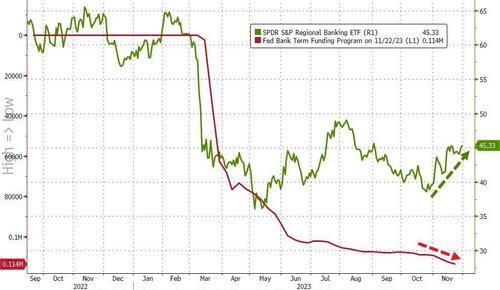

Investors have panic-bought Treasuries, agency, and mortgage debt, recording one of the best months since the 1980s. Stocks are also set to log the best month in a year, as the everything rally has been supported by easing financial conditions fueled by bets the Federal Reserve’s most aggressive interest rate hiking cycle in a generation is not just over but rate cuts are set for late spring next year.

As the Fed pivot injects optimism into markets, sort of like a junkie shooting up heroin, there has been an increase in activity at the buyback desks of multiple banks. Additionally, corporate insiders are showing confidence in the future of their companies by purchasing shares.

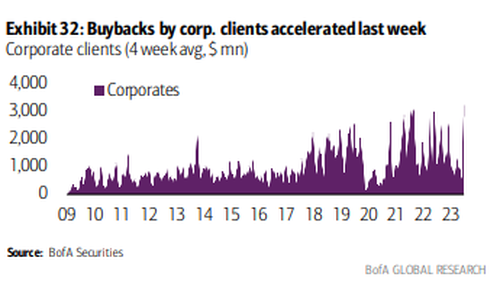

Bloomberg said the buyback desk at Goldman Sachs reported a “big tick up” in activity from its corporate customers repurchasing shares. At the buyback desk at Bank of America, the firm said it just had its busiest week of execution orders in history.

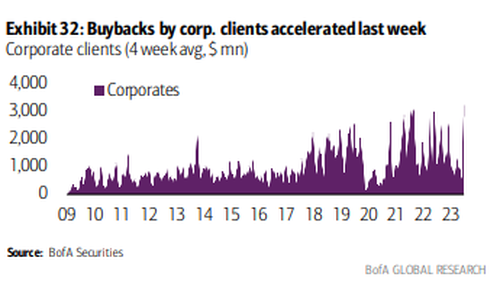

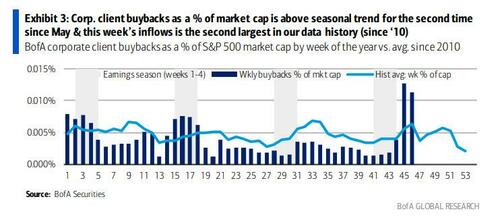

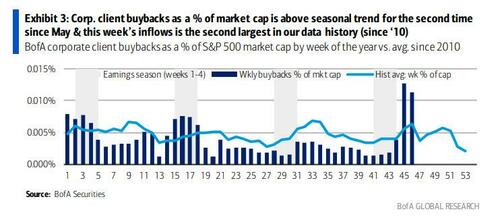

Recall last week, we cited a BofA client flows report that revealed two weeks of record buybacks:

“Corporate client buybacks accelerated the past two weeks and are tracking above seasonal levels for a second week in a row. YTD, corp. client buybacks as a percentage of S&P 500 mkt. cap (0.19%) are below ’22 highs (0.21%) at this time.”

And visually:

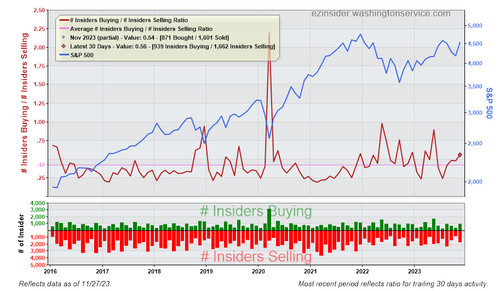

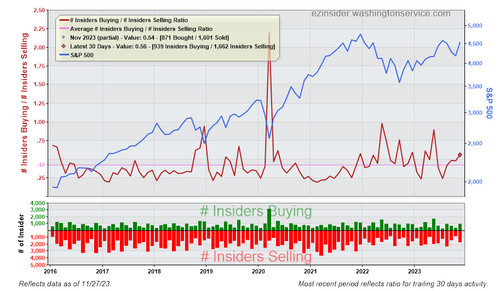

Insider data compiled by Washington Service shows corporate executives are also in the holiday buying mode of shares. These insiders have been purchasing shares of their own firms in November, with the ratio of buyers to sellers hitting six-month highs.

“We could see insiders buying into the bull case of inflation down, rate hikes over, mission accomplished. Insiders want to take more ownership of that message, and they are willing to pony up real money to do so,” said Mike Bailey, director of research at FBB Capital Partners.

Bailey continued, “That is a double-barreled sign of optimism, with companies and individual executives buying back their stock.”

Insider data shows 900 corporate execs purchased their own stock in November, more than double the number in October. However, the number of sellers did rise – but the increase was slight. As a result, the buy-sell ratio for insiders was .54, the highest level since May.

For some context, the current buy-sell ratio pales in comparison with the 2-to-1 reading in March 2020 when stocks crashed in the early days of Covid, and insiders were gobbling up their own shares. Still, increasing buybacks and insider buying activity come as the S&P500 is only 5% off from record highs.

Nomura’s cross-asset strategist Charlie McElligott pointed out earlier this week that the “everything ripper” rally seen through most of November is a product of financial conditions loosening due to a messaging shift from monetary authorities.

Goldman’s Vickie Chang, GIR Macro Markets Strategy, describes this period as a financial conditions ‘loop’:

“I think we are back in FCI loop where you have these periods of tightening and then easing and then back again that’s a result of the inherent difficulty of targeting financial conditions to set monetary policy…

…the market will tend to challenge the edges of some “acceptable” FCI range until something reins them in the other direction.

… it’s starting to look unsustainable this week particularly on the rate relief side.

The market moved fast after the FOMC to take the Fed out of the equation and even before the rally we saw this week it already felt like further yield declines would start to get into “taking it too far” territory with the market clearly pricing more cuts than our “scenario-weighted paths.

At some point those two pillars of this FCI easing will contradict each other and the market is going to have to worry more about the Fed and higher yields and I think that is the risk to hedge going forward.

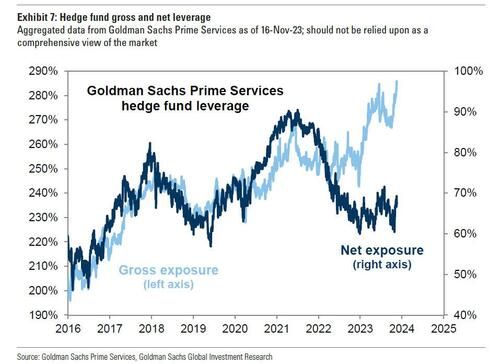

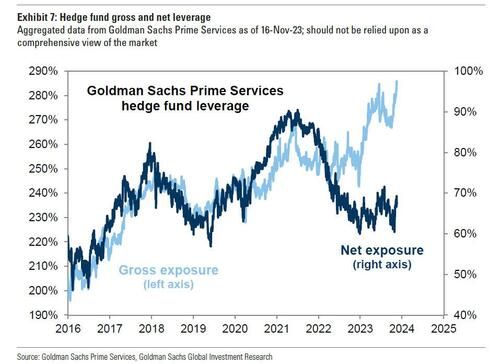

Meanwhile, last week, Goldman’s Prime Brokerage data revealed that hedge funds were trapped in a massive short squeeze.

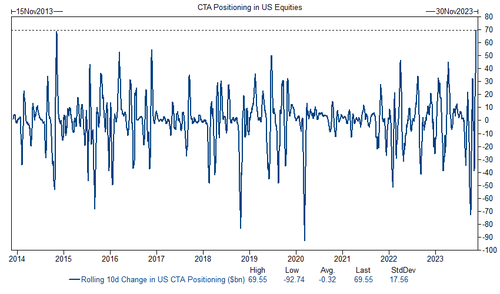

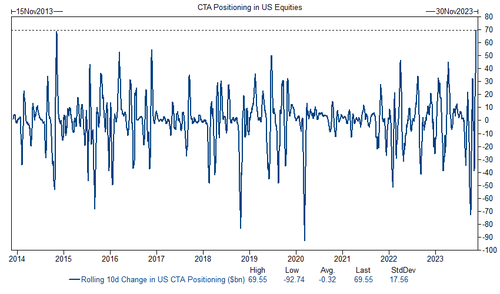

Also, to those who follow fund flows, the outperformance of stocks will hardly come as a surprise. Recall, earlier this month, we revealed that hot on the heels of the biggest 10-day CTA (i.e., trend-following fund) buying frenzy on record…

The soft-landing and Fed-cutting narratives certainly have everyone in a Jim Cramer ‘buy buy buy’ panic. But if financial conditions ease too much, markets will have to worry about high rates and growth again.