McGlinchey: Debt-Ceiling Theater Masks True Depth of DC’s Red Ink

Authored by Brian McGlinchey via starkrealities.substack.com

As the latest debt-ceiling drama winds down, Americans are varyingly exasperated, angered, anxious and maybe even a little bit entertained by the spectacle.

While their emotions vary, most citizens have something in common: They don’t realize they’re being misled about the actual depth of their government’s financial disorder. Despite all the talk of the federal government hitting a Congressionally-set $31.4 trillion debt limit, the truth is that DC’s actual liabilities are far higher than even that disturbing number.

Estimates by the relatively few scholars and organizations who venture to expose Washington’s charade vary, but they overwhelmingly place the federal government’s true total obligations at over $100 trillion. For example, Truth In Accounting’s latest tally puts Uncle Sam’s total IOUs at $156 trillion.

The frequently-mentioned $31 trillion “national debt” figure only encompasses Treasury borrowing in the form of bills, notes and bonds. Critically, it doesn’t include unfunded liabilities. That’s the term for financial promises the government has made without having money set aside to fulfill them.

America’s unfunded liabilities span three main categories of promised future benefits:

-

Federal employee and military veteran pensions and benefits.

-

Social Security retirement income and disability insurance

-

Medicare benefits

Calculations of the present value of unfunded liabilities vary, because they require assumptions about variables including future interest rates, life expectancies and the cost of health care.

Each year, the Treasury produces a mammoth report summarizing the federal government’s financial situation. While the Treasury presents the national debt as it’s commonly understood, and separately presents its own calculation of unfunded liabilities of Social Security, Medicare and similar programs, nowhere in 258 pages does the department combine those numbers and present the hideous $100-trillion-plus total.

The absence of that grand total is no oversight: Letting citizens see the stark reality of the government’s financial condition simply isn’t in the interest of our rulers, whether they’re on the blue team or the red one.

Counting only Treasury borrowing, the federal government’s $31 trillion debt equates to 117% of the country’s $26.5 trillion gross domestic product (GDP), a figure that approximates the country’s annual economic production. That’s alarming enough, but if we use Truth in Accounting’s numbers, the total is a jarring 589% of GDP.

Providing a more relatable perspective, the Chicago-based watchdog group says the “true national debt” comes out to $933,000 per taxpayer.

As I wrote in November, the federal government’s path to financial calamity is hardwired into the budget process, as so-called “mandatory spending” on programs like Social Security, Medicare and Medicaid now represent a whopping 71% of the US budget, more than double the share in 1965.

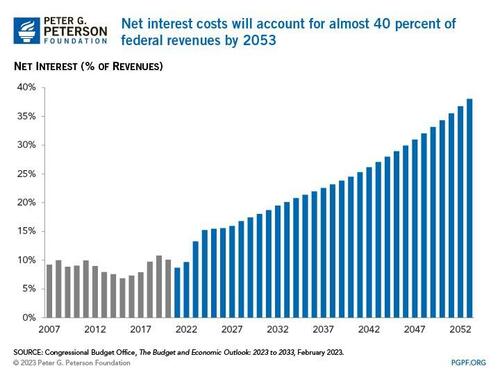

Meanwhile, interest payments alone are consuming ever-higher shares of federal revenues:

There’s good reason why the government chooses not to illuminate citizens about the true national debt. After all, if more Americans grasped the full scope of Washington’s fiscal insanity, they would:

-

Understand that promised Social Security and Medicare benefits are unsustainable — particularly for the youngest Americans, who are currently compelled to fund benefits for older Americans in a coercive Ponzi scheme

-

Be less likely to support costly foreign interventionism, to include the more than $113 billion already spent on the proxy war against Russia in Ukraine — more Americans would question the premise that their security is impacted by who controls Ukraine’s heavily ethnic-Russian Donbas region.

-

Toss aside the rose-colored glasses through which they view big-spending proposals, like last summer’s $375 billion package to fund a crony-enriching and quixotic battle against climate change

-

Apply greater scrutiny to military spending, with more people questioning why the Pentagon should spend more than $7.3 trillion over the next 10 years — more than it spent in the decade that encompassed the peak of US warfare in Iraq and Afghanistan

-

Cast a harsher eye on thinly-disguised vote-buying schemes — from student debt cancellation to reparations for black people — and increasingly disfavor all varieties of wealth redistribution, from subsidies for Iowa farmers to (illegal) aid for Israel.

Stark Realities undermines official narratives, demolishes conventional wisdom and exposes fundamental myths across the political spectrum. Read more and subscribe at starkrealities.substack.com

Tyler Durden

Sat, 06/03/2023 – 12:30

via ZeroHedge News https://ift.tt/m4KyNPj Tyler Durden