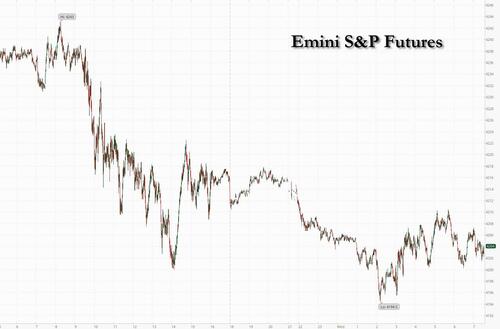

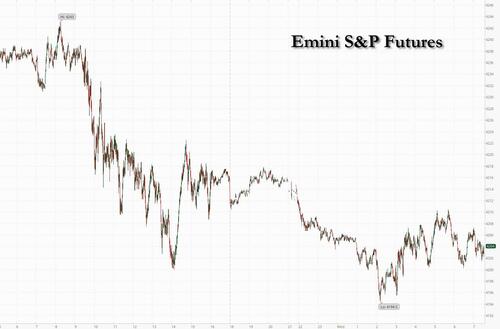

US equity futures are lower and flirting with 4,200 after another round of very ugly economic data out of China (where both mfg and service PMI missed) which dragged Asian markets lower (the HSEI entered a bear market) and slammed European stocks, while traders closely watched the debt ceiling situation after late last night the House Rule Committee advanced the bill which will now be submitted to a full vote in the House later today. That vote may not come until after market hours (~7pm) so headline risk remains.

At 7:30am ET, S&P futures were down 0.4% at 4,200 while Nasdaq futures dropped 0.2% as NVDA dipped back under $400 and exited the trillion dollar market cap club just as fast as it entered. Treasury yields slumped, dropping to 3.64%, down about 4bps, led by European rates as inflation came in weaker than expected in France and German states, prompting traders to trim bets on the path of future ECB rate hikes. The Bloomberg dollar index gained for the first time in four days whie oil extended losses with WTI crude oil futures dropping more than 2.5% after Tuesday’s 4.4% drop; bitcoin got hammered in overnight trading as usual.

In premarket trading, Nvidia dropped back below $400 and is no longer in the $1TN market cap club after soaring 31% over the past three sessions on optimism surrounding artificial intelligence, a trend that contributed to a blowout revenue forecast for the chipmaker last week. Cryptocurrency-exposed stocks also fell in US premarket trading Wednesday as Bitcoin snapped its longest streak since March. The largest cryptocurrency slid along with US equity futures as China’s economic woes reverberated beyond the country’s domestic markets. Here are some other notable premarket movers:

- HP Inc shares drop as much as 4.9% in US premarket trading on Wednesday, after the computer hardware firm reported lower-than- expected second-quarter revenue, highlighting the weakness in PC demand. However, the report suggests that the PC market may have bottomed, Bloomberg Intelligence writes.

- Hewlett Packard Enterprise shares fall as much as 8.4% in premarket trading on Wednesday, after second-quarter revenue and the current-quarter forecast from the information technology services company missed expectations. Analysts note that weakness in the company’s server business offset momentum at its Intelligent Edge unit.

- Ambarella shares drop 18% in US premarket trading after sales guidance from the maker of semiconductor devices fell short of expectations, prompting a downgrade from KeyBanc.

- Avis Budget rises 3.2% in premarket trading after Deutsche Bank upgrades the car rental firm to buy from hold, with its call “primarily valuation- centric.”.

- Chevron Corp. has no sell ratings left after JPMorgan Chase & Co. upgraded the US oil major, saying it is well positioned for a potential downturn.

- LL Flooring Holdings shares surge as much as 25% in premarket trading after founder Tom Sullivan makes another attempt to buy the home-improvement retailer.

- Twilio shares advance as much as 5.1% in premarket trading after The Information reported that activist investor Legion Partners had met with the communication software company’s board of directors and managers to suggest changes to the board.

- Faraday Future shares rise 6% in premarket trading on Wednesday, after the electric-vehicle maker launches an “AI-powered” variant of its FF 91 EV.

- Box’s fiscal 1Q results were solid, the margin outlook continues to improve and opportunities around AI are starting to come into focus for the software firm, analysts said. This is partially offset by a tougher macro picture, which appears to have got incrementally worse over the course of the quarter, they said. Box shares rose 3.4% in after-hours trading.

- Sportsman’s Warehouse dropped 7.8% in extended trading after the sporting-goods retailer’s projections for fiscal second-quarter net sales and adjusted EPS fell short of the average analyst estimates at the midpoint of the ranges.

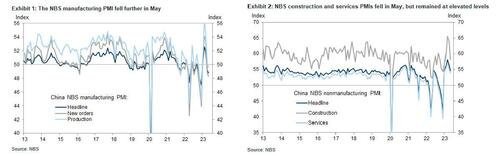

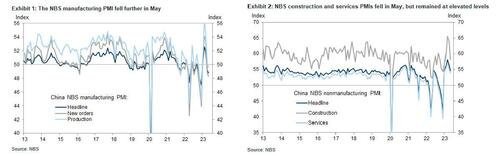

A major cause for the soggy trading sentiment overnight, was China’s NBS manufacturing PMI which fell to a lower-than-expected 48.8 in May from 49.2 in April, below expectations of 49.5, with output sub-index falling the most followed by new orders sub-index. The NBS non-manufacturing PMI moderated to 54.5 in May from 56.4 in April, and also below the 55.2 median estimate, showing ongoing recovery in both the construction and services sectors but at a slower pace. Some more details:

- The China NBS purchasing managers’ indexes (PMIs) survey suggested manufacturing activity contracted in May. The NBS manufacturing PMI headline index fell to 48.8 in May from 49.2 in April. Among five major sub-indexes, the output sub-index fell to 49.6 from 50.2, the new orders sub-index decreased to 48.3 from 48.8 and the employment sub-index declined to 48.4 from 48.8. The suppliers’ delivery times sub-index edged up to 50.5 in May from 50.3 in April, suggesting faster supplier deliveries. The NBS commented that the drop in the May PMI reading was linked to insufficient demand (especially in chemical fibers, non-metallic mineral products and ferrous metal processing industries).

- The official non-manufacturing PMI (comprised of the services and construction sectors) moderated to 54.5 in May (vs. 56.4 in April), which was still solid but lower than market expectations, suggesting continued recovery in construction and services sectors but at a slower sequential pace. The services PMI slowed to 53.8 (vs. 55.1 in April). According to the survey, the PMIs of service industries such as airlines, ship and road transport services and telecommunication were above 60 while the PMI in property sector was below 50 in May. The construction PMI moderated to 58.2 in May (vs.63.9 in April) but remained elevated. The NBS noted that construction enterprises were optimistic about the outlook of construction sector.

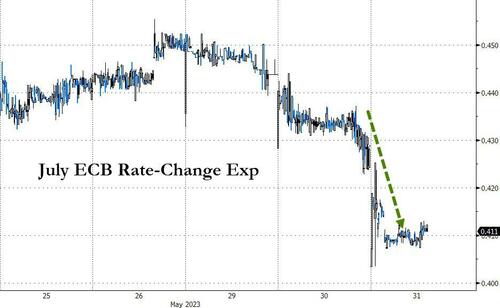

China’s soft manufacturing data added to concerns about the outlook for global economic growth at a time when central banks are still in tightening mode. Meanwhile, weak price data from Europe on Wednesday prompted traders to curb bets on European Central Bank rate hikes, though worries remain about the region’s prospects as demand from its largest trading partner falters. Hawkish comments from Federal Reserve officials added mix of factors traders have to consider.

“We’re facing quite a lot of headwinds: firstly, the China growth story, clearly that’s been a major disappointment. On top of that, there’s a risk of a US recession, and for the euro region, there’s a likelihood that they’re facing stagnation,” Jane Foley, head of FX strategy at Rabobank, said on Bloomberg TV. “So you’ve got a pretty disappointing outlook for growth, not an environment where you really want to be piling en masse into high-risk assets, and therefore the dollar is likely to do well.” Meanwhile, Fedspeak remains hawkish with bonds pricing in a 66% chance for a hike at the June meeting.

In Europe, the Stoxx Europe 600 index headed for its lowest close since March, with China-exposed luxury-goods makers LVMH and Richemont among the biggest laggards, while Swedish landlord SBB plunged to an all-time low after its CEO said his holding company had deferred interest payments on a loan. Software and telecommunications stocks advanced, led by Capgemini SE after the Paris-based firm said it expanded a partnership with Google Cloud in data analytics and artificial intelligence. Here are some other notable European movers:

- B&M gains as much as 6.6% after the UK retailer reported FY results that met market expectations. The results are encouraging, given the current macroeconomic environment, Shore Capital said

- JD Wetherspoon shares jump as much as 6.3%, with Mitchells & Butlers up as much as 3.2%, after HSBC said the UK pub and restaurant sector still looks cheap despite a recent rally

- Huuuge gains as much as 6.1% after the Warsaw-listed mobile games developer announced a $150m share buyback priced at a premium to Tuesday’s close following a first-quarter earnings beat

- LVMH shares fall drop as much as 2.3% on Wednesday, as concerns over China’s economy pummeled luxury stocks exposed to the world’s second economy, with Kering and Hermes both falling 2.7%

- Entain shares decline as much as 3.8% after the UK-based gambling company said an HMRC investigation will likely lead to a “substantial financial penalty”

- SBB shares fall as much as 11%, reaching both all-time intraday lows and on track for their worst close on record, after the embattled landlord’s CEO said his holding company has deferred interest payments

- Impax Asset Management shares sink as much as 11%, hitting the lowest since January, with analysts flagging a hit to profits from hiring by the ESG fund manager

- Heineken shares fall as much as 3% after Femsa’s offering to sell more of its shares in the Dutch brewer at a ~4% discount to Tuesday’s close

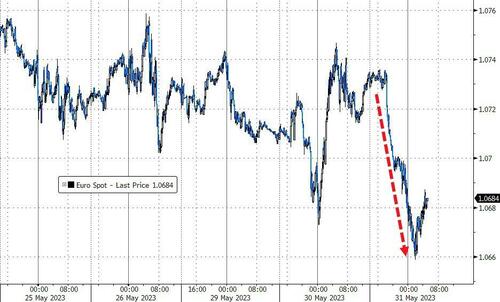

The euro slumped to a two-month through against the dollar after French inflation eased more than anticipated, reaching its lowest level in a year. Data from Germany’s states also signaled inflation may be falling more quickly than expected in the region’s biggest economy, prompting traders to trim bets on future European Central Bank interest-rate increases. European bonds rallied, with the German 10-year yield down about 9 basis points.

“There’s a fairly consistent line with the euro-area CPI numbers: it is coming down,” Paul Donovan, chief economist at UBS Global Wealth Management, said on Bloomberg TV. “This whole idea of stickiness, of inflation sticking around, is really being blown out of the water. Interestingly, we’re also getting this confirmed in the regional data in the US.”

Earlier in the session, Asian equities fell, led by shares listed in Hong Kong, as weaker-than-expected manufacturing data showed the Chinese economy continues to struggle. The MSCI Asia Pacific Index dropped as much as 1.4%, set for its biggest decline since March 14, with a gauge of Chinese stocks in Hong Kong as well as the city’s benchmark index headed for bear markets. Data Wednesday showed China’s manufacturing activity contracted for a second month in May, offering the latest proof that the post-Covid recovery is stalling. Broad weakness also pulled Korean stocks lower, after they briefly headed for a bull market amid foreign demand for the nation’s chipmakers.

“Cyclically, the recovery in China is on a much weaker footing,” Timothy Moe, chief Asia Pacific equity strategist at Goldman Sachs, told Bloomberg Television. For Korea, investors are looking past the earnings trough expected this year to a rebound in the chip sector in 2024, he said. Declines were broad-based, with gauges in Japan, Australia and Thailand also falling. An energy sub-gauge dropped the most as crude prices fell. The broader MSCI Asia gauge is down about 7% from a peak in January as China’s faltering economic recovery and worries about a recession in the US damp sentiment.

- The Hang Seng and Shanghai Comp. declined with Hong Kong dragged lower by notable weakness in the local blue-chip tech stocks and following disappointing Manufacturing and Non-Manufacturing PMI data in which the former printed at a second consecutive month in contraction territory and its weakest reading YTD.

- Japan’s Nikkei 225 was pressured by data releases in which Industrial Production printed a surprise contraction and Retail Sales missed forecasts, with early jitters also from North Korea’s failed satellite launch.

- Australia’s ASX 200 was led lower by underperformance in the commodity-related sectors with energy the worst hit after oil prices slumped by more than 4% yesterday and with the mood not helped by firmer-than-expected monthly CPI.

- Indian stocks posted their sharpest drop in two weeks on Wednesday as most Asian markets declined after China reported weaker-than-expected manufacturing data. The S&P BSE Sensex fell 0.6% to 62,622.24 as of 03:45 p.m. in Mumbai, while the NSE Nifty 50 Index declined 0.5%. The drop was their biggest decline since May 17. Reliance Industries contributed the most to the Sensex’s decline, decreasing 1.8%. Out of 30 shares in the Sensex index, 11 rose, while 19 fell.

In FX, the Bloomberg Dollar Spot Index rises 0.3% with the largest gains for the greenback seen against the Norwegian krone and kiwi. EUR/USD fell as much as 0.7% to 1.0662, the lowest since March 20, as euro-area bond yields dropped; German two- and five-year bond yields fell as much as 10 basis points before paring the move; 10-year yield is down 9bps to 2.25%.

- The Norwegian krone underperformed its Group-of-10 peers for a second day, down 0.8% versus the dollar and 0.2% against the euro

- The Australian and New Zealand dollars fell after a contraction in China’s manufacturing activity, which brought weak long stops onto the radar, according to an Asia- based FX trader

In rates, treasuries extended this week’s gains, with yields richer by ~4bp across the curve, led by bunds: the German 10-year yields are down 9bps after regional prints point to soft German CPI due at 8am New York time, while French inflation slowed more than expected. US session includes four Fed speakers and JOLTS job openings. Treasury gains are led by belly of the curve, tightening 2s5s30s fly by 1.5bp on the day after almost 6bp of tightening Tuesday; 10-year yields around 3.65% with bunds outperforming and trading 5bp richer in the sector. IG issuance slate includes Hong Kong 3Y/5Y/10Y; five deals priced $11.3b Tuesday, with final order books said to be more than four times covered. US economic data slate includes May MNI Chicago PMI (9:45am), April JOLTS job openings (10am) and May Dallas Fed services activity (10:30am)

In commodities, crude futures decline with WTI falling 1.2% to trade below $69. Spot gold is little changed around $1,958. Bitcoin drops 2.4%, sliding below $27,000.

Looking to the day ahead now, and data releases include the May CPI releases from Germany, France and Italy, along with German unemployment for May. In the US there’s also the JOLTS job openings for April, as well as the MNI Chicago PMI for May. From central banks, we’ll hear from the Fed’s Collins, Bowman, Harker and Jefferson, the ECB’s Villeroy and Visco, and the BoE’s Mann. In addition, the Fed will release their Beige Book, and the ECB will release their Financial Stability Review.

Market Snapshot

- S&P 500 futures down 0.3% to 4,203.50

- MXAP down 1.3% to 158.39

- MXAPJ down 1.3% to 501.13

- Nikkei down 1.4% to 30,887.88

- Topix down 1.3% to 2,130.63

- Hang Seng Index down 1.9% to 18,234.27

- Shanghai Composite down 0.6% to 3,204.56

- Sensex down 0.7% to 62,521.87

- Australia S&P/ASX 200 down 1.6% to 7,091.31

- Kospi down 0.3% to 2,577.12

- STOXX Europe 600 down 0.3% to 455.30

- German 10Y yield little changed at 2.26%

- Euro down 0.6% to $1.0670

- Brent Futures down 0.6% to $73.08/bbl

- Gold spot down 0.1% to $1,958.09

- U.S. Dollar Index up 0.36% to 104.54

Top Overnight News from Bloomberg

- China’s economic recovery weakened in May as manufacturing activity continued to slump, prompting investors to dump stocks and call for more stimulus measures to boost growth

- The debt- limit deal struck by President Joe Biden and Speaker Kevin McCarthy is heading toward a vote Wednesday in the House of Representatives after clearing a crucial procedural hurdle with just days remaining to avoid a US default

- French inflation eased to its lowest level in a year, though Italy overshot analyst expectations, underlining the challenge for the European Central Bank as it nears the end of its unprecedented campaign of interest-rate hikes.

- Japan’s biggest life insurers have ramped up their use of longer-dated currency hedges to a record to escape sky-high costs, suggesting they’re buying more riskier securities that benefit from protection.

A more detailed look at global markets corutesy of Newsquawk

APAC stocks were mostly lower following the mixed handover from Wall St where sentiment was clouded as hardliners voiced opposition to the debt ceiling bill, while risk appetite was subdued overnight as participants digested a slew of data releases heading into month-end including disappointing Chinese official PMIs. ASX 200 was led lower by underperformance in the commodity-related sectors with energy the worst hit after oil prices slumped by more than 4% yesterday and with the mood not helped by firmer-than-expected monthly CPI. Nikkei 225 was pressured by data releases in which Industrial Production printed a surprise contraction and Retail Sales missed forecasts, with early jitters also from North Korea’s failed satellite launch. Hang Seng and Shanghai Comp. declined with Hong Kong dragged lower by notable weakness in the local blue-chip tech stocks and following disappointing Manufacturing and Non-Manufacturing PMI data in which the former printed at a second consecutive month in contraction territory and its weakest reading YTD.

Top Asian News

- US imposed sanctions on Chinese and Mexican entities to combat the opioid crisis, according to FT.

- China’s NBS said the economic activity level in China declined slightly in May which indicates the need to strengthen the foundation for recovery and development, according to Reuters.

- Japan’s METI said the decline in semiconductors and flat panel manufacturing equipment were the main contributors pushing down Japan’s industrial output in April and noted that official business sentiment remains bearish as overseas economies continue to weaken.

- RBA Governor Lowe said they are in data-dependent mode and there is not a single variable that drives their decisions, while he added that monetary policy is in a restrictive environment and that they are on a narrow path with success not guaranteed

European bourses are mostly in the red, Euro Stoxx 50 -0.4%, following the soft APAC handover and despite the generally softer inflation data from European nations thus far. Sectors are lower across the board, with Luxury names lagging after the weak Chinese PMI figures. Stateside, futures are all in the red though only modestly so, ES -0.1%, with the NQ in-line with broader action today and NVIDIA pulling back a touch from its recent upside, -1.5% in the pre-market.

Top European News

- Netherlands Senate approved a wide-ranging reform of the Dutch pension system, according to Reuters.

- ECB’s Muller says core inflation shows no signs of slowing yet, very likely that the ECB will hike by 25bp more than once; probably too optimistic to see ECB rate cut in early 2024.

- ECB’s de Guindos says we have to adjust liquidity requirements to modern world; inflation data today and yesterday was positive; victory over inflation is not there but the trajectory is correct; markets are absorbing QT smoothly and positively.

- ECB’s Visco says longer-term inflation expectations remain in line with the definition of price stability; now that rates are in restrictive territory, must proceed with the correct degree of graduality.

- ECB Financial Stability Review: says financial stability outlook remains fragile.

- Spain’s People’s Party (PP) leader says they will reduce public debt if they win the snap election and will reduce electric bill for small consumers and certain companies.

FX

- Yuan’s post-PMI pain revives Greenback fortunes with hawkish Fed’s Mester also boosting the Buck; USD/CNY and USD/CNH top 7.1100 and 7.1300 respectively, while DXY sets new w-t-d peak at 104.630.

- Aussie retreats through 0.6500 irrespective of stronger than forecast CPI, but AUD/NZD remains elevated on RBA rate hike expectations.

- Euro undermined by mostly weaker than expected EZ inflation data, as EUR/USD eyes Fib support just above 1.0650.

- Franc hit by feeble Swiss retail sales and Pound weighed down by decline in Lloyds UK business barometer; USD/CNF above 0.9100 and Cable probing 1.2350

- Yen treading water near 140.00 amidst softer Treasury yields and debt ceiling deal jitters.

- PBoC set USD/CNY mid-point at 7.0821 vs exp. 7.0764 (prev. 7.0818)

Fixed Income

- Debt elevated approaching month end with added impetus via weak Chinese PMIs and mostly cooler than forecast EZ inflation data.

- Bunds, Gilts and T-note all hovering just below best levels between 136.39-135.31, 96.97-37 and 114-14+/00 bounds.

- 2029 German supply reasonably well sponsored with collapse in crude and other commodities supporting the disinflation narrative.

- Germany sells EUR 2.504bln vs exp. EUR 3.00bln 2.10% 2029 Bund: b/c 2.30x (prev. 2.50x), average yield 2.23% (prev. 2.22%) & retention 16.53% (prev. 15.00%).

Commodities

- Crude benchmarks continue to slip following Tuesday’s marked pressure and subdued settlement. Renewed pressure comes after soft Chinese data, broader risk-aversion and ahead of the June 4th OPEC+.

- Currently, WTI Jul and Brent Aug are towards the lower end of respective USD 68.60-69.69/bbl and USD 72.68-73.95/bbl parameters.

- Base metals are dented following the mentioned Chinese data while spot gold is proving relatively resilient to the firmer USD and is only incrementally softer, given the broader underlying tone and its haven status.

- Iraqi cabinet approved USD 417mln for the construction of a third offshore export pipeline.

- Norway Police are responding to report of a gas leak at Equinor’s (EQNR NO) Melkoeya LNG facility.

- Hungary asked the EU to extend import restrictions on grains from Ukraine for five eastern-European states until at least end-2023.

- EU Executive VP Dombrovskis says the EU-US steel and raw material deals are both making progress.

Geopolitics

- A fire broke out at an oil refinery in Russia which was likely due to a falling drone, according to RIA citing the local Governor; subsequently, drone crashed on Ilsky oil refinery in Russia’s south, no damages to infrastructure and no casualties, according to RIA citing local taskforce

- South Korean military said North Korea fired a space satellite, while Japan’s Defence Ministry said North Korea fired what could be a ballistic missile and Japan’s government issued a shelter-in-place order for residents in Okinawa, according to Reuters. Japan’s government later stated that the missile did not fly into Japanese territory and it lifted the evacuation warning, while South Korea said a previous warning by Seoul city was an error. Furthermore, North Korea said an accident occurred during its satellite launch and that it will verify grave defects, as well as conduct a second launch soon, while South Korea’s military said the North Korean projectile was more likely to be a space vehicle rather than a missile.

- US, Japan and South Korea strongly condemned North Korea’s launch, while South Korea said the launch was a serious provocation and a grave violation of UN resolutions, according to Reuters.

- US military said a Chinese fighter pilot performed an unnecessary aggressive manoeuvre during an intercept of a US jet over the South China Sea on May 26th, in which it flew directly in front of the nose of a US air force jet, according to a statement.

- US President Biden’s senior Middle East adviser discussed with Oman a possible outreach to Iran on the nuclear program earlier this month, according to sources cited by Axios.

US Event Calendar

- 07:00: May MBA Mortgage Applications -3.7%, prior -4.6%

- 09:45: May MNI Chicago PMI, est. 47.2, prior 48.6

- 10:00: April JOLTs Job Openings, est. 9.4m, prior 9.59m

- 10:30: May Dallas Fed Services Activity, prior -14.4

- 14:00: Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

The AI hype continued to help push the NASDAQ (+0.32%) to another YTD high yesterday, even if the mood was more subdued elsewhere. For instance, a sizeable majority (296/502) of the S&P 500 (unchanged) actually fell on the day, with the index only treading water thanks to tech. Nvidia climbed +2.99% to a market cap of $991bn, tantalisingly close to the trillion mark which it’s crossed intraday. Otherwise, the weak economic backdrop meant commodity aggregates fell to their lowest levels in nearly two years. And on top of that, sovereign bonds staged a big rally as concern about the outlook resurfaced as the debt ceiling distortions started to wane. So despite some of the headline gains, the last 24 hours have seen several warning lights under the surface, including multiple recession indicators that are flashing with growing alarm. The highlight today might be German, French and Italian CPI after Spain’s surprise fall yesterday (see below).

As a minimum this will be the highlight until the debt ceiling votes comes through. We’re expecting that the House of Representatives to be voting on the deal agreed by President Biden and Speaker McCarthy tonight. That deal is formally called the Fiscal Responsibility Act, and yesterday saw it pass through the House Rules Committee despite the opposition of two Republican members and all Democrats to pass 7-6, meaning it can now be voted on by the full chamber today.

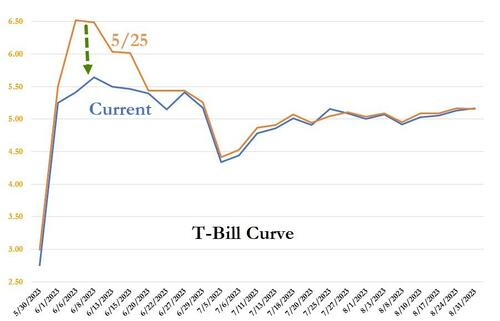

In terms of the prospects for today, investors seem relatively relaxed that this is going to pass. There has been reports overnight that over 150 GOP members would vote to approve the bill, with the balance needed to pass the House coming from Democrats. So things seem on track. Indeed, one of the good news stories from yesterday was that T-bill yields around the X-date fell back to more normal levels again, with the bill expiring June 8th seeing yields fall -75bps to 5.05, after having briefly traded with a 7 handle last week. Also the 1M US Treasury yield is trading at the same level of swaps for the first time since early May, and at the same time 5yr CDS spreads for the US dropped back to their lowest level since March, which shows how fears of default have continued to ebb over recent days. Bear in mind that this deal has the backing of the Biden Administration as well as the Republican leadership in the House and Senate, even if a minority of members have already said they’ll vote against it.

Of course, the event that’s still scars a lot of people is what happened with the first TARP vote in September 2008, which for younger readers was the $700bn bailout package proposed by the Bush Administration at the height of the GFC. Much like today’s deal, it also had the support of leaders in both parties, but it was rejected in the House on its first vote by a 228-205 margin, sparking what was then the biggest one-day decline in the S&P 500 (-8.79%) since Black Monday in 1987. Now clearly we’re not at the height of a once-in-a-generation financial crisis today, but markets have been taken by surprise on these votes before, even if all might look OK for the time being.

Against that backdrop, there was a big rally among sovereign bonds yesterday, with yields on 10yr Treasuries falling -10.8bps to 3.69% (3.68% in Asia). And similarly in Europe, yields on 10yr bunds (-9.2bps), OATs (-9.8bps) and BTPs (-12.6bps) all moved notably lower for a second day. One factor supporting that was good news on the inflation side, since the Spanish CPI print for May came in at just +2.9% using the EU-harmonised measure (vs. +3.3% expected), which was the slowest it’s been since July 2021. Now of course that’s just one country, but it often attracts outsize interest since it’s one of the first to report inflation each month, so is seen as a potential leading indicator for what will happen elsewhere. We will find out more from the EU big-3 CPI prints today. Another supportive factor was that the relentless commodity decline of recent months showed no signs of abating, leaving Bloomberg’s Commodity Spot Index (-1.75%) at its lowest closing level in just over 22 months.

But on top of that, we also had another batch of weak economic data over the last 24 hours, which helped raise concern about the outlook heading into H2. For instance in the US, the Dallas Fed’s manufacturing index fell to -29.1 (vs. -18.0 expected), which is a new low for this cycle. And over in Europe, the European Commission’s economic sentiment indicator for May fell to a 6-month low of 96.5 (vs. 98.8 expected). All that came as various recession indicators continued to worsen, with the 2s10s Treasury yield curve (-4.5bps) closing at a post-SVB low of -76.8bps.

For equities, as we discussed at the top, tech led the way with the FANG+ Index (+1.54%) up to a new YTD high that now leaves its gains for 2023 at a massive +62.68%. It was a similar story for the NASDAQ (+0.32%), which also hit a new YTD high of +24.37%. However, elsewhere the story was mostly one of declines, with the equal-weighted S&P 500 -0.20%. Europe’s STOXX 600 shed -0.92%.

Asian equity markets are trading sharply lower this morning as disappointing factory activity in China is denting sentiment across the region. As I type, the Hang Seng (-2.33%) is leading losses, tumbling to a new low for 2023 while the mainland Chinese markets are also sliding with the CSI (-1.09%) and the Shanghai Composite (-0.73%) trading in the red as the economic recovery in the world’s second biggest economy is losing steam (more below). Elsewhere, the Nikkei (-1.12%) is also trading lower with the KOSPI (-0.20%) reversing earlier gains. Outside of Asia, US equity futures are slightly negative with those on the S&P 500 (-0.23%) and NASDAQ 100 (-0.13%) edging lower.

Coming back to China, the official manufacturing PMI came in at 48.8 (v/s 49.5 expected), the lowest reading since December 2022 and compared to 49.2 in April, rekindling concerns over a slowing Chinese economy. Additionally, the service sector activity expanded at the slowest pace in four months in May, with the official non-manufacturing PMI falling to 54.5 from 56.4 in April. The downbeat PMI surveys have again bolstered expectations that the policymakers may need to roll out stimulus measures to stimulate growth.

In Japan, retail sales surprisingly contracted -1.2% m/m in April (v/s +0.5% expected), following a downwardly revised increase of +0.3%. Separately, Japan’s industrial production also unexpectedly shrank -0.4% m/m in April (v/s +1.4% anticipated) as against last month’s +1.1% increase. Elsewhere, Australia’s inflation accelerated to +6.8% y/y in April (v/s +6.4% expected; +6.3% in March), mainly led by a jump in energy prices, thus increasing pressure on the Reserve Bank of Australia (RBA) to raise interest rates again when they meet next Tuesday.

Finally, there were a few other US data releases yesterday, such as the Conference Board’s consumer confidence measure. That fell to 102.3 in May (vs. 99.0 expected), but from an upwardly revised 103.7 in April. Nevertheless, there were other signs of softness, and the share describing jobs as plentiful fell to a 2-year low of 43.5%. Otherwise, we had some more backward-looking housing indicators, with the S&P CoreLogic Case-Shiller 20-City home index up by +0.45% in March (vs. unch expected), marking its strongest monthly growth since May 2022.

To the day ahead now, and data releases include the May CPI releases from Germany, France and Italy, along with German unemployment for May. In the US there’s also the JOLTS job openings for April, as well as the MNI Chicago PMI for May. From central banks, we’ll hear from the Fed’s Collins, Bowman, Harker and Jefferson, the ECB’s Villeroy and Visco, and the BoE’s Mann. In addition, the Fed will release their Beige Book, and the ECB will release their Financial Stability Review.

BREAKING: House Freedom Caucus leaves open possibility of filing a motion to vacate the chair if Speaker McCarthy pushes through the debt deal

BREAKING: House Freedom Caucus leaves open possibility of filing a motion to vacate the chair if Speaker McCarthy pushes through the debt deal ProudArmyBrat (@leslibless)

ProudArmyBrat (@leslibless)  NO full elimination of 87,000 IRS agents

NO full elimination of 87,000 IRS agents