3/31/1962: Justice Charles Whittaker resigns.

The post Today in Supreme Court History: March 31, 1962 appeared first on Reason.com.

from Latest https://ift.tt/AMIOdtT

via IFTTT

another site

3/31/1962: Justice Charles Whittaker resigns.

The post Today in Supreme Court History: March 31, 1962 appeared first on Reason.com.

from Latest https://ift.tt/AMIOdtT

via IFTTT

Wall Street Bonuses Plunge 26% in 2022, Largest Drop Since Global Financial Crisis

In 2022, Wall Street bonuses plummeted, as per the annual data published Thursday by New York State Comptroller Thomas P. DiNapoli. The average bonus dropped 26%, amounting to $176,700, compared to $240,400 from the prior year.

The plunge in bonuses comes as no surprise considering capital markets had a rough last year with the Federal Reserve hellbent on increasing interest rates in the most aggressive fashion in decades to combat inflation. In doing so, capital markets were roiled, and deal flow for mergers and acquisitions also dried up, resulting in significantly lower profits for Wall Street banks versus a record 2021 year.

“As a result, bonuses returned to pre-pandemic levels, which will mean a decline in related income tax revenue, as anticipated by New York state and the city,” the New York State Comptroller wrote in a press release.

DiNapoli said that bonuses in 2022 reverted to pre-pandemic levels after record highs in 2021.

“Wall Street’s cash bonuses were expected to fall as several factors weighed on the securities’ industry profitability in 2022.

“A 26% decline brings the average bonus closer to what financial employees received prior to the pandemic. While lower bonuses affect income tax revenues for the state and city, our economic recovery does not depend solely on Wall Street. Employment in leisure and hospitality, retail, restaurants and construction must continue to improve for the city and state to fully recover.”

We anticipated that banker bonuses would plunge. Recall:

However, the trend in bonuses comes as Wall Street banks added 10,500 jobs. Total employment increased to 190,800 in 2022 from 180,300 the year before.

Notice how bonuses are sliding but number of Wall Street employees are rising?

Meanwhile, the 2022 bonus pool of $33.7 billion experienced a 21% decline compared to the previous year’s record-setting $42.7 billion, marking it the most significant drop since the Great Recession.

As a major source of revenue, DiNapoli estimates that the securities industry accounted for 22% ($22.9 billion) of the state’s tax collections in state fiscal year (SFY) 2021-22 and 8% ($5.4 billion) of city tax revenue in city tax collections for city fiscal year (CFY) 2022.

In a testament to how much NYC relies on the industry for its tax base, the securities industry provides roughly one-fifth of private-sector wages despite accounting for just 5% of that sector’s employment.

We suspect if capital markets continue to flounder and dealmaking activity remains depressed, 2023 will be a horrible year for bonuses — this could further impact the city’s economic recovery.

Tyler Durden

Fri, 03/31/2023 – 07:45

via ZeroHedge News https://ift.tt/WEmFB7J Tyler Durden

Stocks’ Bullishness Is On Increasingly Thin Ice

Authored by Simon White, Bloomberg macro strategist,

Stocks are prone to significant further downside as overly optimistic hopes of a mild recession and an end to inflation fail to materialize.

Stocks are always glass-half-full. Despite rapid rate rises and pockets of acute stress in the banking sector, they appear to be expecting only a modest downturn and an end to the inflationary regime. Even more rose-tintedly, earnings are behaving as if the recession is already behind us.

Equity markets, though, have a habit of remaining jubilant right up until the asteroid strikes (October 2007?). So you don’t have to be a total killjoy to raise some questions to avoid getting sucked into what is likely to be another bear-market rally.

A cursory look at where equities are tell us they are not fearful about the economic backdrop. Only 16% off the highs and virtually unchanged over the last year, this is one of the mildest bear markets on record.

Stocks are currently trading as if any slump would be gentle. Options on the S&P have started to price in a greater possibility of deeper falls as put skew rises, while bigger upside moves are seen as less likely as call skew falls. Stocks are therefore implying some risk of a downturn, but are not expecting a big shock.

Forward earnings on the other hand have been rising, to the point where the real earnings yield is now positive again.

In fact, earnings and forward earnings’ behavior is historically consistent with a recession that has already started. Earnings are a lagging indicator and typically don’t start falling until after the downturn has begun. Earnings today have already begun to fall. Similarly, forward earnings often only begin to rise once the recession is underway.

Either way — a mild recession or one that’s come and gone — equities appear relaxed about inflation.

Duration is generally to be avoided if you believe inflation is going to remain high. Up until last year, lower-duration sectors such as energy and utilities were leading the market. This year these sectors are underperforming, while higher-duration ones such as tech and consumer discretionary are in front. Stocks are pricing inflation as yesterday’s problem.

But equities look to be mis-pricing recession and inflation risk.

A whole suite of indicators are symptomatic of a recession, and the recent steepening of the yield curve is consistent with a slump beginning as early as June.

Indeed, there is a strong relationship between the maximum inversion of the yield curve before a recession, and the peak-to-trough fall in equities.

As the chart below shows, the ~110 bps peak inversion of the 2s10s curve is consistent with a 35% total fall in equities, i.e. another ~19% fall in the S&P from here.

Further, inflation is likely to remain much stickier than stocks expect. Acyclical inflation in the US is driven by global factors, primarily China.

As China opens up, monetary easing is beginning to gain traction, which is soon expected to feed into higher inflation in China. Thus US inflation, boosted by acyclical inputs, is prone to start rising again, leaving higher-duration stocks and sectors at risk of a selloff.

It’s not just China though: other structural drivers such as elevated profit margins and wage growth are likely to lead to much stickier, more entrenched inflation. Stocks, instead, appear to be taking their cues from inflation swaps, which see headline CPI settling back to ~2.5% within a year.

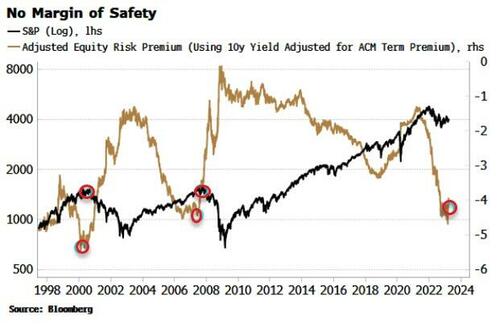

The bond market is also not pricing in the risks of high inflation, inferred by term premium’s largely quiescent behavior so far. The equity risk premium – the excess earnings yield on stocks above Treasury yields – is also at more-than-10-year lows. But if we adjust it for term premium, the ERP is near 20-year lows. As the chart below shows, two of the last major market tops were accompanied by a very low adjusted ERP.

In a world of no or mild recession and inflation’s capitulation it would make sense for this measure to be so low. But there is no margin of safety.

A recession or higher inflation would see the risk premium rise and equities fall, potentially significantly.

Equities may see the glass as half-full, but they might not like the taste of what’s in it.

Tyler Durden

Fri, 03/31/2023 – 07:20

via ZeroHedge News https://ift.tt/JrV1T3e Tyler Durden

Richard Branson’s Virgin Orbit Dreams Crash As Funding ‘Not Secured’

Virgin Orbit shares crashed in premarket trading as the satellite-launch firm associated with British billionaire Richard Branson suspended operations indefinitely due to cash-crunch pressures, which has left the startup financially paralyzed.

CEO Dan Hart held a company-wide meeting on Thursday evening. He told employees that funding was not secured and most employees would be laid off.

“Unfortunately, we’ve not been able to secure the funding to provide a clear path for this company,” Hart said, according to audio of the 1700 ET meeting obtained by CNBC.

“We have no choice but to implement immediate, dramatic and extremely painful changes,” Hart said, adding this is “probably the hardest all-hands that we’ve ever done in my life.”

The CEO explained 90% of the workforce would be laid off, leaving about 100 employees to oversee the process of winding down operations. In a securities filing, the company said 85% of its workforce would be laid off “in order to reduce expenses in light of the company’s inability to secure meaningful funding.”

“This company, this team — all of you — mean a hell of a lot to me. And I have not, and will not, stop supporting you, whether you’re here on the journey or if you’re elsewhere,” Hart said.

Hart added that Virgin Orbit would “provide a severance package for every departing” employee.

As a result of the news, shares of the company plunged as much as 53% in premarket trading in New York. The stock was worth more than $7 a year ago, and after this morning’s drop, it’s only now worth pennies.

Earlier this month, Virgin Orbit announced an “operational pause” due to its inability to raise capital. Funding woes likely stem from the demise of Silicon Valley Bank as the VC funding market froze.

Besides a funding crunch, the company was hit with a major setback after a rocket launch failure in January.

Virgin Orbit is still looking to sell all or part of its business, according to Bloomberg, citing a person familiar with the matter.

Tyler Durden

Fri, 03/31/2023 – 06:55

via ZeroHedge News https://ift.tt/YUAOsVq Tyler Durden

Consolidation In Luxury Is Only A Matter Of Price

By Alexandra Muller and Michael Msika, Bloomberg Markets live reporters and analysts

Luxury stocks have never been this pricey relative to the broader market, but that shouldn’t deter acquisitive predators keen to snap up trophy assets in the sector.

Hugo Boss and British luxury apparel-maker Burberry are among luxury companies being marked out as potential European takeover targets this year, according to an informal Bloomberg survey of 17 M&A desks, fund managers and analysts.

The luxury sector has been on fire this year, with the MSCI Europe Textiles Apparel & Luxury Goods Index rising 19%. That has stretched its premium over the broader market to a record 120%.

Investors have bought these shares to gain from China’s post-Covid reopening and because the industry is studded with companies that have healthy balance sheets and earnings growth, and the pricing power to overcome economic strife. That means targets come with hefty price tags.

Dealmaking in the luxury industry “normally happens at punchy share price levels, as attractive acquisition targets are few and far apart,” says Luca Solca, senior research analyst at Sanford C. Bernstein.

Many expect France’s €415-billion luxury behemoth LVMH to be the one that ends up consolidating rivals. Its track record and de-leveraged balance sheet make it most likely to participate in a deal, Bank of America predicted in January.

In this tough competitive environment for smaller companies, “owners of rare assets may be tempted to fold and sell their brands to larger players, who would be more and more in a position to cherry pick,” Solca adds.

While buyers may need to pay top dollar after months of booming market performance, not all stocks in the sector trade at a heavy premium. In fact, Richemont and Burberry are now heavily discounted to peers, having given up the superior valuation it used to boast.

The survey coincides with a worsening M&A outlook, as higher interest rates and the threat of a recession give buyers pause. European deals in January-March totaled around $137 billion, about 60% below year-earlier levels, and among the slowest starts to the year in two decades, according to data compiled by Bloomberg.

Other names that cropped up in the survey include TMT firms Temenos, Vivendi and Atos, after featuring in December’s poll. Commerzbank and Banco BPM were the only lenders identified as M&A candidates. Representatives for the five companies with the most mentions in the survey either declined to comment or didn’t respond to requests for comment.

Tyler Durden

Fri, 03/31/2023 – 06:30

via ZeroHedge News https://ift.tt/M0Lc3yY Tyler Durden

Abandoned 267-Foot Superyacht In Caribbean Possibly Heading To Auction

An abandoned 267-foot superyacht, purportedly owned by a Russian billionaire, has been anchored at a Caribbean marina for the past year. After some deliberation, the Antigua and Barbuda government plans to sell the vessel at auction to pay for mounting docking fees.

Antigua Observer Newspaper reports the $81 million superyacht “Alfa Nero” is reportedly owned by sanctions-hit oligarch Andrey Guryev. The vessel has been docked in the Caribbean since Russia invaded Ukraine.

Prime Minister Gaston Browne said the vessel is uninsured, posing a risk to other yachts in Falmouth Harbour.

“Now, this is a vessel that could be unmanned if the government does intervene. Anything could go wrong. Maybe some of the doors could open and start to take on water and it sinks,” Browne said.

He continued:

“There could be a fire. In fact, I am told the insurance of the marina could be affected because we have an uninsured vessel sitting in the marina and is a risk to other boats.

“We are talking about billions of dollars of assets in that harbour. And you can imagine if that vessel was to catch fire what will happen.

“Think about the environmental impact, not only in terms of the oil spill and so on, but let us take into consideration that, as it stands now, the sewage system is not working. So, they’re dumping sewage in the water. And that’s one of the areas that we draw water from for the plant. So this issue is a significant threat.”

Browne added:

“The yachting sector contributes more to our economy than even the cruise tourism sector. Understand the reputational damage if we fail to act and we end up with a major catastrophe.”

The mystery of who exactly owns the yacht continues… Blomberg reached out to Guryev’s lawyers, who said:

“As we have informed the Antiguan authorities, Mr. Guryev neither owns nor controls the Alfa Nero and has simply used the vessel from time to time under commercial charter since 2014.”

Antigua Port Manager Darwin Telemaque said if no one claims the vessel by March 31, he will be forced to send it to the auction block shortly after.

Tyler Durden

Fri, 03/31/2023 – 05:45

via ZeroHedge News https://ift.tt/JzWQp3o Tyler Durden

The characters in The White Lotus are all obsessed with getting what they want. Or at least getting what they think other people want.

The second season of the HBO drama repeats the format of the first with a different set of characters and a different setting. Over seven episodes, we watch guests at a luxury Sicilian resort being their worst selves while pretending they’re happy. Infidelity and interpersonal intrigue abound. The knowledge that one of these characters is doomed to die keeps everything pleasingly tense.

Rich people being miserable in the lap of luxury naturally lends itself to explorations of wealth’s ennui and its roots. White Lotus‘ writers walk a fine line of being explicit about that theme while never being too heavy-handed.

The show does try to get somewhat intellectual about its characters’ psychological compulsions. One accuses another of “mimetic desire”—the concept from philosopher René Girard that our desires aren’t authentically our own. Rather, he suggests, we want what we think will earn us others’ praise, admiration, or jealousy.

That’s the academic gloss on the idea, popular among a segment of the nationalist right these days. Ayn Rand’s The Fountainhead, long before Girard, had a much more straightforward term for these people: “second-handers.” Rather than pursue greatness or even satisfaction on their own terms, their ends are all taken “second-hand” from what others want.

White Lotus is critical of people who pursue their authentic desires as well. For all the sex and drugs, there’s a conservative undercurrent to the show. The constant, long-held, low-angle shots of church spires and staring Testa di Moro statues do more than remind viewers they’re in Sicily. It’s a reminder that God is always watching your sins.

The post Review: <i>The White Lotus</i> Explores the Misery of Wealth appeared first on Reason.com.

from Latest https://ift.tt/ZHmiRg7

via IFTTT

Sweden Did Exceptionally Well During The COVID-19 Pandemic

Authored by Peter Gøtzsche via The Brownstone Institute,

No wonder the news media are totally silent about the data that show that Sweden’s open society policy was what the rest of the world should have done, too.

Numerous studies have shown Sweden’s excess death rate to be among the lowest in Europe during the pandemic and in several analyses, Sweden was at the bottom…

This is remarkable considering that Sweden has admitted that it did too little to protect people living in nursing homes.

Unlike the rest of the world, Sweden largely avoided implementing mandatory lockdowns, instead relying on voluntary curbs on social gatherings, and keeping most schools, restaurants, bars and businesses open. Face masks were not mandated and it was very rare to see any Swede dressed as a bank robber.

The Swedish Public Health Agency “gave more advice than threatened punishment” while the rest of the world installed fear in people. “We forbade families to visit their grandmother in the nursing home, we denied men attendance at their children’s births, we limited the number who were allowed to attend church at funerals. Maybe people are willing to accept very strong restrictions if the fear is great enough.”

If we turn to other issues than mortality, it is clear that the harms done by the draconian lockdowns in the rest of the world have been immense in all sorts of ways.

For any intervention in healthcare, we require proof that the benefits exceed the harms. This principle was one of the first and most important victims of the pandemic. Politicians all over the world panicked and lost their heads, and the randomised trials we so badly needed to guide us were never carried out.

We should abbreviate the great pandemic to the great panic.

In my book, “The Chinese virus: Killed millions and scientific freedom,” from March 2022, I have a section about lockdowns.

The reborn intolerance toward alternative ideas has been particularly acrimonious in the debate about lockdowns.

There are two main ways to respond to viral pandemics, described in two publications that both came out in October 2020.

The Great Barrington Declaration is only 514 words, with no references. It emphasizes the devastating effects of lockdowns on short- and long-term public health, with the underprivileged disproportionately harmed. Arguing that for children, COVID-19 is less dangerous than influenza, it suggests that those at minimal risk of death should live their lives normally to build up immunity to the virus through natural infection and to establish herd immunity in the society.

It recommends focused protection of the vulnerable. Nursing homes should use staff with acquired immunity and perform frequent PCR testing for COVID-19 of other staff and all visitors. Retired people living at home should have groceries and other essentials delivered to their home and should meet family members outside when possible.

Staying home when sick should be practiced by everyone. Schools, universities, sports facilities, restaurants, cultural activities, and other businesses should be open. Young low-risk adults should work normally, rather than from home.

I have not found anything in the Declaration to be factually wrong.

The other publication is the John Snow Memorandum, which came out two weeks later. Its 945 words are seriously manipulative. There are factual inaccuracies, and several of its 8 references are to highly unreliable science. The authors claim that SARS-CoV-2 has high infectivity, and that the infection fatality rate of COVID-19 is several times higher than that of seasonal influenza.

This is not correct (see Chapter 5), and the two references the authors use are to studies using modelling, which are highly bias-prone.

They also claim that transmission of the virus can be mitigated through the use of face masks, with no reference, even though this was, and still is, a highly doubtful claim.

“The proportion of vulnerable people constitute as much as 30% of the population in some regions.” This was cherry-picking from yet another modelling study whose authors defined increased risk of severe disease as one of the conditions listed in some guidelines. With such a broad definition, it is easy to scare people. However, they did not tell their readers that the modelling study also estimated that only 4% of the global population would require hospital admission if infected,36 which is similar to influenza.

The two declarations did not elicit enlightened debates, but strongly emotional exchanges of views on social media devoid of facts. The vitriolic attacks were almost exclusively directed against those supporting the Great Barrington Declaration, and many people, including its authors, experienced censorship from Facebook, YouTube and Twitter.

The Great Barrington Declaration has three authors; the John Snow Memorandum has 31. The former was published on a website, which is kept alive, the latter in Lancet, which gives its many authors prestige.

In 2021, over 900,000 people had signed the Great Barrington Declaration, including me, as I have always found that the drastic lockdowns we have had, with all its devastating consequences for our societies, were neither scientifically nor ethically justified. I did Google searches to get an idea how much attention the two declarations have had. For the Great Barrington Declaration, there were 147,000 results; for the John Snow Memorandum only 5,500.

The Great Barrington Declaration has not had much political impact. It is much easier for politicians to be restrictive than keeping the societies open. Once a country has taken drastic measures, such as lockdowns and border closings, other countries are accused of being irresponsible if they don’t do the same – even though their effect is unproven. Politicians will not get in trouble for measures that are too draconian, only if it can be argued that they did too little.

In March 2021, Martin Kulldorff and Jay Bhattacharya, two of the three authors of the Great Barrington Declaration, drew attention to some of the consequences of the current climate of intolerance. In many cases, eminent scientific voices have been effectively silenced, often with gutter tactics. People who oppose lockdowns have been accused of having blood on their hands and their university positions threatened.

Many have chosen to stay quiet rather than face the mob, for example Jonas Ludvigsson, after he had published a ground-breaking Swedish study making it clear that it is safe to keep schools open during the pandemic, for children and teachers alike. This was taboo.

Kulldorff and Bhattacharya argued that with so many COVID-19 deaths, most of which have been in old people, it should be obvious that lockdown strategies have failed to protect the old.

The attacks on the Great Barrington Declaration appear to have been orchestrated from the top. On 8 October 2020, Francis Collins, the director of the US National Institutes of Health (NIH), sent a denigrating email to Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases and advisor for several US Presidents, where he wrote:

“This proposal from the three fringe epidemiologists who met with the Secretary seems to be getting a lot of attention – and even a co-signature from Nobel Prize winner Mike Leavitt at Stanford. There needs to be a quick and devastating published take down of its premises. I don’t see anything like that online yet – is it underway?”

Stefan Baral, an epidemiologist from Johns Hopkins, reported that a letter he wrote about the potential harms of population-wide lockdowns in April 2020 was rejected by more than 10 scientific journals and 6 newspapers, sometimes with the pretence that there was nothing useful in it. It was the first time in his career that he could not get a piece placed anywhere.

In September 2021, BMJ allowed Gavin Yamey and David Gorski to publish an attack on the Great Barrington Declaration called, Covid-19 and the new merchants of doubt. A commentator hit the nail when he wrote:

“This is a shoddy smear that is not for publication. The authors have not shown where their targets are scientifically incorrect, they just attack them for receiving funding from sources they dislike or having their videos and comments removed by social media corporations as if that was some indication of guilt.”

Kulldorff has explained what is wrong with the article. They claimed the Declaration provides support to the anti-vaccine movement and that its authors are peddling a “well-funded sophisticated science denialist campaign based on ideological and corporate interests.” But nobody paid the authors any money for their work or for advocating focused protection, and they would not have undertaken it for a professional gain, as it is far easier to stay silent than put your head above the parapet.

Gorski is behaving like a terrorist on social media, and he is perhaps a troll. Without having any idea what I had decided to talk about, or what my motives and background were, he tweeted about me in 2019 that I had “gone full on antivax.” My talk was about why I am against mandatory vaccination for an organisation called Physicians for Informed Consent. Who could be against informed consent? But when I found out who the other speakers were, I cancelled my talk.

In January 2022, Cochrane published a so-called rapid review of the safety of reopening schools or keeping them open. The 38 included studies comprised 33 modelling studies, three observational studies, one quasi‐experimental and one experimental study with modelling components. Clearly, nothing reliable can come out of this, which the authors admitted: “There were very little data on the actual implementation of interventions.”

Using modelling, you can get any result you want, depending on the assumptions you put into the model. But the authors’ conclusion was plain nonsense: “Our review suggests that a broad range of measures implemented in the school setting can have positive impacts on the transmission of SARS‐CoV‐2, and on healthcare utilisation outcomes related to COVID‐19.”

They should have said that since there were no randomised trials, we don’t know if school closures do more good than harm. What they did is what Tom Jefferson has called “garbage in and garbage out … with a nice little Cochrane logo on it.”

About the failing scientific integrity of Cochrane reviews, the funder of the UK Cochrane groups noted in April 2021 that, “This is a point raised by people in the Collaboration to ensure that garbage does not go into the reviews; otherwise, your reviews will be garbage.”

Even though there was nothing to conclude from it, the authors filled 174 pages – about the length of the book you are currently reading – about the garbage they included in their review, which was funded by the Ministry of Education and Research in Germany.

A 2020 rapid systematic review in a medical journal found that school closures did not contribute to the control of the SARS epidemic in China, Hong Kong, and Singapore.

Lockdowns could even make matters worse. If children are sent home to be looked after by their grandparents because their parents are at work, it could bode disaster for the grandparents. Before the COVID-19 vaccines became available, the median age of those who died was 83.

The whole world missed a fantastic opportunity to find out what the truth was by randomising some schools to be closed while keeping others open, but such trials were never done. Atle Fretheim, research director at the Norwegian Institute of Public Health, tried to do a trial but failed. In March 2020, Norwegian government officials were unwilling to keep schools open. Two months later, as the virus waned, they refused to keep schools closed. Norwegian TV shot the messenger: “Crazy researcher wants to experiment with children.” What was crazy was not to do the study. Craziness was also the norm in USA. In many large American cities, bars were open while schools were closed.

When people argue for or against lockdowns and how long they should last and for whom, they are on uncertain ground. Sweden tried to go on with life as usual, without major lockdowns. Furthermore, Sweden has not mandated the use of face masks and very few people have used them.

Tyler Durden

Fri, 03/31/2023 – 05:00

via ZeroHedge News https://ift.tt/tMi3mgr Tyler Durden

“Biodiversity” Is The New ESG

Over the last few weeks we have reported about billions being pulled from ESG funds, hedge funds losing ESG ratings, and companies and banks scrambling to cover up their ESG appeal in pitch decks, all after “woke” ESG name Silicon Valley Bank went under, forcing the market to focus a bit more on things that matter (i.e. solvency, cash generation) instead of the unicorn and rainbow ESG fairy tale it has been obsessed with over the last 5 years.

But, the more things change, the more they stay the same.

Bloomberg reported this week that with ESG out of favor for all of about five minutes, there’s already a new “buzzword” on the street that we’re certain will drum up the same interest in “green” names: biodiversity.

The term has helped some fund managers expand their asset base by 15% in two months, the report says. This comes after a “150% surge in the number of funds offering such strategies last year”, it continues. While the $2.9 billion in combined assets for the buzzword pales in comparison to ESG, it feels like it could just be the beginning of more herd mentality virtue signaling FOMO like we saw in ESG.

Ingrid Kukuljan, head of impact and sustainable investing and international lead portfolio manager at Federated Hermes, cemented those thoughts, telling Bloomberg: “The move in biodiversity that we have seen is 10 times the speed of what we have seen with carbon. And rightly so, because this is the biggest systemic threat that we face.”

Bloomberg points out the genesis of making biodiversity a key issue:

Since a landmark agreement was struck at the COP15 summit in December, the finance industry has been forced to pay attention to biodiversity. The Global Biodiversity Framework, signed by almost 200 nations, envisages a central role for banks, insurers and asset managers in reaching the stated goal of mobilizing at least $200 billion each year to protect the natural world.

But the report also notes that there’s a lack of reliable biodiversity data, calling some of the calculations a “black box”. Kind of like Silicon Valley Bank’s balance sheet.

Wijnand Broer, program manager at the Partnership for Biodiversity Accounting Financials and partner at CREM, a Netherlands-based consultancy, concluded: “You see more and more data providers entering the market providing biodiversity data, but it’s not always clear what the underlying assumptions are.”

“Biodiversity” is the next big ESG investing buzzword. Likely gonna see bunch of new ETFs with that word in the name.. “The move in bidioversity that we have seen is 10 times the speed of what we’ve seen in carbon” https://t.co/vxBS9N9opZ via @business

— Eric Balchunas (@EricBalchunas) March 28, 2023

Tyler Durden

Fri, 03/31/2023 – 04:15

via ZeroHedge News https://ift.tt/UK0VlF5 Tyler Durden

In 2018, Jaxen Dyson’s father died. Despite having only a last name in common with his dad, the Social Security Administration declared Jaxen dead. It took her several months, but Jaxen’s mother thought she’d cleared the matter up. She even got a letter from the Social Security Administration saying Jaxen was very much alive. But when she did her taxes last year, the IRS refused to let her claim Jaxen as a dependent because government records show he is dead. It’s also refusing to let her claim his this year. The IRS blames the Social Security Administration for the problem, and the Social Security Administration blames the IRS.

The post Brickbat: Dead Again appeared first on Reason.com.

from Latest https://ift.tt/FMEcSam

via IFTTT