US To Launch Multi-Day Strikes Against ‘Iranian Targets’ Across Syria, Iraq

The Biden administration is planning to launch a days-long or even potentially weeks-long bombing campaign on Iranian assets across the Middle East, although there doesn’t appear to be plans to hit Iran directly, according to US officials speaking to NBC and CBS.

The attacks which will reportedly focus on ‘Iranian targets’ inside Syrian and Iraq are meant as retaliation and a supposed deterrent in response to the weekend drone attack which killed three American soldiers at a Jordanian base near the Syrian border. The attacks might extend to the Iranian navy as well, in addition to targeting Iranian personnel or ‘Iran-backed militias’ in Syria and Iraq.

While the Pentagon has said that said the Jordan base attack had the “footprints” of Kataib Hezbollah (or the Shia ‘resistance’ group of Iraq), no culprit has been definitively named, and US officials have also admitted they have not evidence Iran was behind it. But they are now reportedly saying the drone used in the attack was manufactured in Iran.

The New York Times additionally has conceded that despite it being well-known that Tehran arms and funds the main Shia militias in Iraq, there remains no evidence that Tehran is “calling the shots” when it comes to events like attacks on US personnel out of Syria or Iraq.

The chorus of US officials now telegraphing the extent of the strikes to the media strongly suggests at least a days-long campaign of several waves of attacks. “The first thing you see won’t be the last thing,” national security council spokesman John Kirby has said. He added that the operation won’t be a “one-off” as such bombings have tended to go in the past.

However, the longer the bombing lasts, the greater the possibility for things spiraling out of control, possibly growing into a hot war with Iran and its assets. “The Islamic Republic would decisively respond to any attack on the county, its interests and nationals under any pretexts,” Iran’s ambassador to the UN Amir Saeid Iravani has responded.

According to more details via fresh CBS reporting Thursday:

U.S. officials have confirmed to CBS News that plans have been approved for a series of strikes over a number of days against targets — including Iranian personnel and facilities — inside Iraq and Syria. The strikes will come in response to drone and rocket attacks targeting U.S. forces in the region, including the drone attack on Sunday that killed three U.S. service members at the Tower 22 base inside Jordan, near the Syrian border.

Weather will be a major factor in the timing of the strikes, the officials told CBS News, as the U.S. has the capability to carry out strikes in bad weather but prefers to have better visibility of selected targets as a safeguard against inadvertently hitting civilians who might stray into the area at the last moment.

As it became clear this week that the Pentagon is poised to respond in a big way, Kataib Hezbollah announced a suspension of its operations against US forces. The Pentagon has ignored this as essentially too late and irrelevant.

But the Shia militia group’s ‘pause’ in operations appears to have held. “There have been no new attacks on U.S. troop locations in the region since the Iran-backed militia Kataib Hezbollah announced Wednesday that it was suspending military operations against American forces,” reports CBS. And yet, “There was no indication from U.S. officials that the group’s declared suspension was delaying the American military’s retaliatory strikes.”

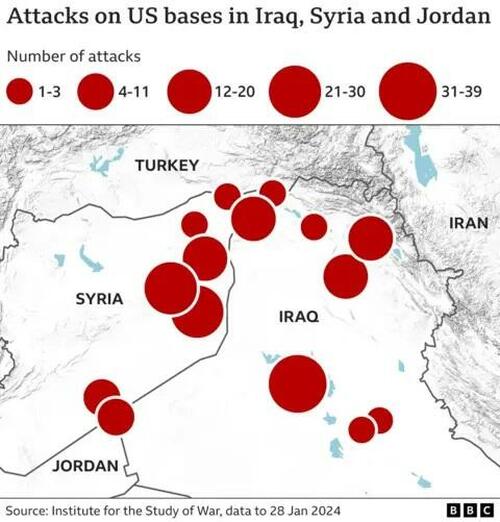

Western reports commonly estimate there’s been at least 140 rocket, mortar, and drone attacks targeting US personnel in Syrian and Iraq since mid-October, connected to events in Gaza…

For several weeks now, Israel has repeatedly bombed areas of Damascus in what have been reported as targeted strikes against Iranian personnel. It’s unclear whether the coming US strikes will also include targets in or near Syrian government centers. While US attacks have over the course of years sporadically hit militant groups in the northeast, especially in Deir Ezzor region, Washington has refrained from attacking Damascus directly over the past few years.

Another interesting question which remains is whether the Pentagon will tip off the Russian side in advance. Russia has a major military presence in Syria and actively monitors some airspace. In prior significant US attacks, the Pentagon has issued advanced warning to the Russians within moments before the launches, so as to avoid inadvertent military confrontation between the two superpowers.

Just out of the hospital and home recovery, Defense Secretary Lloyd Austin says the president “will not tolerate attacks on American troops” at this “dangerous moment in the Middle East.” He also asserted, “Our soldiers were killed by Iranian agents.” Austin at one point “apologized to the American people” for the way he handled his hospital stay, which included days of the White House being left in the dark.

NOW – Austin: “This is a dangerous moment in the Middle East.” pic.twitter.com/9NSevexEhL

— Disclose.tv (@disclosetv) February 1, 2024

This whole US ‘retaliatory’ exercise is likely to see most airstrikes focused on eastern Syria. Given the Pentagon has already repeatedly conducted operations in this area in the context of the years-long occupation of Syria’s oil and gas region, it seems Biden wants to show he’s “doing something” ahead of the election, but an operation which poses less risk for rapid direct escalation with Tehran. He’s going for the “easy” lay up of attacking Syria again.

Tyler Durden

Thu, 02/01/2024 – 11:15

via ZeroHedge News https://ift.tt/zDqXeZU Tyler Durden