Like a good neighbor, State Farm Insurance is warning Californians to stop living and building in high wildfire-risk zones. That is the upshot of a press release in which the insurer states that the company, as a “provider of homeowners insurance in California, will cease accepting new applications including all business and personal lines property and casualty insurance, effective May 27, 2023.” State Farm is taking this step largely because the California Department of Insurance’s system of price controls does not allow it and other insurance companies to charge premiums commensurate with the potential losses they face.

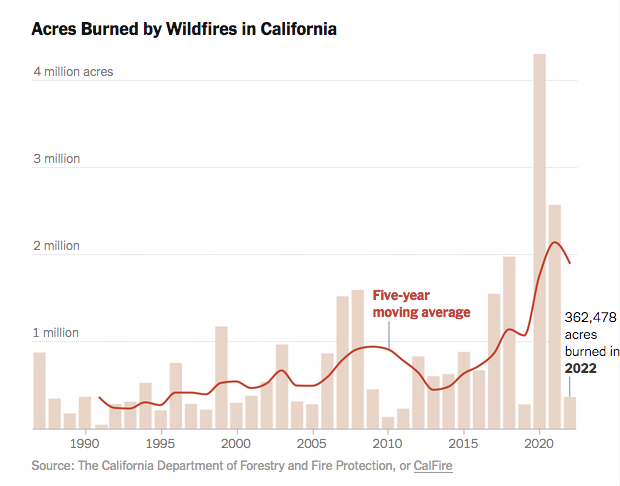

Consequently, State Farm is no longer willing to sell new homeowner insurance policies because the company calculates that it cannot cover potential losses in the face of increasing wildfire risks, fast-rising rebuilding costs, and steep increases in reinsurance rates. Higher rebuilding costs boost the values of the houses and businesses that companies currently insure.

Reinsurance is also a big factor in State Farm’s decision. As part of its system of insurance price controls, the California Department of Insurance does not allow insurance companies to include reinsurance costs in their premiums. Reinsurance is basically “insurance of insurance companies” in which multiple insurance companies share risk by purchasing insurance policies from other insurers to limit their own total loss in case of disaster. And disaster did hit in the Golden State. The insurance companies paid out $13.2 billion and $11.4 billion respectively in 2017 and 2018 for fire damage claims resulting from those two catastrophic wildfire seasons. More recently, reinsurers have increased their rates to take into account large losses stemming from events like Hurricane Ian in Florida and Russia’s invasion of Ukraine.

So, State Farm is declining to write new insurance policies in California “now to improve the company’s financial strength.”

One additional complication is that private insurance companies are forced to contribute to the state’s backstop Fair Access to Insurance Requirements (FAIR) plan. The FAIR plan is basically a high-risk insurance pool that offers last-resort, bare-bones coverage, chiefly for fire losses, to property owners who cannot obtain a policy in the regular market. It was established in 1968, in the wake of urban riots and brush fires, when the California Legislature required insurance companies offering property policies in the state to create and contribute to the plan. It is not taxpayer-financed, and plan premiums are statutorily required to be actuarially sound.

As private insurers increasingly refuse to renew policies, more California homeowners are turning to FAIR plan policies. FAIR plan premiums have been too low to cover the losses its customers have incurred with the result that the plan is $332 million in debt. In other words, the plan is not actuarially sound. This means that the California Department of Insurance is likely to impose a special assessment on private insurers to make up for the FAIR plan’s losses. Private insurers cannot pass along the costs of the assessment to their policyholders. As California’s largest property insurer, State Farm would be on the hook for the largest share of any such special assessment. The way to lower or eliminate the amount that a private insurer could be assessed is to limit the number of policies it sells or simply leave the market altogether.

Insurance premiums, like all prices, are signals to consumers. In this case, higher premiums indicate the existence of increased risks. Because of the California Department of Insurance’s price controls, homeowners have been deprived of market signals that could have steered them to building in less dangerous locales or encouraged them to build more fire-resistant homes. As California homeowners are about to find out, government-imposed market distortions cannot be maintained forever.

The post California Regulations Prevent Insurers From Accurately Pricing Wildfire Risk, so Now They're Fleeing the State appeared first on Reason.com.

from Latest https://ift.tt/A7ojr9l

via IFTTT