Stellar 3Y Auction Stops-Through Thanks To Jump In Foreign Demand

The first refunding auction of the quarter just concluded when the Treasury sold $58BN in 3 Year paper, unchanged from last month’s size and matching the previous record high hit during the covid crisis.

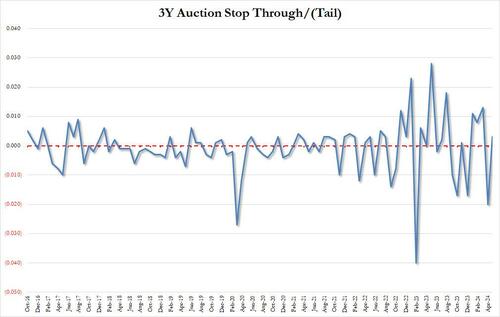

The auction priced at a high yield of 4.605%, up from 4.548% in April, but while that auction tailed by 2bps, today’s auction stopped through the When Issued 4.608% by 0.3bps, the 4th stopping through auction in the past five as shown below.

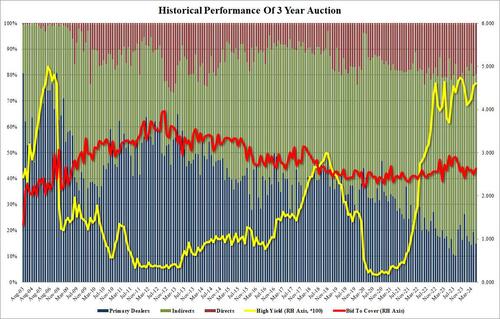

The Bid to Cover rose to 2.632 from 2.497 last month, this was the highest since January and well above the five-auction average of 2.573.

The internals were also solid: indirects jumped to 65.5%, up from 60.3% and above the recent average of 63.0%; and with Directs awarded 19.6%, the second highest since December (only April’s 20.4% was higher), Dealers were left with 14.9% of the final auction, below the recent average of 18.3%.

Overall, this was a very solid auction, with impressive demand and internals. Curiously, in response to the auction the 10Y yield – which was trading near session lows of 4.43% ahead of the auction – moved higher by about 1 basis point.

Tyler Durden

Tue, 05/07/2024 – 13:25

via ZeroHedge News https://ift.tt/pPfZ1VF Tyler Durden