Foreign-Selling Accelerated Into China’s Latest Stimulus-Driven Stock Spike

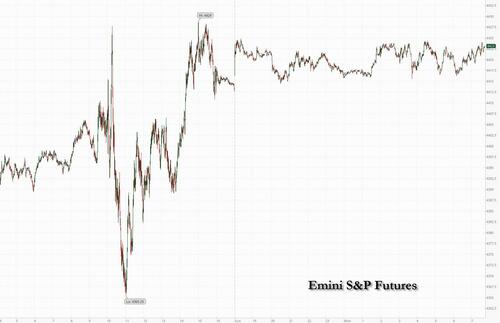

Forgive us if you’ve heard this one before… but China tried (and failed again) to re-ignte animal spirits in its equity market overnight.

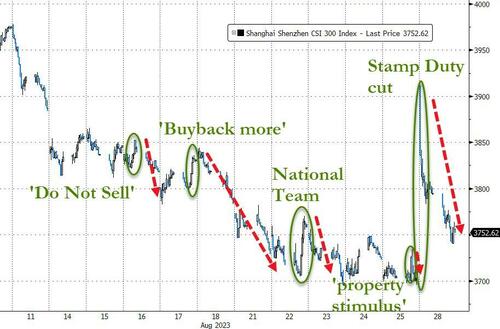

Having strong-armed funds into ‘not selling’ stock last week, then strongly-suggesting that companies escalate their share buyback programs (and then bullying banks into buying yuan to support the currency against the green back), and then clearly stepping with a ‘National Team’ panic bid (that didn’t work) Beijing was faced with the reality that nothing was working with Chinese stocks tumbling still.

Then on Friday, announced property stimulus measures prompted a notably brief pump (and dump) making the 4th attempt in a week to stop the freefall in the struggling nation’s stock market.

So, having achieved nothing, Beijing tried once more with authorities announcing a slew of measures over the weekend, including a slashing of the stamp duty on stock trading and limits on the amount that major shareholders can sell.

It seemed to work as the CSI 300 Index exploded over 5% higher at the open, its largest rise at the open since July 2015.

BUT…just as we warned…

*CHINA’S CSI 300 INDEX JUMPS 5.5% AFTER MEASURES TO BOOST MARKET

this should last about 15 minutes

— zerohedge (@zerohedge) August 28, 2023

The initial euphoria faded into the session, with the index ending just a little over 1% higher.

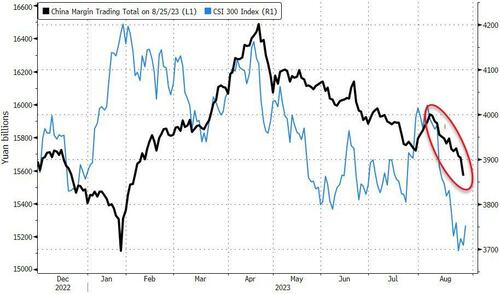

Most notably, it was foreign funds that reportedly accelerated their selling through the day, poised to take this month’s outflows to the biggest on record.

Which in turn sent the yuan lower against the greenback…

As Bloomberg notes, today’s reversal in stocks is extremely rare, looking at historical data since 2002.

The only other time something similar occurred was on November 27, 2008, immediately after the gauge had formed a major trough following the Great Financial Crisis.

For context on how poor the price-action was, the ChiNext Index saw its largest intraday drawdown in more than two years, and the biggest ever pullback seen on an overall up-day.

This chart measures the percentage change from intraday highs to closing prices:

Cutting stamp duty is designed to increase market turnover, especially among retail punters.

“The China authorities are clearly stepping up efforts to rebuild confidence in Beijing’s policy commitment to achieve growth and support the market,” said Xiaojia Zhi, chief China economist at Credit Agricole.

“But then a fundamental growth improvement as well as tangible policy action onshore is needed to really turn the mood around, and therefore more time could be needed.”

Convincing the retail crowd to believe in the recent slew of China stimulus measures will make a big difference to daily volumes.

Having seen those measures fail, Beijing tried again, rolling out China’s Minister of Finance who pledged to prevent and resolve local government debt risks and step up fiscal discipline.

The official Xinhua news agency reported that the MoF said it will ramp up and implement active fiscal policies, and improve the transfer of payments to localities.

Additionally, China will enhance adjustments of macro policies to expand domestic demand, the National Development and Reform Commission said in a separate report to the National People’s Congress Standing Committee.

So, if at first (or fifth) you don’t succeed, try, try, again?

Tyler Durden

Mon, 08/28/2023 – 09:30

via ZeroHedge News https://ift.tt/1qKrtAG Tyler Durden