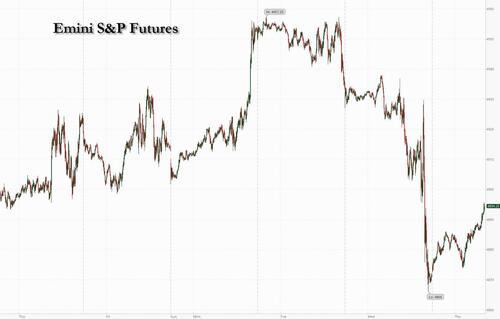

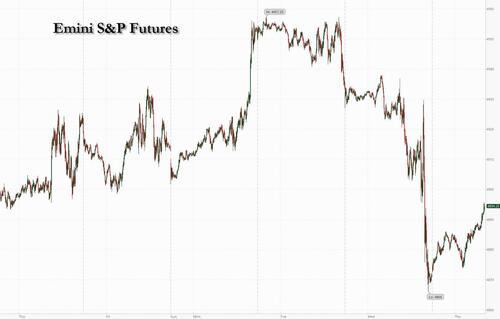

US equity futures rebounded after the worst day for stocks since September, as investors prepared for the next wave of megacap tech earnings while resetting expectations for the timing of Fed rate cuts, which have been pushed back from March to May at the earliest (unless of course there is a new banking crisis). As of 7:50am, S&P 500 futures gained 0.5% following a 1.6% plunge on Wednesday after Powell unleashed Hawkamania on the market during his press conference. Nasdaq 100 climbed 0.6% and awaiting earnings from Apple, Amazon and Meta.It’s the latest update from members of the “Magnificent Seven” stocks that have soared amid aggressive expectations from investors for earnings growth fueled by artificial intelligence applications and easier policy from the Fed. Meanwhile, the epicenter of the new banking crisis, New York Community Bancorp rallied following its record plunge. Interest rates reversed some of Wednesday’s losses with 10Y yields rising 2bps to 3.93% while the dollar was flat, reversing earlier gains.

In premarket trading, Qualcomm shares slipped 1.5% after the chipmaker reported first-quarter results that beat expectations, and provided an outlook for the year. While analysts see signs of a recovery in key markets, the company also warned about high inventory levels. Here are some other notable premarket movers:

- Align Technology (ALGN) jumps 12% after the dental equipment firm reported fourth-quarter results and first-quarter guidance which beat estimates.

- Amplitude (AMPL) slips 3% after Morgan Stanley downgraded the stock, saying the valuation doesn’t reflect the increasingly competitive landscape.

- Arcutis Biotherapeutics (ARQT) drops 6% after the drugmaker filed for a $300m mixed-securities shelf.

- Canada Goose (GOOS) rises 11% after the parka retailer’s fiscal fourth-quarter revenue outlook exceeded the average analyst estimate.

- Cardinal Health (CAH) falls 3% after posting quarterly results.

- MaxLinear (MXL) declines 11% after the semiconductor device company gave a disappointing revenue forecast.

- Nextracker (NXT) surges 21% after the maker of measuring machines for the solar industry boosted its revenue guidance.

- Wolfspeed (WOLF) falls 5% after providing a disappointing revenue forecast.

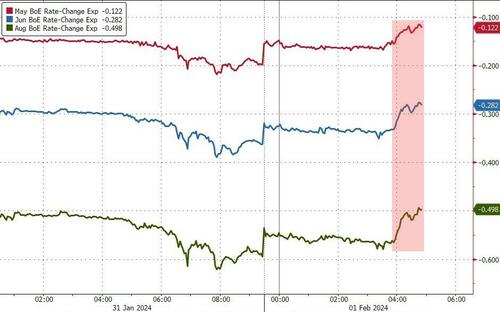

Stocks tumbled on Wednesday after Fed officials signaled they are in no rush to cut rates as they target lower inflation, with Chair Powell saying after Wednesday’s decision he doesn’t think a cut in March is likely. The Bank of England also said more evidence of moderating inflation was needed before it could ease policy, as it decided to keep rates at a 16-year high on Thursday.

“The market got ahead of itself in the last few months and it feels like we will get a respite as rate decreases start to get priced out and we see more rhetoric from central banks pushing back on rate cuts,” said Justin Onuekwusi, chief investment officer at wealth manager St James Place Management Svs Ltd.

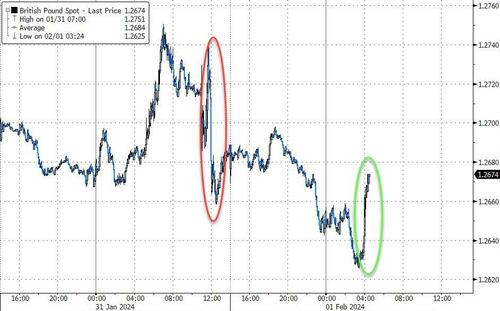

Central banks also dominated markets on Thursday where the pound pared its drop against the dollar and UK bonds fell after the BOE announcement. The central bank slashed its outlook for inflation this year and dropped its guidance that borrowing costs may have to rise again. Its decision to hold was a split view among policymakers, with two voting for a hike, six to keep rates unchanged and the first rate cut vote.

Sweden’s Riksbank earlier held rates steady and said it may lower borrowing costs as soon as the first half of the year, pivoting from a tightening campaign. The Swedish krona fell after the decision.

Meanwhile, European stocks are on the back foot as bank shares slide after some disappointing earnings reports from BNP Paribas and ING. The Stoxx 600 is down 0.1%. Adidas AG slumped on lower-than-expected profit guidance. Deutsche Bank AG rallied after announcing a share buyback and higher revenue goal. Ferrari NV rose after the supercar builder beat estimates. While strong numbers from Shell buoyed the energy sector, poor reports from BNP Paribas and ING weigh on bank shares. Here are the biggest movers Thursday:

- Volvo Car soars as much as 32% after the Swedish firm said it will no longer extend funding to Polestar and is evaluating a restructuring of its holdings in the struggling electric vehicle maker

- Shell gains as much as 2.8% after the oil major reported results that beat estimates and kept up the pace of buybacks, with analysts positive on the performance of the gas and upstream businesses

- Evolution shares jump as much as 7% after the Swedish live casino operator reported in-line fourth-quarter trading. Morgan Stanley describes management commentary as “upbeat”

- Deutsche Bank advances as much as 5.1% after it announced plans for a €675 million buyback in the first half and raised its mid-term revenue target, offsetting an otherwise disappointing 4Q

- Julius Baer extend gains as much as 8.5%, most since July, amid a call with analysts in which the chairman said meaningful inflows were seen at the end of last year

- Axfood climbs as much as 9% following its fourth-quarter earnings report, with DNB seeing a positive report with results ahead for all segments apart from its Dagab logistics unit

- Hexagon rises as much as 6.5%, the most since Dec. 8, after the Swedish industrial software group delivered what DNB Markets describes as a strong print

- Straumann gains as much as 5.3%, the most intraday since Dec. 14, after the Swiss dental equipment firm’s US rival Align reported estimate-beating results

- BNP Paribas shares drop as much as 9.8%, the most intraday since March 2023, after the French bank reported 4Q results that missed estimates and lowered its performance targets

- ING falls as much as 9.6% after the bank reported net interest income for the fourth quarter that missed the average analyst estimate; ING and BNP’s poor reports pull the wider sector downwards, too

- Roche falls as much as 4.5% after the Swiss pharma giant gave a very weak outlook for 2024. Analysts attribute the softness to significant headwinds from the strong Swiss franc

- Adidas slumps as much as 9%, the biggest intraday decline since February 2023, after the sportswear maker forecast operating profit for 2024 of about €500m, well below estimates

Earlier in the session, Asian stocks also declined, as Japan and Australia followed the US market lower, while Chinese stocks surged on the government’s latest policy support efforts. The MSCI Asia Pacific Index declined as much as 0.7% before paring the drop. TSMC, Toyota Motor and Commonwealth Bank of Australia were among the biggest drags. Japanese stocks slid as yen strengthened and Australian shares retreated from Wednesday’s record close after the Federal Reserve pushed back on expectations for US interest rate cuts.

- Hang Seng and Shanghai Comp were mixed with early upside from stronger-than-expected Caixin PMI data and further support pledges although the gains were limited after the substantial PBoC liquidity drain and the mainland index gradually reversed course.

- Nikkei 225 retreated amid recent currency strength and with a slew of earnings influencing price action.

- ASX 200 pulled back from record highs amid weakness in tech and financials, as well as softer data.

In FX, the Bloomberg Dollar Spot Index is up 0.1% while the yen tops the G-10 FX pile, rising 0.1% versus the greenback. The Swedish krona falls 0.8% after the Riksbank left rates on hold and said it may lower borrowing costs as soon as in the first half of the year. The pound falls 0.4% ahead of the BOE decision while the yen was the only gainer against the greenback among its Group-of-10 peers.

- AUD/USD sank 0.9% to 0.6511, the lowest level since November, on reduced risk appetite; Australia’s stock market tumbled from a record high

- USD/SEK rose as much as 0.9% and EUR/SEK jumped 0.6%, after the Riksbank said it may lower borrowing costs as soon as in the first half of the year

- EUR/USD pared a 0.4% loss to trade 0.2% lower at 1.0796 as euro-zone inflation eased less than anticipated at the start of the year

- GBP/USD fell as much as 0.5% to 1.2627 as traders braced for the BOE decision later Thursday; The central bank is likely to deliver a brighter outlook for the UK economy and reduce its forecast for inflation

In rates, US 10-year yields first rose 3bps to 3.95% but have since erased much of the rise which followed Powell’s comments and the fresh concerns about regional lenders. Bunds are lower as data showed euro-zone CPI slowed less than expected in January. German 10-year yields rise 5bps to 2.21%. The dollar issuance slate includes four names so far; dealers are calling for around $150b of supply in February. US economic data includes January Challenger job cuts (7:30am), 4Q nonfarm productivity and weekly jobless claims (8:30am), January S&P US manufacturing PMI (9:45am), December construction spending and January ISM manufacturing (10am)

In commodities, oil rebounded after the biggest decline in three weeks on Wednesday as investors weighed the risks from any US retaliation to a deadly attack in Jordan against signs of robust American supply. WTI rose 0.8% to trade near $76.50, gold dropped to trade near session lows around $2,033.

To the day ahead now, and data releases include the global manufacturing PMIs for January, along with the ISM manufacturing reading from the US. In the Euro Area, there’s also the flash CPI print for January, and in the US there’s the weekly initial jobless claims. From central banks, the Bank of England will announce their latest policy decision, and we’ll also hear from the ECB’s Centeno and Lane. Finally, today’s earnings releases include Apple, Amazon and Meta.

Market Snapshot

- S&P 500 futures up 0.3% to 4,885.75

- STOXX Europe 600 little changed at 485.24

- MXAP down 0.4% to 165.84

- MXAPJ little changed at 503.50

- Nikkei down 0.8% to 36,011.46

- Topix down 0.7% to 2,534.04

- Hang Seng Index up 0.5% to 15,566.21

- Shanghai Composite down 0.6% to 2,770.74

- Sensex little changed at 71,687.82

- Australia S&P/ASX 200 down 1.2% to 7,588.19

- Kospi up 1.8% to 2,542.46

- German 10Y yield little changed at 2.20%

- Euro down 0.2% to $1.0798

- Brent Futures up 0.7% to $81.09/bbl

- Gold spot up 0.1% to $2,042.31

- U.S. Dollar Index up 0.39% to 103.68

Top Overnight News

- Stocks fell in Asia and Europe as investors reset their expectations of when the Federal Reserve will start cutting interest rates and assessed a deluge of corporate earnings.

- Jerome Powell delivered a clear message to traders eager for the central bank to start slashing interest rates: Not so fast.

- Euro-zone inflation eased less than anticipated at the start of the year — testing investor expectations that the European Central Bank will begin lowering interest rates as soon as the spring.

- The US commercial real estate market has been in turmoil since the onset of the Covid-19 pandemic. But New York Community Bancorp and Japan’s Aozora Bank Ltd. delivered a reminder that some lenders are only just beginning to see the pain.

- The Riksbank held rates steady and said it may lower borrowing costs as soon as in the first half of the year, pivoting from a tightening campaign that tipped the Swedish economy into recession.

- Donald Trump’s legal troubles have helped him raise millions of dollars from supporters, but paying to defend himself has siphoned $51.2 million from his White House comeback effort in the past year.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed after the losses on Wall St owing to banking sector fears and Fed Chair Powell’s pushback against a March rate cut, while Chinese Caixin Manufacturing PMI data topped forecasts. ASX 200 pulled back from record highs amid weakness in tech and financials, as well as softer data. Nikkei 225 retreated amid recent currency strength and with a slew of earnings influencing price action. Hang Seng and Shanghai Comp were mixed with early upside from stronger-than-expected Caixin PMI data and further support pledges although the gains were limited after the substantial PBoC liquidity drain and the mainland index gradually reversed course.

Top Asian News

- Chinese President Xi urged efforts to accelerate the development of new productive forces and firmly promote high-quality development, while they must strengthen scientific and technological innovation.

- China’s Finance Ministry said it will implement structural tax cuts in 2024 and support tech innovation and the manufacturing sector. China’s Vice Finance Minister said 2023 tax and fee cuts and rebates totalled CNY 2.2tln, while fiscal policy will help expand domestic demand and they will appropriately increase investment under the central government budget.

- HKMA maintained its base rate unchanged at 5.75%, as expected.

European equities are mixed with clear underperformance in the CAC40, hampered by losses in BNP Paribas (-8.8%) and Dassault Systemes (-6.6%) post-earnings. European sectors hold a mostly negative tilt; Travel & Leisure is propped up by Evolution (+6.2%) whilst the Banking sector remains hampered by losses in BNP Paribas (-8.8%) and ING (-8.9%). US equity futures (ES +0.3%, NQ, +0.5%, RTY +0.1%) are trading on a firmer footing and finding some reprieve after the prior day’s hefty selling; with the NQ outperforming after Tech-induced losses yesterday and as yields generally edge lower stateside. Click here and here for the sessions European pre-market equity newsflow, including earnings from Shell, BT, Roche, Sanofi, BNP Paribas, Deutsche Bank & more.

Earnings

- Shell (SHEL LN) – Q4 (USD): Adj. EBITDA 16.335bln (exp. 16.304bln). Adj. Profit 7.31bln (exp. 6.14bln). Adj. EPS 1.11 (0.97); Announces a share buyback of USD 3.5bln. SEGMENTS Integrated Gas 3.963bln (Co. exp. 3.473bln). Upstream 3.088bln (Co. exp. 2.488bln) Marketing 692mln (Co. exp. 708mln) Chemical & Product 83mln (Co. exp. -126mln) *ndex Weightings: FTSE 100 (8.5% – largest). AEX (15.8% – largest) Stoxx 600 (2.0% – 5th largest). Shares +2.7% in European trade

- BT (BT/A LN) – 9-month update (GBP): Revenue 15.75bln (prev. 15.34bln), adj. EBITDA 6.12bln (exp. 5.95bln). Q3: Revenue 5.34bln (exp. 5.19bln). Reconfirming all FY24 financial outlook metrics. (Newswires) Shares +1.1% in European trade

- Adidas (ADS GY) – FY23 (EUR): Op. profit 268mln (exp. 290mln; prev. 669mln), Revenue 21.43bln (exp. 21.5bln; prev. 22.51bln). FY24 currency-neutral sales growth view at a “mid-single-digit” rate. Decides not to write off most of its Yeezy inventory. FY24 Op view 500mln (exp. 1.27bln). Says unfavourable currency effects are projected to weigh significantly on the company’s profitability in 2024. (Newswires) Index weightings: DAX 40 (2.6%), Euro Stoxx 50 (1%). Shares -5.1% in European trade

- Deutsche Bank (DBK GY) Q4 (EUR): Net 1.26bln (prev. 1.80bln Y/Y). Revenue 6.658bln (exp. 6.783bln). FIC Sales & Trading Revenue 1.50bln (exp. 1.65bln); plans a EUR 675mln share buyback alongside a headcount cut of around 3,500. METRICS Corporate Bank (CB) 1.911bln (exp. 1.869bln). Investment Bank (IB) 1.837bln (exp. 2bln). Private Bank (PB) 2.395bln (exp. 2.315bln). Asset Management 580mln (exp. 635mln). Provisions for credit losses 488mln (prev. 351mln Y/Y). Deposits at year-end 2023 at 622mln (+EUR 11bln Q/Q); slightly above the level of year-end 2022. EUR 900mln in proposed dividends, EUR 0.45 per share, planned for 2023, up 50% over 2022. 2025 TARGETS ~EUR 32bln in revenues, with annual growth targets raised to 5.5%-6.5%. ~EUR 20bln in costs, with EUR 1.3bln savings from measures completed. Positioned to accelerate capital distributions; 2025 dividend guidance of EUR 1.00/shr, subject to a 50% payout ratio. OUTLOOK To be provided at the Annual Media Conference at 09:00 CET today. (Newswires) Index weightings: DAX 40 (1.8%). Shares +4.3% in European trade

- BNP Paribas (BNP FP) – Q4 (EUR): Revenue 10.9bln (exp. 11.4bln). Net 1.07bln (exp. 2.0bln). Sees 2025 ROTE between +11.5-12% (prev. ~12%); announces EUR 1.05bln share buyback; Dividend +18% Y/Y. CET1 ratio 13.2% (exp. 13.3%). ROTE 10.7% (prev. 10.2% Y/Y). OUTLOOK: Affirms CET1 ratio, Net Income, EPS and Cost of Risk guidance. COMMENTARY: “BNP Paribas should continue to grow faster than its underlying economy and to gain market share..”. “Personal Finance and Real Estate initiated in 2023 robust adaptation plans and should return to their nominal profitability as early as 2026” (BNP Paribas). Index weightings: CAC 40 (3.94%). Shares -8.2% in European trade

- Dassault Systems (DSY FP) – Q4 (EUR): Non-IFRS EPS 0.36 (exp. 0.37), Revenue 1.64 (exp. 1.64). Guides Q1 EPS 0.29-0.30, Revenue 1.49-1.52bln, +7.8% Y/Y. Guides initial FY24 EPS 1.21-1.31, Revenue 6.35-6.43bln, +8-10% Y/Y. (Newswires) CAC 40 (1.5%) Shares -9.7% in European trade

- Sanofi (SAN FP) – Q4 (EUR): EPS 1.66 (exp. 1.70), Revenue 10.9bln (exp. 11.4bln). Guides initial FY24 Business EPS “-4.5% to -3.5% Y/Y”. Francois-Xavier Roger was appointed CFO and member of the executive committee. (Newswires) Index weightings: CAC 40 (6.8% – 3rd largest), Euro Stoxx 50 (3.7% – 5th largest). Shares -2.1% in European trade

- ABB (ABBN SW) – Q4 (USD) EPS 0.50 (exp. 0.47). Revenue 8.25bln (exp. 8.105bln). Net Income 921mln (exp. 872mln); Guides operating EBITDA margin to “slightly improve” in 2024 Y/Y; Raises dividend to CHF 0.87/shr (prev. CHF 0.84/shr); Plans share buyback. COMMENTARY: “In the projects- and systems business we expect continued high customer activity, although we face high comparables from last year when large orders came through at a very high level.” “In total, order growth year-on-year should show stronger momentum in the latter part of the year when comparables ease.” “We expect to improve on comparable revenues as well as on Operational EBITA margin, and cash flow should benefit from continued strong operational performance and our continued focus on net working capital efficiency.” “We also plan to continue utilizing share buybacks as a tool to return excess cash to shareholders also during 2024.” (Newswires) Index weightings: SMI (4.8%). Shares +1.7% in European trade

- Roche (ROG SW) – FY (CHF): Net Income 12.35bln (exp. 14.67bln), Revenue 58.72bln (exp. 59.75bln), Core EPS 18.57 (exp. 18.56). Expects to further increase the dividend, proposing 9.60/shr (exp. 9.53/shr). FY (cont). Pharma Sales 44.6bln (44.8bln). Top-five growth drivers Sales 14.8bln, +4.3bln Y/Y. 2024 Sales rising in mid single-digit range. CEO “… exceeded our guidance for 2023. At the same time, the significant appreciation of the Swiss franc versus most currencies strongly impacted results when reported in Swiss francs. We also made good progress in both our pharma and diagnostics product pipeline.” Index weightings: SMI (16.2%). Shares +4.2% in European trade

Top European News

- ECB Chief Economist Lane said inflation is a “smaller problem” but it is still a challenge and the ECB needs more confidence that inflation is headed to the 2% target.

- ECB’s Centeno says if inflation continues on same trajectory in the coming months it is expected that the ECB’s next decision is to cut rates; “if that happens we can start a cycle of normalisation of rates”.

- ECB’s Herodotou expects rates to start to decline this year but must be a data-based approach; any move must not be too fast or too late

- Riksbank maintains its Rate at 4.00% as expected; increases monthly bond sale programme to SEK 6.5bln (prev. 5bln; vs SEB exp 7-8bln); Rate can probably be cut sooner than was indicated in November forecast H1 rate cut cannot be ruled out.

- Riksbank Thedeen says it is possible to have bond sales and to ease policy at same time in principle.

FX

- USD remains supported post-FOMC as traders scale back March easing bets. DXY has advanced to a high of 103.81 with upside seeing 103.82 from Jan 29th and 23rd.

- EUR/USD tripped through 1.08 early doors before finding support at 100DMA at 1.0780 and stopping shy of the 13th Dec low at 1.0773; overall unreactive to EZ Flash HICP.

- Cable has continued to drift lower vs. the USD as has been the case for a lot of other majors but eking out gains with EUR/GBP near a five month low. BoE likely to be the next inflection point for the GBP. A dovish tilt could see Cable open up a test of 1.26 to the downside.

- AUD’s tough week has continued with some citing disappointing building approvals data. Elsewhere, China remained on the backfoot overnight and Dalian iron ore fell. Low print of 0.6518 is the lowest since the November 20 low at 0.6499.

- The SEK is softer post-Riksbank which has been viewed as a dovish hold. Losses for SEK vs. EUR relatively minor compared to recent strength which saw EUR/SEK fall from 11.4256 to 11.1956 from mid-Jan.

- PBoC set USD/CNY mid-point at 7.1049 vs exp. 7.1802 (prev. 7.1039).

- Brazil Central Bank cut the Selic rate by 50bps to 11.25%, as expected, while committee members unanimously anticipate further reductions of the same magnitude in the next meetings. BCB said this pace is appropriate to keep the necessary contractionary monetary policy for the disinflationary process and the total magnitude of the easing cycle throughout time will depend on inflation dynamics, expectations and projections, the output gap and balance of risks.

Fixed Income

- USTs are modestly firmer and just off Wednesday’s post-Powell high. Developments have since been light with markets digesting the latest verbal guidance ahead of US data (ISM) and Tier 1 events (BoE) elsewhere.

- Bund is the clear fixed laggard as it continues to pare Wednesday’s plethora of dovish drivers; though, we remain well above that session’s 134.84 trough with support below from Monday at 134.37.

- Gilts are a touch softer as the space pares from Wednesday’s dovish US data and hasn’t been too swayed by the Fed as focus is firmly on the upcoming BoE.

- Spain sells EUR 6.05bln vs exp. EUR 5.5-6.5bln 1.45% 2029, 0.10% 2031, 3.25% 2034 Bono and EUR 516mln vs exp. EUR 250-750mln 2.05% 2039 I/L.

- France sells EUR 12.988bln vs exp. EUR 11.5-13bln 3.50% 2033, 0.50% 2040, 2.50% 2043 and 3.00% 2054.

Commodities

- Crude is modestly firmer intraday after both contracts settled lower by almost USD 2/bbl apiece yesterday amid the broader risk aversion. Participants look ahead to the JMMC confab pencilled in for 12:00GMT; currently Brent holds just above USD 82/bbl.

- Mixed trade across precious metals with spot gold resilient against the firmer Dollar (albeit back under USD 2,050/oz) but spot OPEC+ JMMC not expected to make any policy recommendations, according to Reuters sources; meeting poised to begin at 11:00GMT; sources added that talks on extending or unwinding voluntary cuts are yet to begin succumbing.

- Base metals are lower across the board as traders digest the watering-down of rate cut expectations by Fed Chair Powell coupled with the recent underwhelming Chinese PMI data alongside the nation’s ongoing property woes.

- OPEC+ JMMC is not expected to make any policy recommendations, according to Reuters sources; meeting poised to begin at 11:00GMT; sources added that talks on extending or unwinding voluntary cuts are yet to begin

- Citi says Saudi Arabia’s capacity decision shows that OPEC+ has little room to raise production in the future; expects medium-term oil market fundamentals to get looser, putting downside pressure on oil prices

- US crude oil production rose 84k BPD in November to 13.308mln BPD (prev. 13.224mln BPD in October), according to the EIA.

Geopolitics

- US fighter jets targeted 10 unmanned Houthi drones and a ground control centre in western Yemen, while it was also reported that US Central Command said a Houthi anti-ship ballistic missile and Iranian UAVs were shot down in the Gulf of Aden.

- White House said National Security Adviser Sullivan and UK Defence Secretary Shapps discussed preventing escalation in the Middle East and ongoing efforts to defend against Houthi attacks, while they reaffirmed support for Ukraine, according to Reuters.

- White House said National Security Advisor Sullivan and Israeli official Dermer met to discuss the flow of humanitarian aid to Gaza and hostage talks, while it also said the US is not looking for war with Iran.

- US senior cybersecurity official Easterly said the US has ‘found and eradicated’ Chinese cyber intrusions in aviation, water, energy and transportation infrastructure.

US Event Calendar

- 07:30: Jan. Challenger Job Cuts YoY -20.0%, prior -20.2%

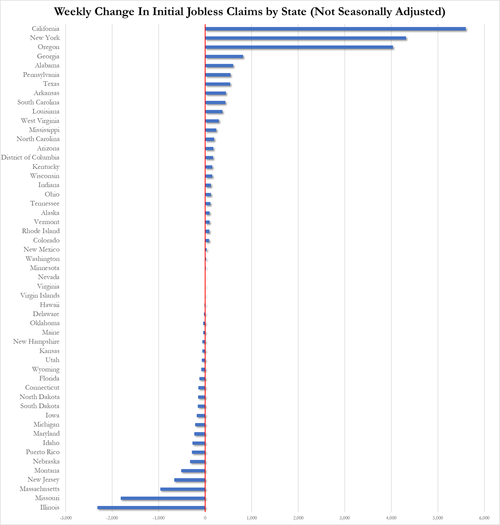

- 08:30: Jan. Initial Jobless Claims, est. 212,000, prior 214,000

- Continuing Claims, est. 1.84m, prior 1.83m

- 08:30: 4Q Unit Labor Costs, est. 1.2%, prior -1.2%

- Q4 Nonfarm Productivity, est. 2.5%, prior 5.2%

- 09:45: Jan. S&P Global US Manufacturing PM, est. 50.3, prior 50.3

- 10:00: Dec. Construction Spending MoM, est. 0.5%, prior 0.4%

- 10:00: Jan. ISM Manufacturing, est. 47.2, prior 47.4

- Jan. ISM Employment, est. 47.0, prior 48.1

- Jan. ISM New Orders, est. 48.2, prior 47.1

- Jan. ISM Prices Paid, est. 46.9, prior 45.2

DB’s Jim Reid concludes the overnight wrap

Risk assets saw their worst performance in months yesterday, with the S&P 500 (-1.61%) down by the most since September. That came as Fed Chair Powell clearly signalled that a March rate cut was unlikely, whilst we got a fresh reminder about the risk of a market accident, as New York Community Bancorp (-37.67%) reported a loss as they raised their expected loan losses on commercial real estate. That meant the KBW Regional Banking Index (-6.00%) saw its largest decline since the regional banking turmoil last March. And overnight, there’ve been fresh signs of concern, as Aozora Bank (-21.49%) in Japan has just reported losses as a result of US commercial property, which has added to fears that the full consequences from higher interest rates are still yet to materialise, particularly given the amount of debt that needs refinancing over 2024 and 2025. This echoes the “race against time” theme we discussed in our 2024 World Outlook, in that the risk of a funding accident is much higher than usual, since we’ve experienced the most rapid series of rate hikes since the early 1980s. And even if the major central banks are now done hiking rates, the impact of tighter policy is still impacting the economy and markets with a lag, so this is still a very important story as we move through 2024.

Given the Fed’s decision as well, it was an incredibly eventful 24 hours in markets, and the FOMC made some important adjustments to their statement. In particular, they dropped their tightening bias, no longer talking about “the extent of any additional policy firming”, but instead talking about “any adjustments to the target range for the federal funds rate”. However, there was still a more hawkish comment, as it said “the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2% “, offering some gentle pushback on expectations of an imminent rate cut.

In the press conference, Powell repeatedly reiterated this need to get “greater confidence” on the disinflation path, even as it was accompanied by a positive take on the disinflation progress so far. Towards the end of the press conference Powell then delivered an explicit pushback against expectations of a March rate cut, saying that a March cut “is probably not the most likely case” and adding “I don’t think it is likely that the Committee will reach a level of confidence by the time of the March meeting”. Our US economists see this raising the bar for a March cut, but we’ve still got two more CPI prints and CPI revisions still to come by then, so continued progress on inflation could still trigger a cut at the next meeting. See their full reaction note here. Meanwhile on QT, Powell said that the FOMC planned to start “in-depth discussion on balance sheet issues” at the March meeting.

With Powell pushing back on a March rate cut, futures lowered the chance of a cut by March to 35% by the close yesterday. That’s the lowest it’s been in over two months, and is only back up slightly to 37% this morning. Nevertheless, the broader risk-off tone meant that investors are still expecting a similar pace of rate cuts over the year as a whole, with 141bps priced in by the December meeting. And in turn, Treasury yields fell significantly, with the 10yr yield down -12.0bps on the day to 3.91%, whilst the 2yr yield was down -12.8bps to 4.21%.

Of course, the Fed weren’t the only reason that bond yields fell significantly, as the news about NY Community Bancorp had already led to a major decline in yields as investors added to the chance of rate cuts. NYCB had bought most of Signature Bank last year, which was one of the banks that failed in the regional banking turmoil in March 2023, and they reported that loan-loss provision was up to $552m in Q4. In turn, that led to losses for other regional banks, and the KBW Regional Banking Index fell -6.00%, marking its worst daily performance since the turmoil last March. And overnight, Moody’s also said that they were placing NYCB’s credit ratings on review for a downgrade. The losses meant that NYCB was down as much as -46% at the US open, before recovering somewhat to end the day -37.67% lower. And overnight, the focus on banks has continued as Japan’s Aozora Bank (-21.49%) has also slumped after they said they expected to see a net loss of ¥28bn for the fiscal year, having previously forecast a profit of ¥24bn. That was connected to losses on US commercial property.

More broadly for equities, the major indices have seen a very weak performance. The S&P 500 was already trading -0.7% lower before the Fed, and Powell’s pushback on a March cut meant it ended the day -1.61% lower. Small-cap stocks saw even bigger losses, with the Russell 2000 down -2.45%, whilst the Magnificent Seven saw their weakest day since October (-3.05%), led by Alphabet’s -7.50% decline, while Microsoft lost -2.69% after both companies reported results the previous evening.

Meanwhile in Asia, there’ve been losses for the Nikkei (-0.71%) and the Shanghai Comp (-0.50%), although other indices have seen more of a recovery, including the Hang Seng (+0.94%) and the KOSPI (+1.66%), whilst the CSI 300 (+0.11%) has moved off its five-year low from the previous session. Separately, the Caixin manufacturing PMI in China remained at 50.8 in January, which was in line with expectations and a third consecutive month in expansionary territory.

Whilst the banking news had helped push yields lower, that move had got further momentum earlier in the day from a couple of data prints that added to hopes for rate cuts. First, there was the ADP’s report of private payrolls, which comes ahead of tomorrow’s US jobs report for January, and only grew by +107k (vs. +150k expected). And second, the Employment Cost Index for Q4 was up by +0.9% (vs. +1.0% expected), which was the slowest growth since Q2 2021, and added to the signs that inflationary pressures were subsiding.

Otherwise, an important piece of news came from the Quarterly Refunding Announcement, where the US Treasury said that they would be increasing the auction sizes for 2yr and 5yr notes by $3bn a month, with increases for other maturities as well. However, they also added that they did not “anticipate needing to make any further increases in nominal coupon or FRN auction sizes, beyond those being announced today, for at least the next several quarters”, s uggesting that potential changes in funding needs during the year may be accommodated by adjusting Treasury bill issuance. Separately, they said that they’d be preparing for a regular buyback program later this year, and would announce the date of the first regular buyback operation at the May refunding.

Meanwhile in Europe yesterday, sovereign bonds had rallied significantly ahead of the Fed, with yields on 10yr bunds (-10.2bps), OATs (-9.4bps) and BTPs (-6.9bps) all seeing sharp declines. In large part, that followed the news above on regional banks and softer US data, but there were also the flash CPI releases for January from France and Germany, which were beneath consensus expectations. In Germany, CPI was down to +3.1% on the EU-harmonised definition (vs. +3.2% expected), whilst French CPI fell to +3.4% (vs. +3.6% expected), so that contrasted with the upside surprise in Spain the previous day. Finally on European equities, there was a pretty divergent performance by country, but the STOXX 600 just about managed to post a +0.01% gain before the Fed’s announcement, which was a 6th consecutive advance for the first time since July, and meant the index closed at a 2-year high.

To the day ahead now, and data releases include the global manufacturing PMIs for January, along with the ISM manufacturing reading from the US. In the Euro Area, there’s also the flash CPI print for January, and in the US there’s the weekly initial jobless claims. From central banks, the Bank of England will announce their latest policy decision, and we’ll also hear from the ECB’s Centeno and Lane. Finally, today’s earnings releases include Apple, Amazon and Meta.