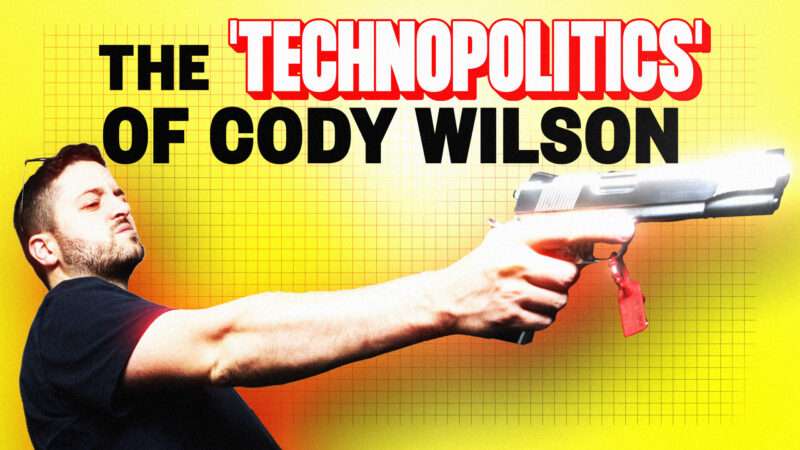

What does Cody Wilson—the founder of Defense Distributed, the company responsible for the world’s first 3D-printed gun—really want? And how close is he to achieving it? That’s the subject of filmmaker Jessica Solce’s new feature documentary Death Athletic: A Dissident Architecture. Solce followed Wilson for seven years as he grew the world’s most famous DIY gun company, prevented multiple lawsuits from shutting it down, faced his own personal legal troubles around a sex case, and established himself as the leading voice and practitioner of crypto-anarchism.

Watch the video above, and a condensed transcript is below.

Reason: What first got you interested in Cody Wilson?

Jessica Solce: I wanted to explore the mischief. I wanted to explore the motivations, the ideals, the ethics, and morals, which is something that nobody had really tapped into, and see where the film would go but not not really knowing how long that would take. I mean, unconsciously, I knew that this was going to be a long journey, but I don’t think anyone consciously sets them up for such a long journey because that’s a difficult pill to swallow.

But I wanted to create something that was, you could say, a historical moment… So that turned into an obsession of watching the story unravel.

Reason: You mentioned some of the mischief. That’s really one of the defining characteristics of Cody’s persona: a mischievous prankster. So what is the role of trolling for Cody Wilson in achieving his political objectives?

Solce: Perhaps at the beginning of his career, we could say he was more, I think, a literal troll filled with mischief and uncertainty of where things would go. But that…turned into trolling bigger marks, right? And learning the power of the symbolic, turning that into something that was real…in the court system that had a very strong ability to kind of change not only law, but change the principles of how things were going to be described and organized as First Amendment and Second Amendment issues.

So, yeah, trolling is I think is still…a strong part of what Cody does. But he doesn’t do it effortlessly or without forethought or without knowing where he’s going with it. There’s meat behind what he’s doing.

Reason: I want to talk a little bit about what those objectives are, what lights you shine on that with this documentary. There’s one part where he talks about himself in Silicon Valley terms as a “disruptor.” He rose to fame as the 3D-printed gun guy. But this clearly is not just about making guns because guns are fun and cool or hunting or even just self-defense. What is your larger understanding of Cody’s objectives?

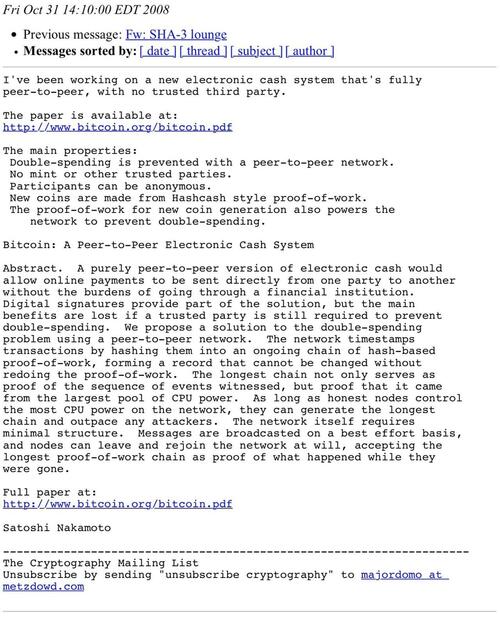

Solce: It’s technopolitics in action. It’s what most people don’t understand or report on. It’s really forcing processes of democratic solutions on two stages where most people have huge debates and issues. So specifically the gun, it’s releasing it on the Internet. Once it’s there, as we all know, it can’t be taken off. It’s kind of like the democratic distribution of information.

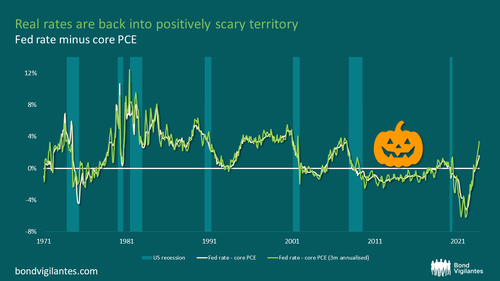

And from there, the statement becomes one of not just anarchy, but of who gets to control. So it’s a demonstration of the inability of governments in this digital age to actually have utility and their idea of controlling and surveilling everything. We see this in all digital technologies from computers to bitcoin to anything in the crypto space.

Reason: The term that you’ve used a couple times: technopolitics. What you mean by that is that there are these technical realities, and at some point, the state has a technical advantage, and at other points you can suppress or undermine that technical advantage? Is there anything else that you want to add to the understanding of technopolitics?

Solce: Sure. I think technopolitics is also the idea that technology is outpacing politics. There is technology that can be critical and force politics. It forces politics that are kind of aged and ancient and not caught up in this time frame of the digital world to catch up. And in doing so, it slows the pace of control and surveillance.

Reason: There’s another part of the documentary that reminds me of what you’re talking about right now, where Cody talks about the gun as a way to express your political will, as an alternative way to vote.

Solce: What I’ve probably come to realize far more is that the threat of guns is actually more, quote-unquote, “dangerous” to governments than the actual having of them, because they’re everywhere in the U.S. The fact that we have these debates and conversations of just taking little parts off of guns and everything when there are like hundreds of millions and lots of people know how to make these little pieces that they’re trying to outlaw… So I think definitely what changed over these last ten years regarding the politics of guns was how ineffective [gun control laws] actually are and how they don’t really reflect a large majority of the people they’re trying to govern, if you will.

Reason: I know that behind the Defense Distributed headquarters, they’ve got a little plaque that has “gun control” emblazoned on it. So that’s their idea: Gun control is dead… Guns are so tied to American political culture. But of course, they have political use outside of our borders. And you had a whole segment that was devoted to that idea.

Solce: This film is important in kind of locking in the historical moment because there’s still so many people that I speak to that still think Cody sold physical guns.

A lot of things Cody was doing at the beginning were, you know, performance art in a way. They were symbolic. They were they were to really get people riled up and understand that we are entering a new era of digital performance, if you will.

There was a lot of other creators, engineers, makers that started putting their creations online in a far more visible fashion.

And even though it’s still a pretty niche environment, it definitely has exploded with different groups and different kind of known figures and YouTube channels. And we’ll see how long those channels stay up.

Reason: In the middle of your making this documentary, Cody was busted for sex with an underage girl on an adults-only app. What was that experience like from a documentary director’s perspective?

Solce: It was it was very rough and trying. It’s a strange moment when you work with and are allowed into someone’s life for such an extensive period of time and you’re building trust and something horrible happens and you have to figure out where you yourself stand, what information that you can gather, and also needing to do your job and get things on film and trying to figure out, specifically for me because I’m always creating in the terms of I’m not putting myself into this film. It’s not about my opinions. It’s about really trying to capture as unadulterated a moment as possible. So, not feeling like a vulture. It was a very intense moment.

Reason: What was your point of view on that?

Solce: If Cody had been searching out, specifically, a minor, Cody will be in jail right now. Period.… It was obvious that there were lies.

And you can have, as a person, issues with prostitution. You can have issues with the idea of sugar babies. You can have issues with, you know, extreme differences of ages, etc. But if the intent was not to, you know, search out a minor and it was proved, then, you know, at one point people have to take responsibility for what is happening.

And I personally and definitely believe that if the situation was different, and if the young lady did not have such an extensive history, [prosecutors] would have pushed harder.

This was not, I think, the clean-cut case that maybe the government officials were hoping for.

Reason: I notice there are several points where Cody talks about the mental and physical toll that constant battles with the government have taken.

As somebody who spent a lot of time with him, what do you think motivates him on a personal level to take on that kind of burden?

Solce: I mean, I think that’s just part of who he is. I think he loves a challenge.

In 2015, the Ghost Gunner had come out. He’s tasting the first moments of his payment services dropping him, of losing money. He’s getting legal issues, credit cards, banks. It’s coming at him from all angles.

But there’s definitely a part of him that, although the challenge is hyper-destructive to your cortisol levels at minimum, he loves it. At the same time, I think people that live this kind of life of really challenging any kind of government or control or building new things, they have to, I think, actually like it.

Reason: He talks about this doomed historical figure, James Fannin [a soldier who was massacred during the Texas Revolution]. It’s a pretty hair-raising bit to me because it makes me seriously wonder, does Cody want to be a martyr? What do you think?

Solce: I do absolutely think he wants to be remembered. But he doesn’t want to be a martyr. He wants to be the winner. So two very, very different things. But I think that moment in that film, he’s definitely in a place where he realizes that all his work might end up being just him being scalped, if you will.

Reason: I have interviewed Cody several times, and it’s always fascinating, but he can come across as fairly, I think, enigmatic. He sometimes speaks in riddles or highly theoretical terms. You spend so much time with them. You met his parents. What are your impressions of him as a real person?

Solce: He is that person. Cody is constantly reading and absorbing. He’s he’s thinking in terms of philosophy and history. It is his jam. This is his motivation. He loves all these parallels that can be created in today’s society versus past fights, past wars, past ideas. So Cody, I think, actually correctly represents himself when he speaks in these high philosophical terms.

Reason: And why do you think that that type of personality has been able to drive this project forward so successfully?

Solce: He’s extremely charismatic and doesn’t shy away from a challenge. Anyone creating something in this space not only has to be smart, that definitely helps, but they have to understand the game and then they have to understand how to play it. They have to both be entertaining and quote-unquote, “correct” in the form of your motivations and possibly the law, which he does.

So the majority of things are instigation to the law, and that’s why he keeps being in the main frame. It’s constantly being on top of what is happening in the moment, like GAT GPT [a customized AI chatbot recently released by Defense Distributed], and also skidding across everything that’s in between legal and non-legal. So he understands the terms of how to get a message into the mainstream.

And this is all very centered to who he is as a person. So I think that’s why it’s so successful. And to have anyone follow you, especially from the beginning, and not even just follow, but work with you or get behind these like kind of intense and possibly very dangerous principles that could get you in trouble, you have to have a level of, I guess, charismatic integrity.

And you can dislike Cody, but from the very beginning, he has not changed the principles that have motivated him. And that is what I hope the film also captures, but in far more in depth than what anyone else has seen.

This interview has been condensed and edited for style and clarity.

Photo Credit: CHUCK KENNEDY/MCT/Newscom; Defense Distributed.

Music Credit: “That Sound,” by Oliver Michael via Artlist.

The post The 'Technopolitics' of Cody Wilson appeared first on Reason.com.

from Latest https://ift.tt/ftJNwsl

via IFTTT