US Futures, Treasuries Extend Selloff As Oil Jumps Ahead Of Fed Minutes

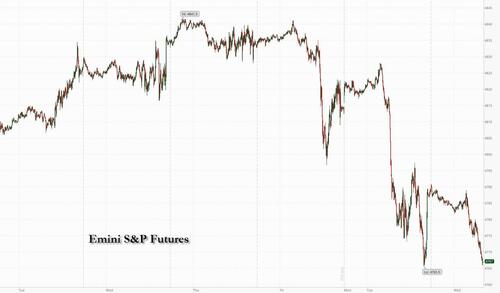

The risk off tone that has dominated the 2024 mood so far extended into a second session, and this time in addition to selling in both stocks and bonds, we are seeing crypto join the fray (the reason being attributed to this tweet). US equity futures and global market are experiencing some selling and profit-taking after the recent torrid Santa Rally, as we enter the first of several important macro data days: today the focus will be on ISM Mfg report and the December Fed Minutes. Interestingly, despite the weakness, yesterday’s US session saw a $7.8bn MOC to buy, and in its market intel note this morning (available to pro subscribers), JPM writes that for all the weakness “it does feel like there are buyers below current levels as the SPX struggles to breach 4,800.” That said, as of 7:45am, S&P futures were down 0.4% to 4,765, near yesterday’s session lows; Nasdaq futures dropped 0.7%. Bond yields are higher as we see bonds come for sale alongside stocks globally. 10Y Treasury yields rose to 3.98%, the highest since mid-December and a move above 4% will likely add more volatility to equity markets; the USD extended its gains; Brent jumped to session high around $77, rising form a sub-$75 low after Libya’s Sharara oil field unexpectedly shutdown amid mass protests, removing some 265K bpd in daily output although commodities overall remain mixed on concerns about China’s economy.

In premarket trading, all the megacap tech names are again lower in follow-on selling after yesterday’s AAPL’s downgrade which sent the stock tumbling almost 4%. Here are some other notable premarket movers:

- Ambarella Inc. shares are down 3.5%, after Wells Fargo Securities downgraded the chipmaker to equal-weight from overweight.

- Dyne Therapeutics rose 84% after it announced initial clinical data from Achieve trial in DM1 patients and Deliver trial in Duchenne muscular dystrophy patients.

- Mercury Systems slips 2.3% after Jefferies downgraded the defense company to underperform from hold saying its guidance “is in need of a reset.”

- Wendy’s falls 1.5% after Barclays cuts the fast-food restaurant operator to equal weight from overweight, seeing near-term challenges to accelerating unit and comparable sales growth.

US markets are poised to extend Tuesday’s slump, which saw the S&P 500 close lower by 0.6% and Nasdaq drop 1.7, registering as the biggest global rout since 1999 for the first full day of trading in a year. Wednesday’s data includes the ISM manufacturing report for December and the JOLTS report of job openings for November, followed by minutes from the Federal Reserve’s last meeting. The minutes will be of particular interest for investors because the December meeting was a key catalyst for the sharp rally in Treasuries, after Fed Chair Jerome Powell said that policymakers had discussed interest-rate cuts.

“It’s a very heavy data week — we have minutes, we have payroll, we have ISM,” said Adarsh Sinha, Bank of America Corp’s co-head of Asia FX & rates strategy on Bloomberg Television. “It’s natural investors are reducing some risks in some of the heavily crowded trades toward year-end.”

“We do not expect such sharp cuts to be supported by the discussion in the minutes, but we will be on the lookout for any mention of rate cuts, what would trigger them and how soon they might come,” said Karl Steiner, head of analysis at Skandinaviska Enskilda Banken AB.

European stocks have followed their Asian counterparts lower while bonds also add to Tuesday’s selloff. The Stoxx 600 falls 0.6%, led by declines in mining and consumer product shares. Defensive sectors advanced with consumer staples and healthcare outperforming the benchmark Stoxx 600 Index while tech shares lag behind. Here are the biggest European movers:

- Maersk extends gains, rising as much as 6.2% and lifting peers, after it decided to stop its ships from sailing through the Red Sea; Goldman Sachs upgrades the stock to neutral

- Novartis shares rise as much as 4.1% after agreeing a licensing deal with US biotech Voyager Therapeutics, with Vontobel seeing it boosting the Swiss firm’s gene therapy strength

- Atos surges as much as 12% after the French tech firm said it received an offer from Airbus for its cybersecurity and data unit, a deal that could potentially avoid heavy share dilution

- GSK gains as much as 2.8% after being upgraded to buy at Jefferies on near-term risk-reward ahead of potential Zantac class action settlements and misplaced concerns on 2024 growth

- Entain rises as much as 2.7% after appointing Ricky Sandler as a non-executive director with immediate effect. Analysts see the appointment as a positive for the share price

- Ryanair drops as much as 3.7% after the budget airline said the removal of its flights from several online travel agencies would reduce its load factor in the near term

- Wizz Air declines as much as 2.3% after revealing its load factor declined in December from the previous year, with Liberum noting this marks Wizz’s first decline in years

- Ashmore drops almost 5% after Numis downgrades to sell “with no obvious reason to own,” also seeing continued challenges within the wealth/asset management sector

“It’s not entirely surprising to see some of the tech stocks that very much propelled the market higher last year take a bit of a breather,” says Richard Saldanha, global equity fund manager at Aviva Investors. There’s value in sectors such as health care and consumer staples, “where earnings remain resilient and relative valuations are looking increasingly attractive,” Saldanha says. Saldanha notes the backdrop of lower inflation and potential for interest rates to come down from recent peaks should support markets, but there’s still a lot of uncertainty given the geopolitical backdrop and the US elections later this year.

Earlier in the session, in Asia, the MSCI regional benchmark sank 1.2% in the steepest retreat since November, driven by a selloff in technology stocks and as sentiment remains muted amid weakness in China; TSMC, Samsung and Alibaba were the biggest drags. Technology stocks tracked declines among Wall Street peers following a surge in Treasury yields. A gauge of tech stocks in Hong Kong dropped more than 2%. Stocks in Japan remained closed for a holiday. Asian equities have started the year on the back foot after a strong rally in the final quarter of 2023 as investors reconsider the potential scale of rate cuts by major central banks and China’s economic woes continue to weigh.

“Overall sentiment in the region has largely tracked the downbeat handover in Wall Street,” said Jun Rong Yeap, a market analyst at IG Asia Pte. “Focus will remain on economic data out of the US, alongside the Fed minutes, to provide cues on the Fed’s policy outlook.”

In FX, the greenback edged higher for a second day, with the Bloomberg Dollar Spot Index rising 0.2%. The Japanese yen is the weakest of the G-10 currencies, falling 0.5% versus the dollar with the USDJPY flirting with 143. The euro pared gains as Germany’s unemployment rate rose, while the Japanese yen sank for the second session.

“It’s a very heavy data week — we have minutes, we have payroll, we have ISM — so I think it’s natural investors are reducing some risks in some of the heavily crowded trades toward year-end like short dollar,” said Adarsh Sinha, BofA’s head of Asia FX & rates strategy on Bloomberg Television

In rates, we are selling continued weakness across the board. Treasuries extended Tuesday’s selloff with yields cheaper by 3bp to 5bp across the curve in a bear steepening move. 10-year TSY yields sit around 3.98%, cheaper by 5bps on the day and lagging bunds and gilts by around 4.5bp and 3bp in the sector as Treasuries lead global bonds lower; long-end led weakness steepens 2s10s, 5s30s spreads by 2bp and 1bp on the day

Another busy corporate issuance slate is expected for Wednesday’s session, follows almost $30b pricing Tuesday, while USD/JPY re-testing 143.00 adds to cheapening pressure on cash yields. Session ahead includes ISM manufacturing and JOLTS data. In the two-day pullback this year, long-end UK bonds have been among the hardest hit. Yields on 30-year UK government notes have risen 14 basis points, more than their US and German equivalents. Investors are ditching long-end gilts to free up cash before the UK sells new debt that may have a higher coupon.

Looking at today’s calendar, US economic data includes December ISM manufacturing and November JOLTS job openings (10am). Fed members scheduled to speak include Barkin at 8:30am; FOMC minutes release is scheduled for 2pm. The Federal Reserve will release minutes of its December meeting — when policymakers had surprised markets by signaling a pivot from rate hikes — later Wednesday while US jobless claims, nonfarm payrolls and factory orders are among the data points due by the end of the week.

Market Snapshot

- S&P 500 futures down 0.2% to 4,778.75

- MXAP down 1.0% to 166.42

- MXAPJ down 1.3% to 517.93

- Nikkei down 0.2% to 33,464.17

- Topix up 0.2% to 2,366.39

- Hang Seng Index down 0.8% to 16,646.41

- Shanghai Composite up 0.2% to 2,967.25

- Sensex down 0.7% to 71,399.28

- Australia S&P/ASX 200 down 1.4% to 7,523.20

- Kospi down 2.3% to 2,607.31

- STOXX Europe 600 down 0.3% to 477.24

- German 10Y yield little changed at 2.07%

- Euro little changed at $1.0941

- Brent Futures down 0.8% to $75.32/bbl

- Gold spot down 0.0% to $2,058.56

- U.S. Dollar Index little changed at 102.28

Top Overnight News

- Two of China’s biggest state-owned banks and a leading joint-stock bank have stepped up reviews of smaller lenders over the past couple of months to identify those with poor asset quality and have a high risk of default. The two state-owned banks have decided to reduce interbank lending limits and set shorter maturity periods for smaller peers deemed high risk, said two of the sources. RTRS

- A Chinese Communist Party newspaper has urged the country’s regulators to end their erratic moves against the platform economy, in a sign of growing concern over policy damage to the health of the country’s ailing internet titans. A front page opinion piece published by the Study Times, the mouthpiece of the Central Party School, on Wednesday argued that regulators must stop the practice of swinging between extremes of lax oversight and “overly strict” regulation so that China’s Big Tech firms can have room to grow. SCMP

- EU regulators will dig deeper into the links between banks and other financial firms such as hedge funds, said the chair of the European Banking Authority, as concerns mount about the potential for contagion from stresses in the wider system. FT

- The EU has added Russia’s state-owned Alrosa, the world’s largest diamond miner, to its sanctions list along with the company’s chief executive Pavel Marinychev. FT

- Oil’s facing a glut this year as production from non-OPEC+ countries like the US runs ahead of demand and traders are skeptical the cartel will be able to implement cuts. BBG

- US national debt tops $34T for the first time, with $1T added in just the last three months. WaPo

- Republican House majority will shrink to 2 following Ohio lawmaker’s early resignation (the resignation will leave the House with 219 Republicans and 213 Dems, which means the GOP can only lose two people on party-line votes). The Hill

- Issuance of convertible debt climbed by 77% last year to $48bn, according to data from LSEG, making it one of the only areas of capital markets to return to pre-pandemic averages after 2022’s market downturn. Experts say the boom in convertibles, a type of bond that can be swapped for shares if a company’s stock price hits a pre-agreed level, is likely to continue this year as companies refinance a wave of maturing debt. FT

- The killing on Tuesday night of a senior Hamas leader marked the biggest hit to the group’s top leadership in years, taking out a key player who was responsible for aligning the Palestinian militant group with Iran and Iran’s proxy Hezbollah. Saleh al-Arouri was killed in Beirut in a suspected Israeli strike, although Israel hasn’t officially claimed responsibility. WSJ

- Manhattan home prices rose for the first time in more than a year, as surging high-end sales propelled the market and lower mortgage rates set the stage for a broader recovery in 2024. Purchases closed at a median of $1.16 million in the fourth quarter, up 5.1% from a year earlier, according to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. It was the first annual increase since the third quarter of 2022, the firms’ data show. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly lower as sentiment reverberated from Wall Street’s downbeat performance despite the lack of a clear driver, while Japanese markets were away on a market holiday. ASX 200 saw the deepest losses in gold names following the recent surge in the Dollar, while Tech also lagged, mimicking the sectoral performance on Wall Street. KOSPI extended its downside with semiconductor names among the biggest losers – Samsung Electronics tumbled 3% at one point. Hang Seng and Shanghai Comp were mixed with the former’s losses led by large-cap Hong Kong stocks also listed in the US (JD.com -4.2%, Baidu -3.0%, Alibaba -2.7%), while Mainland China fluctuated between modest gains and losses, but was ultimately cushioned by stimulus speculation in Chinese press.

Top Asian News

- China is expected to persist in reducing interest rates and the reserve requirement ratio (RRR) throughout 2024, according to the China Securities Journal. Economic Daily reported that additional policies aimed at stabilizing the economy are anticipated to be implemented in China.

- PBoC injected CNY 14bln through 7-day reverse repos at a maintained rate of 1.80% for a net drain of CNY 558bln, according to Reuters.

- Japan reported an earthquake with prelim. magnitude of 5.5, no tsunami warning has been issued after the earthquake, according to NHK.

- Australia PM Albanese said his government would consider new cost-of-living relief measures ahead of the May budget without stoking inflation, according to Reuters.

- Some of China’s large banks tighten interbank lending standard for smaller peers to mitigate credit risk, via Reuters citing sources

European equites, Eurostoxx50 (-0.8%), extend losses in-fitting with the negative risk tone and subdued APAC trade overnight. Pressure which has increased throughout the session despite limited newsflow, though US Futures remain around the APAC low pre-data/minutes. European sectors hold a negative bias; Optimised Personal Care Drug and Grocery is generally lifted by UK supermarkets following a positive Kantar update. Basic Resources suffers from weaker commodity prices. US Equity Futures are lower across the board, though with losses comparably more contained ahead of key US data; RTY (-0.6%) continues yesterday’s underperformance; NQ & ES -0.2%.

Top European News

- Kantar UK Supermarket Update (Dec): Supermarkets saw their highest level of transactions in December since 2019. Grocery price inflation fell to 6.7% in December, its lowest level since April 2022.

- Atos in Early Talks to Sell Cybersecurity Business to Airbus

- Citi’s Manthey Says European Stocks Face Risks After Bullish Run

- German Unemployment Up Less Than Expected After Worker Shortages

- Maersk, Shipping Peers Jump on Red Sea Halt, Goldman Upgrade

- Wizz Air Drops as Load Factor Brings Capacity Concerns: Liberum

- Italy Weighs $1 Billion Package to Boost Electric-Car Sales

- European Council Adds Alrosa, CEO Marinychev to Sanctions List

FX

- DXY is firmer and trades towards the upper end of a 102.07-40 range; traders will await key US data. Thus far, the index has eclipsed the 21-DMA and approaches 21st Dec high (102.45), 102.50, 20th Dec high (102.54), and the 19th, 18th and 15th Dec highs (at 102.63, 102.63 and 102.64 respectively).

- EUR holds around the unchanged mark and trades on either side of 1.0950 after finding support near its 21 DMA at 1.0937.

- The Yen is the G10 underperformer continuing yesterday’s losses as USD/JPY advances to a high of 142.79.

- The Antipodeans are once again divergent, with the Kiwi holding around flat, whilst the Aussie slips; in a reversal of yesterday’s price action, AUD/NZD falls back below 1.08.

- PBoC set USD/CNY mid-point at 7.1002 vs exp. 7.1512 (prev. 7.0770)

Fixed Income

- USTs are pressured, in-fitting with the broader risk tone with yields bid across the curve as attention turns to FOMC Minutes and speak from Fed’s 2024 voter Barkin.

- Bunds continues yesterday’s losses and overall unreactive to the German unemployment data; though, as the risk tone sours more broadly EGBs have bounced from lows, but Bunds remain shy of 137.00 and Tuesday’s best above that.

- Gilts follow EGB and UST price action with the docket sparse on the UK front; session trough at 101.23 remains comfortably above the prior day’s worst at 101.08.

- Germany sells EUR 3.56bln vs exp. EUR 4.5bln 3.1% 2025 Schatz: b/c 1.82 (prev. 2.48x), average yield 2.44% (prev. 2.64%), retention 20.9% (prev. 18.67%)

- Mexico has placed USD 7.5bln in 5-year, 12-year, and 30-year bonds, according to the Finance Ministry cited by Reuters. Demand for the bond offering reached USD 21.3bln.

- Indonesia has launched 5-year, 10-year, and 30-year Dollar bonds at 4.9%, 5.05%, and 5.45%, respectively, according to the term sheet cited by Reuters

Commodities

- WTI and Brent continue to pullback with the complex taking cues for recent Dollar strength and the overall sour risk tone.

- Spot Gold price action is contained though has tilted slightly lower amid firmer Dollar; Base Metals are lower amid negative sentiment in APAC trade overnight.

- UBS forecasts higher spot crude prices this year. Forecasts Brent recovering to USD 80-90bbl and WTI in the USD 75-85bbl range.

- Indian Oil Minister says domestic firms will invest USD 67bln to bolster nat gas infrastructure by the next 5-6yrs; Says they are purchasing 1.5mln BPD of Russian oil.

- Iraq’s oil exports averaged 3.5mln BPD in December, average price of USD 76.96/bbl, via the Oil Ministry.

Geopolitics

- The US has reportedly reached an agreement with Qatar that extends the American military presence at the biggest base in the Middle East – al Udeid – for another 10 years, sources told CNN’s Marqu.

- US CENTCOM said on January 2, Iranian-backed Houthis fired two anti-ship ballistic missiles from Houthi-controlled areas in Yemen into the southern Red Sea, according to Reuters. Multiple commercial ships in the area reported the impact of the anti-ship ballistic missiles (ASBMs) into the surrounding water, although none have reported any damage.

- A senior Chinese official has stated that the upcoming elections in Taiwan (13th Jan) are an important choice between peace and war, prosperity and recession, according to state media.

- Iranian president is set to visit Turkey on Thursday, according to journalist Aslani.

US Event Calendar

- 07:00: Dec. MBA Mortgage Applications -10.7%

- 10:00: Nov. JOLTs Job Openings, est. 8.82m, prior 8.73m

- 10:00: Dec. ISM New Orders, est. 49.1, prior 48.3

- 14:00: Dec. FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

Welcome back and hope you all had a great Christmas and a happy New Year. Since we’ve been away, markets have continued to advance for the most part, with the S&P 500 having now posted 9 consecutive weekly gains for the first time since 2004. However, when it came to the first trading day of 2024 yesterday, markets have fallen back again, with the S&P 500 down -0.57%, whilst the NASDAQ saw a larger -1.63% decline. That decline has continued overnight as well, with the major equity indices in Asia all trading lower.

There have been several factors behind the moves, but an important one was growing scepticism about the chance of near-term rate cuts. For instance, at the end of 2023, futures were fully pricing in a Fed rate cut by March, but after yesterday’s session that had been dialled back to a 87% probability and overnight it has further moved lower to 85%. Likewise at the ECB, the chance of a cut by March has fallen from 71% last Thursday, to 61% yesterday and 59% overnight. Clearly, investors are still pricing in a Q1 rate cut as more likely than not, but there’s been a bit more doubt over the last 48 hours as to whether the aggressive rate cuts priced for 2024 will actually end up happening.

That shift prompted a decent sell-off for sovereign bonds on both sides of the Atlantic, with yields on 10yr Treasuries up +5.0bps to 3.93%. That was particularly evident at the front-end, where the 2yr yield was up +7.0bps to 4.32%. And the effects were clear among other asset classes, sine the dollar index (+0.86%) saw its strongest daily performance since July. Meanwhile in Europe there was a similar pattern, with yields on 10yr bunds (+4.5bps), OATs (+3.9bps) and BTPs (+2.4bps) all rising .

Another factor which dampened sentiment were growing signs of geopolitical risk and the potential impact on supply chains. For instance, yesterday saw the container shipping company Maersk announce that they would be pausing all transit through the Red Sea and the Gulf of Aden “until further notice”. They had already announced a pause until January 2, but the latest statement didn’t put a date on how long it would last. That follows incidents where commercial vessels have come under attack in the Red Sea, which has already led to significant shipping diversions. Brent crude oil prices had been up by more than 2% earlier in the session, but with the broader decline in risk appetite later in the session, they ended the day down -1.49% at $75.89/bbl .

Elsewhere, the data releases from yesterday didn’t really help matters either. Among others, we had the final manufacturing PMI from the US, which was revised down three-tenths from the flash reading to 47.9. To be fair, the picture looked slightly better in the Euro Area, where the manufacturing PMI was revised up two-tenths, but that still left it at a contractionary 44.4, having now remained beneath the 50 mark since June 2022.

All that meant markets got 2024 off to a rough start, with the S&P 500 (-0.57%) down for a second consecutive session, whilst Europe’s STOXX 600 also fell -0.10%. Big tech stocks led the declines, which meant the NASDAQ (-1.63%) and the FANG+ Index (-2.36%) posted significant losses. And there was a decent widening in credit spreads too, with US HY spreads widening by +10bps to 333bps .

Overnight in Asia, that negative trend has continued this morning, with losses for the KOSPI (-2.10%), the Hang Seng (-1.09%), the CSI 300 (-0.66%) and the Shanghai Comp (-0.26%). I n Australia, the S&P/ASX 200 is also down -1.37%, whilst markets in Japan remain closed for a holiday. US equity futures are pointing lower as well, with those on the S&P 500 down -0.07%.

Looking forward, today should offer some more clues on the rate cut speculation, since we’ve got the FOMC minutes from the December meeting out later. That meeting helped turbocharge the year-end rally, since the median dot from officials pencilled in 75bps of cuts this year, and Chair Powell didn’t push back on the rate cut discussion either. In fact, he said that “we’re very focused on not making that mistake” of keeping policy tight for too long. So all eyes will be on any mentions of rate cuts or easing policy.

As well as the Fed minutes, today will also bring the latest ISM manufacturing report for December, along with the JOLTS report of job openings for November. So far at least, the JOLTS has broadly pointed to an easing in labour demand, but to levels that are still consistent with a soft landing. So it will clearly be a good sign for the economy if that momentum can be maintained. Later in the week, we’ll get the US jobs report for December on Friday. Our US economists are looking for a +150k gain in nonfarm payrolls, with the unemployment rate ticking up slightly to 3.8% .

More broadly as we look to the year ahead, it’s clear that several themes are set to feature on the agenda. A big one will be politics, as there are lots of elections scheduled around the world in 2024. One of the most important will be the US Presidential election on November 5, and the current polling averages from FiveThirtyEight still suggest that Joe Biden and Donald Trump are the clear frontrunners for their party’s nominations. That would set up the first direct re-match in a presidential election since 1956. Moreover, attention is likely to shift onto US politics well ahead of November, as the first primaries are taking place later this month. On the Republican side, the Iowa Caucus is happening on January 15, which is then followed by the New Hampshire primary for both parties on January 23.

Meanwhile on the macro side, a big question we’re watching in 2024 is whether a soft landing can be achieved. Clearly the inflation readings have surprised on the downside of late, but we also know that monetary policy operates with a lag and there are still plenty of vulnerabilities. And even as growth surprised on the upside in 2023, several leading indicators of a recession are still pointing in a more negative direction, such as inverted yield curves, or the fact that Temporary Help Services payrolls in the US (a leading indicator in previous cycles) have kept declining. This is why we called our 2024 World Outlook “The Race Against Time…” (link here), as the question is whether rates can fall and lending standards ease quickly enough for there not to be a funding accident.

And lastly, although there are plenty of things we know are going to happen like elections, most years normally see plenty of events materialise that are unexpected surprises at the start. That’s certainly been the pattern in recent years, not least with 2020, when we had the pandemic and an incredibly sharp economic contraction. Then in 2021, inflation returned in a big way for the first time in decades. In 2022, that was then followed by the fastest rate hikes since the early 1980s, whilst Russia’s invasion of Ukraine meant that geopolitics became a significant factor for markets again. Even in 2023, although there wasn’t a single event that dominated in markets, there were still plenty of surprises that occurred along the way, including the regional banking turmoil in March, major excitement about AI from the spring, central banks staying hawkish, and then a phenomenal year-end rally as hopes mounted about a soft landing and potential rate cuts this year. Let’s see what 2024 has in store for us, but recent years have certainly taught us to expect the unexpected.

Looking at the day ahead now, US data releases include the ISM manufacturing reading for December, along with the JOLTS job openings for November. In Germany, there’s also the unemployment report for December. Meanwhile from the Federal Reserve, we’ll get the minutes from the December FOMC meeting, whilst Richmond Fed President Barkin is speaking.

Tyler Durden

Wed, 01/03/2024 – 08:19

via ZeroHedge News https://ift.tt/o2FXbVs Tyler Durden