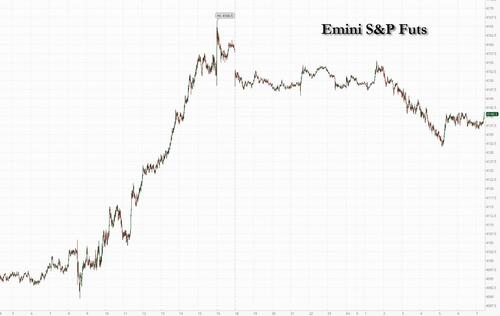

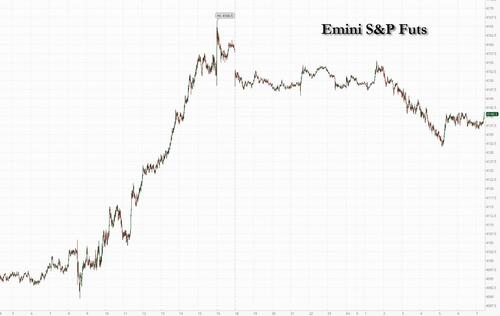

A rally in US tech stocks was set to reverse on Friday as investors punted on a surprisingly downbeat comment by Amazon about the rapid slowdown in AWS sales growth in April, as well as the prospect of more interest-rate hikes, elevated inflation, signs of slowing economic growth and so on. Contracts on the Nasdaq 100 were down 0.3% by 730 a.m. ET after the underlying index soared 2.8% in its best day since Feb. 2 on Thursday following upbeat results this week from a slate of technology heavyweights. S&P 500 futures were also down 0.3% following the benchmark index’s sharpest gain since January. Treasuries bounced, while gold prices edged lower. Oil prices were also set to end the week lower. The dollar, meanwhile, rose while bitcoin was flat.

Amazon.com shares fell in premarket trading after the e-commerce company’s cautious comments on its AWS cloud computing business offset the otherwise strong first-quarter results. Shares had surged as much as 12% in extended trading Thursday, before reversing course as the comments highlighted weakness in Amazon Web Services, its most profitable division, where sales growth had slowed dramatically in April. Cloud stocks dropped in sympathy amid worries that demand for technology is cooling. Microsoft (MSFT US) -0.3%, Snowflake (SNOW US) -3.3%, Datadog (DDOG US) -3%.

In other notable moves in premarket trading, Snap Inc. tumbled after reporting revenue for the first quarter that missed the average analyst estimate. Cloudflare Inc. sank after the cybersecurity-focused software company issued a weaker-than-expected revenue forecast for the current period. Intel Corp. rallied as the chipmaker reported first-quarter results and projected a return to free cash flow in the second half of the year.

Here are the most notable premarket movers:

- Amazon.com slipped 1% in premarket trading after the e-commerce company’s cautious comments on its cloud computing business offset the otherwise strong first-quarter results. Shares had surged as much as 12% in extended trading Thursday, before reversing course after the comments highlighting weakness in Amazon Web Services, its most profitable division

- Intel shares gained 4% in premarket trading, after the chipmaker reported first-quarter results and projected a return to free cash flow in the second half of the year. Analysts noted that the worst might be over for the struggling chipmaker, with some of them saying that its revenues might have found a bottom.

- Snap fell 19% in premarket trading, after reporting revenue for the first quarter that missed the average analyst estimate. Analysts noted that the outlook for the stock has weakened as the social-media company continues to make adjustments to its platform in a tough macro environment.

- Cloudflare fell 24% in premarket trading, poised for its biggest drop ever if its losses hold, after the cybersecurity-focused software company issued a weaker-than- expected revenue forecast for the current period and lowered its full-year revenue outlook. Analysts noted that the company was forced to cut guidance as sales cycles materially lengthened in the aftermath of the SVB collapse and the subsequent banking crisis.

- Pinterest falls 13% in premarket trading after the social-media company gave a forecast that was seen as weak. While analysts noted that the macro backdrop remains tough, some were optimistic that the firm is on track to expand its margins this year.

- Shares of US-listed Hong Kong online brokerage firm Top Financial (TOP US) post a sixfold increase in premarket trading. More than 150,000 shares have been traded as of 4:42 a.m. in New York.

- First Solar shares plunge 9% in US premarket trading, set for their worst day since July 2022, after the solar module manufacturer’s first quarter net sales disappointed, with analysts pointing to sluggish momentum in bookings. Still, brokers noted that the company reiterated its guidance for the year, spurring hopes it will be able to meet forecasts.

- Amgen declined in postmarket trading, as analysts highlight that first quarter revenues for Enbrel and Otezla missed consensus estimates. The company boosted its adjusted earnings per share forecast for the full year.

- Capital One shares dropped in postmarket trading after the company reported adjusted earnings per share for the first quarter that fell short of analyst estimates. The firm reported total deposits for the first quarter that beat the average analyst estimate.

- Alteryx declined in extended trading on Thursday, after the software company gave a second-quarter forecast that was weaker than expected.

While the quarterly reporting season has been far better than many – especially Mike Wilson – feared so far, US stocks have struggled to extend a first-quarter rally amid worries of a recession and a staunchly hawkish Federal Reserve.

CMC Markets chief market strategist, Michael Hewson, said that while the unexpected strength in first-quarter earnings from the technology sector was “no doubt a relief for investors,” it also comes against “very low expectations.” “When the penny finally drops with respect to” an expected weakening in consumer demand, “perhaps the gains this week might start to run out of steam,” he said.

Focus today will be on the Fed’s preferred inflation gauge — the core PCE deflator. Bloomberg Economics expects the reading for March to show core services inflation accelerating from the previous month.

Meanwhile, Bank of America Corp. strategist Michael Hartnett said he expects a drop in earnings and a softening labor market to derail the equity rally further. In a note citing data from EPFR Global, the strategist said US stock funds saw outflows for a second straight week at $2.7 billion.

Markets remain on edge, as data showing a surprise increase in US inflation pressures reinforced expectations of a Federal Reserve interest rate hike next week, and possibly in June. A growth rebound in France and a forecast-beating expansion in Spain have fanned hopes Europe can avert a recession, but an uptick in consumer-price gains points to more rate increases by the European

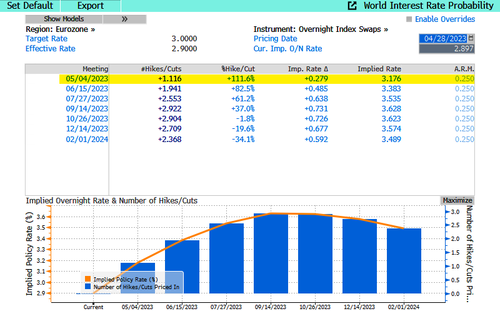

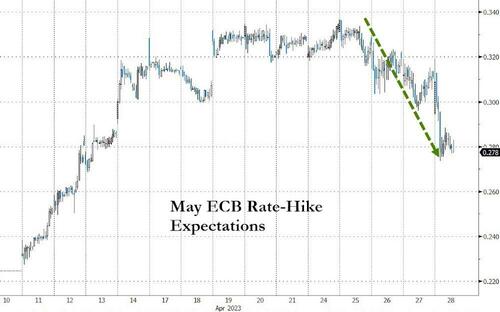

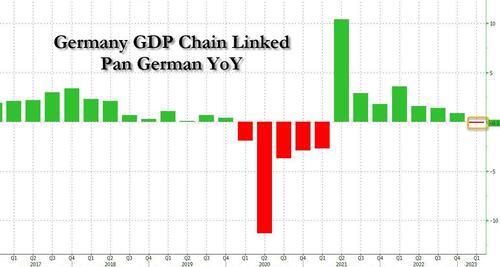

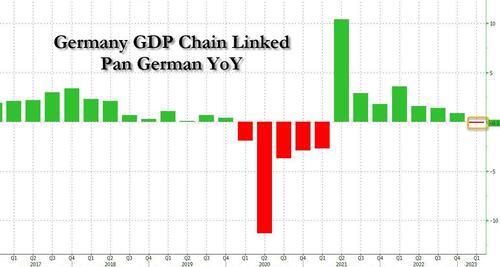

In Europe, traders firmed up bets on the ECB slowing to a 25bps rate hike next week after digesting a raft of growth and inflation figures from the region. The euro-area economy grew slightly less than expected in the first quarter after German economic growth stagnated while regional CPI prints from the bloc’s largest economy suggest the national print will slow later today.

Stocks are also in the red with the Stoxx 600 lower by 0.2% with utilities and travel among the worst performers, but it was banks that were the worst-performing sector in Europe Friday, with the Stoxx 600 Banks Index falling as much as 2.8%, its biggest drop in a month, on worries of resurgent inflation. The subindex was 1.7% lower as vs the Stoxx 600 Index’s 0.2% decline. Spanish and Italian banks were among the worst performers with Sabadell -6.9%, CaixaBank -4.7%, FinecoBank -3.8%, Banco BPM -3.8%. NatWest fell 5.6% after a miss on net interest income and softer guidance on deposit growth offset a profit beat for the UK lender. Here are the most notable European movers:

- Electrolux gains as much as 9.8%, the most in three years, after the Swedish white-goods manufacturer reported better-than-feared 1Q results that pave the way for estimate upgrades

- Numis shares rise as much as 68% to 343p after Deutsche Bank agreed to buy the boutique investment bank, a City household name, in a £410 million-deal

- SCA shares gain as much as 8.5% after the Swedish forestry group’s first-quarter earnings blew past estimates which had been under pressure into the print after weaker results from its peers

- Prudential shares rise as much as 4.7% in early trading, as analysts say the insurer’s new business update looks solid and shows encouraging recoveries in Hong Kong and Indonesia

- Hikma Pharmaceuticals rises as much as 4.9% after the UK firm raised guidance for its generic drugs in a trading update. Barclays says the upgrade will be “taken well” by the market

- Covestro surges by as much as 6.3% after it forecast better-than-expected 2Q Ebitda and resumed buybacks.

- Kingspan shares jump as much as 6.2% after the Irish insulation and building-products maker said it sees first-half trading profit of more than €400m and announced plans to delist from the LSE

- SBB shares fall as much as 14% after the Swedish landlord posted a pretax loss of SEK4 billion in 1Q and announced plans to raise SEK2.6 billion in new class D shares

- Remy Cointreau dropped as much as 9.5%, the most since the Covid market crash of March 2020, after the distiller announced quarterly sales and an outlook that Citi called “very concerning”

- NatWest shares fall as much as 7.1% after a net interest income miss and softer guidance on deposit growth offset a profit beat for the UK lender. Analysts also noted the lack of a guidance upgrade

- Unicaja dropped as much as 10% after the lender reported net income for the first quarter that missed the average analyst estimate, with Morgan Stanley saying these are “disappointing” results

“What looks like sticky contemporaneous inflation remains an issue, preventing the market from getting too carried away on the rate-cutting phase to come in subsequent quarters,”’ wrote Padhraic Garvey, head of global debt and rates strategy at ING Financial Markets.

Earlier in the session, Asian stocks advanced, helping pare their month-to-date loss, as strong corporate earnings boosted optimism for a global economic recovery. Japanese equities extended gains after the results of the Bank of Japan policy meeting (more below). The MSCI Asia Pacific Index climbed as much as 0.8% before paring more than half of those gains, charged higher by TSMC and Samsung after tech earnings bolstered Wall Street overnight. Markets were mostly higher in the region with benchmarks in Japan, Hong Kong and Taiwan among the biggest winners.

Japanese stocks extended gains as the Bank of Japan maintained policy, including stimulus measures, in its first decision under Governor Kazuo Ueda. The Topix rose 1.2% to close at 2,057.48. The Nikkei advanced 1.4% to 28,856.44, its highest close since Aug. 19. The yen weakened 0.8% to around 135 per dollar. The BOJ scrapped its guidance on future interest-rate levels and called for a long-term review of its policies. The central bank also ditched the reference in its guidance to Covid-19 and its expectation that interest rates will stay at current or lower levels. This decision suggests “maintaining status quo,” said Rina Oshimo, a senior strategist at Okasan Securities adding that “the BOJ’s continued monetary easing stance has probably been factored in to some extent beforehand. Investors’ attention is shifting to corporate earnings, and it is difficult to take aggressive positions ahead of the major holidays and important events such as the FOMC meeting in the U.S.” BYD, ANA and China Life Insurance were among the major Asian companies that climbed after reporting better-than-expected quarterly results during Asia’s busiest earnings weak.

Chinese equities advanced as the nation’s top leaders reiterated support for the economy, while warning that domestic demand is still insufficient. The main Asian stock benchmark is still on course for a monthly loss of about 1% in April. The gauge is down roughly 6% from its late-January high amid a rout in Chinese equity market.

Australian stocks gained, with the S&P/ASX 200 index rising 0.2% to close at 7,309.20, supported by banks and mining shares. The gain comes after technology earnings bolstered Wall Street stocks. Still, the Australian benchmark edged 0.3% lower for the week, posting a second straight weekly loss. For the month, the index advanced the most since January. In New Zealand, the S&P/NZX 50 index rose 0.9% to 12,019.84

Indian stocks posted their biggest monthly gain in five to outperform Asian peers, supported by strong foreign inflows and as corporate earnings continue to meet investors’ expectations. The S&P BSE Sensex rose 0.8% on Friday to 61,112.44 in Mumbai, while the NSE Nifty 50 Index advanced by the same magnitude. For the month, the Nifty 50 and BSE-Sensex climbed 4.1% and 3.6%, respectively with shares of automobile, banks and metal companies leading the winners. The MSCI Asia-Pacific index fell 1.1% this month. “Our bottom up model supported by market internals suggests further legs in the ongoing rally,” ICICI Securities’ Dharmesh Shah said in a note on Friday. Stocks of Adani Group saw a sharp rally ahead of the submission of Indian capital market regulator’s report to the Supreme Court-appointed panel on Wednesday. Flagship Adani Enterprises jumped 3.9% while Adani Ports gained 3.3%. Reliance Industries contributed the most to the Sensex’s gain, increasing 1.8%. Out of 30 shares in the Sensex index, 24 rose and six fell

In FX, the Bloomberg US dollar index advanced 0.5%, rising against all its peers Friday, sending the Bloomberg Dollar Spot Index for its biggest weekly advance since early March and its second consecutive weekly gain for the first time since Feb, as the yen plummets after the Bank of Japan policy decision which scrapped their existing rate guidance. The yen led major currency losses Friday, with USD/JPY up as much as 1.7% to 136.18, after the BOJ stuck with stimulus, disappointing those naive souls who think that Japan will ever be able to normalize (it won’t). European data showed the euro zone dodged a winter recession by growing at the start of 2023, despite inflation remaining a menace. The 20-nation economy expanded by 0.1% in the first quarter, falling short of the 0.2% median estimate in a Bloomberg survey of analysts, even as the German’s GDP Chain Linked GDP contracted. As a result, traders firmed up bets on the ECB slowing to a 25 basis-point rate hike in May.

In rates, treasuries gained following wider gains in core European rates as traders priced out some ECB rate-hike premium after a raft of growth and inflation figures from the region. US session features data including employment cost index and PCE deflator. US yields are richer by nearly 5bp across intermediates with 10-year yields around 3.48%, lagging bunds by around 3bp in the sector; US 2s10s spread is flatter by over 1bp on the day with front-end lagging gains further out the curve. German two-year yields are down 9bps at 2.74% while US two-year yields drop 4bps to 4.03%.

In commodities, crude futures are little changed with WTI trading near $74.80. Spot gold falls 0.2% to around $1,983.

Bitcoin has eased further away from the USD 30k mark after failing to convincingly challenge it overnight or in Thursday’s session.

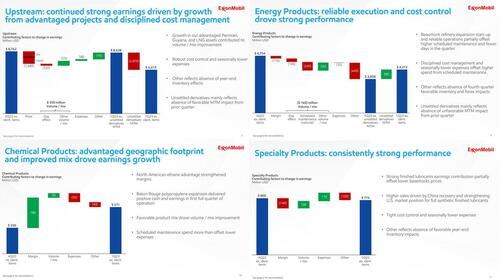

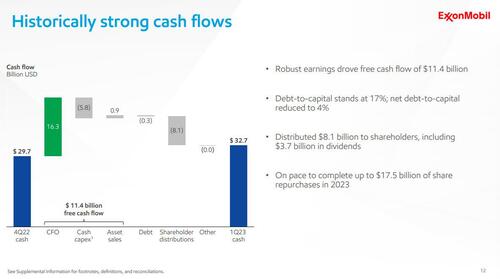

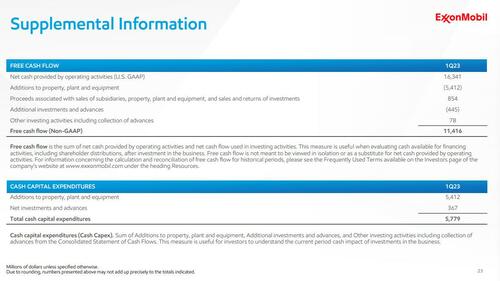

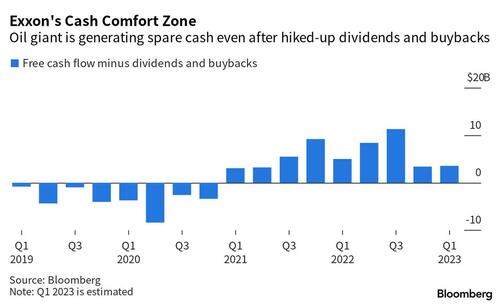

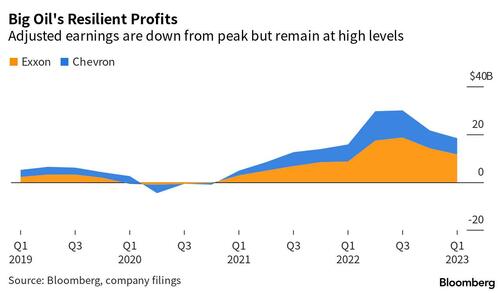

Looking at today’s calendar, we have crucial PCE data coming up at 8:30 a.m. today, accompanied by personal income figures for March that will indicate the pace of wage growth. At 10 a.m., we’ll get the latest reading on the University of Michigan consumer sentiment gauge. On the corporate earnings front, we have Chevron, Exxon, Colgate-Palmolive, Aon, and PetroChina all reporting.

US Market Snapshot

- S&P 500 futures down 0.4% to 4,137.25

- STOXX Europe 600 down 0.3% to 462.57

- MXAP up 0.2% to 160.26

- MXAPJ up 0.3% to 513.43

- Nikkei up 1.4% to 28,856.44

- Topix up 1.2% to 2,057.48

- Hang Seng Index up 0.3% to 19,894.57

- Shanghai Composite up 1.1% to 3,323.28

- Sensex up 0.3% to 60,841.97

- Australia S&P/ASX 200 up 0.2% to 7,309.15

- Kospi up 0.2% to 2,501.53

- German 10Y yield little changed at 2.36%

- Euro down 0.4% to $1.0983

- Brent Futures down 0.4% to $78.05/bbl

- Gold spot down 0.3% to $1,982.30

- U.S. Dollar Index up 0.50% to 102.01

Top Overnight News

- The BOJ has scrapped a key part of its forward guidance on interest rates in Kazuo Ueda’s first board meeting as governor, signaling the first step towards unwinding its ultra-loose monetary policy. The yen fell sharply on Friday as the 71-year-old economist played it safe during his debut, announcing a comprehensive review of the BoJ’s policies while holding off from revising its longstanding yield curve control measures. FT

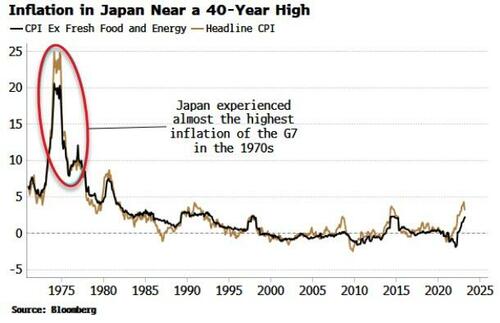

- Japan’s Tokyo CPI overshot the Street consensus for April, coming in at +3.5% on the headline (vs. the Street’s +3.3% forecast and up from +3.3% in March) and +3.8% core (vs. the Street +3.5% and up from +3.4% in March). BBG

- Chinese leaders kept their economic policy stance largely unchanged, signaling it’s too early to pivot toward tighter monetary and fiscal measures or push contentious economic reforms as growth rebounds. BBG

- Russia hurled missiles at cities across Ukraine as people slept early on Friday, killing at least 12 people in the first large-scale air strikes in nearly two months. RTRS

- Inflation in the euro-area muddied the rate debate there too. CPI accelerated in France and Spain and traders and policymakers are braced for the German figure later. GDP data showed the bloc expanded by 0.1% in the first quarter, falling short of the 0.2% consensus. France and Italy bounced back from negative readings in the prior quarter, while Spain gathered momentum and Germany stagnated. BBG

- Chanel rules out an IPO, insisting it will stay a private company, and expresses optimism about Asia but caution in the US. FT

- The repossession industry is seeing an uptick in demand as more Americans struggle to afford their car payments. And companies that specialize in seizing vehicles are having trouble hiring enough agents, after many decamped for other jobs during the pandemic when business largely dried up due to stimulus measures. BBG

- Amazon fell premarket after jolting investors with a warning that cloud sales growth is slowing. The stock had jumped earlier on a profit and revenue beat. Snap is set for its biggest intraday share drop in more than six months after reporting a decline in quarterly revenue. BBG

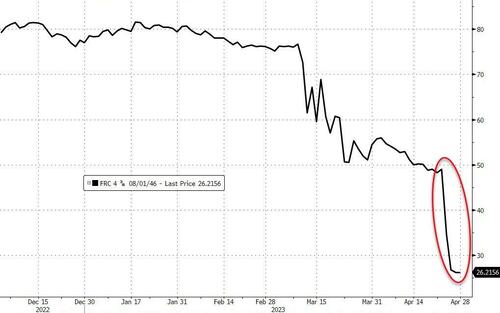

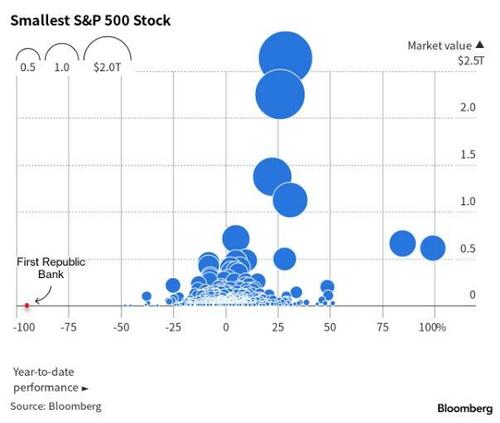

- First Republic’s advisers are working on a private-sector solution they hope can overcome skepticism in Washington and keep the embattled California bank from being shut down by the Federal Deposit Insurance Corporation. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were positive after taking impetus from the rally on Wall St where the S&P 500 and DJIA posted their best daily performance since January as sentiment was fuelled by strong earnings results, while the region also digested a slew of earnings, month-end data releases and the BoJ policy decision. ASX 200 was initially led higher by outperformance in financials and tech, but then faded most of the gains. Nikkei 225 was lifted after Industrial Production and Retail Sales topped forecasts, while the BoJ kept also policy settings unchanged, tweaked its forward guidance which remained dovish and announced it is to conduct a policy review. Hang Seng and Shanghai Comp were firmer amid tech strength and an abundance of earnings releases, with sentiment also supported by the PBoC’s liquidity efforts ahead of the 5-day closure in the mainland.

Top Asian News

- Chinese Commerce Minister Wang Wengtao met German Vice Chancellor Habeck in Berlin to discuss the implementation of economic and trade consensus between both countries, while they also discussed deepening bilateral practical cooperation, creating a fair and just business environment for Chinese and German companies, as well as green cooperation, according to MOFCOM.

- China’s Politburo says China economic expansion is under recovery, but internal momentum is weak; economic transformation faces new constraints. Should prioritise attracting foreign investment and stabilise the basic market for foreign trade/investment.

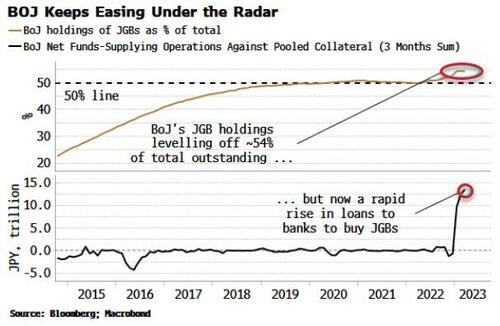

- BoJ kept policy steady with rates at -0.10% and parameters of QQE with YCC maintained, but tweaked its forward guidance whereby it stated that it will take additional easing steps without hesitation as needed while striving for market stability in which the central bank dropped its reference to COVID-19 pandemic and dropped forward guidance that pledged to keep interest rates at current or lower levels. BoJ also announced to conduct a broad-perspective review of monetary policy with a planned time-frame of one to one and a half years and noted that it will patiently continue with monetary easing as uncertainty over Japan’s economy is extremely high.

- Governor Ueda: Will make changes to monetary policy as needed during the review period.; decided to maintain policy easing including YCC, will conduct a review of policy of past 25 years; Japanese CPI is likely to slow below 2% in H2 2023. Review is differentiated from examination/assessment as it does not intend near-term policy changes. Won’t hesitate to ease policy further if necessary.

European bourses are in the red with earnings continuing to be in focus alongside numerous macro developments, with initial downside exacerbated on the softer-than-expected German growth data, though this dynamic has lessened slightly after the near in-line EZ figures and as attention turns to the US docket and next week’s EZ data. Specifically, Euro Stoxx 50 -0.8% with the Banking sector pressured by a poorly received NatWest update with a focus on margins alongside the pullback in yields; more broadly, FRC remains in focus as Reuters reports officials are said to be coordinating urgent rescue talks. Autos are pressured as Mercedes-Benz failed to retain opening gains and after Thursday’s relative outperformance for the sector. Stateside, futures have been somewhat rangebound but showing modest downside, ES -0.3; with the after-market reports from AMZN & INTC in focus as the oil majors begin reporting.

Top European News

- SEB Rises as Bryan Garnier Flags Expected Margin Improvement

- Bunds Lead Treasuries Higher as German Economy Stagnates in 1Q

- Russia Stages Deadly Aerial Assault on Ukraine, Strikes Kyiv

- The World Backed Two Generals. Then Sudan Went to War

- BBC Chairman Sharp Braced for Verdict Over Link to Boris Johnson

- Norges Bank to Keep Cutting Foreign Currency Purchases in May

FX

- Yen sinks as BoJ sticks to ultra-easy policy and gives dovish-sounding guidance via the statement and post-meeting presser; USD/JPY probes 136.00 from sub-133.50 low, EUR/JPY touches 149.50 from under 147.50.

- DXY tops 102.000 compared to 101.420 base amidst broader Dollar recovery gains pre-US PCE and ECI, Euro undermined by largely weaker than forecast EZ data as EUR/USD retreats through 1.1000 and away from mega option expiries at the strike

- Aussie losing battle to defend 0.6600 vs its US rival, but may be aided by decent option expiry interest at the round number

- PBoC set USD/CNY mid-point at 6.9240 vs exp. 6.9249 (prev. 6.9207)

- Norwegian/Norges Bank Currency Purchase (May) NOK 1.4bln vs Exp. NOK 1.0-1.3bln (Prev. NOK 1.5bln).

Fixed Income

- Bunds and fellow EGBs bounce strongly in the wake of mostly sub-consensus Eurozone data, aside from hot French inflation.

- 10 year German benchmark up to 135.26 at best from 133.64, Gilts and T-notes follow suit between 100.53-101.51 and 114-17+/115-08 + bounds pre-US PCE and ECI.

Commodities

- WTI and Brent futures have erased the modest gains seen overnight in light of the German GDP metrics, which saw Europe’s largest economy stagnating Q/Q in Q1; though, in-fitting with European sentiment, the benchmarks have picked up from post-data lows ahead of the US docket & oil major updates.

- The metals complex sees broader pressure from a firmer Dollar. Spot gold remains under USD 2,000/oz but within yesterday’s range.

- Base metals are mostly lower given the downbeat risk tone and the aforementioned firmer Dollar, 3M LME copper eyes USD 8,500/t to the downside.

Geopolitics

- Air raid alerts were issued throughout Ukraine and explosions were reported in several Ukrainian cities including its capital Kyiv, according to Interfax and local Telegram channels.

- US imposed sanctions against Russia’s FSB and the intelligence unit of Iran’s IRGC.

- China’s envoy to Japan Wu said China opposes bullying and meddling with other countries’ internal affairs, as well as opposes pushing one country’s system to others. Wu added the Taiwan issue is China’s internal issue and a red line that should not be crossed, while China hopes for a peaceful resolution to the Taiwan issue but would not promise to abandon the use of force, according to Reuters.

- Russian Defence Ministry says they are increasing the combat readiness of bases in Kyrgyzstan and Tajikistan amid US attempts to restore a military presence in central-Asia, via Tass.

US Event Calendar

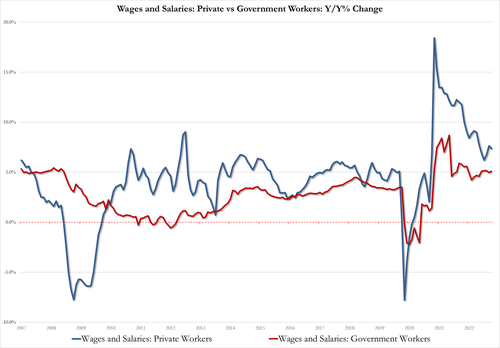

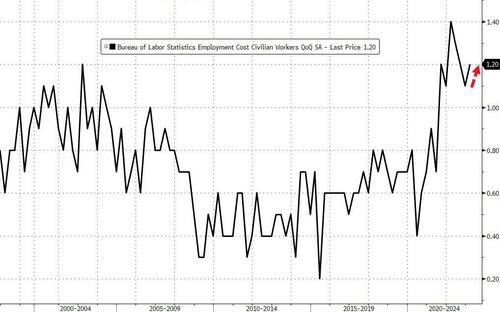

- 08:30: 1Q Employment Cost Index, est. 1.1%, prior 1.0%

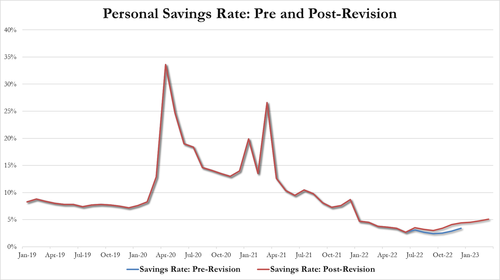

- 08:30: March Personal Income, est. 0.2%, prior 0.3%

- 08:30: March Personal Spending, est. -0.1%, prior 0.2%

- 08:30: March Real Personal Spending, est. -0.1%, prior -0.1%

- 08:30: March PCE Deflator MoM, est. 0.1%, prior 0.3%; PCE Deflator YoY, est. 4.1%, prior 5.0%

- 08:30: March PCE Core Deflator MoM, est. 0.3%, prior 0.3%; PCE Core Deflator YoY, est. 4.6%, prior 4.6%

- 09:45: April MNI Chicago PMI, est. 43.6, prior 43.8

- 10:00: April U. of Mich. Sentiment, est. 63.5, prior 63.5

- 10:00: April U. of Mich. Current Conditions, est. 68.6, prior 68.6

- 10:00: April U. of Mich. Expectations, est. 60.4, prior 60.3

- 10:00: April U. of Mich. 1 Yr Inflation, prior 4.6%

- 10:00: April U. of Mich. 5-10 Yr Inflation, prior 2.9%

- 11:00: April Kansas City Fed Services Activ, prior -4

DB’s Jim Reid concludes the overnight wrap

As we go to press this morning, the main news comes from the Bank of Japan overnight, who unanimously decided to leave their main policy settings unchanged. So the policy balance rate remains at -0.1%, and when it comes to yield cure control, the aim is still that 10yr JGB yields will stay “at around zero percent”. However, there was a shift in their forward guidance, since they dropped the previous phrasing that they expect “short- and long-term policy interest rates to remain at their present or lower levels.” Furthermore, they announced a “broad-perspective review of monetary policy” that would take around 1 to 1.5 years.

Despite the shift in forward guidance, the fact that the BoJ left policy unchanged meant that markets interpreted the meeting in a dovish light, since there had been some speculation about whether Governor Ueda would use his first meeting in charge to change the yield curve control policy. As a result, the Japanese Yen has weakened against the other major currencies this morning, and is currently down -0.60% against the US Dollar. Yields on 10yr JGBs have also fallen in response to the decision, and are now down -3.1bps at 0.43%, whilst the Nikkei has moved higher and is currently up +1.03%. The main exception to that pattern were Japanese banks, with the TOPIX Banks index reversing its earlier gains to fall -0.50%. Elsewhere in Asia, the mood is also pretty positive this morning, with gains for the Hang Seng (+0.87%), the CSI 300 (+0.74%), and the Shanghai Comp (+0.67%).

Looking forward now, we’ve got an eventful day ahead that’ll set us up for the Fed and ECB decisions taking place next week. In the US, we’ll get the Employment Cost Index for Q1, which economists and the Fed treat as a better gauge of wage pressures, since it accounts for benefits on top of wages and salaries. Then we’ve got the PCE inflation data for March coming out, which is the measure that the Fed officially targets. Our US economists at DB still see the various measures as running too fast for the Fed to be comfortable, and they forecast that the ECI will tick up to +1.1% from +1.0% in Q4, whilst they expect monthly core PCE will still be running at +0.3% in March. Keep an eye out on Europe too, since we’ll get the April inflation readings from several countries, including Germany, France and Spain, which will set us up for the Euro Area-wide release on Tuesday. With debate still ongoing as to whether the ECB will deliver another 50bp hike or slow down to a 25bp pace, any upside surprise would keep the pressure up to stick with the faster hikes.

Those releases today will follow on the heels of some further negative surprises for the Fed yesterday. In particular, the core PCE inflation print for Q1 showed that inflation was still running at +4.9% in Q1 (vs. +4.7% expected). Bear in mind that’s up from +4.4% in Q4, which puts a dent in the narrative that inflation is heading lower now. On top of that, growth was quite a bit weaker than expected, coming in at just an annualised rate of +1.1% in Q1 (vs. +1.9% expected).

With those releases in hand, investors focused on the strong inflation data and moved to expect a slightly more hawkish path from the Fed over the coming months. For instance, the chances of a 25bp hike next week bounced back up to 90%, having closed at 79% the previous day as concerns about First Republic mounted. And looking further out, the rate priced in for the December meeting rose by +11.7bps to 4.51%. In turn, that led to a strong selloff in Treasuries, with the 2yr yield up +11.7bps to 4.07%, and the 10yr yield up +7.2bps to 3.52%. Another point to note was that the 3m Treasury bill yield hit yet another post-2007 high yesterday of 5.14%, which speaks to the continued concern around the debt ceiling deadline given that the 1m and 6m yields are still both beneath their peak in early March right before SVB’s collapse.

It was also an eventful day for US equities, with the S&P 500 (+1.96%) surging back after two consecutive losses. It was the best day for the index since January 6 and left the S&P up marginally on the week, with every industry group and 88% of index members moving higher on the day. Meta (+13.93%) was the second best performer in the entire index following its earnings release after the previous day’s close, and the broad rally was led by the more cyclical and growth-oriented sectors. There was also a recovery by First Republic (+8.79%), although there weren’t any new developments yesterday with regard to the bank. After the close, we then heard from Amazon (+4.61% yesterday) which initially traded up +12% in after-market trading as overall sales and cloud-unit sales beat estimates. However later on overnight the stock turned lower and turned negative in after-market trading as the company relayed concerns about cloud-growth slowing. This dragged down other cloud service providers overnight, and futures on the S&P 500 have fallen -0.07% this morning.

Back in Europe, sovereign bond yields similarly saw a strong rise across the continent, with those on 10yr bunds (+6.3bps), OATs (+6.5bps) and BTPs (+8.1bps) all rising on the day. The major equity indices also posted gains too, with the STOXX 600 (+0.18%) recovering after a run of three consecutive declines, although they closed before the later gains in the US, and European equity futures are pointing higher this morning

Looking at yesterday’s other data, the US labour market numbers were more resilient than expected, with the weekly initial jobless claims coming in at 230k (vs. 248k expected). Otherwise, pending home sales in March unexpectedly fell by -5.2% (vs. +0.8% expected), ending a run of three consecutive monthly gains.

To the day ahead now, and the main data highlights include French and German CPI for April, Euro Area GDP for Q1, and German unemployment for April. From the US, we’ll also get the Q1 employment cost index, March’s personal income, personal spending, and PCE inflation, and April’s MNI Chicago PMI. From central banks, we’ll hear from ECB President Lagarde. Finally, earnings releases include Exxon Mobil and Chevron.