Cocoa Grinding Estimates Suggest Demand Destruction Nearing

With cocoa prices hovering over $8,000 a ton in New York, the long-anticipated demand destruction for cocoa is finally approaching. New estimates indicate that global bean processing likely declined in the second quarter.

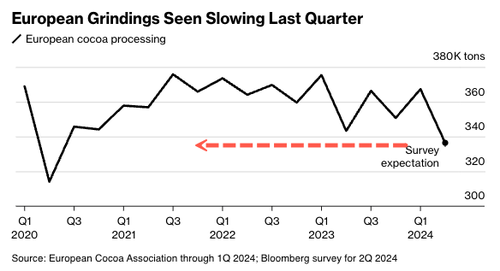

According to six analysts and traders tracked by Bloomberg, second-quarter global grindings—where cocoa transforms into butter and powder used in food products—likely fell from a year earlier. Estimates from European grindings likely fell 2% in the quarter, hitting lows not seen since early 2020. All of the analysts forecasted much larger declines in the second half of the year.

“The cheap stuff is beginning to drop off, and the expensive stuff is coming in,” said Jonathan Parkman, head of agricultural sales at broker Marex Group.

Parkman said, “The worst of input inflation will affect the second half of this year.”

The grinding numbers are nowhere near the deterioration to end elevated cocoa prices, but the estimates suggest emerging demand destruction.

“We are more likely to see a significant change in the grind number in the second half of the year,” said Darren Stetzel, vice president of soft commodities for Asia at broker StoneX.

Stetzel noted that the market has been forced to adapt to the scarcity of beans, which should alleviate some demand pressure. He pointed out that chocolate makers are increasingly using substitutes like palm oil.

Grinding data from Europe is due on Thursday, and Asia and North America will report next week.

Last month, the KitKat-maker warned ‘cocoaflation‘ will soon send candy bar prices higher.

Tyler Durden

Wed, 07/10/2024 – 23:20

via ZeroHedge News https://ift.tt/APnE4KV Tyler Durden