Why You Are Feeling So Much Poorer

Authored by Jeffrey A. Tucker via The Epoch Times,

We are living through the largest pillaging of the American middle class in a half-century. It’s not in the headlines. This is extremely strange. In fact, this might be the first and only article you have read about it. This could be for a reason. If people knew what was happening to them, they would begin to feel very restless, even furious. Some people among the ruling class do not want that.

The Biden administration trumpets its economic achievements. It’s mind-boggling. Call it trolling. Call it gaslighting. Call it whatever you want but you know it is untrue.

Let’s look at the facts.

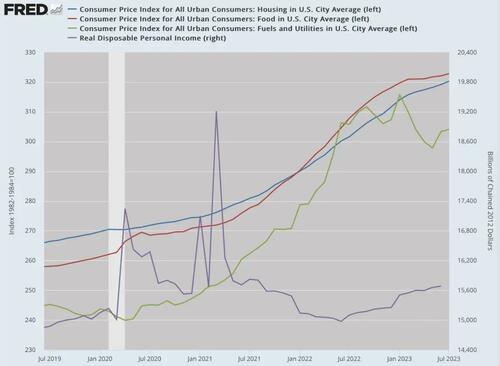

What do you spend money on month-to-month? It’s rent or your mortgage, food at home or out, utilities, and gas. Those are the basic categories. The Consumer Price Index includes far more than that, some items you do not purchase and some that are going up far less than others. So let’s look at government numbers on what you actually purchase; that is, the items and services that you consume that dominate part of your income. And let’s stretch that back three years.

Everything is going up and up and has been for three years. Looking at the items on which you actually spend money, we find increases between 18-plus percent to 22-plus percent. Let’s say we average it all out at 20 percent.

Now let’s look at real disposable income, which is income left over after expenses adjusted for inflation. That result is an increase of a pathetic 3 percent compared with three years ago. The stimulus payments felt great at the time but those are long gone, essentially a head fake. So your income demands are up 20 percent whereas your leftover cash is barely up at all. That’s essentially a disaster for your standard of living.

In short, you have been robbed.

The causal reasons are many but mainly trace to the 43 percent increase in the money supply in the same period, which ate the value of the dollar with a lag. On top of that, supply chains broke, industry was consolidated, commercial freedom wrecked, and labor markets were forcibly disrupted.

Now, let’s compare this to what everyone recognizes as the great inflationary disaster of the postwar period, which is 1978 to 1982. These were the times when the Fed and government pillaged the public, drained away the value of savings and capital, and forced a reorganization of family life. At the end of this period, the average American household went from living off of one income—realizing the American dream—to having two incomes in the household. That happened in 1985 when two-income households became the norm.

At the time, this was called emancipation of women but, looking back, we can see that this was clearly propaganda to cover up an economic disaster. Gender discrimination in the workplace hasn’t really been a major issue for most of the 20th century. Back in the mid-1920s, if you look at unmarried women without children after the age of 18, the employment rate in the city was generally 80 percent. These women left the workforce upon marriage to focus on children and the household whereas the men bore the obligation of providing for the whole.

That was the way we lived until the great inflation. That’s what changed everything. After that, households had to have two incomes to live well instead of one, meaning that one partner had to go to the office rather than tend to the household or otherwise pursue the good life. That the ruling class was able to fob this off as some kind of new liberty (for women) is a tribute to the power of ideologically driven lies.

How do our times compare to then? Well, in three years, we’ve seen the value of the dollar fall 20 percent in terms of what you actually spend money on while income has barely gone up at all. During the great disaster of 43 years ago, this exact same phenomenon occurred over two years rather than three like our own times. In other words, the mass thievery in our times is taking place 50 percent slower than it happened last time. But it is happening nonetheless.

Is it any better if the bus rolls over you slowly or more quickly? It happens either way. That you lose 17 percent of your income in three years or two, what does it really matter? It is only valuable to our ruling-class masters in terms of the extent to which the public complains. A population pillaged slowly—like the frog boiling slowly—is very liable to complain a bit less. Still, the reality is the same.

The great inflation fundamentally changed life in America. We were never the same, economically or culturally. And that raises the real question: what is the current round of thievery going to do to this generation? I wish I had the answers. I don’t really know but we are seeing population-wide demoralization, ill-health, lack of ambition, substance abuse, and widespread despair. However this ends, it’s not going to be good.

Can this be turned around? Yes, but it won’t be easy. It will require massive changes in public administration the likes of which we’ve never experienced. No candidate for office at any level is prepared for what is necessary to reduce the debt, contain the Fed, defang the administrative bureaucracy, reduce the tax burden, and make the American dream affordable again. We are nowhere near speaking the truth at this point.

The emergency, however, is real. A people dealing with growing and relentless improvement, from powers out of their control, can be unpredictable. At a very minimum, it means more crime, more cultural anomie, more distrust, and growing anger. Some leader needs to channel this into a positive and constructive direction else we are doomed to suffer another round that will make the great inflation of the late 1970s look like a mere foreshadowing.

Tyler Durden

Thu, 08/31/2023 – 21:00

via ZeroHedge News https://ift.tt/g80LJpN Tyler Durden