Submitted by David Stockman via Contra Corner blog,

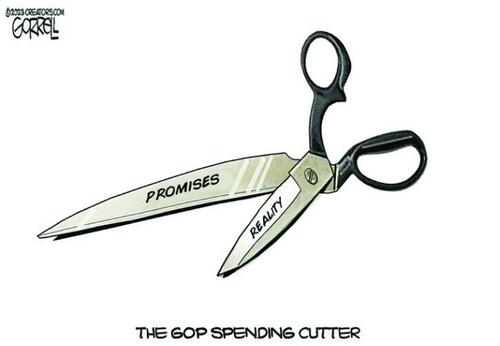

If there was ever any doubt, now we know: Speaker Kevin McCarthy has straw for brains and a Twizzlers stick for a backbone. He was within perhaps five days of breaking the iron grip of America’s fiscal doomsday machine, yet inexplicably he turned tail and threw in the towel for a mess of fiscal pottage.

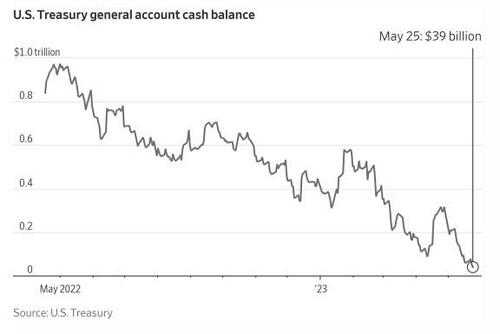

We are referring, of course, to the impending moment when the US Treasury would have been forced to forgo scheduled vendor or beneficiary distributions in order to preserve incoming cash for interest payments and other priorities. That act of spending deferrals and prioritization would have obliterated the debt “default” canard once and for all, paving the way for a nascent fiscal opposition to regain control of the nation’s wretched public finances.

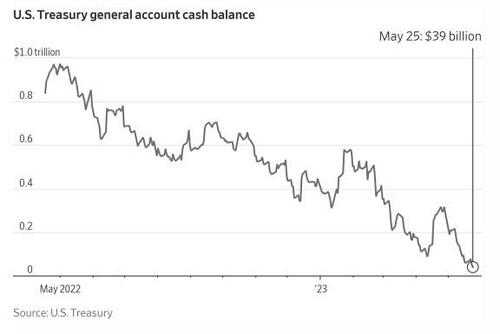

And there should be no doubt that we were damn close to that crystalizing moment. After all, Grandma Yellen herself forewarned just last week on Meet The Press that absent a debt ceiling increase, the Treasury Department would have to prioritize payments and leave some bills unpaid:

“And my assumption is that if the debt ceiling isn’t raised, there will be hard choices to make about what bills go unpaid,” Yellen said on NBC’s “Meet the Press…….“We have to pay interest and principle on outstanding debt. We also have obligations to seniors who count on Social Security, our military that expects pay, contractors who’ve provided services to the federal government, and some bills have to go unpaid….”

And, of course, that prioritization and deferral could have been easily done. Federal receipts are now running about $450 billion per month, meaning that after paying $61 billion of interest, $128 billion for Social Security, $26 billion for Veterans and $47 billion for military pay and O&M there would still be $188 billion left to cover at least 50% of everything else.

That is to say, no sweat with respect to servicing the public debt, and a lot of sweat among the constituencies that would have had payments delayed or reduced.

So, yes, the GOP has truly earned the Stupid Party sobriquet. No ifs, ands or buts about it.

Instead of spending days negotiating over the minutia of budgetary scams, tricks and slights-of-hand, which is the entirety of the McCarthy deal, they should have been demanding from the Treasury a detailed list of scheduled payments by day for the first few weeks in June. And then, in return for continued negotiations on meaningful spending cuts and reforms, demanded assurance from the White House that enough of these due bills would be temporarily stuck in the drawer (deferred), if necessary, to ensure payment of scheduled interest, Social Security, military pay and Veterans pensions.

That is to say, McCarthy had Sleepy Joe over the proverbial barrel. But instead of applying the wood to his political backside good and hard, the Speaker chose to hold Biden’s coat and help him get back up, praising the latter’s supercilious retainers as he did so.

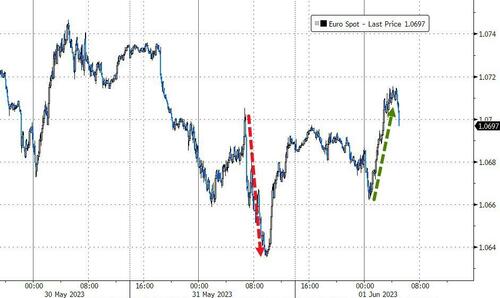

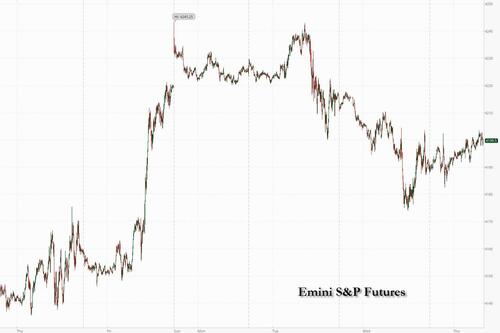

For crying out loud. Upwards of 96% of Uncle Sam’s cash balance had been dissipated over the past year, guaranteeing that expected June collections of well more than $500 billion would not be enough to cover 100% of the scheduled due bills. Accordingly, just a couple of days of missed payments on selective items would have turned the Washington fiscal equation upside down.

The bogeyman of “debt default” would have been completely annihilated. And the legions of interest groups, businesses and individuals who suckle on the Federal teat month-inand-month-out would have screamed to high heaven for relief, which McCarthy would have been positioned to provide to them…..at a price!

Needless to say, the “price” in question has nothing to do with the risible budgetary trivia that passes for the Speaker’s compromise deal. For instance, does the GOP think voters are actually stupid enough to buy the rescission of $28 billion of left-over Covid budget authority, which probably wouldn’t have been spent anyway, when these “saved” funds are to be recycled into FY 2024 appropriations but not counted against the ceiling?

That’s Swamp Creature math, and arrogance, too, like never before.

Even Goldman Sachs says that the budgetary impact of the deal amounts to a pure rounding error in the scheme of things:

The spending deal looks likely to reduce spending by 0.1-0.2% of GDP yoy in 2024 and 2025, compared with a baseline in which funding grows with inflation.

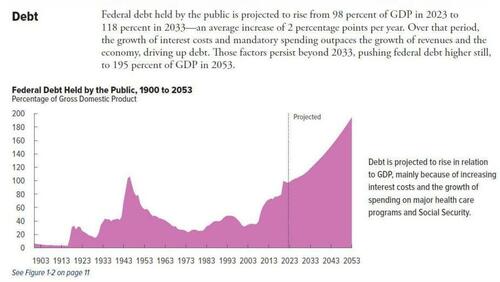

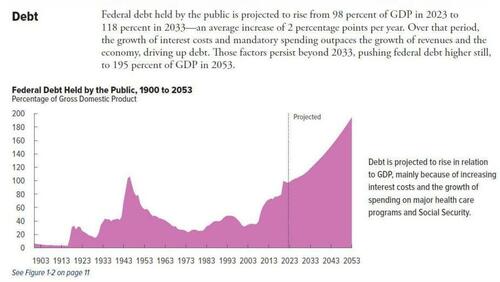

Here’s the point. CBO’s most recent projection shows new deficits of $20.3 trillion over the 10-year budget window—and that’s based on Rosy Scenario economics with no recession, inflation gone away and only gently rising interest rates. Throw-in even a modest dose of realism about the economics and back-out the huge tax increases and spending cuts built into the out-year baseline, which will never be permitted to actually materialize, and you have a de facto public debt of $55 trillion by the early 2030s or more than 200% of the current GDP.

What that amounts to is a long-term structural fiscal equation which is a guaranteed route to financial and political disaster. Thus, CBO’s end year numbers (FY 2033) show current policy receipts at 18.1% of GDP and spending at 25.3% of GDP.

Folks, you can’t borrow 7.3% of GDP every year from now until eternity and get away with it; and most especially not when American society is plunging into a 100 million strong baby boom retirement wave—accompanied by a shrinking work force and tax base owing to collapsing birth rates and Washington’s idiotic migrant worker internment camps at the southern border.

Stated differently, fiscal governance in Washington is totally kaput. They never pass an annual budget resolution and enforcement plan, which was taken as a sacred duty back in the day; and there are never even annual appropriations bills for the mere 25% of the budget still subject to the Congressional “power of the purse”.

Instead, what occurs is a perennial string of short-term Continuing Resolutions (CRs) followed by an 11th hour, 3000 page pork-ridden “Omnibus Appropriations” bill that no one has read and which gives log-rolling (i.e. more domestic for more defense) a new definition.

In short, the debt ceiling was the only fiscal control mechanism left. And even that has been neutered time after time in the last decade by the hideous, flat-out lie that if the Treasury on any given day is one dollar short of being able to cover all of its due bills it must default on each and every one of them including interest payments, thereby destroying the credit of the United States. Yada, yada.

Finally, that lie was being put to the test and would have been eviscerated sometime next week. Yet after a lifetime on the public teat, Kevin McCarthy like his two GOP predecessors surrendered to the Doomsday Machine because he works for the GOP wing of the Swamp, not the voters, current and future.

And he did so while expectorating the most risible of lies:

Republicans are changing the culture and trajectory of Washington—and we’re just getting started.

Not close. Not in the ballpark or even the catcher’s box behind home plate.

The deal does absolutely nothing to change the current “trajectory” toward fiscal disaster because it reduces nary a dime of built-in spending for defense, entitlements/mandatories, veterans and net interest, while those items account for 89% of the $80 trillion of built-in spending over the next decade.

Current 10-Year CBO Baseline for FY 2024-2033:

-

Revenues: $60 trillion;

-

Spending: $80 trillion ;

-

New Debt: $20 trillion;

-

Mandatory Spending & Net Interest: $59 trillion;

-

Discretionary Spending for Defense & Veterans: $12 trillion;

-

Total Spending Exempted From Cuts in McCarthy Deal: $71 trillion;

-

% of Baseline Spending Exempted From Cuts: 89%

For avoidance of doubt, just consider the recent trajectory of defense spending, and the uncut CBO defense baseline for the next decade. That is, the GOP is so enthrall to its warmongering neocon majority that it can’t even talk about spending control with a straight face, as underscored by national defense spending levels since Obama left office.

The schedule below computes to a 52% expansion in just seven years, with Biden getting his full request for FY 2024 under the McCarthy deal.

As it happens, the subsequent FY 2024-2033 spending total for national defense according to the CBO projection is now $10 trillion. The deal does not reduce that by one red cent, either.

In this context it might be noted that FY 2024 defense outlays rise by 11.5% versus the 3.3% gain in defense budget authority advertised for the deal. Of course, that’s because the budgetary tricksters on Capitol Hill never stop their con job.

In fact, the uniparty raised defense budget authority by a whopping $76 billion or 9.7% in FY 2023, which base was incorporated into the more modest gain for FY 2024. But, alas, the cash outlays (which lag) from the FY 2023 appropriations eruption will happen notwithstanding the deal’s budget authority cap for FY 2024.

Back on the farm, that was called closing the barn door after the horses already left.

OMB Record of National Defense Outlays, FY 2017 to FY 2023 and McCarthy Deal Amount for FY 2024:

-

FY 2017: $599 billion;

-

FY 2018: $631 billion;

-

FY 2019: $686 billion;

-

FY 2020: $725 billion;

-

FY 2021: $754 billion;

-

FY 2022: $766 billion;

-

FY 2023: $815 billion;

-

FY 2024P: $909 billion.

With respect to the heart of the budget—entitlements and mandatories—the deal is about as pathetic as could be imagined. The CBO base line total for the 10-year window is $48.3 trillion and we doubt whether the deal would even save $10 billion. That’s 0.02% if anyone is computing.

Actually, as it turns out, CBO is counting. And it concludes that the new exemptions from the food stamps work requirement for veterans, homeless people and young people leaving foster care will cost more than the savings from raising the age cut off for everyone else.

That is to say, the GOP negotiators started with -$130 billion of CBO certified savings in the House based bill and ended up with a +$2 billion increase over 10-years!

And McCarthy says he’s bending the trajectory? Bending over, bar of soap at the ready, is more like it.

Alas, the liberals are no better. They are whining to high heaven about this sensible increase in the working age to 54 years, yet this change would only impact 700,000 able bodied adults, who constitute just 1.7% of current food stamp enrollments.

Indeed, here is a list of the major entitlement programs which are left unscathed by the McCarthy deal. They account for 98% of the CBO baseline for mandatories/entitlements over the FY 2024- 2033:

10-Year Baseline Spending That The McCarthy Deal Leaves Unscathed:

-

Social Security: $18.8 trillion;

-

Medicare: $14.8 trillion;

-

Medicaid, Obamacare and Child Health: $8.0 trillion;

-

Veterans Disability and Comp: $3.0 trillion;

-

Earned Income Tax Credit and Child Credit: $0.9 trillion;

-

Aid to Aged, Blind and Disabled: $0.7 trillion; • Military retirement: $0.9 trillion;

-

Total Mandatories Unscathed: $47.1 trillion;

-

% of CBO Mandatories Baseline: 98%;

As it turns out, the only cuts in the entire entitlement universe contained in the McCarthy deal pertain to the aforementioned foods stamps and family assistance programs, where baseline spending totals about $1.5 trillion over the decade. So our estimated $10 billion cut, which is owing to raising the work requirement for adults without dependents from age 49 to age 54 and excludes the expanded exemptions, amounts to a minuscule 0.7% of the baseline.

Moreover, the resulting hall pass for the remaining $48.29 trillion of built-in mandatory spending was not issued owing to the intransigence of the White House negotiators. Fully 97.3% of the CBO baseline amount for mandatory/entitlement spending was given a no cuts exemption by the GOP caucus, even before they brought their phony “Limit, Save, Grow Act” to the floor last month.

That’s right. The CBO baseline for what amounts to the heart of the Fiscal Doomsday Machine is projected to grow from $3.98 trillion in FY 2023 to $6.14 trillion in FY 2033. And yet the only savings the GOP chose to even table was $130 billion of work requirement savings from Medicaid, foods stamps and family assistance. And when you count the expanded work exemptions, fully 102% of those meager savings were left on the cutting room floor of the White House negotiations.

Then again, an even more complete capitulation occurred on the two items in the original House GOP bill that actually saved a meaningful amount of money. For instance, the GOP cancellation of Biden’s student debt forgiveness plan would have saved $320 billion according to CBO, which savings evaporated to $0.0 billion under the McCarthy deal.

Likewise, there could be no greater blow for free market efficiency and fiscal sanity than the House GOP’s original provision to cancel the ridiculously generous tax credits for overwhelmingly inefficient solar, windmill and electrification investments. These measures designed to save the planet from the phony Climate Crisis were originally guesstimated to cost $270 billion over 10-years when Biden’s so-called Inflation Reduction Act was passed last year.

But in response to the House-passed debt ceiling plan in late April, Congress’ official tax scorekeeper, the Joint Committee on Taxation (JCT), updated its estimates, pegging the costs at $570 billion from 2023 to 2033, or roughly double its original estimate. And that’s nothing compared to a new estimate from researchers at the Brookings Institution, which puts the revenue loss at more than $1 trillion over the coming decade.

So. Pray tell what did McCarthy’s pitiful negotiators do in response to the good news that the House-approved plan would shrink the deficit by up to $1 trillion over a decade?

Why, they effectively said, “just kidding!”

We will keep bashing these senseless give-aways out on the political hustings, but all the green energy interest groups can keep sending their bribe money to the Dems because these huge tax subsidies will remain in place.

As we said, the Stupid Party is driving toward a cliff with its eyes-wide shut.

We truly cannot believe that a majority of the GOP House caucus is bone-headed enough to fall for the McCarthy deal. But if they do the GOP will have forfeited the last chance to stop the nation’s rush toward fiscal armageddon.

Indeed, if the plan is approved the debt ceiling will take its place along side of budget resolutions and annual appropriations bills in the dead letter office of fiscal governance. The only thing the “compromise” pretends to cut is domestic discretionary appropriations excluding veterans health care and when all the gimmicks are peeled away, the IRS, too.

The GOP claims they froze FY 2024 nondefense appropriations below the FY 2023 level, but the so-called freeze is actually loophole-ridden in the fine print and is not binding after FY 2025. And, not surprisingly, these unenforceable “targets” for the out-years (FY 2026-2033) account for 90% of the purported “savings”.

Holy moly. At least the 2011 debt ceiling deal had a 10-year enforcement mechanism based on automatic sequestration. As it happened they loop-holed their way around these caps with “emergency” spending and other exempt gimmicks, and even then the result was a blithering joke.

In return for the debt ceiling increase, appropriated defense and nondefense spending was to be limited to $8.45 trillion over the next 10-years.The actual level, as it turned out, was $10.60 trillion. That is to say, these fakers missed their targets by $2.15 trillion or 25% over the period!

As it also turned out, once the GOP got back into the White House and took partial control of Congress, nondefense discretionary spending literally went into orbit. Here is the path from Obama’s FY 2017 outgoing budget to FY 2023. That’s up by 53%, and now these cats have the gall to call it a freeze!

Non-defense Discretionary Outlays:

-

FY 2017: $610 billion;

-

FY 2018: $639 billion;

-

FY 2019: $661 billion;

-

FY 2020 $914 billion;

-

FY 2021 $895 billion;

-

FY 2022: $912 billion;

-

FY 2023: $936 billion;

-

6-Year Increase: +53%

And yet, and yet. The GOP clowns in the US House now want to count enforcement-free savings from eight years of outyear “targets” that no one in Washington—-and we mean no one—intends to observe.

As we said, the “compromise deal” is a hideous joke, and Kevin McCarthy truly does have sawdust for brains and a Twizzlers stick for a backbone.

There is no other way to interpret the facts. In fact, just five months into his Speakership, McCarthy has already earned his place on the Wall of Shame right along side of Speaker John Boehner and Speaker Paul Ryan.