Futures Rise As Oil Jumps, Yields Gain, Yen Tumbles

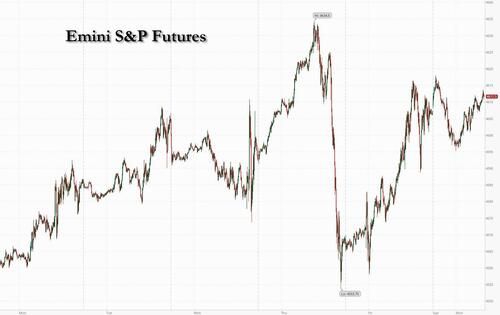

Global stocks markets struggled for direction and US equity futures were flat in Monday’s quiet session following a rally Friday that pushed the Nasdaq 100 nearly 2% higher amid optimism that a soft landing for the world’s biggest economy is within reach. Sentiment was shaken by early weakness in Treasuries – which briefly pushed the 10Y yield to 4.0% after the BOJ was forced to intervene unexpectedly in the bond market one day after “tweaking” its YCC – continued strength in the USD (which sent the yen tumbling contrary to what virtually all so-called experts predicted), and a rally in commodities, and especially oil (and gasoline) which has soared in recent days.

As of 7:30am, US equity futures were 0.1% higher at 4,612 while Nasdaq futures were largely unchanged. Treasury yields edged higher, mirroring moves in UK and European bond markets. Gold drifted lower, while Brent climbed over $85 and to a level where markets will soon realize that headline inflation is about to storm right back; Bitcoin rose 0.3%. Apple and Amazon.com are among companies reporting earnings in the coming days.

The yen tumbled against the dollar, crushing the BOJ’s carefully laid plans to strengthen the currency, after the Bank of Japan announced unscheduled bond-purchase operations to buy debt. The BOJ was seeking to contain a selloff after it said Friday it will allow yields to rise above a 0.5% cap and JGBs promptly did just that.

In premarket trading, Johnson & Johnson shares fall 1.5%, after a judge dismissed the pharmaceutical company’s second attempt at using a unit’s bankruptcy case to press tens of thousands of cancer victims to drop their lawsuits and accept an $8.9 billion settlement. Wells Fargo said the decision should not be a surprise, while Cantor Fitzgerald sees potential liabilities being manageable. Ford Motor dropped after the stock was cut to hold at Jefferies “with a heavy heart,” following results which saw worse-than-expected losses on electric vehicles and a “strategic wobble.” MetLife Inc. gained after Bloomberg News reported that Singapore insurer Great Eastern Holdings Ltd. is in talks to buy the company’s Malaysian venture. Here are some other notable premarket movers:

- Although Adobe may be “late to the party,” there is now more clarity on AI-enabled products and a roadmap toward monetization, Morgan Stanley says in note as it upgrades the stock to overweight from equal-weight. The shares rise 2.2% in premarket trading.

- Apellis Pharma rises 14% after the company said a review into its eye drug Syfovre showed that neither the product nor manufacturing issues caused the rare cases of patients experiencing severe inflammation following treatment.

- Barnes & Noble Education rose as much as 23% after the campus-store chain said it entered into an agreement with its stakeholders and strategic partners on refinancing terms.

- Carvana falls as much as 1.7% in premarket trading after Jefferies becomes the fourth brokerage to turn bearish on the stock this month. The analyst cut the recommendation on the online used-car dealer’s stock to underperform from hold, saying near-term profitability is inflated by transitory tailwinds.

- General Electric fluctuates after Oppenheimer downgrades the stock to market perform from outperform, saying the share’s recent gains “align to fundamentals.”

- MetLife rises as much as 4% after Bloomberg News reports that Singapore insurer Great Eastern Holdings is in talks to buy the company’s Malaysian venture.

- Palantir Technologies shares rise as much as 5.7%, set to extend Friday’s 10% gain on growing optimism over the software firm’s exposure to AI.

- Sweetgreen shares gain 7.2% after the fast-casual restaurant chain was upgraded to overweight from neutral at Piper Sandler. While it has been “tough sledding” for the company since going public, analysts Brian Mullan and Aisling Grueninger feel the “tide may be turning here a bit.”

- Wayfair shares jump 5.3%, after the home-goods retailer was upgraded to overweight from neutral at Piper Sandler, which said the company is “on the cusp of driving sustained Ebitda profitability.”

In the world of confused central bankers, ECB President Christine Lagarde told Le Figaro newspaper the ECB could hike again, even if it pauses at its next meeting. In the US, Federal Reserve Bank of Minneapolis President Neel Kashkari described the inflation outlook as “quite positive,” despite the likelihood of job losses and slower growth. Yields on German bonds and US Treasuries climbed.

“The narrative that markets will be focused on is if it’s going to be a soft landing or not,” said Vivek Paul, senior portfolio strategist at BlackRock Investment Institute. “We’ll learn more about that once the upcoming data indicate if rapidly cooling inflation is indeed the start of a broader trend or it continues to be volatile.”

According to Mike Wilson, who in his latest weekly note once again refused to turn bearish thus assuring more stock market gains, was kind enough to explain again what is causing the rally he never saw coming: he suggests that US equities are tracking the same path they did in 2019, which was one of the best years for the S&P 500 over the past decade. The benchmark is set to close out a fifth month of gains, the longest such winning streak since August 2021.

“The data we have today suggests to us that we are in a policy-driven, late-cycle rally,” Wilson, a staunch equities bear, wrote in a note. The latest example of such a period occurred in 2019 when the Federal Reserve paused and then cut rates and its balance sheet expanded toward the end of the year. “These developments fostered a robust rally in equities that was driven almost exclusively by multiple and not earnings, as has been the case this year.”

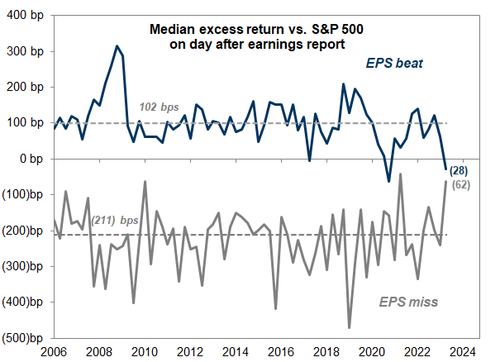

Meanwhile, investors aren’t rushing to buy shares of companies that beat second-quarter profit estimates. These firms are still underperforming the S&P 500 Index by the most in 18 years on the day after results, according to Goldman chief equity strategist David Kostin. “Investors have not rewarded stocks posting positive surprises,” Kostin wrote in a note.

European stocks edged higher although the food & beverage sector has struggled after Heineken slumped as much as 6.4% after the Dutch brewer reduced its earnings forecast, with consumption waning as consumers react to price increases. The Stoxx 600 is up 0.2%. Here are the most notable European movers:

- Erste Group shares gain as much as 2.5% after the Austrian lender reported what KBW says were a decent set of results and upgraded its guidance for a key profitability metric above consensus estimates

- Galp shares rise as much as 3.5% to the highest intraday level since February after adjusted net income and Ebitda at the Portuguese energy company beat analyst estimates

- Dr. Martens shares rise as much as 6.5% after Sky News reported that activist investment firm Sparta Capital has acquired a stake worth tens of millions of pounds in the UK bootmaker

- Heineken shares slide as much as 6.4%, their steepest drop since October, after the Dutch brewer lowered its earnings guidance, having missed sales expectations in key markets such as Vietnam

- Amadeus IT falls as much as 4.7%, extending its drop following Friday’s earnings, as Oddo downgrades the Spanish travel-booking services company to neutral

- Nemetschek drops as much as 4.6% after 2Q results, with analysts highlighting the software firm’s weaker margins and noting that growth slowed at the segment that offers architecture planning and design tools

- Hensoldt falls as much as 5.2%, extending Friday’s losses after it reported results that showed weakness in its Optronics division, even as overall order intake bounced back

- Bollore declines as much as 3% after the French conglomerate reported 1H results that Oddo (neutral) says came in slightly lower than expected

- Sage Group shares drop as much as 1.2% after the software company is downgraded to hold from buy at Canaccord Genuity, which says the stock needs “a breather after a banner year”

Earlier in the session, Asia’s benchmark equity gauge was headed for its highest close since April 2022 as heavyweight markets China and Japan rallied on domestic drivers. The MSCI Asia Pacific Index advanced as much as 1.1%, climbing for a sixth straight day in its longest streak of gains in three months. Chinese stocks led the region higher on increasing signs that Beijing is determined to shore up economic growth and boost the stock market. The country’s property gauge is set to enter a bull market as the latest China Mfg PMI print beat expectations, rising to 49.3 vs. 49.2 survey; and up from 49.0 previously. The rally in China also boosted MSCI’s key emerging markets index, with the measure on track for its highest close in 2023 on Monday.

“The last two years have reminded us of the unpredictability of market events and the power of mean reversion,” said Bryan Cheung, associate director for manager research at Morningstar. “Investors should rebalance their portfolios from areas that have gotten more expensive, like the tech sector, into more attractively valued areas such as value-tilted sectors and non-US markets like Asia and emerging markets.” Elsewhere, Japanese gauges climbed more than 1% as the yen weakened after the Bank of Japan announced unscheduled bond-purchase operations and following a tweak to its yield-curve control policy Friday.

Asian stocks are poised to have their best month since January, amid improving prospects for the Chinese market, growing expectations of a soft landing in the US and the continued demand for artificial intelligence-linked shares. Still, the MSCI index’s gains are only about half that of the S&P 500. “Since last quarter, we have been recommending a balanced portfolio approach across Asia on one side chasing momentum in the region while also safeguarding against potential recession through high-yielding stocks,” Sanford C. Bernstein strategists including Rupal Agarwal wrote in a note. “We still find ample macro, valuation, earnings support” for these high-yielding names, they added.

Japan remains a focus for traders. On Friday, BOJ Governor Kazuo Ueda said the central bank would allow 10-year bond yields to rise above a ceiling it now calls a point of reference. The half-assed move, as is now widely understood, was meant not to signal normalization – as the BOJ is terrified what that would do to the bond market – but to boost the yen. Unfortunately, the latest YCC tweak has crashed and burned immediatley as the yen plunged after the Bank of Japan announced unscheduled bond-purchase operations to buy debt. The BOJ was seeking to contain a selloff after it said Friday it will allow yields to rise above a 0.5% cap.

“We had the BOJ today making sure yields remained capped,” said Jane Foley, head of currency strategy at Rabobank. “They clearly don’t want yields rising too much, so today’s action drove home the point it was perhaps more of a technical adjustment than a change in policy.”

Australia’s ASX 200 lagged with strength in the commodity-related sectors offset by weakness in consumer stocks and financials, with the mood cautious ahead of tomorrow’s RBA rate decision where there is a discrepancy between money markets pricing and analysts’ median expectations on whether the central bank will hike or pause.

In FX, the Bloomberg Dollar Spot Index is up 0.1% while the Australian and New Zealand dollars are the best performers among the G-10’s. The yen plunged after the Bank of Japan announced unscheduled bond purchases, an indication that the dovish central bank isn’t yet ready to let yields soar. USD/JPY rose as much as 0.95% to 142.50, swinging from an intraday low of 140.70. BOJ said it would buy 300 billion yen ($2.1 billion) of five-to-10 year notes at market- level yields. On Friday, it said a previous yield ceiling of 0.5% for 10-year bonds is now a reference point rather than a limit, raising expectations it would let rates rise.

In rates, treasuries are slightly cheaper across the curve following rangebound Asia and early London sessions, while front-end outperforms slightly, steepening 2s10s spread by almost 2bp on the day. Downside pressure emerged during Asia session as Japanese bonds slid for a second day, prompting policy makers to step in to buy the notes. Japanese 10-year yields top 0.6% in Asia after the BOJ conducted an unscheduled bond-buying operation while the yen falls 0.9% versus the greenback. Bund futures are also lower although there was little reaction shown to euro-area CPI data. German 10-year yields are up 2bps. Treasuries also fall: US 10-year yields were around 3.96%, erasing an earlier spike to 4.0%, and cheaper by around 2bps vs Friday close with bunds and gilts trading broadly in line in the sector. Fed-dated OIS steady on the day with around 11bp of rate hike premium priced over the next two policy meetings, unchanged from Friday close. Monday’s few scheduled events include Fed’s Senior Loan Officer opinion survey release at 2pm New York time.

In commodities, crude futures advance with WTI rising 1%. Spot gold falls 0.3%.

Today’s macro data focus is SLOOS (which tends to precede moves in actual lending by ~2 quarters) and Chicago PMI.

Market Snapshot

- S&P 500 futures up 0.2% at 4,614

- STOXX Europe 600 little changed at 470.90

- German 10Y yield little changed at 2.51%

- Euro little changed at $1.1014

- Brent Futures little changed at $84.93/bbl

- MXAP up 0.2% to 170.37

- MXAPJ up 0.3% to 540.44

- Nikkei up 1.3% to 33,172.22

- Topix up 1.4% to 2,322.56

- Hang Seng Index up 0.8% to 20,078.94

- Shanghai Composite up 0.5% to 3,291.04

- Sensex up 0.4% to 66,425.08

- Australia S&P/ASX 200 little changed at 7,410.42

- Kospi up 0.9% to 2,632.58

- Gold spot down 0.3% to $1,954.19

- U.S. Dollar Index up 0.21% to 101.83

Top Overnight News

- China signaled fresh efforts to boost consumption though stopped short of direct fiscal support, while major cities pledged to aid the property market. China’s NBS PMIs were mixed for July, with decent Manufacturing (49.3, up from 49 in June and ahead of the Street’s 48.9 forecast) but poor Non-manufacturing (51.5, down from 53.2 in June and below the Street’s 53 forecast). BBG / RTRS

- The Biden administration is hunting for malicious computer code it believes China has hidden deep inside the networks controlling power grids, communications systems and water supplies that feed military bases in the United States and around the world, according to American military, intelligence and national security officials. NYT

- The US will provide Taiwan with $345mn in weapons, marking the first time the Pentagon will send arms directly to the country to boost its defenses amid rising concern about assertive Chinese military activity. FT

- Lagarde said the ECB has made “great progress” in its fight against inflation and she called Q2 GDP numbers from Germany and Spain “quite encouraging”. RTRS

- Europe’s July CPI was inline at +5.3% on the headline, but core came in a bit hotter at +5.5%, flat vs. June and above the Street’s +5.4% forecast. The core CPI in Europe really hasn’t descended that far from the peak of +5.7% in March. RTRS

- Zelensky warns that “war is coming to Russia” after Moscow hit with drone attacks (“gradually, the war is returning to the territory of Russia, to its symbolic centers and military bases, and this is an inevitable, natural and absolutely fair process”). London Telegraph

- Kashkari said the inflation outlook is “quite positive” and it “now appears the US will avoid a recession”, but he’s not sure the Fed is done hiking rates. RTRS

- AI programs come under further scrutiny from content creators – websites, authors, and other content creators are increasingly demanding compensation from generative AI programs feeding off their work. WSJ

- Blackstone’s BREIT is selling assets to raise liquidity for redemptions and to build data centers for the boom in AI computing demand. FT

A more detailed look at global markets courtesy of Newsquawk

Asian stocks headed into month-end mostly on the front foot as the region sustained last Friday’s tech-led momentum from Wall St and as participants digested the latest support efforts from China and mixed PMI data. ASX 200 lagged with strength in the commodity-related sectors offset by weakness in consumer stocks and financials, with the mood cautious ahead of tomorrow’s RBA rate decision where there is a discrepancy between money markets pricing and analysts’ median expectations on whether the central bank will hike or pause. Nikkei 225 was boosted from the open and rose back above the 33,000 level amid a weaker currency and as markets digested the BoJ’s recent shift to a more flexible approach which provided early tailwinds for financials, while the central bank announced unscheduled bond purchases and participants also shrugged off disappointing Industrial Production data. Hang Seng and Shanghai Comp were higher amid stimulus-related optimism as Chinese officials are set to announce more measures for consumption, recovery and expansion, while the NDRC said it will solidly promote development and reform, as well as stick to the general principle of making economic stability a top priority. Furthermore, mixed official PMI data from China failed to dampen the mood in which headline Manufacturing PMI slightly topped forecasts but remained in contraction territory and Non-Manufacturing PMI disappointed with the slowest pace of increase since December 2022.

Top Asian News

- China issued measures to recover and expand consumption including expanding consumption in NEVs and reasonably boosting consumption credit, while it will enhance financial support on consumption, according to a State Council document.

- Chinese officials from several agencies will hold a press conference on Monday at 08:00BST/03:00EDT to announce more measures for consumption, recovery and expansion, according to Bloomberg.

- China’s NDRC said it will solidly promote development and reform, as well as stick to the general principle of making economic stability a top priority and pursuing progress while ensuring stability, according to Xinhua.

- Major Chinese cities including Beijing, Shenzhen and Guangzhou vowed to better meet rising housing needs after China’s housing minister called for more efforts to strengthen the property market with measures such as lowering payment requirements and mortgage rates for first-time homebuyers, according to Global Times.

- Chinese Vice Premier He Lifeng said at the China-France economic and financial dialogue that the Chinese side appreciates the French side’s decision to extend 5G licences in some cities to Huawei and the two sides will sign a cooperation agreement on grape cultivation and wine production. Furthermore, the two sides welcomed the recent trial certification of an Airbus (AIR FP) helicopter and aircraft, according to Reuters.

- French Economic Minister Le Maire said China must remain a key partner for all European countries specifically France in tackling climate change and said they need China as a key partner for global growth, while he added that they are totally opposed to the idea of decoupling and want to get better access to Chinese markets, according to Reuters. Furthermore, Le Maire said the European car industry can withstand cheap Chinese EVs, according to FT.

- Italy’s Defence Minister Crosetto said Italy made an improvised and atrocious decision when it joined China’s Belt and Road Initiative under a previous government in 2019, according to Reuters.

- Alibaba (9988 HK) affiliate Ant Group’s listing is unlikely to occur in the short term, according to a Chinese state media report.

- Japan’s Labour Ministry is reportedly proposing a record increase in the minimum hourly wage to lift it above JPY 1,000 to help low-income households tackle inflation, according to Bloomberg.

- Japan LDP Senior Official Seko says BoJ policy tweak sends a message to exit from easing finally, according to Jiji; BoJ decision could throw cold water on the Japanese economy and needs high attention.

- China’s NDRC Deputy Director says we should give full play to the decisive role in the market of resource allocation. Will improve long-term mechanisms for expanding household consumption.

- China Commerce Ministry issues export controls on drone-related equipment; effective September 1st.

European bourses are mixed/steady around the unchanged mark on month-end, Euro Stoxx 50 +0.3%. Action which follows a mostly firmer APAC handover given Friday’s Wall St momentum and the latest Chinese stimulus, with mixed Chinese PMIs failing to offset the tone. Within Europe, sectors feature underperformance in Construction/Materials, perhaps after the latest HS2 update while Food, Beverage & Tobacco also lags after Heineken’s -6.0% Q2 update featuring downbeat sector commentary. Stateside, futures are essentially unchanged with specifics limited and the earning docket sparse in the pre-market ahead of a relatively busy PM agenda.

Top European News

- UK’s financial regulator is under increasing pressure to overhaul rules governing the bank accounts for politicians amid the Farage ‘debanking’ fallout, according to FT.

- ECB’s Lagarde reiterated that the ECB is to assess the situation on a meeting-by-meeting basis and a pause would not mean that there would not be any rate hikes after, while she also stated that Q2 GDP figures for France, Germany and Spain are encouraging, according to an interview in Le Figaro.

- Bundesbank’s deputy head Claudia Buch said the ECB needs a more critical mindset on banks and warned the sector still faces significant risks from major macroeconomic upheaval, according to FT.

FX

- The Dollar Index is kicking off the last trading day of July on the front foot and going against some month-end models, albeit likely on the back of BoJ-induced JPY weakness overnight.

- JPY resides as the marked laggard following the BoJ’s back-door YCC tweak last week, which was undermined by an unscheduled JGB operation as the 10yr JGB yield topped 60bps.

- Antipodeans are the standout outperformers amid Chinese stimulus optimism, with a string of recent reports suggesting China is focusing on its ailing domestic consumption, whilst China’s Manufacturing PMI marginally topping expectations could be providing some tailwinds.

- EUR saw little reaction on the EZ Flash CPIs, which headline print in-line whilst core and super-core marginally topping forecast, with another inflation report due before the ECB’s next meeting.

- PBoC set USD/CNY mid-point at 7.1305 vs exp. 7.1524 (prev. 7.1338)

Fixed Income

- Core benchmarks are under pressure this morning with JGBs continuing their post-BoJ selling in APAC trade, which prompted Japan to step in with an unscheduled purchase; action which seemingly settled the complex.

- EGBs are pressured with Bunds at the lower-end of 132.45-132.82 parameters while Gilts reside at the 95.47 trough which is 36 ticks above Friday’s base.

- Bunds saw limited two-way action on the EZ Flash data points, ultimately settling around pre-release figures with market pricing little changed.

- Periphery in-fitting but, as is often the case, slightly more contained with BTPs and Bonos digesting their own incremental updates.

- USTs following suit to the above though a packed agenda ahead including Fed’s 2023 voter Goolsbee, the SLOOS and Treasury estimates ahead of Wednesday’s quarterly refunding.

Commodities

- WTI and Brent futures have been trending higher since after the Chinese equities open overnight, with participants attributing the initial softness in prices to mixed Chinese PMIs, whilst the recovery has been partially pinned on continued Chinese efforts to boost its domestic consumption.

- Spot gold is modestly softer amid the Dollar’s strength and ahead of this week’s key risk events including the BoE, US ISM PMIs, and the US Jobs Report. Spot gold sees its 100 DMA at USD 1,967.72 today and the DMA seen at 1,946.02/oz.

- Base metals are mixed in tandem with the broader mood across the market. 3M LME copper has waned from best levels around USD 8,739/t to levels just under USD 8,700/t with the red metal underpinned by Chinese stimulus hopes. It’s also worth noting Chinese export controls on key chipmaking material will come into effect on Tuesday 1st August

- Iran’s Oil Minister Owji said Tehran will pursue its rights in the Durra Field if other parties shun cooperation, according to Shana.

- Russian President Putin said he agreed to have talks with Turkish President Erdogan on Wednesday and that a Turkish gas hub is still on the agenda, while he noted that they want to set up an electronic platform for gas sales in Turkey and don’t want to store gas there, according to Reuters.

- Oman Crude OSP was calculated at USD 80.54/bbl for September (prev. USD 74.78/bbl August), according to DME data.

- UK PM Sunak will today commit to going ahead with oil and gas exploration and production in the North Sea, according to the Times. Subsequently confirmed

Geopolitics

- Russian President Putin said that they do not reject talks on Ukraine but noted a ceasefire is hard to implement when the Ukrainian army is on the offensive, while he added there should be agreement on both sides and that there are no significant changes on the Ukrainian front for now. Furthermore, Putin also commented that no one wants a direct clash between NATO and Russian forces in Syria and that the Russian Navy is to get 30 new ships this year, according to Reuters.

- Russian Foreign Ministry spokeswoman said Russia has received around 30 peace initiatives on Ukraine, according to TASS.

- Two skyscrapers in Moscow’s premier business district were damaged by drone strikes, while Moscow’s Mayor said Ukrainian drones caused damage although there were no casualties, according to FT.

- Ukrainian President Zelensky has warned war is coming back to Russia following the drone attack on the Russian capital Moscow on Sunday, according to the BBC.

- Ukrainian Chief of Staff said Ukraine will start negotiations on security guarantees with the US next week.

- Polish PM Morawiecki said a group of Wagner mercenaries in Belarus have moved closer to the Polish border and may stage a ‘hybrid attack’ inside Poland, while he added that Wagner fighters may pose as migrants to enter the EU and that the situation is getting increasingly dangerous, according to Politico.

- Russia’s embassy in Moldova announced it will temporarily stop providing appointments for consular matters in what Moldovan officials said is a situation linked to the order by the country’s officials to cut staff, according to Reuters.

- Saudi Arabia will host a Ukrainian-organized peace summit in early August in an effort to find a way to start negotiations over the war in Ukraine, according to an official cited by Politico. Furthermore, it was reported that Ukraine, Brazil, India and South Africa are expected to attend but Russia is not.

- US Secretary of State Blinken said China has repeatedly assured the US that it is not providing material, lethal assistance in Ukraine.

- US President Biden’s administration believes China implanted malware in key US power and communications networks in a ‘ticking time bomb’ that could disrupt the military in the event of a conflict or if China were to move against Taiwan, according to NYT.

- US is to provide Taiwan with military aid of up to USD 345mln, according to the White House.

- Senior Israeli lawmaker said it is too early to speak of a Saudi normalisation deal being in the works, according to Reuters.

Crypto

- SEC reportedly asked Coinbase (COIN) to halt trading in everything aside from Bitcoin prior to suing the exchange, according to the CEO cited by FT.

US Event Calendar

- 09:45: July MNI Chicago PMI, est. 43.3, prior 41.5

- 10:30: July Dallas Fed Manf. Activity, est. -22.5, prior -23.2

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Central Banks

- 09:20: Fed’s Goolsbee Speaks on Yahoo! Finance Live

DB’s Jim Reid concludes the overnight wrap

Given that the outcome of the September FOMC (19th-20th) will likely depend on the two CPIs and two payroll reports prior to the meeting, all roads this week lead to US payrolls on Friday. Ahead of that tomorrow JOLTs data will give clues as to the current tightness of the labour market underneath the headline numbers. For those of us who still believe old fashioned metrics of the cycle matter, then the quarterly Fed SLOOS later today could actually be the most informative for where the economy might be in 6-12 months. We also have the manufacturing (tomorrow) and services (Thursday) ISMs as a timely indicator of the momentum in the US economy.

Today’s Eurozone CPI and GDP prints will also be closely watched after the German and French prints on Friday. With the ECB now as data dependent as the Fed, these releases take on added significance ahead of their September 14th meeting.

Stand by also for a marginal 25bps vs 50bps BoE meeting on Thursday (DB at 25bps) and another close call for the RBA tomorrow where a 25bps hike is expected against no change. Another packed week for corporate earnings will feature names including Apple, Amazon (both Thursday), AMD (tomorrow) and Qualcomm (Wednesday). Otherwise, 169 S&P 500 and 87 Stoxx 600 companies will be reporting this week.

Going through some of the key releases now and starting with payrolls. While our economists expect some payback from state and local government education hiring for the headline print (+175k forecast, consensus at +200k vs. +209k previously), they expect a slight pick up in private (+175k vs. +149k) payrolls inline with consensus. This would be below the three-month averages for headline (+244k) and private (+196k) payrolls gains. Watch out for average hourly earnings and hours worked as well. Also keep an eye out for the unpredictable and less reliable ADP (Wednesday). Last month’s +497k blew away all forecasts, and led to a yield sell-off, but this week our economists are expecting a more normal +175k.

Unit labour costs and productivity numbers on Thursday will also be in focus following the GDP and ECI data last week. Our team forecasts preliminary Q2 growth in productivity to come in at +1.1% following a -2.1% print previously. Unit labour costs are seen moderating from +4.2% to +2.6%.

Our UK economist Sanjay Raja previews the BoE meeting on Thursday here. He expects a +25bps hike taking the Bank Rate to 5.25%, although it is a close call between that and +50bps. Beyond next week’s decision, Sanjay sees two more +25bps hikes, with rate cuts potentially starting from Q2-24. The central bank’s Decision Maker Panel survey will be out that day as well.

In Europe, the main events will be today with the July flash CPI and Q2 GDP prints for the euro area. Country prints out on Friday have already given a good sense of the direction of travel. July inflation came in at +6.5% in Germany, (+6.6% exp), +5.1% in France (+5.0% exp) and +2.1% in Spain (+1.6% exp). Our European economists now see euro area headline inflation tracking at a low +5.4% (consensus +5.3%), and at +5.5% for core (consensus +5.4%). This would be the lowest headline inflation since January 2022, but with core inflation only a couple of tenths below its peak this March. Meanwhile, our economists now expect a +0.3% qoq Q2 GDP print (with risks tilted to +0.4%), though the upside versus consensus (+0.2%) is mostly due a distorted +3.3% print in Ireland last Friday. Elsewhere, growth disappointed in Germany, stagnating in Q2 (0.0% qoq vs +0.1% exp) after the technical recession seen during the winter. But it was stronger in France (+0.5% vs +0.1% exp) and Spain (+0.4% qoq, in line with exp).

After the official China PMI earlier today (more below), we see the Caixin indicators for manufacturing (tomorrow) and services (Thursday) to further enhance our understanding of the current state of the Chinese economy as we wait for fresh stimulus announcements. Our Chief China economist recaps last Monday’s Politburo meeting and highlights its market implications here.

In earnings, with around half of the S&P 500 companies having already reported results, all eyes will be on Apple and Amazon, releasing earnings Thursday. Elsewhere in tech, AMD and Qualcomm will be closely watched when it comes to chips. Uber, Shopify and PayPal also report. See Binky Chadha’s review of the strong reporting season so far here.

Asian equity markets are rallying this morning following Friday’s gains on Wall Street. As I check my screens, the Nikkei (+1.54%) is leading gains with the Hang Seng (+1.37%), the KOSPI (+0.80%), the CSI (+0.78%) and the Shanghai Composite (+0.49%) also higher. S&P 500 (-0.15%) and NASDAQ 100 (-0.22%) futures are slightly lower. Meanwhile, yields on 10yr USTs (+3.79 bps) have edged higher trading at 3.99% as we go to print.

Data from China showed that the official manufacturing activity contracted for the fourth straight month as the manufacturing PMI came in at 49.3 in July (v/s 48.9 expected) and compared to a reading of 49.0 in June. Meanwhile, the official non-manufacturing PMI dropped to 51.5 in July (v/s 53.0 expected) from a level of 53.2 in June, marking its lowest reading this year thus highlighting that the world’s second biggest economy is struggling to revive growth momentum amid soft global demand. There is encouraging stimulus talk though, hence the equity rally this morning. Elsewhere in Japan monthly activity data was a bit mixed. Retail sales contracted -0.4% m/m in June (v/s -0.7% expected), against the prior month’s upwardly revised +1.4% increase. Meanwhile, industrial output rebounded +2.0% m/m in June (v/s +2.4% expected, -2.2% in May).

The BOJ earlier announced an unscheduled Japanese Government Bond (JGB) purchase operation as yields on the 10yr JGBs rose to a fresh nine-year high of 0.607% before moving back to 0.587% after the BOJ’s surprise decision. They bought 300 billion yen ($2.1 billion) of 5-to-10 year notes at market yields. Meanwhile, the Japanese yen has given back most of its post BOJ gains after Friday’s YCC tweak and is currently trading at 141.81 versus the dollar.

Looking back on last week now, after the short, sharp risk-off as a result of the BoJ YCC surprise, a positive mood returned to markets on Friday as several US economic data releases added to optimism that the world’s largest economy could achieve a soft landing yet. The first release was the US June core PCE price index, which rose 4.1% year-on-year, below the anticipated 4.2%. In month-on-month terms, this was at 0.2% (as expected), down from 0.3% in the previous month, adding support to the narrative of softening inflation that had picked up pace following the US CPI data release earlier in the month. Building on this, the US employment cost index for Q2 increased 1.0% (vs 1.1% expected), another piece of evidence for the decelerating inflation story. On the back of the data, market pricing for the chances of another Fed hike by November (around terminal timing) eased to 37% (from 40% on Thursday), but this was still up from 33% a week earlier.

Against the backdrop of a potential soft landing, US 10yr Treasuries rallied on Friday, as yields fell -4.9bps, but were still up +11.4bps in weekly terms. 2yr yields followed suite, falling -5.3bps on Friday, but this time reversing much of their rise earlier in the week (+3.5bps week-on-week).

Over in Europe, 10yr bund yields gained +2.6bps week-on-week (and +2.0bps on Friday). However, 2yr bunds rallied by -4.2bps on Friday as ECB rate expectations moved lower with ECB commentary consistent with a slightly dovish take on the ECB meeting the previous day. A 44% chance of a 25bp hike is now priced in for September, the first time this has been below 50% since mid-June.

The US fixed income rally on Friday was a partial reversal of the sell off late on Thursday that came after a Nikkei report that the Bank of Japan may make changes to its YCC policy, a move confirmed by the BoJ on Friday as it effectively moved the upper end the YCC band to +1%. The change was seen as an initial step towards policy normalisation in Japan, though BoJ’s Ueda said he did not expect long-term yields to rise to 1%. Against this backdrop, the Nikkei fell -0.40% on Friday, but this failed to erase the week’s gains of +1.41%, its largest weekly up move since mid-June. Yields on 10-year Japanese government bonds jumped to their highest level since 2014, climbing +11.8bps on the week to 0.57%. However, the FX market response saw the yen reversing its earlier gains after a volatile day, closing the day lower at 141.16, virtually in line with its pre-Nikkei story level, having traded just above 138 early on Friday.

Equities rallied on Friday off the back of the positive US economic data. The S&P 500 gained +1.01% week-on-week, and +0.99% on Friday as 9 out of the 11 major constituent sectors rallied, securing its third consecutive week of gains. The NASDAQ relatively outperformed, gaining +1.90% week-on-week (and +2.02% on Friday), with outperformance by the tech megacaps. The STOXX 600 likewise gained +1.16% on the week in its third consecutive week of gains, although the rally stumbled on Friday with the index closing down -0.20%.

Finally, turning to commodities, oil recorded another weekly gain. Brent crude rose +0.89% on Friday, with a weekly increase of +4.84% to $84.99/bbl, buoyed by the improving growth outlook for the US and China’s recent pledge to boost stimulus. This marks its fifth weekly rise in a row, with Brent up +17.6% since 27 June. WTI crude was similarly up +4.55% on the week, to $80.58/bbl (and +0.61% on the week).

Tyler Durden

Mon, 07/31/2023 – 08:13

via ZeroHedge News https://ift.tt/BVozORD Tyler Durden