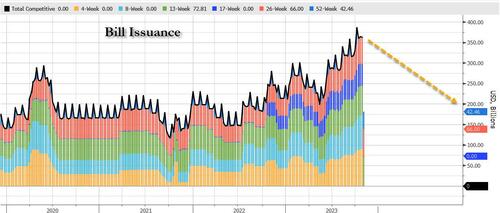

US equity futures are weaker to start the new month ahead of today’s Fed meeting (which as we previewed earlier will be a nothingburger now that the Treasury itself is raising yields with its relentless debt issuance and doing the Fed’s job for it) as well as macro data dump which includes the Treasury’s Q4 refunding statement. As of 8:00am, S&P and Nasdaq 100 futures dropped by about 0.4%. The USD is stronger with bonds catching a bid. Commodities are mixed with crude/base metals up, while natgas, gold down, and both softs/grains mixed. Today’s data focus includes the Fed, ADP, JOLTS, ISM, vehicle sales; Treasury refunding announcement at 8.30a ET. We also get a deluge of consumer-sector earnings today.

In premarket trading, WeWork plunged 42% after the Wall Street Journal reported that the company plans to file for bankruptcy as early as next week. First Solar rises about 4.1% after earnings beat consensus expectations as the solar panel company avoided an industrywide slowdown. Here are the other notable premarket movers:

- Canada Goose slides 9.5% after the apparel company slashed its annual forecasts.

- Crispr Therapeutics jumps 9.2% after the company’s potential gene-editing treatment for sickle cell disease gained support from some advisers to the FDA.

- Estée Lauder Cos.slips 15% after the company lowered its full-year outlook citing continued weakness in Asia travel retail and in mainland China.

- Lumen Technologies shares are down 5.5% after the wireline telecommunications company reported third-quarter results that are seen as mixed.

- MasTec tumbles about 16% after the infrastructure construction firm cut its year profit and revenue forecast.

- Match Group slumps 9% after the dating-app firm provided fourth-quarter revenue guidance that didn’t meet consensus expectations.

- Paycom Software tumbles 37% after the employment software company slashed its full-year forecast.

- Wayfair drops 13% after posting 3Q results.

- WeWork shares fall 35% following a report in the Wall Street Journal that the company plans to file for bankruptcy.

- Yum China drops 12% after the restaurant operator reported third-quarter comparable sales that fell short of estimates.

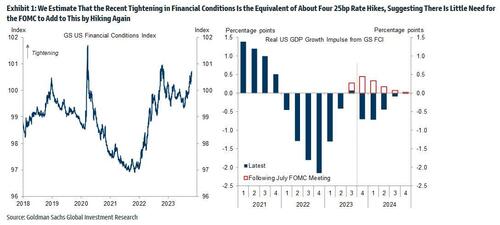

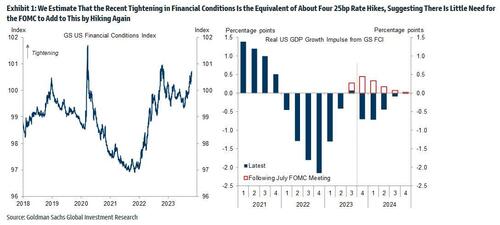

Turning to today’s main event, in what will be a mostly nothingburger event (see preview here), the Fed is expected to hold rates steady at a 22-year high for a second meeting, while leaving open the possibility of another hike as soon as December with economic growth staying resilient. The recent surge in US Treasury yields has contributed to a tightening of financial conditions, which according to Goldman is the equivalent of as many as 4 additional rate hikes…

… leading even hawkish Federal Open Market Committee members to indicate patience over further rate moves.

“The Nov. 1 FOMC meeting has little drama attached to it. Very little is priced in and we do not expect the Fed to surprise,” Steven Englander, head of global G-10 FX research and North America macro strategy at Standard Chartered Bank, wrote in a note. “The big question is how much of the yield increase at the long end of the curve reflects changed expectations on growth and how much can be viewed as restraining growth down the road.”

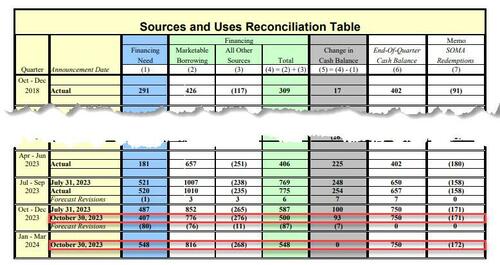

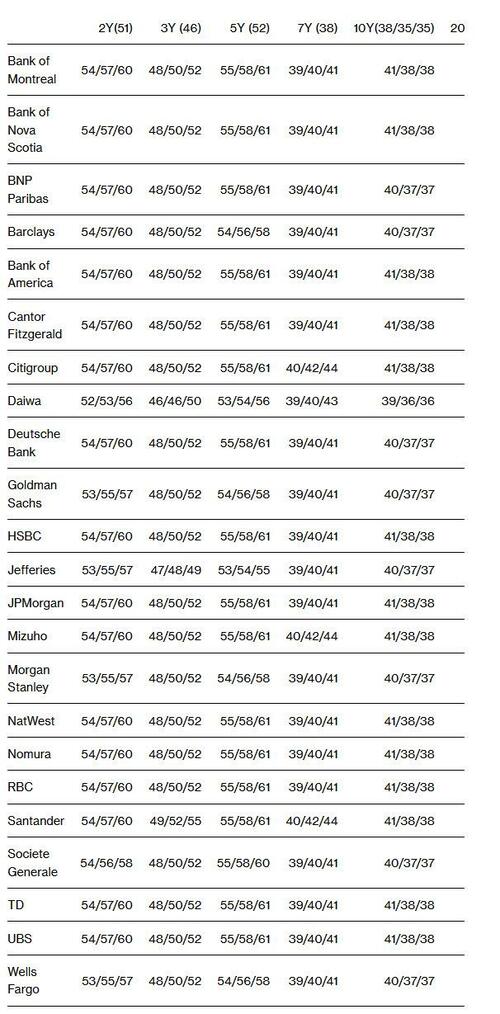

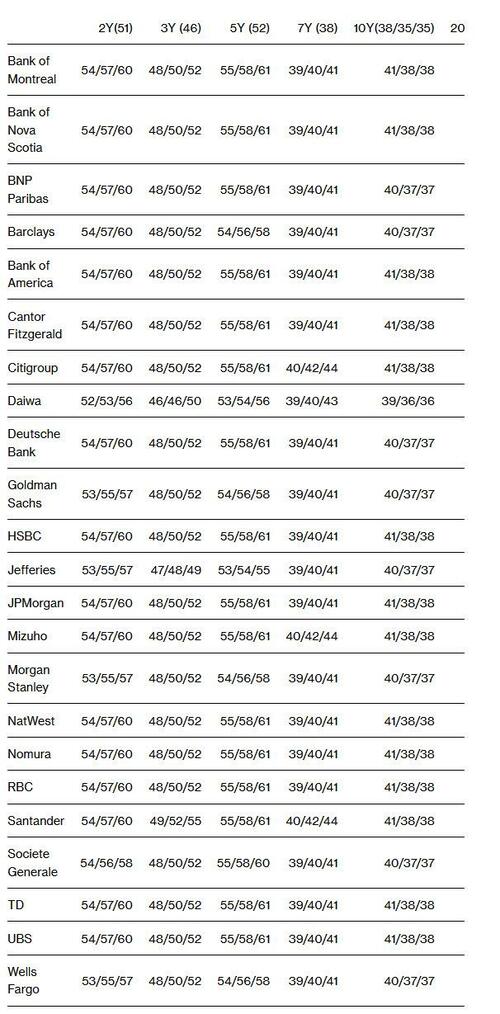

Separately, turning to the day’s “other” big event, the Treasury’s Quarterly Refunding Announcement, bond dealers are expecting the Treasury to unveil another round of increases this week to its note and bond auctions, though a sizable minority forecast the department will slow the pace of growth to avoid jolting yields higher.

European stocks have fared slightly better meanwhile, with the Stoxx 600 little changed. Retail, insurance and health care are the best performing sectors. European retailers outperformed the broader market, led by Next Plc as it increased its profit guidance. Orsted A/S plunged 22% after taking a $4 billion hit on abandoned US wind projects. Here are the most notable European movers:

- GSK shares rise as much as 3.3%, after the pharmaceutical company increased its outlook for the second time this year, helped by its vaccine to prevent a common respiratory virus in adults

- Next shares jump as much as 3.8% after the clothing retailer boosted its pretax profit guidance for the full year, meeting consensus expectations. Analysts said the update was better than expected

- Barry Callebaut rises as much as 4.5%, with full-year results for the chocolate maker seen broadly in line. The company’s medium-term guidance aspirations are, however, described as “uninspiring” by ZKB

- Smurfit Kappa shares were up as much as 3.7% on the Irish stock exchange Wednesday as the paper packaging company reported that its order books were improving

- BP falls as much as 2.8% as JPMorgan cuts to underweight, flagging potential for further impairment in offshore wind business and weakening momentum in share buybacks

- Orsted shares slide as much as 22% in Copenhagen after the company drops the development of two US wind projects, recording impairment charges significantly above its previous predictions in the latest blow to the struggling industry

- Wolters Kluwer falls as much as 4.8%, the most since May, after nine-month results showed organic growth slowed in the third quarter from first-half levels

- Skanska falls as much as 13%, after the Swedish construction and property development group reported third-quarter sales heavily impacted by weak margins, significant impairments and an uncertain outlook

- Segro drops as much as 4%, the worst performer on the Stoxx 600 real estate index on Wednesday, after Goldman cuts the warehouse landlord to sell, saying balance sheet constraints are set to cap its near-term earnings growth

- Iveco shares fall as much as 8%, the most in 16 months, after the Italian commercial vehicle manufacturer’s free-cash-flow missed estimates

- Aston Martin shares fall as much as 18% after the British automaker lowered its outlook as supply-chain issues weighed on its new DB12 sports car output. Oddo calls the results “weak”

- Asos shares slide as much as 11% after FY24 revenue guidance was meaningfully below consensus expectations as the the online fashion retailer focuses on clearing inventory in what is seen as a reset year

Earlier in the session, Asian equities rose ahead of the Federal Reserve meeting, led by Japanese stocks after the Bank of Japan maintained its negative-rate policy. The MSCI Asia Pacific Index climbed as much as 1.1%, on track for its first gain in three sessions. Chinese shares were flat. Japan’s markets endured another day of turbulence as authorities fired verbal warnings on the yen and stepped into the bond market. In the end, Japan’s stocks climbed more than 2% on relief over ultra-low borrowing costs and a weak yen. Industrial and consumer discretionary shares led sectoral gains in the region.

- Hang Seng and Shanghai Comp were cautious as Chinese Caixin Manufacturing PMI data followed suit to the recent deterioration seen in the official release and amid some disappointment after the PBoC’s open market operations resulted in a net daily drain despite prior reports that the central bank is likely to add further liquidity.

- Japan’s Nikkei 225 was the biggest gainer amid reports that Japan’s new economic package is to total around JPY 17tln and after recent currency weakness in the aftermath of the BoJ’s modest YCC tweak.

- Australia’s ASX 200 was positive as outperformance in the mining and real estate sectors picked up the slack from defensives and helped shrug off the surprise contraction in building approvals data.

- Indian stocks dropped for a second day, side-stepping gains in most Asian markets, led by a selloff in technology companies and lenders. The S&P BSE Sensex declined 0.4% to 63,591.33 in Mumbai, while the NSE Nifty 50 Index lost 0.5% to 18,989.15. The MSCI Asia Pacific Index was up 1%. Technology and banks stocks, which make up about half of the benchmarks, were among the leading sectoral losers. The BSE Bankex fell 0.4%, while BSE IT was down 0.8%.

In FX, the Bloomberg Dollar Spot Index climbed 0.1% as markets braced for the Federal Reserve to hold rates steady. The yen is stronger after some government jawboning earlier on Wednesday, rising 0.3% versus the greenback. The euro drops 0.3%.

- USD/JPY dropped as much as 0.4% to 151.14 after Japan’s top currency official Masato Kanda warned authorities are on standby to intervene if needed

- NZD/USD fell as much as 0.6% to 0.5789 after New Zealand’s unemployment rate rose to a two-year high; AUD/USD reversed declines to rise 0.1% to 0.6343 after China’s manufacturing activity unexpectedly shrank in October

- GBP/USD dipped 0.1% to 1.2142 after UK house prices unexpectedly rose the most in over a year

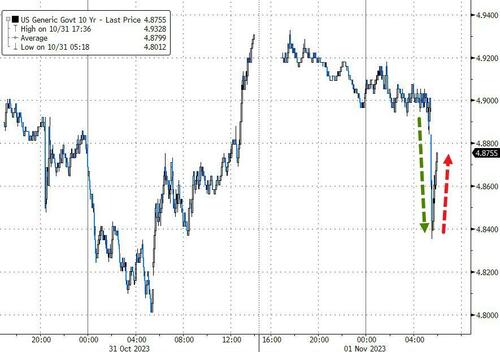

In rates, treasury futures are near top of day’s range, with yields lower by 2bp to 3bp across the curve, unwinding portion of late Tuesday selloff around the 4 p.m. New York-time close. US 10-year borrowing costs fall 3bps to 4.89%; steepening of 5s30s extends through Tuesday session highs ahead of the 8:30 a.m. New York time Treasury announcement of details of quarterly debt refunding. US session focus also on data with ADP employment change, manufacturing PMI and JOLTS due, ahead of the Fed rate decision. US yields richer by 2bp to 3bp across the curve, with spreads broadly within one basis point of Monday session close; small steepening move added into 5s30s, takes spread through Tuesday highs and peaking through 24bp; 10-year yields around 4.90%, outperforming bunds and gilts by 5bp and 7bp in the sector

In commodities, oil climbed after slumping in the first two days of the week, as a still-contained Israel-Hamas war shifted attention to global demand. WTI rose 1.1% to trade near $82. Spot gold is flat.

Bitcoin was a touch softer on the session perhaps given some modest USD strength but generally BTC is fairly contained and exhibiting similar price action to the broader market which is moving into a pre-FOMC/Quarterly Refunding tone.

To the day ahead now, and the main highlight will be the Federal Reserve’s decision and Chair Powell’s subsequent press conference. We’ll also get the US Treasury’s quarterly refunding announcement. On the data side, we’ll get the global manufacturing PMIs for October, as well as the ISM manufacturing print from the US. Elsewhere in the US, we’ll get the JOLTS report for September, and the ADP’s report of private payrolls for October. Finally, today’s earnings releases include AIG and Airbnb.

Market Snapshot

- S&P 500 futures down 0.3% to 4,200.75

- MXAP up 1.0% to 152.20

- MXAPJ little changed at 472.28

- Nikkei up 2.4% to 31,601.65

- Topix up 2.5% to 2,310.68

- Hang Seng Index little changed at 17,101.78

- Shanghai Composite up 0.1% to 3,023.08

- Sensex down 0.3% to 63,679.06

- Australia S&P/ASX 200 up 0.8% to 6,838.31

- Kospi up 1.0% to 2,301.56

- STOXX Europe 600 up 0.2% to 434.52

- German 10Y yield little changed at 2.84%

- Euro down 0.2% to $1.0558

- Brent Futures up 0.6% to $85.51/bbl

- Gold spot down 0.3% to $1,978.82

- U.S. Dollar Index up 0.13% to 106.80

Top Overnight News

- The BOJ intervened in the government bond market on Wednesday to rein in a jump in yields to fresh decade highs, underlining the challenge for the central bank a day after loosening its grip on long-term interest rates. The battered yen recovered some ground on threats of intervention from Japanese authorities, and as investors shifted focus to the Federal Reserve’s policy decision later in the day. RTRS

- China’s Caixin manufacturing PMI falls short in Oct, coming in at 49.5 (down from 50.6 in Sept and below the Street’s 50.8 forecast). BBG

- The House of Representatives China committee will introduce a bill on Wednesday that would ban the US government from buying Chinese drones, in a bid to bolster a Senate push after past efforts were derailed by lobbying. FT

- The EU’s stores of natural gas are nearing full capacity, leading the bloc’s energy companies to park excess reserves in Ukraine ahead of the peak demand of the winter months. According to figures from Gas Infrastructure Europe, the EU’s chambers are now almost 99% full, surpassing Brussels’ target of 90% of storage capacity by November. FT

- Egyptian television has broadcast images of people leaving Gaza after a deal to allow the critically wounded out of the enclave for the first time since the start of the Israel Hamas war three weeks ago. FT

- The US and Israel are exploring options for the future of the Gaza Strip, including the possibility of a multinational force that may involve American troops if Israeli forces succeed in ousting Hamas, people familiar with the matter said. RTRS

- Fed officials appear to have signaled that they will not be hiking at their November meeting this week. We interpret their recent comments, recapped in our latest Fed Chatterbox, to imply that most would prefer not to hike again, consistent with our forecast that the FOMC will hold the funds rate at 5.25-5.5% until late next year. The market is pricing very little chance of a hike this week and only a roughly 20% probability of a hike at the December meeting. GIR

- Two Sigma plans to spin out its PE impact-investing unit amid internal discontent after its inaugural fund raised less than its target, people familiar said. BBG

- Central banks in G10 countries have stopped hiking rates (for the most part), but all have adopted a “higher for longer” outlook. RTRS

- Private credit’s success is creating a $500 billion headache: finding a home for all the money that’s been raised. Fund managers potentially lost out on more than $7 billion of lending deals in less than 48 hours this week, highlighting the difficulties they face in allocating billions of dollars of dry powder following the industry’s rapid expansion. BBG

A more detailed look at global markets courtesy of Nwesquawk

APAC stocks traded predominantly higher albeit with upside capped for some indices heading into the FOMC announcement and as the region digested another deluge of data releases including disappointing Chinese Caixin Manufacturing PMI which printed its first contraction in three months. ASX 200 was positive as outperformance in the mining and real estate sectors picked up the slack from defensives and helped shrug off the surprise contraction in building approvals data. Nikkei 225 was the biggest gainer amid reports that Japan’s new economic package is to total around JPY 17tln and after recent currency weakness in the aftermath of the BoJ’s modest YCC tweak. Hang Seng and Shanghai Comp were cautious as Chinese Caixin Manufacturing PMI data followed suit to the recent deterioration seen in the official release and amid some disappointment after the PBoC’s open market operations resulted in a net daily drain despite prior reports that the central bank is likely to add further liquidity.

Top Asian News

- White House said US President Biden is aiming to have a constructive conversation with Chinese President Xi in San Francisco in November.

- Japan’s government is considering spending over JPY 17tln for a package of measures to ease the pain from rising inflation and will compile a supplementary budget for the current fiscal year of around JPY 13.1tln to fund part of the package, according to a draft cited by Reuters.

- Total size of Japan’s economic package is expected to be around JPY 37.4tln, according to Jiji News.

European bourses are little changed on the session with cash picking up from a softer open while futures have deteriorated slightly, Euro Stoxx 50 -0.1%. Sectors are being dictated by earnings updates with Retail outperforming post-Next while Health Care benefits from GSK. At the other end of the spectrum, Media lags after Wolters Kluwer though Utilities are not far behind given pronounced losses in Orsted. Stateside, futures are in the red with specifics slim ahead of the FOMC and Quarterly Refunding, ES -0.3% & NQ -0.4%; preview and primer respectively available for both events. Following those Tier 1 events, after-market earnings include QCOM ABNB, ABNB, MDLZ, MET & PYPL.

Top European News

- The Times’ Shadow MPC voted 7-2 in favour of keeping rates on hold.

FX

- Greenback grinds higher ahead of Fed and packed agenda in the lead up, DXY eclipses month end high within 106.89-64 range.

- Yen claws back post-BoJ losses with the aid of more audible verbal intervention, USD/JPY retreats from 151.70 to 151.15 at one stage.

- Euro probes semi-round number support at 1.0550 vs Dollar after losing 1.0600+ status.

- Kiwi labours after weaker than forecast NZ jobs and labour cost metrics, NZD/USD drifts down from 0.5827 to sub-0.5800 and AUD/NZD cross pops back above 1.0900.

- PBoC set USD/CNY mid-point at 7.1778 vs exp. 7.3327 (prev. 7.1779)

- Japan’s top currency diplomat Kanda said speculative FX moves seen cannot be explained by fundamentals and he is concerned that one-sided, sharp FX moves negatively affect the economy, while he added that authorities may or may not say when they conduct intervene, according to Reuters.

- Japanese Chief Cabinet Secretary Matsuno said it is important for FX to move stably reflecting economic fundamentals and rapid FX moves are undesirable, while he won’t rule out any steps to respond to disorderly FX moves.

Fixed Income

- Bonds remain cautious in advance of the FOMC, but pare some declines as broad risk sentiment waivers.

- Bunds, Gilts and T-note meander between 128.42-75, 92.63-91 and 105-27+/106-03 + parameters.

- 2028 UK issuance reasonably well received on the eve of the BoE and 7 year German supply may go well given current concession.

Commodities

- Commodities have, broadly speaking, spent the bulk of the European morning fairly contained with fresh catalysts limited ahead of a particularly busy US agenda headlined by Quarterly Refunding & the FOMC.

- The sessions current peaks of USD 82.26/bbl and USD 86.22/bbl for WTI Dec’23 and Brent Jan’24 respectively printed in the wake of remarks from Iran’s Supreme Leader.

- Iran’s Supreme Leader Khamenei says Muslim countries should stop exporting oil and food to Israel, via Tasnim. Echoes recent remarks. For instance, on October 18th Khamenei called for for its neighbouring nations to impose an oil embargo on Israel alongside the expulsion of Israeli ambassadors.

- US Private Energy Inventories (bbls): Crude +1.3mln (exp. +1.3mln), Gasoline -0.4mln (exp. -0.8mln), Distillates -2.5mln (exp. -1.5mln), Cushing +0.4mln.

- Russian oil exports from the Black Sea port of Tuapse planned at 1.103mln/T in November (1.142mln/T in October), via Reuters citing traders.

- Spot gold is essentially unchanged and around recent levels ahead of the packed docket while base metals have a modest negative bias, following suit to the broader risk tone from an equity perspective and in the wake of disappointing Chinese PMIs.

Geopolitics

- US Secretary of State Blinken is to travel to Israel on Friday to meet with the Israeli government and will make other stops in the region, according to the State Department. Furthermore, Blinken held a call with Israel’s President and emphasised the need to take precautions to minimise the harm to civilians.

- US Pentagon said an additional 300 US troops will be heading to the Middle East but will not be going to Israel.

- Chilean President Boric said Chile recalled its ambassador to Israel for consultations given Israel’s ‘violations of international humanitarian law’ in the Gaza Strip, according to Reuters.

- Iranian Defense Minister says they will unveil a new long-range defense system in a couple of weeks, via IranNuances.

- The Rafah border crossing has opened from Gaza into Egypt; for humanitarian purposes to allow the transit of foreign nationals and those with severe injuries.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications -2.1%, prior -1.0%

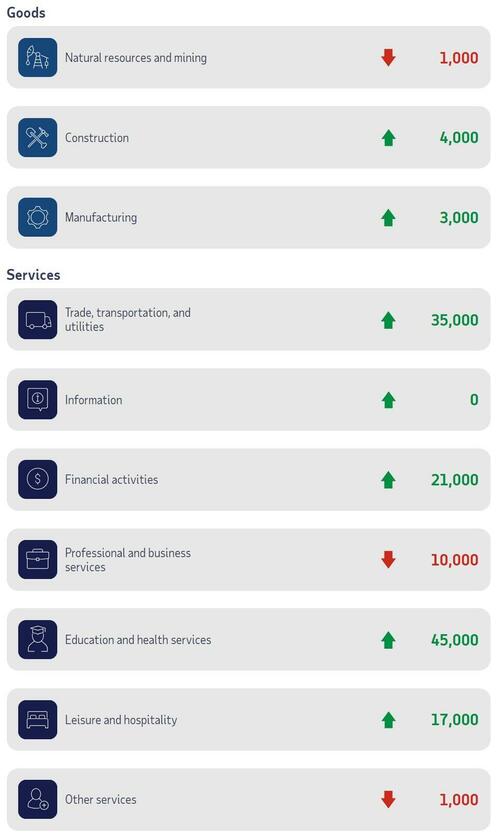

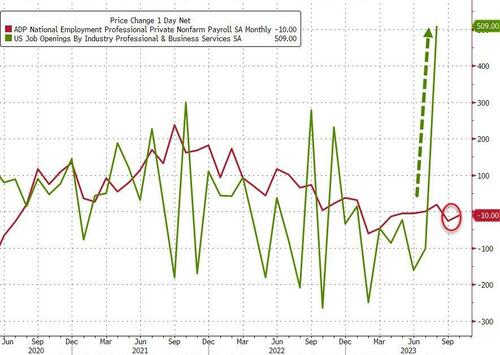

- 08:15: Oct. ADP Employment Change, est. 150,000, prior 89,000

- 09:45: Oct. S&P Global US Manufacturing PMI, est. 50.0, prior 50.0

- 10:00: Oct. ISM Employment, est. 50.6, prior 51.2

- 10:00: Sept. JOLTs Job Openings, est. 9.4m, prior 9.61m

- 10:00: Sept. Construction Spending MoM, est. 0.4%, prior 0.5%

- 10:00: Oct. ISM Manufacturing, est. 49.0, prior 49.0

- 14:00: Nov. FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

Hopefully you’ve all survived Halloween without too many tricks. My best trick was to miss trick or treating with the family on a wet night as I got home too late from work. There is absolutely no truth to the rumor that I hid in the bushes outside our house until they’d left to avoid attending.

Given the time of year its apt to say it was a slightly scary month for markets. Henry will shortly be releasing our performance review covering how different financial assets fared over October. Overall, it was another weak month for markets, with the main story being the attack by Hamas on Israel on October 7. However, we also had a fresh round of strong US data and further rises in long-term borrowing costs, with US Treasuries losing ground for a 6th consecutive month. Equities didn’t do well either, with the S&P 500 down for a 3rd month in a row for the first time since the pandemic turmoil of March 2020. See the full report in your inboxes shortly.

With October out of the way, attention will now turn to a couple of important events in the US today. First up, there’s the Treasury’s quarterly refunding statement, which goes over how they plan to fund their borrowing needs, including the plan for bond auctions over the months ahead. Normally this doesn’t get too much attention but given the massive runup in rates over recent months, especially since the last refunding announcement, the concern is that any surprises could help push long-dated yields even higher, although this risk will be much better priced now than it was in August. Our US rates strategist Steven Zeng has a preview of the refunding announcement here, and his view is that the Treasury will be responsive to the recent market move. The coupon size forecast sees a similar cadence of increases as announced in August, but with a slight tapering among 10yr to 30yr maturities.

That Treasury announcement is expected at 12:30 London time, but later on at 18:00 London we’ve then got the latest policy decision from the Federal Reserve. At this meeting, they’re widely expected to keep rates unchanged, so our US economists write in their preview (here) that the focus will be on any guidance Chair Powell has to offer in his press conference. They think Powell is likely to reiterate that the FOMC can “proceed carefully” on upcoming decisions. But since the last meeting, there’s been a strong payrolls number and core CPI was at a 5-month high in September, so it’ll be interesting to see how that might be shaping their thinking. Shortly before the meeting, we’ll also get the latest JOLTS report that features job openings and the quits rate, which is a good barometer for how tight the labour market is.

Ahead of the important refunding and FOMC day, Treasuries had rallied for much of the yesterday, with the 10yr yield trading 8bps lower early on shortly before the US data releases. However, bonds sold off from there. A 6bp rise in final 90 minutes of trading, likely reflecting month-end flows, left 10yr yields +3.7bps higher on the day at 4.93%. The 2yr yield rose +3.4bps to 5.09%, with the recent run of curve steepening that left the 2s10s at its steepest in a year on Monday taking a pause.

The initial turn from the intra-day yield lows came with the Employment Cost Index data for Q3, which surprised slightly on the upside at +1.1% (vs. +1.0% expected) and was up a tenth from the Q2 number. Conversely, the Conference Board’s latest consumer confidence release struck a more dovish tone, which fell to a 5-month low of 102.6 in October (vs. 100.5 expected). Furthermore, the present situation component fell to an 11-month low of 143.1.

For equities, the picture was pretty positive ahead of the Fed today, with the S&P 500 seeing a +0.65% advance and climbing for a second day after a run of 8 days out of 9 in negative territory. As on Monday, the gains were broad-based ones, with all 24 industry groups in the S&P 500 up on the day. Banks (+1.42%) were among the outperformers, while the small-cap Russell 2000 (+0.91%) saw a further recovery after its recent lows on Friday. By contrast, the megacap tech stocks were one of the weaker performers yesterday, with the Magnificent Seven up a marginal +0.10%. Nvidia traded nearly -5% lower early on, down to its lowest level since June intra-day, before recovering to close down -0.93%.

In Europe, the main news yesterday was on the economic side, with the latest data offering more downside surprises in the European inflation numbers. In particular, the flash CPI release for the Euro Area fell to just 2.9% in October (vs 3.1% expected), which was the lowest since July 2021, and a big fall from its 10.7% rate at the same point in 2022. Core inflation also fell back to 4.2%, but that’s proven much stickier than the headline number, which is now being pushed down by the -11.1% decline in energy prices over the last year.

The other important story from the Euro Area was the initial look at Q3 growth, which unexpectedly showed a -0.1% contraction (vs. unch expected). To be fair it wasn’t all bad news, since the Q2 number was revised up a tenth to show a +0.2% expansion, but this was still the worst quarterly performance for the Euro Area since Q2 2020 at the height of the pandemic. In response to the data, especially the inflation downside, our European economists have shifted their expectation of the first ECB rate cut from Sep-24 to Jun-24. While they continue to see cuts playing out at a pace of 25bp per quarter thereafter, they see risks skewed towards a faster pace of easing. See their update here.

Markets also responded by slightly moving forward expectations of ECB rate cuts next year. While a full 25bp rate cut continues to be priced by next June, the chances of a cut by March rose to 36%, from 33% on Monday and 23% as of Friday (prior to some of the country inflation prints). Sovereign bonds mostly rallied across the continent, with yields on 10yr bunds (-1.6bps), OATs (-0.7bps) and BTPs (-1.0bps) all moving lower.

Staying in Europe, the STOXX 600 saw a +0.59% rise yesterday but the picture was much more divergent by country. The UK FTSE 100 was down -0.08%, weighed upon by its large share of energy and materials stocks which underperformed. However, the German DAX was up +0.64%, and Italy’s FTSE MIB up +1.47%.

Overnight in Asia, the BoJ announced an unscheduled bond purchase program to curb the rise in yields after the BoJ decision to loosen its grip on YCC the previous morning. In the announcement, the central bank stated it will buy 300 billion yen of 5-to-10-year debt and 100 billion yen of 3-to-5-year securities. The decision comes as the 10yr yield on Japanese government bonds reaches its highest level since 2012 at 0.956%, as I type, up +2.2bps.

The Japanese yen hit a 33-year low after the BoJ decision the previous morning, but has rallied +0.3% this morning after comments from Japan’s chief currency official Kanda, who stated that Japan is “on standby” to counter volatility in the exchange rate. Kanda also highlighted that “speculation [was] the biggest factor behind recent foreign exchange moves”, and not fundamentals. Against this backdrop, the Nikkei 225 is trading up +2.14% this morning.

In other news this morning, the Chinese October Caixin manufacturing PMI disappointed at 49.5 (vs 50.8 expected), slipping from 50.6 into mildly contractionary territory. The Shanghai Comp and CSI 300 dropped initially on the result, before paring back losses, and are trading modestly up at +0.16% and +0.05% respectively as I type. In Hong Kong, the Hang Seng is down -0.09%, and elsewhere in Asia, the Korean Kospi is trading up +0.91%. S&P 500 futures are trading down -0.23% and Treasury yields have dipped back -1.3bps across the curve with a flattening bias.

Finally, in other notable US data prints yesterday, the FHFA’s house price index was up by +0.6% in August (vs. +0.5% expected), and the MNI Chicago PMI fell to 44.0 (vs. 45.0 expected).

To the day ahead now, and the main highlight will be the Federal Reserve’s decision and Chair Powell’s subsequent press conference. We’ll also get the US Treasury’s quarterly refunding announcement. On the data side, we’ll get the global manufacturing PMIs for October, as well as the ISM manufacturing print from the US. Elsewhere in the US, we’ll get the JOLTS report for September, and the ADP’s report of private payrolls for October. Finally, today’s earnings releases include AIG and Airbnb.