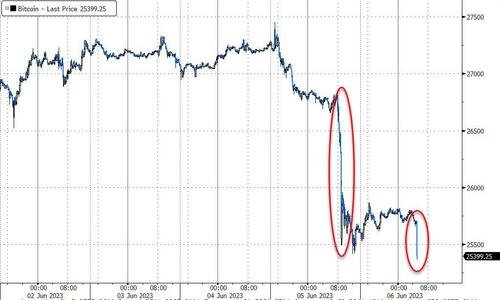

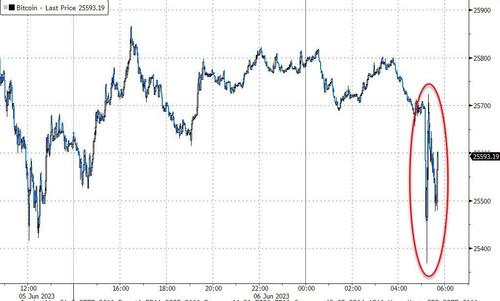

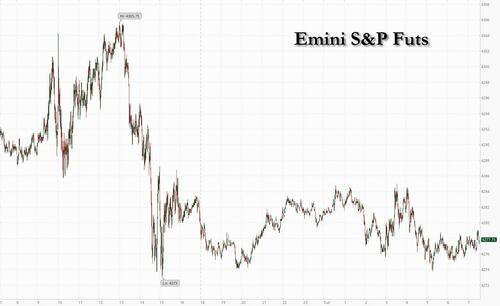

US equity futures are flat, bond yields are lower, the dollar is higher, and commodities (ex-Ags) are weaker as the excitement over the Saudi 1mmb/d production cut fizzles and as hedge fund shorts once again take the upper hand. Ags are higher led by wheat on headlines from Ukraine, where a dam was damaged in an explosion.

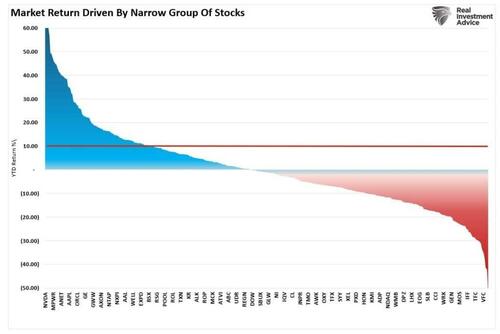

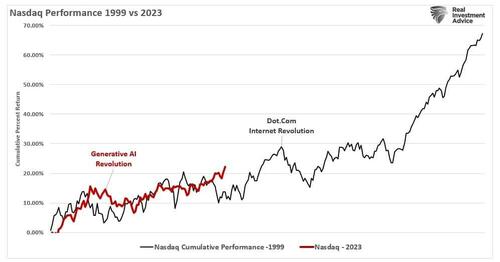

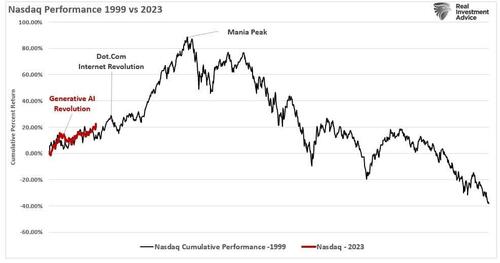

As of 7:45am ET, S&P futures were unchanged with the Nasdaq fractionally in the red as well, with Apple down 0.4% in premarket trading on concern the ludicrous price ($3500) of its much-anticipated mixed-reality headset will crater demand. European semiconductor firms slid after Taiwan Semiconductor — the main chipmaker to Apple — said capital spending will be at the lower end of its guidance range. Overall, there appears to be a mild risk-off tone pre-market, With the S&P 500 on the edge of a new bull market, there’s a sense among traders that markets have run up too fast on the hype for artificial intelligence. The balance of the week is light on macro data points so markets may trade in a tight range into CPI/Fed next week.

In premarket trading, tech Mega caps were mixed pre-mkt as investors digest AAPL’s developer day. AAPL is down 0.7% in early trading after the iPhone maker launched its much- anticipated mixed-reality headset at an eye-popping price of $3,499. While analysts were optimistic about the product and technology, they acknowledged that the price point was high and that it would limit the number of shipments in the near- term. Chevron fell 1%, while declines in Shell and BP weighed on Europe’s main stock benchmark after crude gave up all its gains spurred by news of Saudi Arabia’s supply cut. Other notable premarket movers:

- Mobileye shares declined 5.2% in premarket trading after chipmaker Intel said it will sell part of its holdings in the Israeli automated driving technology maker.

- Unity Software shares jump as much as 5.7% in premarket trading, extending Monday’s 17% gain after Apple said it’s working with the video-game engine maker for its new Vision Pro headset.

- Blue Bird dropped 8.5% in postmarket trading Monday after holders Coliseum Capital and American Securities offered 5 million shares in the school-bus maker via BofA Securities, Barclays, Jefferies, BMO Capital Markets and Piper Sandler.

- HealthEquity Inc. (HQY US) gained 6% postmarket after the healthcare savings account provider boosted its year profit and revenue forecast. First quarter profit and sales topped estimates.

“Our stance towards equities is a cautious one,” said Steven Bell, chief economist for EMEA at Columbia Threadneedle Investments, noting the asset class doesn’t look cheap and earnings growth forecasts look too optimistic. “We don’t expect a dramatic decline, but bonds look more attractive on a relative basis.”

European stocks slipped into the session as energy, telecom and autos underperform. Euro Stoxx 50 falls 0.4%. Stoxx 600 drops 0.1%, FTSE MIB lags regionals, sliding 0.6%. Meanwhile, the euro weakened and German bonds gained Tuesday after the European Central Bank said euro-area consumer inflation expectations eased significantly in April. Here are the most notable premarket movers:

- Idorsia shares soared as much as 21%, the most on record, before paring the gain. The Swiss biotech started exclusive negotiations with an undisclosed party regarding its Asia Pacific businesses.

- Banca Monte dei Paschi gained as much as 3.6% after la Repubblica reported that BPER Banca could be a possible suitor for the lender, citing unidentified sources.

- BAT shares fluctuated before trading up 0.3% after the company reaffirmed its full-year revenue forecast in constant currency. The unchanged outlook is “broadly reassuring” given the disappointing US performance, according to Investec.

- Chemring shares rose as much as 10.6% after the defense company reported half-year results and kept its forecasts for 2023 unchanged. Jefferies said that the update was strong and shows more organic revenue growth potential.

- ASML shares slumped as much as 1.8% after TSMC said its capex budget this year will be near the lower end of its guidance range, denting hopes that a recent boom in demand for artificial intelligence computing chips would encourage chipmakers to boost capacity. Other European semiconductor equipment makers also fell.

- Boohoo shares dropped as much as 2.7% after the online fast-fashion retailer was downgraded to neutral from outperform at Davy. The broker said Boohoo is better placed to “survive” Shein than Asos, but now has a smaller comparative advantage.

- Shares of Swiss utility BKW fell as much as 12%, the most on record, after UBS cut its recommendation to sell from buy, citing falling energy prices and the stock’s recent rally.

- Deutsche Pfandbriefbank fell as much as 5.5% after Citi downgraded the stock to sell and moved its price target to a Street-low of €6.1, based on the German lender’s real estate exposure.

Earlier in the session, Asian stocks rose to a three-month high, helped by a rally in Chinese developers. There are signs that Beijing is taking steps to bolster the economy, with authorities asking some of the biggest banks to lower their deposit rates. Elsewhere, stocks traded mixed with price action rangebound following on from the subdued performance stateside where participants ‘sold the news’ following Apple’s headset announcement and with sentiment clouded by weak data releases.

- Hang Seng and Shanghai Comp. were somewhat varied with the former boosted by strength in property names, although the mainland was less decisive and lagged amid mixed US-China rhetoric.

- Nikkei 225 was initially pressured after disappointing Household Spending and Labour Earnings data which briefly dragged the index beneath the psychological 32,000 level where it then found support and staged a recovery amid dip buying.

- Australia’s ASX 200 was led lower by underperformance in the consumer-related sectors and top-weighted financial industry, with losses later exacerbated after the RBA delivered a surprise 25bps rate hike to lift the Cash Rate Target to 4.10% and it also kept the door open for further policy tightening.

- Indian stocks ended little changed on Tuesday, while gauges of small- and mid-sized companies extended their record runs as investors looked to rotate allocations following the end of the earnings season. The S&P BSE Sensex Index was little changed as was the NSE Nifty 50 Index. BSE’s small and midcap indexes rallied for the 12th consecutive session and scaled new records despite momentum being overbought based on the 14-day RSI. The key gauges traded lower for a large part of the session on Tuesday before erasing losses in the final 30 minutes of trade, helped by a recovery in banking stocks. The benchmark Sensex has traded close to its previous peak over the last few sessions but so far has failed to climb to a new record. The Sensex and Nifty have risen about 3.2% and 2.7% this year but trail the 8% rally in small and mid-cap gauges.

Elsewhere, Australia unexpectedly hiked on Tuesday and kept the door open to further increases, sparking a rally in the country’s currency.

In FX, the Bloomberg Dollar Spot Index was up near session highs, recovering from early weakness; AUD and JPY are the strongest performers in G-10 FX, NOK and GBP underperform. The EUR/USD dropped -0.2% after after the latest ECB survey shows consumers’ inflation expectations fell significantly in April. AUD/USD leads gains, rallying as much as 1% after the RBA increased its cash rate by a quarter percentage point and said further tightening may be needed. Only 10 of 30 economists surveyed by Bloomberg predicted the rate hike

In rates, German bonds outperform Treasuries and gilts across the curve as yields drop, led by short-end bunds. Treasuries are slightly richer across the curve, following wider gains in bunds after an ECB survey shows consumers’ inflation expectations fell significantly in April. Yields are richer by 1bp-2bp across the curve with intermediates outperforming slightly, steepening 5s30s by 1bp on the day; 10- year yields around 3.66%, richer by 2bp vs Monday’s close with bunds outperforming by 3.5bp in the sector. The two-year Treasury yield slips 1bps to 4.45%, 10-year yield down 2bps to 3.66%, slightly steepening the 2-year/10-year curve. German curve sharply bull-steepens over early London session following consumer inflation expectations data — Germany 2-year yields remain richer by 8bp on the day with 2s10s spread steeper by 2.5bp, 5s30s by 4bp. Dollar IG issuance slate includes NAB 2Y/5Y and ADB 2Y/10Y; twelve companies priced $20.1b Monday, surpassing weekly volume projection in a single day; desks project around $80b for the month of June.

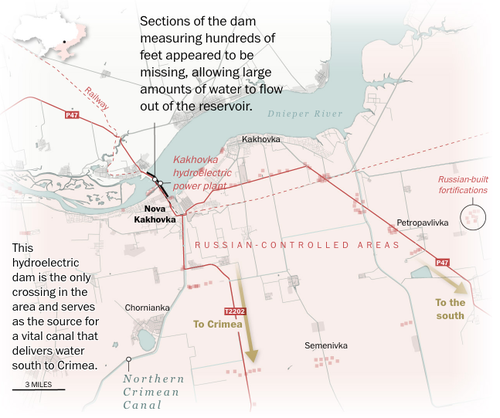

In commodity markets, wheat surged after Ukraine said Russian forces blew up a giant dam in the country’s south, unleashing a torrent of floodwater that threatens thousands of people and poses a potential threat to Black Sea grain supplies. Meanwhile, crude drifted 2.2% lower to trade near $70.58. Most base metals trade in the green; LME nickel rises 1.4%, outperforming peers. LME aluminum lags, dropping 1.1%. Spot gold is little changed at $1,962/oz

Looking ahead, the US session has no economic data releases or Fed speakers scheduled, amid quiet period ahead of June FOMC meeting.

Market Snapshot

- S&P 500 futures little changed at 4,277.50

- MXAP up 0.3% to 164.13

- MXAPJ down 0.2% to 514.04

- Nikkei up 0.9% to 32,506.78

- Topix up 0.7% to 2,236.28

- Hang Seng Index little changed at 19,099.28

- Shanghai Composite down 1.1% to 3,195.34

- Sensex down 0.3% to 62,586.79

- Australia S&P/ASX 200 down 1.2% to 7,129.64

- Kospi up 0.5% to 2,615.41

- STOXX Europe 600 little changed at 459.93

- German 10Y yield little changed at 2.34%

- Euro down 0.1% to $1.0702

- Brent Futures down 2.1% to $75.12/bbl

- Gold spot down 0.2% to $1,958.11

- U.S. Dollar Index little changed at 104.02

Top Overnight News

- Australia’s central bank surprised the mkt and raised interest rates by a quarter-point to an 11-year high, and warned that further tightening may be required to ensure that inflation returns to target. RTRS

- Chinese authorities asked the nation’s biggest banks to lower their deposit rates for at least the second time in less than a year, according to people familiar with the matter, marking an escalated effort to boost the world’s second-largest economy. BBG

- China will likely further cut banks’ reserve ratio and interest rates in the second half of this year to support the economy, the China Securities Journal reported on Tuesday, citing policy advisors and economists. RTRS

- Underlying price pressures in the euro zone may prove more difficult to tame but monetary policy is showing signs of effectiveness and further rate hikes must be done step by step, Dutch central bank chief Klaas Knot said on Tuesday. RTRS

- Eurozone inflation expectations decreased significantly according to the latest ECB survey, reversing most of the increases seen in the previous month. ECB

- Something unusual has happened to the price of butter in Germany this year — it has fallen sharply even as the cost of many other foods kept rising at double-digit rates. Following a dip in energy prices, surging food costs have become the main source of inflation for the eurozone consumers. They are up 20% since the start of last year, causing alarm among politicians and central bankers. But economists and industry executives increasingly believe the factors behind a fall in the price of German butter — down almost 30% since in December as dairy producers’ costs have fallen — will soon begin to have a broader impact. FT

- A major dam and power station in a Russian-occupied part of Ukraine were destroyed Tuesday, with both sides accusing each other of being responsible for an incident that has caused serious flooding, put thousands of homes at risk and potentially threatened the safety of Europe’s largest nuclear power plant. WSJ

- Eight years after he first announced he was running for president, Chris Christie is readying for a return to the national stage. The brash former governor of New Jersey is expected to launch his second presidential run on Tuesday with a town hall-style event in Manchester, New Hampshire, some 300 miles north of his home state. FT

- Citadel brought back retired portfolio manager Drew Gillanders to expand the fund’s equities trading in Europe. The 51-year-old, who worked at Citadel between 2019 and 2022, will report to co-CIO Pablo Salame. BBG

- Recession risk has receded as the debt ceiling crisis fades and the banking sector stabilizes. Although labor market rebalancing and inflation progress have been encouraging, a firmer growth outlook will likely prompt the Fed to hike again in July (and push several other DM central banks in a more hawkish direction too). GIR

A more detailed summary of global markets courtesy of Newsquawk

APAC stocks traded mixed with price action mostly rangebound following on from the subdued performance stateside where participants ‘sold the news’ following Apple’s headset announcement and with sentiment clouded by weak data releases. ASX 200 was led lower by underperformance in the consumer-related sectors and top-weighted financial industry, with losses later exacerbated after the RBA delivered a surprise 25bps rate hike to lift the Cash Rate Target to 4.10% and it also kept the door open for further policy tightening. Nikkei 225 was initially pressured after disappointing Household Spending and Labour Earnings data which briefly dragged the index beneath the psychological 32,000 level where it then found support and staged a recovery amid dip buying. Hang Seng and Shanghai Comp. were somewhat varied with the former boosted by strength in property names, although the mainland was less decisive and lagged amid mixed US-China rhetoric.

Top Asian News

- RBA surprisingly raised the Cash Rate Target by 25bps to 4.10% (exp. 3.85%), while it reiterated that the Board remains resolute in its determination to return inflation to the target and some further tightening of monetary policy may be required. It also repeated that inflation in Australia has passed its peak, but at 7% is still too high and it will be some time yet before it is back in the target range. RBA stated that this further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe, as well as noted that recent data indicates that the upside risks to the inflation outlook have increased and the Board has responded to this.

- China has reportedly asked the largest banks to cut deposit rates to boost the economy, according to Bloomberg sources. State-owned lenders including Bank of China, ICBC, and Bank of Communications were advised to cut rates on a range of products, including demand deposits by 5bps and 3yr and 5yr time deposits by at least 10bps.

- Former ByteDance executive claimed the Chinese Communist Party accessed TikTok’s Hong Kong user data, according to WSJ. It was separately reported that Vietnam’s ministry found TikTok violations during its inspection.

- BoJ Governor Ueda said BoJ is to continue QQE until the inflation target is achieved, and added inflation and inflation expectations are heightening, according to Reuters.

European equities trade with little in the way of firm direction as incremental catalysts for the region remain light. Equity sectors in Europe are mixed with Health Care top of the leaderboard whilst Energy lags to the downside with WTI and Brent both below Friday’s closing levels despite efforts by OPEC+. US equity futures are hugging the unchanged mark with the ES around 20 points shy of the 4300 mark after venturing as high as 4305.75 yesterday.

Top European News

- ECB’s Knot said inflation is still way too high but the worst is behind us; underlying pressures will prove more difficult to bring down. He said they are seeing first signs that monetary policy tightening is being transmitted to the real economy, and will keep tightening policy until we see inflation return to 2% target, but this will be done step by step.

- ECB Consumer Expectations Survey (Apr): Inflation Expectations: 4.1% 12-months ahead (Mar 5.0%), 3yr ahead 2.5% (Mar 2.9%). Nominal Income: 1.1% over the next 12-months (Mar 1.3%). Nominal Spending: 3.8% over the next 12-months (Mar 4.1%)

- Barclaycard said UK May consumer spending rose 3.6% Y/Y and noted that higher food prices limited discretionary spending, according to Reuters.

FX

- DXY edged higher throughout the European morning and currently resides near session highs above 104.00.

- JPY is continues to claw back losses at the expense of its US counterpart as yields softened.

- Aussie remains the clear G10 outperformer in wake of another largely unexpected 25 bp rate rise from the RBA overnight.

- Euro eased back from circa 1.0732 against the Dollar to sub-1.0700 and the base of 1bln option expiries between the round number and 1.0695.

- PBoC set USD/CNY mid-point at 7.1075 vs exp. 7.1080 (prev. 7.0904)

Fixed Income

- Debt futures have racked up bigger and longer-lasting gains on a combination of bullish or supportive factors ranging from geopolitical developments, disinflationary vibes and a deeper reversal in oil that should have dovish implications for price pressures ahead.

- Bunds have been up to 135.57 for a 100+ tick flip from Eurex trough to peak.

- Gilts probed 97.00 within a 97.06-96.35 range in wake of a well received 2053 DMO tap

- US Treasuries are above 114-00 between 114-06+/113-24 overnight parameters.

- UK sells GBP 2.5bln 3.75% 2053 Gilt: b/c 2.58x (Prev. 2.50x), average yield 4.478% (Prev. 4.083%) & tail 0.5bps (Prev. 0.2bps)

Commodities

- WTI and Brent futures continue trundling lower as the post-OPEC pop faded, with prices now back at levels seen in the run-up to last weekend’s confab.

- Asian refiners are likely to take less oil from Saudi Arabia for July and buy more spot cargoes such as those from the UAE after the surprise price hike and output cut, according to Reuters citing traders.

- Kazakhstan Energy Minister said the country will go ahead with the USD 16.5bln claim against international oil giants over costs, no plans for out-of-court settlement, according to Reuters.

- Spot gold is relatively steady around the USD 1,950/oz mark and within recent ranges, with some potential haven support underpinning prices.

- Base are mostly softer with LME copper still hovering above USD 8,250/t following the recent gains as China looks to bolster its property sector. On that note, iron ore continued to benefit from these tailwinds and printed higher levels in around seven weeks.

- Shanghai futures exchange says trading of alumina futures will begin on June 9th.

Geopolitics

RUSSIA-UKRAINE

- Russia’s Federal Security Service (FSB) says Ukraine planning a “dirty bomb” attack in Russia, via RIA.

- Twitter sources reported that the Nova Kakhovka Dam was blown up in southern Ukraine, while Ukraine’s south military command later confirmed that the dam was blown up by Russian forces. Furthermore, a Moscow-backed official said there was no critical danger to the Zaporizhzhia nuclear plant yet from the destruction of the dam, according to Reuters.

- Russia’s Defence Ministry said they destroyed 8 leopard tanks in the Donetsk region and that Ukraine continues with its offensive in Donetsk, while it also noted huge losses were inflicted on Ukrainian forces in Donetsk and that Ukrainian forces are deploying fresh troops in the eastern combat zone, according to Reuters.

- Ukraine’s State Atomic Agency said the destruction of the Kakhova dam poses a risk to the Zaporizhzhia nuclear power plant, but the situation is under control, according to Reuters.

- Ukraine’s Foreign Minister said Ukraine will “probably” only be able to join NATO after the end of the war and said Ukraine has enough weapons to begin its counter-offensive, according to Reuters.

OTHER

- White House said the US is seeing an increasing level of aggressiveness by China’s military and the US is prepared to address growing aggressiveness. White House stated the US wants to see Beijing justify what it is doing with increased military and said both recent Chinese intercepts occurred in international space, while it added that it won’t be long before someone gets hurt and that unsafe intercepts can lead to miscalculations.

- South Korea has scrambled air force jets after Russian and Chinese military planes entered its air defence zone, according to joint chiefs; did not violate South Korean air space.

US Event Calendar

DB’s Jim Reid concludes the overnight wrap

DB Research has just released our latest World Outlook featuring our updated views on economics and markets. We’ve called this edition “The Waiting Game…” because we maintain our call for a US recession in Q4 as the lags from tighter monetary policy really start to hit. As we’ve felt for a while, you have to respect the lag and be patient. Markets on the other hand are anything but and want instant gratification. That’s what makes it an interesting time now and for the next few months ahead.

To recap we think this hard landing is the logical next step in a succession of all-too foreseeable events since the pandemic: the biggest increase in the money supply in decades, followed by the highest inflation in decades, and then the most aggressive series of rate hikes in decades. A hard landing is just the next phase of this. If you’re looking for hope we are optimistic about the prospects of AI changing the nature of our economies in the years ahead. We desperately need a new source of growth given weak productivity and poor demographics. And although AI is unlikely to help us out of this cycle, its promise is a hope we cling onto as we move deeper into the 2020s after a very challenging start to the decade.

Finally in terms of adverts, Steve Caprio on my credit team has an update to our view this morning (link here). He posits that while the consensus view among clients is for a summer squeeze, we see little reason to chase the market and so we retain our defensive positioning across ratings and tenors.

Markets certainly stopped chasing and squeezing yesterday, in part thanks to a weak ISM services print that helped to ramp up fears about a recession. Earlier in the day it had looked rather different, and at one point the S&P 500 was even on track to close in bull market territory, having risen by over 20% since its closing low last October. But the negative data surprise ultimately dominated, and that led to a decent risk-off move that meant the index fell short of that milestone by the close.

In terms of the release, the ISM services for May came in at 50.3 (vs. 52.4 expected), so just above the 50-mark that separates expansion from contraction and the second lowest since the pandemic, only beating a strange out of the blue plunge in December. The sub-components didn’t look too promising either, with new orders down to 52.9, whilst employment at 49.2 was in contractionary territory for the first time since December. Other releases out yesterday were a bit weaker-than-expected too, with April’s factory orders only up by +0.4% (vs. +0.8% expected), alongside downward revisions to the previous month.

Treasuries rallied on the back of the ISM, and the 10yr yield gave up its initial rise to fall by almost -8bps intraday straight after the release, before closing -0.1bps down on the day at 3.683%. Another contributing factor was that the weak data led to growing expectations that the Fed would pause their rate hikes at their meeting next week, with only a 24.5% chance of a hike now priced in down from 30.5% at the end of last week. Ultimately, markets are increasingly coalescing around the idea that the Fed will skip a meeting in June before delivering another hike in July, which is in line with the updated call from our US economists in the World Outlook. This morning in Asia, yields on 10yr USTs (+1.73 bps) are slightly higher again as we go to print.

Sovereign bonds in Europe lost ground more consistently yesterday after ECB President Lagarde continued to signal more rate hikes ahead at the European Parliament. Among others, Lagarde said that the ECB’s “future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive”. And in turn, that helped to cement investors in their conviction that the ECB would proceed with another 25bp hike next week. As a result, yields on 10yr bunds (+6.9bps), OATs (+6.3bps) and BTPs (+6.8bps) all moved higher on the day.

For equities, it was an up-and-down day, and in the end the S&P 500 (-0.20%) closed lower, after being +0.40% at the day’s highs. In addition to the weaker US data, specific factors appeared to weigh during the day. Oil majors reversed their initial gains from the OPEC+ news over the weekend, while Apple closed -0.76% lower, after being up over 2% intra-day at one point. This comes as the world’s largest technology company unveiled their new “mixed reality” headset with a sticker price of $3499. With tech stocks slipping, the NASDAQ (-0.09%) was largely flat on the day, though its YTD gains still stand at +26.40%.

Back in Europe, the more negative tone continued to take hold, with the STOXX 600 (-0.48%) getting the week off to a rough start. In part, that reflected a surge in European natural gas prices (+24.9%) following their recent declines. And that occurred alongside a broader spike in energy prices, following the decision from Saudi Arabia to cut its oil output by 1 million barrels per day. However a late drop in risk sentiment near the US close meant Brent crude (+0.76%) ended the day at $76.71/bbl, whilst WTI (+0.57%) closed at $71.89/bbl with both contracts trading comfortably off their intraday highs.

Overnight, the Reserve Bank of Australia (RBA) lifted its official interest rate by +25bps to 4.1%, a level not seen since early 2012 amid concerns inflation is taking too long to come down. Markets overall had anticipated no change for this month but a number of economists (including DB’s) had made a late call for a hike in recent days so it wasn’t a total surprise. Markets have repriced terminal 20bps higher in the few minutes between the hike and us going to press. Looking ahead, speeches from the RBA Governor Philip Lowe and Deputy Governor Michele Bullock scheduled for tomorrow will be the key to gaining any hints for future rate hikes from the central bank. DB still think they have two more hikes in the pipeline in August and then September.

Asian equity markets are extending their recent gains this morning even with the western world risk off yesterday. As I type, the Hang Seng (+0.43%) and the Nikkei (+0.41%) are edging higher while the CSI (+0.09%) and the Shanghai Composite (+0.05%) are just above flat. Meanwhile, markets in South Korea are closed for a holiday. US stock futures are flat to down with those tied to the S&P 500 (-0.02%) and NASDAQ 100 (-0.03%) struggling to gain traction.

Early morning data showed that Japanese household spending remained weak, dropping -4.4% y/y in April (v/s -2.4% expected) and recording its sharpest decline since July 2021, underlining a patchy economic recovery. It followed a -1.9% contraction in the preceding month. Other data showed that cash earnings/nominal wages, grew +1.0% y/y in April (v/s +1.8% expected), smaller than expected and an upwardly revised +1.3% rise logged in March. Meanwhile, real wages fell -3.0% y/y in April (v/s -2.0% expected; -2.3% in March), marking the 13th straight month of year-on-year declines, as persistently high inflation is outstripping nominal pay growth.

In the political sphere, the 2024 US presidential field is continuing to take shape, and yesterday saw former Vice President Mike Pence jump in on the Republican side. According to the FiveThirtyEight average, Pence is currently polling in third place for the primary on 5.4%, but is still well behind former President Trump on 53.9%, and Florida Governor Ron DeSantis on 21.1%. Separately, former New Jersey Governor and 2016 candidate Chris Christie is expected to announce his candidacy today as well.

Finally, when it came to yesterday’s other data, the final Euro Area PMIs were a bit weaker than expected. For instance, the Euro Area composite PMI for May came in at 52.8 (vs. flash 53.3), and the services PMI was revised down to 55.1 (vs. flash 55.9), adding to a trend of negative European data surprises since late April. In the meantime, data showed that PPI inflation in the Euro Area fell to just +1.0% in April (vs. +1.7% expected), which is its lowest level since January 2021, and down from a peak of +43.4% back in August.

To the day ahead now, and data releases include German factory orders and Euro Area retail sales for April, along with the German and UK construction PMIs for May. Otherwise, the ECB will be releasing their Consumer Expectations Survey, with our own European dbDIG survey suggesting that the ECB survey should show an easing of inflation expectations.