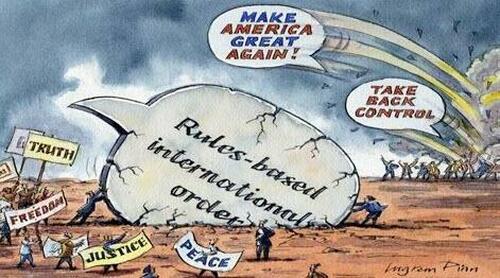

Understanding The International Rules Based Disorder

Authored by Larry Johnson via Sonar21.com,

Have you heard of the “International Rules Based Order?” Russia, according to Washington and NATO, is violating those rules (China too) and must be punished. We can’t have “rule breakers” mucking up global tranquility can we?

Since 1945, the United States has pursued its global interests by building and maintaining various alliances, economic institutions, security organizations, political and liberal norms, and other tools — often collectively referred to as the international order…

Building an international order has been a formal program of US foreign policy since at least the 1940s and an aspirational goal since the nation’s founding. According to its post–World War II architects, the international order protects US values by maintaining an environment in which the ideals of a free and democratic society — like that of the United States — can flourish. The United States has used both power and idealistic notions of shared interests to underwrite the rules-based order. In this sense, it employed both hard and soft power to construct the order.

Got it?

The so-called international order basically is a system of rules that the United States sets and arbitrarily decides whether or not a foreign country is complying or disobeying.

The bottom line?

These “rules” are designed to promote US interests at the expense of others.

What is a rule?

It is, “an authoritative, prescribed direction for conduct, especially one of the regulations governing procedure in a legislative body or a regulation observed by the players in a game, sport, or contest.” In theory, the rule is supposed to apply to everyone.

Let’s take basketball (appropriate in light of March Madness currently underway in the United States) and look at how genuine rules are supposed to work in a competitive environment. There is a set amount of time for a college game — 40 minutes, two 20 minute halves. You, as a rules official, cannot arbitrarily give one team that you like more time to play in hopes that they score more points and finally prevail. Any player who makes a basket outside the 3 point line is awarded 3 points for his team. Any player who possesses the ball and takes more than two steps without dribbling is guilty of traveling and the ball is turned over to the other team.

When we look at the so-called international rules to promote global order a very different picture emerges. We are essentially talking about an international casino and the United States traditionally has behaved like a crooked dealer who makes sure that friends of the casino win. Here is one example. If protestors take to the streets and try to overthrow a government the United States likes, that is bad and those protestors must be punished. However, if the government has fallen out of favor with the United States then the protestors are sanctified beings carrying out God’s will and must be supported.

Iran is a case in point. Last October, Washington cheered on protests in Iran and punished Iranian authorities for trying to quell the activity:

The United States on Wednesday imposed a slew of new sanctions against Iranian officials involved in the ongoing crackdown on nationwide protests in Iran – the latest US response to Tehran’s efforts to quash outrage after the death of 22-year-old Mahsa Amini.

“It has been 40 days since the death of 22-year-old Mahsa Amini in the custody of Iran’s so-called ‘Morality Police,’ and we join her family and the Iranian people for a day of mourning and reflection,” Secretary of State Antony Blinken said in a statement.

“The United States is committed to supporting the Iranian people and ensuring that those responsible for the brutal crackdown on the ongoing nationwide protests in Iran are held accountable,” Blinken said. “Today, we are announcing a joint action between the State and Treasury Departments designating 14 individuals and three entities using five different authorities, demonstrating our commitment to use all appropriate tools to hold all levels of the Iranian government to account.”

https://www.cnn.com/2022/10/06/politics/us-iran-sanctions/index.html

Ditto for Georgia (the country not the state). When the legislature in Tbilisi passed a law intended to limit foreign interference in Georgia, protestors took to the streets and battled police in early March:

Police in the Georgian capital Tbilisi used tear gas, water cannon and stun grenades late on Wednesday as they moved to break up the second straight day of protests against a “foreign agents” law which critics say would limit press freedom and undercut the country’s efforts to become a candidate for EU membership.

https://www.theguardian.com/world/2023/mar/08/georgia-opposition-protes…

And Washington’s response to that “violent insurrection?”

In Washington, State Department spokesman Ned Price voiced solidarity with the protestors.

“We urge the government of Georgia to respect the freedom of peaceful assembly and peaceful protests,” Price said. “We are standing with the people of Georgia and the aspirations that they have.”

If you watched any of the videos of the Georgia protests, they were not peaceful.

Quite a contrast to what took place in the United States on January 6, 2021, when Donald Trump supporters surrounded the US Capitol. The Trump supporters are condemned, prosecuted and imprisoned as insurrectionists bent on sedition. The evidence from that day indicates that agents of the US Government (as well as a few Ukrainian members of AZOV) were in the crowd trying to stir them to violence. Once those protestors entered the Capitol, very few participated in acts of violence. But, because they opposed Joe Biden, they are treated as despicable criminals. Tucker punches back against the Biden Administration propaganda meme.

Iran, who was widely condemned in Europe for its response to protestors, is having great fun with French President Macron’s response to French citizens angry over raising the retirement age without a vote by the French legislature:

Iranian authorities commented on the mass protests and strikes in France. According to Iranian Foreign Ministry spokesman Nasser Kanani, official Paris should listen to the French people and abandon the “barbaric methods of violence against people defending their democratic rights”.

Rules about protests are small potatoes compared to the Big rule about not carrying out military activities in a foreign country unless you have been invited to send your forces to provide assistance or you have been attacked. The United States and NATO insist that Russia is a major violator of this rule and must be punished. Russia, for its part, argues that it is acting to protect Russian speaking Ukrainians who have been shelled relentlessly by the Government of Ukraine since 2014 and to oppose NATO’s expansion to its borders.

Neither Russia nor China give any credence to complaints and outrage from the West because of America’s own sordid record of military campaigns in Vietnam, Iraq, Syria, Panama, the former country of Yugoslavia, Somalia and Afghanistan.

Here is the harsh truth about the Rules Based International Order. It is an anachronism created in the wake of World War II by the United States, it is unraveling and the Biden Administration continues to enact policies that will hasten its demise.

Keep your eye on Israel. It is being wracked with protests over a proposed law to strip its Supreme Court of power and consolidate that power with the Executive. The rifts within Israel are profound and widening by the day. Prime Minister Benjamin Netanyahu fired the Defense Minister today and Israel’s Consul General resigned in protest.

Why do I bring this up? Because there is no signal yet from the Biden Administration whether it will bless these protests as “following the international rules” or condemn Netanyahu as a violator of those rules.

Laments about the “International Based Rules of Order” exposes the fact that America no longer has the strength nor the ability to impose its will on others. China, Russia, Iran, Saudi Arabia, India and South Africa, to mention a prominent few, are awake to this reality and are busy creating an alternative international order that will put the United States on the sidelines. I believe this is the most important consequence of the proxy war between NATO and Russia in Ukraine.

The weak underbelly of America has been exposed and no amount of threats or sanctions from Washington will change that reality.

Tyler Durden

Mon, 04/03/2023 – 15:05

via ZeroHedge News https://ift.tt/V6uGRBJ Tyler Durden