Feb. ISM Prices Paid, est. 46.5, prior 44.5

- 10:00: Jan. Construction Spending MoM, est. 0.2%, prior -0.4%

DB’s Jim Reid concludes the overnight wrap

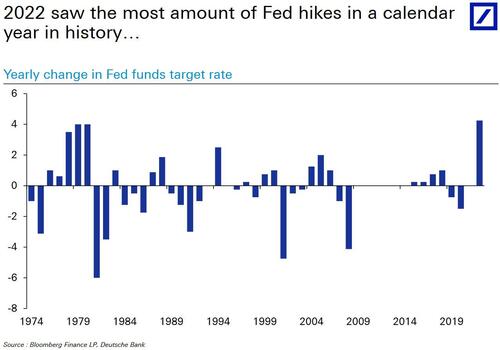

Welcome to March. Since it’s the start of a new month, we’ll shortly be releasing our regular performance review looking at how different assets performed over February. It was a pretty bad month on the whole, with losses across equities, credit, sovereign bonds and commodities. That came amidst growing concern about inflation, which led investors to ramp up their expectations for central bank rate hikes. For bonds in particular it was an awful month, with Bloomberg’s global aggregate bond index seeing its worst February performance since its inception back in 1990 after seeing its best January the month before. See the full report in your inboxes shortly.

That theme of the month continued into the final day yesterday, with another bond selloff thanks to European inflation data that came in hotter than expected once again. Specifically, French inflation hit a multi-decade high of +7.2% on the EU-harmonised measure (vs. +7.0% expected), whilst Spanish inflation unexpectedly rose to +6.1% using the same definition (vs. +5.7% expected). This is clearly not the direction that central banks or investors were expecting them to be moving at this point, so all eyes will now be on today’s German CPI release to see if that’s replicated, ahead of the full Euro Area release tomorrow.

For Germany DB continue to expect the headline rate to fall substantially during 2023. But core inflation is expected to remain elevated during H1 2023 (probably averaging around 5.5%) before starting to ease only gradually in H2. Our economists worry that there remains the risk that overly strong wage outcomes and second round effects keep core inflation in the 5%-plus range for much longer. With regards today’s preliminary print, DB expect the CPI index to rise by c. 0.8% mom, keeping the year-over-year rate unchanged at 8.7%. Core inflation at 5.9% YoY, (+0.7% mom – both DB) will be the main focus. See DB’s Sebastian Becker’s preview and overall German inflation views here. Just after we go to print, but before you read this, the North Rhine Westphalia region will have just published their inflation numbers so have a look out for that as it will give you clues for the national numbers out a few hours later.

Overnight we’ve seen a decent change in momentum for risk as upbeat China data has revived optimism for the reopening trade that has been flagging of late. As I type, the Hang Seng (+3.37%) is sharply up buoyed by a rally in Chinese listed tech stocks with the CSI (+1.36%), the Shanghai Composite (+0.7%) and the Nikkei (+0.16%) all trading in positive territory. Elsewhere, markets in South Korea are closed today for a holiday. In overnight trading, US equity futures have bounced from half a percent losses to be just positive as I type.

The market bounce has been due to the official China manufacturing index growing at the fastest pace in more than a decade with the index advancing to 52.6 in February (v/s 50.6 expected) from 50.1 in January indicating that the world’s second biggest economy improved markedly after the lifting of Covid-19 restrictions in December. At the same time, the official non-manufacturing PMI rose to 56.3 (v/s 54.9 expected) from 54.4 in January, notching the fastest pace of expansion since March 2021. The improvement was seen in the nation’s private gauge of manufacturing activity as the Caixin manufacturing PMI edged up to 51.6 in February (ending six months of contraction) from 49.2 in January. Elsewhere, Australia’s GDP came in weaker than expected in the fourth quarter of 2022 with the economy expanding +0.5% (v/s +0.8% expected), down from the prior’s quarter’s revised reading of +0.7%, hinting that rate hikes are now weighing on the local economy.

Back to yesterday, and with inflation proving more resilient than expected yesterday, investors dialled up the amount of rate hikes they’re expecting from the ECB this year. In fact, overnight index swaps are now pricing in +149bps of further rate hikes by year-end, which implies a very significant chance that the deposit rate will climb as high as 3.9%. That’s pretty astonishing when you consider it was only a year ago (shortly after Russia invaded Ukraine) that there were genuine doubts about whether the ECB would be able to hike at all, and 10yr bund yields briefly moved back into negative territory.

We’ve come a long way since then, with yesterday seeing yields on 10yr bunds (+6.9bps) close at a post-2011 high of 2.65%, even if it was above 2.70% at the intraday peak. It was a similar story across the continent, with yields on 10yr OATs (+6.6bps) at their highest since 2012, and those on 10yr gilts (+2.1bps) at their highest since Liz Truss’ time as PM. Meanwhile at the front-end, 2yr German yields were up +6.3bps to 3.137%, which is something we haven’t seen since 2008. So a day of records across the board.

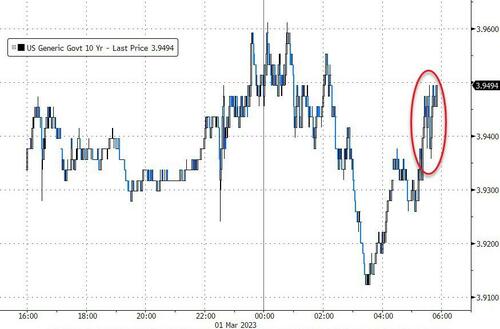

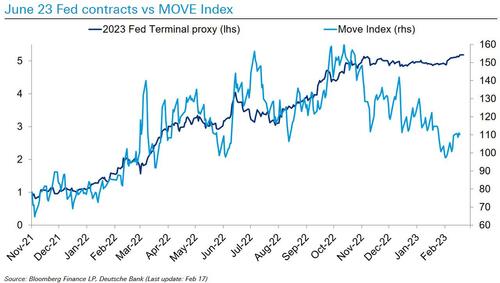

Over in the US, pricing for the Fed’s terminal rate was up to a new closing high of 5.424% for the September meeting, with the July meeting nearly identically priced. That drove a further repricing of the front end, with the 2yr yield finishing up +3.75bps to 4.816% – its highest closing level since 2007. There was a significant volatility into month-end, with 2yr yields as low as 4.785% just over an hour before the close. 10yr yields finished up +0.6bps to 3.920% (and are +1.17 bps higher overnight), after earlier breaking above the 3.98% mark intraday for the first time since November. Chicago Fed President Goolsbee made his first public speech since taking the position in January. He did not explicitly comment on monetary policy, but warned that policymakers should be careful to take too much of a signal from financial markets.

This backdrop on the rates side meant that equities struggled to gain much momentum, with the S&P 500 moving between small gains and losses all session until finally selling off in the last 2 hours of trading to finish down -0.30% and near the lows of the day. That left the index -2.61% lower over the month as a whole. The losses were driven by a mix of defensives (Utilities -1.7%) and more cyclical sectors (Energy -1.4%). Meanwhile, the small-cap Russell 2000 (+0.04%) and the FANG+ index (+0.08%) of megacap tech stocks were able to just finish above flat, while the Dow Jones ended the day down -0.71%, bringing its YTD decline to -1.48% now. Over in Europe, the STOXX 600 (-0.32%) posted a modest decline, but the broader outperformance of European equities (particularly in the south) held into February, with Italy’s FTSE MIB advancing a further +0.12% yesterday, thus bringing its YTD gain to +15.91%.

Another factor that didn’t help on the rates side yesterday were the increases across a wide range of commodities. For instance, Brent crude oil prices were up +1.81% to $83.89/bbl, just as WTI advanced +1.81% to $76.61/bbl. It was much the same story for metals too, with copper prices up +1.75%, and gold advancing +0.54%. Clearly the European inflation numbers were the main factor behind the rates moves, but declining commodity prices have been a tailwind behind the falling inflation numbers over recent months, and any sign of a reversal would be bad news when it comes to the broader inflation picture.

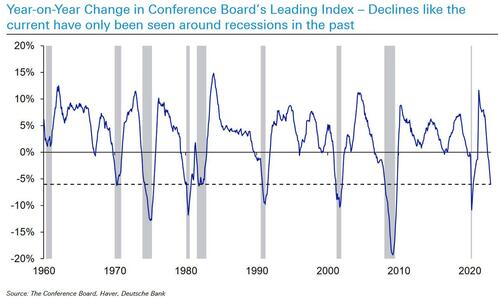

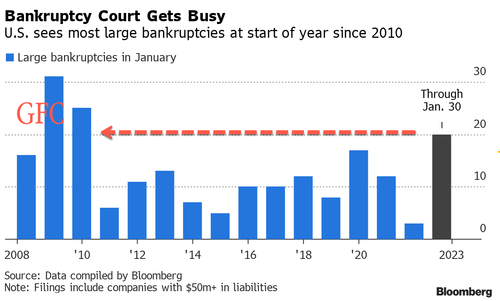

Back in the US, we had a few lower-tier data prints yesterday ahead of the ISM prints this week. The pattern was generally an underwhelming one for the February releases, with the MNI Chicago PMI unexpectedly falling to 43.6 (vs. 45.5 expected). We also had the Richmond Fed’s manufacturing index, which was another that unexpectedly fell to -16 (vs. -5 expected). Bear in mind the last two occasions it got as low as that were during the Covid-19 pandemic and the GFC, with the latest reading being the lowest since May 2020. And finally, there was the Conference Board’s consumer confidence reading for February, which fell to 102.9 (vs. 108.5 expected), with expectations falling to a 7-month low of 69.7. Could higher yields over the last month have made an impact?

To the day ahead now, and data releases include the global manufacturing PMIs for February and the ISM manufacturing reading from the US. Otherwise, we’ll get Germany’s CPI and unemployment for February, and UK mortgage approvals for January. From central banks, we’ll hear from BoE Governor Bailey, the Fed’s Kashkari, and the ECB’s Villeroy, Nagel and Visco. Finally, earnings releases include Salesforce and Lowe’s.