Nvidia Earnings Preview: What Traders Want To See For Another Explosion Higher

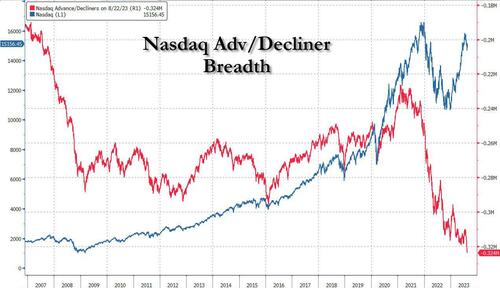

This is it: the moment all traders, and certainly tech-heads, have been waiting for for the past 3 months: Nvidia, which single-handedly pushed the Nasdaq into a bull market since May when it reported blowout earnings that sent its stock up a stunning 25%, and which has sent market breadth to the lowest on record as traders have dumped anything that it not AI-related and bought, well, Nvidia…

… reports earnings after the closing bell at 4:20pm ET, and as many veteran traders have suggested, the fate of the next 10,000 Nasdaq points is in the hands of the versatile video graphics, bitcoin mining, AI-chip company.

Based on what I am seeing on my feed, Nvidia $NVDA earnings tonight hold the key to the next 10,000 points in the Nasdaq

— Joe Kunkle (@OptionsHawk) August 23, 2023

Let’s preview today’s main event starting with consensus expectations:

- Q2 EPS exp. 2.07,

- Q2 revenue exp. 11.224bln

The outlook will be absolutely key:

- Full year EPS view exp. 8.25

- Full year revenue view (exp. 44.5bln).

Revenue breakdown:

- DataCenter (exp. 7.691bln)

- Gaming (exp. 2.4bln)

- Automotive (exp. 317mln)

- Professional visualisation (exp. 308mln)

- OEM and IP (exp. 101mln)

As everyone knows, NVDA has soared an unprecedented 221% YTD on AI optimism given the company is a huge beneficiary with its equipment a necessity for those looking to build powerful AI tools, helping take its market cap north of $1 trillion.

The strength in the stock now sees it hold a 4.3% weight in the Nasdaq 100 and a 2.9% weighting in the S&P 500. Just this past Monday, NVDA rose another 8.5% in anticipation of its earnings where analysts are seemingly more and more optimistic about their results following a slew of PT upgrades.

Citing Refinitv/Reuters data, Newsquawk notes that tech earnings so far have predominantly beaten estimates with 93% beating, 2% being in line, and 5% missing expectations, showing a quarterly surprise of 7.6% for the sector overall. Looking at the subsector, Semiconductor & Semiconductor Equipment, 94% have beaten with 6% being in line with estimates, showing an overall quarterly surprise of 18.4%, making it one of the outperforming sectors over the latest earnings season, only falling behind the 23.5% upside surprise in autos (TSLA, GM, F, BWA, APTV) and the 26.3% upside surprise in the retail sector (AMZN, AZO, EBAY, HD, TJX etc).

Some more details from the sell-side:

- 15 Analysts rate NVDA as a strong buy, while 29 have it as a buy, 6 are hold and 1 recommends a sell, with 0 holding a strong sell opinion on the Co.

- Analysts at Zacks recall the Q1 report, where it saw huge beats on both EPS and revenue, which helped the stock rally 24% in the following week. With the strong outperformance in NVDA. analysts have been heavily raising expectations with the quarterly estimates expected to show a 304% Y/Y gain in EPS and revenue is expected to show a 65% Y/Y gain.

- KeyBanc, HSBC and BMO were the latest to raise their forecasts for the name ahead of earnings, all citing the longer term potential and guidance given accelerating AI trends.

Here is how JPM tech trader Stuart Humphrey summed up the semi sector in general, and Nvidia in particular, earlier this week:

“Last week brought trying times. But the tide has turned, and it feels like NVDA might be back. And thank the lord as the AI bellwether name has been more than a crowded long. There is still longer term concern that major customers in China and now (as the FT points out) Saudi Arabia are racing accumulate as many GPUs as possible – though once this demand is satisfied and GPUs have been optimized, folks wonder if we run into a demand problem? Nevertheless, sell-side previews are out and about and pumping up bogeys. Topline sounds like people are expecting $12B for next Q with DC at least $8B of that. And in terms of a guide, some folks getting crazy and are in the $14-15B range- which at the high end would imply +36% q/q topline growth! This kind of number feels a touch high to me, but if it sniffs this- one could argue that into this print, it doesn’t matter if demand will eventually decline next year – still will be rerated higher. Have spoken to a few, who will look to sell the news after next Q and Oct end guide. But until then, think we ought to be ready for the rumor mill to continue to provide a little boost. Stock reports after the bell next Wednesday.”

Humphrey followed up with the following note late yesterday: “The anticipation is LITERALLY killing us! The line in the sand Oct-Q guide feels like $14B but maybe creeping up after yesterday’s chatter to $14.5B. While I know there is pushback because people worry too much too fast isn’t sustainable, I am reminded that non-linear math is tough to anticipate and to model. Even still, I am positive on the stock and believe it will trade higher after numbers. Tactically there is a number it needs to work because it is the most crowded name out there, but even if it doesn’t hit expectations perfectly, I think we have a while before we really do have to worry about the current demand falling off. Call me an optimist – so be it! On the flow front, our supply last week is nowhere and instead we have seen HFs adding in smaller lots with LOs more apt to wait for the print.”

To be sure, expectations are sky high, and NVDA may have to truly blow them away to move higher than the 9% move that is currently priced in. On the other hand, even a small hiccup in the outlook and the stock could plunge.

JPM’s Tech Sector Specialists Jack Atherton and Scott Silver conducted a survey, and the results are below. Jack tells us, “Focusing on NVDA, myself and Scott Silver have received >70 entries to this survey and I’d say a good portion of those are bulls trying to keep expectations in check. While the answers below reflect buyside expects of $11.9b FQ2 revenue, and $13.5b FQ3 guide, I think it needs to be $12b+ and $14b+ respectively for the stock to work. Given the technical pressure across mega-cap tech, investors need an incremental reason to defend the names they’re already max long.”

- FQ2 revenue (guide $11.0b +/-2%): $11.9b (range $11.1 – 13.0b)

- FQ3 revenue guide (consensus $12.3b): $13.5b (range $12.8 – 15.0b)

- FQ3 GM guide (consensus 70.5%): 71.1% (range 70.0 – 73.5%)

A Q&A with JPM Equity Analyst Harlan Sur (courtesy of Dave Reller): Harlan thinks we’re coming out of the bottom of the cycle in the next 1-2 quarters, and we should start to see positive earnings revisions that should be the next leg higher for the group. Harlan wisely called for a bottom in the group in late summer 2022 when I met him in his office in San Francisco. Semi stocks have outperformed the broader markets since July 2022, and we expect that trend to continue through 2023. The most frequent questions from PMs we met with this week…

- “How much is priced into Nvidia?” Harlan is Overweight on NVDA but is concerned that people are looking at supply chain data points from TSMC and getting too optimistic on CY24. He hosted a call with 185 investors in Asia this week and some expect NVDA to earn $18-20 in EPS next year.

- “When do I need to pay attention to Intel again?” Not for at least 12 months until we see more execution success especially around their 18A node.

- “Who aside from NVDA and AMD are the biggest AI beneficiaries?” AVGO

- “What stock is the Rodney Dangerfield of the group?” MCHP

- “When will the group hit the next air pocket or when will customers realize they ordered too many GPUs?” Probably not until late ’24 or early ’25.

More in the full note available to pro subs.

Tyler Durden

Wed, 08/23/2023 – 15:13

via ZeroHedge News https://ift.tt/6c17GiC Tyler Durden