Via NorthmanTrader.com,

Markets have been on a tear since election night. The principle reason: The perceived notion of another set of stimulus packages hitting markets during the next presidency. Specifically the notions of corporate tax cuts and increased infrastructure and military spending have sent financial and industrial stocks flying higher resulting in new highs on many indices.

The global central bank inspired multiple expansion that has transpired in 2016 as a result of over $2.2 trillion in annual QE programs and continued low rates found another boost in the new found belief that more easing is coming in form of a Trump presidency. The result: Both stocks and yields have risen dramatically in just a couple of weeks on an expected reflation trade.

The main themes that have emerged: 1. Lower taxes are good for earnings and will stimulate the economy. 2. A large infrastructure bill and increased military spending is good for corporations that supply such services and hence are good for employment. Ergo buy stocks. Inflation is coming and that’s good for banks and hence good for stocks.

This all sounds good on paper and this is all it is at the moment as nothing of the sort will come to fruition until at least 2017, but these items are clearly being priced into markets.

But there is a big problem with all of this: None of the policies priced in actually look to address the promises made.

Let’s start with the budget. And note the current budget is already running at a deficit of $616B for the current year.

Firstly one has to recognize the difference between the discretionary budget and the mandatory budget. The mandatory budget is made of obligations that can’t really be touched. Social security and medicare chiefly among them. These outlays look like this:

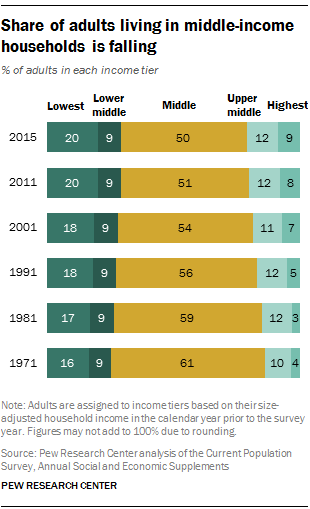

The Trump campaign ran heavy on helping the middle class and making America great again. While the definition of the latter statement seems open to interpretation cutting social security and medicare seem somewhat incompatible with helping the middle class. So consider the mandatory budget fixed.

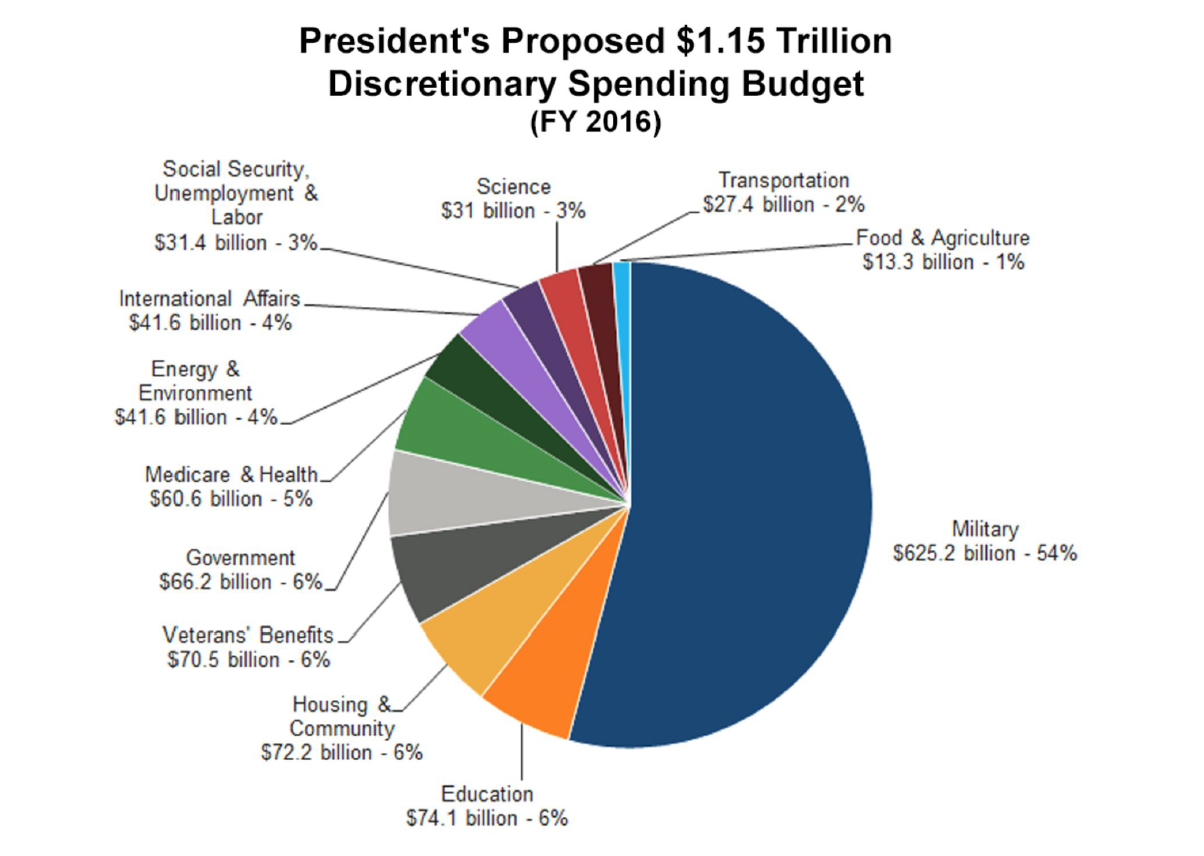

You then have the discretionary budget. This is where Congress and the president can actually make adjustments in practical terms and guess what? More than half of the discretionary budget is traditionally already allocated to the military:

That’s right. So if Donald Trump wants to increase military spending and introduce a major infrastructure bill he has only 2 choices: Cut existing programs and/or raise the debt further.

What will be cut? More specifically what will be cut to offset the increases in military spending?

The answer is you can’t cut enough to increase military spending, introduce a $1 trillion infrastructure spending bill AND cut taxes on top of that.

So you must raise debt.

Here’s the problem and it’s twofold.

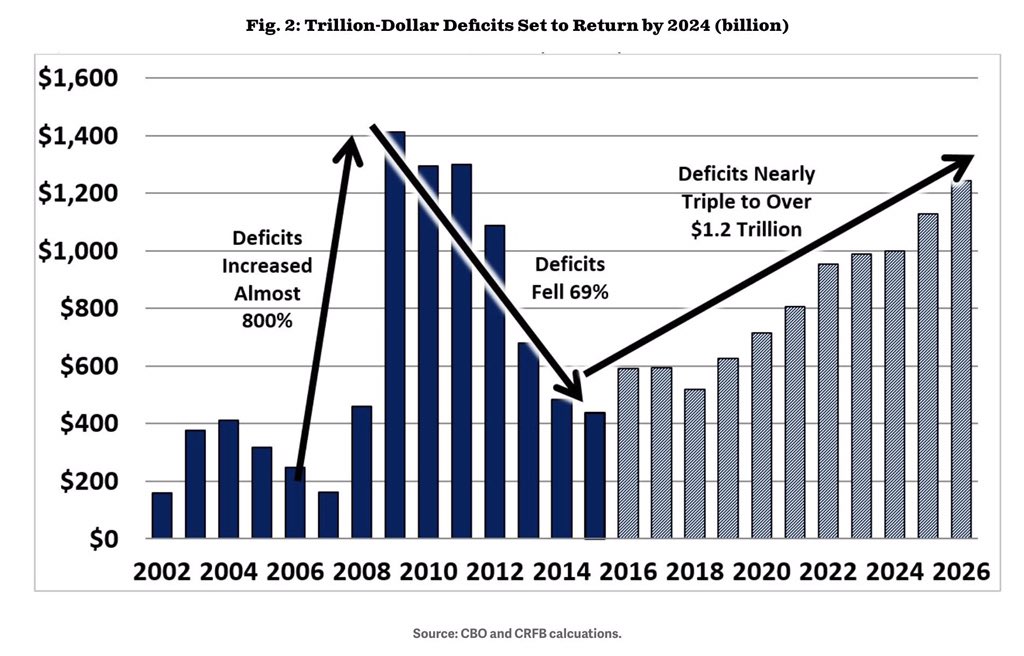

First, the debt is already scheduled to increase going forward. According to the CBO it’s only a matter of time before we hit $30 trillion in debt and that’s with current spending plans. Deficits as far as the eye can see.

And much of these deficits are driven by pension gaps that keep eating holes into the federal budget. But of course discretionary budget items do their bidding as well. As do interest payments on the debt.

And this is all before the new team comes in and wants to introduce the items it has talked about. So the future is clear: Massive additional debt required.

Which brings us to the second part of the problem: Markets want it both ways: Increased deficit, excuse me, stimulus spending, and higher inflation as well.

This will cramp everybody’s style because higher rates require higher financing costs of debt which already run at a clip of $432B annually with close to record low rates. These payment obligations will rise as rates increase.

And so here we are now:

As should be obvious: Record levels of debt have only been sustainable because of artificially low rates.

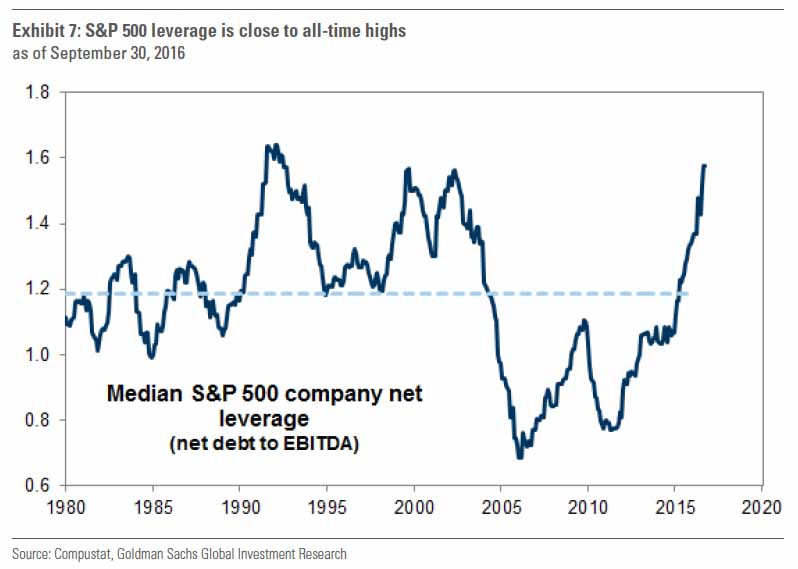

And it’s not only a government issue. Corporations, thanks to low rates, have also loaded up massively on debt. In fact, net debt to EBITDA is near record highs:

Yet the impact of higher rates may reveal the hidden weakness on balance sheets. From Barron’s:

“Corporations also face their own rate reckoning, with $2 trillion in debt coming due in the next two years. “The increase in borrowing costs will reveal the fallacy that balance sheets are strong and companies are awash in cash,” Steph says. The cash, she points out, is concentrated among the top 25 companies in the S&P 500. The bottom 250 have only $90 billion of the index members’ $1.6 trillion.”

But don’t worry they say. Lower corporate taxes will make everything wonderful. More earnings for companies is good for the economy and will spur growth. Really?

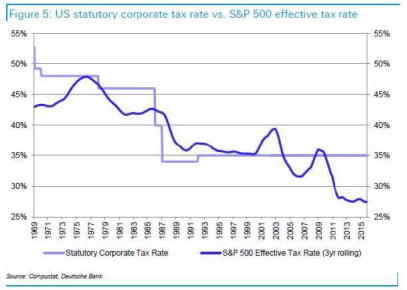

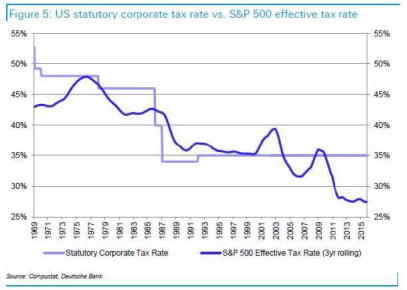

Let’s test that thinking a bit. First of all let’s please all recognize that effective corporate tax rates are at their lowest levels ever. Ever is a long time. And the fact is they have been on the decline for decades:

Note the inverse relationship between ever lower effective tax rates and ever increasing government debt. Corporations have legally, with creative accounting teams, lawyers, tax shelters and decades long lobbying efforts gained favorable tax treatments that individuals can only dream about. In fact, many corporate giants pay little to no effective corporate taxes whatsoever. Some indeed pay none. And some of these companies are some of the most profitable companies in America.

So who will benefit from even lower corporate taxes?

First of all it’s not that clear cut to assume that companies will benefit on day one from sudden tax cuts:

Citigroup CFO says cut in US tax rate could bring $4 billion charge

Still it is the markets’ expectation that US corporations can repatriate cash and see benefits to the bottom line.

Will this help the economy? Will it expand hiring? Increase CAPEX and investment in the future? Don’t assume so. Goldman Sachs already has the growth market pegged: More buybacks baby.

“A significant portion of returning funds will be directed to buybacks based on the pattern of the tax holiday in 2004,” the team, led by Chief U.S. Equity Strategist David Kostin, write. They estimate that $150 billion (or 20 percent of total buybacks) will be driven by repatriated overseas cash. They predict buybacks 30 percent higher than last year, compared to just 5 percent higher without the repatriation impact.”

This chart highlights the emerging proportions:

So who benefits? Well, the same folks that always benefit. The top 1%. In fact, this is also what an analysis of the proposed tax cuts suggests:

“If you look at the most wealthy, the top 1 percent would get about half of the benefits of his tax cuts, and a millionaire, for example, would get an average tax cut of $317,000,” she says.

But a family earning between $40,000 and $50,000 a year would get a tax cut of only $560, she says, and millions of middle-class working families will see their tax bills rise under Trump’s plan — especially single-parent families.

“A single parent who’s earning $75,000 and has two school-age children, they would face a tax increase of over $2,400,” Batchelder says. That’s if they had no child-care deductions; the increase in taxes comes partly because the Trump plan eliminates the $4,000 exemption for each person in a household.”

I don’t know what “drain the swamp” means. But so far the beneficiaries of an anticipated Trump presidency are the same people that have benefited from all previous presidencies: The rich. And based on the stock market’s reaction that is exactly who is anticipating to benefit the most:

Specifically the banks which have epitomized “the swamp” to many Americans, having been convicted of consumer fraud with billions of penalty judgements for years on end as a result of taking advantage on unsuspecting American consumers, these same banks have benefited the most from this recent rally. Indeed just this year Wells Fargo got into trouble for running a deceptive program and the CEO was forced to resign just a few weeks ago. And Republicans want to deregulate the banks again? The answer is a giddy yes:

“There is a joke going around here that if I’d have known how good Trump was going to be for Wall Street, I’d have campaigned for him,” one Goldman Sachs executive told the outlet. “What people are reacting to is this incredible cultural shift. People thought it might be 10 or 15 years until regulators stopped demanding heads and now all of a sudden you can envision it happening overnight.”

The irony should not escape anyone. Nor should the fact that everything that is being proposed does one thing primarily: Add to the national debt for the benefit of the 1%. Sound familiar?

Worried about all that new debt? Don’t. After all our new president is the king of debt:

“I’m the king of debt. I’m great with debt. Nobody knows debt better than me,” Trump told Norah O’Donnell in an interview that aired on “CBS This Morning.” “I’ve made a fortune by using debt, and if things don’t work out I renegotiate the debt. I mean, that’s a smart thing, not a stupid thing.”

“How do you renegotiate the debt?” O’Donnell followed up.

“You go back and you say, hey guess what, the economy crashed,” Trump replied. “I’m going to give you back half.”

In plain speak that’s called default. That is of course the track record of Donald Trump the business man. How Donald Trump as president will deal with the reality of government remains to be seen. It may require some reading up on the issues. But then that’s self admittedly not his strong suit and don’t expect this to change. His priority appears to be, well, himself:

“He has no time to read, he said: “I never have. I’m always busy doing a lot. Now I’m more busy, I guess, than ever before.”

Trump’s desk is piled high with magazines, nearly all of them with himself on their covers, and each morning, he reviews a pile of printouts of news articles about himself that his secretary delivers to his desk. But there are no shelves of books in his office, no computer on his desk.”

Before you think I’m a disgruntled Hillary supporter: I am not. I did not think she was the right person to handle the big structural issues our country is facing. She was too much ingrained within the establishment and had voiced no agenda to tackle them. I’m just a citizen that sees major trouble brewing based on my ongoing assessment of the math and the structural issues that plague the global economy and I see no practical answers coming from either political party, nor do I see an earnest desire to even have a conversation about it.

In fact, I do think the country needs a wake up call to get serious about tackling the big issues. The early assessment here seems to suggest that Donald Trump is not interested in tackling the big issues, but rather will be exacerbating them under the guise of wanting to fix them. In that sense he may end up bringing about the wake-up call that is needed.

For now the stock market is celebrating with anticipation of all the perceived good things to come. But every honeymoon ends. And so far there is no evidence to suggest that the middle class will benefit. Indeed the evidence so far suggests that Donald Trump’s election promises will end up being what voters are used to getting whenever they are promised change and better times ahead: Empty promises:

But hey it’s early in the process and we have plenty of time to see what they will actually do. But do we have the time?

One has to wonder. But there are signs that reality is already making itself noticed:

“It was supposed to be a big, beautiful infrastructure bill. But President-elect Donald Trump’s pitch for a $1 trillion upgrade of the nation’s roads, bridges, tunnels and airports is already running into potholes as it meets reality in Washington.

The overwhelming sticking point, as always, is how to pay for it.

So it’s back to hope. Ok. For now stocks have priced in a nirvana and perfection where debt doesn’t matter. I suspect they will not put up well with empty promises. But who knows, maybe magic will happen. After all if the 2016 political season has proven anything it is this: Anything is possible.

But buyers here at $SPX near 2200 seem to think that’s a 100% guarantee. Best of luck.

via http://ift.tt/2geDPX6 Tyler Durden