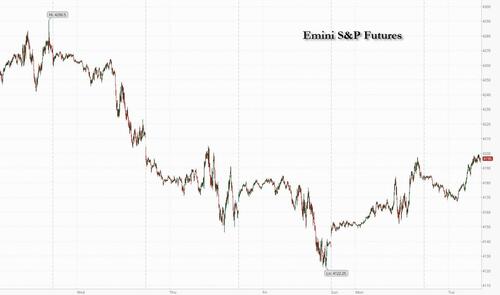

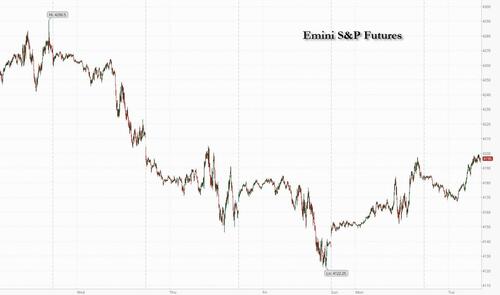

Futures were higher and European bourses were solidly in the green on the last day of the month, extending yesterday’s blistering rally which sent the S&P 1.2% higher and which took place after most of the mutual-fund year-end tax loss selling had exhausted itself during last week’s rout. As of 7:45am, S&P futures were higher by 0.2%, Nasdaq 100 futs gained 0.1%, while Europe’s Estoxx 50 outperforms, higher by around 1% on the day with materials sector outperforming. Treasury yields are lower after the US Treasury reduced its estimate for federal borrowing for the current quarter, citing stronger-than-expected revenue; the dollar was weaker against most major currencies, except the yen. Oil prices are edging higher after dropping in the prior session. Israel stepped up ground operations in Gaza and struck more targets in Lebanon and Syria overnight.

In premarket trading, Samsung Electronics profit beat expectations and it pointed toward a memory chip recovery, AB InBev also outpaced estimates and the performance of its peers, while Vans and North Face owner VFC plunged more than 6% after pulling its full-year guidance. Sarepta Therapeutics cratered 46% after saying results from its Embark Phase 3 study of Elevidys in patients with Duchenne muscular dystrophy between the ages of 4 through 7 years missed its main goal. Here are some other notable premarket movers:

- Amkor Technology drops 13% after the semiconductor packaging company’s net sales forecast for the fourth-quarter missed expectations.

- Arista Networks jumps 10% after the communications-equipment company reported fourth-quarter adjusted earnings per share and revenue that beat estimates.

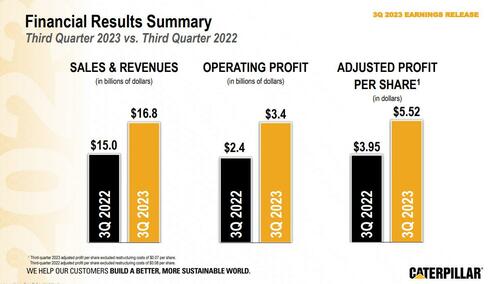

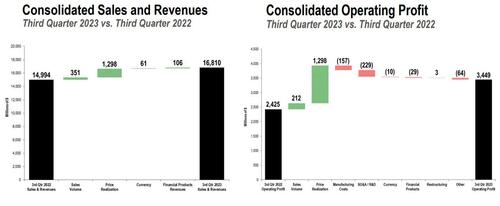

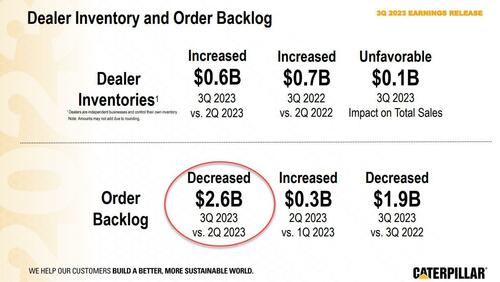

- Caterpillar Inc. falls 4% after the machinery maker reported a sequential decline in its order backlog.

- Chewy rises about 4% as Morgan Stanley upgrades the pet products company to overweight, saying the 50% year-to-date selloff in the stock is overdone.

- Harmonic shares are down 11% after the communications equipment company cut its full-year forecast.

- JetBlue drops 7% after the low-cost carrier missed Wall Street’s earnings estimates and forecast a worse-than-expected loss this quarter.

- Lattice Semiconductor falls 15% after the chip maker’s 4Q revenue forecast fell short of analyst estimates.

- Lyft drops 3% after MoffettNathanson gives the stock a rare sell rating and set its price target at a Street-low.

- PetMed tumbles 28% after the pet pharmaceutical firm suspended its quarterly dividend and posted 2Q earnings that disappointed.

- Pinterest jumps 16% after the social-networking company reported third-quarter results that beat expectations.

- VF Corp. (VFC) falls about 6% after the apparel and footwear company withdrew guidance for the fiscal year.

European stocks are also higher. The Stoxx 600 gains 0.7% with the real estate subindex the biggest outperformer, fueled by a continued retreat of bond yields. Swiss pharma giant Roche plunges on a disappointing drug study, pulling the sector lower, while fossil fuel giant BP slides after its third-quarter report missed expectations. Here are the most notable movers:

- Wartsila jumps as much as 19%, the most since October 2008, after the Finnish marine and energy equipment manufacturer reported a strong beat to third-quarter figures

- DSM-Firmenich gains as much as 8.8%, the most since its April listing, after the nutrition and chemicals company reported better-than-expected 3Q earnings, as well as reassuring guidances

- Real estate stocks rise for a fourth session on Tuesday, outperforming the broader market, as bond yields decline. The Stoxx Europe 600 Real Estate Index rises as much as 2.4%, the most in about three weeks

- Rolls-Royce gains as much as 6% to be best performer on FTSE 100 as Barclays upgrades the jet-engine maker to overweight, saying a fall over the past month presents a chance to buy

- Anheuser-Busch InBev rises as much as 4% after the brewer reported 3Q earnings ahead of estimates. In what was a challenging period for peers, the performance “stands out,” RBC said

- Spectris advances as much as 4.8% as the electrical engineering company says it expects full-year adjusted operating profit to come in toward the high end of a guided range

- Roche falls as much as 4% to the lowest in five years after a trial of the Swiss drugmaker’s gene therapy for Duchenne muscular dystrophy did not meet the main goal in a study

- BP declines as much as 5.5% after the energy company’s third-quarter profit fell short of estimates. Weak results in gas marketing offset a strong performance in oil trading

- AMS-Osram drops as much as 4.4%, to the lowest intraday since 2009. The chipmaker’s 4Q guidance missed estimates and analysts said 2024 comments were on the cautious side

- SES falls as much as 4.6% after the company said it’s delaying launches of five O3b mPOWER satellites, a move that will cause a mid-single digit percentage hit to 2024 sales and adj. Ebitda

- Carlsberg declines as much as 3.2%, reaching the lowest intraday level since 2022, after the brewer reported third-quarter revenue that missed estimates, driven by weak Asia numbers

- OMV slides as much as 4.3%, the most intraday since June, after Austrian refiner reported “slightly disappointing” 3Q clean CCS operating profit that missed estimates

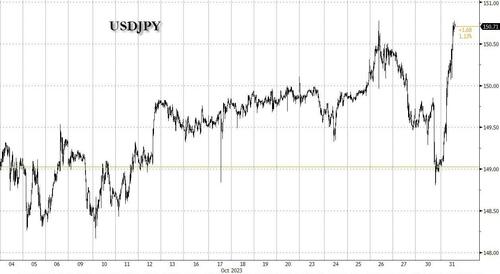

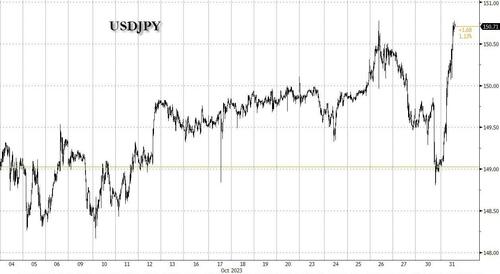

And while stocks may struggle to keep their early gains, the biggest mover overnight was the Japanese yen which plunged the most in two months after the Bank of Japan made only minor changes to its policy settings, disappointing many who had expected more after the bank had leaked a far more bombastic report to the Nikkei. In its wishy-washy announcement, the BOJ halfheartedly ended YCC, saying the 1% cap on the 10Y would now be a reference rate, inviting bond bears to promptly test out how much higher yields will rise. Meanwhile, the implosion in the yen is sparking even more inflation which as noted below, is already crushing Kishida’s approval polling, and ensures that there will very soon be a major scandal between the Japanese government and the BOJ.

“This is the first critical test of whether Japanese officials care about the speed of JPY depreciation or specific levels,” said Simon Harvey, head of fx analysis at Monex Europe. “Thankfully for them lower Treasury yields are delaying any urgency for an answer, but any unexpected hawkish comments from Chair Powell tomorrow or a larger issuance in longer-date Treasuries could force the issue as soon as tomorrow.”

“It looks like loose monetary policy is likely to stay in place for some time to come,” he wrote in a note. “They are now in a corner and cannot afford to allow long-term bond yields to rise much further.”

The prospect of a weaker yen and negative interest rates means Japanese equities are in line for more gains, according to Charles-Henry Monchau, chief investment officer at Bank Syz. The Nikkei 225 added 0.5% on Tuesday, bringing its year-to-date rally to 18%. Japan’s gains stood in stark contrast to the rest of the global equity market. The S&P 500 is on track for a 2.8% retreat in October, a third monthly loss.

Elsewhere in Asia, stocks dipped led by Chinese equities, after data showed the nation’s factory activity fell back into contraction in October. The MSCI Asia Pacific Index slipped as much as 0.6%, erasing a small early advance after the China PMI figures, which also showed an expansion of the services sector unexpectedly eased. Consumer discretionary and materials were the worst performers. Earnings remain a big focus in what is the second-busiest week this reporting season for Asia. China’s Ganfeng Lithium and Japan’s Panasonic were among the biggest losers on the regional gauge after their results.

Equities in Japan advanced after the central bank announced its decision to keep its easy monetary policy, making only minor changes to its yield-curve-control settings.

- The Hang Seng and Shanghai Comp were pressured following disappointing PMI data which showed China’s factory activity returned into contractionary territory for October, while there were also plenty of earnings releases including from the likes of Bank of China, BYD and PetroChina.

- Australia’s ASX 200 finished flat as strength in real estate, financials and the consumer sectors was offset by underperformance in mining stocks and after the weak factory activity data from Australia’s largest trading partner.

- Japan’s Nikkei 225 was initially choppy after Industrial Production and Retail Sales missed estimates although the index was later supported following the BoJ policy announcement in which the central bank announced a less aggressive than anticipated tweak to YCC.

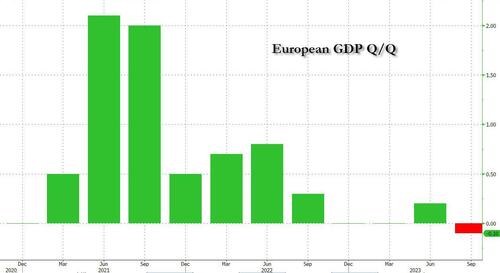

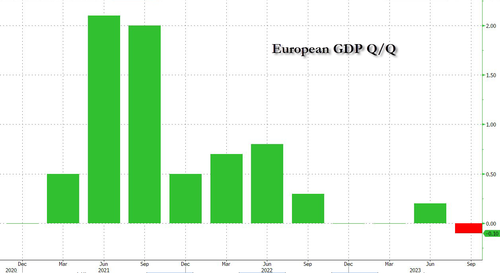

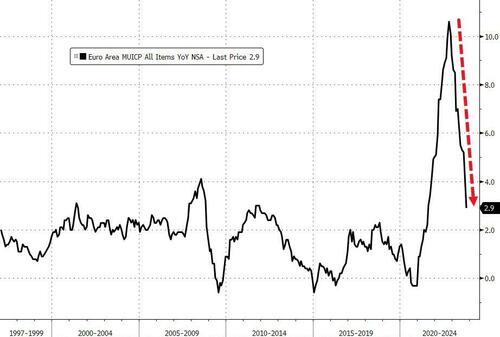

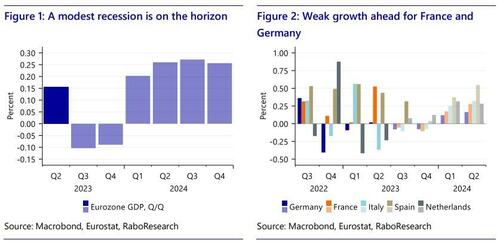

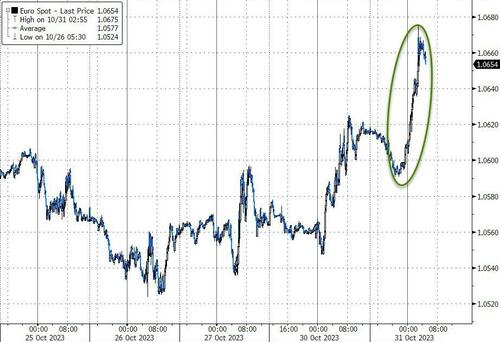

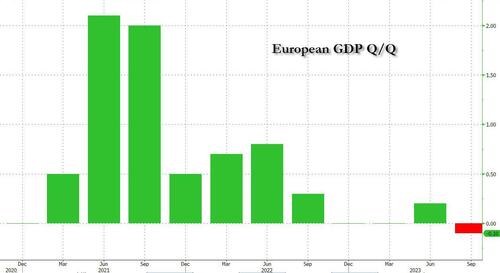

In FX, the Japanese yen tumbled over 1% versus the dollar after the Bank of Japan tweaked its yield curve control policy but disappointed hawks by once again taking a more dovish way out, one which is sure to spark more inflation and lead to a collapse of the already extremely unpopular Kishida government. The euro was is one of the best performing G-10 currencies meanwhile, rising 0.5%, despite euro-area CPI coming in below forecasts and GDP shrinking back into contraction!

In rates, treasuries rallied along with bunds and gilts. US 10-year yields fall 8bps to 4.82%, bull-flattening with futures near top of day’s range into early US session, with yields richer by 3bp to 8bp across the curve. Treasuries were well supported overnight, following the Bank of Japan’s modest policy tweak, saying the 1% level for JGB 10-year yields is now a reference point and adopts a flexible bond-buying stance, disappointing investors who expected a clearer policy signal. Core European rates lag Treasuries, while bunds held gains after Euro-area inflation eased to its lowest level in more than two years. US yields richer by up to 8bp across long-end of the curve, flattening 5s30s spread by 1.8bp on the day — 2s10s spread tightens over 4bp vs. Monday close with front-end underperforming; US 10-year yields around 4.82%, richer by 7.5bp on the day and outperforming bunds and gilts by 3.5bp and 0.5bp in the sector.

In commodities, oil prices rebounded after a steep drop yesterday as investors tracked developments in the Middle East. Israel struck more targets in Lebanon and Syria overnight, while stepping up its ground operations in Gaza. West Texas Intermediate rose 1% to near $83 a barrel. Spot gold climbed 0.1%.

Bitcoin was flatish on the session, holding around the $34.5k mark, with action contained and very much rangebound thus far as we await key US catalysts including the ECI before the week’s main Tier 1 events begin from a US perspective.

US economic data includes 3Q employment cost index (8:30am), August FHFA house price index, S&P Case-shiller house prices (9am), October MNI Chicago PMI (9:45am), consumer confidence (10am) and Dallas Fed services index (10:30am)

To the day ahead now, data releases include the Euro Area flash CPI release for October, as well as the Q3 GDP release, both of which came below expectations, with GDP once again contracting. Over in the US, there’s the Employment Cost Index for Q3 (8:30am), August FHFA house price index, S&P Case-shiller house prices (9am), October MNI Chicago PMI (9:45am), consumer confidence (10am) and Dallas Fed services index (10:30am). From central banks, there are several ECB speakers including Vice President de Guindos, and the ECB’s De Cos, Visco, Muller and Nagel. Lastly, today’s earnings releases include BP, Pfizer and Caterpillar.

Market Snapshot

- S&P 500 futures little changed at 4,182.25

- STOXX Europe 600 up 0.3% to 432.21

- MXAP down 0.5% to 151.20

- MXAPJ down 0.7% to 472.75

- Nikkei up 0.5% to 30,858.85

- Topix up 1.0% to 2,253.72

- Hang Seng Index down 1.7% to 17,112.48

- Shanghai Composite little changed at 3,018.77

- Sensex down 0.2% to 63,978.37

- Australia S&P/ASX 200 up 0.1% to 6,780.68

- Kospi down 1.4% to 2,277.99

- German 10Y yield little changed at 2.79%

- Euro up 0.2% to $1.0634

- Brent Futures up 0.9% to $88.25/bbl

- Gold spot up 0.0% to $1,996.79

- U.S. Dollar Index little changed at 106.14

Top Overnight News from Bloomberg

- China’s NBS PMIs fall short of expectations, with manufacturing coming in at 49.5 (down from 50.2 in Sept and below the Street’s 50.2 forecast) and non-manufacturing at 50.6 (down from 51.7 in Sept and below the Street’s 52 forecast). RTRS

- President Xi Jinping underscored his concerns — and more conservative social views — about China’s shrinking population in a speech calling on a key women’s organization to help bolster the nation’s birthrate by promoting a “culture” of childbirth. BBG

- Nvidia’s $5 Billion of China Orders in Limbo After Latest U.S. Curbs. Tech company had been pushing to make chip shipments for next year before new restrictions came into effect. WSJ

- The yen fell below 150 after the BOJ made only minor tweaks to its yield-control strategy. Governor Kazuo Ueda said the 1% cap on 10-year JGB yields is now just a “reference,” but doubts they’ll rise much higher. BBG

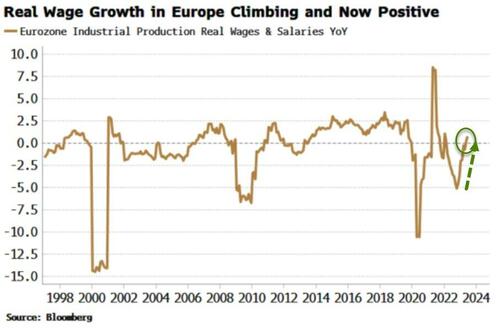

- Euro-area inflation eased to its lowest level in more than two years as the bloc’s economy unexpectedly shrank following an unprecedented ramp-up in interest rates. CPI rose 2.9% in October — down from 4.3%. GDP fell 0.1%, missing estimates for stagnation. BBG

- Israel struck more targets in Lebanon and Syria, while stepping up its ground operations in Gaza. The UN warned that the situation in Syria is “at its most dangerous for a long time.” Iran’s foreign minister will visit Qatar today to discuss the situation in Gaza. BBG

- Russia has restricted western companies that sell their Russian assets from withdrawing the proceeds in dollars and euros, imposing additional de facto currency controls in an effort to shore up the weakening rouble. FT

- Central banks have loaded up on more gold than previously thought this year, offering crucial support to prices. Purchases for the first nine months totaled 800 tons, driven mainly by China, Poland and Singapore — more than the same period last year, which ended with record demand. BBG

- VFC pulled its guidance for its current fiscal year, slashed its dividend and said it will replace the president of its Vans brand. VF has come under pressure from activist investors this month. Shares fell nearly 9% premarket. WSJ

- Commercial real-estate lending has slowed sharply, threatening a rise in defaults on expiring debt and a sharp decline in new construction…

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a deluge of data releases at month-end including disappointing Chinese official PMIs, while participants also digested a slew of earnings releases and the conclusion of the BoJ’s live meeting. ASX 200 finished flat as strength in real estate, financials and the consumer sectors was offset by underperformance in mining stocks and after the weak factory activity data from Australia’s largest trading partner. Nikkei 225 was initially choppy after Industrial Production and Retail Sales missed estimates although the index was later supported following the BoJ policy announcement in which the central bank announced a less aggressive than anticipated tweak to YCC. Hang Seng and Shanghai Comp were pressured following disappointing PMI data which showed China’s factory activity returned into contractionary territory for October, while there were also plenty of earnings releases including from the likes of Bank of China, BYD and PetroChina.

Top Asian News

- China’s Foreign Minister Wang met with the French Foreign Affairs Adviser to the President and the sides had friendly, in-depth exchanges regarding China-France and China-EU relations, as well as international and regional issues. Furthermore, Wang said he hopes the EU will adopt a more pragmatic and rational attitude in cooperation with China and avoid external interference, ensure mutual openness and promote stable bilateral relations.

- US is to send its strongest-ever delegation to the China import expo amid improving relations, according to SCMP.

- China interbank overnight repo rate rate jumps to as high as 50%, via official data.

European bourses are in the green, Euro Stoxx 50 +0.8%, following a mixed APAC handover and solid US lead with the region unreactive to the latest CPI & GDP metrics. APAC trade was mixed on account of numerous data points including soft Chinese official PMIs. Sectors are mostly firmer though Energy lagging given benchmark pricing and a poorly received update from BP while Healthcare slips after a disappointing drug update from Roche. At the other end of the spectrum, Chemical names outperform given cost-cutting measures from BASF. Stateside, futures are modestly firmer and have been moving directionally with European peers ahead of US data and a handful of earnings, ES +0.3%. Caterpillar Inc (CAT) Q3 2023 (USD): EPS 5.52 (exp. 4.79), Revenue 16.8bln (exp. 16.59bln), Financial Rev 822mln (exp 766mln), Adj. Operating Income 3.50bln (exp 3.09bln).

Top European News

- UK insolvency service Q3 insolvencies in England and Wales total 6208; after seasonal adjustment, the number of company insolvencies in Q3’23 was 2% lower than in Q2’23, but 10% higher than Q3’22.

- ECB’s Visco says ECB needs to be cautious in coming months after hiking rates so much and so quickly; EZ inflation is falling as expected and demand seen further contained in coming months due to delayed impact of rate hikes. A reason for recent rises in Italian bond spreads is probably that investors doubt Italy’s economic growth potential and control of public finances. Fears of a wage-spiral in EZ and unanchored inflation expectations have sharply diminished.

FX

- Hawkish sources set Yen up for steep fall as BoJ sticks to dovish guidance after fixing flexible YCT ceiling at 1%, USD/JPY rebounds from 149.03 to 150.75 alongside Yen crosses.

- Euro boosted by breach of 160.00 in EUR/JPY as EUR/USD reclaims 1.0600+ status and and leans on the DXY, Dollar index retreats from 106.45 to 105.89

- Kiwi encouraged by upbeat ANZ business survey, with NZD/USD probing 0.5850 and AUD/USD cross reversing through 1.0900.

- Aussie hampered with Yuan after disappointing Chinese PMIs, AUD/USD capped around 0.6350, USD/CNY above 7.3100 and USD/CNH over 7.3300.

- PBoC set USD/CNY mid-point at 7.1779 vs exp. 7.3024 (prev. 7.1781)

Fixed Income

- Bonds firmly underpinned approaching month end.

- Gilts and T-note pick up the baton from EGBs to hover towards upper end of respective 93.51-09 and 106-19/02 ranges.

- Bunds off best levels between 129.33-128.65 parameters and BTPs regroup within 110.70-15 bounds in relief post-Italian month end supply.

Commodities

- Crude futures consolidated overnight after settling lower by USD 3.23/bbl and USD 2.85/bbl respectively on Monday, paring all of Friday’s gains and more after an unwind of some of the geopolitical risk.

- Currently, WTI Dec resides just under USD 83/bbl (in a USD 82.29-83.17/bbl range) while Brent Jan trades around USD 87/bbl (in a USD 86.30-87.22/bbl parameter).

- Spot gold is flat after seeing a similar unwinding of geopolitical premia while base metals are mixed but with modest gains given the risk tone; Dalian** iron ore** bid on Chinese optimism and as the likes of ING highlight potential strike action in Australia.

BOJ

- BoJ maintained NIRP at -0.10% and the 10yr JGB yield target at 0% but widened the reference range to 100bps up or down from the target from 50bps and made YCC more flexible with the decision on YCC made by 8-1 vote in which board member Nakamura dissented. BoJ said it will regard the upper bound of 1% for the 10yr JGB yield as a reference in market operations and will guide market operations nimbly, while it will flexibly increase JGB buying, fixed-rate operations and collateral fund-supplying operations. Furthermore, it will determine the offer rate for fixed-rate JGB buying operations each time by taking into account market rates and other factors.

- BoJ Governor Ueda says will patiently continue monetary easing with decided new measures; Will not hesitate to take additional easing measures if necessary; Getting gradually closer to achieving price target. Closely working with government and monitoring the situation on FX.** FX could affect policy if it impacts price outlook. Next spring’s wage talks will be an important factor**. Click here for more detail.

- Japanese PM Kishida says excessive FX moves are not desirable; weak JPY has various reasons including yield differentials.

Geopolitics

- White House National Security Adviser Sullivan met with the Saudi Defence Minister and confirmed President Biden’s commitment to support the defence of US partners against threats from state and non-state actors including those backed by Iran.

- Drone intercepted over the Red Sea reportedly launched from Yemen, according to Walla News’ Elster; “drone launched by Yemen’s Houthi rebels have been intercepted by the IDF over the Red Sea”, according to Faytuks News.

- Yemeni Houthis claim launch of drone towards Israel, according to Sky News Arabia citing AFP.

US Event Calendar

- 08:30: 3Q Employment Cost Index, est. 1.0%, prior 1.0%

- 09:00: Aug. S&P/Case-Shiller US HPI YoY, est. 1.78%, prior 0.98%

- 09:00: Aug. S&P CS Composite-20 YoY, est. 1.75%, prior 0.13%

- 09:00: Aug. S&P/CS 20 City MoM SA, est. 0.80%, prior 0.87%

- 09:45: Oct. MNI Chicago PMI, est. 45.0, prior 44.1

- 10:00: Oct. Conf. Board Consumer Confidence, est. 100.5, prior 103.0

- 10:00: Oct. Conf. Board Expectations, prior 73.7

- 10:00: Oct. Conf. Board Present Situation, prior 147.1

- 10:30: Oct. Dallas Fed Services Activity, prior -8.6

DB’s Jim Reid concludes the overnight wrap

On Halloween, the Bank of Japan (BOJ) has decided not to scare markets too much this morning and has only tweaked its yield curve control settings marginally by allowing 10yr Japanese government bond yields to increase above 1% – redefining it as a loose “upper bound” rather than a rigid cap. The central bank’s modest policy shift has led to a decline in the yen, slipping as much as -0.76% to 150.17 per dollar as investors were pricing in the risk of a greater change in the BOJ’s accommodative monetary policy stance. The Nikkei (+0.49%) is seeing gains as weakness in the yen is helping provide an additional boost. Meanwhile, yields on 10yr JGBs reached 0.957% early in Asia trading (from 0.89% at the previous close) before paring back slightly to 0.942% as we type and ahead of the press conference. Inflation forecasts have been increased but it still feels to us that the BoJ are very optimistic about the likelihood of hitting the 2% target so if we’re correct the YCC will be abandoned soon.

Moving on to other Asian equities, markets are mostly trading lower this morning after the latest batch of PMI data from China showed economic momentum continuing to wane in the world’s second biggest economy at the beginning of fourth quarter (more on this below). In terms of specific index moves, the Hang Seng (-1.77%) is leading losses across the region with the KOSPI (-1.32%), the CSI (-0.66%) and the Shanghai Composite (-0.38%) also trading in the red. S&P 500 (-0.38%) and NASDAQ 100 (-0.57%) futures are moving lower after a strong day yesterday. Yields on 10yr USTs (-2bps) are slightly lower at 4.87% as I type .

Coming back to China, the official manufacturing PMI unexpectedly contracted to 49.5 (50.2 expected) in October from 50.2, signalling renewed weakness in the sector. At the same time, the non-manufacturing PMI also dropped to 50.6 (52 expected) from 51.7 in September. The disappointing data suggests that the economy is still struggling despite better-than-expected Q3 GDP data reported recently. This might partly explain the stimulus package last week. Elsewhere, retail sales in Japan rose +5.8% y/y in September (v/s +5.9% expected), softening after four straight months of accelerating growth. It follows an expansion of +7.0% in August. Meanwhile, industrial output shrank -4.6% y/y in September and worse than expectations of -2.3% whilst the jobless rate dropped to 2.6% as expected in September from 2.7% previously.

Before the Bank of Japan announcement, risk assets saw a solid rally yesterday as investors grew hopeful that a material escalation in the Middle East would be avoided for now, particularly relative to concerns last Friday. That helped drive a major decline in oil prices, with WTI Crude (-3.78% to $82.31/bbl) erasing its rise since Hamas’ attack on Israel on October 7. Moreover, the Israeli shekel (+1.09%) saw its best daily performance in that time against the US Dollar, whilst gold (-0.42%) also lost ground, having closed above $2,000/oz on Friday for the first time in months. So in terms of the assets most sensitive to an escalation, it was one of the largest moving days since the current conflict began.

That backdrop helped support a recovery in global equities, with the S&P 500 (+1.20%) putting in its strongest session in two months after losing ground in 8 of the 9 previous sessions. However, it was fixed income that saw some of the more interesting moves, since yields on 10yr Treasuries were back up another +5.8bps to 4.89% ahead of the Fed’s decision and the Treasury refunding announcement tomorrow. Yields briefly rallied by c. 3bps after the Treasury reduced its net borrowing estimate for the current quarter to $776bn from the $852bn it had expected back in late July. However, this estimate was close to our rates strategists’ expectations, and bonds more than reversed the move by the close.

The 2s10s Treasury curve steepened another +0.8bps to close at -16.2bps. That’s the steepest that the 2s10s curve has been since July 2022, and means that the curve has steepened by over 60bps in just over a month. Clearly we’ve still got a bit further to go before the curve has a positive slope again, but if we did get back into positive territory, that would end the longest sustained period of inversion for the 2s10s yield curve since 1980. Remember from my CoTD last week here that every recession in the last 70 years has followed an inversion that had steepened up considerably from the most inverted point.

Over in Europe, sovereign bonds outperformed after the flash October CPI prints for Germany and Spain both surprised on the downside. In Germany, CPI fell to 3.0% on the EU-harmonised measure (vs. 3.3% expected), which is the lowest it’s been since June 2021. And in Spain, it came in at 3.5%, which was two-tenths higher than the September figure, but still beneath the 3.8% expected by the consensus. So that was some good news ahead of the Euro Area-wide CPI print today, which our European economists now see tracking at 3.0% for headline and 4.1% for core (vs BBG consensus at 3.1% and 4.2%, respectively). The data helped yields fall across the Euro Area with those on 10yr bunds (-0.9bps), OATs (-1.7bps) and BTPs (-6.9bps) all coming down on the day. The 10yr BTP-Bund has declined by a sizeable 11bps in the three sessions since last week’s ECB meeting.

Alongside the inflation data, we had the latest growth numbers out of Germany, which showed Q3 GDP only contracted by -0.1% (vs. -0.2% expected), and the Q1 and Q2 figures were revised upwards as well. But even with the better-than-expected news, this is hardly showing a booming economy, and our German economists point out that GDP has still stagnated over the last 18 months. They keep their full-year growth forecast for 2023 at -0.5% (link here) with 2024 at +0.3%, expecting growth to remain around stagnation in Q4-23 and Q1-24.

With all that in mind, equities put in an strong performance yesterday, with the S&P 500 (+1.20%) and Europe’s STOXX 600 (+0.36%) both moving higher on the day. The NASDAQ rose by +1.16%. It was broad-based advance for US equities, with 23 of 24 S&P industry groups rising on the day. The one exception was autos (-4.09%), which were weighed down by a -4.79% decline for Tesla on concerns over Chinese competitors, UAW agreements elsewhere in the sector, and production cuts from battery maker Panasonic which hinted at softer EV demand. The small cap Russell 2000 underperformed the broad rally (+0.63%) after hitting its lowest level since November 2020 on Friday. As my CoTD showed here yesterday, the Russell 2000 is now at levels in real price terms that it first surpassed in 2015. So beneath the surface and without the Magnificent Seven, US equities continue to correct from very high valuation with inflation helping in that process.

Elsewhere yesterday, the UK housing market showed little sign of a revival, as mortgage approvals in September fell to an 8-month low of 43.3k (vs. 44.5k expected). Furthermore, the latest M4 money supply data showed a year-on-year contraction of -3.9%, which is the fastest decline since August 2012. The releases come ahead of the Bank of England’s policy decision on Thursday, where they’re widely expected to keep rates on hold at 5.25%.

To the day ahead now, and data releases include the Euro Area flash CPI release for October, as well as the Q3 GDP release. Over in the US, there’s the Employment Cost Index for Q3, the Conference Board’s consumer confidence for October, the MNI Chicago PMI for October, and the FHFA house price index for August. From central banks, there are several ECB speakers including Vice President de Guindos, and the ECB’s De Cos, Visco, Muller and Nagel. Lastly, today’s earnings releases include BP, Pfizer and Caterpillar.