Futures, Bonds Dip As German Inflation Comes In Hotter Than Expected

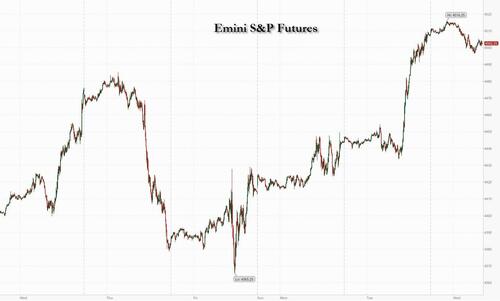

US equity futures are lower, following most European bourses and bonds in the red European after the latest round of German regional data suggested inflation may not yet be fully on the retreat in the euro region. As of 7:45am ET, S&P and Nasdaq 100 futures were both down about 0.1% after the S&P 500 jumped by the most since June on Tuesday after unexpectedly weak JOLTS jobs and consumer-confidence readings in the US raised hopes the Federal Reserve may be nearing the end of its tightening cycle.

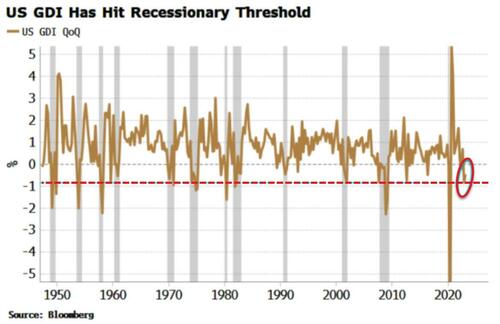

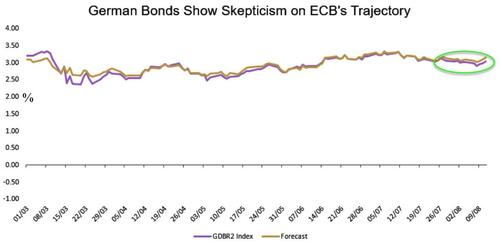

German 10-year bund yields jumped as much as 7bps points to 2.58% after regional reports showed inflation accelerated in four of six German states in August, ahead of figures for the overall German economy due later Wednesday. A separate report showed Spanish inflation also quickened. The dollar weakened as the session has progressed and is trading lower against most G-10 currencies. Oil prices remain higher but metals are mixed, with copper slightly lower. Today, we get the latest ADP (which has been a terrible predictor of NFP numbers) and GDP revision which JPM expects to be revised down to 2.0% from 2.4%, below the consensus of no revision. China will release PMI-Mfg. and PMI-Srvcs tonight at 9.30pm ET.

In premarket trading, megacap tech names are mostly lower; with NVDA dropping -0.8% after closing at an all time high yesterday. HP Inc. slumped 10% after the technology hardware company cut its full-year cash flow and profit outlook. Treasury yields ticked higher and a gauge of the dollar was steady. Chinese stocks listed in the US fell in premarket trading, paring gains following a 6% rally in the Nasdaq Golden Dragon China Index in the previous two sessions. Alibaba -1.6%, Baidu -1.3%, PDD Holdings unchanged, JD.com -1.9%, NetEase -1.3%, Trip.com -2.3%, KE Holdings -2.4%, ZTO Express -4.8%. EV stocks lead losses; Nio falls 3.8%, extending a decline since reporting on Tuesday; Li Auto -3.9%, Xpeng -2.8%. Here are other notable premarket movers:

- Alphabet analysts were positive about the company’s artificial intelligence updates at its Google Cloud Next event. The tech giant also announced a new AI infrastructure and software as part of an expanded partnership with Nvidia. Shares fluctuate.

- Ambarella drops 21% after its forecast for third-quarter revenue fell short of Wall Street expectations, prompting a slew of price target cuts from analysts.

- Box falls 9.1% after the infrastructure software company cut its full-year revenue forecast, with analysts flagging pressure on the firm’s clients against a tough macroeconomic backdrop.

- FibroGen tumbles 22% after the biotech company’s Phase 3 LELANTOS-2 trial of pamrevlumab for the treatment of ambulatory patients with Duchenne muscular dystrophy did not meet the primary endpoint.

- Globalstar rises 6.1% as the company named former CEO and executive chairman of Qualcomm, Paul Jacobs, as its new CEO.

Investors will monitor reports on US economic growth and private-sector employment later Wednesday, as well as key non-farm payrolls numbers on Friday, to further ascertain the economy’s resilience amid high interest rates. “Data is king right now in terms of market sentiment,” said Susannah Streeter, an analyst at Hargreaves Lansdown Plc. “The non-farm payroll snapshot on Friday will crown the week, and if it points to a fresh slowdown in hiring, we could see another spurt in stock prices.”

Meanwhile, stronger than expected German and Spanish inflation data muddied the waters for European policy makers as they approach the September rates decision. Market pricing implies roughly even odds of a quarter-point increase by the European Central Bank to 4%. Further clouding the outlook was data showing that euro-area economic confidence slowed more than anticipated this month.

European stocks and bund futures are in the red after Spanish and German inflation data kept the possibility of another ECB rate hike firmly on the table. The Stoxx 600 is down 0.3%, led by declines in the utility, technology and consumer sectors. Banks and basis resources gained while utilities led the decline as Orsted A/S plunged more than 20% after the Danish power generator forecast potential impairments of up to $2.3 billion relating to its US portfolio. Among other individual movers, Prudential Plc climbed more than 4% after posting a rise in new business profit. Here are the most notable European movers:

- Orsted slumps as much as 21%, the most on record, after the Danish power generator forecast potential impairments of up to $2.3b relating to its US portfolio. Jefferies called the update a “clear negative”

- Delivery Hero shares fall as much as 7.3% to the lowest level since June. Analysts say the food delivery company’s first-half gross margins were slightly below estimates

- Mining group Eramet SA, oil and gas producer Maurel & Prom and a listed unit of TotalEnergies SE all sank after soldiers seized power in OPEC member Gabon, where the companies have operations

- Brunello Cucinelli gains as much as 6.2%, the most intraday since March 16, as the Italian luxury company said it expects full-year revenue to rise by about 19%, at the top end of previous guidance

- Aroundtown rises as much as 8.9% after the German landlord raises its full-year guidance for funds from operations (FFO). Berenberg says aiming for a higher earnings level was a “positive surprise”

- Prudential rises as much as 4.6% after the insurer reports improved new business profit from its insurance operation. Analysts highlight the company’s strong performance in Hong Kong

- Opus Global, a Hungarian holding company, fell as much as 12% after announcing it will suspend its share buyback program and may resume purchases after Oct. 2, when it’s due to publish 2Q results

In Asia, the MSCI Asia Pacific Index came off its highs after earlier rising as much as 1%, as the strong rally in Chinese equity markets gradually evaporated. Tech stocks such as TSMC and Samsung were the top contributors to the gauge’s gains. Benchmarks had earlier rallied, with the Hang Seng Index rising as much as 1.4%, after Chinese state-owned lenders were reported to prepare to reduce rates on the majority of outstanding mortgages, as well as on deposits.

- Hang Seng and Shanghai Comp both opened with gains as the region conformed to the global risk appetite, with the Shanghai Comp on a more cautious footing after US Commerce Secretary Raimondo suggested US firms complain that China is “un-investable”, while participants also awaited the speculated mortgage rates cuts. In other news, China is reportedly exploring ways to make its own AI memory chips despite US sanctions, according to SCMP sources.

- Australia’s ASX 200 led the gain in the region, rising more than 1% as a slide in the country’s inflation data bolstered prospects for the rate freeze next week.

- Nikkei 225 saw its machinery sector leading the gains, although the index’s upside is hampered by the recent gains in the JPY.

- Indian stocks ended flat on Wednesday as banks and utilities declined while technology shares were among gainers. The S&P BSE Sensex Index was little changed at 65,087.25 in Mumbai, while the NSE Nifty 50 Index was flat at 19,347.45. Out of 31 stocks in the index, 17 rose and 14 fell. The Nifty has traded below its 20-day moving average for the fourth session in a row despite positive global cues.

“These little piecemeal policy shifts are probably very good in the short term for sentiment, but they don’t necessarily create this sort of surge in terms of the local economy,” Dwyfor Evans, head of APAC macro strategy at State Street Global Markets, said on Bloomberg Television. “There are still bigger issues at play here that I think are holding investors back still at this particular point.”

In FX, the Bloomberg Dollar Spot Index rose 0.1%; it dropped 0.4% on Tuesday as bets for a Federal Reserve hike by year-end were pared back significantly following weak US consumer confidence and JOLTS data

- EUR/USD strengthened after data showed inflation in Germany and Spain accelerated, bolstering possibility that ECB may have to raise rates further. Euro bearish sentiment in options over the next month eases following the latest data out of the US and the euro area.

- Australia’s dollar fell after weaker-than-expected inflation bolstered prospects that the RBA will stand pat on rates next week. AUD/USD slipped 0.1% after adding 0.8% on Tuesday. The pair briefly fell to 0.6450 earlier Wednesday. Bids for exporters remain layered 0.6440/50, according to traders. Reserve Bank pricing sees an implied rate of 4.164% by the December meeting from 4.175% yesterday

In rates, treasuries were under pressure as the US trading day begins, paced by bunds, where bear-flattening ensued after German inflation rose more than forecast. US yields remain inside Tuesday’s bull-steepening ranges. German 10-year yields rise 6bps to 2.57% while Treasuries also declined, paring some of Tuesday’s rally: yields were higher by 1bp-3bp across the maturity spectrum with the curve steeper, following short-end-led declines of more than 10bp Tuesday. Market-implied expectations for Fed policy are little changed, pricing in just over 50% odds of a quarter-point rate increase in November. Treasuries may draw support from expectations that month-end index rebalancing late Thursday, estimated to extend its duration by 0.12 year, will spur buying. Focal points of US session include August ADP employment change ahead of broader jobs report Friday, and the second estimate of 2Q GDP, a month after the first one exceeded economist estimates, sparking a bond market selloff.

In commodities, crude futures advance, with WTI rising 0.6% to trade near $81.70. Spot gold rises 0.1%.

Bitcoin is under modest pressure despite the relatively directionless USD action. Currently, BTC resides at the low end of USD 27.29-27.75k parameters, which are well within Tuesday’s more pronounced USD 26-28.14k bounds.

To the day ahead now, and data releases include the German and Spanish CPI readings for August, UK mortgage approvals for July, whilst in the US there’s the ADP’s report of private payrolls for August, the second estimate of Q2 GDP, along with pending home sales for July. Today’s earnings releases include Salesforce.

Market Snapshot

- S&P 500 futures down 0.1% to 4,501.00

- MXAP up 0.3% to 161.60

- MXAPJ up 0.3% to 508.58

- Nikkei up 0.3% to 32,333.46

- Topix up 0.4% to 2,313.38

- Hang Seng Index little changed at 18,482.86

- Shanghai Composite little changed at 3,137.14

- Sensex up 0.4% to 65,352.93

- Australia S&P/ASX 200 up 1.2% to 7,297.75

- Kospi up 0.4% to 2,561.22

- STOXX Europe 600 down 0.1% to 459.35

- German 10Y yield little changed at 2.56%

- Euro down 0.1% to $1.0865

- Brent Futures up 0.2% to $85.70/bbl

- Gold spot down 0.1% to $1,936.26

- U.S. Dollar Index up 0.11% to 103.64

Top Overnight News

- Leading BOJ hawk Naoki Tamura hinted that the central bank may attain its long sought-after goal of 2% inflation on a stable basis by early 2024, which may pave the way for higher rates. He hopes the bank will have a “higher resolution” picture around January to March. Economists surveyed by Bloomberg still see April as the most likely month for a policy change. BBG

- China has asked two of the nation’s biggest financial firms to examine the books of Zhongrong International Trust Co., potentially paving the way for a state-led rescue of the troubled shadow lender. BBG

- Australia’s CPI in Jul moved down to +4.9% from +5.4% in June and below the Street’s +5.2% forecast. BBG

- Spain’s CPI for Aug ran slightly hot, with the core number coming in at +6.1% (down from +6.2% in Jul but ahead of the Street’s +6% forecast) and headline +2.4% (up from +2.1% in Jul and inline w/the Street’s +2.4% forecast). BBG

- Ukrainian drones struck seven Russian regions overnight, destroying several military cargo planes, in Kyiv’s most sweeping unmanned aerial attack inside enemy territory since Moscow invaded last year. FT

- Soldiers seized power in OPEC member Gabon, canceling an Aug. 26 presidential election that was set to extend the Bongo family’s 56-year hold on power. The military takeover is the ninth in sub-Saharan Africa since 2020 and follows a coup in Niger last month, raising concerns of further regional instability. BBG

- US oil stockpiles slumped by 11.5 million barrels last week, the API is said to have reported. That would cut total holdings to the lowest this year if confirmed by the EIA. Supplies at Cushing dropped 2.24 million to the least since early January. BBG

- Founders and venture capitalists who flocked to artificial-intelligence startups are learning that turning the chatbot buzz into successful businesses is harder than it seems. Almost a year into the boom ignited by the November launch of ChatGPT, some startups that epitomized the zeal for so-called generative AI are now navigating layoffs and reduced user interest. WSJ

- Amazon is being threatened with legal action from the US medicines watchdog over the sales of “unapproved” drugs on its online site, as the tech giant faces scrutiny while seeking to break further into the $4tn American healthcare industry. FT

A more detailed look at global markets courtesy of Newsuawk

APAC stocks traded positively across the board following the JOLTS-induced gains seen on Wall Street and in the run-up to month end. ASX 200 saw its upside driven by the industrial sector and closely followed by its gold sector, with a further boost seen from the softer-than-expected Aussie CPI data. Nikkei 225 saw its machinery sector leading the gains, although the index’s upside is hampered by the recent gains in the JPY. Hang Seng and Shanghai Comp both opened with gains as the region conformed to the global risk appetite, with the Shanghai Comp on a more cautious footing after US Commerce Secretary Raimondo suggested US firms complain that China is “un-investable”, while participants also awaited the speculated mortgage rates cuts. In other news, China is reportedly exploring ways to make its own AI memory chips despite US sanctions, according to SCMP sources.

Top Asian News

- BoJ Board Member Tamura said BoJ will take steps to curb an excessive rise in interest rates, such as increasing bond buying if BoJ sees speculative and sharp moves that deviate from fundamentals. BoJ Board Member Tamura said he personally feels that sustained and stable achievement of the 2% inflation target is in sight, and it is appropriate to keep easy policy now given uncertainty on hitting the price goal; does not expect 10yr JGB yield to rise to 1.0%. There is a good chance Japan’s economic growth will exceed expectations, he said.

- China is reportedly exploring ways to make its own AI memory chips despite US sanctions, SCMP sources said; “China’s top DRAM maker, ChangXin Memory Technologies, is the country’s best hope for specialist chips, but it may take up to four years to deliver products”.

- Country Garden (2007 HK) will raise HKD 270mln via new share issues at HKD 0.77 each, according to Reuters.

- Chinese regulators urge money brokers to ensure data security, according to Reuters.

- PBoC injected CNY 382bln via 7-day reverse repos with the maintained rate at 1.80% for a CNY 81bln net injection.

- PBoC holds a meeting with private firms in order to promote their financing, according to Yicai.

European bourses are in the red, Euro Stoxx 50 -0.6%, with stocks generally soft after yesterday’s upside. The current session’s pressure is a function of more hawkish ECB expectations for September after German-state and Spanish metrics. Sectors are mostly in the red with Tech underperforming as yields rise, a narrative which is supporting Banking/Insurance names. Stateside, futures are modestly softer, ES -0.2% ahead of a busy US agenda; NQ -0.3% lags incrementally given the mentioned yield moves.

Top European News

- EU Chamber of Commerce President says “uninvestable” is not a term that we would use to describe China; China is under-invested in terms of the FDI it has been able to attract for Europe.

- ECB’s Centeno says EZ economic growth indicators have been surprising on the downside recently, downside risks for growth outlined in June projections are materialising. Not seeing de-anchoring of inflation expectations. Seeing a degree of flexibility in the labour market that was not evident in the past.

FX

- Greenback steadier after a collapse on lower job openings and loss of consumer confidence.

- DXY attempts to form a base around 103.50 – Kiwi cedes ground to Buck along with Yen and Aussie following weak Antipodean data and somewhat mixed BoJ rhetoric

- NZD/USD pivots 0.5950, USD/JPY reclaims 146.00+ status and AUD/USD tests 0.6450 from a peak above 21 DMA.

- Euro underpinned as German state CPIs imply upside bias to national outturn.

- EUR/USD approaches 1.0900 and the top of the band of expiries.

- PBoC sets USD/CNY mid-point at 7.1816 vs exp. 7.2773 (prev. 7.1851)

Fixed Income

- Broad debt retracement from Tuesday’s US data-inspired highs, with EGBs leading the way and peers down in sympathy.

- Bunds below the prior session low within 131.83-132.56 range.

- T-note towards base of 110-18+/28 bounds and Gilts trying to stay afloat between 94.35-91 parameters.

- Australia sells AUD 700mln 2.75% 2028 Bonds: b/c 3.25x (prev. 5.70x), average yield 3.8331% (prev. 3.5188%)

- UK DMO intends to schedule 11 conventional Gilt auctions and four I/L in the October-December period.

Commodities

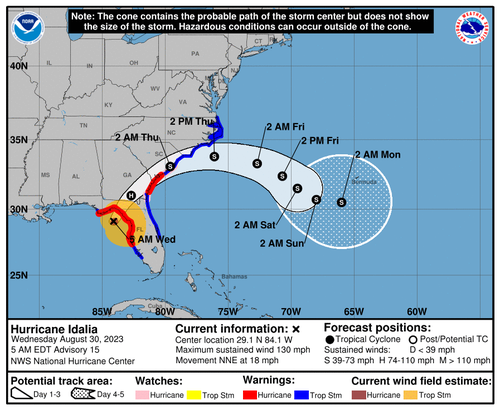

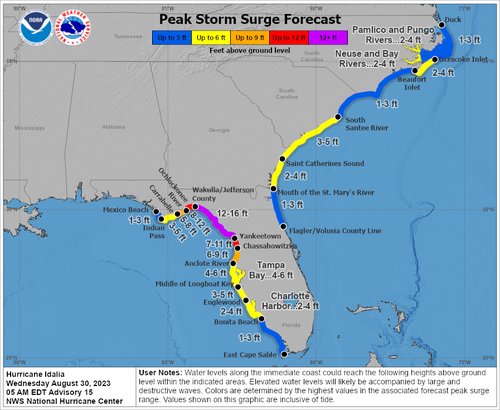

- Currently, WTI Oct’23 and Brent Nov’23 are at the top-end of sub-USD 1/bbl parameters, a peak which printed in proximity to Idalia getting upgraded to a category four hurricane.

- Spot gold is unchanged in extremely narrow circa. USD 3/oz bounds as the DXY struggles to meaningfully deviate from the neutral point ahead of a packed afternoon agenda; base metals mixed.

- US Energy Inventory Data (bbls): Crude -11.5mln (exp. -2.9mln), Gasoline +1.4mln (exp. -1.4mln), Distillate +2.5mln (exp. +0.1mln), Cushing -2.2mln.

- NHC says Idalia rapidly intensifies into a Category 4 Hurricane, catastrophic storm surge and destructive winds are nearing Florida Big Bend region. “Idalia could continue to strengthen before it reaches the Big Bend coast of Florida in a few hours. While Idalia should weaken after landfall, it is likely to still be a hurricane while moving across southern Georgia, and near the coast of Georgia or southern South Carolina late today. Idalia should emerge off the southeastern United States coast early on Thursday and move eastward through late week.”

- Japanese PM Kishida says aims to bring down retail gasoline prices to around JPY 175/litre in October (currently JPY 185/litre).

Geopolitics

- Explosions were reported at Pskov Airport in western Russia, near the border with Estonia, according to BNO Newsroom.

- The Chinese Embassy in the US said China is working to ease market access further and treat foreign firms in the same manner as domestic firms, and added that China will only open its doors wider to the outside world. The embassy noted cyber security review on Micron (MU) is necessary for safeguarding national security, according to Reuters.

- Senior Gabonese military officers appear on television and claim they have taken power and borders are closed until further notice; Gabon soldiers announce the cancellation of elections, and the dissolution of institutions on TV, via AFP.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications, prior -4.2%

- 08:15: Aug. ADP Employment Change, est. 195,000, prior 324,000

- 08:30: 2Q GDP Annualized QoQ, est. 2.4%, prior 2.4%

- 2Q GDP Price Index, est. 2.2%, prior 2.2%

- 2Q Core PCE Price Index QoQ, est. 3.8%, prior 3.8%

- 2Q Personal Consumption, est. 1.8%, prior 1.6%

- 08:30: July Retail Inventories MoM, est. 0.5%, prior 0.7%

- 08:30: July Advance Goods Trade Balance, est. -$90b, prior -$87.8b, revised -$88.8b

- 08:30: July Wholesale Inventories MoM, est. -0.3%, prior -0.5%

- 10:00: July Pending Home Sales (MoM), est. -1.0%, prior 0.3%

- July Pending Home Sales YoY, est. -15.7%, prior -14.8%

DB’s Jim Reid concludes the morning wrap

I was back in the office yesterday after two weeks high up in the French Alps. For our entire trip it was mostly over 30 degrees even at altitude. However the day after we got back it snowed there. I think it would have blown the kids’ mind to have seen that after the weather we had. Talking of the kids, my twins were 6 yesterday. The biggest problem with that is that we bought them new bikes, plus one for Maisie. However this is the first ones we’ve bought that have not come preassembled. So last night my wife and I cursed, swore, and injured ourselves in the pursuit of building three bikes. If you happen to see me in the next few days I guarantee if you look closely enough you’ll see oil somewhere on me that I haven’t been able to get out.

It’s certainly not been a dull second half of August in my absense. To be fair the first half when I was around wasn’t dull either. Markets have swung from narrative to narrative with the soft landing one winning out handsomely yesterday or as a minimum the narrative that the Fed is more likely than not to be done hiking. Although with two whole days left of this choppy month, there’s plenty of time for that to change again.

The big driver yesterday was the latest JOLTS report which showed a further, and large, softening in the US labour market. That came alongside a weak consumer confidence print from the Conference Board, where the present situation component fell to a 9-month low. Together, those two releases led to growing hopes that the Fed would call it a day on their rate hikes, which sent yields on 10yr Treasuries down -8.2bps on the day to 4.12% with 2yrs falling a sizeable -15.4bps, the largest yield decline in nearly 4 months. Equities also rallied strongly on the back of those headlines, with the S&P 500 having its best day since early June (+1.45%) as it advanced for a third day in a row to 2-week highs.

In terms of the details of the JOLTS report, the main headline was that job openings fell to 8.827m in July (vs. 9.5m expected), which was the lowest it had been since March 2021. That meant that the ratio of job openings per unemployed individuals fell back to 1.51 as well, which is the lowest since September 2021, although above the levels around 1.2 seen before the Covid-19 pandemic. The other big story from the release was the decline in the quits rate of those voluntarily leaving their jobs, which is also a good metric for how confident workers are feeling about their prospects. That fell back to 2.3% in July, which is the first time it’s been back at its pre-pandemic level since the current surge in inflation began.

So far at least, this decline in job openings has occurred even as unemployment has remained at historically low levels. Or in other words, the fall in job openings doesn’t appear to have been at the expense of jobs, which is exactly what the Fed are wanting to see. But once these metrics have started falling in the past, it can be hard to know when they’re going to stop, not least since monetary policy operates with time lags that make it hard to feel your way through in real time. So outside of a sudden shock, any path to a hard landing will almost certainly be via signs of a soft landing first.

If you have that concern it would have been heightened by the Conference Board’s latest consumer confidence print. It showed a decline in the headline measure to 106.1 (vs. 116.0 expected), with drops in the present situation and expectations components as well. On top of that, there was another signal that the labour market was weakening, since the gap between the number saying jobs were “plentiful” compared to those saying they were “hard to get” fell to the narrowest since April 2021. So this print and the JOLTS numbers set the stage nicely for Friday’s payrolls.

For now the data put an abrupt stop to the growing narrative that the Fed would still deliver another rate hike in the current cycle. Indeed, the chance of another rate hike by November fell from 71% immediately before the JOLTS report to 51% by yesterday’s close.

For equities, the prospect of fewer rate hikes outweighed any concerns around the data being weak. The S&P 500 saw a near-continuous rally during the day to rise by +1.45%, its strongest gain since 2 June, ironically the last time we saw a strong US payrolls beat. So for a completely opposite reason. All 24 industry groups of the S&P 500 gained, with tech stocks leading the advance. This helped the NASDAQ (+1.74%) to hit a 3-week high, whilst the FANG+ Index rose +3.10% (its largest gain since late May).

Back in Europe, there was also a decent market rally following the releases, with yields on 10yr bunds (-5.3bps), OATs (-5.6bps) and BTPs (-7.2bps) all falling back. Likewise for equities, the STOXX 600 (+0.97%) posted a strong advance, although that was helped by the UK’s return from holiday, since the FTSE 100 (+1.72%) caught up with the previous day’s gains. Today however, attention will turn to the flash CPI numbers for August, with the country releases from Spain and Germany out today ahead of the Euro Area-wide release tomorrow. That’s the biggest remaining input for the ECB’s next decision in a couple of weeks’ time, with markets still narrowly expecting that the ECB will finally pause their hiking cycle after 9 consecutive increases.

In the cryptocurrency space, Bitcoin saw its strongest gain in two months, up +7.15% to $28,005, as the prospects for a first spot Bitcoin ETF improved after a court ruling in the US. It was also a positive day for commodities, with Brent crude (+1.27% to $85.49/bl) moving back above $85 for the first time in two weeks. Across asset classes, the US dollar was the one notable loser of the day, with the broad dollar index (-0.51%) having its weakest day in over three weeks.

Asian equity markets are also trading higher with the S&P/ASX 200 (+1.36%) leading gains across the region as Australia’s inflation softened in July (more below) with the Nikkei on track for its third consecutive day of gains (+0.94%), with the KOSPI (+0.62%) and the Hang Seng (+0.47%) also trading in positive territory. Elsewhere, stocks in mainland China are struggling to gain traction with the CSI (+0.04%) and the Shanghai Composite (+0.03%) both just above flat after losing earlier gains. S&P 500 (+0.17%) and NASDAQ 100 (+0.27%) futures are edging higher again. 10yr USTs (+1.37 bps) yields have edged back up a bit after the big rally yesterday.

Coming back to Australia, data showed that the inflation rate moderated to +4.9% y/y in July (v/s +5.2% expected), its lowest level in 17 months as against a level of +5.4% in June thus reducing the possibility of the Reserve Bank of Australia (RBA) raising interest rates again. Following the release, the Australian dollar lost ground against what has been a weak 24 hours for the US dollar and is down -0.14% at $0.6472 as I type.

News from various sources (like Bloomberg) are indicating that some Chinese state-owned banks are preparing to slash interest rates on existing mortgages and deposits very soon as Beijing is ramping up its efforts to revive growth in the world’s second-largest economy. So watch for headlines there.

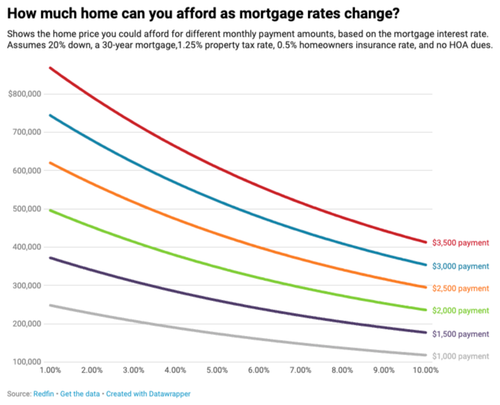

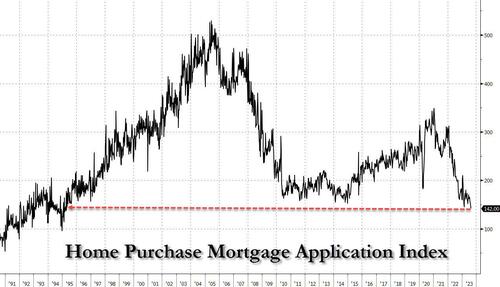

Back to yesterday and the other US data release was on housing for June. According to the 20-City index from S&P CoreLogic Case-Shiller, prices were up another +0.92% that month (vs. +0.80% expected), which is the third consecutive month that prices grew by at least +0.9%. Clearly, housing is only one sector of the economy, but it’s highly sensitive to interest rates, and this is a further sign that it’s picking back up again. On a year-on-year basis, the 20-city index is now only down by -1.17% (vs. -1.60% expected). That said, the house price resilience may be as much about the drag from higher rates on supply of housing in a still solid economy as it as sign of resilient demand.

To the day ahead now, and data releases include the German and Spanish CPI readings for August, UK mortgage approvals for July, whilst in the US there’s the ADP’s report of private payrolls for August, the second estimate of Q2 GDP, along with pending home sales for July. Today’s earnings releases include Salesforce.

Tyler Durden

Wed, 08/30/2023 – 08:11

via ZeroHedge News https://ift.tt/iI5ltsy Tyler Durden

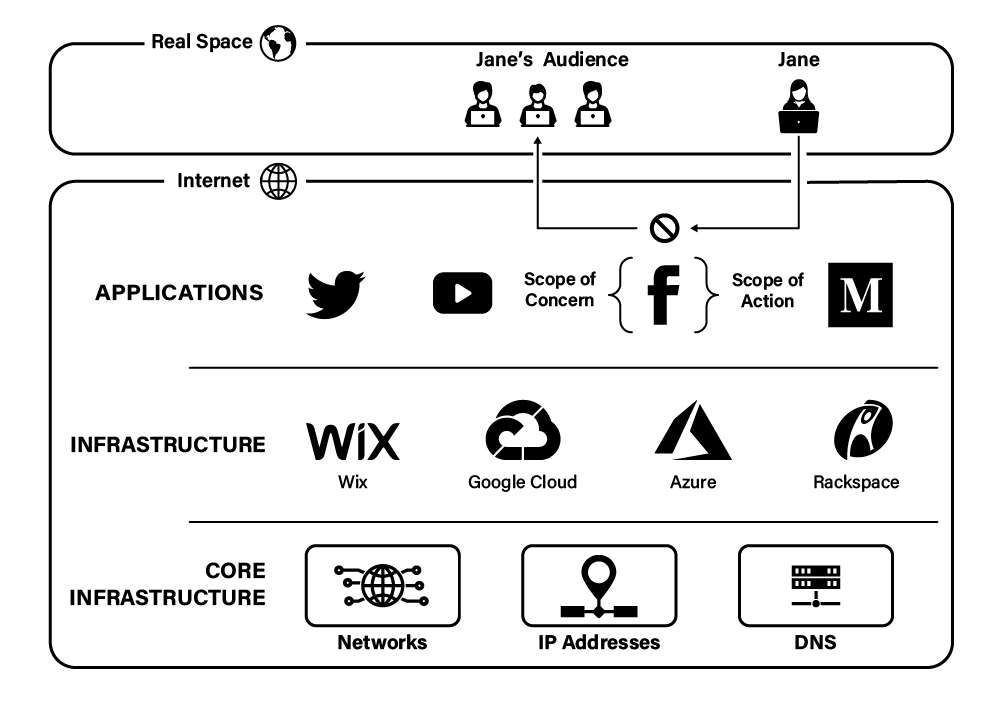

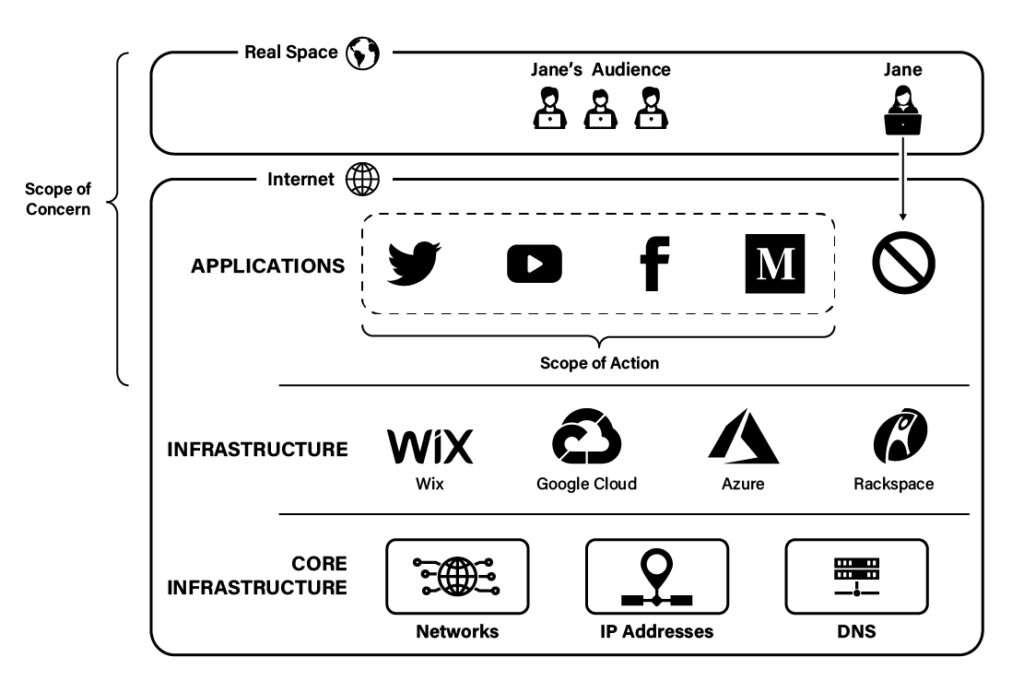

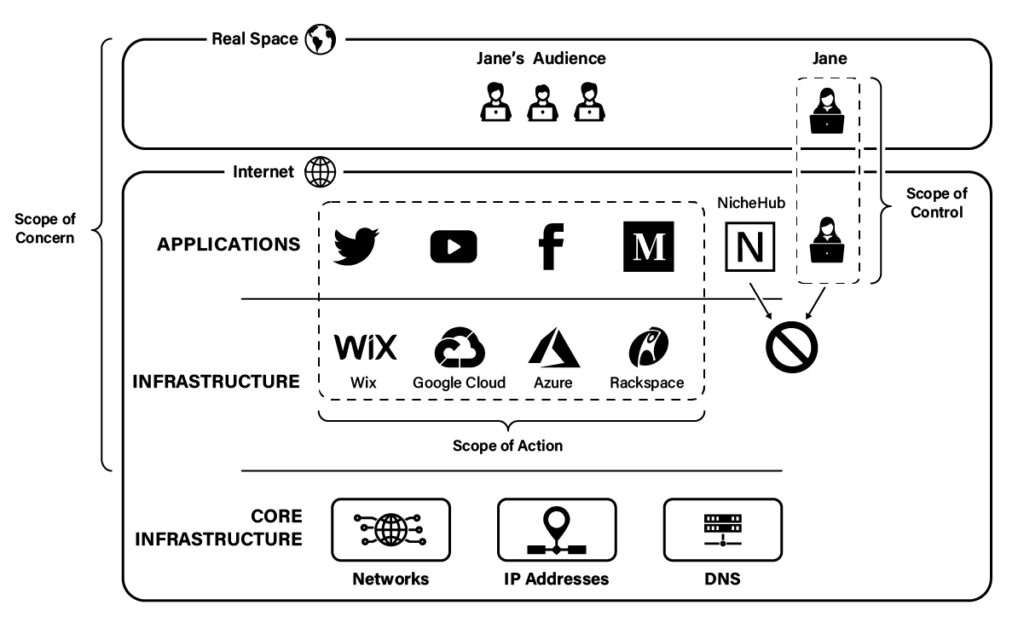

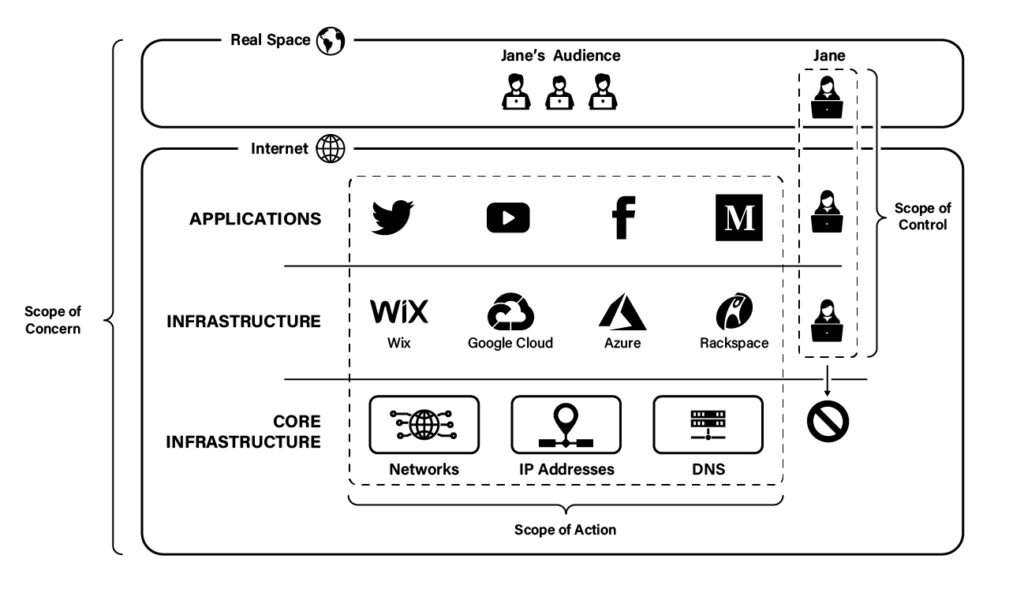

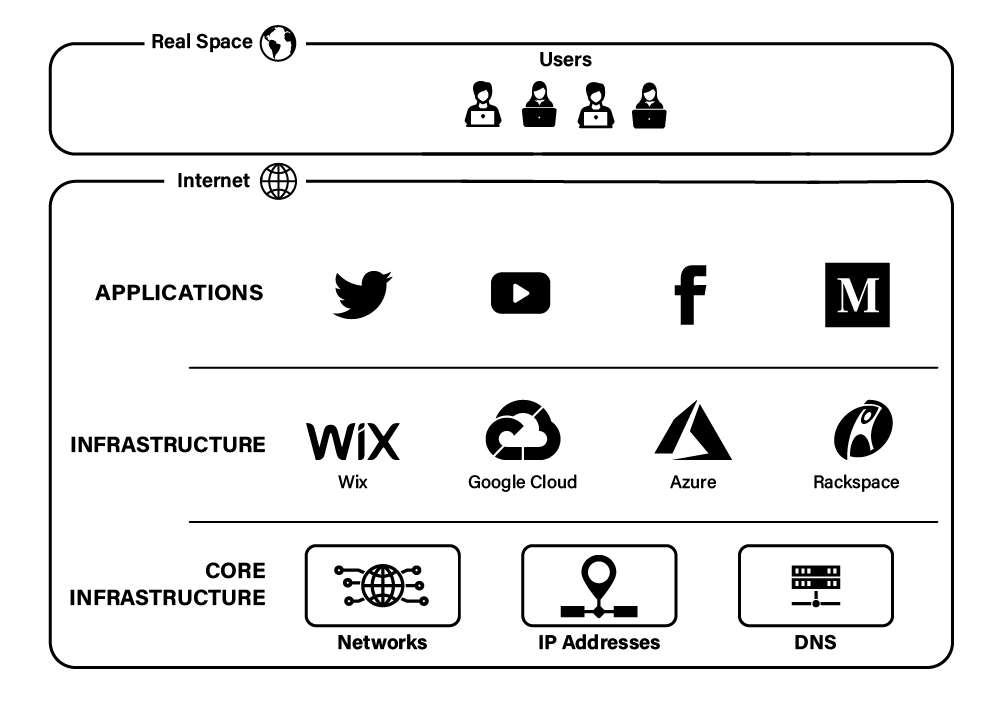

With this structure in mind, we now turn to content moderation. As we’ll see, content moderation has evolved (and thereby become more aggressive and more concerning) by capturing more real estate within the internet stack. In the following discussion, I divide that evolution into four primary stages: classic content moderation, deplatforming/no-platforming, deep deplatforming, and viewpoint foreclosure. And to make the concepts relatable, I’ll use a running case study of a fictional internet user who finds herself a victim of this evolution as she is eventually chased off the internet.

With this structure in mind, we now turn to content moderation. As we’ll see, content moderation has evolved (and thereby become more aggressive and more concerning) by capturing more real estate within the internet stack. In the following discussion, I divide that evolution into four primary stages: classic content moderation, deplatforming/no-platforming, deep deplatforming, and viewpoint foreclosure. And to make the concepts relatable, I’ll use a running case study of a fictional internet user who finds herself a victim of this evolution as she is eventually chased off the internet.