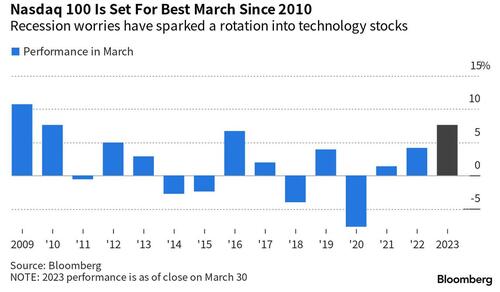

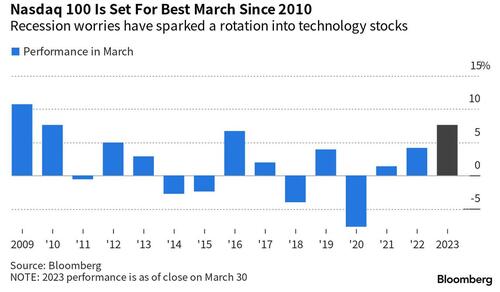

US futures extended gains for the 3rd straight day and are on pace to rise 6 of the past 7 days, led by the Nasdaq 100 which is set for its best March in more than a decade as investors bet on a softening in central-bank policy amid worries about a recession while the slowdown in new money market fund injections eased fears about the ongoing bank run.

Contracts on the Nasdaq 100 were up 0.3% as of 7:45 a.m. in New York, while S&P 500 futures also rose 0.2% hitting the highest level in 6 weeks.

For the month, the tech-heavy gauge is tracking an increase of about 7.7%, its biggest March advance since 2010. The benchmark S&P 500 is also set for a small monthly gain as the rates outlook overshadowed concerns about turmoil in the banking sector and a possible economic contraction.

The dollar strengthened Friday, trimming some of its sharp declines this month. Treasury yields steadied at the end of a quarter of wild swings. Investors have struggled to adjust for banking collapses and the shifting outlook for interest rates amid high inflation and threats to economic growth. The two-year yield was around 4.13% Friday while the 10-year maturity was about 3.55%.

Among notable premarket movers, Nikola Corp. dropped 8.6% after a $100 million share offering priced at a 20% discount to the stock’s last close. Digital World Acquisition Corp., the special-purpose acquisition company merging with Trump Media, rallied as much as 16% following former President Donald Trump’s indictment. Virgin Orbit shares slump a record 40% after the satellite launch provider said it’s ceasing operations indefinitely. Here are the other notable premarket movers:

- Digital World Acquisition, the blank-check firm taking Trump Media public, rallied 8% in premarket trading, advancing along with other stocks tied to Donald Trump after the indictment of the former president. Phunware , a software firm that worked on Trump’s reelection campaign, rose 2.5%, while video platform Rumble gained 14%.

- Advance Auto Parts upgraded to equal-weight at Barclays, which says that rather than a positive call it is based on significant year-to-date underperformance. The stock gains 1.1%.

- Alphabet Inc.’s price target is lowered to $117 from $120 at Piper Sandler, which cites concerns about competition in artificial intelligence technology.

- Blackberry shares drop 3.8% after the cybersecurity company’s fourth- quarter revenue missed analyst estimates, with brokers flagging the impact of some large government deals slipping, as well as needing more convincing that important metrics were recovering.

- Generac shares are down 3% after BofA Global Research downgrades the generator company to underperform from neutral.

- IonQ shares are up more than 4% after the quantum-computing company reported fourth-quarter results that beat expectations and gave a full-year revenue forecast that was ahead of the consensus estimate.

US stocks have experienced a big sector rotation this month with technology stocks rallying amid bets of lower interest rates, while economically-linked cyclical sectors lagged behind following their outperformance at the start of the year. The Nasdaq 100 is up nearly 19% in the first quarter, its best January-March performance since 2012. That rotation prompted momentum-chasing penguins, pardon strategists at Citigroup to upgrade US stocks to overweight from underweight, saying they “perform more defensively than other markets” during earnings recessions.

Michael Hewson, chief market analyst at CMC Markets UK, said US stock markets “have undergone a bit of a crisis of confidence with concern about the effects of much higher rates giving way to concern about the health of the US banking system.”

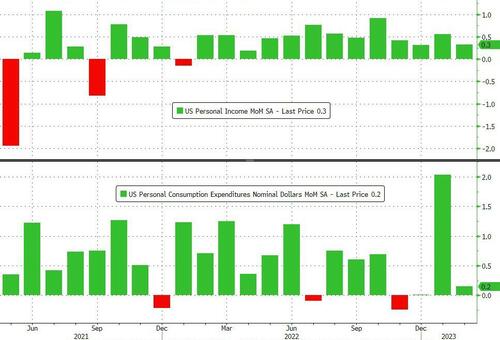

On the outlook for rates, all eyes Friday are on the so-called PCE Core Deflator, which is expected to show a slight easing of price pressures in February, though it should still be well above target. A round of Fed speakers on Thursday suggested more monetary tightening was necessary to quell inflation, even after the collapse of three US banks this month.

“The Fed’s preferred measure of inflation could generate some volatility within the fixed income markets if we see any surprises,” economists at Rand Merchant Bank in Johannesburg wrote in a note. “Risks are tilted to the upside, and if the data shows that inflation pressures remained strong in February, the inversion of the US yield could deepen even further.”

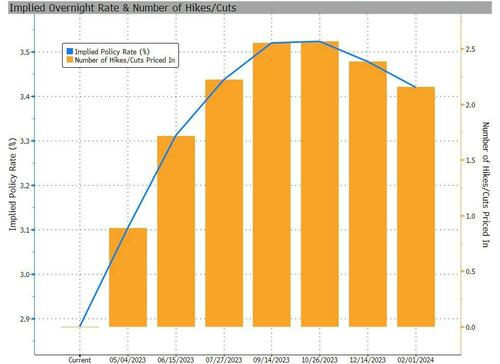

Traders will also be on guard for any choppiness amid quarter-end rebalancing from pension funds and options hedging activity, especially the famous JPM collar which has a 4065 strike. And they continue to debate the extent to which policy makers may cut interest rates this year. Several strategists have said markets are wrong to expect easing by the Fed this this year as the labor market remains robust, though US unemployment claims ticked up for the first time in three weeks.

European stocks are ahead with the Stoxx 600 up 0.3% and on course for a third day of gains. Personal care, retailers and consumer products are the strongest-performing sectors while miners and banks fall. Here are some notable premarket movers:

- Air France-KLM rises as much as 4.5%, IAG 3.2%, Lufthansa 3.3% and EasyJet 3.8% following bullish notes on the sector from Deutsche Bank and Barclays and a slew of upgrades

- Ocado gains as much as 7.9%, while AutoStore falls as much as 12% after a UK court invalidated the two remaining patent lawsuits the Norwegian firm had filed against Ocado

- SAF-Holland rises as much as 7.6%, extending gains following Thursday morning’s results, as Hauck & Aufhaeuser lifts its PT to a new Street high

- CD Projekt soars as much as 9.8% after posting the second-highest quarterly earnings fueled by stronger sales of Cyberpunk 2077 and Witcher 3 games

- Getin Holding soars as much as 27% after the company proposes a record dividend of 0.58 zloty per share, its first payout since 2013

- Computacenter shares gain as much as 3.2% on Friday after the IT reseller posted better-than-expected results, saying demand from most of its largest customers remains solid

- Torm rises as much as 9.6% after holder OCM Njord Holdings Sarl terminated a planned secondary public offering of 5 million class A shares in the Danish tanker operator

- Marston’s shares rise as much as 5.3%, with analysts saying the pub operator’s amendment and extension of its debt facilities should provide some relief for investors

- Jungheinrich shares slide as much as 9.2% after the forklifts and stackers manufacturer’s cautious outlook for 2023 overshadowed a strong end to 2022

- EMIS shares plunged as much as 24% after Britain’s competition regulator said it would investigate UnitedHealth’s deal to acquire the health-technology company

Earlier in the session, Asian stocks headed for a fourth day of gains as data showed China’s economy gained momentum in March, while concerns about global banking turmoil and elevated interest rates eased. The MSCI Asia Pacific Index rose as much as 1.1%, set to cap a second-straight weekly gain, boosted by consumer discretionary and materials shares. Most regional markets gained, led by Japan, South Korea and Hong Kong. Indian shares jumped after returning from a holiday. Chinese stocks got a boost after a report that manufacturing continued to expand amid a strong pickup in services activity and construction. The report offered investors more confidence about an economic rebound after stringent Covid restrictions were dropped. Spinoff plans for JD.com and Alibaba units also lifted sentiment for tech shares. Read: China’s Strong PMIs Show Economic Recovery Gaining Traction The latest data “confirms the early cycle economic recovery is on track, paving the way for earning revisions to stabilize and improve from 2Q,” analysts at UBS Global Wealth Management’s chief investment office wrote in a report. “We expect over 20% upside for MSCI China by year-end, with the recent consolidation presenting an attractive entry point.” Globally, concerns over the financial sector continued to cool and investors digested a round of Federal Reserve commentary. Bank of Boston President Susan Collins said the banking system is sound and more interest-rate increases are needed to bring down inflation.

Japanese stocks rebounded, following US peers higher, as concerns over the financial sector continued to cool and investors digested a round of Fed commentary. The Topix Index rose 1% to 2,003.50 as of market close Tokyo time, while the Nikkei advanced 0.9% to 28,041.48. Mitsui & Co. contributed the most to the Topix Index gain, increasing 7.6%. Out of 2,160 stocks in the index, 1,471 rose and 588 fell, while 101 were unchanged. Meanwhile, Japanese semiconductor-related stocks pared earlier gains after Japan said it will tighten chip gear exports to help restrict tech shipments to China. Japan Trading Firms Gain on Reported Plans to Improve Returns “Besides the stabilizing overseas markets, expectations for firm corporate earnings outlooks are also boosting Japanese equities,” said Rina Oshimo, a senior strategist at Okasan Securities. “Japan’s macro economy this year is more resilient than overseas, mainly driven by reopening growth, and the government’s policy for childcare support is also positive material.

Australian stocks also advanced: the S&P/ASX 200 index rose 0.8% to close at 7,177.80, boosted by mining and bank shares. Stocks across Asia advanced with US and European equity futures, underscoring investor optimism in the face of banking turmoil and elevated interest rates. The benchmark snapped seven weeks of losses, rising 3.2% for the week, the most since the week of Nov. 11. The index also posted a second straight quarter of gains. The focus will now be on Australia’s central bank, which is set to make a rate decision Tuesday. The RBA is expected to keep borrowing costs unchanged at next week’s meeting, delivering its first pause since initiating a policy tightening cycle in May 2022. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,884.50.

India stocks rallied the most in more than four months on Friday bouncing back from their oversold levels to trim losses for the quarter. The S&P BSE Sensex Index rose 1.8% to 58,991.52 in Mumbai, while the NSE Nifty 50 Index advanced 1.6% to 17,359.75. The gauges posted their biggest single-day rallies since Nov. 11, narrowing their losses for the quarter to 3% and 4%, respectively. Even with the gains this week, the indices clocked their worst quarterly performance since June 2022 after scaling to their record peaks in December. Globally tightening monetary conditions and the impact of inflation have dampened the outlook for economic growth and shrunk the valuation gap that India enjoyed over its peers. Foreigners turned buyers of local shares in March after three straight months of outflows, purchasing a net of $1.4b of stocks through March 28, while domestic institutional investors remain supportive of equities. Reliance Industries contributed the most to the Sensex’s advance, increasing 4.3% after the company firmed up its plan for separating its financial services business, a move that will potentially result into value creation for the country’s biggest listed firm. Out of 30 shares in the Sensex index, 26 rose and 4 fell

In FX, the Bloomberg Dollar Spot Index rose 0.2%, boosted by gain versus the yen; the dollar is set to end the quarter 1.4% lower, its first consecutive quarterly loss in more than two years, amid easing concerns about the global banking sector and money market wagers on Federal Reserve interest-rate cuts. USD/JPY rallied as much as 0.8% as Japan’s fiscal year-end flows dominated and haven bids waned amid easing concerns about the global banking sector; International Monetary Fund said the nation’s central bank should avoid a premature exit from monetary easing.

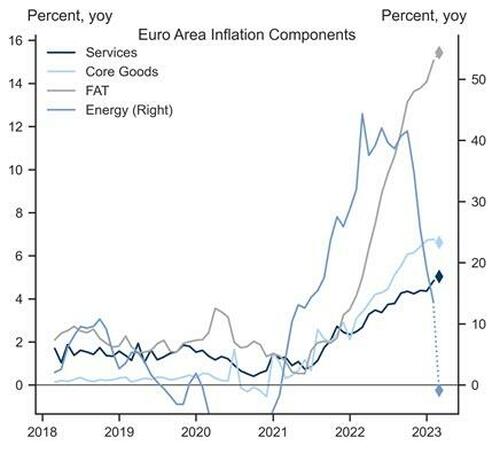

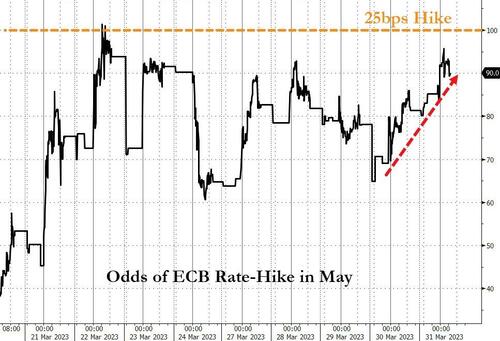

In rates, US 10-year yields are down 2 bps at 3.537% ahead of the core PCE data due later today. Treasury 2-year yields cheaper by ~2bp on the day with 2s10s flatter by 3bp to -61bp from a high of around -50bp Thursday. Bunds outperform little-changed US 10-year by 2bp while gilts lag by 3bp. Earlier, ECB rate-hike premium was unwound slightly after euro-area core inflation accelerated to 5.7% in March, matching the median forecast. IG dollar issuance slate empty so far; a couple of names priced $1.4b Thursday, leaving March total around $100b vs $150b that was expected. Bund futures rallied as traders trimmed ECB rate bets after euro-area inflation slowed more than expected in March, although the core rate did accelerate. German 10-year yields are flat at 2.37% while the Euro is down 0.2% versus the greenback. US economic data slate includes February personal income/spending with PCE deflator (8:30am), March MNI Chicago PMI (9:45am) and March final University of Michigan sentiment (10am).

In commodites, US crude futures are little changed with WTI at $74.35. Spot gold is also flat around $1,980

Looking to the day ahead. We have quite a busy day data wise, with the US PCE deflator data, the March MNI Chicago PMI and the February personal spending and income data. In Europe, we have the Eurozone March CPI data and the February unemployment. We will also see the release of the Italian March CPI and the January industrial index, the German march unemployment change, February retail sales and the import price index, and lastly the French March CPI. February CPI and consumer spending. Finally, we will hear from several central bankers, including the ECB’s Lagarde and Kazaks, as well as the Fed’s Williams, Waller and Cook.

Market Snapshot

- S&P 500 futures little changed at 4,082.00

- MXAP up 0.6% to 161.90

- MXAPJ up 0.5% to 523.44

- Nikkei up 0.9% to 28,041.48

- Topix up 1.0% to 2,003.50

- Hang Seng Index up 0.4% to 20,400.11

- Shanghai Composite up 0.4% to 3,272.86

- Sensex up 1.7% to 58,952.31

- Australia S&P/ASX 200 up 0.8% to 7,177.75

- Kospi up 1.0% to 2,476.86

- STOXX Europe 600 up 0.2% to 455.58

- German 10Y yield little changed at 2.39%

- Euro down 0.3% to $1.0876

- Brent Futures down 0.9% to $78.54/bbl

- Gold spot down 0.3% to $1,975.10

- US Dollar Index up 0.30% to 102.45

Top Overnight News

- Former President Donald Trump faces a set of legal requirements no American leader has had to confront after being indicted by a Manhattan grand jury on Thursday in a probe of hush money payments to a porn star during his 2016 campaign — a historic event in American law and politics that is certain to divide an already polarized society and electorate: BBG

- The BOJ expanded the range of its planned bond purchases next quarter, giving itself the option to dial back buying. It will buy ¥100 billion to ¥500 billion ($750 million to $3.8 billion) of 10-to-25-year bonds per operation, compared with a range of ¥200 billion to ¥400 billion in the first quarter. It also widened the range of purchase amounts for other maturities above one year. BBG

- The China Securities Regulatory Commission last month released long-awaited guidelines that require all mainland Chinese companies planning share sales outside the domestic A-share market to inform the regulator beforehand. That applies to jurisdictions that have been popular venues for Chinese listings, including Hong Kong and the U.S. Companies in some technology fields that haven’t yet generated revenue will be able to explore listings in Hong Kong, after the city’s stock exchange last week finalized a new set of rules known as Chapter 18C. WSJ

- China’s economic recovery gathered pace in March, with gauges for manufacturing, services and construction activity remaining strong, boosting the outlook for growth this year: BBG

- The U.S. and South Korea are both seeking to extradite captured crypto entrepreneur Do Kwon from Montenegro, authorities in the tiny European nation said this week, setting up competing bids to prosecute him over criminal charges tied to the collapse of his TerraUSD stablecoin. WSJ

- Eurozone inflation has fallen sharply to its lowest level for a year after a decline in energy costs. Harmonized consumer prices in the euro area rose by 6.9 per cent in the year to March, down from 8.5 per cent the previous month, to reach their lowest level since February 2022. The drop, due to a 0.9 per cent fall in energy prices, was steeper than a forecast by economists polled by Reuters, who had expected March eurozone inflation of 7.1%. FT

- Underlying inflation in the euro area hit a record in March, handing ammunition to European Central Bank officials who say interest-rate increases aren’t over yet: BBG

- Banks reduced their borrowings from two Fed backstop lending facilities in the most recent week, a sign that liquidity demand may be stabilizing. US institutions had a combined $152.6 billion in outstanding borrowings, compared with $163.9 billion the previous week. But US banks are facing a new problem as savers flee for higher deposit rates. BBG

- Finland has cleared the last significant hurdle in its bid to join Nato after Turkey’s parliament approved the Nordic country’s accession to the western military alliance. FT

- Investors are still flooding into cash, with $60.1 billion entering money markets funds in the week through Wednesday, according to EPFR data. That brings the quarterly flow into cash to about $508 billion, the most since the very start of the pandemic. BBG

-

- A majority of Americans don’t think a college degree is worth the cost, according to a new Wall Street Journal-NORC poll, a new low in confidence in what has long been a hallmark of the American dream. The survey, conducted with NORC at the University of Chicago, a nonpartisan research organization, found that 56% of Americans think earning a four-year degree is a bad bet compared with 42% who retain faith in the credential. WSJ

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly firmer at quarter-end as they took impetus from the tech-led gains on Wall Street and with participants digesting a slew of data releases including better-than-expected Chinese PMI figures. ASX 200 was led by the mining and resources sectors after the strong data from Australia’s largest trading partner although the upside was capped ahead of next week’s RBA meeting with a recent Reuters poll showing near-even expectations amongst economists between a hike and a pause. Nikkei 225 gained heading into the end of the fiscal year and climbed back above the 28,000 level after encouraging Industrial Production and Retail Sales data but was off highs with chipmakers later pressured after Japan announced to impose new restrictions on chip-making gear. Hang Seng and Shanghai Comp. were positive after the strong Chinese PMI data in which Manufacturing PMI topped forecasts and Non-Manufacturing PMI rose to its highest since 2011, with the outperformance in Hong Kong led by tech as JD.com plans to spin off its industrials and property units. However, the gains in the mainland were limited amid a deluge of earnings releases including mixed results from China’s mega-banks and with the nation’s largest property developer Country Garden posting its first annual loss since its listing in 2007.

Top Asian News

- Chinese Vice Finance Minister Zhu said China needs to step up fiscal policy adjustments to support the economy and that China will move steadily in implementing preferential tax and fee policies. Zhu also stated that China will effectively ease tax burdens of small firms and household businesses, while he noted that recently announced preferential tax and fee policies will reduce companies’ burdens by CNY 480bln per year, according to Reuters.

- China’s Ambassador to the EU warned the bloc of ‘peril’ in following the US on trade curbs, while he urged resistance to ‘unwarranted’ pressure and said that Beijing will not be ‘trampled’, according to FT.

- Japan is to impose new restrictions of chip-making gear, according to Bloomberg and Reuters. Japan said it will impose restrictions on 23 types of chip-making equipment from July. Japanese officials said the scope of restrictions went further than the US measures imposed in 2022. Chip-equipment exporters would need licenses for all regions. The measures will affect a broader range of companies than previously expected, according to FT.

- Agricultural Bank of China (1288 HK) says NIM for the banking sector will continue to shrink in Q1; Co. says its NIM faces downward pressure in 2023. Bank of China (3988 HK) CFO says they are to face a mild decline in NIM this year.

- Japan is to end current COVID border measures on May 8th, via TBS; replaced with random genomic surveillance at airports.

European bourses are firmer, Euro Stoxx 50 +0.3%, continuing the positive APAC tone with incremental impetus from as-expected EZ Core HICP. Sectors are mixed with Banks lagging as yields retreat post-HICP while Personal Care/Drug names outperform. Stateside, futures are incrementally in the green with the tone more cautious ahead of PCE data and Fed speak, incl. Williams, thereafter.

Top European News

- UK PM Sunak’s office said Britain will join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership Trans-Pacific after the bloc’s members reached an agreement on Britain joining the trade pact, while Japan’s Economy Minister said they aim for an early signing of UK joining the CPTPP, according to Reuters.

- Sartorius to Buy French Biotech Polyplus for $2.6 Billion

- DSV Slips as JPMorgan Cuts Rating, Prefers Kuehne + Nagel

- Energy Cliff-Edge Threatens Thousands of British Businesses

- German Unemployment Rises More Than Expected on Sluggish Economy

FX

- USD/JPY and Yen crosses still marching higher into month end as importer hedging and buy orders persist, headline pair popped above 133.50 before topping out and DXY holding 102.000+ status as a result.

- Aussie unable to keep hold of 0.6700 handle as AUD/NZD cross retreats through 1.0700 on divergent RBA/RBNZ rate expectations.

- Euro mixed after EZ inflation data showing a softer than forecast headline, but firmer than previous core, EUR/USD sub-1.0900, but EUR/CHF nearer parity than 0.9950.

- Cable unable to hold above 1.2400 irrespective of UK Q4 GDP upgrades as Buck bounces broadly pre-US PCE.

Fixed Income

- EGBs experienced a marked bounce following the EZ inflation measure after dipping on the initial French reading; with the EZ figure showing a larger than expected cooling in the headline while the core measures are stick but were as-expected.

- Specifically, Bunds have been up to a 135.64 peak which saw the associated yield pullback from 2.40% best towards the 2.30% mark.

- USTs and Gilts have been moving in tandem with EGBs; though, USTs are somewhat more cautious ahead of upcoming events with yields slightly firmer as it stands.

- BoJ Q2 Bond Purchase plans; expands range for mid-to-superlong purchases for Q2. Click here for more detail.

Commodities

- WTI and Brent are mixed/flat after settling higher by over USD 1.0bbl on Thursday with the overall tone tentative ahead of the US docket while crude specifically is cognisant of next week’s JMMC.

- Specifically, benchmarks are near-unchanged but at the upper-end of USD 73.77-74.67/bbl and USD 78.54-79.18/bbl parameters.

- Metals hold a slight downward bias in otherwise tentative trade for the space with the USD’s strength capping any potential upside from the somewhat cauutious tone.

Geopolitics

- Japanese Finance Minister Suzuki said Japan is to extend the suspension of its most favoured nation treatment on tariffs for Russia, while it was also reported that Japan banned Russia-bound exports of steel, aluminium and aircraft from April 7th, according to the Ministry of Economy, Trade and Industry cited by Reuters.

- Turkish parliament approved a bill to clear the way for Finland’s NATO accession, according to Reuters.

- Deputy Chairman of the Russian National Security Council says “our army will arrive in Kiev if necessary”.

- Belarusian President Lukashenko warns that the West seeks to invade his country with the aim of “destroying” it; The war is not far from us and there are attempts to drag us into it; return of nuclear weapons is not blackmail but a safeguard. Says, talks to resolve the conflict in Ukraine need to commence now, a ceasefire without pre-conditions should be declared.

- Russia’s Kremlin says Russian President Putin is to hold an “important” meeting of Security Council today; Foreign Ministry Lavrov to present a new concept of Russian foreign policy. Will talk to Belarussian President next week about Lukashenko’s call for immediate peace talks, cContinuation of special military operation is the only way to achieve goals at the moment.

US Event Calendar

- 08:30: Feb. Personal Income, est. 0.2%, prior 0.6%

- Personal Spending, est. 0.3%, prior 1.8%

- Real Personal Spending, est. -0.1%, prior 1.1%

- 08:30: Feb. PCE Deflator MoM, est. 0.3%, prior 0.6%

- Feb. PCE Core Deflator YoY, est. 4.7%, prior 4.7%

- Feb. PCE Deflator YoY, est. 5.1%, prior 5.4%

- Feb. PCE Core Deflator MoM, est. 0.4%, prior 0.6%

- 09:45: March MNI Chicago PMI, est. 43.0, prior 43.6

- 10:00: March U. of Mich. Sentiment, est. 63.2, prior 63.4

- Current Conditions, est. 66.4, prior 66.4

- Expectations, est. 61.4, prior 61.5

- 1 Yr Inflation, est. 3.8%, prior 3.8%

- 5-10 Yr Inflation, est. 2.8%, prior 2.8%

Central Banks

- 15:05: Fed’s Williams Speaks at Housatonic Community College

- 17:45: Fed’s Cook Discusses US Economy and Monetary Policy

- 22:00: Fed’s Waller Discusses the Phillips Curve

DB’s Karthik Nagalingam completes the overnight wrap

For a fourth straight day, market behaviour was rather benign with risk-sentiment remaining positive and volatility ebbing. Equity indices in both the US and Europe rose moderately, while longer-dated sovereign yields in the two regions diverged as inflation data is coming back to the foreground. Hotter-than-expected European inflation led to a selloff in bonds, and today we will get more inflation data from both sides of the pond.

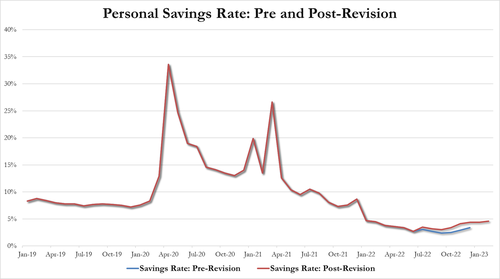

Given the calmer market narrative around the global banking system, focus today will be on the US PCE data. Fed members had an approximation of what PCE would look like given recent CPI and PPI prints when they rose rates 25bps last week but seeing how the underlying components are tracking may force market participants to refocus on pricing pressures. However, the market is likely to look through anything but an extraordinary print, given that the recent banking crisis will not be reflected in the data. Our US economists see a +0.36% advance for core PCE in February (+0.57% in January) and m/m declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%).

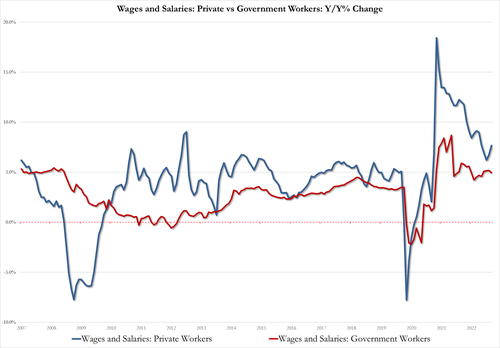

Ahead of the PCE print there was a bevy of Fed speakers yesterday, all of whom highlighted the fact that inflation remained too hot. Boston Fed President Collins (non-voter), while at a conference in Washington DC said, “Inflation remains too high, and recent indicators reinforce my view that there is more work to do.” Separately, Minneapolis Fed President Kashkari (voter) said that the stresses on the banking sector could last longer than expected, but also said that “the services part of the economy has not yet slowed down and … wage growth is still growing faster than what is consistent with our 2% inflation target.” Lastly, Richmond President Barkin (non-voter) said that “if inflation persists, we can react by raising rates further,” and pointed out that the committee was discussing a 50bp hike just a few weeks ago. He had no stated preference on the size of a future rate hike, but he said that continuing to fight inflation was the priority.

These comments did little to change fed futures yesterday, as the market priced in just an extra +4.0bps for the rate following the December Fed meeting, increasing expectations to 4.387%. That was their highest closing level since March 10 – the day of the collapse of Silicon Valley Bank. The expectations around the May meeting rose marginally, with futures now pricing in a 55% chance of a 25bp hike, up from 47% the day before. While fed speakers don’t seem ready to talk about cutting rates, the market is still pricing in over two 25bps rate cuts by year-end after hitting a terminal rate in May.

Against this backdrop, the more policy sensitive US 2yr yield was up +2.1bps to 4.12% – returning to roughly where they were before the most recent Fed rate hike on the 21 March. Meanwhile the US 10yr yield fell back -1.5bps after trading in a tight 6bp range all day, although yields have slightly pulled back (+1.51bps) overnight as we go to print. It was a different story in Europe, as 10yr bund yields rose +4.6bps to 2.37% and German 2yrs rose +9.5bps to 2.75%, their highest level since the third week of March. 10yr OATs (+5.2bps) and BTPs (+8.5bps) underperformed, while 10yr gilts yields rose by +4.6bps as well.

As noted above, the selloff in European bonds began after the German inflation print showed an unexpected acceleration in price growth, with German CPI up to +0.8% (vs +0.7% expected) month-on-month, and +7.8% year-on-year (vs +7.5% expected) on the EU-harmonised measure. Eurozone CPI data for March later today will complete the picture, and our European economists expect euro-area EU-harmonised CPI to fall from 8.6% in February to 7.1% year-on-year, but with risks slightly to the upside following the German print. See their note here.

Following the upside surprise on German CPI, the terminal ECB rate priced in by overnight index swaps for the December meeting climbed +10.7bps to 3.44%, pricing in barely any cuts (5bps) by the end of 2023 with the terminal rate expected for October at 3.49%.

Turning to equities, the S&P 500 was up +0.57% with all but 3 of 24 industry groups gaining on the day. Semiconductors (+1.61%), consumer discretionary retail (+1.21%), and real estate (+1.19%) outperformed. The outperformance of technology continued, leading the NASDAQ (+0.73%) to maintain its trajectory for its best quarter since 2020. The only three S&P 500 industries down on the day were diversified financials (-0.13%), consumer durables (-0.21%) and banks (-1.00%). The underperformance in banks was primarily driven by the regionals with First Republic (-4.0%) the clear laggard, while Fifth Third (-2.6%), Zion (-2.4%), and M&T Bank (-2.3%) were in the next tier of underperformers. The larger banks outperformed with Citi (+0.3%) the only S&P bank constituent higher on the day, while JPM (-0.3%) and BofA (-1.3%) saw smaller losses.

After markets closed, the Fed released their weekly H.4.1 balance sheet data showing how banks were using the Fed’s new bank lending facility and the discount window. Over the prior week, discount window borrowing was down from $110bn to $80bn, there was no further extension of credit to SVB or Signature, and the bank term funding program saw increased borrowing of $64bn from $54bn the week prior. The foreign repo facility, FIMA, saw use fall from $60bn to $55bn. Overall this shows modest improvement across the complex and should add to the narrative that the pain is mostly contained.

In Europe, the STOXX 600 similarly gained on the day (+1.03%), with real estate (+3.74%) as well as information technology (+2.54%) driving performance. Food and Beverage (-0.47%) was the only industry group weaker off the back of the German CPI data, as the finer details of the release showed price inflation for food inched higher. Additionally, unlike in the US, European financials continued to rally back yesterday with as European banks climbed +1.84% and are now up +6.62% on the year. Looking into other bourses, the CAC and the DAX were up +1.06% and +1.26% respectively.

This morning, Asian equity markets have carried over the overnight gains on Wall Street. Across the region, the Hang Seng (+1.46%) is leading gains with the KOSPI (+1.06%), Nikkei (+1.01%), CSI (+0.35%) and the Shanghai Composite (+0.33%) also rising. In overnight trading, US equity futures are pointing to further gains with those on the S&P 500 (+0.28%) and NASDAQ 100 (+0.34%) edging higher.

China equities are outperforming following the official manufacturing PMI beating expectations at 51.9, and the non-manufacturing PMI rising to 58.2 in March. That is the non-manufacturing index’s highest level since May 2011. This data suggests that the economic recovery in the world’s second biggest economy remains on track even amid weaker global demand and a continued property market downturn.

There was also a batch of economic data out of Japan indicating that inflation in Tokyo is still above trend after coming in at +3.3% y/y in March (vs +3.2% expected) compared to +3.4% recorded last month. At the same time, core Tokyo CPI rose +3.2% y/y (vs +3.1% expected) in March, following a peak of +4.3% back in December. So further improvement but not as much as the market was looking for. Labour market conditions loosened slightly as the unemployment rate unexpectedly rose to +2.6% in February from +2.4% in January, while the jobs to applicant ratio moved lower to +1.34 (vs +1.36 expected). Retail sales jumped +1.4% m/m in February, compared to January’s downwardly revised increase of +0.8%. Meanwhile, industrial production rebounded +4.5% m/m in February (vs +2.7% expected) on easing supply bottlenecks for carmakers.

It was a big day for data release yesterday. Starting with the US, weekly jobless claims came in at 198,000 (vs 196,000 expected) suggesting a slight softening in an otherwise tight labour market. Continued claims was lower than expected (1,689k vs 1,700k expected), having remained in a tight range over the past few months now. The third revision to 4Q’22 US GDP saw annualised quarter-over-quarter GDP taken down to 2.6% (2.7% prior) on the back of lower personal consumption (1.0% vs 1.4% prior). 4Q’22 PCE was revised +0.1pp higher to 4.4%.

In Europe, we had several confidence data points for March in the Eurozone demonstrating a slight weakening relative to February. Economic confidence was down to 99.3 (vs 100 expected), industrial confidence became negative at -0.2 (vs 0.5 expected) and services confidence fell a tenth to 9.4 (vs 10 expected). Consumer confidence remained steady at -19.2. This contrasted with the services-driven improvement in the PMIs for March. Looking on the individual country level, the Spanish CPI rose +1.1% month-on-month (vs +1.6% expected) and +3.1% year-on-year (vs +3.7% expected) year-on-year on the EU-harmonised measure. Italian February PPI came in at -1.3% month-on-month, and 10% year-on-year.

Finally on commodities, oil rose sharply again yesterday for its third gain out of the last 4 days, as Bloomberg reported that it is highly unlikely that exports from Iraq will resume this week. Officials from the Kurdistan Regional Government are set to re-enter discussions with Iraqi officials early next week. WTI crude contracts were up +1.92% to $74.37/bbl whilst Brent crude hit $79.27/bbl after climbing +1.26%.

Now to the day ahead. We have quite a busy day data wise, with the US PCE deflator data, the March MNI Chicago PMI and the February personal spending and income data. From the UK we have the March Lloyds business barometer and the Q4 current account balance. In Europe, we have the Eurozone March CPI data and the February unemployment. We will also see the release of the Italian March CPI and the January industrial index, the German march unemployment change, February retail sales and the import price index, and lastly the French March CPI. February CPI and consumer spending. Finally, we will hear from several central bankers, including the ECB’s Lagarde and Kazaks, as well as the Fed’s Williams, Waller and Cook.