Last week when I wrote about the dumbest guy of the week, I should have known it wouldn’t be a one-time thing.

A week ago I wrote about Congressman Jamaal Bowman, who was demanding that the US government make “at a minimum” $14 trillion worth of reparations payments.

(Remember, this is the same guy who ‘accidentally’ pulled the fire alarm in the Capitol on September 30, 2023, which just happened to disrupt a critical Congressional vote that he was hoping to stall.)

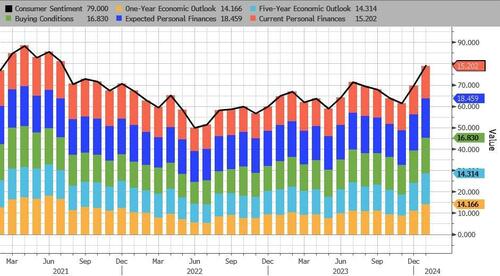

As a member of Congress, Bowman surely knows that the national debt is already $34 trillion. He surely knows that last year’s deficit was nearly $2 trillion. He surely knows that Congress itself projects another $20 trillion in new debt over the next decade.

Yet in addition to all that debt, Mr. Bowman wants to dole out an additional $14 trillion in reparation payments.

And his plan for how to come up with the money? “We [spend] it into existence,” he says. In other words, more debt.

One can only marvel at this intellectual giant’s grasp of economics.

But the competition for the biggest Inspired Idiot is fierce. And this week the Senator from Massachusetts, Elizabeth Warren, carries the torch.

First some quick background.

In August 2022, Amazon announced plans to acquire iRobot, which makes the robotic ‘Roomba’ vacuum cleaner, for $1.7 billion.

And boy did that infuriate Elizabeth Warren.

She quickly wrote a letter to the Federal Trade Commission (FTC) urging it to “use its authority to oppose the Amazon–iRobot transaction.”

Why? Well according to Warren’s inspired idiot logic, she claimed that the deal “could harm consumers”, as if we helpless little people will somehow suffer grievous bodily injury if Amazon buys a vacuum cleaner company.

Now, Amazon was probably planning to use the iRobot device to harvest even more consumer data, just like Amazon does with just about all of its other products and services.

Call me old-fashioned, but I believe consumers are capable of making that decision themselves, i.e. whether they are willing to trade privacy for convenience. I’m not. Others are.

But Ms. Warren is making the decision for everyone. She clearly knows what’s in your family’s best interest more than you do. And thank goodness we have people like Elizabeth Warren making these decisions on our behalf.

So, this week, after nearly 18 months of pressure from Senator Warren— plus more regulatory scrutiny from inspired idiots in the European Union— Amazon finally walked away from the deal… citing insurmountable regulatory hurdles.

The immediate response was that iRobot, devoid of additional funding that Amazon would have provided, immediately laid off one-third of its work force.

You did it Lizzy! You saved the day!

Regulatory red tape almost always hurts the economy. But in this case, there’s a clear line of destruction, from a single Inspired Idiot to hundreds of people who lost their jobs as a direct result of her fanaticism.

I remember a similar case in 2019 when New York Rep. AOC opposed a planned Amazon headquarters that would have brought tens of thousands of jobs, and hundreds of millions in tax revenue to New York.

Her major beef was that, in exchange for billions in investment, Amazon would have received a partial tax break. AOC wasn’t having any of that.

So she chased Amazon out of town… then actually celebrated the lost investment, lost job growth, and lost tax revenue as a victory for the people!

It’s no surprise that, over the past five years, other large companies and wealthy individuals have fled the state to lower tax, more business-friendly jurisdictions (like Florida). And New York now has a massive financial deficit.

Bizarrely, voters keep re-electing these Inspired Idiots.

AOC hasn’t lost her job. Elizabeth Warren hasn’t lost her job. But iRobot staff have lost theirs.

Now, Sen. Warren has been a very special talent this week… because in addition to slaying the jobs of hundreds of workers at iRobot, she also sent another nasty letter to the CEO of Walgreens.

Walgreens recently announced that they were closing several locations in some of the crappiest neighborhoods in Massachusetts, Warren’s home state.

Naturally Warren whined that “these closures are occurring within the larger legacy of historic racial and economic discrimination that has created significant pharmacy and food deserts and lack of access to transportation in these neighborhoods.”

Yes, that may be true. I imagine no impoverished neighborhood would want to lose a vital drug store.

But maybe they ought to consider the reasons why Walgreens is leaving, which are completely obvious: it’s unprofitable (and dangerous) to operate in high-crime areas where half of your merchandise is shoplifted.

Yet Inspired Idiots like Warren (and the people who run these big cities) decriminalize shoplifting. Local prosecutors won’t do anything. The police can’t do anything. Security guards in the stores can’t do anything.

Why should any rational business owner continue operating in such an environment?

One of the honorable mentions this week goes to Rep. Ayanna Pressley, another Inspired Idiot who made these comments on the Walgreens matter:

“When a Walgreens leaves a neighborhood, they disrupt an entire community, and they take with them baby formula, diapers, asthma inhalers, lifesaving medications, and of course jobs. These closures are not arbitrary, and they are not innocent. They are life threatening acts of racial and economic discrimination… Shame on you Walgreens!”

Now, the three politicians who signed this angry letter to Walgreens— Senators Warren and Markey, plus Rep. Ayanna Pressley, have a combined 76 years in government.

You’d think that with 76 years they could have done something to lift their constituents out of grinding poverty by now.

But no, the problem is clearly racist pharmacies which—gasp—make perfectly rational business decisions to close unprofitable stores.

Warren obviously has enough pull to torpedo the Amazon/iRobot deal. But apparently, she’s a helpless babe when it comes to actually cleaning up the streets and delivering economic opportunity for her constituents.

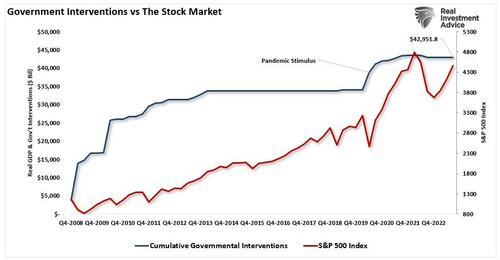

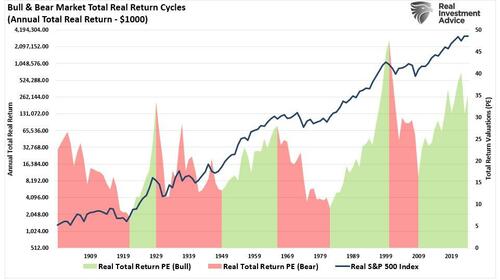

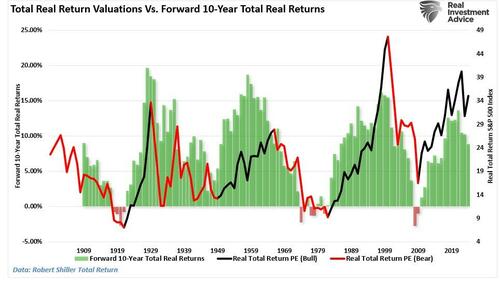

These stories are important to highlight. The country is on a clear trajectory to the mother of all financial crises over the next 5 to 10 years, and there is only a narrow window to escape that outcome.

Averting disaster should be politicians’ top priority— encouraging productivity, cutting red tape, and being friendly to both large and small businesses.

But their approach instead is to shame companies, over-regulate the economy, and destroy jobs.

These people are dangerous lunatics, and they’re making things worse— not better. This is why it’s so critical to have a rock-solid Plan B for what’s coming down the road.

Source

from Schiff Sovereign https://ift.tt/kwfdiFR

via IFTTT