Authored by Matthew Piepenburg via GoldSwitzerland.com,

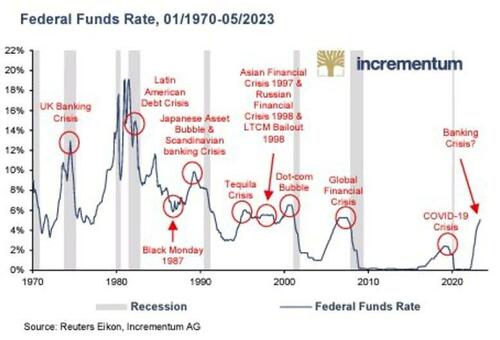

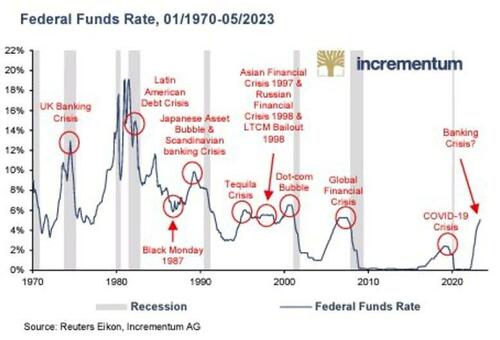

We have hardly been the first nor the last to realize that rising rates “break things.”

We’ve all seen the disastrous credit events in the repo crisis of late 2019, the UST debacle in March of 2020, the gilt implosion of October 2022 and, of course, the banking crisis of March, 2023.

And behind, beneath, above and below each of these debacles lies a bemused central banker.

There’s More “Breaking” to Come

But there’s far more “breaking” to come.

As for recessions, the data is equally (and objectively) abundant that those rising rates (red circles below) tend to correlate directly with recessions, both soft and hard (grey lines below).

Powell can re-define recessions with words, but despite his double speak, he too knows that a recession is already under, or at the very least, directly off, the American bow.

Powell’s Un-Spoken “Plan”?

It has always been my contention that the rate hikes of late have been a public ruse to allegedly “defeat inflation,” when in fact inflation and negative real rates were always part of the unofficial plan to help inflate away portions of Uncle Sam’s openly embarrassing bar tab.

More importantly, Powell’s deeper motive (in my opinion) for the rate hikes of 2022 was done in order to give the Fed something to cut once the mammoth recession they’ve publicly denied becomes, well: mathematically undeniable.

The Past as Prologue

As in 2018, when Powell forward-guided rate hikes simultaneously with QT (Fed balance sheet reduction via UST dumping), the end result was disastrous (remember December 2018 and the days of 10% daily market swings).

This disaster was soon followed by an inevitable/foreseeable rate “pause” and then more QE.

The current pattern is fairly similar.

Although a QT policy of letting the Fed’s reserve of bonds “mature” rather than be dumped into the open market slightly differentiates 2022’s rate hikes from 2018, the end-game of raising rates into an even greater debt bubble will end with even more pain, volatility (and ultimately, QE) than seen in the 2018-2019 debacle/policy.

This pattern is easy to see because the Realpolitik of the bond market is easy to see.

The Bond Market is the Thing

In the most simplistic terms, Uncle Sam survives off debt, which means he survives off of IOUs (i.e., USTs).

If no one buys those IOUs, Uncle Sam falls off his bar stool into a puddle of his own tears as USTs fall further in price and hence yields and rates rise further in interest-expense pain.

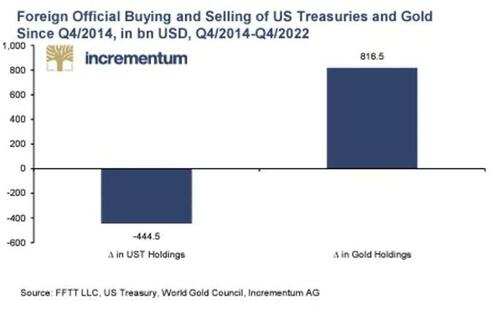

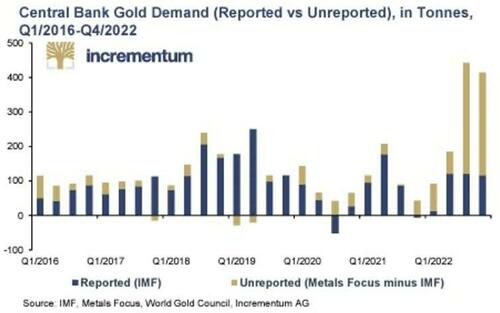

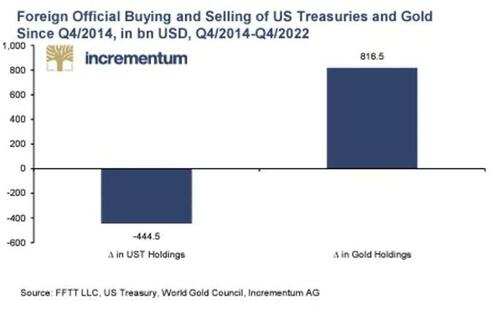

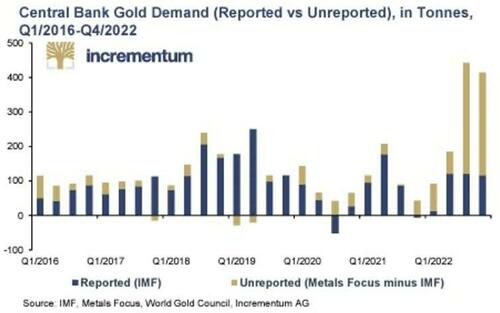

And as 2022 reminds, that weaponized USD led to Uncle Sam’s worst fears coming foreseeably true as the world dumped USTs at the same time central banks made historically unprecedented purchases of gold.

The Next Moves Are Fairly Easy to See…

Needless to say, this bond-dumping scares the “H-E- double-toothpicks” out of Uncle Sam and his cadre of corporatist, number-crunching technocrats at the Treasury Dept and FOMC, as even they know what we all know: Someone or some thing has to buy Uncle Sam’s IOUs or it’s game over.

And who do you think that buyer will be?

All together now: “The Federal Reserve.”

And where will the money needed to buy those unloved USTs ultimately come from?

All together now: “An inflationary mouse-clicker at the Eccles Building.”

Pain, then Pleasure for Stocks, But No Way Out for the Dollar

But between now and that oh-so-foreseeable QE end-game, more things will need to break, which means we are likely to see deflationary forces (tanking market, emerging recession) followed by profoundly inflationary money printing.

Or stated more simply, stocks will tank and then stocks will rise as the currency which measures (and “saves”) them gets more and more diluted by failed policy makers and a Fed which should never have been conceived in 1910.

Why do I believe this?

Well, the markets, rather than Powell, are telling us so.

Let’s dig in.

The Futures Markets: Neon-Flashing Signs of Stock Market “Uh-Oh”

There are a number of signs pointing toward an “uh-oh” moment in risk assets.

The fact, for example, that we are seeing oil futures pricing oil lower despite production cuts (what the fancy lads call “backwardation”) stems from a market anticipating the kind of tanking oil demand that only comes from a much-anticipated stock market fall (mean reversion) in the wake of an equally anticipated recession in 2023.

The Eurodollar futures market is also screaming of a similar market fall in the coming months.

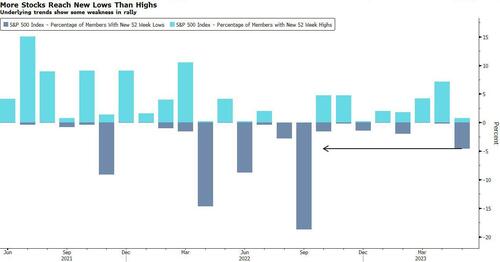

But perhaps most importantly (or obviously), the S&P futures market is now net-short at levels surpassing 2011 and approaching the levels of late 2007.

If I recall, those were not promising times for subsequent stock prices…

Or stated more simply, the big boys at those oh-so clever hedge funds (who are tracking credit crunches, bond flows and Powell’s “higher-for-longer” meme) are betting heavily against the S&P as the “higher-for-longer” Powell soon becomes the “higher-something-broke-again” Powell.

In short: The next thing to “break” will be stocks.

What Goes Naturally Down Then Goes Un-Naturally Up

Then comes the volatility and the dip-buyers after stocks take a hit (driven by more bank failures and rate hikes) which could be worse than 2008.

It’s my view that hedge funds are waiting to buy low and are biding their time like snipers patiently hiding behind a bond-market breastwork.

That is, they have been piling into negative-yielding USTs of late (that is, willingly losing a bit of return) as a holding pattern “asset” which they will then quickly dump to buy discounted equities once the stock market pukes as per above.

Amidst this looming volatility (buy the VIX?), I thus foresee a subsequent move out of anemic bonds and back into discounted stocks.

Of course, if the hedge funds start dumping Uncle Sam’s IOUs, their yields and rates will get dangerously higher (expensive) for Uncle Sam, which means Uncle Fed will have to do what it did in 2019/2020 and start mouse-clicking more instant liquidity to control Treasury yields and monetize America’s increasingly unloved UST market.

Such QE will be good for stocks dying on the field, but bad for the inherent purchasing power of an ever-more debased and diluted USD.

Chess vs. Checkers

Thus, deflationary or inflationary, the end-game for the neutered USD and its checker-level financial planners is fairly foreseeable, which means the end-game for gold is no less so.

See why the chess-players (mostly Eastern Central Banks) are stacking gold at levels higher than ever recorded?

A Rigged Game

This journey from tanking markets to rising markets is a game which many insiders at the hedge funds know and play well.

Furthermore, it’s a game the Fed has no choice to play, as a rising stock market (and capital gains taxes) is one of the few ways Uncle Sam can get tax receipts at a level high enough to pay its $800B (and climbing) interest expense on debt.

The rise-and-fall stock game is rigged, and ultimately, as I’ve written, “Rigged to Fail,” but regardless of its immoral and capitalism-destroying mandate, one can front-run the Fed if one sees the totally centralized chess-board.