Authored by Lance Roberts via RealInvestmentAdvice.com,

With 2023 behind us, what does a stellar “Santa Claus” rally tell us about what to expect? What about this year being a Presidential election year? These questions make it an excellent time to review our “investor resolutions.” However, before we commit to our resolutions, let’s check what January may have in store.

So Goes January

There is an abundance of “Wall Street Axioms” surrounding the first month of the New Year as investors anxiously try to predict what is in store for the next twelve months. You are likely familiar with the “Superbowl Indicator,” “So Goes The First 5 Days. So Goes The Month,” and “So Goes The Month, So Goes The Year.”

Considering that trying to predict the markets more than just a few days in advance is mostly an exercise in “folly,” it is nonetheless a traditional ritual as the old year passes into the new. While Wall Street consistently espouses overly optimistic projections of year-end returns, reality has often tended to be somewhat different.

However, from an investment management perspective, we can look at some of the statistical evidence for January to gain insight into future performance tendencies. From this analysis, we can gain some respect for the risks that might lie ahead.

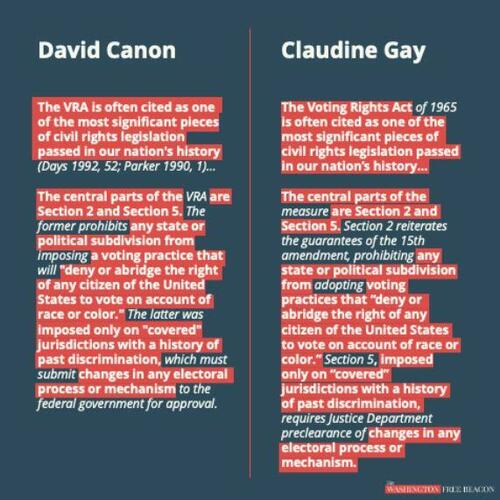

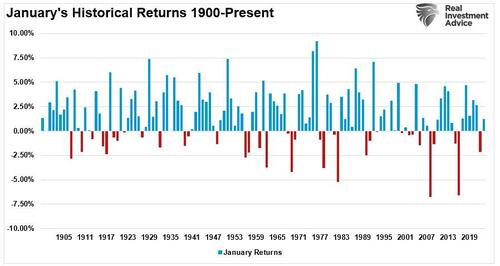

According to StockTrader’s Almanac, the direction of January’s trading (gain/loss for the month) has predicted the course of the rest of the year 75% of the time. From a broad historical perspective, the chart below shows the January performance from 1900.

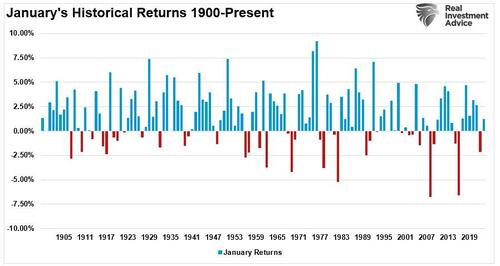

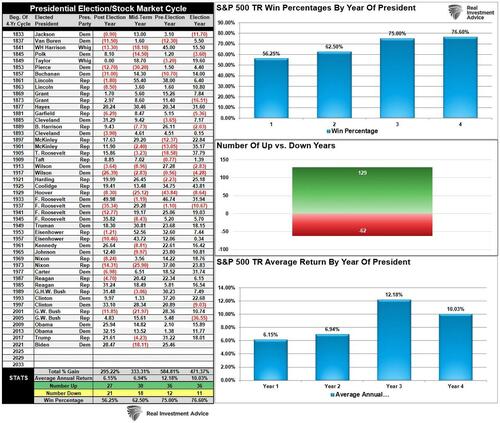

Furthermore, twelve of the last sixteen presidential election years followed January’s direction. Speaking of presidential election years, 2023 was held to form with a strong return year, as has been the norm over the last century. 2024, a Presidential election year, also has a high win rate with an average return of 10% and a 76% chance of success.

Digging In

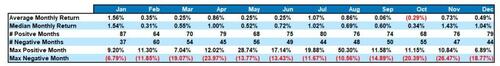

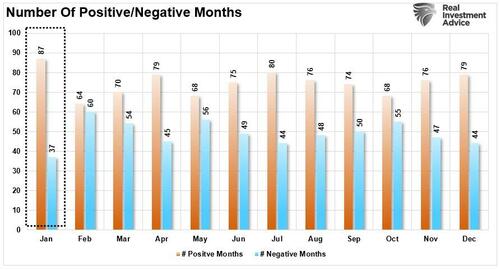

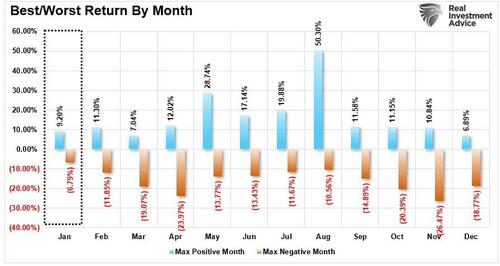

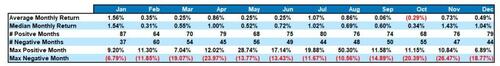

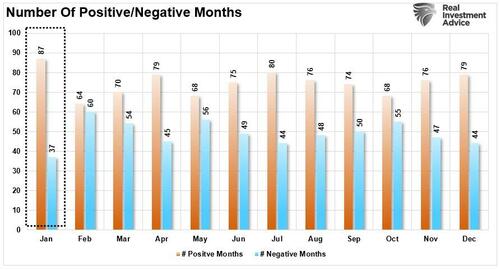

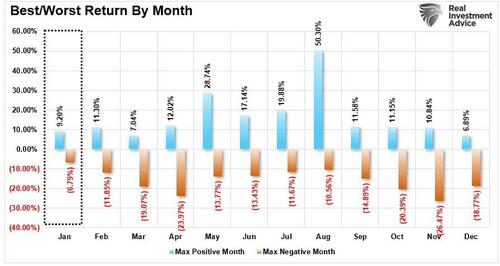

The table and chart below show the monthly statistics for the S&P 500. As you will notice, there are some significant outliers, like August, with a 50% one-month return. These anomalies occurred during the 1930s following the crash of 1929.

The critical point is that January tends to be one of the best return months of the year, while February and March are significantly weaker.

January is the most favorable return month, followed only by December, April, and July.

But January is not always a winner. While the statistical odds are high, particularly after a strong start, it does not always end that way. It is worth noting that while January’s maximum positive return was 9.2%, the maximum drawdown was the mildest at -6.79%.

Following a huge “Santa Rally” during December, we will be watching January closely for clues we may glean heading into 2024. It is not unrealistic to expect a weaker January to play out with stock grossly extended and overbought from December.

However, such is why “investor resolutions” will play an essential role over the next 12 months. Importantly, it is not the market that investors need to combat but their own “psychology.”

Why We Continue To Repeat Our Mistakes

Every year, Dalbar Research publishes an extensive study that repeatedly shows three primary reasons for investor failure.

The key issues are a lack of capital to invest and psychology. Dalbar defined nine of the irrational investment behavioral biases specifically:

-

Loss Aversion – The fear of loss leads to a withdrawal of capital at the worst possible time. Also known as “panic selling.”

-

Narrow Framing – Making decisions about one part of the portfolio without considering the effects on the total.

-

Anchoring – The process of remaining focused on what happened previously and not adapting to a changing market.

-

Mental Accounting – Separating the performance of investments mentally to justify success and failure.

-

Lack of Diversification – Believing a portfolio is diversified when it is actually a highly correlated pool of assets.

-

Herding– Following what everyone else is doing. Such leads to “buy high/sell low.”

-

Regret – Not performing a necessary action due to the regret of a previous failure.

-

Media Response – The media is biased toward optimism to sell products from advertisers and attract views/readership.

-

Optimism – Overly optimistic assumptions tend to lead to rather dramatic reversions when met with reality.

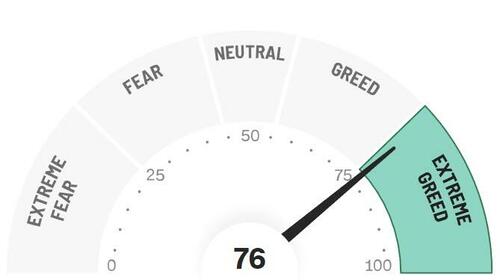

The “herding effect” and “loss aversion” are the most significant behaviors that compound the issues of investor mistakes over time. As markets rise, individuals believe the current price trend will continue indefinitely. The longer the rising trend lasts, the more ingrained the belief becomes. Eventually, the last of the “holdouts” finally “buy in” as the market evolves into a “euphoric state.”

The cycle then repeats itself.

While 2023 was bullish, investor allocations to equities remain elevated, and optimism is high heading into 2024. Given that investors’ behavioral traits run counter-intuitive to the “buy low/sell high” investment rule, such suggests the risk of disappointment is elevated.

Such is why it is vital to follow a set of resolutions.

Investor Resolutions For 2024

Each year, I review my annual resolutions for the coming year to be a better investor and portfolio manager:

I will:

-

Do more of what is working and less of what isn’t.

-

Remember that the “Trend Is My Friend.”

-

Be either bullish or bearish, but not “hoggish.” (Hogs get slaughtered)

-

Remember, it is “Okay” to pay taxes.

-

Maximize profits by staging my buys, working my orders, and getting the best price.

-

Look to buy damaged opportunities, not damaged investments.

-

Diversify to control my risk.

-

Control my risk by always having pre-determined sell levels and stop-losses.

-

Do my homework. I will do my homework. I will do my homework.

-

Not allow panic to influence my buy/sell decisions.

-

Remember that “cash” is for winners.

-

Expect, but not fear, corrections.

-

Expect to be wrong, and I will correct errors quickly.

-

Check “hope” at the door.

-

Be flexible.

-

Have the patience to allow my discipline and strategy to work.

-

Turn off the television, put down the newspaper, and focus on my analysis.

Each year, I do my best to adhere to my resolutions. Sometimes, I fail.

However, such is the practice of reviewing these guides to reset my focus for the New Year. There is no easy road to being a successful investor. But following a set of basic rules, maintaining discipline, and having focus can significantly increase the odds of long-term success.

Conclusion

While most financial media and blogosphere suggest that investors should only “buy and hold” for the long term, the reality of capital destruction during significant market declines is a far more pernicious issue.

With market valuations elevated, leverage high, and economic weakness present; investors should be observing the month of January for clues. The weight of evidence suggests that this could be a year of disappointment despite ongoing “bullish calls” for the markets in the year ahead.

Pay attention. And adhere to your resolutions.

May you have a Happy and Prosperous 2024.

See You Next Week.