Authored by Alasdair Macleod via GoldMoney.com,

Deflating the credit bubble

The theme of this article is debt deflation. How likely is it that the downturn in broad money supply will continue, and if so, why? And what are the consequences?

The major central banks have increasingly resorted to interest rate management as their principal means of demand management. Yet history shows little correlation between managed interest rates and the growth of credit, which is represented by broad money statistics.

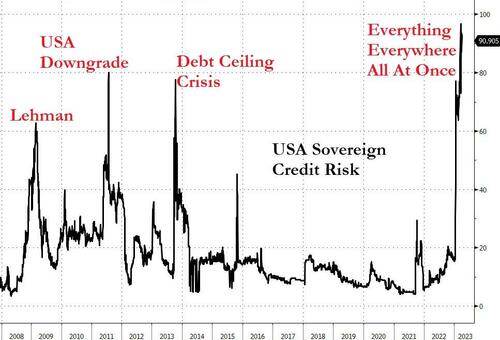

It can only be concluded that central banks have finally lost control over interest rates, and that they are now being driven by the contraction of commercial bank credit. The great unwind of the credit bubble, which was four decades in the making, is being driven by a growing fear of lending risk among bankers, exacerbated by the recent failures of a few significant banks. For bankers, it is no longer a time for greed, but for fear and a reduction of their debt obligations.

This article draws on the experience of the 1970s for empirical evidence and expands on the reasons behind it. It notes that the dynamics behind the crisis for the UK, which led to gilts being issued with coupons over 15%, in some key respects were milder than that faced by the US and other nations today.

It can only result in debt traps being sprung on government finances, and a shift from credit creation by commercial banks to central banks.

The visible debasement of the most senior form of credit will only exacerbate the problems for government funding, increasing their welfare costs, collapsing tax revenues, and escalating borrowing costs.

Introduction

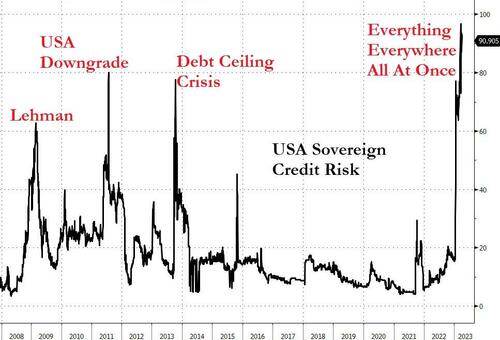

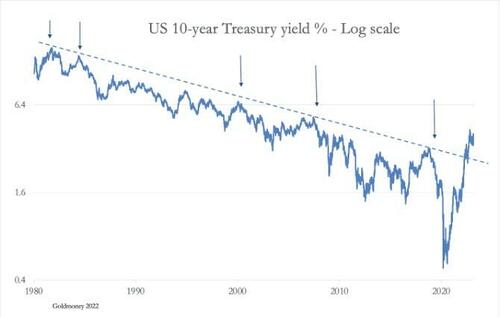

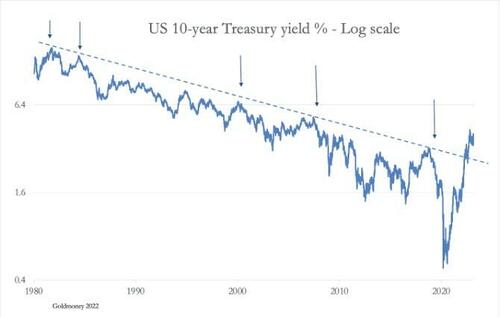

There is no more clear evidence of a fundamental change in the long-term interest rate trend than the yield on the 10-Year US Treasury note, which has violated its long-term downtrend as shown in the chart below.

While it is an error to place too much emphasis on mechanical chart relationships, we can see good reasons for this break in trend to be a very important indicator. It calls an end to the long-term downtrend in interest rates, abetted by the Fed’s interest rate policies. In time, historians might well record the extraordinary delusions of monetary policy makers that led to a debt and valuation trap which is destroying the currency correctly — unless, that is, history is written by the policy makers.

That is eminently possible, but there is a more accurate description of policy failure. The various moves by statisticians to conceal the evidence of rising prices ended when central banks suppressed official interest rates to or below the zero bound. Not only did statistical method create the illusion that inflation as officially defined was not a problem, but it encouraged policy makers to more aggressively suppress interest rates to get an apparently flatlining CPI to rise to the 2% target. With the covid pandemic as justification, the Fed suppressed interest rates to the zero bound and proceeded with quantitative easing to unprecedented levels in an attempt to suppress all bond yields. And even before then, negative interest rates, which are wholly illogical, were introduced in Japan, the Eurozone and Switzerland.

If the Fed had stuck to its policy of adjusting its funds rate in line with the inflation of consumer prices, it would have begun increasing them in April 2021, when the CPI(U) inflation rate jumped to 4.1%, up from 1.7% in only two months. But that adjustment was not made until the following March, when the Fed increased the target range by just one quarter of a per cent to 0.25%—0.50%, by which time the CPI(U) was rising at 8.5% against a year previously.

The official story, that inflation was transitory was baseless. But it was sanctions against a belligerent Russia backfiring on the NATO alliance which alerted everyone to the conditions for a collapse in credit values in the major western currencies. Accordingly, energy, commodity, food, and producer prices which had already been rising suddenly broke higher. Central banks were bewildered. They could see no reason for it, other than the Russian situation, and it was argued that Russia would either be defeated, or its economy would collapse under sanctions. Inflation was still deemed to be transient.

Officially, it remains transient, only it’s taking a little longer than first thought to return to 2%. Every statist forecast for price inflation assumes that this is the case. Our headline chart to this article, of the new rising trend in bond yields says otherwise. And the longer it takes for the inflation dragon to be slain, the more the general public will believe it is likely to become permanent and act accordingly.

The speech delivered by the Bank of England’s Governor to the London School of Economics on 27 March is indicative of the Bank’s thinking. A word search of its sixteen pages reveals only one reference to credit, and none to money supply, M0, 1, 2, 3, or 4, but 31 to interest rates and 13 to Bank Rate. There were 27 references to r*, which is the hypothetical interest rate that would sustain demand in line with supply. New Keynesian models were mentioned once, and monetarism or the term monetarist not at all.

Rather than wading through central bank-speak, these word searches are a useful guide to official thinking. And given the absence of references to money supply and credit, this speech on monetary policy was actually not about monetary policy at all, despite being mentioned 46 times. From the references, the Governor’s speech appears to have been written for him by seventeen in-house economists, a committee bound together by the groupthink which is evident in the text.

This group-thinking is not just evident at the Bank of England. The Fed’s FOMC minutes similarly lack references to credit and money with respect to monetary policy. But there are always multiple references to interest rates.

Erroneous beliefs over the role of interest rates

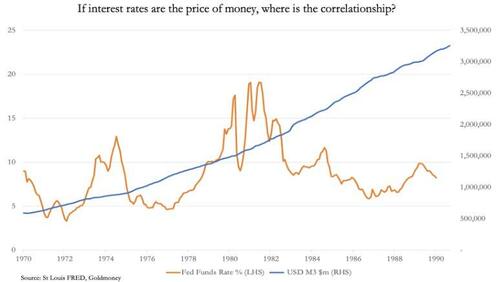

Central bankers and the entire investment community believe the relationship between prices and money is governed solely by interest rates, as their policy documents reveal. In other words, to contain inflation, which the establishment refers to as increases in the consumer price index, interest rate management is the principal, possibly the only tool. But contrary to the import of the Governor’s speech referred to above, there is little or no empirical evidence to support this thesis. Arguably, the single exception was in the early 1980s, when Fed Chairman, Paul Volcker raised the Fed funds rate as high as 19.5% — but I address this next.

Empirical evidence on its own is insufficient — a proper explanation is required. The Volcker story ignores the actual relationship between interest rates and credit, which we can surely agree is the fuel which drives both production and consumer demand and is the central concern of monetarists. The relationship is shown in Figure 1.

Expectations of continually rising prices which had built up from 1977 were suppressed in the early 1980s by near 20% Fed Funds Rates. But credit measured by M3 continued to expand unabated —even increasing its rate of expansion marginally to accommodate higher interest payments. The only conclusion we can draw from this chart is that irrespective of interest rate trends, money supply soared on regardless.

However, increasing interest rates to punitive levels did reduce expectations of rising prices, which were threatening to undermine confidence in the currency. But other than this extreme action, as a means of controlling credit expansion interest rate policy was an abject failure. This failure was not widely appreciated at the time, when the focus, as it is today, was on the consequence for prices.

But finally, we are now seeing bank credit beginning to contract for the first time since the depression. It is tempting to attribute the current contraction in broad money supply to the sharp rise in the Fed funds rate. But the link is only indirect and has little or nothing to do with controlling the dollar’s loss of purchasing power, or put another way, rising prices.

Instead, the contraction in bank credit is due to commercial bankers becoming cautious over bank lending. As we saw with the Silicon Valley Bank failure, some banks invested in medium- and long-term bonds when the cost of funding was significantly lower than the coupon returns available on the bonds. Rising interest rates then increased the cost of funding so that it was higher than the bond coupons and led to capital losses. This was a direct consequence of interest rate increases. Furthermore, central banks themselves have been caught out the same way but on a far larger scale. While SVB failed, it is assumed that central banks are immune to the same failure, because they can readily expand their balance sheets to provide liquidity.

But we must now examine the true relationship between credit and interest rates. Instead of changes in interest rates driving changes in total bank credit, it is the other way round. If banks reduce the level of credit relative to demand for it, then interest rates must reflect the shortage of credit and can only rise. It is the collective actions of the commercial banks that is now driving interest rates higher, and not central bank policy.

This leads us to a worrying conclusion. We are currently in a global banking crisis, triggered to some extent by the contraction of bank credit. Unless the banking cohort drops its collective lending caution, then interest rates are bound to rise further, irrespective of the policies and desires of the rate setters in the central banks. And It’s not just bankers’ caution over lending to financial and non-financial sectors, but also lending to their weaker brethren.

For the banking system to function, balance sheet imbalances arising from deposit flows must be corrected. But the moment the banking community suspects there is a run on one of their number, that bank is simply cut off from the required funding.

The conventional method of dealing with a bank’s inability to fund itself in wholesale markets is for the central bank to intervene to make up for deposit shortfalls. For a bank to resort to this funding is not just embarrassing, but it confirms its pariah status. Northern Rock faced a depositor run in September 2007. The Bank of England stepped in, but despite the Bank’s support, Northern Rock never recovered and was taking into public ownership the following February.

Undoubtedly, there are other banks of all sizes in trouble today, both in domestic and international banking markets. It is a consequence of the end of the credit bubble and sets the tone for intra-bank relationships.

Imagine you are managing a bank. In this increasingly febrile credit atmosphere, you will be acutely aware of counterparty risk. You will be reducing your credit line maximums in wholesale markets across the board. You will be drawing up a list of banks to whom you will not lend. You will be reviewing your derivative counterparty exposures. You will dispose of all marketable bonds with maturities longer than a year, and you will be reviewing loan collateral values.

You will ensure your deposit rates are set to retain deposits, but not raised sufficiently to create suspicions of insolvency. And even for long-established commercial relationships, you will seek to increase your lending rates. You will hope that by protecting lending margins you will foster a reputation for sound, conservative management. Maintaining market and depositor reputations have become paramount. But above all, you will be taking steps to reduce the ratio of balance sheet assets to equity to more conservative levels.

Alerted by SVB and Credit Suisse, every bank will be striving for similar objectives. Credit contraction will continue everywhere, with the possible exception of banking markets disconnected from the western financial markets, such as Russia and China.

In the Eurozone, even a modest rise in interest rates from here will almost certainly lead to a substantial contraction of its bloated repo market, often backed by dodgy collateral. Through bank balance sheets, this would be reflected in a contraction of outstanding bank credit in a banking system riddled with hidden bad debts, and where G-SIB banks have total asset to equity ratios of over twenty times. As ringmaster, the ECB is effectively trapped. Furthermore, with the entire euro system of the ECB and national central banks nearly all in balance sheet deficits, American and other bankers will steer clear of new commitments and counterparty risks with the eurozone as a matter of policy.

The US has its own crisis, being heavily dependent on financial markets, upon which the Fed has relied to keep economic confidence intact. If bond values continue to decline, heavily indebted government finances will destabilise. And zombie corporations, overloaded with unproductive debt will fail, potentially leading to depression-era levels of unemployment.

Put briefly, we have moved on from the Volcker years and today the overall debt situation is more serious than it has ever been in modern times. The solution whereby central banks expand their way out of the consequences of interest rate increases without collapsing their currencies is no longer an option, an illusion when the driving factors behind interest rates are properly understood. To appreciate why, we must understand the answer to the question posed above about the non-correlation between interest rates and the quantities of currency and credit. Only then can we truly see the extent of the fallacies driving contemporary monetary policies.

Interest rates reflect time, not cost

If there is one reason why the state will always fail in its monetary policies, it is the inability of the bureaucratic mind to incorporate time into its decision-making. In the productive market economy, which is little more than a name for the collective actions of transacting individuals and their businesses, time is central. A producer incorporates time in his profit calculations, and a consumer incorporates time in his needs and desires, whether wanting something immediately or being prepared to defer his purchase. And because money is the link between both earnings and spending and savings and investment, time is of the essence for money as well. It is this irrefutable fact that leads to a preference for money to be possessed sooner rather than later. And if a human actor is to part with it temporarily to be returned later, naturally he or she will expect compensation for the loss of its utility.

Fundamentally, this is what the general level of interest rates in the market economy represents. It is the time preference factor, set between transacting humans, which values possession in the future less than possession today. It is the background to the rate of interest banks must pay on deposits to balance their books. It is fundamental to a businessman’s calculations, setting the acceptable interest rate for loan finance.

To pure time preference, we must add an element for counterparty risk, so that when banks are deemed risky, the spread over pure time preference will increase. And when transacting humans anticipate a fall in purchasing power before money owed is returned, that is yet another factor for depositors to take into account.

The common central bank target for price inflation of 2% implies that interest compensation to include an element of time preference and monetary depreciation suggests a base case for a deposit rate of between 3%—5%. We arrive at this figure in the knowledge that under the gold standard in the nineteenth century, the deposit rate had declined to 3% without inflation of prices, a moderate deflation perhaps being expected.

Therefore, with the general level of prices in dollars rising at about 6% currently, depositors should more naturally expect one-year deposit rates of about 7% or 8%, after tax deductions. We can therefore see why the Fed is motivated to talk down price inflation to the 2% target. And why, therefore, buying US Treasuries at a current yield of 3.6% is presumed by compliant investors to be reasonable value.

But other than a safe-haven play for short-dated US T-bills, nothing could be further from the truth. The long-term interest rate trend is clearly for them to rise as credit continues to contract taking bond yields up with them, and debt markets are likely to become increasingly volatile. This was certainly the experience of a similar situation fifty years ago, which merits examining.

Debt funding in the 1970s

With bank credit now contracting, it is only a matter of time before the US Government will find its funding costs rising materially. Not only will that affect the outlook for its spending plans, but there is a risk of periods of funding disruption. Relying on its proven auction process may no longer be sensible — after all, auction success has been against a background of generally declining interest rates and bond yields, ensuring continuing demand from pension funds, insurance companies and foreign governments.

It is well worth revisiting the 1970s precedent to assess future funding conditions, now that the underlying trend is for interest rates to rise over time. The 1970s was the last time there was a funding crisis due to rising interest rates. But it wasn’t the US Government that suffered so much, because it ran relatively small budget deficits relative to the size of the economy at that time — the largest being an unprecedented $74 million in 1976 (compared with $3,131,917 million in 2020, over 42,000 times the 1976 deficit).

It was the UK that had problems, but on a far smaller relative scale than today. Periodically, the Bank of England, acting for the UK Treasury, was unable to fund its budget deficit, which peaked at 6.9% of GDP in 1975/76, forcing the then Chancellor (Denis Healey) to borrow $3,900 million from the IMF to cover the entire deficit. Following this episode, IMF restrictions on government spending capped the UK budget deficit at approximately 5% in the years following, and the rate of price inflation, which had peaked at 25% in 1975, declined to 8.4% in 1978. Furthermore, in late-1973 there had been a combined commercial property and banking crisis on a scale never seen in the UK before. And during the bear market in equities, between May 1972 and the end of 1974 the FT 30 Share Index fell over 70%.

For comparison, the US deficit to GDP ratio in 2020 was 11.6%, and 10.3% in 2021, nearly double that of the UK at the height of its crisis. With similarly socialistic policies which led to a sterling crisis forty-five years ago, the dangers facing the dollar, which are potentially far greater, have yet to materialise. And the IMF cannot come to the rescue of the US, as it did for the UK in 1976.

Crucially, the Bank of England lacked the tools to hide the true extent of monetary inflation. Intentionally or not, to a degree government statisticians and central banks can massage the numbers today with the financial press being little the wiser. But that changes nothing, other than fooling markets for just a little longer.

Back in seventies Britain, the initial cause of a series of funding crises was that the Bank of England, under pressure from politicians, did not accept the market’s demands for higher interest rates. This sent a negative message to foreign holders of sterling, weakening the exchange rate, triggering foreign selling of gilts, and raising fears of further imported price inflation.

Meanwhile, government spending continued apace (as described above), pushing extra currency into circulation without it being absorbed by debt issuance funded by genuine savings. And as sterling weakened and money supply figures deteriorated at an increased pace, yet higher interest rates would be required to persuade investing institutions to subscribe for new gilt issues. These episodes were dubbed buyers’ strikes.

The longer the delay in accepting reality, the greater the chasm became between market expectations and the authorities’ position. Only as a last resort would the politicians and the Keynesians at the UK’s Treasury throw in the towel. The Bank of England then had the authority to fund at its discretion. It deployed what became known in the gilt market as the Grand Old Duke of York strategy, after the nursery rhyme: “He had ten thousand men. He marched them up to the top of the hill, then marched them down again.” The Bank of England would raise interest rates to the top of the hill to take all expectations of higher rates out of the market, then issue gilt stocks to absorb pent-up investment liquidity before allowing and encouraging rates to fall again. That was how 15% Treasury 1985, 15 ¼% Treasury 1996, and the 15 ½% Treasury 1998 gilts came to be issued on separate occasions.

At the top of the interest rate hill and following the announcement of the terms of the new gilt, having weakened on foreign selling sterling would then recover. The crisis passed, and the money supply figures corrected themselves. Paul Volcker at the Fed did something similar at the Fed in June 1981 when he raised the Fed funds rate to 19.1% — except the objective was less about funding and more about killing expectations of price inflation.

Though they are currently being ignored, there are worrying similarities between the UK’s experience in the mid-seventies and the Fed’s position today. The US budget deficit has been and remains far higher than the one that forced the UK to call in the IMF, as much as 11.6% of GDP and over 42,000 times the US deficit in 1976. With the highly indebted US economy bound to be undermined by rising interest rates, the outlook is not for recovery as forecast by the Congressional Budget Office, but for further deterioration, requiring continual and accelerating inflationary funding.

And no one yet is contemplating Treasury coupons at anything like the 15% seen in UK gilts during the similar conditions of the 1970s.

The response to rising interest rates

The case has now been made that it is contracting credit which is driving interest rates higher, not central bank policy. Having become used to continual expansion of credit tied to fiat currencies — in other words not anchored in value to anything material — we will have to learn to adjust to the conditions of credit contraction.

Monetarists and neo-Keynesians would argue that contracting credit will lead to falling prices and deflation. They do not seem to appreciate the consequences of unemployed consumers no longer producing goods and services. If anything, productivity gearing means supply is likely to diminish at a faster rate than employment, leading to product shortages instead of lower prices. This was evident in the UK in the mid-seventies when high unemployment accompanied economic stagnation — the so-called stagflation.

Furthermore, there is little or no leeway in both Keynesian and monetarist modelling for the human response. It does not allow for changing levels of confidence in the users of a fiat currency backed by nothing tangible. Instead, monetarist policy recommendations fall in line with the neo-Keynesians, and that is to reflate like mad to prevent a recession, or even worse, a depression.

Putting to one side the errors in mainstream economic analysis, it is almost certain that central banks will do their utmost to stop broad money supply statistics from contracting. And while they trumpet their independence from their governments, they have a primary duty to keep them funded.

The fallout from rising interest rates will undoubtedly lead to higher government budget deficits. Tax revenues will decline, and welfare costs increase. And to the extent that the currency loses its value, there will be additional burdens from indexation of welfare costs and index-linked bonds.

The dangers from rising interest rates

We now turn to the consequences of rising interest rates on government funding. There seems little doubt that as interest rates move higher and debt funding costs with them, governments will find themselves unable to escape from a debt trap.

According to the Bank for International Settlements, core government debt in the advanced economies last September stood at 103.3% of GDP. In the United States, it was 112.6%, the UK 100.8%, and the Euro area 93.1%. Italy was 147.2%, Greece 178.8%, and Japan 228.3%. In all cases, total government debt ratios including non-core debt are even higher.[ii]

In 2010, respected economists (Carmen Reinhart and Kenneth Rogoff) concluded that at a government debt to GDP rate of over 90% it becomes exceedingly difficult for a nation to grow its way out of its debt burden. For many countries that Rubicon was crossed not long after. Now that the long-term trend of declining interest rates has been dramatically reversed Reinhart and Rogoff’s reasoning is about to be tested.

It is not yet widely understood that the contraction of bank credit is forcing lending rates higher, and that they are no longer under the control of monetary policy. The Fed appears to sense this, because it has switched its attention from trying to control short-term rates to suppressing Treasury yields for longer maturities by its Bank Term Funding Programme. The BTFP allows banks to submit Treasury and agency debt as collateral at redemption value with no haircut against a one-year loan from the Fed. Though the cost of funding is tied to higher rates than the coupons on existing debt, it allows a bank to buy the debt at a significant discount in the market. Against the funding cost, the profit is material, unless yields on Treasuries and agency debt are driven much lower by this arbitrage.

A bank profiting from the arrangement merely reinvests the accumulating loans from the Fed in short-term Treasury and other bills which currently have a yield similar to the cost of funding. From the US Treasury’s point of view, interest on new debt becomes materially reduced, and its debt maturity profile can be extended. From the Fed’s viewpoint, the mark-to-market crisis which collapsed Silicon Valley Bank is averted. But the BTFP is little more than a delaying tactic.

Banks allocating precious balance sheet space to this activity will be displacing depositors as a source of funding with Fed currency. In accordance with Basel 3’s net stable funding rules, larger depositors are increasingly likely to be turned away. Therefore, while the Fed is busy rigging the bond market, the market demand will be for deposit replacement: large deposits migrating into Treasury bills and the like.

This is part of a process whereby contracting commercial bank credit will be replaced by expanding central bank credit. All credit, whether between individuals or between individuals and their banks refers for its value to central bank credit for which it is exchangeable in the form of banknotes. It is the expansion of central bank credit which has the most impact on currency valuations in terms of goods and services.

Summary and conclusion

It seems extraordinary that the link between changes in the quantities of currency and credit, epitomised by deposit-based monetary statistics, and interest rates is being totally disregarded by governments, monetary authorities, and the entire investment establishment. But that is certainly the case today. And no one seems to expect much more than an increase of a few basis points in global interest rates before they subsequently decline.

Furthermore, rising prices measured by the CPI have caught the policy establishment unawares. Nor should we be surprised that the current situation continues to be analysed through a neo-Keynesian lens, when we know that it is Keynesian fallacies that has led us to the current crisis. The crisis is now of emerging debt traps not just for the US Government, but governments in nearly all the other major jurisdictions.

The Keynesian belief that government economic and monetary management is superior to free markets is set to be discredited by market reality, which can only be suppressed so far. It has led to savers being forced to accept deeply and further deepening negative yields on their bond investments. So far, they have been prepared to have their pockets picked by this means, but that cannot last much longer. When it becomes clear that inflation of prices is only a marker for currency debasement, and that this debasement can only continue, these deeply negative rates will no longer be available to subsidise profligate government spending.

The scale of an interest rate and bond market crisis for the dollar as the reserve currency appears to be severely underestimated. The sudden emergence of runaway price inflation las year has led to tentative comparisons being made between the current situation and the 1970s. But so far, there is little evidence that these comparisons are being taken seriously enough.

If they were, analysts would have to conclude that events in common with the 1970s, which led to high nominal bond yields and coupons in UK gilts exceeding 15%, are potentially far more destabilising today than they were then. That being so, the world is on the edge of a substantial bear market in financial assets driven by global bond prices normalising from the current deeply negative real rates to levels that truly reflect deteriorating government finances. All financial asset values will be undermined by this adjustment.

It is increasingly difficult to see a way out of these difficulties, and the Keynesian hope that economic growth will deal with the debt problem is simply naïve. In 2010, respected economists (Carmen Reinhart and Kenneth Rogoff) concluded that at a government debt to GDP rate of over 90% it becomes exceedingly difficult for a nation to grow its way out of its debt burden. With advanced economies averaging debt to GDP ratios significantly greater than 90%, there are debt traps for governments almost everywhere ready to be sprung.

In highly indebted fiat currency economies, there can only be one outcome: once one falls into a crisis, the others will follow. The cost in terms of accelerating currency debasements will lead to the destruction of public faith in their currencies as well. And with a government core debt ratio to GDP of 112.6%, the US with its dollars is up there with the others to be destabilised, being over-owned by foreigners already beginning to sell dollars and transmitting risk to all currencies that regard the dollar as its principal reserve currency.

It can only be concluded that the adjustment to market reality is likely to be more violent than anything seen in the 1970s.